Dear Bankless Nation,

Sushiswap started out as a fork of Uniswap V2, and launched with a relatively controversial approach.

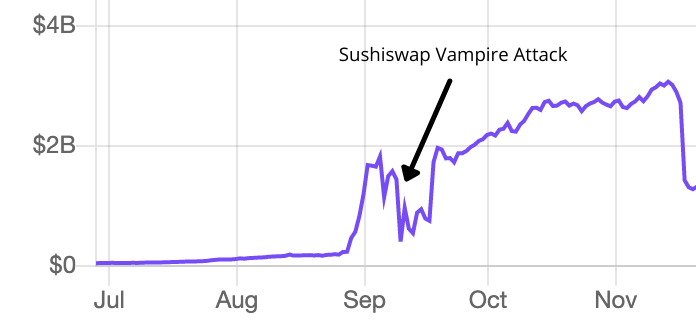

The anon dev team used what’s called a vampire attack, where the protocol heavily incentivized existing Uniswap LPs to migrate their liquidity to Sushiswap using the SUSHI token as a reward.

This was before Uniswap launched its own UNI token. An intense battle ensued over the next few weeks as the protocols fought over liquidity, and ultimately forced Uniswap (a project that took a strong stance on not needing a native token) to launch UNI.

There was another issue as well. The anon founder, Chef Nomi, rug pulled the Sushiswap ‘developer fund’, and took off with ~$10M worth of ETH from the protocol. He later returned the money, but his reputation was damaged. He hasn’t been seen much since.

The good thing is that Sushiswap has evolved well beyond its rocky origin story as a Uniswap fork. They’ve actually become one of the most successful DeFi protocols to date with billions of dollars in liquidity, one of the top DEXs in terms of daily volume, and generating a significant amount of revenue for xSUSHI holders.

They’ve also launched an expanded product suite including lending, token launchpads, NFT exchanges, cross-chain implementations, and more.

So we had William take some time to research everything that’s going on with Sushiswap.

Let’s dig in.

- Lucas

P.S. Ledger just launched their Paraswap integration—allows you to swap tokens at the best price directly from your Ledger Live app. Idk might be worth using Paraswap….

P.P.S. Ryan is out this week on vacation! I’ll be taking point on the opening notes till he gets back. Bear with me :)

📺 Watch State of the Nation #51: Pioneering Crypto Culture

We’re testing out a new Bankless show with a not-Ryan co-host. Who could it be???

👕 Bankless DAO MetaFactory Merch Drop #2 is Live!

All merch is scarce af! Open for 72 hrs. We’ll never make these again. Get in before it’s too late.

Tactic Tuesday

Guest Writer: William M. Peaster, Bankless contributor and Metaversal writer

How to use Sushiswap

Sushiswap is a decentralized exchange that makes it easy to trade among a wide range of crypto assets. The interesting part is that the Sushi developer team has expanded to a suite of decentralized products well beyond its flagship DEX protocol.

This Bankless tactic will help you familiarize yourself with all of Sushi’s current offerings so you can make the most of this project’s various services!

- Goal: Learn what Sushi currently has to offer

- Skill: Intermediate

- Effort: Varies, depending on which product/s you try

- ROI: APYs in the triple-digits if you partake in Sushi’s ongoing yield farms

A Sushiswap Primer

Sushi is an automated market maker-styled (AMM) decentralized exchange (DEX) that launched in August 2020, right toward the end of the first and now crypto-legendary DeFi Summer.

A fork of Uniswap V2, Sushi quickly gained traction last year with how it competed with Uniswap. The Sushi team used a “vampire attack” in order to win over liquidity from Uniswap by offering liquidity providers (LPs) enticing $SUSHI rewards.

Not long after this vampire attack began, Sushi founder Chef Nomi ran off with over $10M worth of the Sushi project’s ETH. He later returned it. Nomi was quickly ostracized from the project, and the Sushi team started its second life, with a new captain at the helm: talented dev 0xMaki, by building out the original Sushi AMM into what it is today: a multi-faceted DeFi suite of financial products.

The State of the Sushi

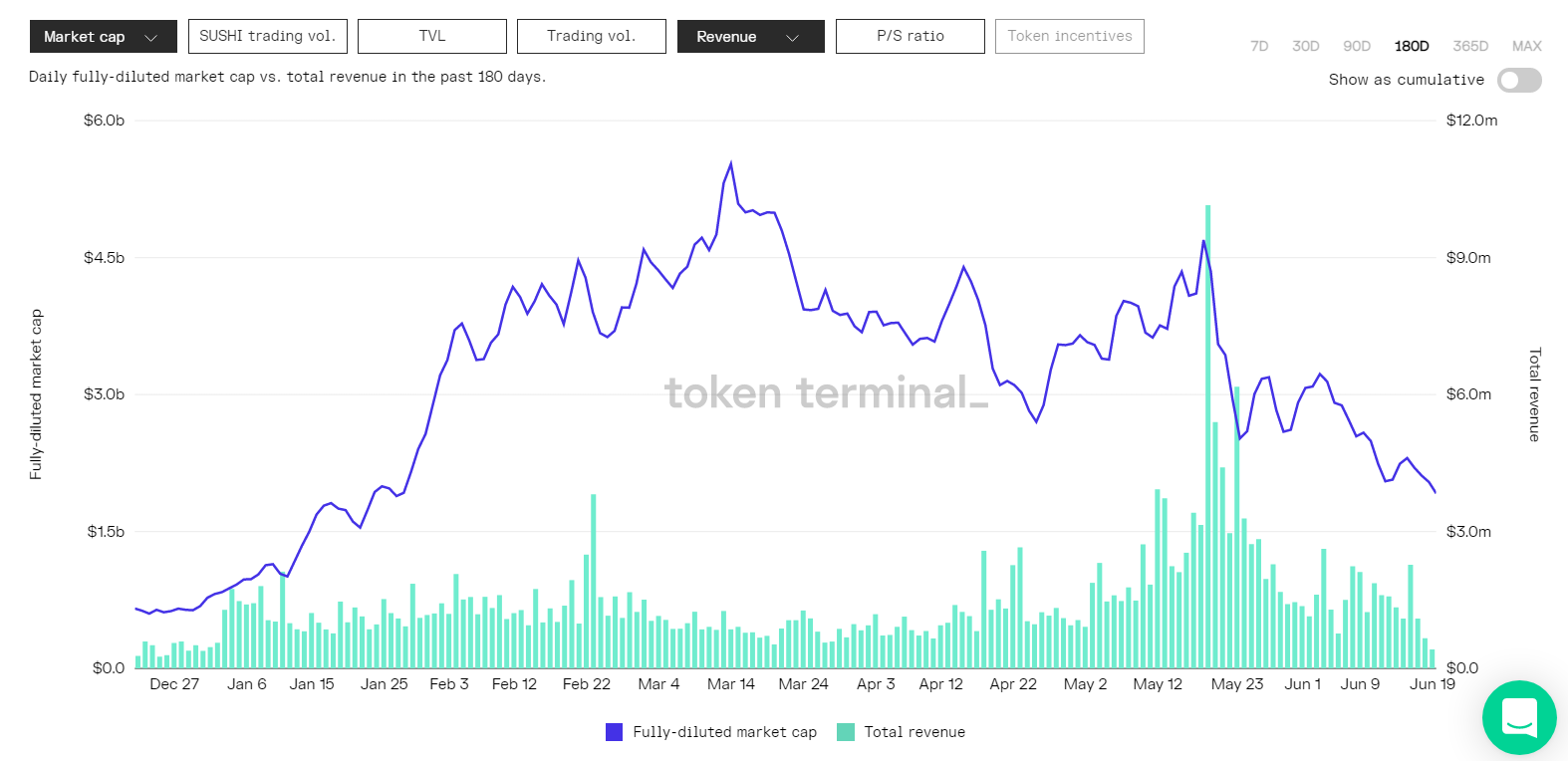

So how is Sushi faring these days? Pretty good, if you dive into the numbers!

DeFi Pulse highlights that Sushi currently has +$2.75B in total value locked (TVL) on Ethereum and up to $3.8B if you factor in Sushi’s multi-chain implementations (e.g. Ethereum, Polygon, BSC, etc.). This makes Sushi one of the top 10 most used dApps in all of crypto.

Token Terminal also indicates that Sushi is pulling in millions of dollars worth of revenue on a daily basis. Not bad for a DEX that hasn’t even had its first birthday yet, right!

Sushi’s products and offerings

As mentioned, Sushi isn’t just an AMM anymore. The Sushi developer team has been working concertedly in recent months to expand Sushi’s offerings into wider domains, like margin trading and NFT trading.

In this article, we’ll explore all the services Sushi’s currently offering to users.

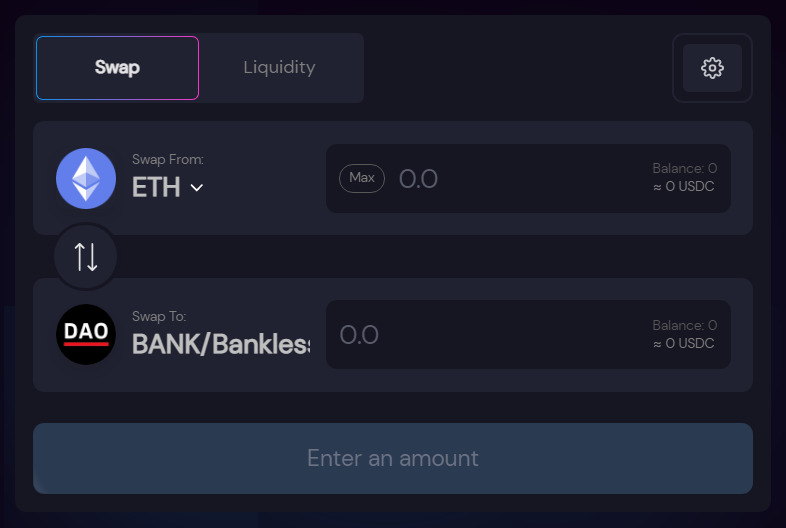

Swaps/pool system

The bread and butter of Sushi is its AMM, which allows anyone to swap and provide liquidity for the long tail of token pairs. To swap your crypto assets or serve as an LP, just head over to Sushi’s Swap page and thumb between the “Swap” or “Liquidity” interface as needed.

You can search for desired tokens via this interface by searching for them by name or by pasting in their token contract address into the provided search bar.

SushiBar

SushiBar is Sushi’s profit-sharing system. You stake SUSHI through SushiBar, and you receive xSUSHI in return, which grants you the right to start earning a cut of all the swap fees accrued throughout the entire Sushi ecosystem, i.e. across multiple blockchain implementations.

The other benefit of xSUSHI and SushiBar is that it directly affords holders Sushi governance rights, so you don’t have to “unstake” your SUSHI as is the case with several other DeFi tokens in order to vote on project’s governance proposals.

Onsen

One of Sushi’s early strategies is to serve as a hub for long-tail asset trading (i.e. “selling low volumes of hard-to-find items to many customers”).

To accomplish this, Sushi incentivizes many smaller trading pairs. This is where the Onsen program comes in. Onsen is a liquidity bootstrapping service provided to new DeFi projects. It gives such projects the ability to accelerate their on-hand liquidity by offering $SUSHI rewards to participants.

In this way, new projects don’t have to heavily incentivize users with their own native governance token; instead, they can lean on Onsen to incentivize these same users with $SUSHI. The net result? Sushi gets more liquidity, and young projects get the early liquidity they need to survive.

🤪 Fun Fact: Bankless DAO’s $BANK token was recently added to Sushiswap’s Onsen!

BentoBox

BentoBox is a DeFi vault system that pools funds around the Sushi ecosystem. You supply assets, Sushi puts them to work in DeFi, and the rest takes care of itself.

That said, BentoBox is still being built out, so we don’t know the full picture regarding how the BentoBox will work. What we do know is that the liquidity pooled up in the BentoBox can be used in other Sushi apps, so the more robust the liquidity, the more options that are available.

Kashi

Kashi, which means lending in Japanese, is the first app built atop the BentoBox system. The lending service lets users create and customize their own decentralized borrowing and lending markets, with each of these markets isolated from one another.

As the Sushi team explains in their docs:

“Kashi’s unique design enables a new kind of lending and borrowing. The ability to isolate risks in individual lending markets means that Kashi can permit users to add any token. In addition, isolating the risks of the different lending markets enables users to achieve leverage in one click, without ever leaving the platform.”

Miso

Another service Sushi released earlier this year was MISO, i.e. Minimal Initial Sushi Offering. The product is centered around facilitating streamlined token genesis events (TGE) through the Sushi platform via crowd sales, batch sales, and Dutch-styled auctions.

The code involves a native TokenFactory, escrow capabilities, yield farms, and more.

Shoyu

Last week in Metaversal, I published a write-up on Sushi’s coming NFT exchange and launchpad. The project, dubbed Shoyu, is being built as a suite of tools that are catered to Web3 artists and collectors.

What’s interesting is that Shoyu (and also all of Sushi’s other offerings) will generate fee revenues for xSUSHI holders over time. So if you’re big on Shoyu’s NFT potential, holding xSUSHI is a natural next step!

Multi-chain deployments

The days where DeFi builders solely deploy to Ethereum are dwindling. This doesn’t strictly mean that Ethereum is losing out, it just means that developers are looking to expand the surface area of their product suite. It’s a natural move for many.

Now there are multiple DeFi blockchains with Ethereum acting as a central hub for these chains, so the Sushi team is acting accordingly by taking an “all of the above” approach to liquidity.

In other words, Sushi’s already deployed its AMM to multiple chains like xDAI, BSC, Fantom, Moonbeam, and more. Wherever there’s DeFi, Sushi’s going. They want to be a hub for liquidity on any chain. So if you’re interested in trying out these cross-chain implementations, your best bet is to add these networks to your MetaMask wallet and to dive in from there.

That said, for people who are mainly comfortable with Ethereum, the best Sushi cross-chain option to use right now is Polygon, as Polygon’s sidechain has been explicitly designed to cater to Ethereum users. So navigate to Sushi, switch to the Polygon network, and enjoy fast and cheap trades.

Then you can transfer your assets back to Ethereum as you wish!

Conclusion

Sushi may have started out as a fork of Uniswap V2, but the project has evolved into a new DeFi beast altogether.

Of course, it’s ultimately up to you to decide which dapps you want to use. Yet what makes Sushi particularly compelling is that it’s not only one of DeFi’s top exchanges, it’s also branching out into new DeFi and NFT territories via products like Kashi and Shoyu.

Accordingly, Sushi may compete with other DEXes when it comes to AMM trading, but no other DEXes can compete with the expanded products and services that Sushi’s team has put out and is continuing to put out. Sushi’s in a league of its own in this regard, which is why the project’s making a name for itself these days!

Action steps

🍣 Try any of Sushi’s products by going to sushi.com

Level up with other Bankless resources on Sushi:

Participate in the Bankless DAO MetaFactory Drop!