How to migrate LEND and stake AAVE

Last day to get a ticket to Invest Ethereum! Fresh insights from Vitalik and other DeFi leaders.

Dear Bankless Nation,

Aave recently announced Aavenomics—a major token economics and governance upgrade aimed at reforming the protocol’s native token.

It features a new token, AAVE, which allows anyone to participate in governance as well as the right to start earning protocol incentives.

So if you’re holding onto LEND you’ll need to migrate over. Good thing it’s really easy.

Better yet, there’s a reward for migrating. Once you have your AAVE, you can stake the tokens into the Safety Module (SM).

You’re protecting the protocol in return for a suite of incentives including AAVE rewards, protocol fees, and interestingly, BAL rewards.

This is an essential for any DeFi investor who uses Aave.

William teaches us how to get this done in a few minutes.

- RSA

P.S. More Aave? Check our Aave to Billions podcast with Stani the Founder.

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

We just released episode 18 of State of the Nation!

📺 Watch State of the Nation #18: ANTICIPATING w/ @TimBeiko

EIP 1559, ETH 2.0, Elections, Market Crossroads

We’re now live streaming State of the Nation—join us at 2pm EST every Tuesday!

TACTICS TUESDAY

Tactic #60: How to migrate and stake AAVE

Bankless Writer: William M. Peaster, creator of the DeFi Arts Intelligencer

Aave recently began its migration to AAVE, the protocol’s new governance token, improving on token economics and creating an insurance system secured by AAVE.

This tactic will show you how to migrate your LEND, Aave’s legacy token, to AAVE so you earn protocol incentives by protecting and securing the protocol.

- Goal: Migrate LEND to AAVE for Safety Module staking

- Skill: Easy

- Effort: 10 mins

- ROI: Currently ~8% APY

Background on Aave

Starting as P2P lending platform ETHLend in 2017, Aave rebranded in September 2018 and hit Ethereum main net in January 2020 as the decentralized borrowing and lending protocol we know and love today.

Aave has been one of DeFi’s rising stars this year as veterans and new DeFi users alike have been attracted to the robustness and flexibility of the protocol. Offering both stable and variable interest rates, Aave allows lenders to supply assets like Dai, USDC, and others into a pool for anyone to borrow from. For their service, lenders receive interesting-streaming aTokens, e.g. aDai, on a 1:1 basis to collateral.

Aave differentiates itself from its lending peers like Compound and Maker through unique offerings like aTokens and native support for flash loans — uncollateralized loans where borrowing and repayment takes place in a single transaction.

Aavenomics and the AAVE Migration

This summer, Aave unveiled Aavenomics, a major token economics upgrade optimizing the Aave ecosystem for the long haul.

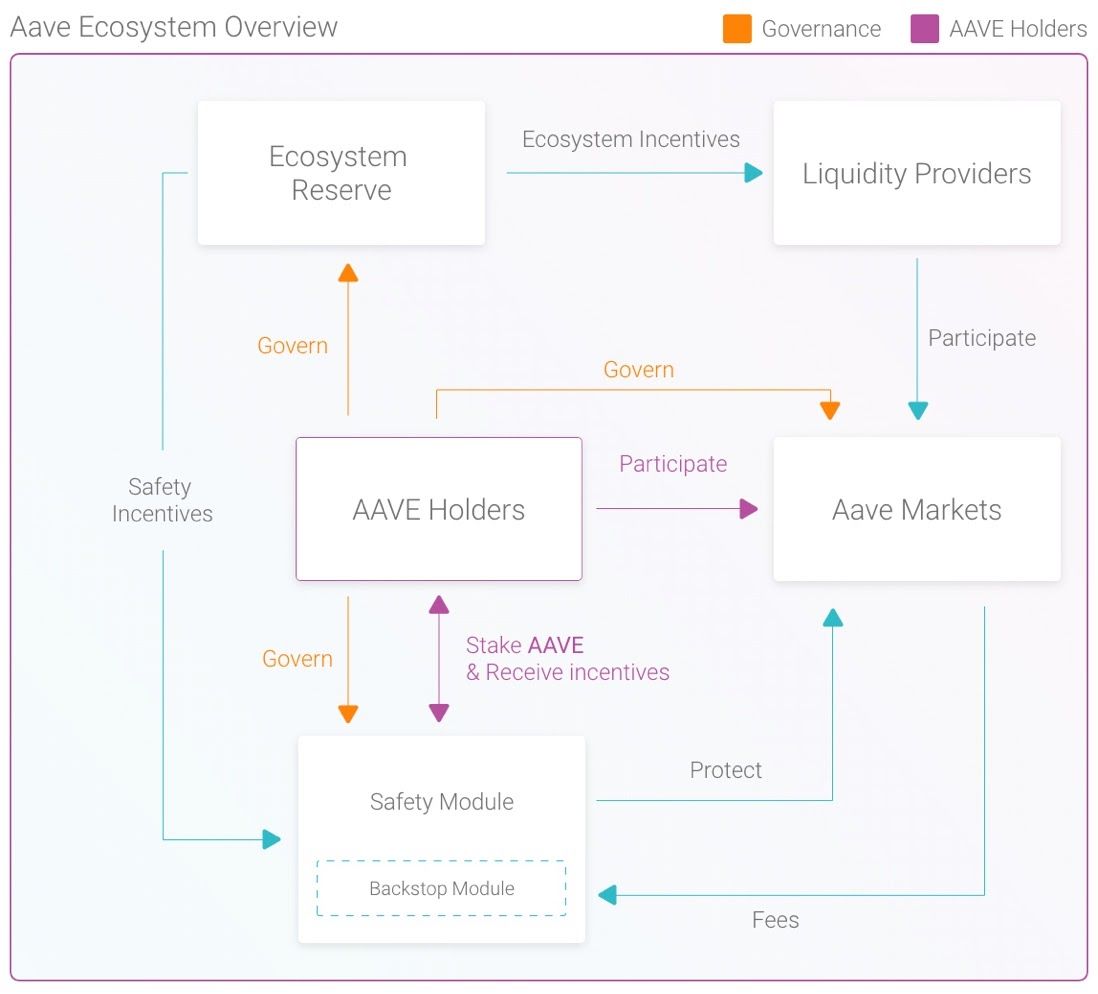

The upgrade outlines a token supply reduction to lower the 1.3 billion LEND supply to 16 million AAVE. A system was introduced for migrating LEND to AAVE on a 100:1 basis, and the migration would account for 13 million AAVE. The other 3 million tokens were set aside for the Aave Ecosystem Reserve, a fund for bootstrapping protocol incentives as voted on via Aave governance.

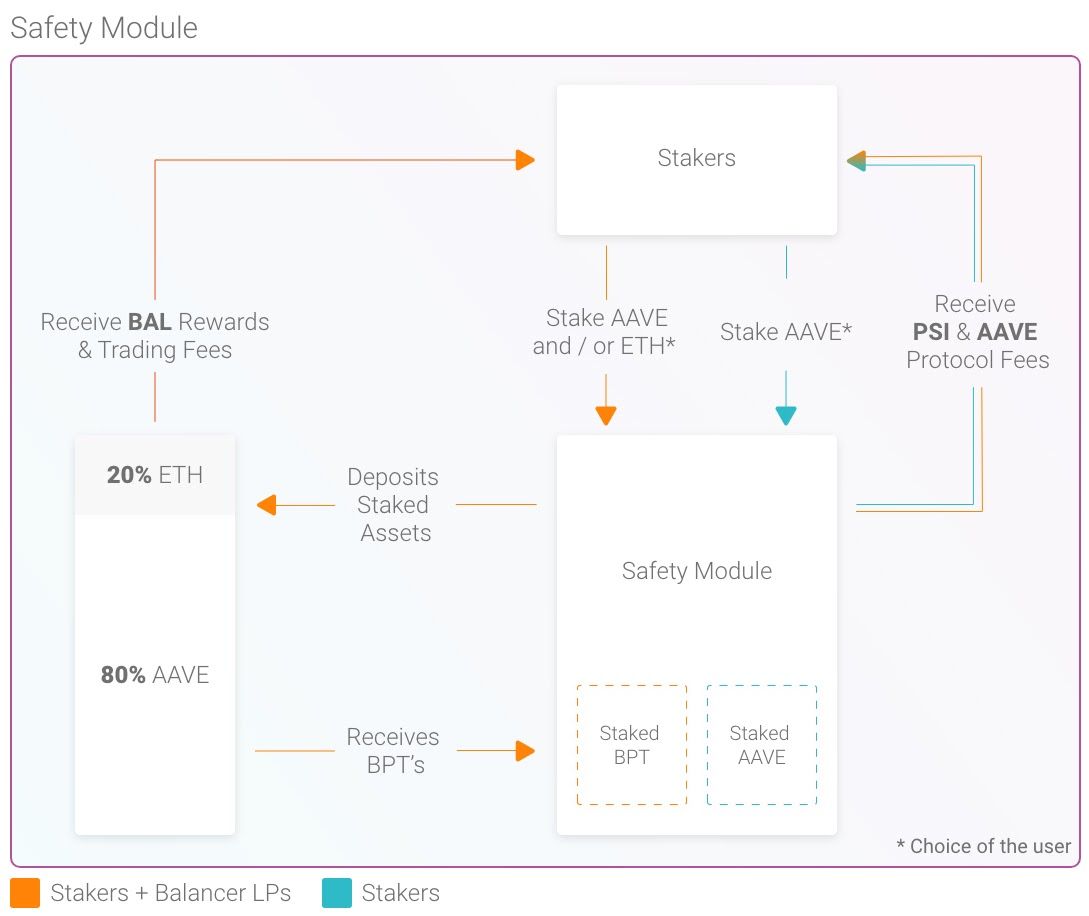

But the most pivotal aspect of Aavenomics was the introduction of the Aave Safety Module (SM), which is built atop an 80% AAVE / 20% ETH Balancer liquidity pool. At its core, the SM provides insurance against shortfall events — similar to the one Maker experienced this year’s on Black Thursday market crash.

The system lets users stake AAVE or provide liquidity to the aforementioned AAVE/ETH pair to prevent deficits in Aave’s money markets. For providing this insurance, stakers earn Safety Incentives (SI), Aave protocol fees, BAL rewards and trading fees from the Balancer pool.

The Aavenomics proposal was open to a community vote in September, and the plan easily sailed through governance. With the migration approved, a migration portal was launched on October 2nd and LEND holders are currently transitioning over to AAVE.

Now it’s your turn!

How to Migrate and Stake AAVE

The LEND migration is currently open-ended, so for now you don’t have to be in any rush to start the process. Whenever you’re ready, here’s what you’ll need to do:

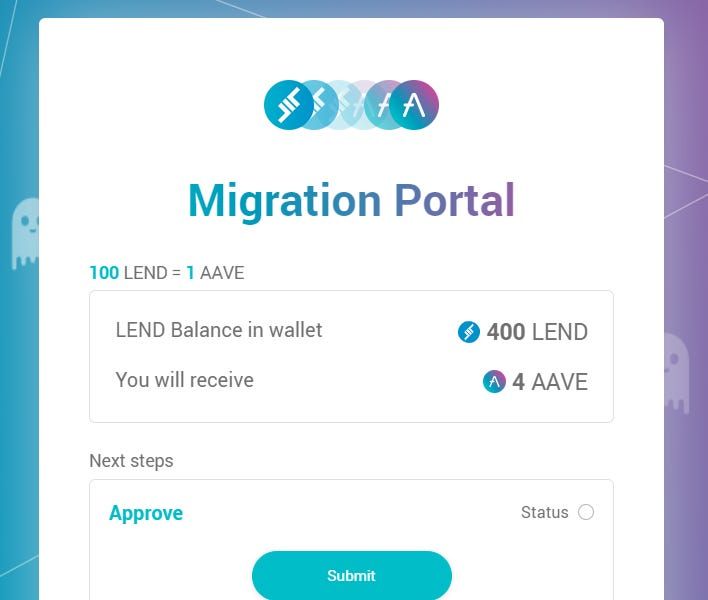

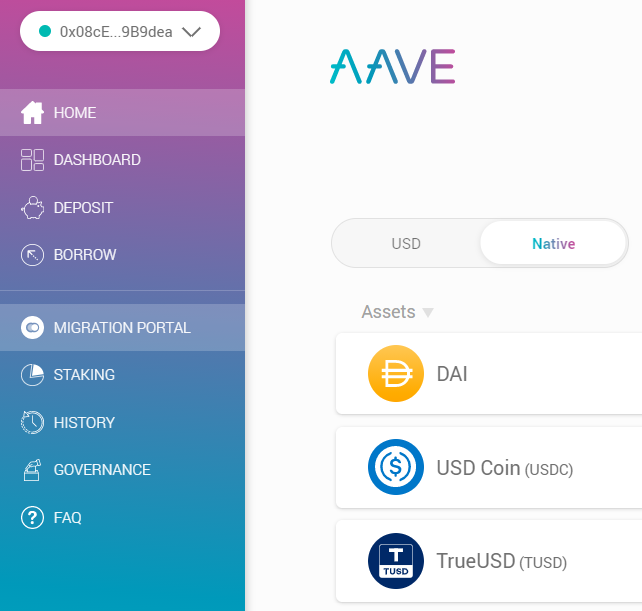

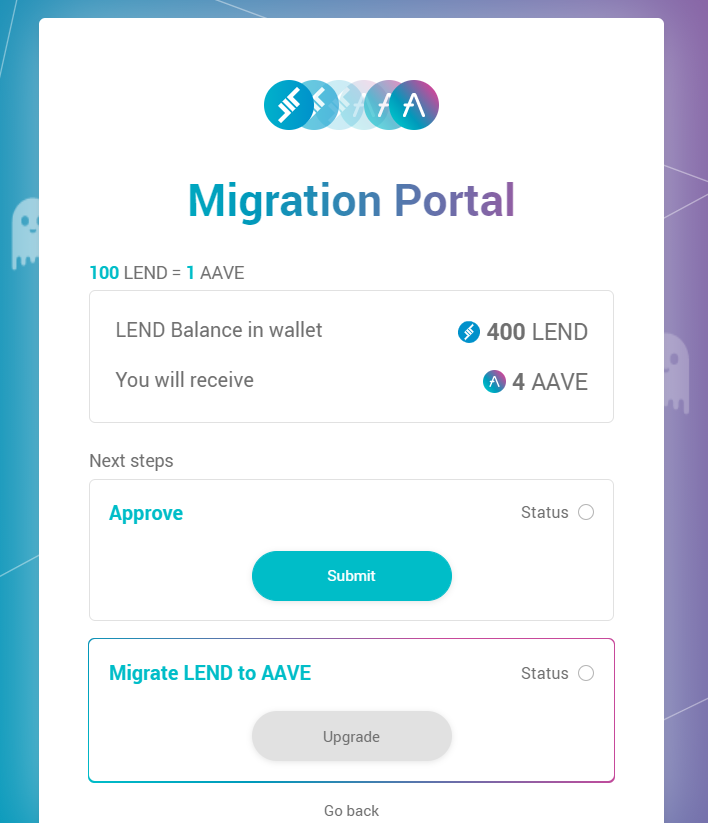

1. Navigate to app.aave.com. Click on the “Migration Portal” tab on the left-hand side of the page.

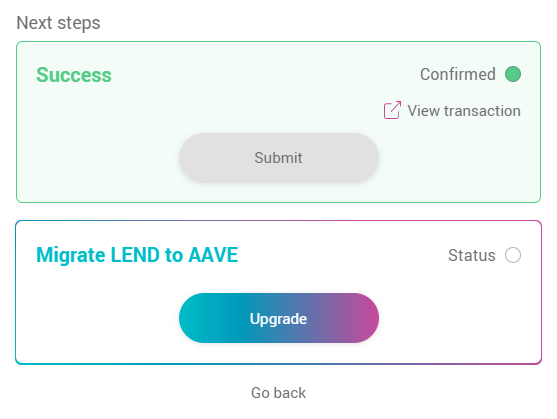

2. Approve the migration transaction. The portal will automatically identify how much LEND you have to migrate. Press “Submit” and pay the small approval transaction.

3. Migrate your LEND to AAVE. Click “Upgrade” and confirm the migration transaction in your wallet.

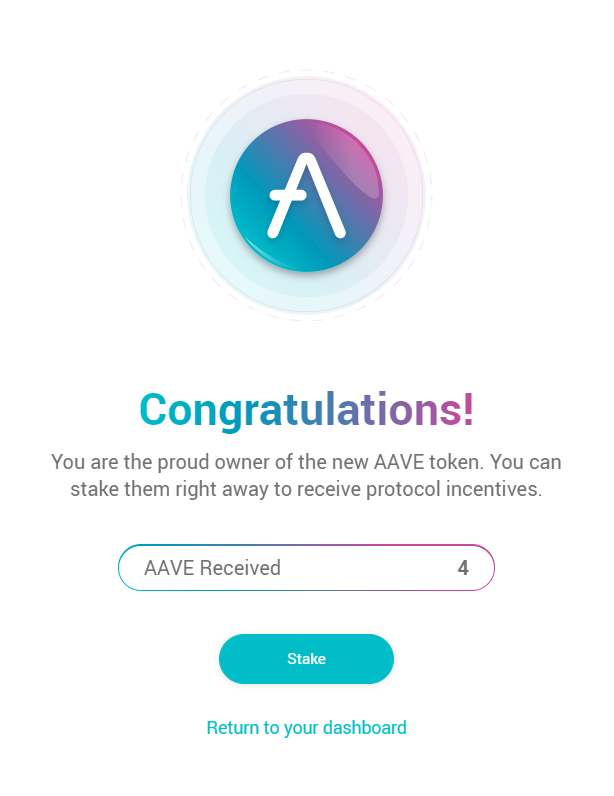

4. Now it’s time to stake your AAVE. Once you finish migrating your LEND, Aave will immediately hit you with a prompt asking whether you want to start staking right away. We’ll click “Stake.”

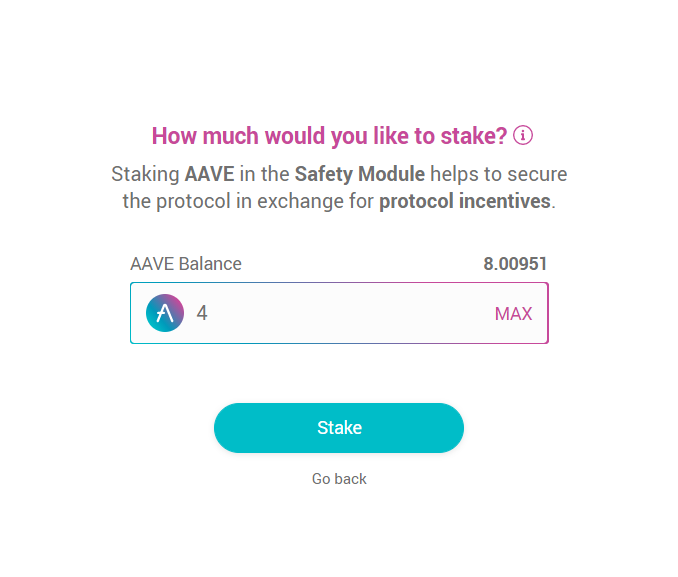

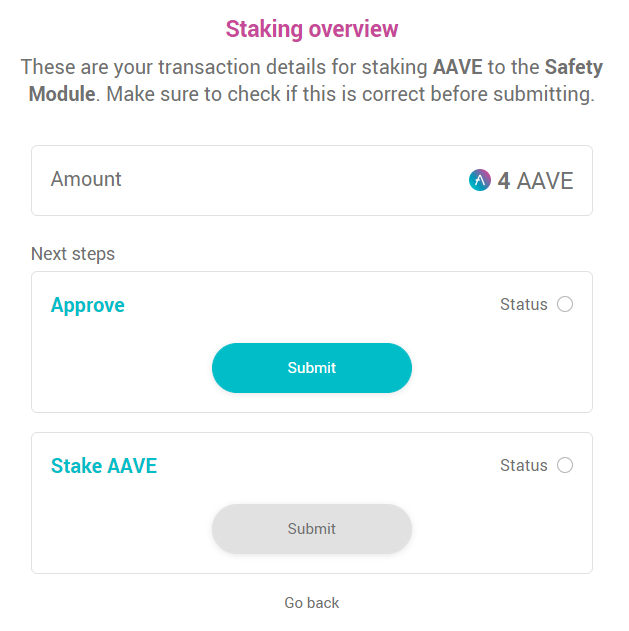

5. Select how much AAVE you want to stake. You can press “Max” to stake all your Aave or specify a smaller amount if you’d like. I’m going to stake 4 AAVE as a test. Once ready, I’ll hit “Stake.” It’s important to recognize that staked AAVE is subject up to a 30% slashing fee if the protocol ever experiences a shortfall event.

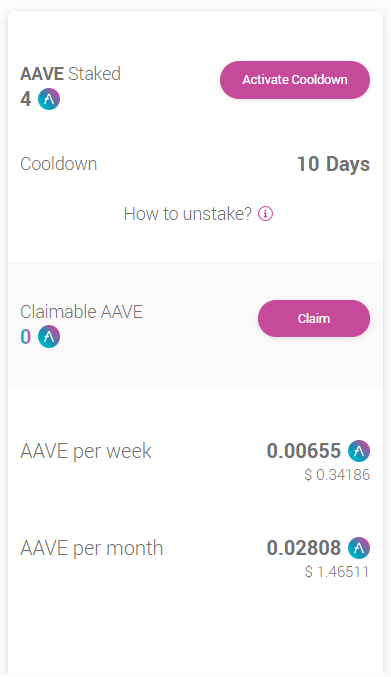

6. Mind the cooldown / countdown period. An informational prompt will pop up reminding prospective stakers that up to 30% of their deposits can be slashed during shortfall events and that there’s a 10-day cooldown period for withdrawing your stake. Press “I understand” to go to the staking portal, which looks like this:

7. Approve and Stake your AAVE. Approve the staking transaction, and once that’s done, click “Submit” in the staking portal. With the completion of this second transaction, you’ll have successfully staked your AAVE. You can easily monitor your position and rewards from within the staking portal.

You’re now defending the Aave protocol as a safety staker! You automatically start earning fees and AAVE rewards for doing so. Well done!

Aavenomics is a major upgrade for Aave that’s meant to “future-proof” the money markets protocol for years to come. Instead of waiting for another Black Thursday event, Aave’s mitigating shortfall threats in advance by incentivizing stakers to create an insurance shield. It’s a bold move that’ll likely cement Aave’s already dominant position in DeFi.

If you’re interested in learning more about Aave, hop into the project’s Discord any time.

Action steps:

- Migrate your LEND to AAVE

- Stake AAVE to start earning protocol incentives for your service

- Listen to our podcast with Stani from Aave to learn more

Author Bio

William M. Peaster is a professional writer and creator of the DeFi Arts Intelligencer. He’s recently been contributing content to DeFi Pulse Farmer, defiprime, and beyond.

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open-source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.