How Transaction Ordering Can Save Humanity

Dear Bankless Nation,

I’ve been going through Dan Carlin’s The Destroyer of Worlds podcast recently. It tells the story of how humanity gained world ending atomic technology and how since gaining it, has almost ended itself about half a dozen times.

Sobering.

The button for thermonuclear war was almost pressed…not by willing leaders of nations…but by unwilling leaders with no alternative—forced to destroy every person they’ve ever known. This is the unseen power of Moloch.

Moloch, the destroyer of worlds.

How can we win?

David’s been exploring that question recently. This is the continuation.

And there is hope.

Strap in.

- RSA

P.S. We hosted an AMA with Felix Feng, Founder of Set Protocol today! Watch here.

How transaction ordering can save humanity

These 6 subjects, when appropriately stitched together, can save humanity:

1. Mempool

The Ethereum Memory Pool, where unconfirmed transactions live.

2. Frontrunning

Bots that look at the Mempool, and see if there’s any arbitrage available from the to-be-included transaction.

3. MEV

Miner Extractable Value: The total amount of value able to be extracted from the specific ordering of transactions in a block. This value ultimately ends up in the hands of the miners.

4. Optimism & MEVA

Optimism is an L2 Rollups scaling solution, which formally separates the role of transaction ordering and transaction inclusion in the L2 chain. The right to order transactions is auctioned to the public in a ‘MEVA’, or Miner Extractable Value Auction.

5. Public Goods

In economics, a public good is a good that is both non-excludable and non-rivalrous, in that individuals cannot be excluded from use or could benefit from without paying for it, and where use by one individual does not reduce availability to others or the good can be used simultaneously by more than one person.

Importantly, Public Goods suffer from the Free-Rider problem, which is how Public Goods deteriorate into Common Goods by unmetered usage. Think: the depletion of a stream by agriculture farms, or the reduction in air quality by polluters. Free-Riders exhaust public goods, because they’re not incentivized or compelled to pay for the maintenance of Public Goods. No one wants to bear the financial burden of sustaining Public Goods, we all want someone else to maintain them.

6. The Great Filter

The Great Filter Theory arises from the Fermi Paradox, which arises from the Drake Equation.

Drake Equation: An equation that attempts to estimate the probability of intelligent extraterrestrial life. Using all reasonable parameters as inputs to the equation, the Drake Equation predicts that there is probably life out there.

The Fermi Paradox: The Drake Equation predicts the probability of life in our observable Universe, but for some reason we haven’t found any. Why not? Where are all the aliens? Are we really alone in this Universe?

The Great Filter Theory is the idea that some filter exists that prevents life from progressing from lifeless matter to a space-faring intergalactic species observable to our eyes on Earth. During the development of civilization, a species naturally runs into the Great Filter, and the civilization cannot pass through it.

I contend the most likely ‘Filter’ out there is the repeated emergence of Moloch, stomping the advances of civilization by incentivizing defection from the group at all possible instances.

But before we get there, let’s expand on 1-6:

Mempool

A ‘mempool’, or Memory Pool, is a pool of transactions that haven’t been included into their respective blockchain. When you are watching your transaction pending on Etherscan, your transaction is in Ethereums’s mempool.

When you make a transaction on Ethereum, before it’s formally included in the chain by miners (validators, in PoS), you broadcast it to an Ethereum node. This Ethereum node broadcasts it to its peers, and through this process, all Ethereum nodes are aware of your signed transaction.

Rational miners prioritize the transactions with the highest fee paid, as this is how they maximize their profits. Obviously, it makes sense to include those who are willing to pay more first.

Frontrunning

Frontrunning isn’t specific to crypto; it’s an activity as old as markets. However in Ethereum, the act of ‘frontrunning’ has never been more clear, concrete, and objective than in previous instances of markets.

It comes in all shapes and sizes, but the general pattern is that someone (usually someone more sophisticated and capable) sees someone else broadcast a transaction to the Ethereum Mempool that clearly makes them a profit.

Any rational actor who sees this is incentivized to execute this same exact transaction, but with a slightly higher gas fee. Miners will include this new transaction instead of the previous one, in order to take the extra fee the frontrunner offered. The frontrunner pockets the arbitrage, the miner receives a slightly higher fee, and the original transactor receives nothing.

MEV

MEV stands for Miner Extractable Value. It is completely derived from the logical combination of what you get when you combine Miners and Frontrunners together.

Frontrunners scan the Mempool in order find transactions attempting to score arbitrage on Ethereum. Then, they pay miners a little bit more for the same transaction to pocket the arbitrage themselves.

But what happens when two or many frontrunners discover a transaction that has arbitrage value? In these cases, frontrunners keep bidding higher and higher gas fees in order to claim the transaction for themselves. A rational frontrunner will bid a gas fee amount that is up to the value of the arbitrage itself, because any rational frontrunner will pay $9,999 in gas for $10,000 in rewards, pocketing themselves a risk-free $1.

When many Front-runners try and claim a transaction, ultimately the miners win. They’re the ones that get to pocket the value of the arbitrage.

This is what we call Miner Extractable Value.

This value comes out of the power that the ordering of Mempool transactions enables. Whoever orders transactions get to direct the value of all arbitrage opportunities in the Ethereum mempool. Naturally, those with the privilege of transaction sequencing are incentivized to direct this value to themselves.

Also, there’s nothing stopping miners from also being frontrunners. In fact, it’s rational to assume that miners, as the party with the power to order Ethereum transactions, also start acting as frontrunners. Miners who don’t start frontrunning transactions will ultimately lose profitability against the miners that do front-run them.

The part of the Ethereum community paying attention to MEV generally assumes that all miners will eventually begin to operate as frontrunners in the future (Watch the Dan Robinson State of the Nation video for more info).

Optimism & MEVA

Optimism is an Ethereum layer-2 scaling solution that uses Optimistic Rollups to process many transactions off-chain while retaining the L1 security guarantees of Ethereum. Importantly, it also separates the roles of transaction ordering, and block validation into two distinct parties.

Importantly, the Optimism system enables the capture and repurposing of MEV.

In the Optimism L2 system, the roles that miners have (to order transactions and validate blocks) is divided into two separate actors: Sequencers order transactions and Validators add them to the Optimism L2 blockchain.

The right to become a sequencer is then auctioned off to the free market. This is called MEVA, or MEV Auctions, where the right to be able to capture MEV is repeatedly auctioned off for baskets of time.

Note: The specific designs around how a MEV Auction works in practice is still under construction, but the general idea is that there are different ways to extract and focus MEV with a free-market auction mechanism. As Optimism gets rolled out to more and more DeFi apps, the data will come in about how to best construct a MEVA.

Just as frontrunners attempted to outbid each other’s transactions to capture MEV, those who wish to capture MEVA are forced to bid for the right to sequence transactions, and ultimately hands this value off to the auctioneer.

That auctioneer is Optimism, and the Optimism team intends to enable the redirecting of this captured value to parties that were never going to be able to access it in the first place, but arguably should have:

The developers who built the contracts in the first place!

If there’s a group of average retail market participants who are using a Public Good like Uniswap, then there is therefore MEV. If there is MEV, there are bids to sequence the transaction. If there are bids to sequence the transactions, then there are MEVAs where the value is converged.

But this entire chain of economic activity is a result of some developer that built the contracts being transacted on in the first place… and nowhere in this economic chain is the developer being compensated or rewarded for their work.

Optimism and MEVA fixes this, offering a potential business model for smart-contract developers.

But… we can go bigger….

Public Goods

For longer commentary on Public Goods and how it relates to DeFi, read Global Public Goods and the Protocol Sink Thesis.

In short, public goods are things that everyone can benefit from.

Wikipedia’s definition of a Public Good:

In economics, a public good is a good that is both non-excludable and non-rivalrous, in that individuals cannot be excluded from use or could benefit from without paying for it, and where use by one individual does not reduce availability to others or the good can be used simultaneously by more than one person. This is in contrast to a common good such as wild fish stocks in the ocean, which is non-excludable but is rivalrous to a certain degree, as if too many fish are harvested, the stocks will be depleted.

Importantly, Public Goods don’t get exhausted the more they are used. Air, water, sunlight are all public goods. Listening to a radio broadcast does not prevent others from also listening. Street lights illuminate the roads for everyone, equally.

Public Goods often fall victim to the free-rider problem.

The free-rider problem is the burden on a shared resource that is created by its use or overuse by people who aren't paying their fair share. Street lights are public goods that require resources to build and consume energy for their operation; this requires taxes upon its users and anyone not paying taxes places a burden on the ability for this public good to scale and become more useful. This is why streetlights are not a GPG; their use does not make them more scalable.

The biggest reason why there are so few public goods in the world is because no single person is incentivized to pay for their upkeep. We all want to have public goods… clean air, clean water, paved roads, etc… but we don’t want to pay for it ourselves.

Additionally, large-scale companies are incentivized to use and consume Public Goods above and beyond what is sustainable, as it represents little to no costs on them to do this, while systemically it creates a worse environment for everyone.

Moloch

We’ve written about Moloch on the newsletter in the piece Ethereum: Slayer of Moloch as well as on this week’s Bankless Podcast episode: Slaying Moloch.

Moloch is the God of why we can’t have nice things; the reason why corporations will exhaust Public Goods into extinction, even when it’s a net-negative for all of us.

Moloch is the Canaanite God of Child Sacrifice (or so modern interpretations suggest).

An alternative label of Moloch is as a power of sufficient strength that compels humans to forgo all of their values, in order to achieve an advantage over others. The power behind Moloch is illustrated by seemingly endless examples of humans engaging in actions or behaviors that are a huge net-negative for everyone involved. However, as a result of localized, short-term incentives, all agents involved devolve into a state that everyone can agree is negative, but no one can escape from the incentives that created the status-quo in the first place.

Moloch results in us giving up our values and sacrificing our children at the pyre, even though we all can agree that none of us want to do this at all.

Some quick examples of Moloch:

Tragedy of the Commons

There are 10 fisherman who live off of the fish in a lake. However, if they all attempt to capture as many fish as possible, they will over-fish the lake and eventually deplete the entire stock of available fish, so that there are no fish left. If this were to happen, then all 10 fisherman would starve.

The fisherman all agree to only fish at 70% of their capacity, an amount deemed safe to establish a healthy equilibrium between fish-capture and fish-breeding.

Except, one fisherman realizes he can return to his previous level of maximum fishing capacity without any costs to himself because everyone else is limiting themselves to 70% capacity. This fisherman becomes the most profitable fisherman, and all the other fisherman take notice. One-by-one, all other fisherman defect from the agreement to only fish at 70% capacity, and they all return to maximum capacity fishing. Eventually, they all fish the lake into depletion, and they all starve as a result.

Defense Spending

Large countries can spend anywhere from 5% to 30% of their budget on defense. In the absence of war – a condition which has mostly held for the past fifty years – all this does is sap money away from infrastructure, health, education, or economic growth. But any country that fails to spend enough money on defense risks being invaded by a neighboring country that did. Therefore, almost all countries try to spend some money on defense.

From a god’s-eye-view, the best solution is world peace and no country having an army at all. From within the system, no country can unilaterally enforce that, so their best option is to keep on throwing their money into missiles that lie in silos unused.

Capitalism

A capitalist in a cutthroat industry employs workers in a sweatshop to sew garments, which he sells at minimal profit. Maybe he would like to pay his workers more, or give them nicer working conditions. But he can’t, because that would raise the price of his products and he would be outcompeted by his cheaper rivals and go bankrupt. Maybe many of his rivals are nice people who would like to pay their workers more, but unless they have some kind of ironclad guarantee that none of them are going to defect by undercutting their prices they can’t do it.

Companies in sufficiently intense competition are forced to abandon all values except optimizing-for-profit or else be outcompeted by companies that optimized for profit better and so can sell the same service at a lower price.

I think the most interesting example that illustrates the reach of Molochs power is how these same patterns are found in cancer, something that doesn’t have a brain but still succumbs to Molochs power

Cancer

The human body is supposed to be made up of cells living harmoniously and pooling their resources for the greater good of the organism. If a cell defects from this equilibrium by investing its resources into copying itself, it and its descendants will flourish, eventually outcompeting all the other cells and taking over the body. Once cancer reaches this point, the host body dies. The horse bit the hand that feeds it, and now there is no longer any incoming nourishment into the body as a whole, including the cancer itself. Out of pure profit-maximalist, the cancer blew up the whole system.

The Great Filter Theory

The Great Filter Theory originates at the Drake Equation.

The Drake equation is a probabilistic argument used to estimate the number of active, communicative extraterrestrial civilizations in the Milky Way galaxy. In short, the Drake Equation predicts that it’s there’s probably alien life ‘out there’.

The prediction of the Drake Equation creates the Fermi Paradox. If there is a high likelihood that alien life should exist, why does it? Where are all the aliens?

The Great Filter is the unknown, hypothesized filter that exists that is the thing that prevents dead, lifeless matter from propagating into intergalactic, space-faring civilizations.

We know this filter exists, using the following assumptions.

- The Drake Equation predicts the likelihood of life, from what we can observe.

- There isn’t life, from what we can observe.

- Something must be causing this.

At some point, something must stop extra-terrestrial life from developing into inter-galactic civilizations that would be viewable by our Earth-bound capabilities.

The simplest solution is that it’s actually really really difficult for dead matter to spontaneously formulate self-replicative structures that begin to form DNA, and automatically iterate into the life we know it today.

If this isn’t the reason why we don’t see observable life, then I believe the next likely culprit is Moloch.

Moloch, the monster that perpetually lays traps for the conscious to fall into

Moloch, the beast that monetizes defection

Moloch, who rewards dehumanization

Moloch, who incentivizes cruelty

Moloch the omnipotent, the omnipresent

The most likely outcome of any life that came before us is their defeat at the hands of Moloch. Not to mention the plethora of instances where humanity has its own close-calls with Moloch.

The Cuban Missile Crisis put humanity at one-stroke to midnight. We were able to get out of this one, but it didn’t stop mass nuclear proliferation, perpetually placing humanity one-step away from nuclear winter.

Global warming is advancing.

The constituency of the world’s largest GDP Nation is at artificially magnified polarizations, and without a basic common understanding of facts.

There are a growing number of possible outcomes where our inability to govern…. our inability to coordinate our desires to become our outcomes, result in the ruin of the human story.

It seems that humanity has been traversing history by the lucky navigation of a treacherous terrain comprised of incentive traps and long-tail risks.

Working backwards, it’s fair to say that Moloch is a reasonable culprit behind the Fermi Paradox. He is a generalizable answer to the question ‘why haven’t others made it?’. Importantly, he seems to be rearing his head right now, as so much of the world seems ineligible to coordinate.

The Sword that Slays Moloch

So you’re probably wondering: David, how the hell is this all relevant? (RSA: cause that’s what I’m wondering)

Well…Ethereum is a platform that hosts generalized economic activity.

The buyer and the seller are the fundamental basis of all economic transactions. Between a buyer and a seller, there is a double-coincidence of wants that represents an arbitrable transaction, where someone could give both the buyer and the seller slightly less than what they originally asked for, but both still accept the trade. MEV exists because of opportunities like this, and that MEV can be captured by MEVAs.

MEVAs can direct funds to places previously not receiving funds. It makes sense to direct the funds to the developers who built the contracts producing the MEV, but the true power lies in the ability to direct the funds anywhere.

As discussed in the Bankless podcast Slaying Moloch, what gives Kevin and Ameen optimism about Ethereum is the ability to iterate, experiment, and refine governance and coordination mechanisms. Specifically, coordination mechanisms that coordinate capital.

Ethereum’s yield farming mania was fundamentally based on the ability of a community to generate a treasury and point that treasury to something that’s beneficial for the community. Yearn and YAMs are prime examples, as both communities have generated meaningful income in their treasuries, and have successfully leveraged these funds to compensating labor, audits, and even marketing!

Most exciting, both Yearn and YAMs direct 1% of their received funds to Gitcoin, a platform that uses the free market to fund Public Goods.

Those that leverage the Optimism L2 scaling solution have the ability to sell the MEV to the highest bidder, and the operator of the Optimism L2 chain receives the funds. If the Optimism operator is incentivized to keep MEV extraction at a reasonable level, or else encourage the defection of its users. Operators will have some amount of control over the amount of value extracted be sequencers and will represent the overall level of revenue extracted from the system.

Operators themselves can increase, or decrease MEV extraction based on what’s right for their users and their implementation, and likely will find some equilibrium between extracting MEV, and ensuring their Optimistic L2 is an attractive place to engage in economic activity for their users.

Too little MEV and your L2 can become market-inefficient (and you also receive less revenue). Too much MEV, and your L2 becomes a hostile environment for its users, and they will likely take their economic activity elsewhere.

As a result, where an Optimism L2 operator chooses to direct MEV will become a huge part of the equation that incentives people to transaction on their platform. Operators that donate money to legalizing pedophilia will likely find themselves without customers, and will also incentivize the forking of their platform by a new Operator who promises to direct funding towards something more beneficial for humanity.

As a result of Optimism, the choice of ‘where MEV should go?’ is given to the people who elect to use a specific platform. Maybe I’m being overly optimistic (😏) but I believe the average person is good, and will choose to transact on platforms that align with their values and ethos.

Funding the Real World

I think various operators of Optimism L2s will commit some of the MEV they capture from MEVAs to funding things beyond their own protocol development. Once contracts are out and deployed they are inexpensive to maintain, so directing the captured MEV to something else seems like a logical next step.

I believe a few Optimism L2 operators will signal their intent to direct some of the captured MEV to funding Public Goods. Starting with Gitcoin (as seen with Yearn and YAMs) and then scaling up to larger and more systemic public goods.

This is how the economic activity of Ethereum can begin to impact the real world. MEVAs can fund things in the physical world, not just on Ethereum. MEVAs can direct funds to GiveWell, a charity specializing in researching the best ROI on donations. Or they can direct funds to Ethereum-based DAOs, which are committed to allocating funds to help solve real-world problems.

MolochDAO, the first successful DAO on Ethereum, was made with this purpose. To collect and focus capital in order to fund efforts to help build Ethereum. Imagine if we were able to fund MolochDAO from MEVAs, rather than individuals giving up their money as donations! No one has to donate anything, because MEVAs capture value automatically; all you have to do is participate in the Ethereum economy!

This is how, in the Slaying Moloch Podcast, we talked about Ethereum can be the tool that ends nuclear proliferation, global warming, deforestation, the great pacific garbage patch, etc.

MEVAs produce a perpetual source of revenue, and the social contract directs this revenue to funding things that are getting in the way of humanity progressing.

MEVAs are a brand new tool in humanity’s tool belt that is always available for when Moloch rears is ugly head. If there’s ever a moment where Moloch creates a defection incentive, there’s likely a way where a MEVA can outbid Moloch and incentivize coordination.

It’s just a matter of how to build it.

The Path through the Dark Forest

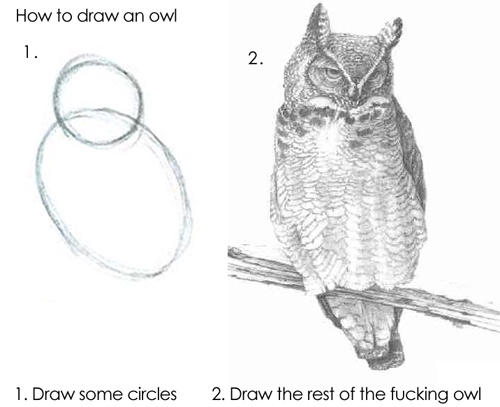

I’ll admit, saying Ethereum can end nuclear proliferation and global warming is like the ‘draw the rest of the owl’ meme. We have the beginning stages of a grand picture fleshed out, but how to get from Point A to Point B is largely unknown.

Fortunately, some very smart people are working on navigating through the Dark Forest of unknown outcomes. As discussed in the Moloch Slayer podcast, what gives us optimism that we can find a path through the Dark Forest of Moloch Traps is Ethereum’s ability to quickly iterate on governance and coordination mechanisms. We will tinker and experiment our way into drawing ‘the rest of the damn owl’, and so far 2020 has been an extremely progressive year in the community experimentation front.

HEY GUYS I THINK I SEE A PATH THROUGH THE DARK FOREST. pic.twitter.com/72aR478z9f

— Kev.Ξth (🍄,🟢) (@owocki) September 13, 2020

Here’s Ethereum’s recipe for success:

What gives me optimism is we have:

— karl.floersch.eth (✨🔴_🔴✨) (@karl_dot_tech) September 13, 2020

1) a magical platform for permissionlessly innovating new governance mechanisms (Eth!)

2) a research community dedicated to improving governance/coordination, &

3) tons of people who are happy to be early adopters of these governance experiments

1) Ethereum, and the builders on top of it

2) A community of researchers (ethresear.ch)

3) People who are willing to be early participants in these experiments (that’s YOU)

So congratulations, all that yield-farming and YOLO’ing you did, you were part of this grand data-gathering experiment for discovering optimal incentive and coordination mechanisms. We now have SO MUCH MORE data than we did in 2019, and the information gained over the last few months will be invaluable to designing and iterating on future coordination mechanisms.

The best part is that everyone who was participating in these experiments were simply acting as rational, profit-maximizing agents. When we are all allowed to be rational economic agents, and the mechanisms being deployed create coordination and alignment from the individual inputs from each participant, we have a path to claiming some of Moloch’s territory as our own.

We’re going to Slay Moloch, and we’re going to make money doing it.

Action steps

Understand how Ethereum’s technology can save humanity

Read up on all the resources mentioned: