Inside Chainlink's new CryptoPunk oracle 🔗

Dear Bankless Nation,

What if you could easily lend and get credit against your CryptoPunk without selling it?

And what if decentralized oracle network Chainlink built ‘Punk price feeds, so the aforementioned lending process could be permissionless and trustless?

Here, cue in JPEG’d: a new Chainlink-powered NFT lending protocol that’s aiming to bridge the gap between DeFi and NFTs!

First JPEG’d is setting its sights on CryptoPunks, but Chainlink’s on-chain oracle for ‘Punks floor can be replicated and expanded to other NFT projects, so this will be a big thread to watch going forward.

Let’s see what the interesting meld’s all about in today’s Metaversal 👇

-WMP

First, what is JPEG’d?

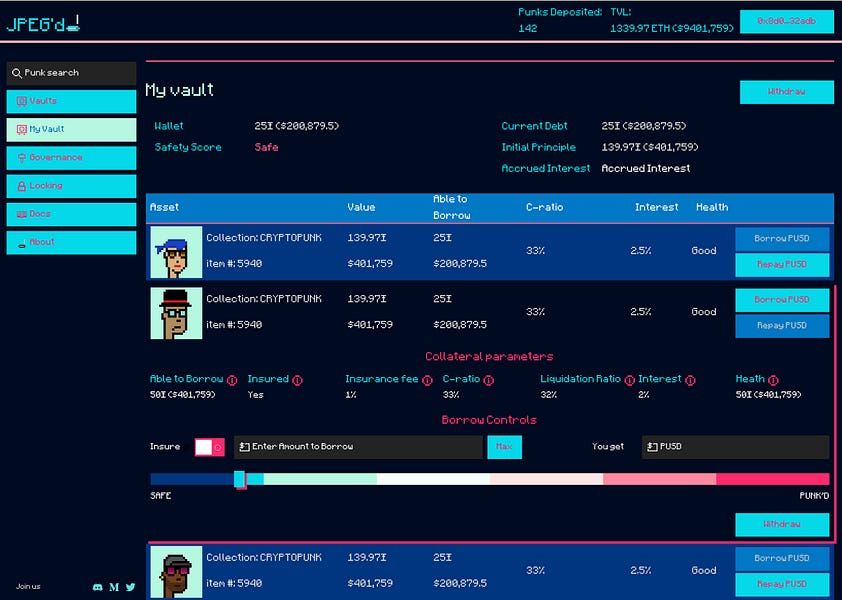

This weekend a group of anonymous builders introduced JPEG’d, an NFT lending protocol, to the world. Their proposed mission? To provide a new DeFi primitive called non-fungible debt positions, or NFDPs, for the cryptoeconomy.

In this way, you can think about JPEG’d as akin to MakerDAO but for NFTs. Instead of opening up a collateralized debt position (or Maker Vault as they’re called now) with ETH or ERC-20 collateral to draw out stablecoin loans, JPEG’d users will be able to do so with NFTs starting first with CryptoPunks.

As the JPEG’d team explained in their announcement post:

“Users will deposit their Cryptopunks into a smart contract and be able to mint a synthetic stablecoin, PUSd, effectively giving them liquidity on their punks and able to earn yield in DeFi. This transforms cryptopunks from static investments, into yield-earning products. The protocol will be managed by a governance token, JPEG, that will oversee, administer, and change parameters to the protocol.”

Enter the Oracle

The Chainlink oracle network, that is.

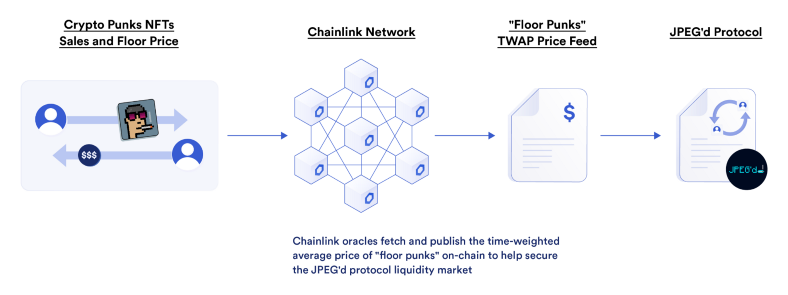

The JPEG’d devs already confirmed last week that Chainlink was building a “custom price oracle” to track the CryptoPunks floor in ETH, so we knew a unique price feed was on the way. Now we’ve gotten a better look at how it’ll work thanks to a new post published by JPEG’d today. In short:

Zooming in a bit, here’s how the process will work:

- CryptoPunks secondary sales take place, upon which ‘Punks floor prices (the lowest-priced Punks at any given time) continuously fluctuate.

- Chainlink’s custom-built oracle will track “both sales and floor prices to create a blended price that will be used to value floor ‘Punks.” The ensuing valuations are Time-Weighted Average Prices, or TWAPs.

- The oracle will also aim to disregard all outliers, e.g. rare CryptoPunk sales, wash trades, etc. Accordingly, it will play a foundational role in ensuring the JPEG’d ‘Punks marketplace stays solvent and in facilitating liquidations as needed.

The big picture takeaway? This JPEG’d + Chainlink collab points the way to a future where many NFT collections will be securely priced on-chain and thus be more readily usable as DeFi collateral 🧠

“We believe Chainlink will set the standard for on-chain NFT pricing,” as a JPEG’d spokesperson told Metaversal today.

What’s next?

Like I mentioned previously, JPEG’d is starting but not ending with CryptoPunks. The protocol’s builders plan to expand to other popular NFT projects like Art Blocks, Bored Ape Yacht Club, and beyond in the months ahead.

As such, each of these integrations will require bespoke decentralized price feeds too, so Chainlink has the opportunity to keep doing one of the things it does best: making smart contracts smarter at the increasingly teeming crossroads of DeFi and NFTs!

Action steps

- 📰 Read “Introducing JPEG’d: DeFi Meets NFTs” by JPEG’d

- 💸 Read “How to get a loan on your NFT” by Bankless

- 💎 Read “How to value NFTs” by Bankless