1 DAI = 1 Bankless scholarship 👇

Gitcoin’s running a grant match and if you send 1 DAI to the Bankless grant we can give 1 scholarship to someone who needs it. Your 1 DAI is now 100x matched.

👉Give 1 DAI to the Bankless Scholarship grant

We’ll award these scholarships to students and deserving community nominees you help select—right now we 50 to give. Can we hit 100? Let’s get Ethereum to the world!

Dear Crypto Natives,

Language is one of my favorite decentralized systems. It’s permissionless—anyone can invent a word. Some new words die. Others are forked. Others never take off.

For a new word to survive it must be both sticky and viral.

That’s because individual human brains are the nodes that run language. Each individual chooses to accept or reject a new word. The more memetic the better the acceptance and transmission rates of a word. Language is inherently open source. No one owns English. But once a word gains network effect it becomes hard to displace.

Does that remind of you crypto systems at all?

New technology movements always invent new words:

PC: windows, desktop, filesystem, workbench, applets

Internet: E-mail, cyberspace, e-commerce, “surfing web” 🕸️

Web 2: likes, tweets, mentions, stories

Notice something about these? They’re all metaphors. Analogs to the physical. They import a previous framework to help explain a new concept.

The buttons on the iPhone Calculator app didn’t need beveled edges but they were a useful bridge for people who grew up using the buttons of physical calculators. The bookshelf for iBooks, the spinning Compass, the notepad lines—all visual metaphors. Bridges to a new technology. Temporary aides. Skeuomorphisms.

Yet, when we explain crypto we get caught saying stuff like this:

“Ethereum is a cryptoeconomically secured decentralized blockchain platform that enables the creation of autonomous smart contracts”

Ugh. No wonder we’re so boring at parties.

If we’re looking to mainstream this stuff technical precision isn’t the best way to explain it. We need metaphors—they are the bridge.

“Bitcoin is digital gold”

“ETH is money”

If I’m talking to someone in finance, I’ll tell them TokenSets are “Automated ETFs”. This allows them to import their ETF mental model. Will we need the ETF model for Sets 5 years in the future? Maybe not. Metaphors are just a bridge.

I like metaphors of economy & nationstate for Ethereum:

- Ethereum = economy (like US)

- ETH = money (reserve asset)

- DAI = money (daily spending)

- ETH issuance = monetary policy

- Staked ETH = T-bills

- Miners/validators = military

- ETH address = bank account

- ENS = bank account name

- Wallet = vault

- Maker loans = equity loans

- MKR = bank stock

- cDAI = savings account

Are these 100% analogous? No. But they’re close. And most importantly, they help real people understand what we’re doing here.

I say we embrace the metaphors.

- RSA

An NBA player tokenized his future income on Ethereum last week—that’s cool—you know what else is cool? Earning 6% on DAI with no additional risk!

MARKET MONDAY:

Scan this section and dig into anything interesting

Market numbers

- ETH steady at $143 from $143 last Monday

- BTC up to $8,112 from $7,731 last Monday

- DAI stability fee up to 6% with savings rate up to 6% 🔥

Market opportunities

(Lend) DAI at 6% using Dai Savings rate (no additional risk vs holding DAI 🔥)

Or 6% using CHAI (similar risk as DSR)

Or 10% DAI at crypto.com (but has counterparty risk)

(Lend) USDC on BlockFi at 8.6% (newly launched—solid rate)

(Stake) Earn ETH by staking ZRX token (yep! earning money)

(Bet) on sports results w/ DAI at Degens (review by Bankless member)

New stuff

- Bitwala now supports ETH (source)

- Big Ambro wallet update (from MyEtherWallet)

- TokenTax provide Compound tax importer (get 10% off)

What’s hot

- Over 40% of all DAI is already in the Dai Savings Rate

- NBA star Spencer Dinwiddie tokenized his earnings on Ethereum (more)

Money reads

- State of DeFi report 🔥 (there are 40,000 of us) - Binance Research

- Most accessible overview of the money system I’ve read - Noam Levenson

- Bitcoin’s Lifetime growth numbers - Joel from Decentralised

- Can manipulate cost of governance by changing vote times - Joel Monegro

WHAT I’M DOING

Check out a few opportunities I’m capturing right now with my crypto money

Got my donations matched on GitCoin grants. I gave to my favorite media projects (like EthHub) since attracting new users is my focus right now. The matching is powerful—for instance, each $1 DAI you give to the Bankless grant is matched 100x.

Entered fair market value on my crypto for self-directed IRAs. If you’re in the U.S. and you opened a self-directed IRA, you need to enter the fair-market value of your crypto assets as of 12/31/2019 and report to IRS or risk possible penalties. If you used a third-party like RocketDollar for your self-directed IRA as I recommended here you can enter these details in their interface and they’ll handle it.

Tried Curve a liquidity pool for stablecoins. A Uniswap for stablecoins. Pretty limited functionality and liquidity now but has potential as a liquidity pool for aggregators like 1inch and DEX.ag to dip into. Might be profit opportunity later as a liquidity provider. Wait for audits and better vetting!

What’s the coolest thing you did last week in crypto? Here’s what you’ve been up to:

- Got my donations matched on gitcoin - sassal0x

- Test drove Aave (see Weekly Assignment!) - @CryptoParent (+more)

- Was announced as a launch-day trader on tokensets - @krugman25

- Sold 2 mystics for 5.4 eth to stock up on land at AxieInfinity - @ethAur44

- Worked on building out leveraged liquidity positions - @cryptonomik

- Started two Swarm nodes up and uploaded a tiny website to the censorship resistant distributed file system - @cyber_hokie

👉See more in thread from last week.

WEEKLY ASSIGNMENT:

Make time to complete this assignment before next week

Get a fixed loan on Aave. (15 minutes) Aave (“aw-vay”) launched last week. It’s a lending & borrowing protocol like Compound but with two additions.

What’s special about Aave?

The first is Flash Loans—this allows seconds long undercollateralized loans. Developers will be first to use this new money lego. Expect to see it surface in apps like Zerion, InstaDapp, and DeFiSaver—example case—re-finance a $1,000 Maker loan without needing $1,000 to pay it off first. (more examples)

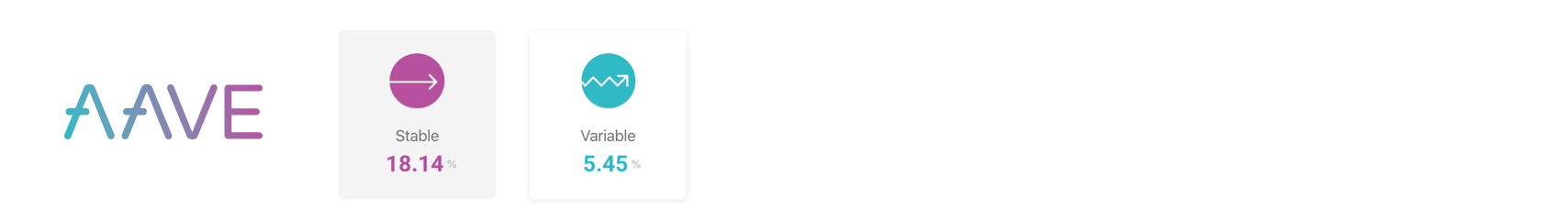

The second is fixed rate loans. When you borrow on Compound the rate is variable. It can fluctuate by the minute. But with Aave you can select a “Stable” rate when borrowing. Getting a stable fixed loan is today’s assignment.

Requirements: MetaMask account with some ETH

- Go to Aave Deposit in the Aave app & connect with MetaMask

- Deposit some ETH (keep it small—I did .01 ETH as a test)

- Set amount of DAI to borrow (it’s collateralized by the ETH you deposited)

- Pick “Stable” instead of “Variable” (Stable is the Fixed loan)

- Click “Continue” to borrow

Congrats! You just withdrew a fixed rate loan (learn about the differences). Cool right?

Now, this fixed loan has some caveats. While it does not have a time horizon, it can rebalance both up or down. Rates will increase against you if the deposit earning rate on ETH is higher than the stable rate—unclear the frequency of this, but the designers of the protocol tell me it will be rare (we’ll see!). Rates can also decrease in your favor if the stable rate decreases below the rate you locked into. This rate decrease does not happen automatically and requires a smart contract call.

While Aave has been audited as a new protocol the risks are higher. Wouldn’t add big amts yet.

Extra Credit Learning

(Beginner) Introduction to cryptocurrency course 🔥

(Beginner) Decent list of twitter follows (how to use crypto twitter)

(Beginner) Coinbase beginners intro to DeFi (resource for friends)

(Beginners) Guide to using DeFi on Ethereum by EthHub

(Intermediate) TUTORIAL: Ultimate guide to Uniswap

(Intermediate) Costs of running your own Eth2 validator

(Advanced) NFT bible (lives up to its name)

TAKES:

Read my takes but draw your own conclusions

- DeFi needs to figure out affiliate marketing to compete

- Anyone else think a multi-chain world is kinda clunky?

- 12 crypto exchange hacks last year cost $292m—this is why we bankless

- China’s capital outlays via crypto about $11b last year—what a use case!

- The main market for crypto is in Asia—this includes DAI

- Cool to see DAI at CES reminded me of Coinbase in 2013

TWEET-A-QUESTION

Tweet me your question—I reply to one per week

Question from Twitter:

What’s the lowest fee route of going from USD to DAI these days?

RSA Response:

The fastest way to get DAI is through a service like Wyre (e.g. ApplePay or card) or Ramp. This will cost 2-4% (including slippage) depending on the amount.

If you’re aiming for lowest fee route and have time, I like CoinbasePro. Just transfer USD to Coinbase and convert it to USDC (this part is free). After conversion, trade the USDC for DAI on the Coinbase DAI/USDC pair.

At the moment DAI trades for 0.999 USDC on Coinbase. After exchange fees 1 USDC would buy you .995 DAI. So just set limit orders and wait. Cost is about .5%.

Another option: after converting to USDC you can use a DEX aggregator instead of the Coinbase exchange to further reduce exchange fees.

The best option is to be even more strategic. Historically, DAI price drops about 1-2% temporarily when ETH rallies and trades at or above par when ETH price is stagnant or weak. You can wait for the ETH rallies and buy DAI at a discount!

- RSA

Some recent tweets…

Actions

- Execute any good market opportunities you saw

- Complete weekly assignment: Get a fixed loan on Aave

Level up—no interruption. $12 per mo. Includes Inner Circle & Deal Sheet.

Let’s onboard 1 billion people to open finance…

If you believe in what we’re doing don’t keep it to yourself—share Bankless with as many people as possible.

Post. Tweet. Tell. That’s how we take back our money system.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.