Dear Bankless Nation,

When it comes to good NFT projects, we see things like talented creators, innovative mechanisms, and vibrant communities as significant plusses.

Yet what makes for bad NFT projects?

What are key signs of trouble to look out for?

Below, I’ve compiled a list of over a dozen red flags to keep in mind as you explore new NFT efforts. They range from matters of negligence to matters of outright manipulation. Let’s stay safe out there…

-WMP

A checklist of NFT red flags

🚩 Indefensible mint prices

With an endless variety of creative possibilities, there’s plenty of wiggle room as to what constitutes “reasonable” NFT mint prices. There’s no singular right answer here. But if a new team is charging far above what its predecessors or comparable peer projects have charged, it suggests they might be focused on securing your ETH more than anything else.

🚩 Sketchy social media activity

An NFT project DMs you out of the blue to steer your attention to its upcoming drop, which you actually saw a promoted tweet about a few hours prior. Now you click on the collection’s profile and note that 1) none of your followers follow the project, and 2) it has an unusually large amount of followers for a new project. These are all red flags! Legit projects don’t solicit individuals’ attention via DMs or use Web2 ads; they have organic interest and don’t have to buy followers.

🚩 Artificial floor maintenance

See a project’s leadership discussing or working to maintain a certain NFT floor price? Then run away, and run away fast. They’ve betrayed that they’re just running a financial scheme and have little to no sincere interest in cultural value or community. This insincerity will color any and all troubles they run into going forward, so beware.

🚩 Abusive Discord behavior

A huge cause for concern is when an NFT team bans people from its Discord for asking reasonable questions. You want to see projects be accommodating and forthright, not combative and secretive. There’s no good reason for teams to abuse their moderation responsibilities.

🚩 No audits

Audit reports from security firms aren’t perfect, but they do provide some basic security checks. If you’re in Web3, you want to be using audited DeFi and NFT projects since unaudited infrastructure can be more readily abused or exploited. The problem is that every audit firm is utterly swamped with demand lately. Not wanting to wait forever, some new NFT projects are thus taking their chances by launching their infra unaudited. Tread cautiously with such projects accordingly.

🚩 Bad design

A project that’s been poorly designed can lead to bugs, inefficient gas, exploitable mints, and more. Gauging bad code and so forth is difficult for novices and plenty of non-technical experts, so following people who do know better and learning from their judgments is key.

🚩 Low-quality art

If you come across a project with art that looks like it was thought out and finished in an hour by a Fiverr content farm, maybe it was. So if the NFT team itself didn’t take their content very seriously, then why should you? And keep in mind, there is a vast divide between tasteful/charming/parodic/weird minimalistic work and kitsch crap. You be the judge, but in my experience where projects fall along this spectrum tends to be pretty self-evident.

🚩 Selling allowlist spots

A newer thing I’ve started to see is NFT teams selling allowlist spots to their own NFT launches. Wow. This is just cash-grab behavior, plain and simple, and I personally can’t see how it’s defensible in any way.

🚩 Overpromising

Are the creators of a new NFT collection saying their work is “blue-chip quality” and going to become the next Bored Ape Yacht Club? Does the project’s roadmap metaphorically stretch to the moon, or claim outlandish stuff like how it will literally become the first NFT marketplace for the actual moon? Avoid the hot air of pure rhetoric.

🚩 Totally anonymous team

Having a totally anonymous team isn’t problematic per se. People have a right to privacy, and in many cases the quality of projects and codebases, etc., will speak for itself. However, in worst case scenarios totally anonymous teams can do serious damage like rugging liquidity and then face little to no accountability.

🚩 Lack of a track record

NFT projects that lack experienced NFT veterans on their teams are more likely to flame out compared to teams that have even just one savvy NFT user.

🚩 Unverified on Etherscan

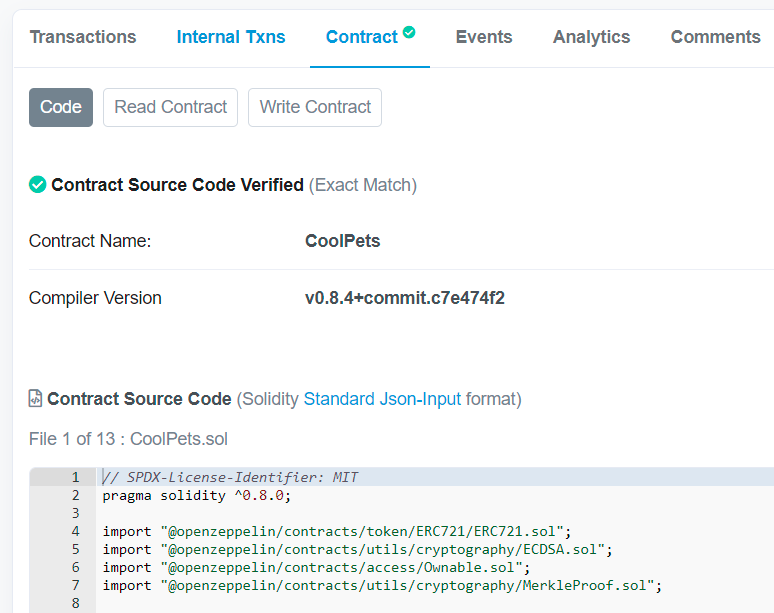

Verifying your code through Etherscan ensures to the public that it works on Ethereum as it’s supposed to. Using unverified smart contracts means you don’t have that fundamental performance guarantee, so this is something you’ll definitely want to watch out for in the course of your NFT activities. For example, you can see how the Cool Pets smart contract is verified courtesy of its checkmarked status. Be careful with projects that aren’t similarly checkmarked.

🚩 Poor ownership distribution

Let’s say a 10k PFP project catches your eye, but then you go check its OpenSea collection page and notice that ownership of the project’s NFTs is distributed across a few hundred individuals. That’s insane ownership concentration and means all of those folks can exert big influence over the collection’s market.

Conclusion

Some of the red flags described above should be automatic dealbreakers, like abusive Discord behavior. Others, like totally anonymous teams, aren’t always consequential but in the very least are worth noting. Get in the habit of spotting these red flags so you can more shrewdly navigate your NFT activities.

Action steps

- ⚠️ Practice your NFT safety review skills: pick a new project and then scrutinize it according to the checklist of potential red flags described above.

- 🚨 Did I miss any NFT project red flags? Let me know in the comments below!

- 📖 Read my other Bankless write-ups this week: How to prepare for L2 tokens and The Nouns are going to the Super Bowl