How to setup a crypto 401k for your side-hustle

How cool would it be to have Bankless in video format? That’s where I want to go next. But I need your help! If you want the Bankless program in video give 1 DAI & let’s make it happen!

Dear Crypto Natives,

I sometimes laugh at the Bitcoin ETF idea.

Truth is: brokerages aren’t meant to hold crypto.

Bitcoin in an ETF is backwards. It’s like a motorized carriage. It’s like hosting the .pdf of a newspaper and calling it wsj.com.

(Above) Picture of the first Bitcoin ETF with an SEC commissioner enjoying his ride to progress!

That’s fine—we don’t need it. We can break our retirement accounts of brokerage jail now. All it takes is a bankless tactic and a bit of perseverance.

I wrote about breaking an IRA out of brokerage jail in the very first bankless tactic. It’s time to revisit. This time for 401ks.

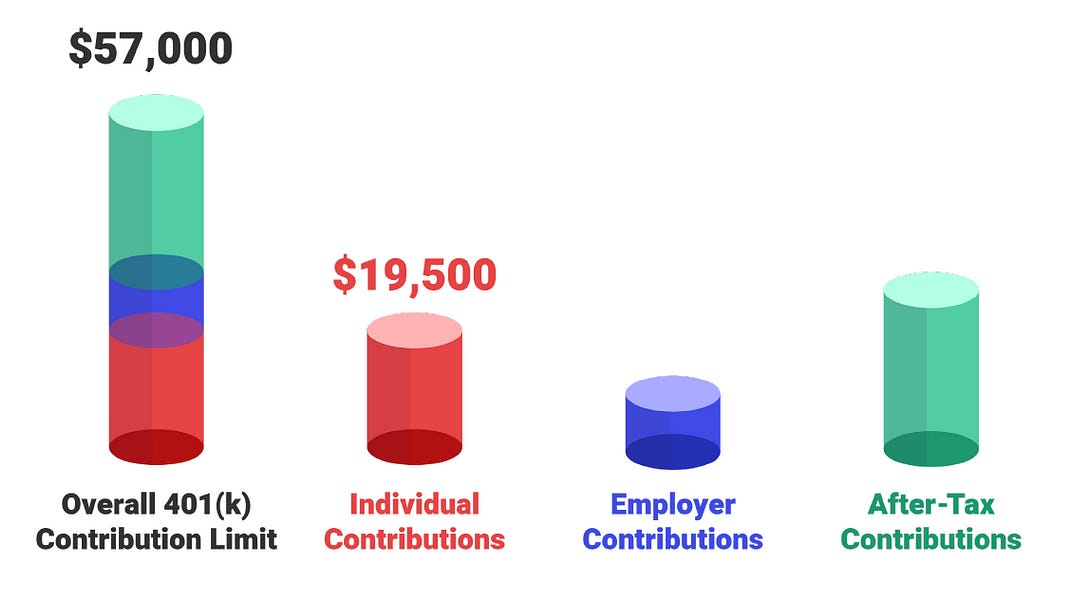

If you have a side-hustle and some good income then you can break up to $57k per year of your money out of brokerage jail in 5 steps using this tactic.

Cars. Not motorized carriages.

Bankless. Not brokerage jail.

Let’s level up.

-RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

Btw, we just release episode 1 of our new Tuesday video show—State of the Nation!

Watch State of the Nation—episode #1. And let me know what you think!

TACTICS TUESDAY:

Tactic #42: How to make your own cryptocurrency 401k for your side-hustle

You live in the U.S., you make good money, and have a side-hustle. Did you know you can setup a 401k and contribute up to $57k per year into a tax sheltered crypto account? You can buy crypto with it. You can stake, lend, earn, trade—no taxes. No brokerage. All bankless. This tactic builds off tactic #1 but is targeted at solo-entrepreneurs with side-hustle income streams living in the U.S.

- Goal: Tax shelter your crypto in an 401k

- Skill: Advanced

- Effort: 5-10 hours (3-4 weeks)

- ROI: $360 setup fee + $15 per mo for 15 - 37% on crypto gains

Why jail break?

If you have a retirement account like an IRA or 401k it’s locked in brokerage jail. Fidelity, Schwab, e-Trade—these are the prisons of traditional finance.

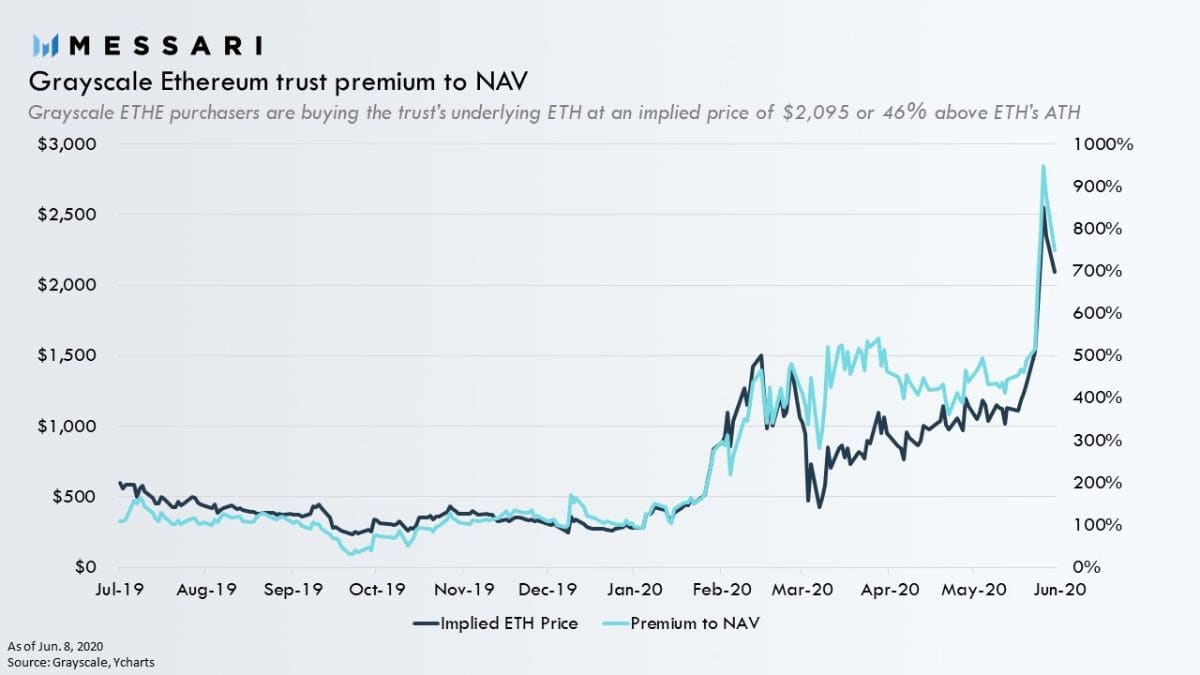

If you want to buy crypto inside a brokerage jail…too bad. The only thing you can buy are crypto IOUs like GBTC or ETHE. This is triple crappy because:

- You can’t do anything with your crypto—no staking, no lending, no DeFi

- You’re wasting 2% on management fees—a massive compounding cost

- You’re paying 3-8x more—ETHE sells for $2k per ETH!

(Above) Do you like to buy ETH for $2,500 when outside jail you can buy it for $250? Cause I don’t.

I’m convinced this is one of the biggest retail ripoffs going on in this space. (I’m not mad at ETHE or GBTC btw—the SEC is the one causing this by blocking retail ETFs.)

That’s why I encourage Bankless readers to break their retirement accounts out of jail and start self-directed retirement accounts where they can buy crypto in a tax sheltered way. I call these crypto IRAs and crypto 401ks.

The easy button for jail breaking your retirement account…

While you can setup a self-directed retirement account yourself, my favorite easy button is Rocket Dollar. I use Rocket. The Bankless community uses Rocket. Their fees are reasonable. And they give us discounts! Easy choice.

🎁Save $50 on Rocket Dollar self-directed IRA and 401ks. Click here and use coupon code BANKLESS. Rocket is the provider I use for all my crypto retirement accounts.

Make a cryptocurrency 401k

The goal of this tactic is to help you save on capital gains taxes and jail break your retirement accounts so they can access everything in crypto and DeFi.

You can benefit from this tactic if you:

- Live in the U.S.

- Want to minimize taxes

- Want to invest in crypto & amplify gains with DeFi

- Have a side-hustle producing income (more is better!)

- Don’t have an employee (contractors are fine—but you can’t have an employee)

Do you check the boxes? Awesome.

You’re about to unlock a massive tax savings level up. We’ll get into to the crypto 401k in a minute.

But let’s say only the first 3 apply to you. Don’t be sad! There’s still a bunch of things you can do to save big on taxes…

⚠️NOTE: Things to do if you’re not eligible for this 401k option…

If you don’t fit the criteria for the crypto 401k option there are still some things you can do to jail break your retirement money. Look at these three options:

- Open a ROTH IRA for 2019 ($6k limit—until July 15, 2020)

- Open a ROTH IRA for 2020 ($6k limit)

- Open a ROTH IRA for Spouse 2019/2020 (another $6k limit)

Together this helps you un-jail $12k if single and $24k if married. Here’s the tactic.

If you have an existing IRA…

Of course the above requires you to have non-retirement money laying around. But maybe you want to convert existing retirement funds. If so, consider these options:

- Convert your existing or a spouses ROTH IRAs to crypto ROTH IRA

- Convert a Traditional IRA to a ROTH IRA and then convert to crypto ROTH

The ROTH to ROTH conversion is covered here. This is a no-brainer if you have a ROTH imo. There’s no tax event, just some paperwork and fees (e.g. RocketDollar charges $360 setup and $15 per month).

I’ve done one of these personally—took 3-4 weeks, and a bit of back and forth on paperwork with my brokerage. But totally worth it. I’m doing one for my spouse now.

Traditional ROTH to crypto ROTH conversion…

While you can convert a traditional IRA to a ROTH IRA the downside is that it’ll tigger a tax event. That means you’ll have to pay income taxes in the year you convert on the amount in the Traditional IRA. Maybe this makes sense for you. Maybe not. You’ll have to weigh this option to see if it works. More details on this option here.

Back to the crypto 401k…

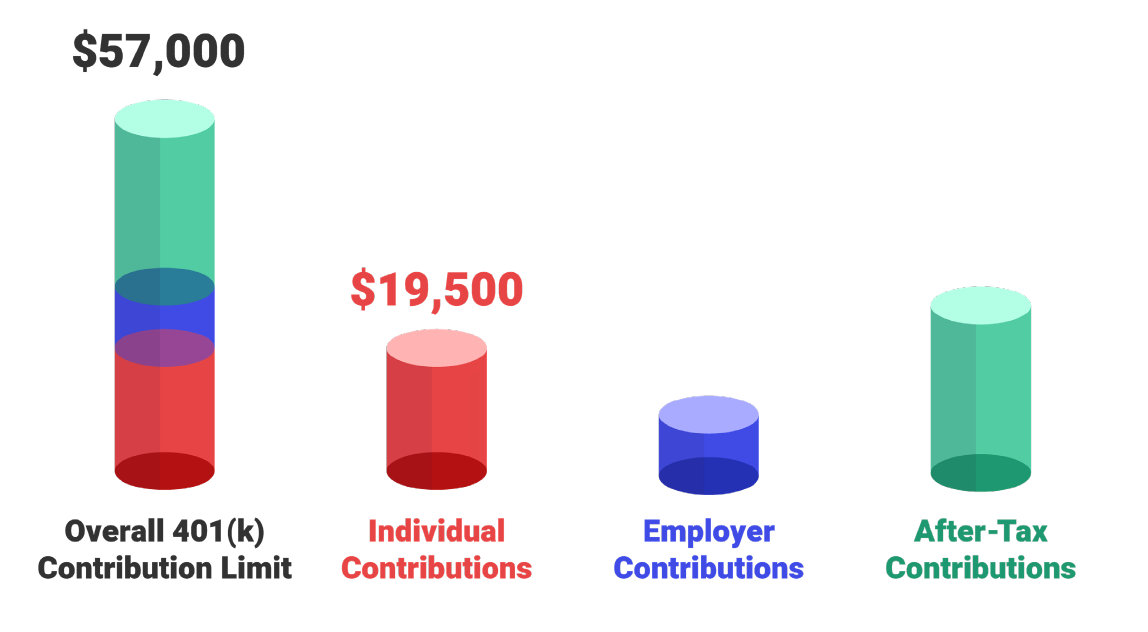

Ok, let’s get back to the crypto 401k. This is for the entrepreneur with a side hustle. Rocket Dollar calls it a Solo401k—or the Mega Backdoor. Mega is an appropriate because this strategy allows you to contribute up to $57k per year!

Here’s you setup a crypto 401k in five steps:

1) Hustle for that income

Remember you need income to make this work. More income is better because the contribution limits are generous! Probably six-figures or higher before this is worth it.

The income can from your W2-job (somewhere you’re employed) and/or your side hustle. Both income sources can be contributed. But at least some must come from your side-hustle (e.g. a contract job, rental income, podcast ad revenue).

You also have to be a supersaver—one of those high-time-preference people that doesn’t spend most of the money they earn.

Oh, also…you can’t have an employee. Just contractors. Solo401k means solo.

2) Setup the infrastructure

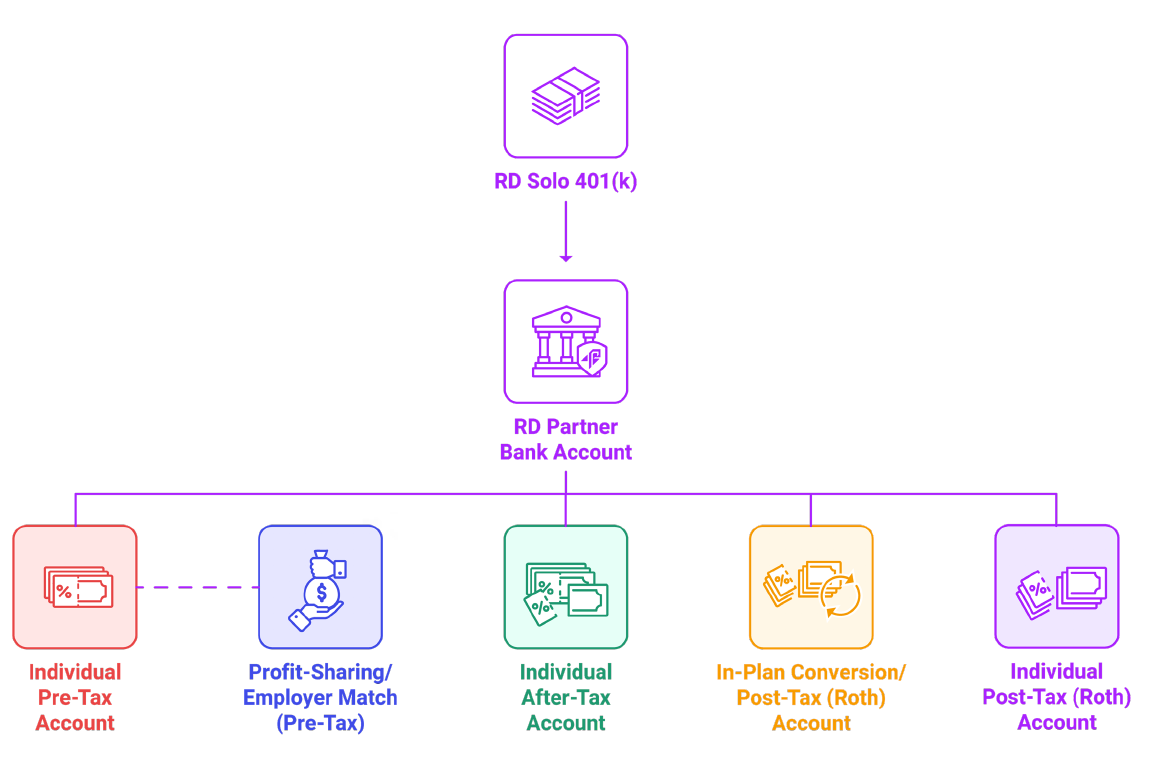

The infrastructure for setting this up is legal entities (e.g. LLCs), bank accounts, and someone who knows what they’re doing. Again, I recommend just pushing the Rocket Dollar easy button but you’re free to try to emulate a structure like this on your own:

3) Start contributing to your buckets

Once you have the account intrastruture setup you can start contributing by transferring funds to the bank account holding your 401k structure. (From there, you can move money to a crypto exchange—that’s step #4)

Think of the accounts in your 401k structure as buckets. Each bucket has dollar limit. You can’t fill above the dollar limit. And each bucket has rules.

The first bucket is easy to fill:

- Individual Contribution—Max out your individual contribution bucket ($19,500 for under 50, $26,000 for over 50, catch-ups for 2020)—this can be W2 and/or side-hustle income for current year. Also, these are pre-tax dollars that you can defer against your current year’s income. 🔥

That gets you $19,500.

Then add employer contributions bucket (you are the employer in this case):

- Employer contribution—this portion is calculated using an IRS calculator. It’s all pre-tax so you can defer against your current year’s income. If you’re unsure on the amounts, just ask Rocket.

Then add after-tax bucket:

After-tax contributions—This gets a bit more complicated but your after-tax contributions are calculated like this:

This is after-tax only, so you can’t defer contributions against your current year’s income in this bucket. It also requires some conversions from the Individual After-Tax account to the In-Plan Conversion/Post-Tax Account that you setup. You can read about it on page 9 of this whitepaper.

Ok, now your funds are tax sheltered. Next is the fun part. Buying crypto!

4) Move money an exchange & buy crypto!

Before you move money from the bank account holding your 401k to an exchange you’ll have to setup a new account on the crypto exchange in the name of the LLC holding your 401k structure.

⚠️Protip: Gemini & Coinbase. In my experience Gemini processes new business accounts in a few days. Coinbase is harder. You might try both to setup both parallel.

Once the exchange account is setup you can Wire or ACH transfer your funds and buy crypto. Buy ETH, buy BTC, buy DeFi assets or bank tokens—it’s up to you.

5) Hold, trade, lend, earn, stake—DeFi is open!

Since you’re now in a tax sheltered account, any trades you make don’t require capital gains tax reporting. That means no tax events on income you earn from lending, staking, or liquidity mining!

And best of all you’re no longer stuck in the jail of brokerage assets—once you withdraw from the exchange, your funds are free and you have access to the entire DeFi ecosystem in a tax sheltered way!

That’s it!

5 steps to break up to $57k per year out of brokerage jail.

⚠️Protip: Don’t co-mingle your funds. I wrote about this in tactic #1 but if you withdraw funds from an exchange you’ll want to make sure you keep all crypto 401k activity in separate ETH/BTC addresses—don’t co-mingle with your taxable addresses!

Final Thoughts

If you want tax sheltered crypto outside your brokerage and inside the open crypto money system then self-directed retirement accounts are the way to do it. If you live in the U.S. and have some money then consider this a must-do bankless hack.

A crypto Roth IRA is a great place to start (You have until July 15, 2020 to contribute for 2019 so get on it now!). But if you’re earning lots of income and have a side-hustle you have an even better option—that’s the crypto 401k we showed you today.

Last thing—taking your retirement account bankless requires some effort—paperwork, patience, time. It took me about 10 hours and 4 weeks to get setup.

But what’s the value of tax sheltered crypto?

What if crypto goes 10x again?

$57k (contribution) * 10x (asset growth) * 35% (tax on gains) = $200k in tax savings.

That’s $200k in savings for $15 per month and a handful of hours.

Those are the kind of returns we like.

Those are bankless returns.

Action steps

- Start a self-directed crypto IRA & contribute $6k before July 15, 2020

(you’d have to start now—it can take weeks to transfer from brokerage) - Start a crypto Solo401k if you have a side-hustle & are a crypto supersaver

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.