How to mint trustless BTC on Ethereum

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

Trustless Bitcoin is one of the most desired assets in DeFi.

Today, we largely rely on WBTC for tokenized bitcoin on Ethereum. Yeah…it works. Yeah…it allows us to use BTC throughout a range of DeFi applications. But it’s not trustless. We have to rely on BitGo to custody & hold the assets.

Relying on a centralized entity in decentralized finance? Yuck.

That’s why we need a more decentralized, more trustless version of BTC on Ethereum. And that’s why the engineers over at Keep Network created tBTC.

It’s trust-minimized BTC on Ethereum. So rather than relying on a single institution, you rely on a decentralized group of “signers” who are incentivized to act honestly.

Trust BitGo to hold my bitcoin? Meh.

Maybe game theory and financial incentives can do the work.

Here’s how to mint trustless BTC on Ethereum.

- RSA

P.S. 📢Coindesk’s Invest: Ethereum event is on Oct 14 and I think you’re gonna love it. Vitalik & industry leaders talking DeFi and the Ethereum economy. Register with “BANKLESS” to get 25$ off. Early bird special ends tomorrow!

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

We just released episode 16 of State of the Nation!

📺 Watch State of the Nation #16: RETREATING w/ @jchervinsky

BitMEX REKT, SEC Action, and is DeFi safe??

We’re now live streaming State of the Nation—join us at 2pm EST every Tuesday!

TACTICS TUESDAY

Tactic #58: How to mint tBTC on Ethereum

Guest Writer: Carolyn Reckhow, Head of Business Development & Strategy at Keep.

With the diverse range of options for using BTC in DeFi, there’s a growing demand for BTC within the Ethereum ecosystem. And given the decentralized and trust-minimized ethos of crypto finance, we need ways to safely and securely hold our bitcoin on Ethereum without having to rely on centralized third parties.

TBTC is one of those options. TBTC lets Bitcoin holders safely access Ethereum applications simply by exchanging their BTC ontbtc.network for tBTC, an ERC-20 fully backed and matched by at least 1 BTC held in reserve.

Most importantly, tBTC is trust-minimized—it uses a random beacon to select “signers” who are bonded 150% of the value in ETH. They also have responsibility for the deposited BTC. So rather than relying on BitGo, you can rely on a decentralized network of actors, all of who are incentivized to act honestly and in your best interest.

You can convert tBTC to BTC, and vice-versa, whenever you want, with no intermediary needed to sign off.

And it’s simple: it only takes a few easy steps to mint tBTC on tbtc.network and track their Bitcoin.

Let’s learn how to mint tBTC and start earning safely with your Bitcoin!

- Goal: Migrate your BTC to Ethereum using Keep Network

- Skill: Intermediate

- Effort: 70 minutes (mainly for BTC confirmations)

- ROI: The most trust-minimized way to access DeFi apps with your Bitcoin

Background on tBTC

tBTC’s developers worked hard to develop a trust-minimized asset that meets the standards and ethos of DeFi. Built on Keep Network, tBTC leverages advanced cryptography to allow users to safely and transparently use trustless Bitcoin on Ethereum.

From a high level, Keep Network achieves this in 3 simple steps:

- Takes BTC on Bitcoin

- Calls on a decentralized group of “signers” (explained below) to store safely & trustlessly store BTC

- Once your BTC has provably landed with the signers, you receive tBTC at a peg of 1:1 on Ethereum.

Better yet, the process can be reversed just as easily using the exact same steps.

With all of that in mind, there’s plenty of important factors behind tBTC’s design that make it so attractive for DeFi.

Here’s a few of them:

Secure, Transparent & Open source

One of the major design goals of tBTC was to eliminate any uncertainty with the asset — a critical aspect that has kept a significant amount of BTC on the sidelines in decentralized finance. Not everyone wants to trust BitGo to securely store their BTC.

That said, we wanted to ensure tBTC was entirely transparent and secure for all users. That’s why tBTC is fully open-sourced and leverages the highest standards of cryptography.

Dig into all of tBTC’s and Keep Network’s code right here whenever you want.

🧠 tBTC & Keep Network uses an elliptic curve signature algorithm called t-ECDSA. This same curve is also used today by Binance (and similar tech is being built by Zcash & Gnosis).

Signer Groups

The other major pain point tBTC aims to address is eliminating counterparty risk.

To do this, it uses a system of “signer groups” that allows tBTC to process transactions without a centralized, trusted middleman.

Signers operate in groups of three. In order for a transaction to be verified, all three signers must approve the same transaction. Importantly, signers receive a fee of 20 basis points (bps) for every tBTC minted — a critical mechanism to ensure network participation.

Equally as important, there also needs to be a mechanism to ensure signers behave honestly and in the best interest of the minter.

In order to solve this, tBTC uses a random beacon: a decentralized random selection tool for selecting signers from a pool in a cryptographically secure and decentralized way. This beacon cannot be gamed or manipulated.

The final piece to ensure signers act honestly (and don’t steal the BTC they custody) is that all signers must post a “bond” equal to 150% of the amount of BTC being deposited. This bond acts as collateral to ensure good behavior as any signer who tries to steal the BTC, their bond would be forfeited and the signer would lose more than they gained.

Now that we have that out of the way, let’s dive into how to mint tBTC.

How to mint tBTC

Follow this step-by-step guide for using the tBTC dApp.

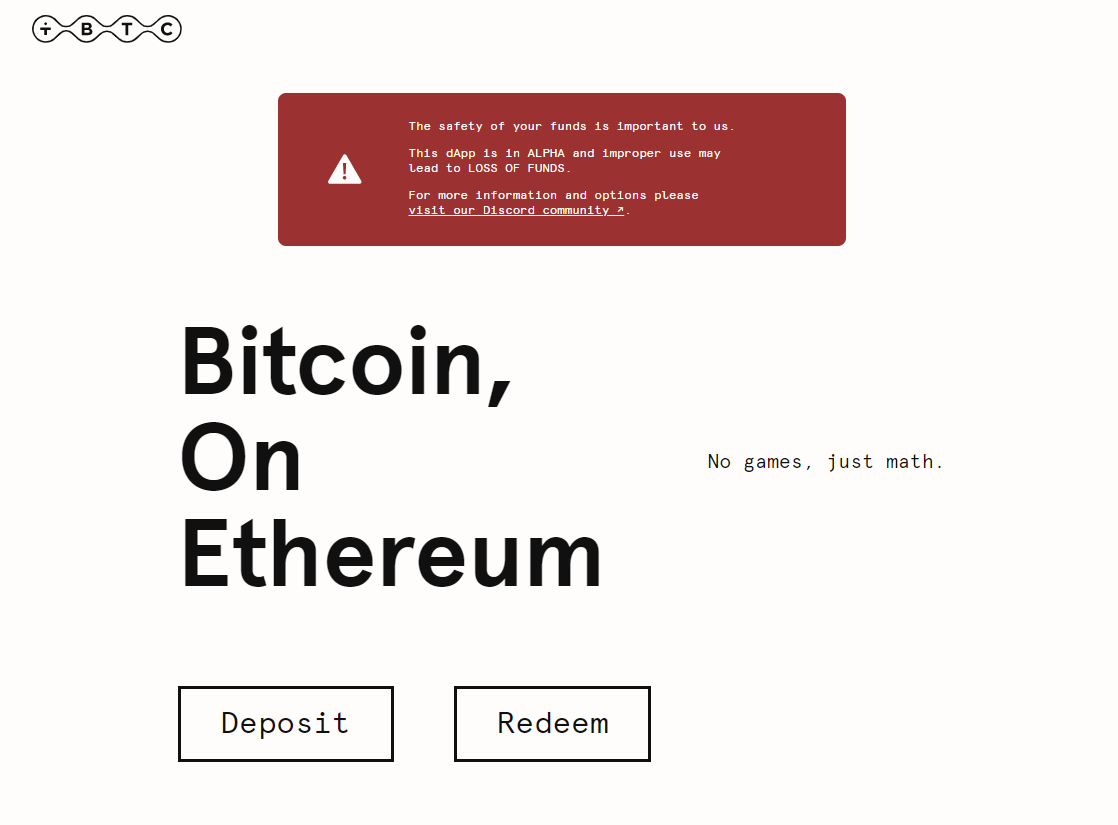

Before anything else, make sure you have some ETH in your wallet and head over to the tBTC minting app.

- Once there, click on “Deposit”.

- Connect your Ethereum wallet. The app currently supports Metamask, Ledger, and Trezor hardware wallets.

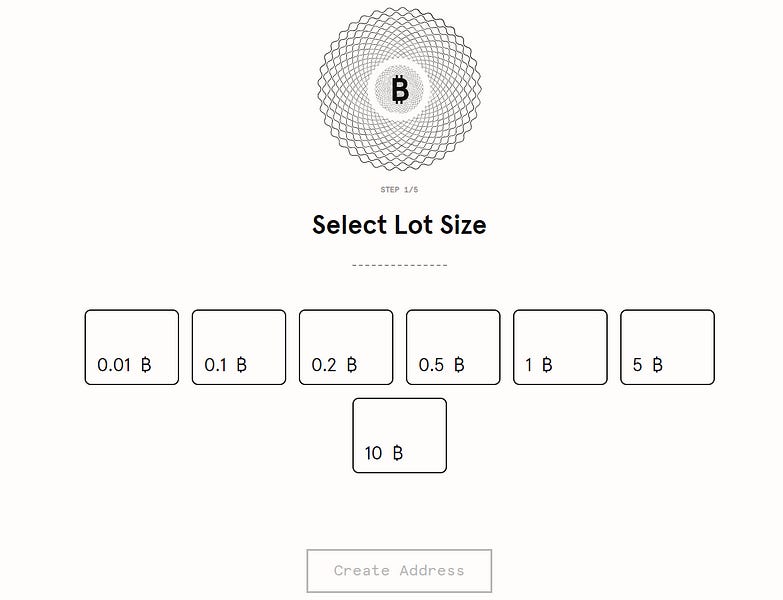

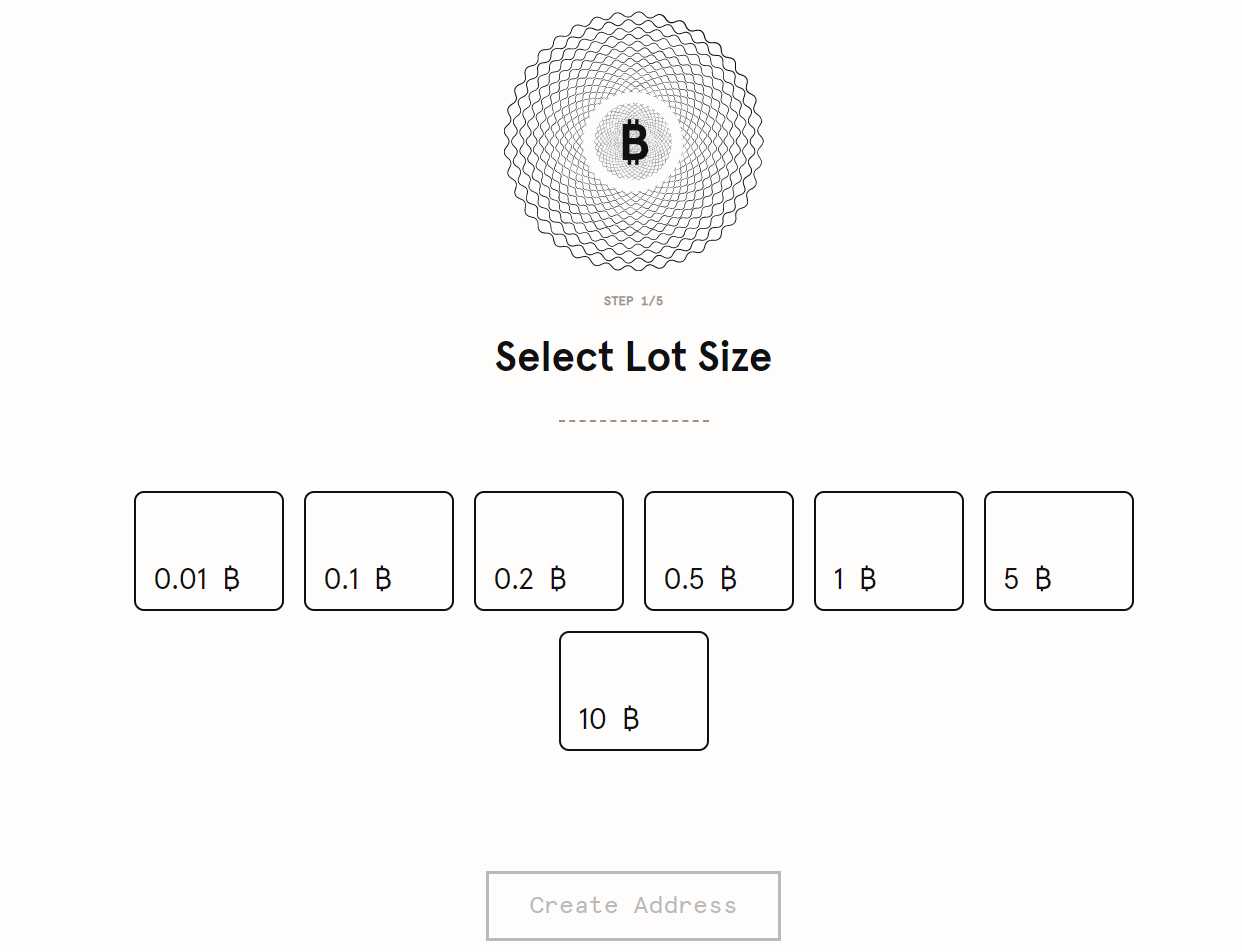

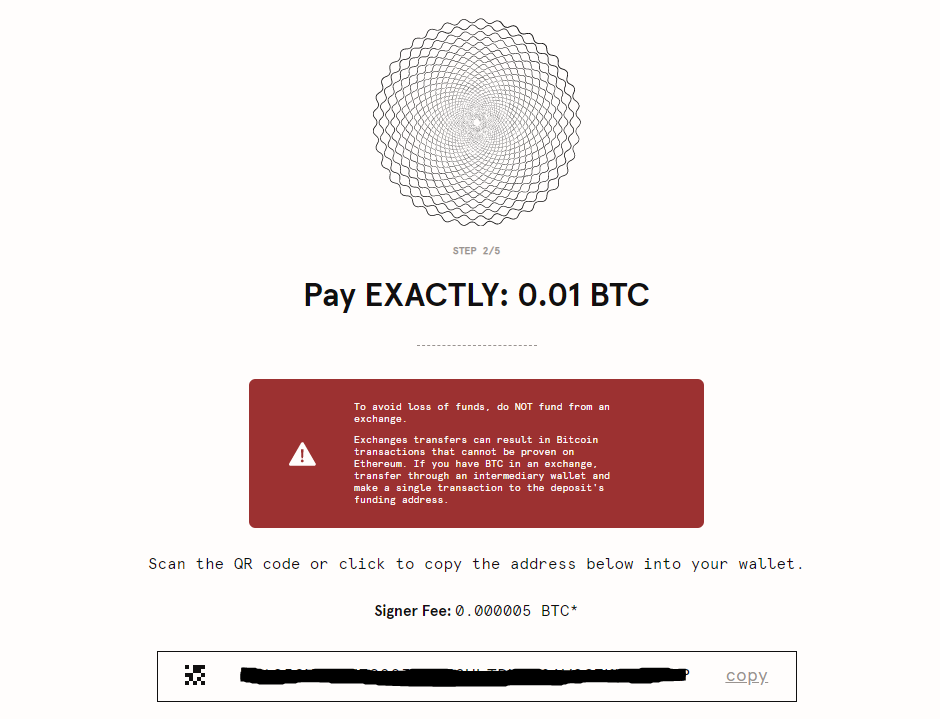

- Select the desired lot size. You have a handful of options between 0.01 BTC - 10 BTC. Once selected, click “create address".

The transaction to request a BTC address will be sent to your ETH wallet. Review and accept the transaction (this one requests assembly of a new group of ETH bonded signers). Estimated tx costs range between $60 - $100.

Also, review and accept the next transactions for small ETH amounts (this one actually requests the BTC address).

Once confirmed, you’ll see a BTC address. Send BTC based on your selected lot size in step 3 (in our example 0.1 BTC) to the given BTC address.

Note: DO NOT send Bitcoin from an exchange wallet

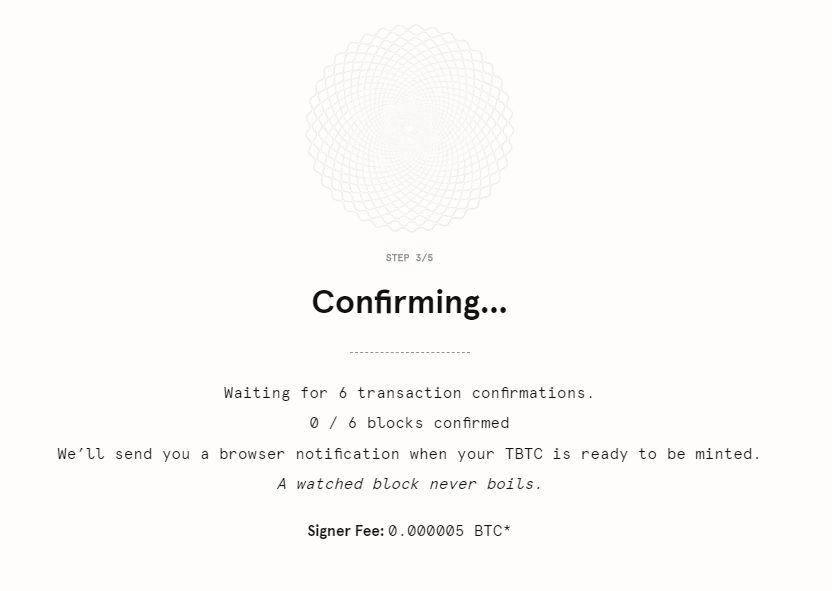

- Send the same amount of BTC as your lot size from your BTC wallet to the generated BTC address. Once sent, you have to wait for 6 block BTC confirmations. This is the part that can take about an hour.

Don’t forget to come back to your browser to complete the transaction if you’re not watching blocks.

- Review and accept the transaction. This transaction submits the SPV proof (proof that your BTC tx landed) to the Ethereum chain.

- Review and accept the next ETH transaction, this one finishes the process and mints tBTC.

- The TBTC minting process is now complete. You should have TBTC in your Ethereum wallet.

Congratulations! You have successfully minted TBTC safely and have access to Ethereum DeFi apps. You may need to manually add the token to view it — here’s the tBTC contract address.

You’re now free to use tBTC on Ethereum. While tBTC is still new, it has promising prospects of being integrated into some of the most popular DeFi protocols like Compound and Maker.

Just give it some time and soon we’ll be able to use trustless bitcoin in trustless financial applications on Ethereum.

For anyone looking for more information, check out these resources on Keep Networl:

Action steps:

- Try minting tBTC on Ethereum using the above steps

- Read Is tokenized BTC bullish for ETH?

Author Bio

Carolyn Reckhow is the Head of Business Development & Strategy at Keep Network, the protocol enabling censorship-resistant, private data in the blockchain ecosystem. She previously worked at Casa, a secure BTC storage solution, and Consensys.

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open-source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.