Dear Bankless Nation,

Earlier this summer, I wrote a primer on NFT smart contract approaches you should know about.

Yet settling on a foundational smart contract approach is half the battle when it comes to launching an NFT project. The other half comes from deciding on which NFT drop style to use.

Of course, it’s possible to configure NFT contracts and drop styles in all sorts of different combos. It’s also entirely possible to blend different drop approaches together in various ways.

Altogether, though, there are a handful of fundamental drop styles you’ll want to keep track of in the contemporary NFT ecosystem. For today’s Metaversal, let’s walk through the basics of these main styles.

-WMP

Popular NFT drop styles

First come first serve (FCFS) mints

An NFT drop style in which minting is open on a “first come first serve” basis either to anyone in the public or to specific subsets of NFT community members.

Variants:

- Permissionless — Anyone can mint on a FCFS basis | Example: Bored Ape Yacht Club

- Token-gated — Anyone who holds a specified token can mint on an FCFS basis | Example: Blitnauts, which can only be minted by Blitmap holders

- Raffle-based — Entails using a raffle system to allocate a limited number of allowlist spots for a FCFS mint | Example: Boki final sale)

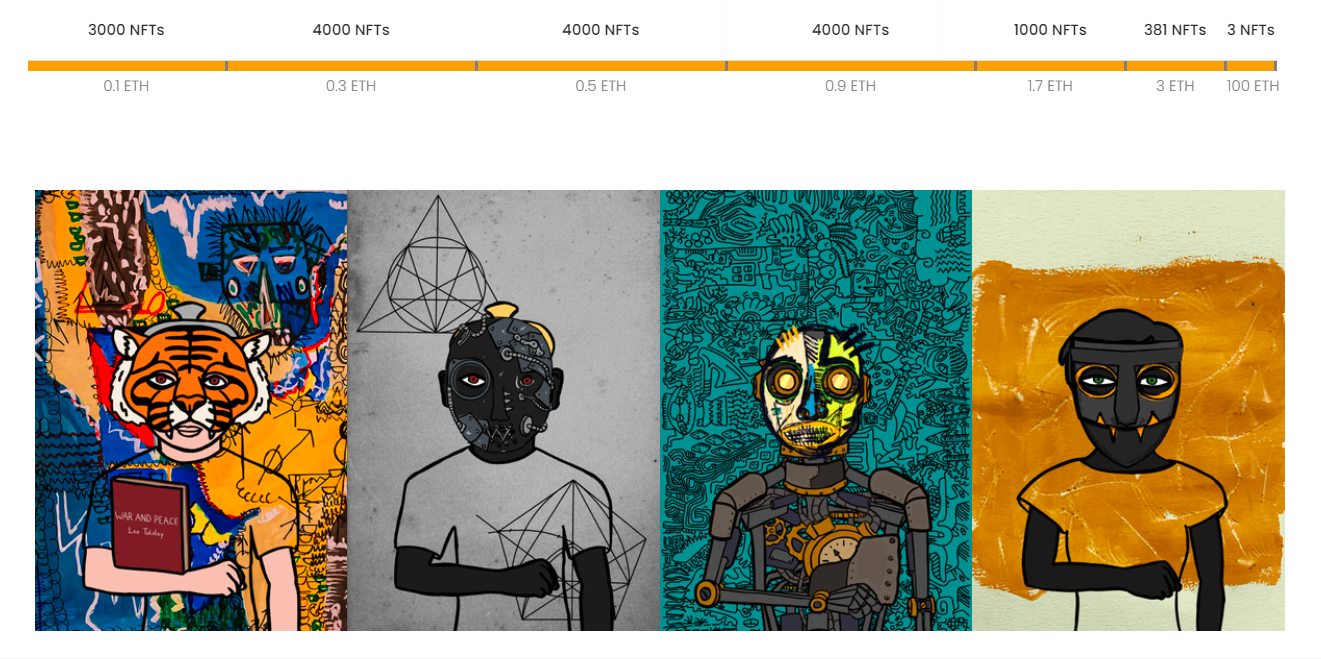

- Price-tiered — a drop style in which different supply tiers in a collection have different mint prices, e.g. NFT IDs 0-999 at 0.1 ETH, 1000-1999 at 0.2 ETH, and so forth | Example: The Hashmasks

The Pros:

- Simple for builders to implement

- Simple for minters to use

The Cons:

- Low-priced, high-demand FCFS mints can lead to “gas wars” that congest an entire chain, e.g. Ethereum

- Prone to failed transactions near the end of mint events

- Prone to being overwhelmed by bot minters

- Not time-zone agnostic since FCFS mints often mint out rapidly

Dutch auctions (DAs)

An NFT drop style in which a collection’s NFTs start at an initial mint price — e.g. 10 ETH — and that price drops by a particular sum periodically — e.g. by 0.25 ETH every 30 minutes — until a designated price floor is hit or a demand equilibrium is reached and all the NFTs sell out.

Examples:

- Art Blocks — To mitigate gas wars and to focus on supporting artists over miners, generative art dapp Art Blocks began giving artists the ability to launch their collections via dutch auctions as of the summer of 2021

- Azuki — The anime-themed PFP collection launched through a dutch auction mint in January 2022, but the collection minted out in minutes without its initial 1 ETH mint price ever declining

- Forgotten Runes Warrior’s Guild — The Forgotten Runes Wizard’s Club extension collection started its Phase 1 release with a dutch auction; the initial mint price was set at 2.5 ETH though that sunk down to the final designated resting price of 0.6 ETH over the course of the mint

The Pros:

- Brings transparency to the NFT bidding and price discovery processes

The Cons:

- Often favors the most deep-pocketed collectors who can afford to mint at or near the initial auction price

Free claims / free mints

An NFT drop style in which a collection’s NFTs are free to mint besides the gas costs associated with the claim transactions. Lately, projects that opt for this style typically rely on above-average secondary sale royalty rates to bring in revenues.

Examples:

- CryptoPunks — Nowadays it seems hard to believe, but when the most iconic NFT collection of all time was released back in 2017, all the ‘Punks NFTs were free to claim!

- Loot — Dom Hofman released Loot, an on-chain adventure gear collection, as a free mint in August 2021. All NFTs from the collection were claimed from the smart contract within a matter of hours

- goblintown — The wild goblin-themed NFT collection that took the NFT space by storm earlier this year was released per a “1 free + gas mint per wallet” drop style

The Pros:

- The low cost makes these drops accessible to many users

- Projects are incentivized to continue delivering since continued progress will support better royalty revenues over time

The Cons:

- The rise of low-fee / zero-fee NFT marketplaces could eat into free mint projects’ revenue prospects going forward

- Prone to being overwhelmed by bot minters

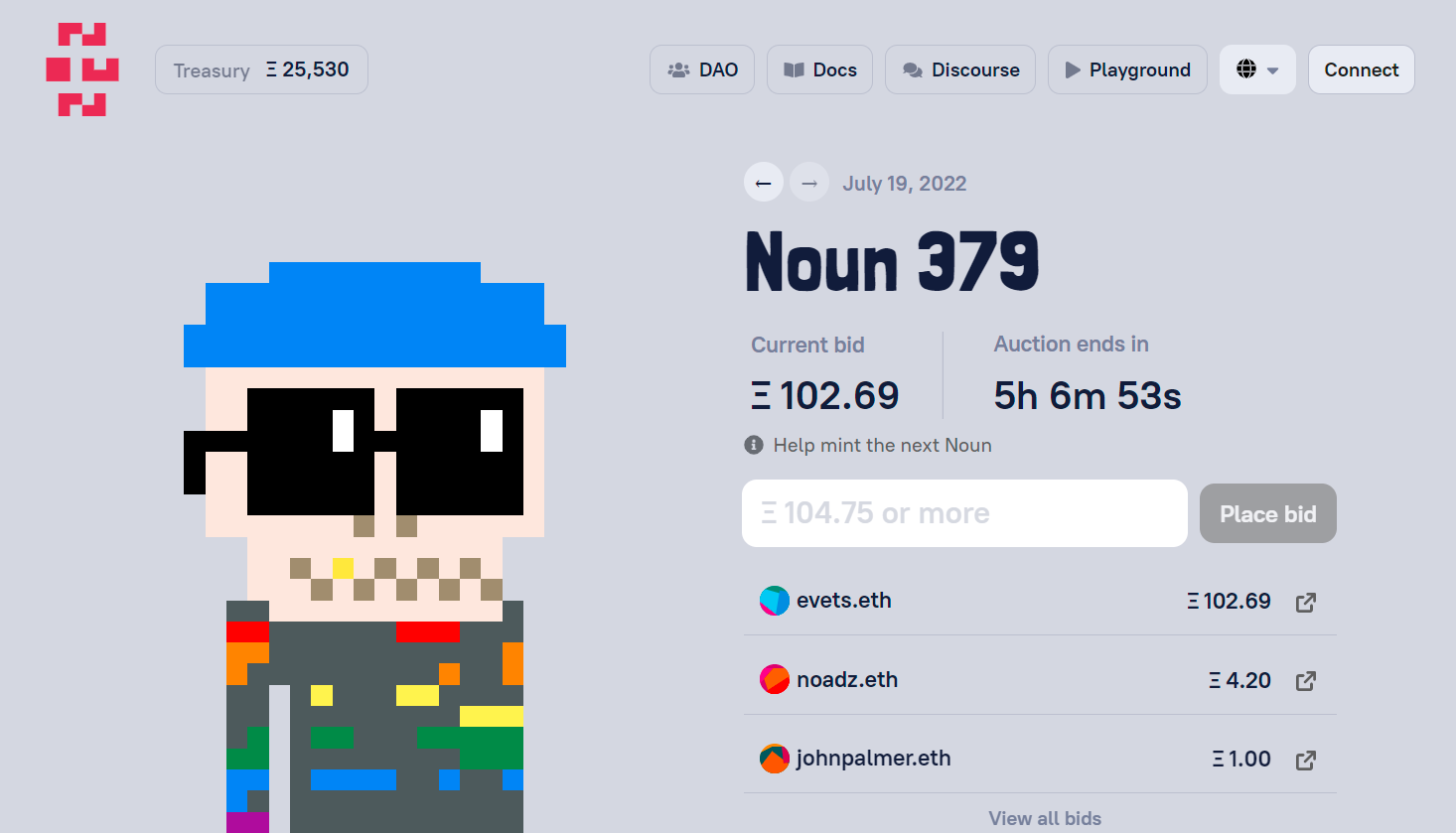

Nounish auctions

An NFT drop style pioneered by Nouns DAO that entails generating and auctioning one new NFT every day indefinitely. However, lately we’ve seen a wave of projects adopt the Nounish distribution style while experimenting with its NFT pacing, i.e. releasing more than one NFT a day and so forth.

Variants:

- Nouns DAO — “One Noun, every day, forever” is the rallying cry of the main Nouns project; the underlying protocol generates an avatar from a bank of traits, auctions the avatar, and settles that auction once per day

- Lil Nouns DAO — Auctions one Lil Noun NFT every 15 minutes per day forevermore

- WizardsDAO — Auctions 3 Wizard NFTs per day until the total collection supply reaches 2,000 NFTs

The Pros:

- This drop/distribution style is a new on-chain primitive that projects can use to build an NFT community over time

- The pacing and parameters can be customized in different ways

The Cons:

- This drop style is ultimately experimental

- High demand can lead to auctions becoming inaccessible price-wise to many

- The Nouns Protocol is elegantly designed and pretty complex, so you’d need an expert Solidity developer to fork out and build off it

Open editions (OEs)

An NFT drop style in which a creator or project releases an NFT with no hard supply cap.

Variants:

- Infinite — An infinite OE is a drop where the collection has an infinite possible supply and minting never closes. A recent example comes courtesy of “The Room of Infinite Paintings” project:

- Timed — A timed OE is a drop that has no set supply cap but that only offers open minting for a limited window of time. A recent example is Zora’s “State of Mind” drop, which ran for three days earlier this month and raised over 123 ETH in that span:

The Pros:

- Flexible to creators and collections, as everyone who wants one can get one

- Easy to launch with contemporary web3 creator tooling

Honorable mentions: Bonding curves & MultiRaffle

An NFT drop style that’s seemingly grown out of favor over the last year is the bonding curve mint approach.

One of the pioneers of this format in the NFT space was the EulerBeats project, which sold (and allows for the reselling of) its NFTs along a price curve determined by a specific mathematical formula. As the EulerBeats documentation notes:

“Any collector can buy a print based on the price formula set on a bonding curve. As the number of prints in circulation grows for a particular original, the price of issuing its next print increases at an exponential rate. [...] The bonding curve acts as a liquid market that allows a print holder to burn their print token, thus reducing the current print token supply of the associated Original, in exchange for receiving the burn price at that time. Thus, the burning process returns ETH to the print token burner from the reserve.”

Lastly, an NFT drop style that hasn’t gained much traction but that I think should have way more adoption is MultiRaffle, a raffle-style reference implementation created by Paradigm’s Anish Agnihotri and Hasu.

Simply put, MultiRaffle is the result of Agnihotri and Hasu’s research into what the fairest, most efficient NFT drop could look like. Accordingly, in MultiRaffle the duo optimize for unexploitable fairness, preventing race conditions, and maximizing a mint’s cost efficiency from top to bottom.

I’m sure some MultiRaffle experiments have materialized already, though I personally haven’t seen any since Agnihotri and Hasu published their associated research post back in October 2021. That’s a shame, because it’s clear this drop style would be balanced and fair in ways that are really admirable and conscientious.

Action steps

- 🔭 Familiarize yourself with the top contemporary NFT drop styles

- 🙇 Check out my previous primer Create your own PFP collection if you missed it!