Dear Bankless Nation,

Gas fees suck.

Don’t get me wrong—high fee revenue is a good problem for a chain to have.

But high gas fees means smaller users get priced out. Yes Eth2 is coming, we have layer 2 apps in production, and promising scaling solution like Arbitrum and Optimism coming soon.

But today, there’s one scaling solution that’s garnered a lot of attention: Polygon.

After rebranding from Matic Network back in February, Polygon has rocketed into prominence within the DeFi and the Ethereum space.

The scaling solution now has over $11B in value locked and features a growing ecosystem of familiar DeFi protocols like Aave, Sushiswap, Curve, OpenSea and PoolTogether.

No, it’s not perfect. It doesn’t inherit all of the security guarantees of Ethereum…yet. But it’s a step forward. Anthony Sassano surfaced the tradeoffs very well in his thread today. (Disclosure: I’m an advisor to Polygon for many of the same reasons as Anthony)

Bottomline for DeFi users: there’s a ton to do on the Polygon network today and the gas costs are virtually zero, so you should give it a try.

Here’s the lowdown from Ben Giove on how to use Polygon and some of the cool things you can do on it today.

- RSA

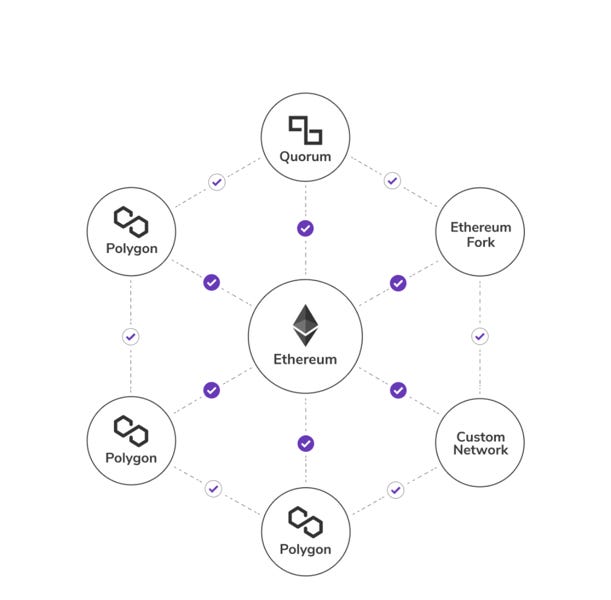

Polygon has a vision of building Ethereum’s internet of blockchains. In short, Polygon provides a generalized framework to allow developers to create custom, application specific chains that leverage Ethereum’s security, as well as provide an interoperable network that links together a variety of different scaling solutions such as zk-rollups, optimistic-rollups, and sidechains.

This tactic will focus on all the things you can do on Polygon’s PoS chain, one of the more successful implementations from the camp. There’s tons to do in this emerging DeFi ecosystem with familiar protocols.

Let’s explore.

- Goal: Become a Polygod

- Skill: Intermediate

- Effort: 20 mins to get onboarded to your first app

- ROI: High yielding farms + significant savings on gas fees!

All The Things You Can Do on the Polygon PoS Chain

You probably don’t need me to tell you this, but using Ethereum is expensive. The overwhelming demand for its blockspace has driven up gas prices, pushing the network to its limits and users out to other, lower cost (but more centralized) chains like Binance Smart Chain (BSC).

For those of us wanting to live a bankless life, or spend the wee hours of the night degen-ing around in DeFi, this is an incredible source of frustration, FOMO, and disappointment. Ethereum needs to scale, or it risks losing users and capital to other chains that doesn’t have the same commitment to self-sovereignty, credible neutrality, and decentralization.

Fortunately, this long-standing gas crisis may soon be nearing a resolution. A plethora of different scaling solutions are being rolled out (😉) as we speak including Layer 2s, Ethereum aligned sidechains, and of course, ETH 2.0.

One of the first of these solutions seeing meaningful adoption is the Polygon PoS chain. Its growth has absolutely exploded in recent weeks, with the network supporting over $8.9 billion in value locked, and protocols new and old deploying every day. Accompanied by a substantial rise in the price of MATIC, Polygon is the talk of the town on crypto twitter.

And after spending some time playing around on Polygon, let me tell you this: it certainly lives up to the hype. Transactions are lightning fast and dirt cheap. With more of the apps we know and love from Ethereum L1 setting up shop, users are also beginning to reap the rewards of composability.

By the end of this piece, you’ll learn about all the different things you can do, and just how much you’ll save in gas, on Polygon.

What is Polygon?

Polygon has a vision of building Ethereum’s internet of blockchains. Essentially, Polygon provides a generalized framework to allow developers to create custom, application specific chains that leverage Ethereum’s security, as well as provide an interoperable network that links together a variety of different scaling solutions such as zk-rollups, optimistic-rollups, and sidechains.

⬆️ Level up: For a more thorough explanation, check out this great video by the legendary Finematics

The focus of this piece is on the Polygon PoS Chain, which has found itself as the first product from Polygon to gain significant traction. The chain falls somewhere on the spectrum between a sidechain and a pure layer-two scaling solution like a rollup, which completely inherits the main chains security.

Architecture and Security Assumptions

Before using Polygon or any other network, it is important to understand its architecture, as well as some important security assumptions you make as a user. This is new technology after all, so please use at your own risk!

Polygon is secured through a proof-of-stake consensus mechanism where validators stake MATIC tokens in smart contracts that are hosted on the Ethereum main chain. For reference, there is currently over $2.6 billion of MATIC staked in these contracts.

To get funds from Ethereum to Polygon, you must go through what is known as a bridge. In a nutshell, bridges work through the use of a lock and mint mechanism.

In the case of Polygon, when you deposit funds into a bridge, they are really being held (locked) in a contract on Ethereum, and then recreated (minted) on Polygon. To withdraw funds, you will have to go back through the bridge. When doing this, the tokens that you send through the bridge will be burned on Polygon and the funds in the contract on Ethereum will be unlocked.

On Polygon, you’ll have your choice of using two bridges: the Plasma Bridge, and the PoS Bridge. The Plasma Bridge inherits its security from the Ethereum main chain, however, it takes seven days for the withdrawal process to be completed. The PoS bridge is secured by the same set of validators and staked MATIC that is securing the chain itself, and has withdrawal times of roughly three hours.

Tying it all together, the contracts holding the staked MATIC are responsible for the security of the chain and of the funds locked in the PoS bridge. This is something to keep in mind because both the staking and bridge contracts can be altered through the use of a proxy that is controlled by a multi-sig wallet.

This wallet was originally a 2/3 multi-sig, but has now been upgraded to a 5/8 scheme. It was recently confirmed by the team that four of these signers are the Polygon co-founders, and four are prominent members from other Polygon DeFi projects.

🔐 To read more about Polygon’s use of multi-sigs, click here.

This is a centralization vector and certainly a risk factor to consider when deciding to use Polygon. If this wallet were to be compromised, the security of the network, along with the ability to move funds back to Ethereum, would be in serious jeopardy.

Beyond the multi-sig, about 31% of the MATIC staked has been delegated to a node run by Binance. This centralization of stake is another factor to keep in mind when deciding whether to make the move to Polygon.

How to use Polygon

Before using Polygon there are a few steps you’ll have to take. First, you will need to configure the network in your wallet, and then as discussed above, you’ll have to use one of the two bridges to move funds over from Ethereum L1.

Below are some guides that will go into detail on how to do this:

- Adding Matic Mainnet to Metamask

- Migrating funds using the Matic PoS Bridge

- Migrating funds using Zapper

🤦♂️ REMINDER: As a certain author learned the hard way, always remember that you have enough MATIC in your wallet to pay for gas!

What you can do on Polygon

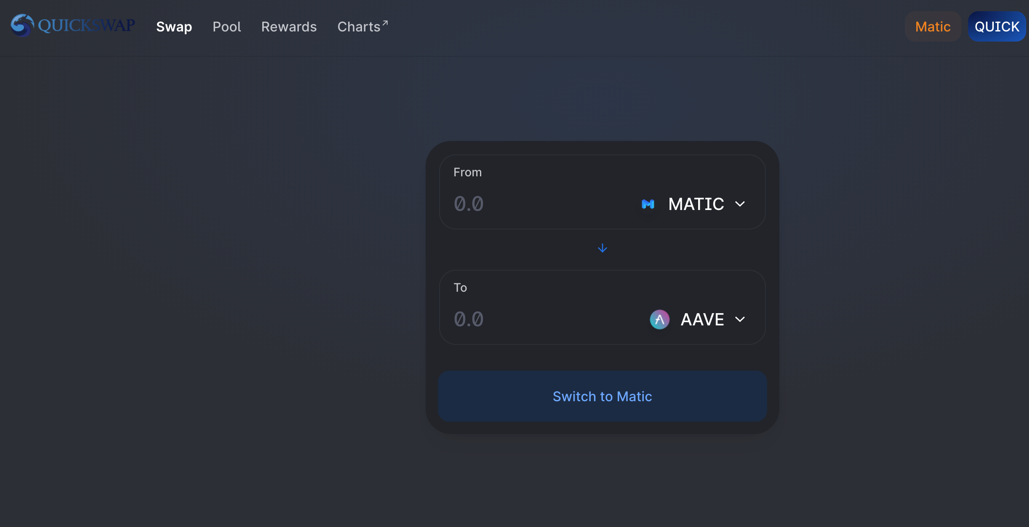

1. Swap and Provide Liquidity on QuickSwap

Decentralized exchanges (DEXs) are at the heart of any blockchain-based financial system. This is no different on Polygon, with the most popular DEX on the network going by the name of QuickSwap. A Uniswap V2 fork, QuickSwap has exploded in popularity in recent days. The protocol certainly lives up to its name: with Polygon’s 2.1 second average block time, trades on QuickSwap are confirmed in the blink of an eye.

The protocol has attracted over $650 million in liquidity in recent weeks while processing between $150-250 million in daily volume. As a result, QuickSwap is earning hundreds of thousands of dollars in daily fees for its liquidity providers.

For LPs looking to earn additional sources of income beyond trading fees, there are currently over 100 incentivized pools. LPs of these pools can earn QUICK rewards, QuickSwaps native governance token, along with the 0.25% of trading volume in the form of fees.

In addition, similar to the SushiBar on SushiSwap, QUICK holders can stake their QUICK tokens to receive 0.04% of trading fees generated by the protocol in the form of dQUICK tokens.

Gas Savings

While DEXs are among the cheapest DeFi protocols to use, they are still not suitable for small trades. At current gas prices, trading on Uniswap costs around $30-80+, and the cost to provide liquidity to the protocol is usually over $100.

These costs are drastically reduced on QuickSwap. To put it in perspective, the cost of a swap and to provide liquidity are both $0.0002, meaning that it is 435,000x cheaper to trade and 785,000x cheaper to initiate an LP position on Polygon than it is on Ethereum Layer 1 🤯!

This means users with a balance of any size can swap or LP to their hearts content without worrying about gas fees taking a large chunk out of their profits!

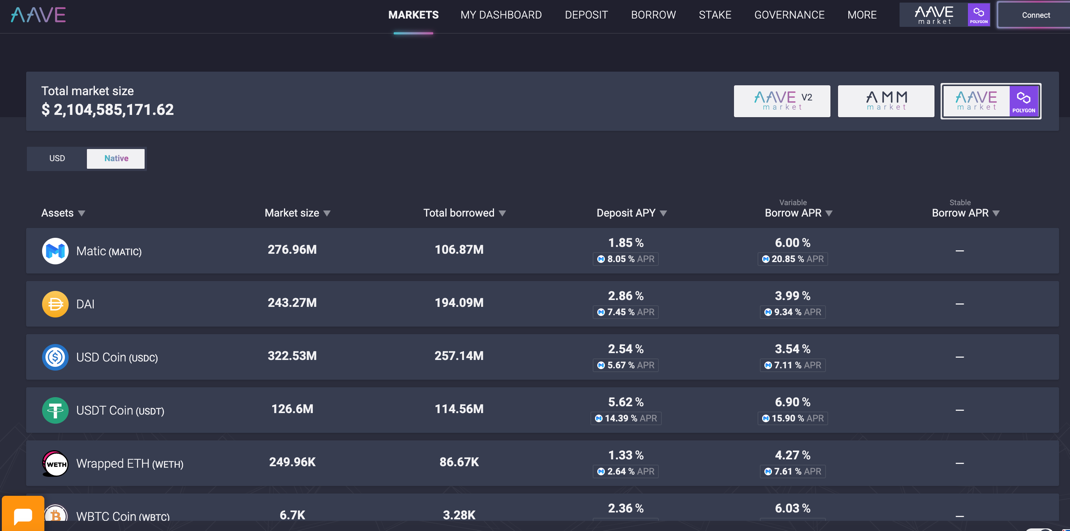

2. Borrow & Lend on Aave

Aave was one of the first major DeFi projects to announce a deployment to Polygon. Following the announcement, Aave’s Polygon integration attracted over $5.1 billion in liquidity. Just like Aave on Ethereum L1, users can deposit assets to the protocol and use them as collateral to borrow.

Aave’s Polygon market currently supports deposits for seven assets: USDT, USDC, DAI, wBTC, wETH, MATIC and AAVE, and borrows for all except for the latter. While a limited slate compared to the Ethereum markets, and there is not currently support for staking or collateral swaps, users can still borrow against some of the most liquid assets in DeFi as to yield farm, leverage long, or short an asset.

You can also earn MATIC for using the protocol, with 1% of the total MATIC supply being allocated towards Aave users and APRs generally ranging between 5-15%.

Gas Savings

The gas savings for using Aave on Polygon are even more noticeable than that of QuickSwap. At current gas prices as of writing, depositing capital into Aave on Ethereum L1 costs ~$95 dollars, while borrowing will set a user back about $125+, meaning it costs over $200+ to take full advantage of the protocol.

On Polygon, these combined costs are reduced by a factor of 235,000x, as deposits and borrows cost a mere $0.001 each!

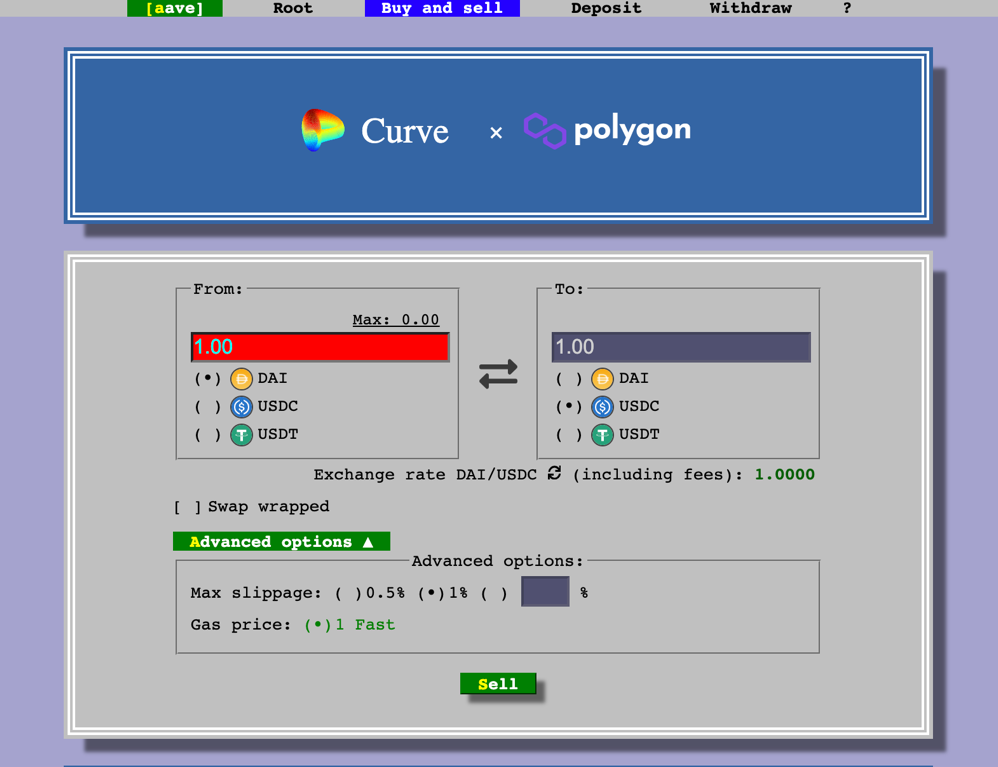

3. Swap and Provide Liquidity on Curve

Curve is another major DeFi project with a recent deployment on Polygon. While not offering the full, farming-frenzy suite of pools that we have come to know on Ethereum L1, Curve currently offers a singular Polygon pool, named “Aave”, where users can deposit their aTokens that they received from Aave’s Polygon integration.

In one click, users can deposit and stake aDAI, aUSDC, or aUSDT (or just directly deposit the non-aToken version of those assets) to earn 0.02% of every trade in fees, as well as MATIC rewards. The pool has attracted over $464 million in liquidity and is facilitating north of $50 million in daily volume. On top of this, LPs can earn a combined APY that consistently falls within the 35-45% range.

This integration is DeFi composability at its finest: Users can make it rain yield by employing a strategy where they:

- Deposit an asset into Aave and earn interest and MATIC rewards

- Borrow stables with the cost subsidized by more MATIC rewards

- Deposit those stables into the Curve pool to earn trading fees and even more MATIC rewards

Gas Savings

Surprise! The gas savings are immense. At current prices, swapping on Curve costs ~$70, while depositing and staking as an LP will set a user back another $110. On Polygon, these costs are reduced to a minuscule $0.0002. Those are 355,000x and 570,000x reductions in cost, respesctively!

4. Swap, provide liquidity, lend and borrow on SushiSwap

SushiSwap is yet another popular protocol that has deployed on Polygon. In the two weeks since launching, the project has already garnered $620 million in liquidity, and processing tens of millions in daily volume.

Just like on Ethereum, users can leverage SushiSwap to trade tokens and provide liquidity. The protocol is also incentivizing nine popular trading pairs, where liquidity providers can stake their SLP tokens to earn both SUSHI and MATIC rewards, along with the usual 0.25% trading fee. While the yields have compressed in recent days, stakers can currently earn between 30-110% APY, depending on the pair.

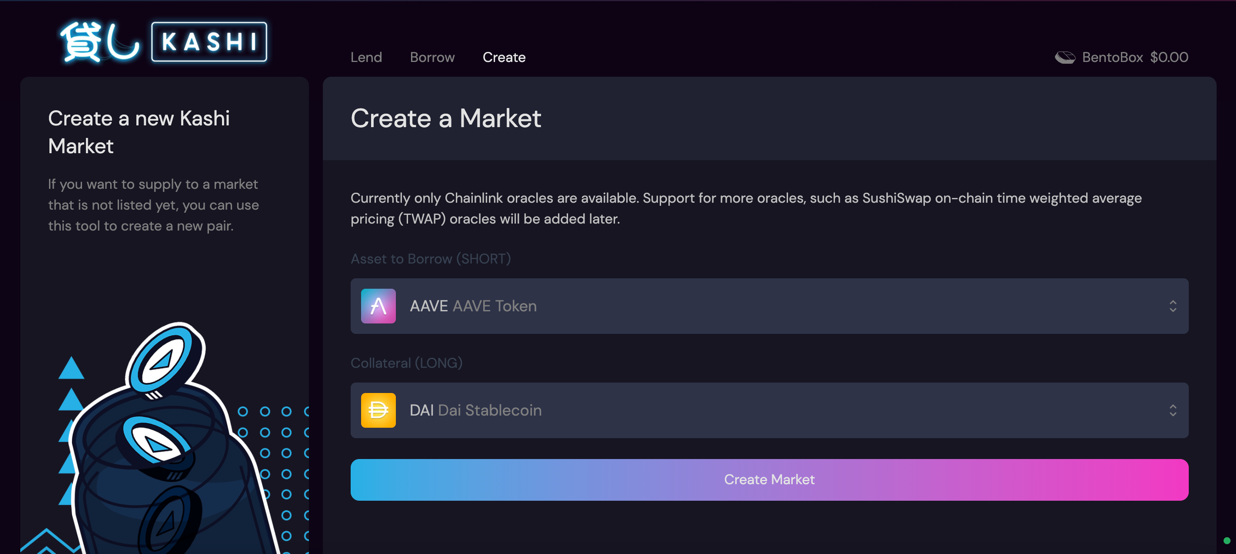

In addition to the exchange, users can also take advantage one of Sushi’s newest items on the menu: Kashi! Kashi is the first app built on top of the BentoBox vault, and allows anyone to create their own isolated borrowing and lending pairs.

To create a pair, all you’ll have to do is:

- Pick an asset to borrow

- Pick an asset to use as collateral

- Click ‘create’ to launch it!

While there is a more extensive offering on Ethereum, Kashi on Polygon currently supports creating pairs using any combination of ETH, DAI, AAVE, MATIC, USDC, USDT, and wBTC.

Gas Savings

I’m running out of creative ways to say this but: The savings of using SushiSwap on Polygon are huge! Sushi is expensive in real life, and also on Ethereum.

At current gas prices, it costs about $57 to do a swap, $95 to provide liquidity, and $98 to create a Kashi pair. On Polygon, those costs are reduced to $0.0002, $.00004, and $0.0004, respectively. This translates to savings of 285,000x, 237,500x, and 245,000x!

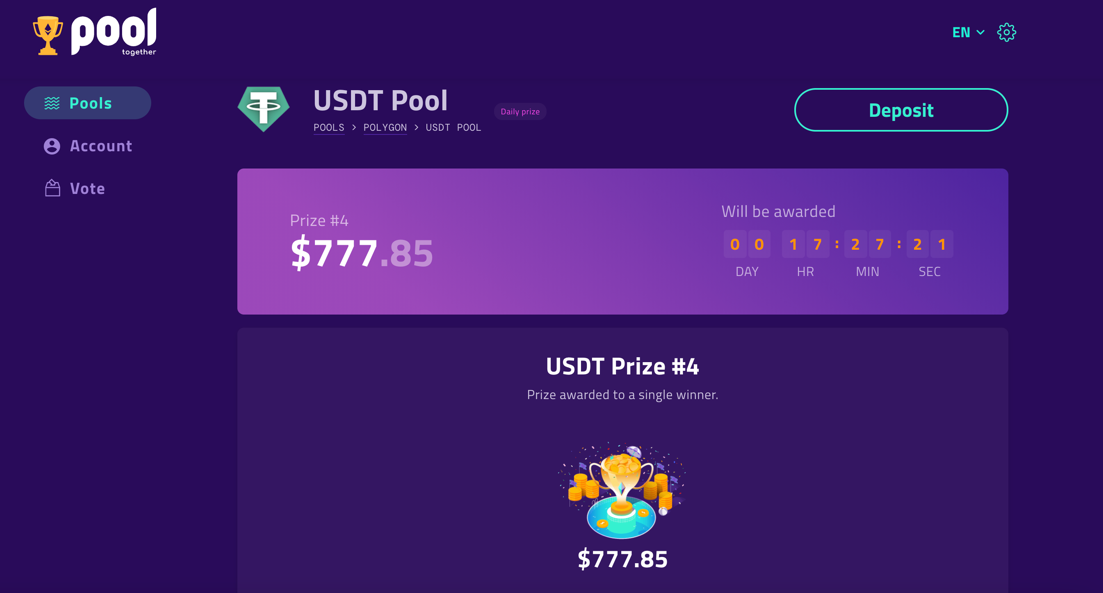

5. Enter the Lottery on PoolTogether

Feeling down about losing the recent Bankless Badge raffles?

You can now play the odds again on Polygon using PoolTogether! The no-loss lottery protocol is currently offering a USDT pool paying out daily prizes. The pool currently holds over $8.2 million in deposits, with the daily jackpot typically ranging between $1000-2000. Like with Curve, the protocol also channels the power of DeFi composability by sourcing the yield for the prize pool from Aave’s Polygon market.

In addition to a chance at taking home the main prize, lottery participants can earn a yield win or lose, as depositors in the pool will receive MATIC rewards at an APR that hovers around 20-25%.

Gas Savings

I’m a broken record at this point…But the reduction in gas cost is ASTRONOMICAL. The cost to enter the PoolTogether lottery on Ethereum L1 is $183, while on Polygon it’s just $0.0006. That’s a 305,000x decrease!

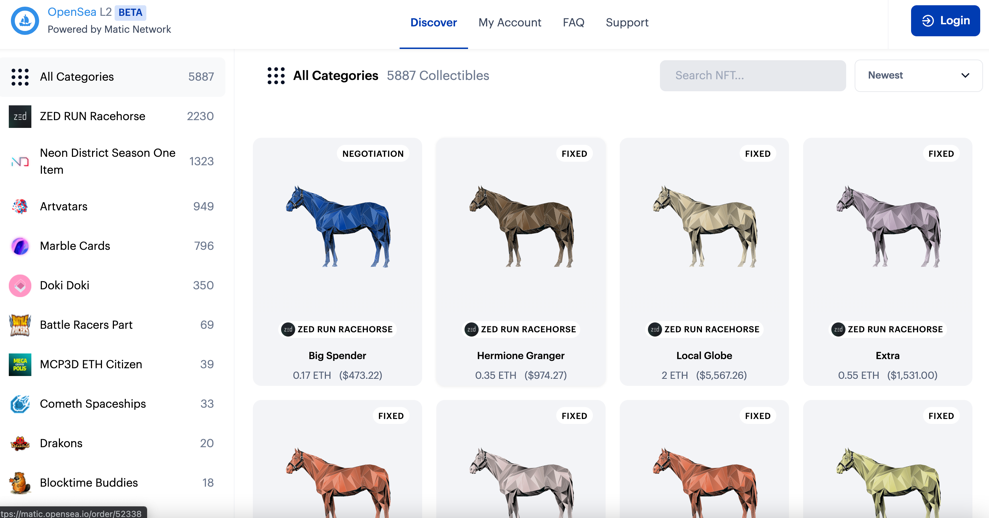

6. Collect NFTs on OpenSea

The top NFT marketplace now also has a beta deployment on Polygon! While it doesn’t feature nearly as extensive an offering of tokens as on L1, collectors can still purchase a variety of different NFTs. Interestingly, gaming tokens appear to be the most popular collections on the marketplace. NFT’s related to ZED a digital horse racing and ownership game, and Neon District, a cyberpunk themed RPG, account for over 60% of the total collectibles listed.

Gas Savings

While the cost of becoming a DeFi chad is reduced to near zero, the cost of becoming an NFT collector on Polygon is literally zero. That’s because OpenSea L2 completely subsidizes the cost of gas for buying NFTs. What would cost $72 on Ethereum L1 is now free. That’s the power of Polygon, sers.

Conclusion

Scaling for Ethereum is here, and it lives up to the hype. On Polygon, you can move money between applications at the speed of light and at virtually zero cost. While it doesn’t inherit all of the security guarantees of Ethereum, this is a step towards realizing that vision of the internet of money that we all signed up for.

There’s plenty you can do on Polygon, and more apps are deploying each and every day. And as mentioned, while there are some security tradeoffs, early pioneers are currently compensated with high yields and/or subsidized costs of usage, not to mention the gas fee savings!

The nightmare that is prohibitively expensive gas is finally coming to an end. The Ethereum economy is now accessible to anyone again.

You can become a Polygod and experience the future of finance.

Action steps

- Try out DeFi on Polygon

- Read about all the other things you can do on Layer 2