Dear Bankless Nation,

There’s no denying that NFTs have blown up.

Beeple sold his collection for $69M on a Christie’s auction.

An Alien CryptoPunk sold for $7.2M.

Fewocious broke new sales records on Super Rare.

And all of this was just last week. Pretty wild.

You’re probably asking: “how are NFTs getting these valuations??”

That’s a great question. Unlike DeFi tokens, NFTs don’t have on-chain cash flows (yet). There’s no P/E ratios or DCF models you can apply to them.

But there are things you can keep an eye out for—subjective and objective traits that make can make one NFT more valuable than another. (We discussed this yesterday with Andrew Steinwold).

Today, William walks us through seven traits that drive the value of an NFT.

- RSA

Guest Writer: William M. Peaster, lead writer of Bankless’s NFT publication Metaversal.

How to value NFTs

More people are learning about and collecting NFTs than ever before. But is there a way you can accurately value these unique digital assets so you can build and manage your NFT collection like a pro?

This tactic will help you answer this exact question. We’ll outline a range of different approaches you can take to NFT valuations and how you can use them to your advantage.

Let’s get into it.

- Goal: Learn how to gauge the value of NFTs

- Skill: Easy/Intermediate

- Effort: 10 mins - 1 hour starting out

- ROI: Considerable if you capably apply NFT valuation skills during your NFT buys/sells

Ways to value NFTs

There are subjective and objective dimensions to valuing NFTs.

One person might think their low-trait CryptoPunk they claimed for free back in 2017 is priceless. However, collectors on NFT marketplaces like OpenSea and Rarible routinely trade these kinds of basic Punks and in turn, continuously ensure objective floor prices naturally develop.

Such fluctuating price floors can objectively tell us that a given group of NFTs are worth at least this much currently.

For example, the CryptoPunks price floor is ~19 ETH at the time of writing, so if you list a CryptoPunk for around this price, there’s a decent chance it’ll sell quickly because many buyers track the most affordable possibilities.

When it comes to objective valuations, you also have to consider rare traits when applicable (like how Axies with Mystic parts are prized in Axie Infinity), as well as projects whose primary sale prices are hard-coded.

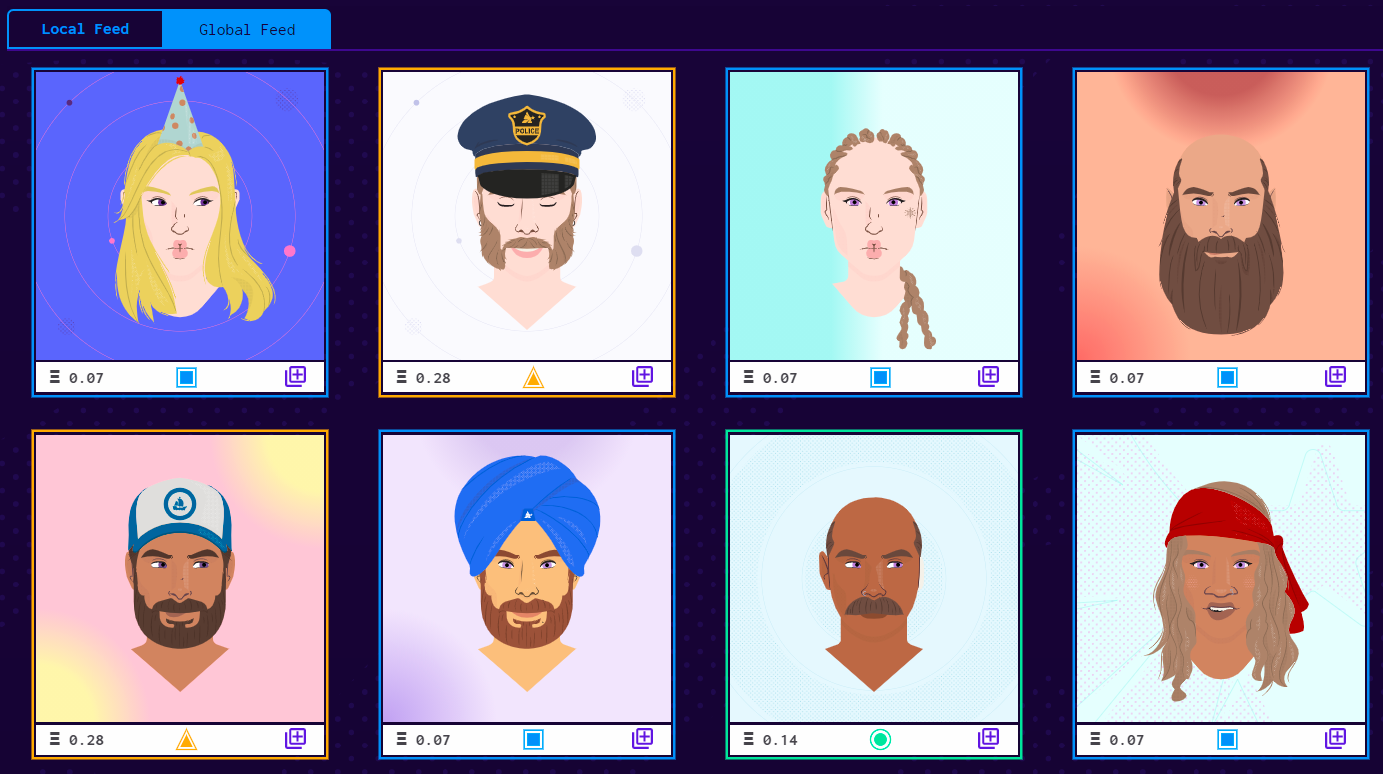

Examples here include EulerBeats-like bonding curve or how a Common Avastar is always initially 0.07 ETH, an Uncommon Avastar is always initially 0.14 ETH, and so on.

There’s also the time dimension that’s key to scrutinize.

In other words, what was this NFT worth in the past? What is it worth today, and what could it be worth years into the future? How has it’s value changed over time, rapidly or in spurts and with booms and busts? Digging into these questions is a great way to get a better handle on any NFT’s valuation.

Lastly, there’s an analytic dimension to valuing NFTs that brings together subjectivity, objectivity, and time. What I mean is being able to consider these other dimensions simultaneously and then analyzing and estimating a conservative, neutral, and aggressive valuation for an NFT on a rolling basis. This gives you a framework to approach and understand the implications of all the ‘ifs’, like what if this asset’s market heats up, or what if it cools down, or what if it stays flat?

Let’s say you have a CrypoKitties Founder Cat (among the first 100 CryptoKitties created), and you want to conclude how it might fare over the next year.

If the NFT bull market continues over the coming months, your aggressive analysis is likely that your Kitty can easily fetch dozens of ETH, while your conservative analysis is probably that you can at least fetch whatever the Founder Cat floor price is if an NFT bear market breaks out and you want to sell. In the meantime, you’re holding the Kitty and analyzing its valuation somewhere at the nexus of its many possibilities.

Yet this is all just the bird’s-eye view of how people approach understanding NFT valuations.

The best way to accurately value an NFT is to weigh the reigning market conditions against that NFT’s fundamental, objective elements. What are its parts? How is it built? What can it do?

Let’s walk through the most important of these elements, value-additive factors below.

7 Traits that Drive NFT Value

1. Chain security

The entire point of NFTs is that they’re immutable and guaranteed digital assets—as long as their underlying blockchain infrastructure stays immutable and guaranteed, that is!

As such, Ethereum is the reigning NFT network in no small part thanks to the fact that it’s easily the most secure smart contract platform running today, and that dominance is poised to continue for the foreseeable future.

In other words, the chain an NFT is minted on contributes to, and secures, it’s value over time. This is why NFTs minted on Ethereum are currently more valuable than NFTs minted elsewhere. They’re simply more secure.

Key Questions on Chain Security:

- Is the host chain secure?

- Is it sufficiently decentralized?

2. On-chainness

NFTs minted totally on-chain, like Avastars, Aavegotchis, and Art Blocks drops, only rely on their respective Ethereum smart contracts to exist. This means they’ll be around for as long as Ethereum exists, which will probably be a very long time.

On the flip side, some NFT projects opt for ease and flexibility by making their NFTs rely on external, off-chain providers like AWS. This introduces a dimension of trust, so you have to hope that the project will stick around and keep their servers running.

Otherwise, you might effectively have a blank NFT within a few years.

Accordingly, the more on-chain an NFT is, the more raw self-evident value it has — it proves itself and can prove itself at any time.

Key Questions for On-chain vs. Off-chain:

- Where is this NFT hosted?

- Is this NFT fully on-chain (meaning it will last perpetually into the future)?

3. Age

NFTs can also gain value depending on when they were minted. For example, NFTs started really heating up in 2020/2021, so NFTs that precede this era are already starting to take on the status of digital artifacts, i.e. the earliest objects in a cultural revolution.

Things are still so early around NFTs, though, that I don’t think this age factor is settled at all yet. In the end, it might be that any NFTs minted before 2030 or whatever take on special meaning. We’ll see.

In the meantime, the earliest NFT projects are already commanding impressive valuations (e.g. CryptoPunks). Many collectors have rallied around the fact that these NFTs are from 2017, the prehistory of the medium.

So like wine, always keep age in mind!

Key Questions on Age:

- When was the NFT minted?

- Is there any historical relevance to this NFT?

4. Creator & community

If a person with no following and no history of creating drops an NFT on OpenSea and doesn’t announce it, will it sell? Surely not without further efforts!

That’s why an NFT published by a major artist or creator gives it value. It’s imbued with the magic of the issuer’s digital fingerprint—exactly like an autograph. Importantly, having engaged communities creates demand.

Naturally, the more popular the creator, the bigger the community, the more valuable the NFT is — and this dynamic is basically true for any market.

Key Questions on the Creator & Community:

- Does the creator have a following on socials like Twitter and Instagram?

- Do they interact with their fans often?

- Do you think the creator could grow their brand in the future?

5. Scarcity

In the NFT ecosystem, we’ve seen creators release NFTs as 1 of 1s or multi-editions like 1 of 10s, 1 of 50s, 1 of 100s, etc.

Obviously, the 1 of 1s are hyper-scarce, so they’re more valuable on a foundational level than pieces that have been diluted with multiple editions. However, this doesn’t mean multi-editions can’t be valuable—we’ve seen them go for thousands of dollars as well!

Platforms like SuperRare only support 1 of 1 editions, so if you’re shopping for rare 1 of 1 NFTs, you’ll have guarantees that there’s only one artist authentic piece in circulation!

Key Questions on Edition Scarcity:

- How many pieces were minted?

- Will the artist maintain their social contract and not mint more of these?

6. Release Pace

Has a creator minted 1,000 1 of 1 NFTs across the span of a year, or just 12?

What I mean is that figuring out the production pace of a given kind of NFT is key to understanding its value.

A project that offers unlimited mints of an NFT at 0.01 is generally not as enticing as buying an NFT from an artist who’s committed to minting only 25 NFTs ever. Naturally, prominent artists that only release a select few pieces every year tend to sell for higher than similar-caliber aritsts that release pieces multiple times a week.

However, there are unique occasions like how Beeple sold his entire collection—5,000 pieces where he created 1 every day for over 13 years—for nearly $70M. It took over a decade of persistent work to build up that valuation though!

Key Questions on Release Pace:

- At what pace is this artist minting new pieces (daily, weekly, monthly, annually, etc.)?

- How many pieces have they minted?

7. Richness (e.g. Audio)

We’re starting to see more and more visual NFTs minted with accompanying audio. This dynamic offers users a richer artistic experience than just a plain old NFT. Who doesn’t like music playing while their NFT goes on that oddly satisfying loop?

With that in mind, audio can boost an NFT’s value in being sensually additive—especially if the audio is done in collaboration with major artists.

Expect to see visual-audio melds become more of an artistic norm going forward via NFTs, accordingly.

Key Questions on Audio:

- Does the NFT have audio?

- Who worked on the audio for this piece?

Bonus: Project-Specific Rarity

Some NFT projects, like CryptoPunks and Axie Infinity, have their NFTs centered around a varying assortments of traits. For CryptoPunks, alien and ape punks are some of the most valuable compared to the standard punk. Similarly, Mystic Axies are the rarest (and often most valuable) Axies on the market.

The rarer its traits, the more likely an NFT will fetch a significant profit in NFT marketplaces.

So if you ever see a big NFT sale and you’re confused about it, dig into the underlying traits — their rarity will likely give you a better idea of why the sale happened!

Conclusion

There aren’t necessarily right or wrong answers when it comes to valuing NFTs, though there are certainly a lot of dynamics consider if you’re trying to do so.

Your best bet is taking a holistic approach, understanding all the aspects of projects, before pulling any triggers.

For example, the NFT ecosystem just rediscovered the MoonCats project, which was released right after CryptoPunks—but it went dark after 2017. Now hundreds of folks have minted MoonCats and are trying to value them on OpenSea.

The truth?

We’re all still figuring out how to accurately value them, and there’s certainly no right answer yet. And we’ll value them differently now than we do in 1, 3, or 10 years.

But applying the fundamentals: Is this on-chain? Is this reputable? Does the artist have a community? Are their unique traits?

These are basic questions that you need to ask yourself when looking to buy an NFT. Take everything you know about the NFT and put it into use—that’s the trick.

You have to tackle valuing an NFT from multiple angles. But if you can, you’re way ahead of the curve.

Action steps

- Explore NFTs on the market and evaluate them based on the above tips

- Subscribe to Metaversal to stay up to date on all things NFTs.