How to make money with automated options strategies

Dear Bankless Nation,

Structured financial products are a huge market in traditional finance.

These are pre-packaged investment products with the goal of giving retail investors (and institutions!) an easy, customizable way to earn dependable returns on their money based on their goals and risk appetite.

In TradFi, Bloomberg estimates that this is a $7 trillion market. 👀

The good part is that we know in DeFi that we can build better, more advanced versions of these structured products. DeFi’s open, permissionless ecosystem enables multiple protocols to compose into highly optimized products, providing investors with some of the best yields in the world.

One of the new players in this space is Ribbon Finance. They launched a few months ago, but have already gained solid traction within the space. The first product release were Theta Vaults.

These vaults take deposited assets and deploy them into more-advanced options strategies on Opyn, like covered calls and put selling. The vaults earn a yield with these strategies and automatically re-deposit it to compound the returns for depositors.

This is a new emerging DeFi protocol offering high passive income returns. Potentially promising.

Here’s what you need to know & how to use it.

- RSA

P.S. dYdX Governance token dropped today! Premium subs got everything they need to know with an Alpha Alert. Want to get them in the future? Get on the bankless program.

How to make money with Ribbon Finance

Ribbon Finance is a decentralized protocol for creating crypto structured products, i.e. prepackaged and cross-protocol DeFi investment strategies.

The project’s declared mission is to create “sustainable alpha for everyone.” This Bankless tactic will show you how to make good on that alpha via depositing into Ribbon’s first product offerings.

- Goal: Use Ribbon Finance

- Skill: Easy—Ribbon handles all the complexities under the hood!

- Effort: 1 hour to familiarize yourself with the project

- ROI: APYs ranging from ~10% to ~54.5% (w/o liquidity mining!)

Ribbons’s First Products: Theta Vaults

Wait…what are structured products?

In short, they’re financial products bundled per specific investment strategies. In TradFi, these are widely popular because they can be composed in many different ways, providing investors flexibility and highly customizable approaches to generating returns. (Here’s a decent definition)

Whatever they can do in TradFi, we can do better in DeFi.

Turns out DeFi’s open ecosystem of programmable “money legos” is perfect for fostering crypto-native structured products. One young project doing compelling work in this vertical right now is Ribbon Finance, which launched only a handful of months ago but is already making a name for itself with its initial crypto structured products.

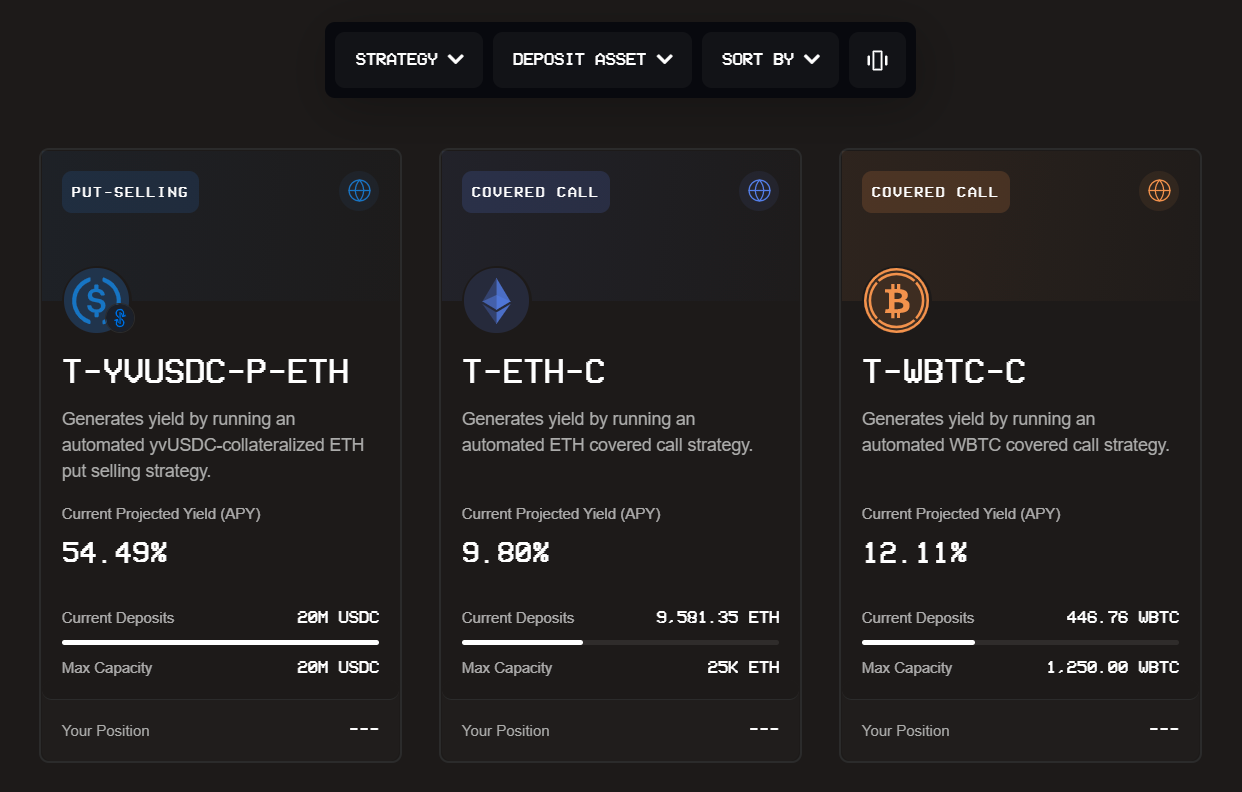

The first of these products, of which four are live on main net today, are what’s called Theta Vaults. The name may sound intimidating at first, but it just denotes that users deposit crypto into these Vaults to earn yields via the vaults running automated options selling strategies.

Depositors to Ribbon’s Theta Vaults get to abstract the difficulty out of participating in advanced, custom-tailored DeFi yield opportunities. Two transactions and voila, you’re in and earning automated returns in complex DeFi strategies. The Vaults also reinvest earnings back into their respective strategies, meaning depositors earn compounding returns!

Out of the gate, Ribbon’s Theta Vaults currently generate yields through two distinct option selling strategies, covered calls and put selling.

I’ll detail how these strategies work in the Vault primers below.

Before going any further, note that Ribbon currently has deposit caps on these Vaults to keep them from swelling in size too quickly in their earliest days. The good thing is that Ribbon’s builders have said they will likely remove these caps in the future!

💰 Vault #1: ETH Put Selling

- Current vault cap: 50 million USDC

- Current projected yield: ~43.7% APY

- Depositing Asset: USDC

Vault Strategy

Ribbon’s ETH Put Selling Vault earns depositors yield by conducting a “weekly automated ETH put-selling strategy.” The process works like so:

- Users deposit USDC into the Vault and receive rUSDC-ETH-P-THETA tokens representing their deposits.

- The Vault allocates 10% of the deposits to facilitate withdrawals and invests the remaining 90%.

- The Vault manager—currently the Ribbon team—invests its funds weekly on Fridays by creating ETH put options via decentralized options protocol Opyn, thus receiving oTokens (the put options). For those newer to options, “puts” grant holders the right to sell ETH at a given price at or before a specific time.

- The Vault sells the oTokens, which have a specified expiry and strike price, to market makers in over-the-counter (OTC) transactions via decentralized trading protocol Airswap. The Vault earns fees for doing so, thus the accrual of these fees is this strategy’s yield-generation method.

- If the options expire out-of-the-money (meaning the market price of ETH is higher than an option’s strike price at expiration), they become worthless and their underlying USDC collateral in Opyn gets returned to the Vault.

- If the options expire in-the-money (i.e. the market price of ETH is lower than an option’s strike price at expiration), they can be exercised by market makers. These stakeholders can claim the “difference between the price of ETH and the strike price at expiry.”

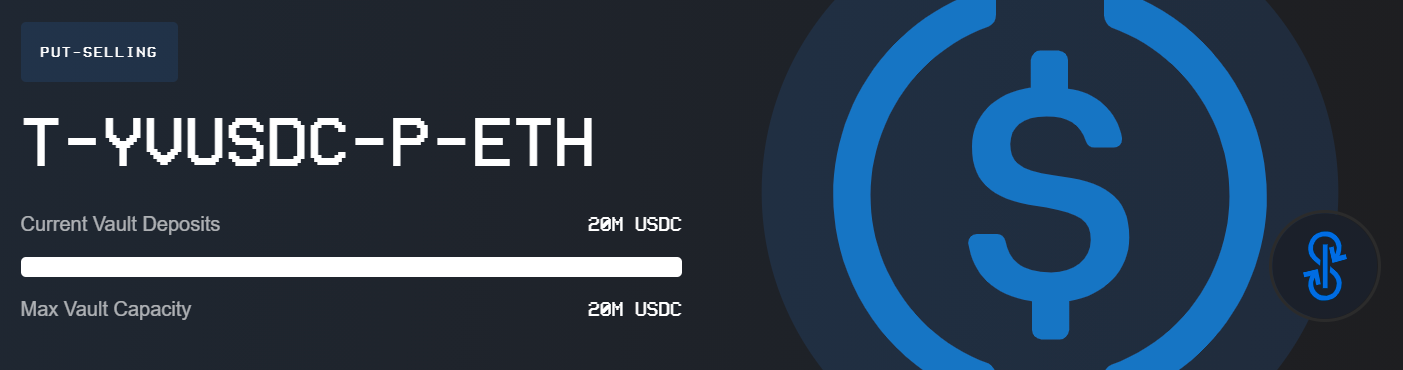

💰 Vault #2: yvUSDC ETH Put Selling Vault

- Current vault capacity: 20 million USDC, presently reached

- Current projected yield: ~54.4% APY

- Depositing Asset: USDC

Vault Strategy

Ribbon’s yvUSDC ETH Put Selling Vault is the protocol’s newest crypto structured product. It works similarly to the previously described ETH Put Selling Vault, but it receives interest-bearing yvUSDC (i.e. Yearn Vault tokens) as collateral from depositors and invests that instead of plain USDC.

This method of option writing gives the underlying depositors the benefit of earning yields from Yearn and Ribbon simultaneously.

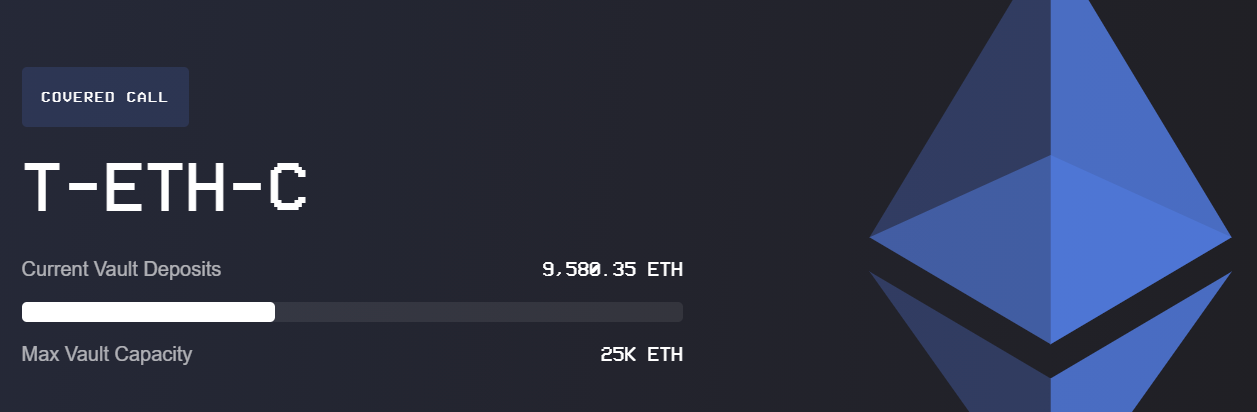

💰 Vault #3: ETH Covered Call Vault

- Current vault cap: 25,000 ETH

- Current projected yield: ~ 9.8% APY

- Depositing Asset: ETH

Vault Strategy

Ribbon’s ETH Covered Call Vault earns depositors yield by conducting a “weekly automated cover call strategy.” Under the hood, this process plays out like so:

- Users deposit ETH into the Vault and receive r-ETH-THETA tokens representing their deposits.

- The Vault allocates 10% of the deposits to facilitate withdrawals and invests the remaining 90%.

- The Vault manager invests its funds weekly on Fridays by creating ETH call options via Opyn and thus receives the calls as oTokens. Remember: these calls grant holders the right to buy ETH at a given price at or before a specific time.

- The Vault sells the oTokens to market makers OTC via AirSwap and earns fees for doing so. These fees are key as they comprise this strategy’s fundamental yield-generation method.

- If the options expire out-of-the-money (OTM), they become worthless and their underlying USDC collateral in Opyn gets returned to the Vault.

- If the options expire in-the-money (ITM), they can be exercised by market makers. These stakeholders can claim the “difference between the price of ETH and the strike price at expiry.”

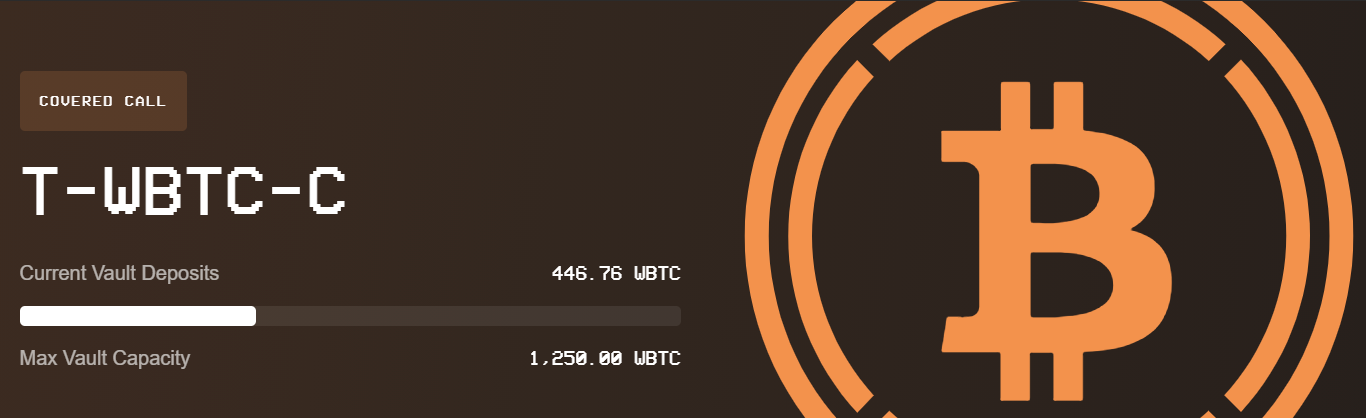

💰 Vault #4: WBTC Covered Call Vault

- Current vault cap: 1,250 WBTC

- Current projected yield: ~12.1% APY

- Depositing Asset: WBTC

Vault Strategy

Ribbon’s WBTC Covered Call Vault earns depositors yield by conducting a “weekly automated cover call strategy.”

Accordingly, this Vault works just like the aforementioned ETH Covered Call Vault except it’s centered around Wrapped Bitcoin (WBTC), meaning depositors deposit WBTC and receive r-WBTC-THETA tokens.

Ribbon staking returning soon?

Between June 18th and July 16th, the Ribbon team conducted its inaugural liquidity mining program to help bootstrap the protocol.

During this period, Ribbon users could stake their vault deposit tokens for the ETH Covered Call Vault, the ETH Put Selling Vault, and the WBTC Covered Call Vault to earn RBN governance tokens.

The Ribbon community’s already discussing the launch of a second LM program, so keep your eyes peeled on Ribbon and the project’s Staking dashboard if you’re keen on participating.

How to deposit into Ribbon’s Theta Vaults

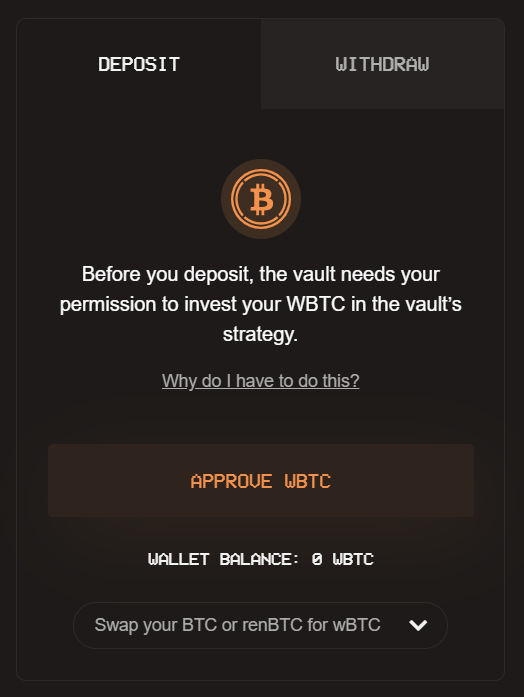

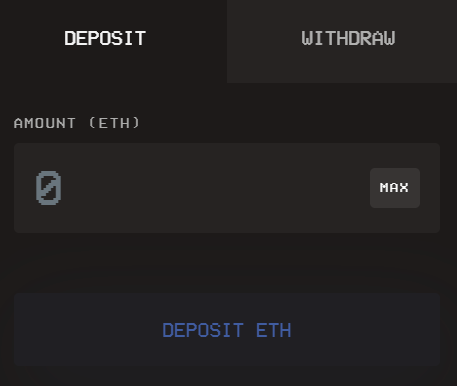

If you’ve never used Ribbon before, you’ll first have to submit an approval transaction for whatever Vault you want to join, granting it approval to spend your funds.

To do this, simply head to app.ribbon.finance, connect your wallet, select a Vault, and then press the “Approve” button. You’ll be prompted to sign a transaction in your wallet, and once you’ve completed that you’ll be ready to supply funds to your chosen Vault.

Select how many ETH/tokens you want to supply through the sidebar interface, and once this second transaction confirms you’ll officially be earning yield through your strategy of choice.

🗒️ Note: Like all things DeFi, you can withdraw your deposit through the same sidebar interface whenever you’d like!

Looking Ahead

Ribbon Finance has only gotten started, so if it’s smooth sailing from here then expect the protocol to foster the creation of many more crypto structured products going forward. Theta Vaults are the beginning but a variety of strategies are undoubtedly on the way.

If you’re interested in diving deeper into Ribbon, consider following the project’s Twitter for official comms.

This way you’ll be the first to know when Ribbon launches more liquidity mining programs, through which you could become a governance stakeholder by yield farming your way to some RBN!

Action steps

- 🤠 Try making your first deposit into Ribbon Finance!