Is PERP Undervalued?

Dear Bankless Nation,

It’s Token Thursday. Ready to dive into PERP? 😍

Every time we write something on DeFi perpetuals we feel compelled to remind you…

Perpetuals are the largest derivatives product in crypto….by far.

So this market is massive.

The question…why aren’t they dominant in DeFi yet?

It seems the market is telling us decentralized derivatives protocols don’t yet stack up. Centralized exchanges (aka crypto banks) are still winning by a wide margin.

But we don’t think that lead will last. We believe DeFi protocols will eventually flippen centralized exchanges on all fronts—derivatives included.

Today Ben dives into one of the DeFi projects leading those efforts right now for perpetuals: Perpetual Protocol.

This incredible analysis answers one key question: is PERP undervalued?

Read on to find out.

- RSA

An Overview Of Perpetual Protocol and PERP

NOTHING IN THIS ARTICLE IS FINANCIAL OR INVESTMENT ADVICE. DO YOUR OWN RESEARCH.

The noise has washed away. A post-crash, range-bound market has led to a dramatic decline in trading volumes, DeFi activity, and social media chatter from its peak in May 2021.

Whether it’s due to bearishness, boredom, or enjoying summer in a reopening world, it feels like people have tuned out of crypto again. 🦀

And even though some people have their eyes off the ball, there’s still a plethora of DeFi protocols with tremendous potential for growth and strong fundamentals. No area is more emblematic of this than the derivatives sector. Despite the notional value of derivatives estimated to be worth a staggering $1 quadrillion in TradFi, it’s been a different story in DeFi (so far).

It’s hard to pinpoint the exact reason—whether it’s inherent complexity, high gas-fees, or other factors, derivatives have yet to truly take off.

But there has been one notable exception to that rule...Perpetual Protocol.

A decentralized exchange for trading perpetual contracts, crypto’s most popular derivatives product, Perpetual Protocol has quickly emerged as the market leader in this category since launching in December 2020.

Is PERP poised to become one of the next bear market gems?

Let’s find out.

Perpetuals 101

Before we dive into the protocol, let's take a moment to go over what perpetuals are.

Perpetual contracts are a type of derivative instrument that are similar to futures. For those who may not know, futures contracts are an agreement between two parties to exchange an asset, or the cash equivalent of that asset, at a predetermined time, known as the expiration date.

👀 Fun Fact: Perpetuals are crypto native, as they were invented by Bitmex!

To initiate a futures contract, both parties will have to post collateral that is held by a counterparty. From there, a trader can gain leveraged exposure to an asset in order to speculate on its price, or hedge their portfolio. This can all be done without having to take custody of the underlying asset itself if the futures contract is cash settled.

Where perpetual swaps differ from traditional futures is that they have no expiration date (hence the name).

This characteristic is a key reason as to why perpetuals have found product market-fit within the crypto ecosystem, as not having to deal with an expiring contract makes them more accessible and easier to manage for retail traders than traditional futures.

However, the lack of an expiration date comes with tradeoffs. With traditional futures, the closer a contract gets to expiring, the more its price will converge upon the spot price of the underlying asset. For perpetuals to be able to keep the price of the derivative as close as possible to that of the underlying asset, market participants must pay what is known as the funding payment.

Funding payments are made at predetermined intervals set by the exchange, such as hourly on FTX and Perpetual Protocol, with the size of the payment known as the funding rate.

🤓 To see how funding rates are calculated on Perpetual Protocol, click here.

Depending on the price of the contract, either longs or shorts will make funding payments to each other. For instance, if the price of the derivative exceeds the value of the underlying asset, to incentivize traders to bring its price down, longs will have to make funding payments to shorts. The opposite holds true if the price trades below the spot value of the underlying asset, where in that case shorts would have to pay longs.

What is Perpetual Protocol?

Now that we understand what perpetuals are, we can dive into the protocol itself.

Perpetual Protocol enables users to trade perpetual contracts with up to 10x leverage entirely on-chain. Transactions are processed on xDai, an EVM-compatible chain, meaning that the protocol can offer lightning fast transaction speeds with minimal gas fees.

In fact, fees on xDai are so low that the protocol subsidizes gas for MetaMask users.

This strategy has allowed Perpetual Protocol to quickly find product-market fit, with trading volumes sitting at around $60M per day, making it the largest derivatives DEX and placing it within the top 10 in the world.

Traditionally, AMMs have only been able to support spot trading (i.e. swapping one token for another). However, Perpetual Protocol enables derivatives trading on an AMM through the use of synthetic assets, or “virtual assets”, which makes both shorting and leverage possible.

How Perpetual Protocol Works

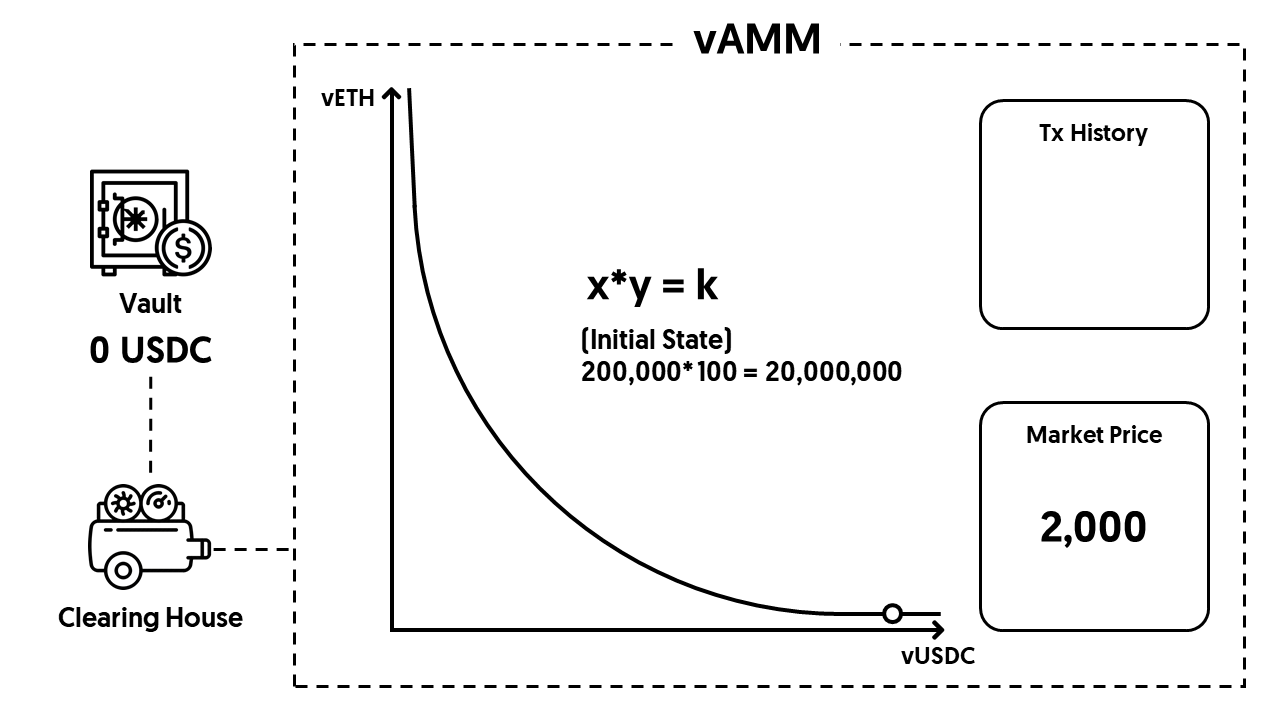

When a market is created on Perpetual Protocol, the developers will manually set the liquidity (the x and y) for it based on past experience. The protocol's liquidity is virtual, as the “x’s and y’s” are just numbers stored inside an AMM, which is why the team has named Perpetual Protocol’s AMM the virtual AMM (vAMM).

Whenever a trader wants to open a position in a market, he needs to send USDC to what's known as the Clearing House. The Clearing House will apply the direction (long or short) and the leverage to the collateral (the USDC), and then use the x*y=k formula inside a vAMM to calculate how much a trader should get in return. In other words, Perpetual Protocol only uses vAMMs to calculate the price of the virtual assets, as opposed to facilitating the exchange of real tokens.

Let’s walk through an example to see how this works.

Let's assume the price of ETH is trading at 2,000 USDC when we launch the ETH perpetual market. The developers can then manually set the x (the number of vUSDC) in the vAMM to 200K and y (the number of vETH) in this vAMM to 100. As previously mentioned, the liquidity inside a vAMM is virtual as in both of the x and y are numbers.

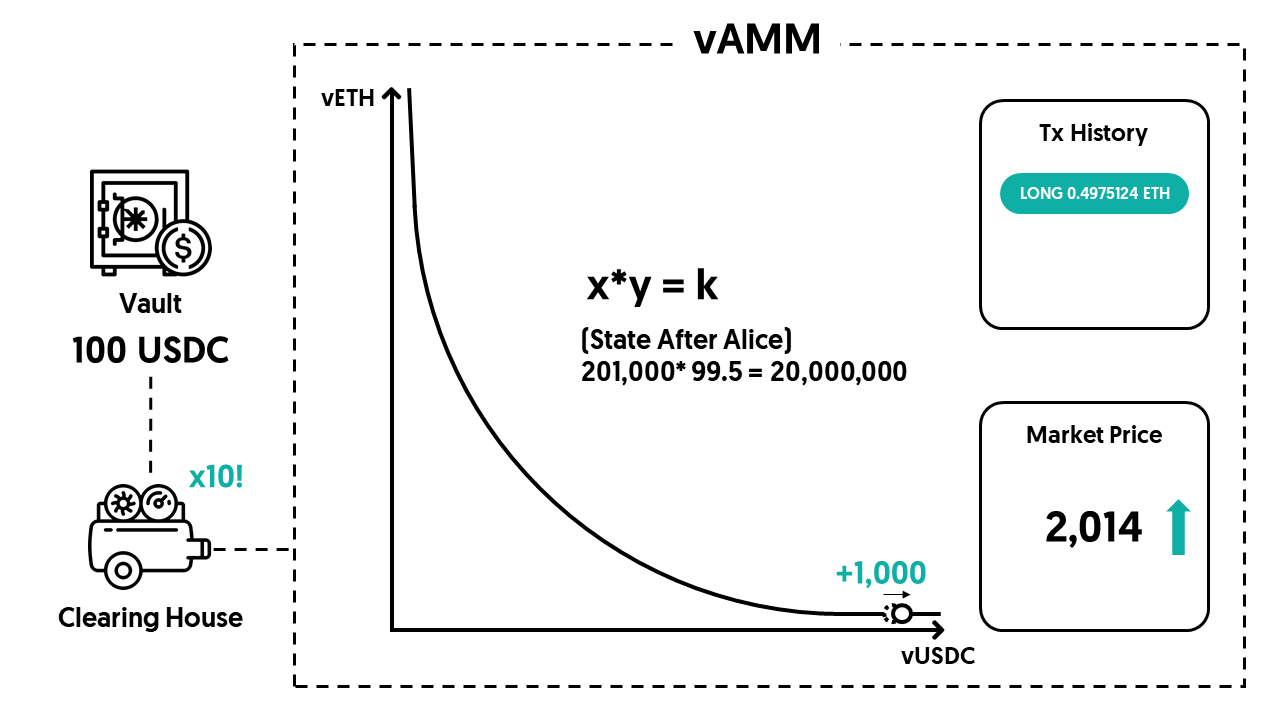

Let’s say a trader named Alice wants to use 100 USDC as collateral to open a 10x long position.

Alice would first deposit 100 USDC to the Vault, a smart contract that stores the real tokens inside the Perpetual Protocol system. Following this, the Clearing House will apply the direction (long) and the leverage (10x) to the collateral, and then use the vAMM to calculate how much the trader can get in return. In Alice’s case, the x increased by 1,000 vUSDC, and y decreased by 0.4975 vETH, so the latter is how much Alice gets in return.

To learn more about what will happen if there are multiple traders, and the math behind each transaction, check out Perpetual Protocols documentation.

🧠 Note: The above explanation only applies to the current version of Perpetual Protocol as the next iteration is still under development. Perpetual Protocol v2 will be on Arbitrum and introduce new features such as multi-collateral, cross-margin, and permissionless market creation. You can check the announcement here.

PERP Token Economics

Now that we understand the Perpetual Protocol, we can dive into its token.

While used for governance, PERP is far from “valueless” or static. Rather, it plays a key role within the Perpetual Protocol ecosystem, and has clear value accrual mechanisms.

Aside from governing, the primary utility of PERP centers around its ability to be staked within the protocol. This turns the token into a productive asset, as holders who stake can earn streams of income in the form of PERP rewards, and in the future, once the protocol enters “Stage 2” of staking, a portion of trading fees generated by the exchange. Despite only paying out token rewards at this time, stakers can still earn a yield that currently sits at 34.3% APR.

Currently, Perpetual Protocol charges a 0.10% fee on every trade made in the vAMM, with 100% of fees going towards an insurance fund that is used as a backstop the protocol in the event that positions become under-collateralized, and bad debt is unable to be liquidated.

Once “Stage 2” goes live, 50% of fees, or 0.05% of volumes, will be distributed to stakers in a dividend type-manner similar to SushiSwap, Curve, or Synthetix. Furthermore, once V2 goes live, PERP holders will be able to earn additional trading fees from user-created “private markets,” as well as lending interest through deploying capital from the insurance fund into low-risk yield strategies.

Supply & Demand Dynamics Of PERP Staking

Diving deeper into the mechanics of staking, we can see that it plays a key role in influencing the supply and demand dynamics of PERP in a way that’s favorable for its price.

For starters, it has taken a considerable portion of supply off the open market, as over 21 million tokens, about 50% of the current circulating supply, is staked. This not only increases the scarcity of PERP, but also can help to blunt sell pressure during periods of market volatility, as holders who wish to un-stake their tokens are forced to wait through a seven day “cooldown period” until their assets become liquid.

We may have seen the efficacy of this mechanism during the May 19th crash, as PERP finished the day down 6.5%, compared to a 31.6% decline in the DeFi Pulse Index (DPI).

In addition, the way in which PERP rewards are distributed is also favorable for its price. As we know, token incentives are a double edged sword: While effective in directing capital to a protocol's desired destination, they can place downward pressure on price, as rewards are often harvested and sold by yield farmers.

Perpetual Protocol helps to mitigate this through vesting. While trading fees paid out to stakers are liquid, token rewards vest over the course of six months.

This can be incredibly effective at reducing sell pressure, as it means fewer tokens are being dumped into the market. For instance, if fee capture was active last week, of the 150,000 PERP distributed to stakers, just 24% was liquid, i.e. able to be instantly sold.

From that, we can see that this rewards structure provides Perpetual Protocol with the best of both worlds in that it can reduce short-term sell pressure on PERP, while still being able to provide an attractive enough opportunity to incentivize stakers. Furthermore, it also encourages long-term holders to stake their tokens, as they likely have less of a need for immediate liquidity on their token rewards compared to mercenary farmers.

Protocol Backstop

Despite providing cash flows and favorable supply and demand dynamics, tokenholders still bear a considerable amount of inflation risk. That’s because like MakerDAO’s MKR, PERP acts as a backstop to protect the solvency of the protocol. Should the insurance fund be depleted, PERP functions as the “token of last resort” in that it will be minted by the protocol to re-collateralize the system.

While this provides an incentive for Perpetual Protocol to continually drive value to the token, such as through the mechanisms above, to keep that backstop as large as possible, it also means that holders run the risk of facing significant dilution should catastrophe strike.

Governance and Community

Having an active and engaged governance process and community is vital to the success of any DeFi project, particularly one in its youth like Perpetual Protocol.

Post-launch, Perpetual Protocol has been very actively managed, with 16 governance proposals having been put to vote on Snapshot since January 2021. On average, about 532,000 tokens have voted per proposal, which accounts for 1.2% of the current circulating supply, and roughly 3.5% of the circulating supply at the time the protocol went live on mainnet.

While it is a problem that plagues DeFi as a whole, this is a low level of turnout.

Furthermore, the level of governance participation among the community has dropped over time, as the first eight proposals garnered about an average of 618,000 votes, while this has declined more than 30% to ~427,000 over the last eight.

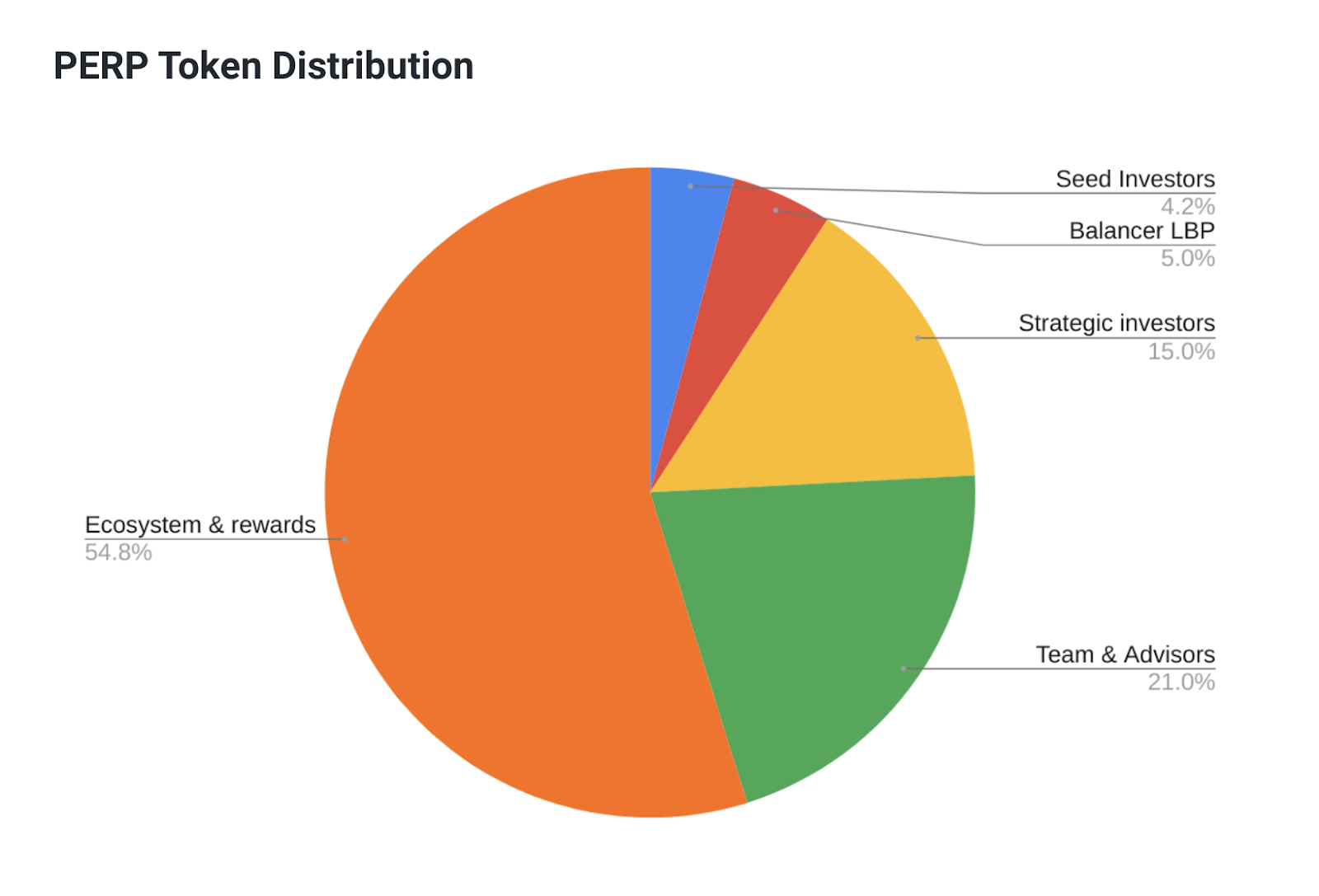

It’s also important to note that governance of the protocol is not yet fully decentralized, as proposals still have to be implemented on-chain by the team. In addition, control over the protocol is also heavily concentrated, as 40.2% of the token supply is controlled by the team and investors. Aside from being a centralizing force, this may pose a regulatory risk to the protocol, particularly as derivatives, such as those offered by Binance, have come under scrutiny in recent weeks.

Despite these concerns, Perpetual Protocol has an incredibly strong ecosystem of stakeholders. The project was backed by a top-tier group of investors, including firms such as Three Arrows Capital, Alameda Research, Multicoin Capital, and CMS Holdings. In addition, the protocol also partnered with Delphi Digital for its token design.

Whether it be through usage of the protocol, partnerships, or general advice, this cohort is likely to be a key factor in helping put the protocol and the community in a strong position to succeed.

On-Chain Valuation Metrics

Perpetual Protocol has plenty of promise: But has it lived up to the hype in practice?

Taking a look at some on-chain metrics, we can see that the protocol has shown strong signs of finding product-market-fit within DeFi.

Volumes and Revenues

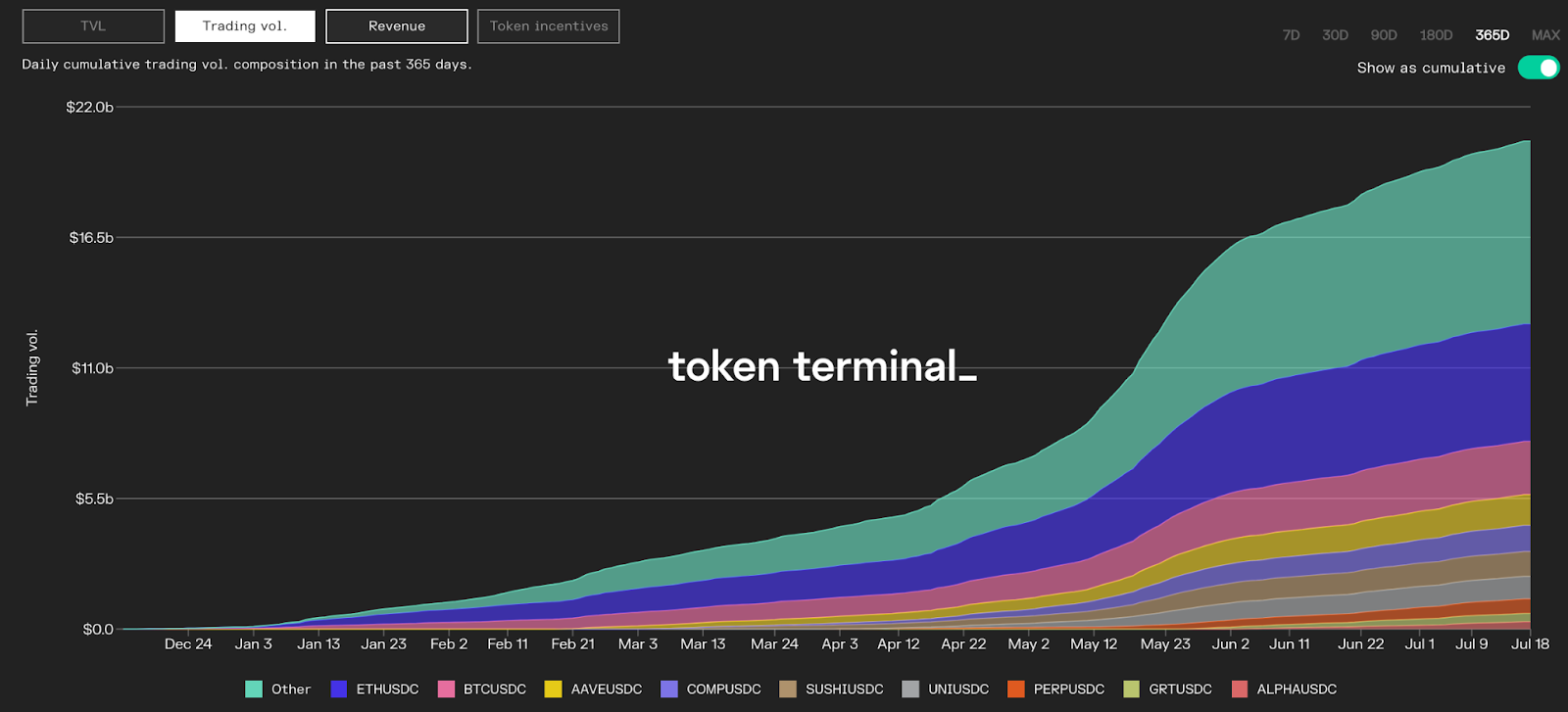

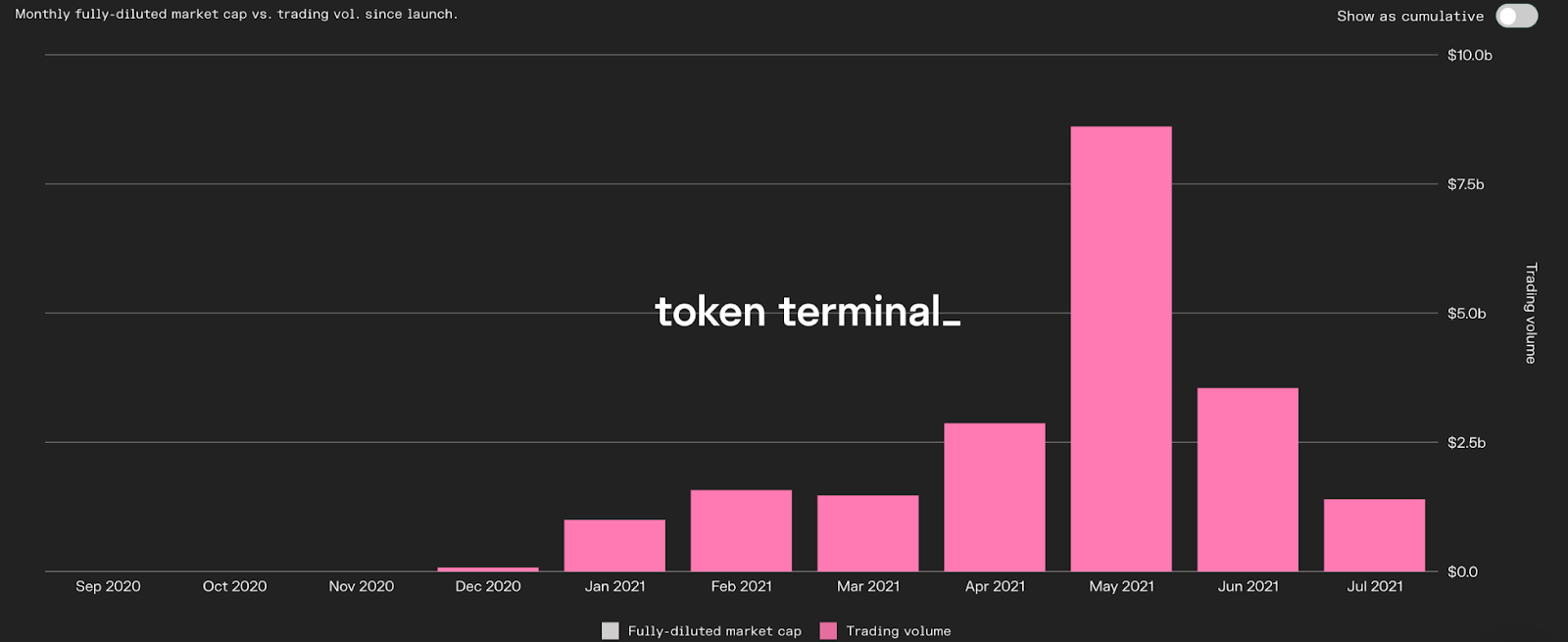

Perpetual Protocol has experienced explosive growth since its launch in December 2021, facilitating over $20.6 billion in cumulative trading volume in roughly eight months.

As revenue corresponds directly to volumes given that the protocol earns a 0.1% fee on every trade, it experienced a similarly meteoric trajectory, with $20.6 million in fees being directed to the insurance fund. Had the 50/50 split been in effect, this would have translated to $10.3 million in earnings for PERP stakers.

Looking into the composition of volumes, we can see that the perpetuals generating the highest amount of fees, and therefore revenue, have been the ETH/USDC, BTC/USDC, and COMP/USDC which have done $4.9 billion, $2.2 billion, and $1.3 billion respectively. Together, the three account for over 40% of the protocol's cumulative volume and revenues.

Perpetual Protocol's growth is even more impressive when considering that it’s managed to facilitate this level of trading activity while requiring minimal levels of liquidity, as it currently holds just $10.1 million in value locked. This indicates that the vAMM model is highly capital efficient, and that fees and revenue are generated from the notional value of the derivatives within the vAMM.

Diving deeper, we can see that monthly volumes grew at an astounding 10,939% rate from $77.9 million in December 2020 to $8.6 billion in May 2021, while the crypto markets were in the midst of a major bull-run and trading activity increased across both CeFi and DeFi, this growth wildly outpaced that of the broader spot DEX market, which rose “just” 523% over that same time-frame.

This far above-average growth is a strong indicator that Perpetual Protocol’s ascent can be attributed to organic demand to use its product, and can not just be attributed to a “rising tide that lifts all boats.”

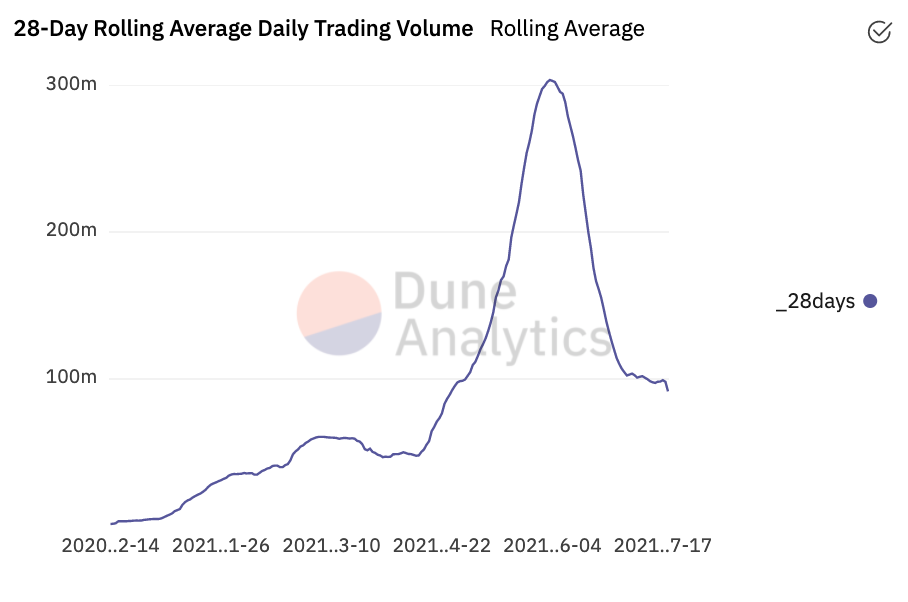

However, the past few months have told a different story, as volumes have decreased dramatically since peaking during the crash of May 19. The 28-day rolling average of daily volume has fallen 69.9% from its high of $303.4 million to $91.4 million, reaching as low as $45 million on some days.

While a drastic descent, it is also in-line with that of the broader market, as overall DEX volumes are on pace to fall over 60% as well between May and July 2021. Although the decline in trading on Perpetual Protocol has not come out of nowhere, it does illustrate that the protocols volumes, and thus revenues, are highly correlated to market and DeFi activity.

Users

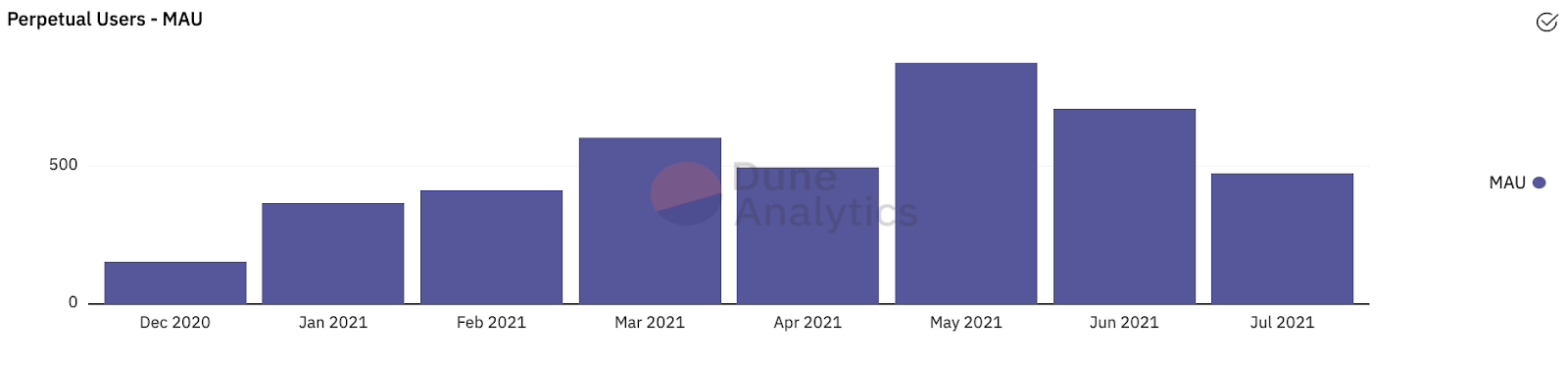

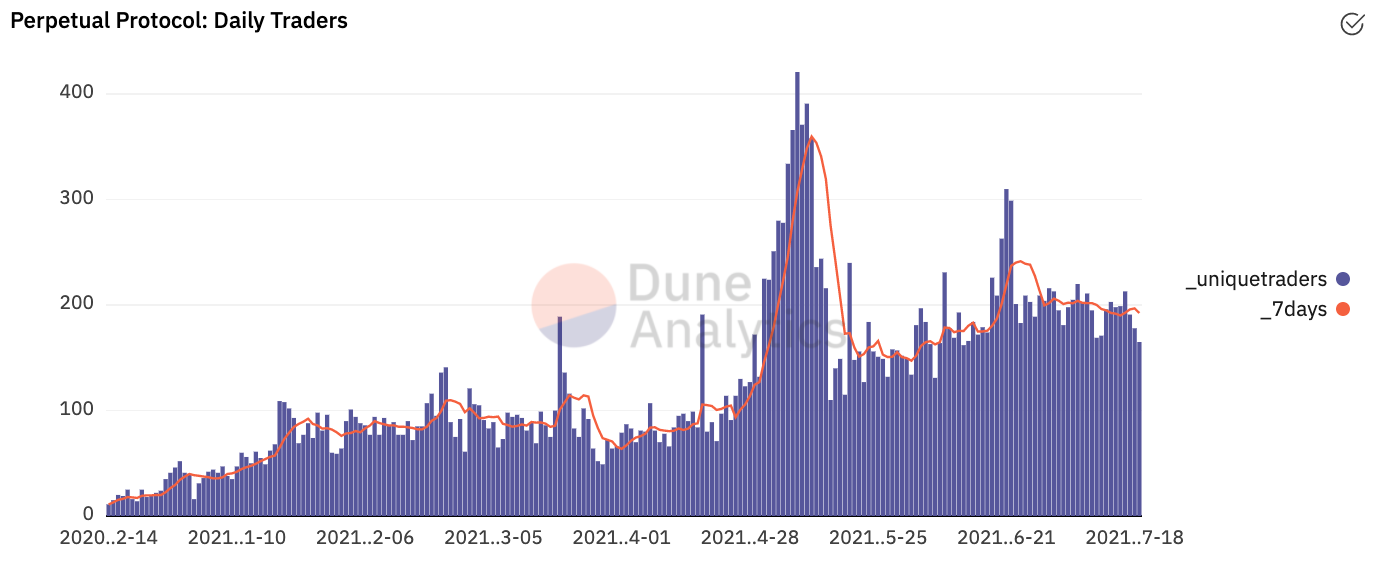

Amid the recent bull run, Perpetual Protocol saw strong user growth. Monthly active users (MAUs) increased dramatically between December 2020 and May 2021, rising 471% from 153 to 874, and over 2200 traders have interacted with the protocol since inception.

This is validation that Perpetual Protocols strategy of leveraging xDai has been a success, as it came during a period that saw other projects' user growth plateau due to high gas-fees on Ethereum L1. In addition, the growth also occurred while the exchange is not currently eligible for use by traders in the United States, likely due to the previously mentioned regulatory concerns.

However, like volumes and fees, user counts have fallen similarly in recent months, with the 7-day moving average of traders declining 47% from 359 to 196.

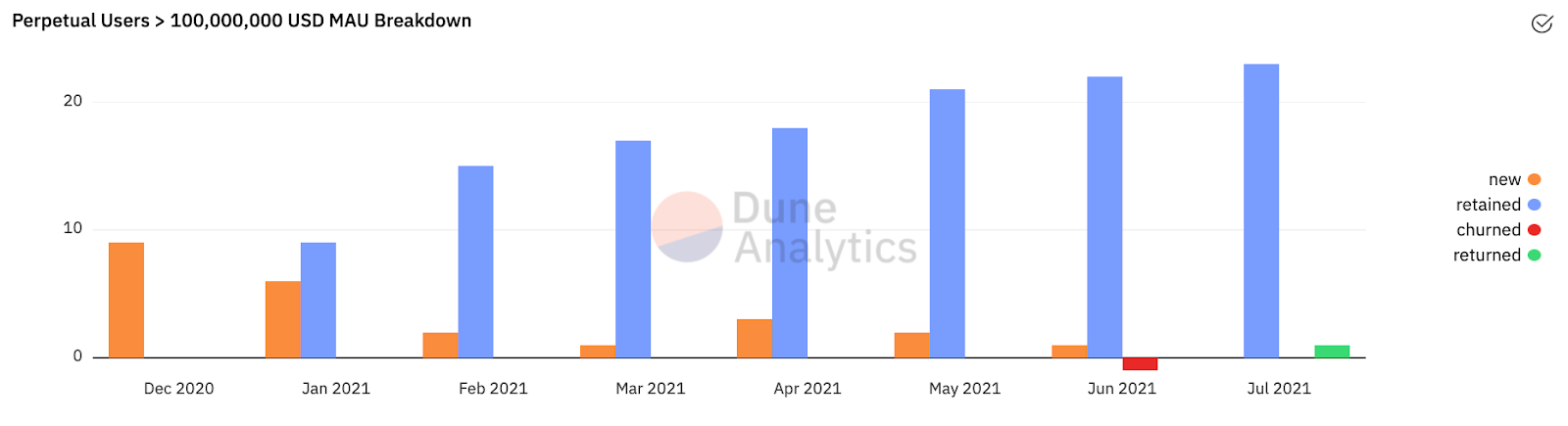

Despite that decline, there are still some encouraging numbers when it comes to user metrics. For starters, Perpetual Protocol has not seen any decline in the amount of whales using the platform, with the count of addresses that have traded over $100 million in volume increasing since the crash from 23 to 24.

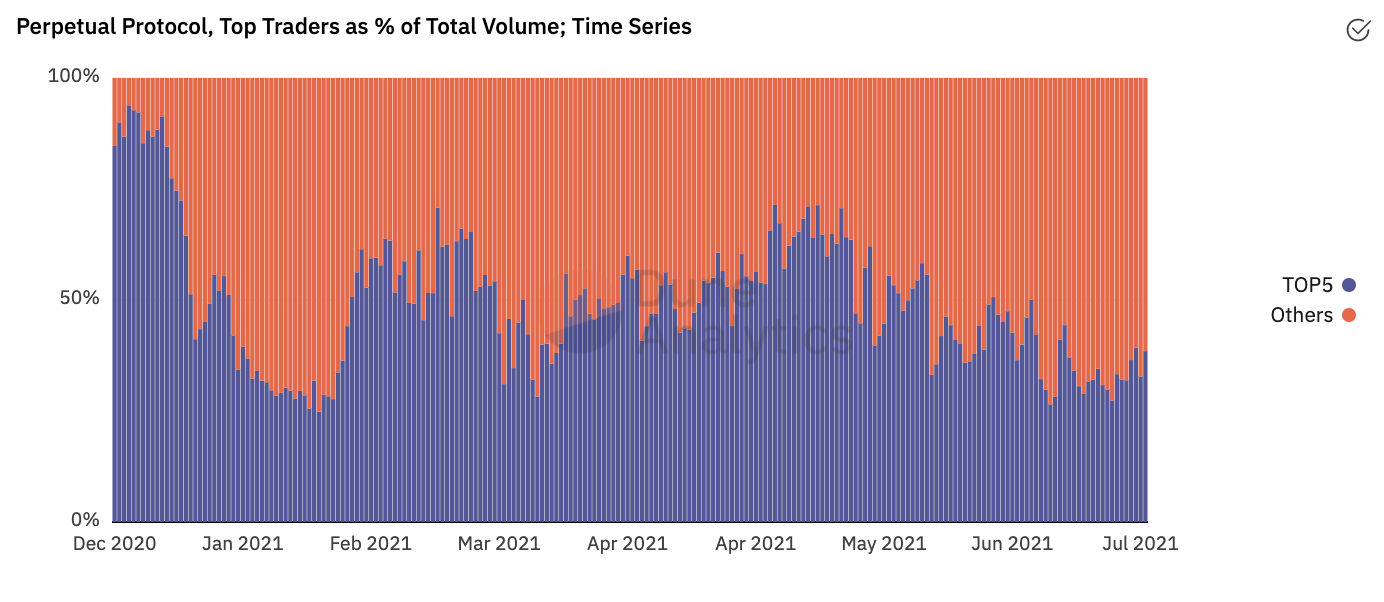

In addition to retaining whales, Perpetual Protocol has also seen less concentration of volume among them, with the top-5 addresses accounting for 38.5% of volume, down considerably from its May peak of 71.4%.

This user-stickiness indicates that the decline in trading volumes, and therefore revenue, is linked more to the general slowdown in market activity in recent months, rather than an organic decrease in demand to use the platform from users.

Market Share

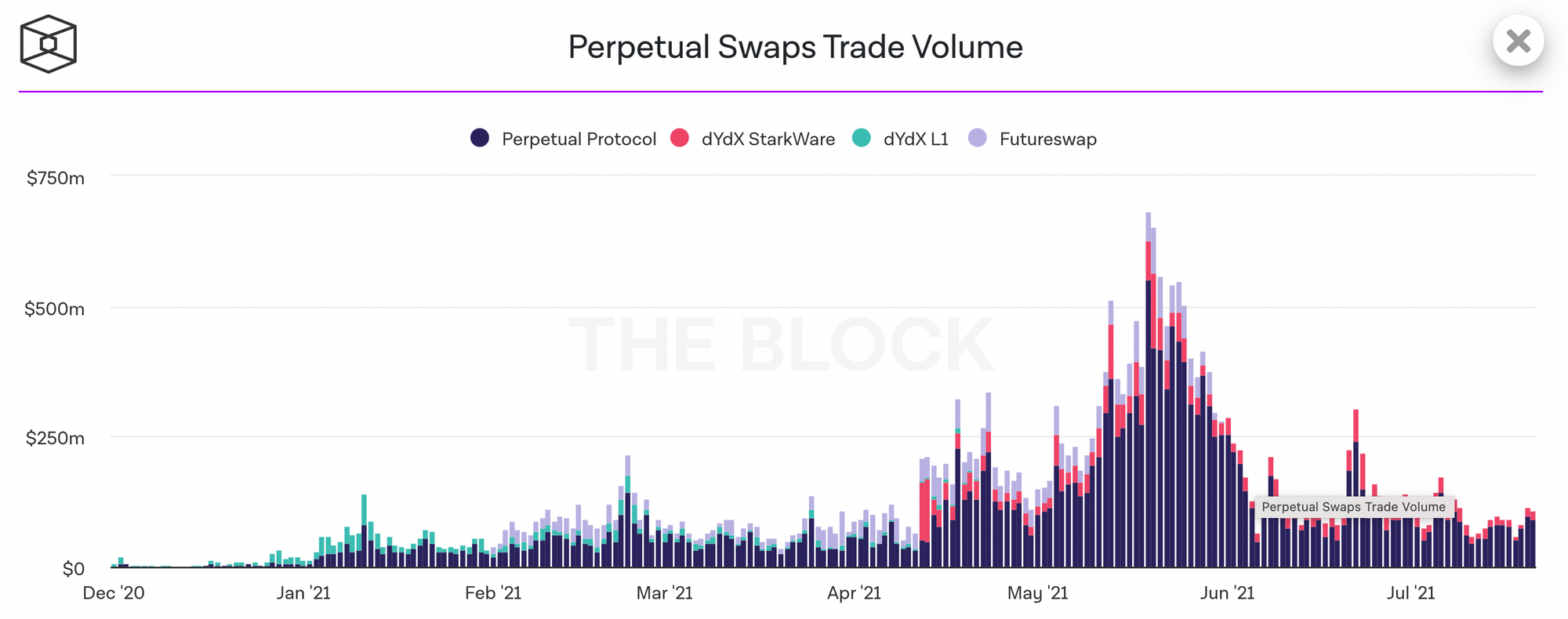

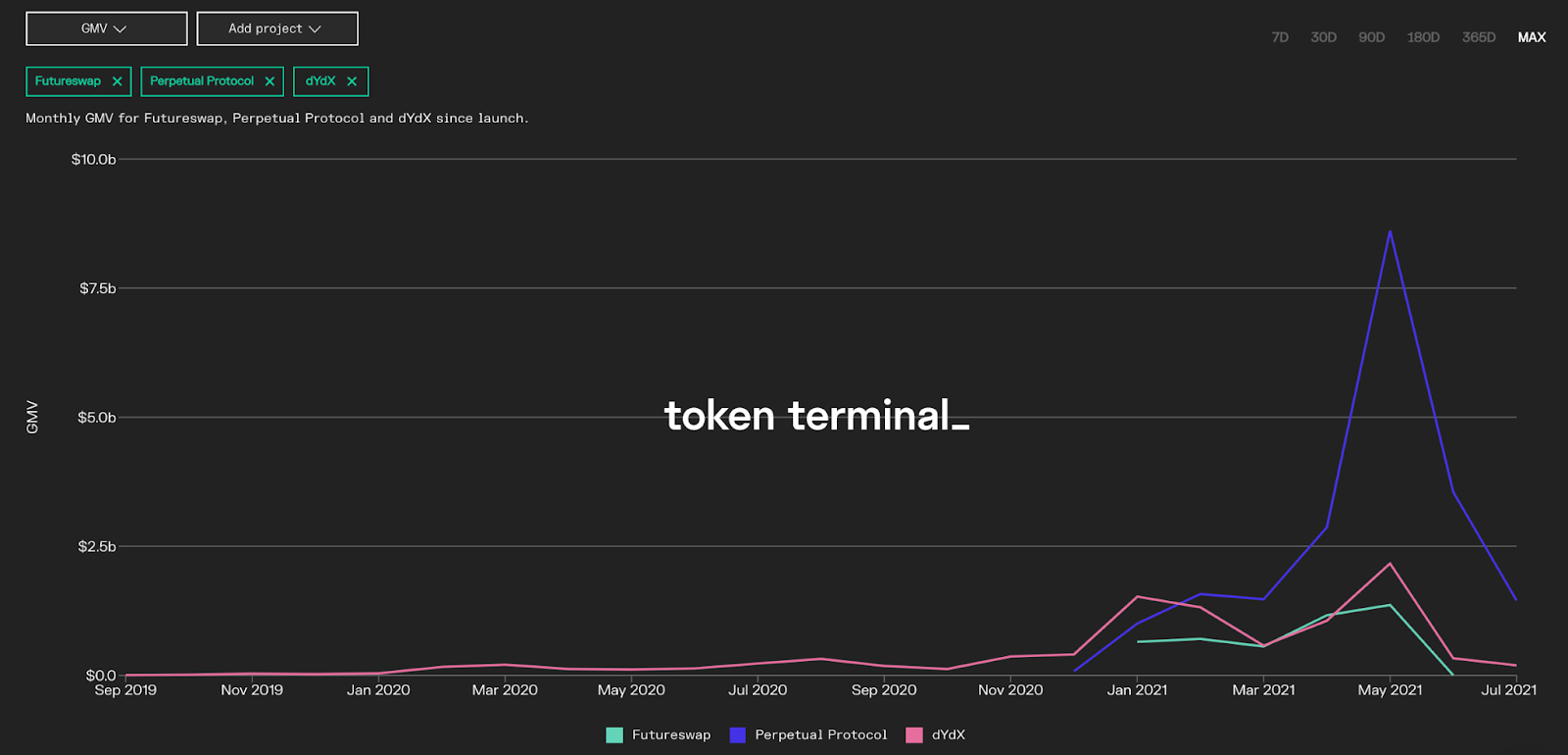

Despite its status as a relatively new protocol, Perpetual Protocol has quickly gained a dominant share over the DeFi perpetuals market.

At the peak of market activity in May 2021, the protocol had 70% share of the $12.2 billion in monthly volumes facilitated between themselves, dYdX, and Futureswap—the two other major DeFi perpetuals exchanges which did 18% and 12% of volume, respectively.

While it's unclear what happened to the data for Futureswap in July of 2021, Perpetual Protocol has managed to widen the gap between themselves and dYdX, doing more than 7x in volumes so far in July 2021, compared to 3.9x in May.

Perpetual Protocol’s increased share over dYdX may be attributable to a few different factors. A primary one may be that gas-free trading has increased accessibility of using the protocol: As we know, gas fees, particularly with computationally intensive derivatives transactions, can price out smaller users.

Despite its early lead, competition from dYdX is not likely to go anywhere. The project has embraced a strategy similar to Perpetual Protocol by leveraging the power of Layer 2 by building their own rollup on Starkware, allowing dYdX to also offer gasless trading.

This, along with a massive $65 million Series B funding round raised in June 2021, means that Perpetual Protocol is likely to face formidable competition for the foreseeable future. Lastly, the ability to overtake dYdX in such a quick-time frame suggests that the DeFi derivatives market is still highly unsettled, and subject to rapid, major shake-ups in the competitive landscape, which Perpetual Protocol may itself fall victim to.

Intrinsic Valuation

Now that we understand Perpetual Protocol, the token economics, and how the project has performed since launch, we can try and determine the intrinsic value of PERP using a Discounted Cash Flow Model (DCF). While growth estimates are very difficult to estimate for a months old project in an incredibly volatile DeFi market, it can help establish a rough estimate as to what the token may be worth.

This model should be taken with a grain of salt, and uses conservative estimates. But by doing some basic projections, we can see that it’s possible PERP is actually highly undervalued.

To play around with the model, as well as relative valuation metrics, yourself, click here

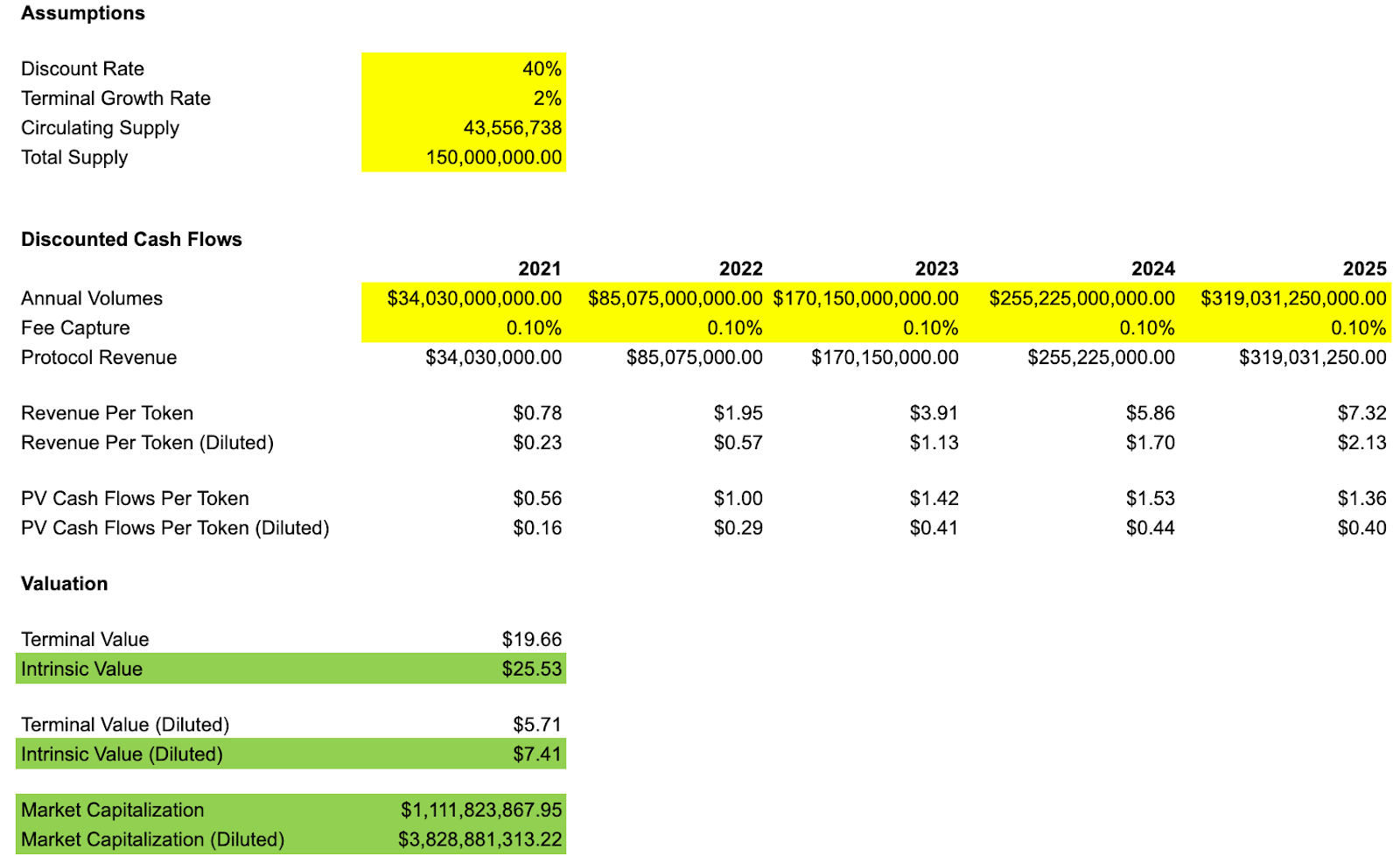

Assumptions

The model assumes that the protocol will maintain its fee capture rate of 0.10%, and that revenue will increase about 9.38x over five years, but at a decelerating rate. (The number for 2021 was taken from annualized revenue based on the past 30-days).

It should be noted that due to the reflexivity in DeFi and cyclicality of crypto, there is a good chance growth decreases in some years, but rapidly increases in others. However, it is very hard to project when that will occur, so we will assume volumes increase each year, but at a slower rate.

While this may seem aggressive, growth like this is not unprecedented. It could wind up being conservative, as DEX volumes have grown more than 30x since June 2020, while centralized exchange volumes grew over 40x between June 2017 and June 2021.

To reflect the high level of returns that investors require to match the massive risk that they take on by investing in an early-stage DeFi protocol, a discount rate of 40% was chosen which is within the range used by venture capitalists. In addition, a terminal growth rate of 2%, a figure in-line with that of traditional global GDP growth, was also chosen.

Valuation

As we can see, by these parameters PERP has an intrinsic value of $25.53 per token, with a valuation (FDV) of $1.11 billion. Given that token trades at a price of $6.29, and a market-cap of $273 million, this suggests it could have 305% upside if it traded to its estimated intrinsic value.

Again, this model is for illustrative purposes only, it is NOT an end all, be all. There are major assumptions made. That being said, it does show that Perpetual Protocol may be highly undervalued relative to its long-run growth potential.

Relative Valuation

Now that we have a basis for PERP’s intrinsic valuation, let’s see how it’s valued relative to its peers. Because dYdX does not currently have a token (but soon?), and Futureswap does not have available data beyond June 2021, we’ll compare it to other decentralized exchanges with similar fee-capture models.

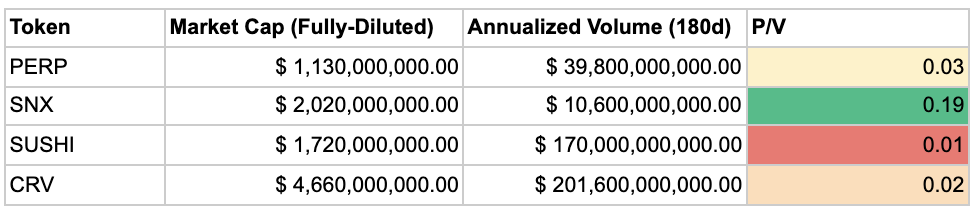

Price-Volume (PV)

For any decentralized exchange, volumes are the key fundamental metric to look at. If there’s no volume, there’s no revenue. And if there’s no protocol revenue, well…

As we can see, Perpetual Protocol trades closely in line with SushiSwap and Curve, while Synthetix trades at a significant premium. This suggests that either Synthetix is overvalued, or the market may not view Perpetual Protocol, and the others, as having as strong an ability to maintain or increase their current level of fee capture.

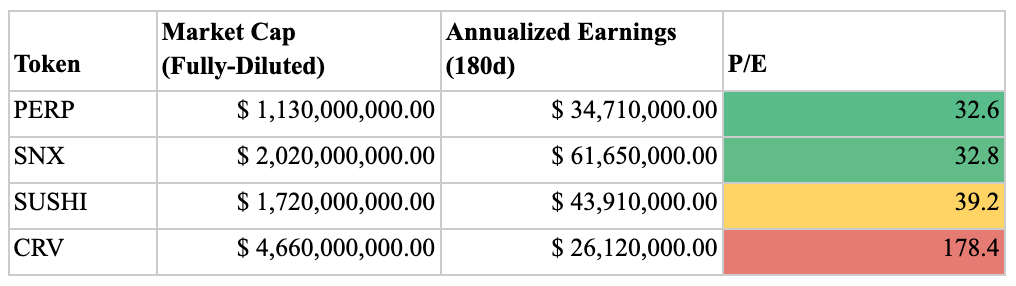

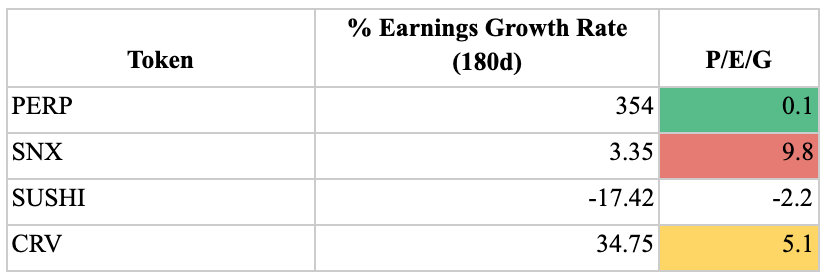

Price-Earnings (PE) and Price-Earnings-Growth (PEG)

While Perpetual Protocol does not stand-out as undervalued on a P/S basis, the story is a bit different when looking at Price-Earnings (P/E).

As we can see, the protocol is trading at the cheapest multiple relative to its peers, valued inline with fellow derivatives exchange Synthetix, while trading slightly below SushiSwap and significantly below Curve. While a low P/E could mean that PERP is a bargain, it can also be a sign that the market does not view its competitive positioning or growth prospects as favorably.

However, a closer look does suggest that PERP may be genuinely undervalued compared to its peers.

That’s because relative to its growth, PERP is trading at a tremendous discount. We can see this by looking at the Price-Earnings-Growth (PEG) ratio, which is calculated by dividing an asset's PE by its earnings growth rate. Perpetual Protocol has a PEG of 0.1, meaning that despite having a growth rate more than 10x that of its closest peer, Curve, investors are paying 51x less per unit of growth for the former than they are for the latter.

This is not to say Curve is overvalued, but instead it may indicate that the market is significantly discounting Perpetual Protocols incredible growth.

Risk Factors

Any crypto-asset, particularly DeFi tokens, carry tremendous amounts of risk. Let’s reiterate the major ones specific to Perpetual Protocol that we have touched on throughout the piece.

1. Under-collateralization & Smart Contract Risk

The solvency of the Perpetual Protocol system is dependent on under-collateralized positions being able to be liquidated. While the insurance fund and the ability to mint PERP are mechanisms used to backstop the protocol, the possibility always exists that not all bad debt is able to be liquidated.

And of course, there is always the risk of a catastrophic smart contract bug or exploit that results in the loss of user funds.

2. Slowdown In Crypto Trading and DeFi Activity

Perpetual Protocol’s revenues are entirely dependent on trading volume, which means a decrease in trading and DeFi activity would lead to a decline in them.

3. Centralized Governance and Token Supply

As we know, a substantial portion of Perpetual Protocol’s token supply is held by the team and investors. This poses a major risk in that governance could potentially be controlled by a few entities. In addition, governance is not yet fully decentralized.

4. Regulatory Concerns

As previously mentioned, Perpetual Protocol is not available to users in the United States because of regulatory concerns. Pressure from governments have ratcheted up across all different areas and stakeholders within the industry, whether it be miners, stablecoin issuers, exchanges, or lending platforms.

5. Fast Moving DeFi Derivatives Landscape

DeFi evolves at an incredible pace, and the competitive landscape is constantly shifting. Particularly with the derivatives landscape being so nascent, it’s possible a competitor or new entrant takes share in the market as quickly as Perpetual Protocol did.

6. Crypto Bear Market

Crypto prices have fallen drastically over the past few months. Were the market to decline further, PERP, as a small-cap token, could see declines far greater than the market average.

Conclusion

Not everything is perfect with Perpetual Protocol: The project is still young, and in an unsettled sector of DeFi. Governance is still also highly centralized and the protocol has struggled with low voter turnout.

That being said, Perpetual Protocol seems to be an incredibly promising project. The protocol has an innovative design, strong token economics and value accrual mechanisms, explosive growth that indicates product-market fit, dominant competitive positioning in a growing vertical, and a potentially undervalued token. Importantly, it has the numbers to back all of this up.

Could PERP emerge from a potential bear market as a future DeFi blue chip?

Up to you to decide.

Thank you to Weiting Chen and Lucas Campbell for their help with this piece!

Disclosure: The author does not hold PERP and has no affiliation to Perpetual Protocol.

Action steps

Research Perpetual Protocol

Level up on more Bankless resources on perpetuals