Dear Bankless Nation,

A few months ago, Fei Protocol and Rari Capital made a multi-billion dollar protocol merger into Tribe DAO.

The merger set precedent for how DeFi protocols could complete one in the future.

With it, the protocol seems to be taking a vertically integrated approach to dominate the DeFi space. Tribe DAO wants to own the whole DeFi stack.

They now have a decentralized stablecoin, an innovative lending market, and a gameplan for onboarding other projects under its wing.

All that’s left is a DEX. 👀

Oh…and they have hundreds of millions of dollars in crypto assets.

This begs one question: Is TRIBE undervalued?

Ben thinks so.

- RSA

Although the price of DeFi tokens has fallen considerably, many protocols have seen their fundamentals improve through entrenched competitive positioning and influence due to controlling a diversified stockpile of assets.

One DAO that fits this bill is Tribe DAO. Born from the blockbuster merger between Fei Protocol and Rari Capital, Tribe DAO represents a new “Protocol Mafia” that is quickly emerging as a DeFi juggernaut.

Sitting on a war chest of more than $600 million, Tribe is in a position to establish itself as a force within DeFi after combining the Fei Protocol’s stablecoin with Rari’s isolated lending markets. Furthermore, with each protocol having withstood a significant test in its early days, such as the FEI post-launch depegging, and the Rari exploit, both have demonstrated their resilience and ability to withstand the brutal rigors of DeFi.

This of course posits the question every investor, ape, and degen has on their mind:

What is a token governing an entity like that worth?

Is TRIBE undervalued?

Let’s find out.

Tribe DAO Overview

Let’s break down each of the four sub-DAOs, and core product offerings, to come out of Tribe DAO.

1. Fei Protocol

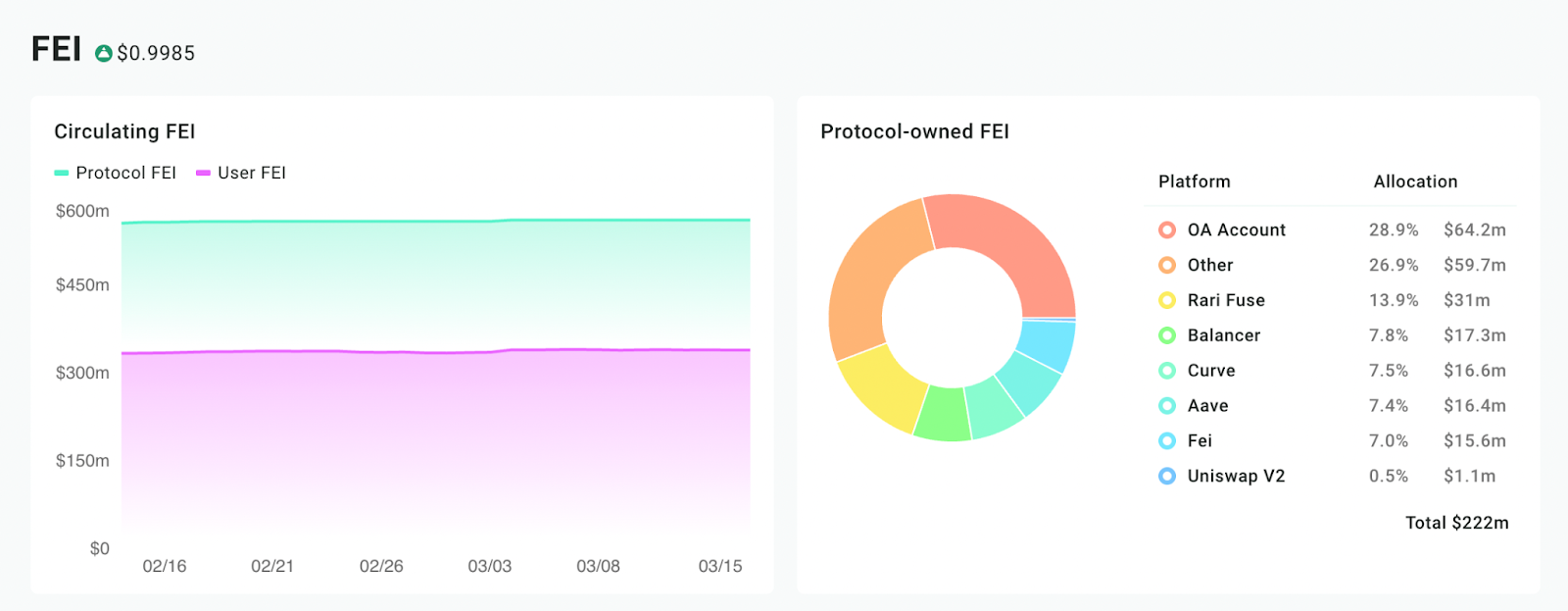

The first project within Tribe DAO is Fei Protocol. It’s the issuer of the FEI stablecoin, the 11th largest stablecoin by market cap, with a supply of more than $558 million.

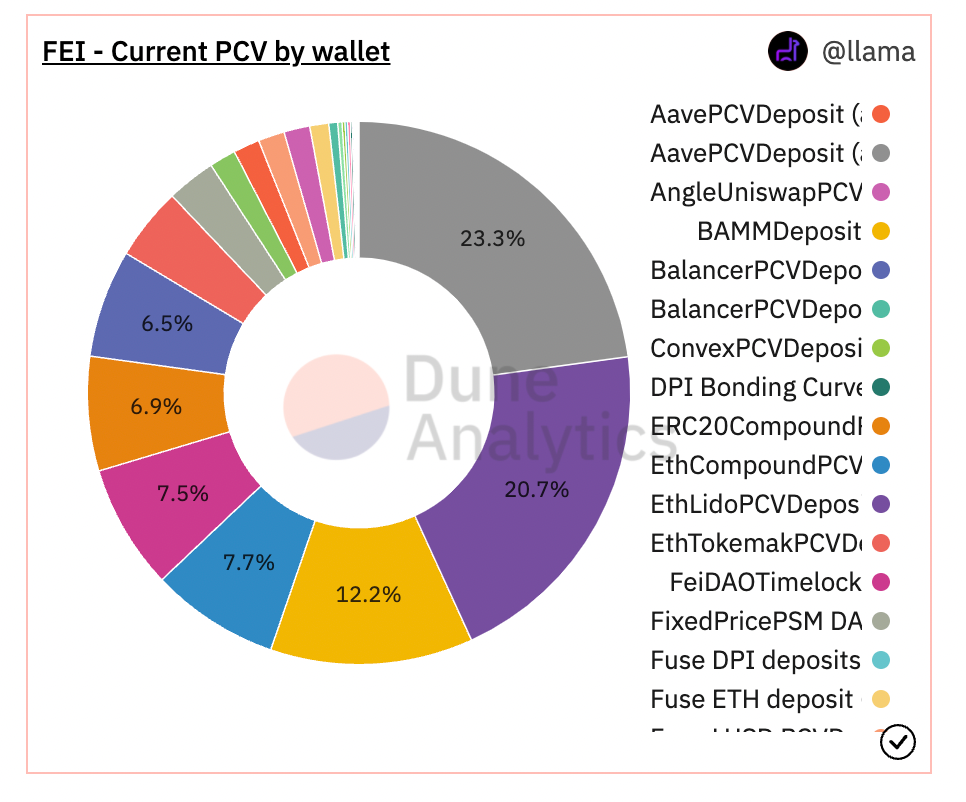

Initially bootstrapped through a genesis event in which they raised $1.3 billion of public market funds, FEI is a dollar-pegged, overcollateralized, stablecoin backed by a stockpile of assets, known as protocol-controlled value (PCV). Fei has deployed its PCV into a variety of different DeFi protocols, such as Lido, Convex, and Fuse in order to generate yield and bootstrap liquidity.

A key characteristic of the PCV is that it is made up entirely of decentralized assets, consisting of a mix of ETH, non-centralized stablecoins, and DeFi governance tokens.

Although it initially used mechanisms such as direct incentives to achieve stability, FEI significantly broke its peg following its launch. This spurred significant changes in the design of Fei, such as leading to the removal of direct incentives and ultimately culminated in the launch of Fei V2.

Fei V2 included several key upgrades, such as 1:1 redeemability between FEI and its underlying collateral, as well as plans to utilize completing Balancer V2 to algorithmically manage the PCV.

An additional service offered by Fei is Liquidity-As-A-Service (LAAS). A partnership with Ondo Finance, LAAS helps DAOs reduce their cost of liquidity by providing them the ability to rent it, as DAO who deposit their native token into Ondo’s LP vaults will see it matched with an equal amount of FEI. Fei earns a fixed fee based on the amount of liquidity provided, while the beneficiary DAO is entitled to all the swap fees and assumes the impermanent loss risk.

2. Rari Capital

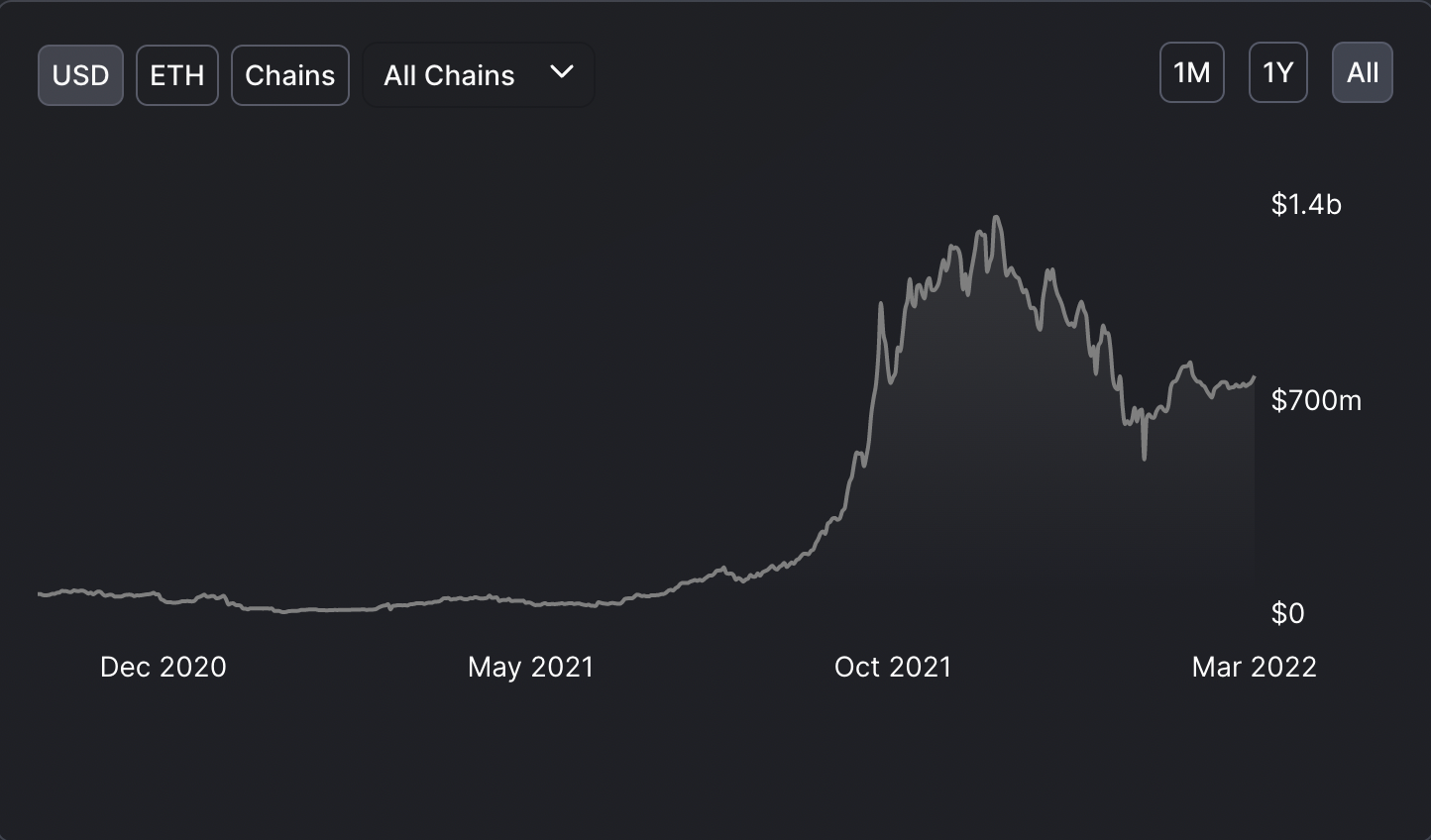

The second major sub-DAO within Tribe is Rari Capital. Rari is most well known for Fuse, which enables anyone to create their own isolated lending market. Fuse is the third largest money market protocol on Ethereum, with more than $789 million in TVL.

Fuse pools are highly customizable and have increased functionality relative to incumbent protocols. For example administrators can alter numerous pool parameters, such as picking their own oracle provider, while DAOs, through the use of a feature known as flywheel, can launch liquidity mining programs from within a Fuse pool, allowing users to borrow against their LP position while simultaneously earning rewards.

🤓 You can learn more about Rari Capital here.

As mentioned earlier, Rari helped spur the creation of Tribe DAO, through the blockbuster merger with Fei. The largest of its kind in DeFi history, the deal was executed by enabling holders of Rari’s native governance token, RGT, to exchange their assets for TRIBE at a rate of approximately 26.7 TRIBE per RGT. Although it was met with initial apprehension among some community members, the merger went through with overwhelming on-chain support.

The synergies of the merger have already begun to demonstrate themselves, as numerous Fuse pools have been seeded with FEI liquidity, while the upcoming launch of Tribe Turbo leverages the capabilities of both Fei and Fuse.

3. Volt Protocol and 4. Midas Capital

Along with Fei and Rari, there are two new protocols that have been recently onboarded into Tribe DAO, with more likely to follow through Tribe Launch, a program designed to onboard new DAOs into the Tribe ecosystem.

The first, Volt Protocol, is developing a stablecoin, VOLT, that tracks increases in CPI. The protocol leverages both FEI and Fuse in its design and issuance mechanisms and will be governed by the VCON token, 25% of whose supply will be owned by the Tribe DAO.

The second, Midas Capital, has the goal of helping scale and deploy Fuse to EVM-compatible chains. Although Fuse has been deployed by the Rari team to Arbitrum, Midas should help Rari take advantage of the emerging market opportunities that lie in the $40 billion+ in TVL living on non-Ethereum L1, EVM-chains.

🚨 Alpha: To learn more about Tribe Turbo and Tribe Launch, watch Joey Santoro’s ETH Denver talk!

TRIBE’s Competitive Advantages

1. PCV Warchest

A major competitive advantage for Tribe DAO is its stockpile of assets through what’s known as Protocol Controlled Value (PCV).

Tribe DAO can deploy its PCV to earn yield, as well as use it to mint FEI, known as protocol-owned FEI (POF).

Like PCV, POF can be deployed in ways that are strategically beneficial to the DAO, such as generating cash flow through earning additional yield and strategically bootstrapping liquidity across different Fuse pools and AMM pools.

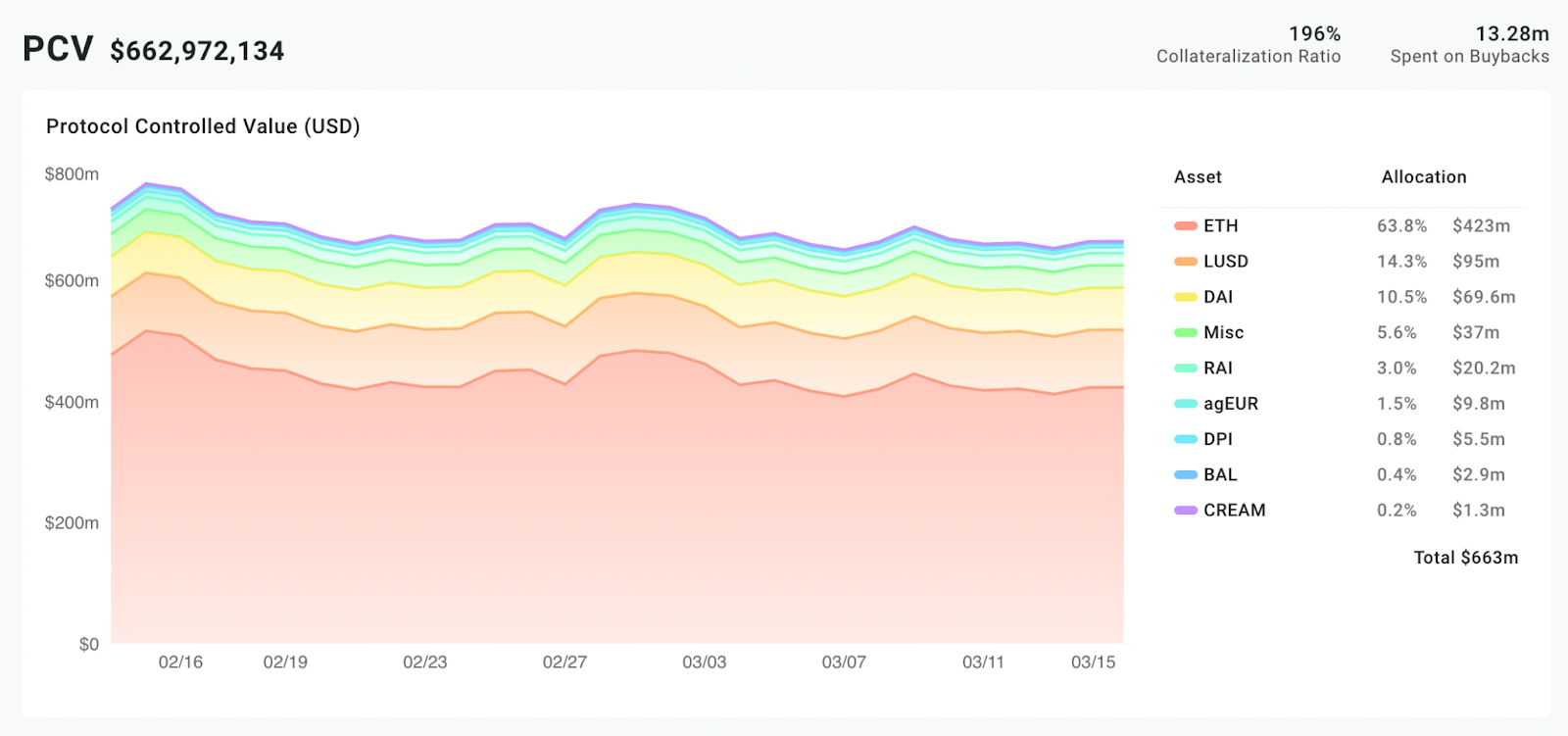

Although it sits below the highs of November 2021, the PCV is currently valued at $662 million.

Diving into its composition, we can see that 93.8% of the PCV is made up of ETH and stable assets. This means that the PCV should be able to retain a healthy portion of its value during bearish market conditions, as seen in the beginning of 2022, allowing the Tribe to be well-capitalized far into the future.

In addition, the heavy weight towards these assets can also boost the PCV’s utility and access to yield opportunities, as the two groups of assets are the most widely integrated throughout DeFi protocols.

This massive and growing war chest should help to position Tribe DAO as a DeFi kingmaker and allow them to exert significant influence over yields and liquidity flows.

2. Vertical Integration

A critical benefit of the Fei-Rari merger was that it helped vertically integrate the Tribe DAO by providing them with both a stablecoin and lending market. These are two of the three major types of protocols, with the third being an AMM, needed for a DAO to control all layers of the DeFi stack.

In essence, “controlling the stack” means a DeFi protocol, or DAO mafia can influence interest rates, liquidity flows and create their own self-sovereign financial system without any dependencies on any third-party protocols. In an increasingly competitive and fast-moving DeFi landscape, this can dramatically increase a DAOs chances of survival over the long run, and drastically improve their competitive positioning.

Although Tribe DAO does not currently own an AMM, they have strong ties to one through their strong ties with Balancer. Along with planning to utilize the DEX to manage PCV, in November 2021 Tribe DAO and Balancer executed a $9 million token swap. This is likely to align both protocols for the foreseeable future, helping to fill the “AMM gap.”

3. Intellectual Capital

Tribe DAO is made up of an incredibly talented team of developers, contributors, and community members.

Both Fei and Rari managed to establish product-market fit before the merger, with the market cap of FEI reaching $756 million, more than double its all-time low reached in July 2021, and the TVL of Rari sitting at $1.16 billion at the time the acquisition was proposed. This demonstrates the strong engineering, business, and community-building skills of both teams.

In addition, given the innovation brought about by both Fei and Fuse, as well as the both teams proven ability to consistently ship new features and products, it seems highly likely that the DAO and community will be able to adapt to the rapid, ever-changing DeFi landscape.

4. Partnerships and Integrations

Both the Fei and Rari teams have demonstrated outstanding business development skills.

More than 20 DAOs have launched, or plan to launch, Fuse Pools, while Fei has partnered with a variety of projects such as Index Coop, Angle Protocol, and as previously mentioned, Balancer.

This demonstrates that the Tribe DAO is highly collaborative and capable of forming strategic and mutually beneficial partnerships within DeFi. Given the increasing value seen in DAO-to-DAO partnerships and one of the core-DeFi value propositions being composability, it seems unlikely that the Tribe will be left in an unfavorable position that isolates them from the rest of the DeFi community and hurts their competitive positioning.

Token Economics

Just as “the stock is not the business” in traditional equity markets, “the token is not the protocol” in crypto markets.

As seen over the course of the past year, many DeFi projects with strong fundamentals have drastically underperformed market indices and benchmarks, due in large part to poor token design.

Let’s take a look at the token economics of TRIBE to see if it can avoid a similar fate.

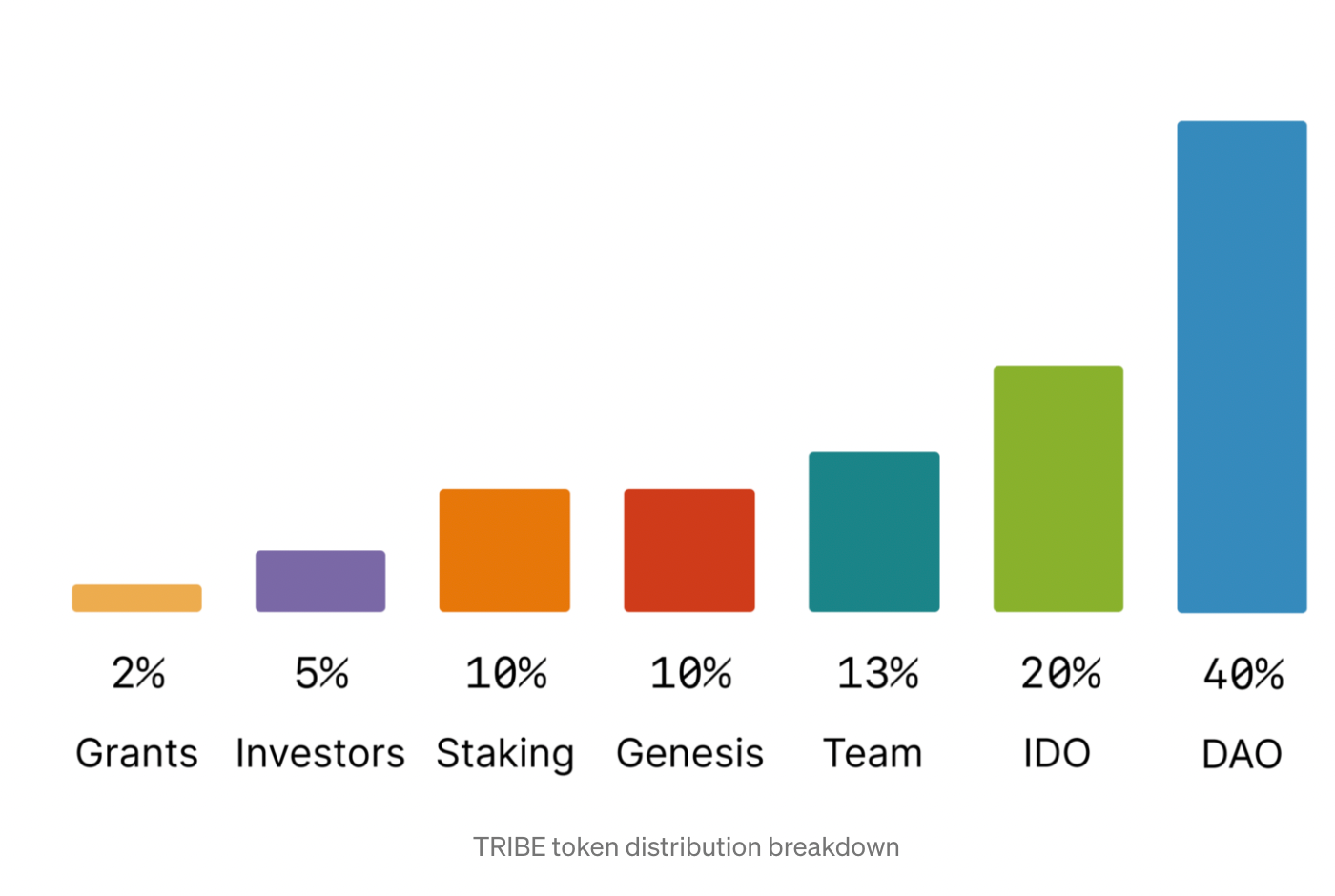

Token Distribution

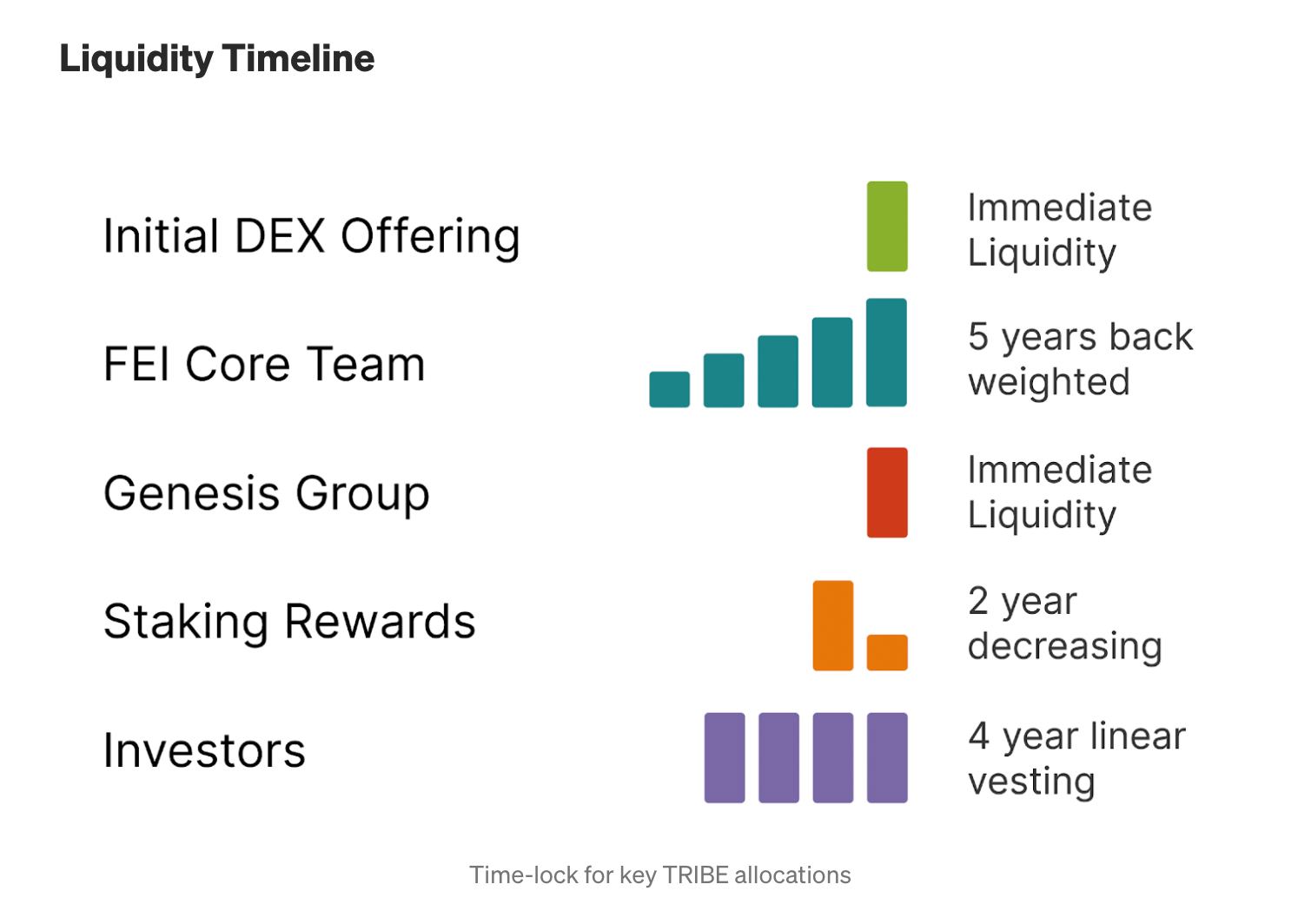

As we can see, the initial allocations for TRIBE are highly distributed, with just 18% going to the team and early investors. The allocation between these two groups is significantly lower than that of many other DeFi protocols, with genesis participants alone receiving a two times greater allocation than private-round investors.

In addition, TRIBE benefits from unusually long vesting periods, with investor and team tokens vesting over four and five years respectively. Furthermore, the team allocation is back-weighted, meaning token holders will have to endure less inflation in the early years of the protocol.

This combination of a more equitable token distribution and prolonged vesting schedules suggests that Tribe DAO is one that is highly long-term oriented, and likely to make decisions with an emphasis on long-run stability and sustainability.

Token Usage

TRIBE plays two key roles within both Tribe DAO and Fei Protocol:

- Governance Rights

- Protocol Backstop

Like most DeFi tokens, TRIBE is utilized for governance within the DAO as a whole, with holders able to vote on a variety of items such as PCV allocations. However, TRIBE also holds meta-governance rights for assets held by the DAO treasury or in the PCV with AAVE, ANGLE, BAL, COMP, CRV, CVX, INDEX, and TOKE making up the tokens in which these rights can be exercised.

Tribe DAO has been one of the DeFi’s meta-governance pioneers, as they famously utilized INDEX meta-governance, to help reach the threshold required to get FEI listed on Aave. Although these tokens make up a small portion of PCV relative to ETH and stable assets, TRIBE’s broad meta-governance rights could prove valuable to DAOs in the future, increasing the attractiveness of the token among that class of buyer.

TRIBE’s second main use is that of protocol backstop for FEI. Similar to the role of MKR within MakerDAO, if FEI were to become undercollateralized, TRIBE would be minted in order to service redemptions from the PCV and re-collateralize the protocol.

Supply and Demand Dynamics

The main demand driver and value-accrual mechanism for TRIBE are buybacks, as 20% of the “protocol equity,” the value of the PCV if all FEI were redeemed for its underlying collateral, is allocated towards weekly purchases of TRIBE which is re-distributed back to the protocol treasury.

Along with helping incentivize growth and responsible management of the PCV, these buybacks should serve as a source of perpetual buy pressure on TRIBE. To date, more than $13.28 million worth of buybacks has been executed.

Although there is the perpetual risk of a major inflationary shock were FEI to be undercollateralized, TRIBE is currently only being emitted through liquidity mining in “FeiRari,” a Fuse pool operated by the Tribe DAO. Although this may place sell pressure on the token as it is harvested by yield farmers, in the long run, due to the size of the PCV, the protocol is well-positioned to avoid a reliance, and perhaps entirely remove emissions.

As it stands today, the tokenomics for TRIBE seem highly favorable for investors, especially in comparison to the rampant inflationary tokenomics seen across DeFi.

Lastly, Fei Protocol co-founder Joey Santoro has teased a proposed tokenomics revamp that could potentially further improve the supply and demand dynamics.

DCF Valuation

Now that we understand Tribe DAO’s offerings, competitive advantages, and token economics, let’s take a look at Tribe DAOs financials and attempt to value it using a discounted cash flow (DCF) model.

There are three primary sources of cash flow for the Tribe DAO:

- Yield on POF earned from allocating FEI across DeFi protocols.

- Yield on PCV from similarly deploying these assets into various DeFi protocols.

- Platform Fees earned from Fuse, which are generated from taking a cut of the spread between interest paid to depositors and lenders.

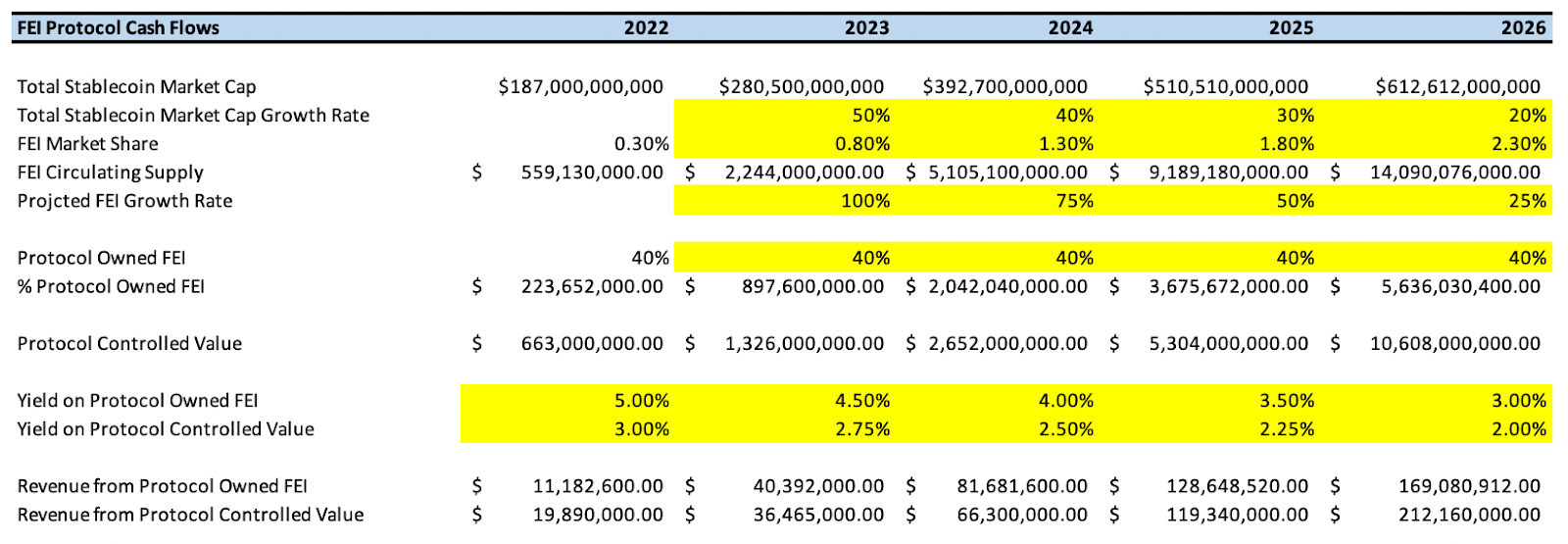

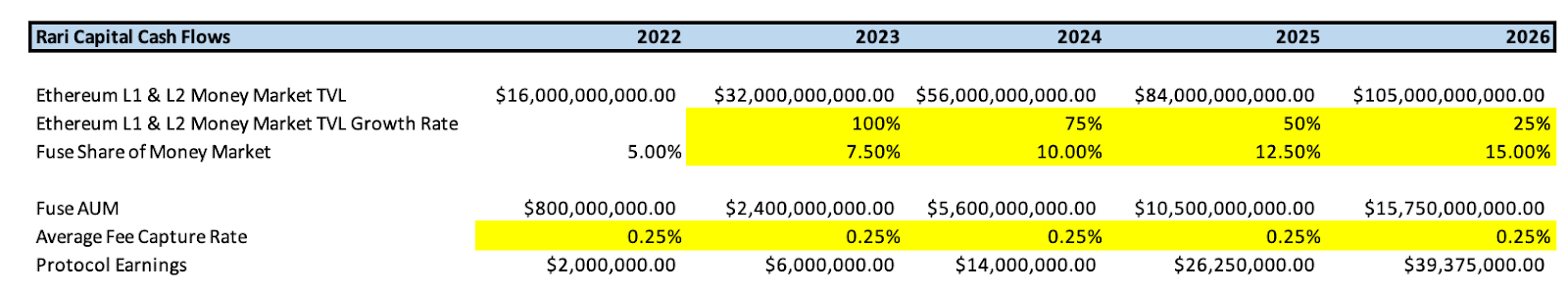

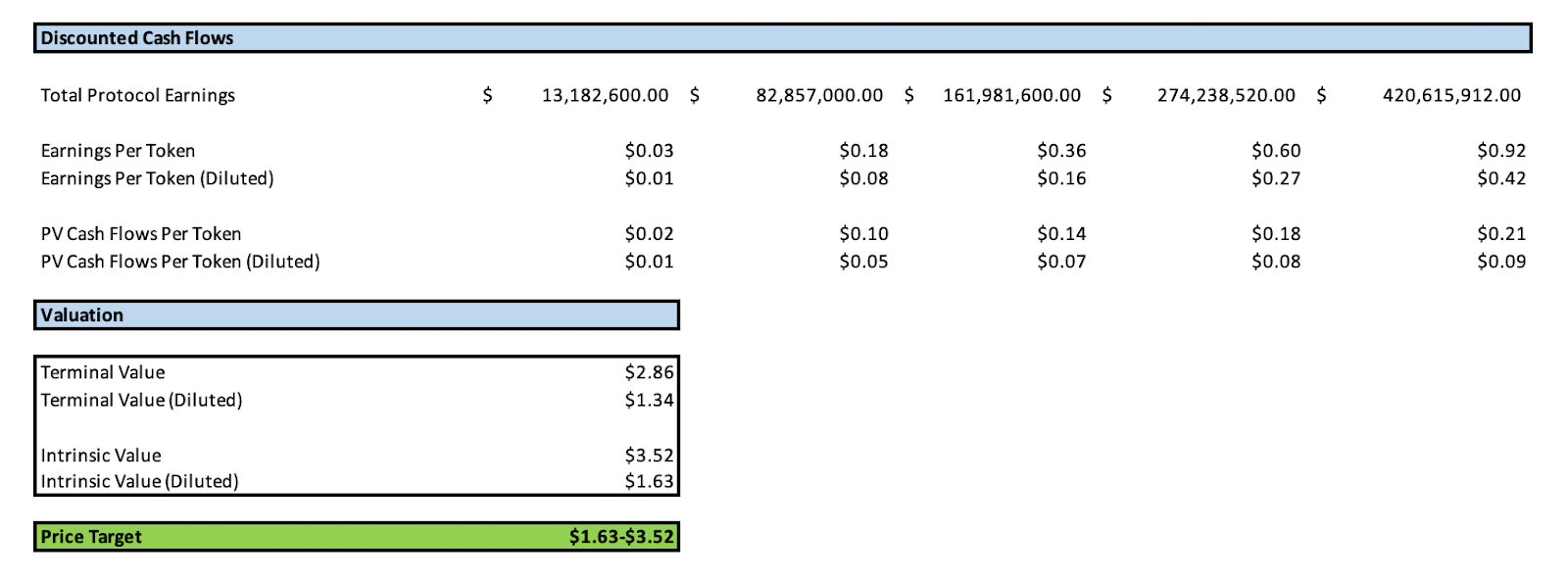

The model attempts to project the growth of both the FEI stablecoin and Fuse as a means of estimating the cash flows generated from each of these three sources.

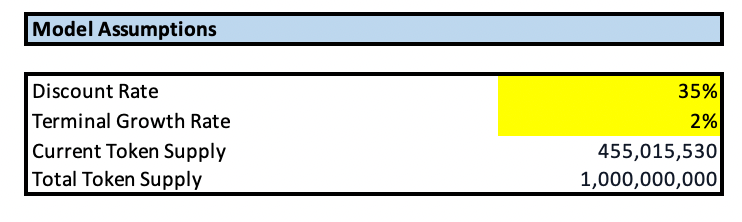

The model uses a discount rate of 35%, a figure in-line with the average range used to value early-stage businesses by venture capitalists, as well as a 2% terminal growth rate that tracks global projected growth.

The model assumes that the stablecoin market will grow 227% over the next five years at increasingly decelerating rates. Given the previously mentioned competitive advantages of which it is the beneficiary, it’s projected that FEI will increasingly grow its market share over the next four years, with the size of the PCV growing proportionally.

The model also projects that through deployments to AMMs, lending markets, and liquid staking services, the DAO will be able to earn an initial 5% yield on protocol-owned FEI, and 3% on PCV, with this yield expected to decrease as the protocol scales.

The model projects that the lending sector across Ethereum Layer 1 and Layer 2s, will grow 556% over the next five years at decelerating annual growth rates. Given its addressable market of all assets within DeFi, Fuse is expected to take an increasingly large market share within the sector (the model does not account for Midas Capital deployments).

Although utilization, and therefore interest earned, varies wildly between pools, the model projects that Rari will earn a 0.25% overall take rate based on AUM.

By summing the total cash flows generated by the two protocols and discounting them back to the present, we calculate that the fair value for TRIBE lies between $1.63-$3.52.

Based on the current price of $0.58, this implies an upside of 207%-564%.

Disclaimer: This model should be viewed as a potential framework for valuing TRIBE, rather than an end-all, be-all proclamation of its value. The model does not take into account the “commodity premium or discount” inherent in a crypto-asset based on its token economics. The model makes several key assumptions with regards to growth of the stablecoin and lending sectors, as well as the Tribe DAOs ability to monetize their POF, PCV, and Fuse. Given the nascency of DeFi and the DAO, both factors are incredibly difficult to project. The numbers listed under ‘2022’ are based on the current figures as of writing.

👉 To play around with the full model, click here.👈

Risks

1. Competition

Competition is incredibly fierce in the stablecoin space, as twenty-four have a market cap greater than $100 million, while nine have a market cap that exceeds $1 billion. Given the massive addressable market of the sector, it’s highly unlikely competition ramps down for the foreseeable future.

Competition is similarly intense within the isolated lending market space, with upstart protocols such as Euler Finance and Silo Finance seeing major interest among investors. Furthermore, the recent launch of Aave V3 includes some isolated lending features, further muddying the competitive waters.

2. PCV Risk

As previously mentioned, Fei’s PCV is deposited across a variety of different protocols. Although the risk is spread across these protocols, if one or more were to be exploited, or if DeFi were to suffer a major systemic event, a substantial portion of PCV could be lost, putting FEI, and the many Fuse pools in which it deposited, at risk of becoming undercollateralized.

3. Emissions

Although there is the continuous presence of buybacks, there are active TRIBE emissions, putting the token in the crosshairs of yield farmers, potentially placing downward pressure on the TRIBE price. In addition, given the back-weighted vesting and potential for significant price appreciation, the back-weighted vesting could pose the risk of large future sales from team and core contributors.

4. Regulatory Concerns

Stablecoin issuers, as well as DeFi as a whole, may face a crackdown from regulators. Although Tribe DAO utilizes fully decentralized, on-chain governance, it still runs the risk of incurring scrutiny among government agencies looking to reign in DeFi.

Conclusion

With two innovative products, a massive PCV warchest, and led by a strong cohort of contributors that continually builds, ships, and makes deals, the Tribe DAO seems poised to be a DeFi mafia that emerges from this bear market as a DeFi superpower.

Although the protocol faces several significant sources of risk, with strong tokenomics (and more changes on the horizon), and a valuation that implies strong potential upside from current prices, investors should not miss the forest for the trees when taking a look at TRIBE.

Action steps

- Evaluate TRIBE for yourself—is it undervalued?

- Play around with the DCF model yourself!