Maker DAO's Existential Crisis

Dear Bankless nation,

Here’s a recap of the biggest crypto news in the first week of September.

Maker DAO drama

There’s a nifty taxonomy for stablecoins that crypto analysts like to use: 1) Fiat-backed stablecoins (we don’t like these because regulators can censor them); 2) Crypto-backed stablecoins (we like these because they’re uncensorable); and 3) Algorithmic stablecoins (which have fallen out of favor with Terra’s crash).

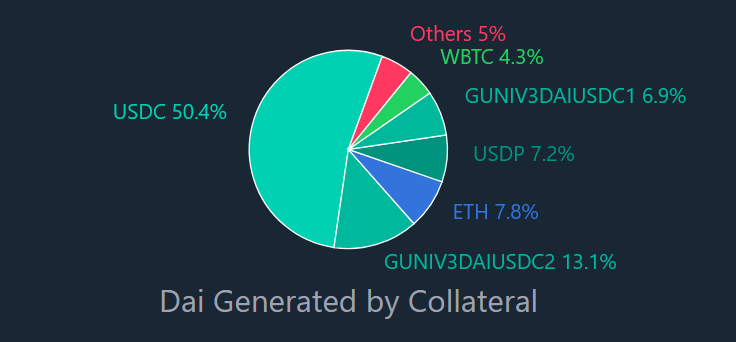

Maker’s stablecoin DAI is pegged into the “decentralized” stablecoin bucket, because it’s crypto-collaterized. But as they often say, decentralization is a spectrum and DAI is also collateralized by centralized stablecoins like USDC.

Now, DAI is still powered by smart contracts on the blockchain and transparent, so that makes it partially-centralized or partially-decentralized, depending on whether you’re a glass half-full or hall-empty kind of person.

Does that make DAI good or bad? There are two kinds of reactions you can have at this point, depending on what hat you wear.

The first is to strap on a philosopher hat on and go full “muh decentralization”. And indeed, that hat is easy to wear. There are plenty of decentralized stablecoins that one can point to, for instance, Reflexer Finance’s free-floating RAI which is purely crypto-collateralized and not USD-pegged. But philosophers fail at thinking empirically, and they forget RAI’s circulating supply of 5.2 million is a pittance of DAI’s (6.5 billion). So while RAI approximates the decentralized ideals of crypto, it doesn’t face the same scalability issues as Maker and doesn’t achieve user adoption on the same levels, which is, umm, the whole point.

The second reaction to DAI’s partial-centralization is of course to wear the pragmatic hat where growth and user adoption takes precedence over annoying, abstract philosophical ideals (until of course, regulators remind you of them). DAI’s partial-centralization is regrettable but it’s still a relative improvement to fiat money which is good and what brought us to crypto to begin with.

As usual, difficult tradeoffs emerge. Pragmatists want to grow, but that necessitates sacrificing decentralization. Philosophers want to maintain trustlessness and decentralization, but that comes with lower scalability. A nice Twitter thread by Greg Di Prisco this week summarizes the various ideological camps that have emerged within Maker’s governance community in recent months. At the heart of the conflicts between these camps sit that tradeoff.

The arbitrary and sudden element of the Tornado Cash sanctions by the U.S. Treasury, it seems, have triggered a community-wide knee-jerk reaction within the Maker community – what Jacek Czarnecki laments as “reactive, underinformed, sometimes ignorant” – to rethink its regulatory compliance strategy.

Maker’s existential crisis brings into focus two main centralized vectors that Maker has embraced in the past year for the sake of growth:

- The first is of course DAI’s heavy reliance on USDC collateralization. Some context to how we got here: Maker introduced its peg-stability module (PSM) in early 2021 which allows the minting of DAI with dollar-stable assets. This allows for greater scalability due to low demand to mint DAI against decentralized collateral like ETH - users want to hold DAI, but they don’t want to short ETH-USD in the process. The drawback here is that it sacrifices trustlessness since centralized USD-pegged assets increase regulatory risk, as Circle’s freezing of 75,000 USDC in OFAC-blacklisted Tornado Cash addresses earlier this month so clearly demonstrated.

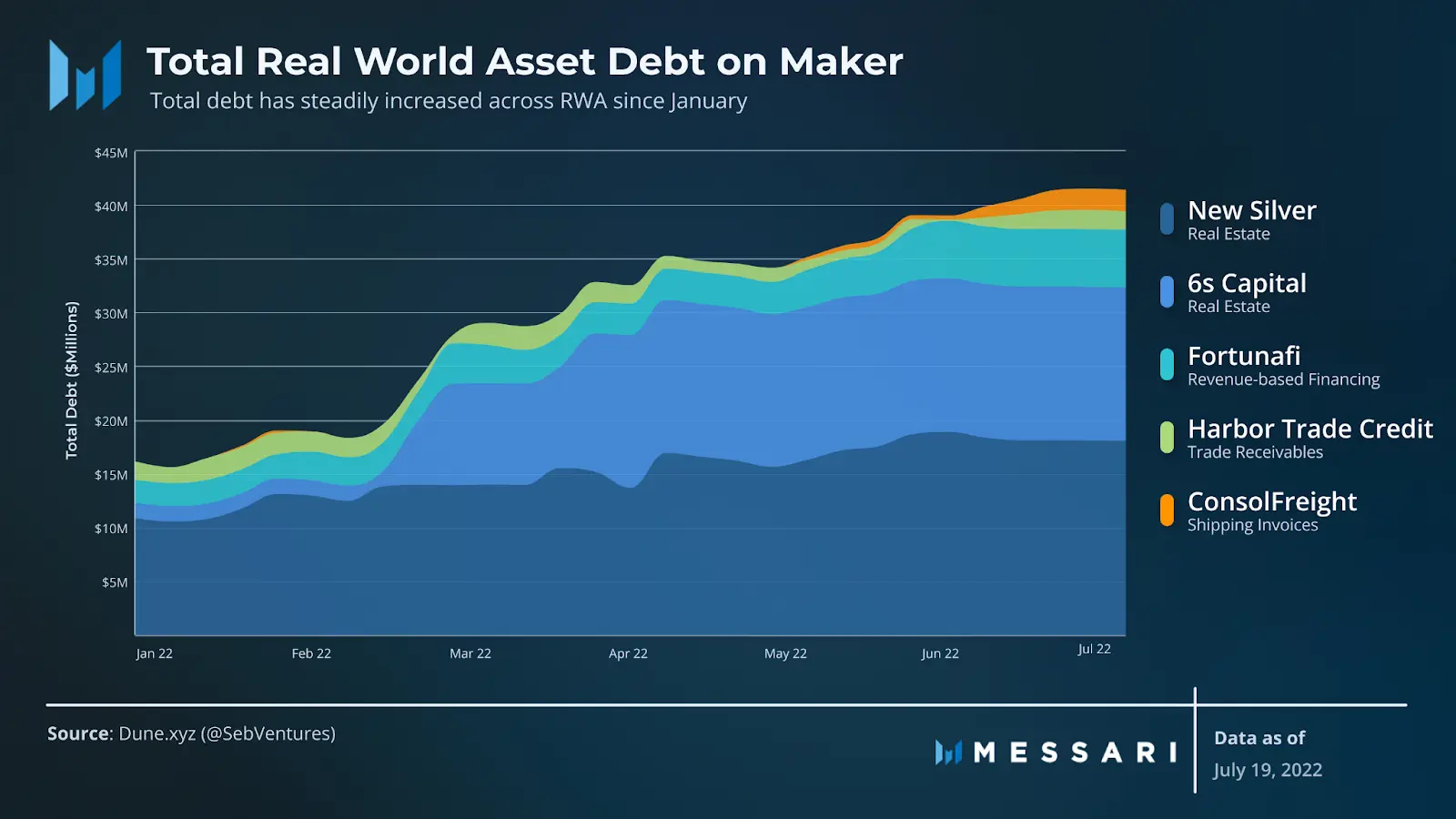

- Second is Maker’s real-world-asset (RWA) exposure, which includes secured loans for real estate development, tokenized cash flowing assets, US Treasury and corporate bonds and more. Maker’s RWAs make up a non-trivial ~8-10% of Maker’s annualized revenues.

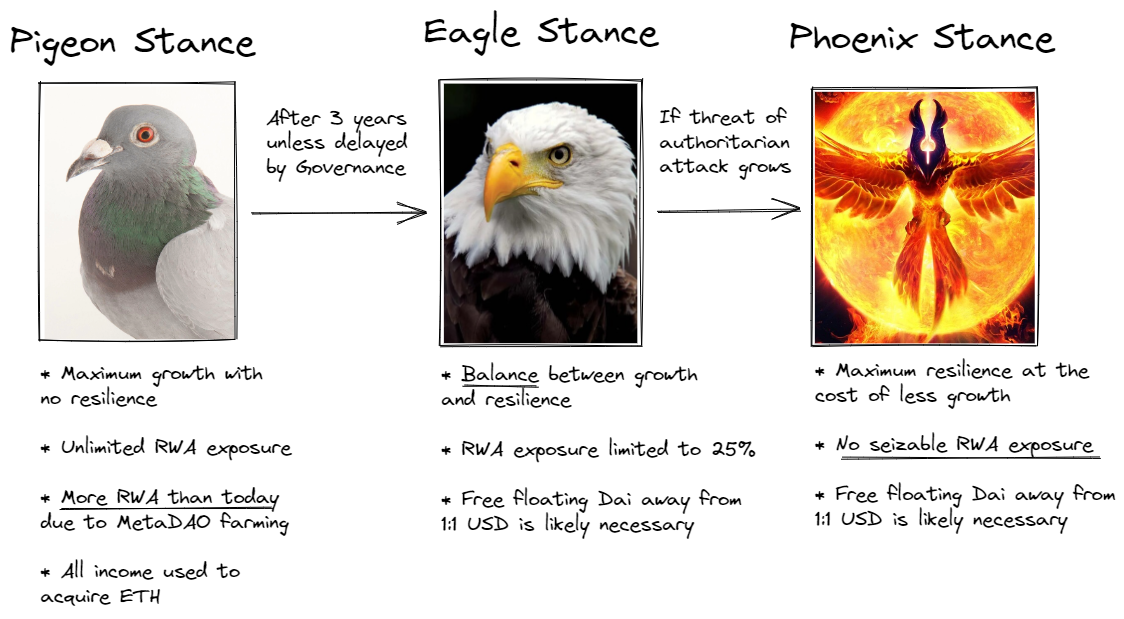

In a bombshell thread this week titled “The Path of Compliance and the Path of Decentralization: Why Maker has no choice but to prepare to free float Dai”, Maker co-founder Rune Christensen is proposing a path that drastically limits its dependence on centralized assets, because well, look what happened to Tornado Cash?

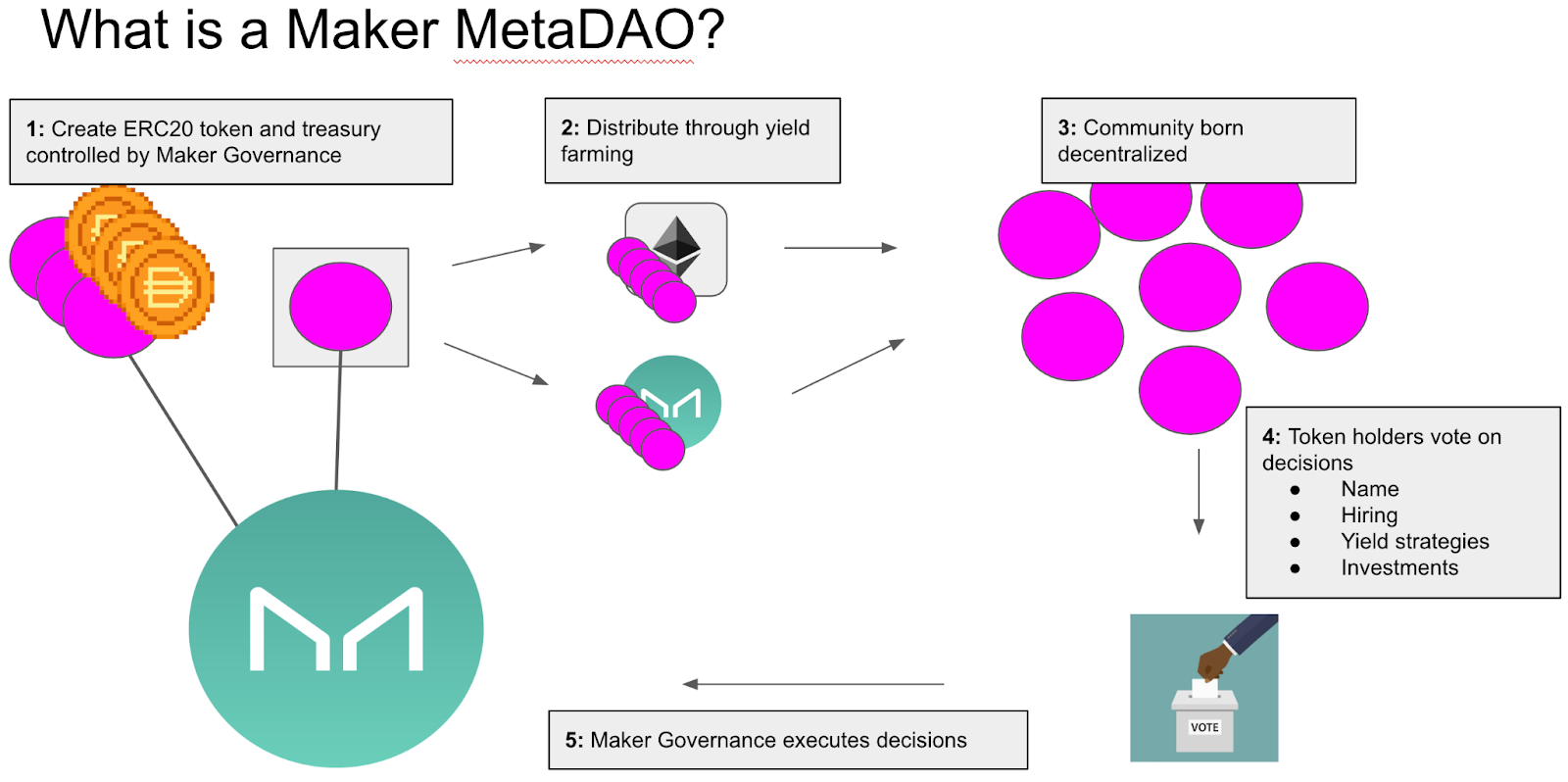

Central to Christensen’s decentralized vision of Maker are two primary tools: MetaDAOs and Protocol Owned Vaults (see The Endgame Plan for fuller details). A combination of both these tools would effectively reduce Maker’s existing regulatory risk over time and put it on a viable path to growth.

- MetaDAOs (aka Maker subDAOs) can issue its own token, which delivers yield farming rewards to users and offset any declining value of a free-floating DAI. The key here is that MetaDAOs, with its strong alignment to Maker, can help incentivize some form of demand for DAI despite its free-floating volatility. (This, of course, depends on many unknowns, namely the value of these MetaDAO projects - why are these MetaDAO tokens valuable to retail? Why would retail be buying them?)

- Protocol Owned Vaults on the other hand is a strategy to capitalize on the Ethereum Merge. This sees Maker launching its own version of synthetic ETH that can be used to issue overcollaterized DAI against it, while earning staked ETH’s annual 4-5% yield. While the Merge is scheduled to happen in a few weeks, Beacon Chain withdrawals won’t be enabled until the scheduled Shanghai network upgrade that is ~6-12 months post-Merge.

Finally, Christensen lays out a timeline for Maker.

Web3 News Roundup

Arbitrum launches Nitro

Arbitrum launched this week its largest network upgrade yet, promising lower fees and higher transaction speeds.

To learn more about Nitro, see this week’s State of the Nation podcast with Arbitrum founders Steven Goldfeder and Harry Kalodner, as well as Ben’s article this week on how to gain exposure to Arbitrum.

Avalanche drama

Anonymous whistleblowers are alleging that Ava Lab founders orchestrated a concerted effort with law firm Roche Freedman to cripple its market competition through class-action lawsuits. You can check out the insidious details of this conspiracy story for yourself, of which Avalanche founder Emin Gün Sirer has vehemently denied.

Coinbase liquid-staking

The largest US crypto exchange is dipping its toes into the lucrative liquid-staking market on the eve of the Merge. Coinbase announced this week cbETH, its staked ETH derivative token.

The move makes sense for Coinbase who already accounts for ~15% of ETH2 Beacon Chain deposits, compared to 31% for Lido and 5% for Rocketpool. Note though that Coinbase’s cbETH staking fee is significantly higher at 25% than its competitors Lido (10%) and Rocketpool (15%).

Hetzner bans crypto mining

The Tornado Cash sanctions have kicked up a flurry of recent conversations on how vulnerable to censorship the second largest blockchain is. It continues this week as cloud hosting provider Hetzner who powers 10% of Ethereum is threatening to ban all crypto mining/staking.

Other news:

Vitalik is launching a book; SudoSwap announces its governance token; Optimism hits all-time-highs on transaction count and gas usage; Facebook and Instagram accelerates NFT integration; Orca Protocol rebrands to Metropolis; Michael Saylor gets sued for tax fraud.

Here’s what we have lined up next week.

- Zooko and Arthur Hayes are joining us on the podcast!

- Ben drops his monthly Token Ratings

- William shows us how to use DeFi with privacy

Until next week.

- Donovan