How to make BANK flipping crypto collectibles

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

In the early days of the internet we’d prefix everything with e. You shopped using eCommerce and you sent customers eNewsletters.

Somewhere along the line we dropped the e—the internet became the default.

We call them cryptocollectibles today. But give them a decade or so….we’ll just them collectibles. Crypto will become the default.

Continuing from tactic #28—you’re stuck inside so go explore something new!

Today we’re going to explore something new—how to stack ETH by flipping collectibles. The guy who wrote this does it for a living.

Sound weird?

I’ve got news—the 2020s are gonna get weirder. And the weird shall inherit the earth.

So let’s get weird. Let’s get bankless. Let’s front-run this crypto collectible thing.

-RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

TACTICS TUESDAY:

Tactic #29: How to make BANK flipping cryptocollectibles

Guest post: Matty from dclblogger.com, crypto NTF trader & educator

In today’s tactic you’ll start learning how to spot opportunity & make money in NFTs. (Note: NFTs = cryptocollectibles, they’re the same thing)

- Goal: Learn how to spot potential buy and sell opportunities for NFTs

- Skill: Intermediate

- Effort: Consistent work—many hours spent researching then $ to burn while learning

- ROI: Immense. 10-30%+. I’ve made 400% in some cases.

A intro on how to spot opportunity & make money in NFTs

In 2017-2018 my cryptocurrency ‘HODL’ strategy taught me a valuable lesson.

You won’t make any money unless you sell.

So I decided to learn how to use my SKILL to consistently increase my net worth.

No more did I simply hodl coins but started looking for opportunities to buy and sell NFT’s (also know as CryptoCollectibles) to make ETH or MANA profits. This way, I could increase my portfolio as an additional way to accumulate. Similar to day trading.

(Above) Feb to September 2018 Trading in Decentraland. Mine is the top wallet.

Why do people buy NFT’s?

NFT projects are predominantly games that have tokenized assets. Like Gods Unchained Cards where each card is an NFT token and can be traded on the blockchain or Axie Infinity Pets (see tactic #28) where each can be bred, trained and battled in a massive pet universe.

Some of these assets have sold for $10s of thousands!

(Above) This Atlas ID #8840817 from Gods Unchained sold for $31k in December—listing here

People buy NFT’s for all kinds of reasons. The billion dollar Fortnite skins industry proves that people love to collect rare digital items to showcase their achievements and represent themselves in the digital world.

In some other projects like Decentraland, you can own one of 45,000 Private Lands and build things in VR!

An NFT can be used to represent all kinds of things. Skins, swords, access tokens, digital lands, digital pets—there’s people even selling digital businesses and games as NFT tokens on Decentraland!

⚠️Tip: Want to learn more about NFTs? Read the NFT Bible by OpenSea.

Unlike fungible tokens (bitcoin, ethereum, gold, etc) where each coin has the same worth as the other, Non Fungible Items are assets where each item cannot be simply traded for another. That’s where the term ‘NFT’ comes from. Non Fungible Token.

You cannot simply trade a Land with coordinates 43,56 with another with coordinates 49,60. One crypto kitty is always different to another.

So EACH have different values ranging from a couple of dollars to hundreds of thousands of dollars.

In between these trades, there is profit for those that understand the market.

This is where flippers like us come into play.

Flipping NFTs for Profit—Case Studies

👉Here are a few NFT flip examples ranging from a few hundred to $10k’s in profit.

How to spot what’s hot

There are many NFT games out there. And people are finding their own ways to make money.

Learning each project and spotting opportunities takes time. You need to learn which stage of the project is at, where growth seems to be happening, what the safe market price is to buy something and make sure you can sell at a profit immediately.

A lot of people buy thinking the value will go up and they’ll sell in a few months for a profit. Rarely does it go that way.

Strategy—Buy in Bulk & Sell Individually

Scout the trading channels for sellers that are trying to sell large quantities of items and offer them a bulk price. Larger investors can’t be bothered listing individual items and waiting for each to sell. When you put money on the table for ALL of their portfolio, it’s very hard to turn an offer down.

After you’ve researched and are up to date on market values of items, you want to try pick them up at a price you know you can sell immediately for 10-30% profit.

⚠️Tip: Use nonfungible.com to keep track of NFT sales history.

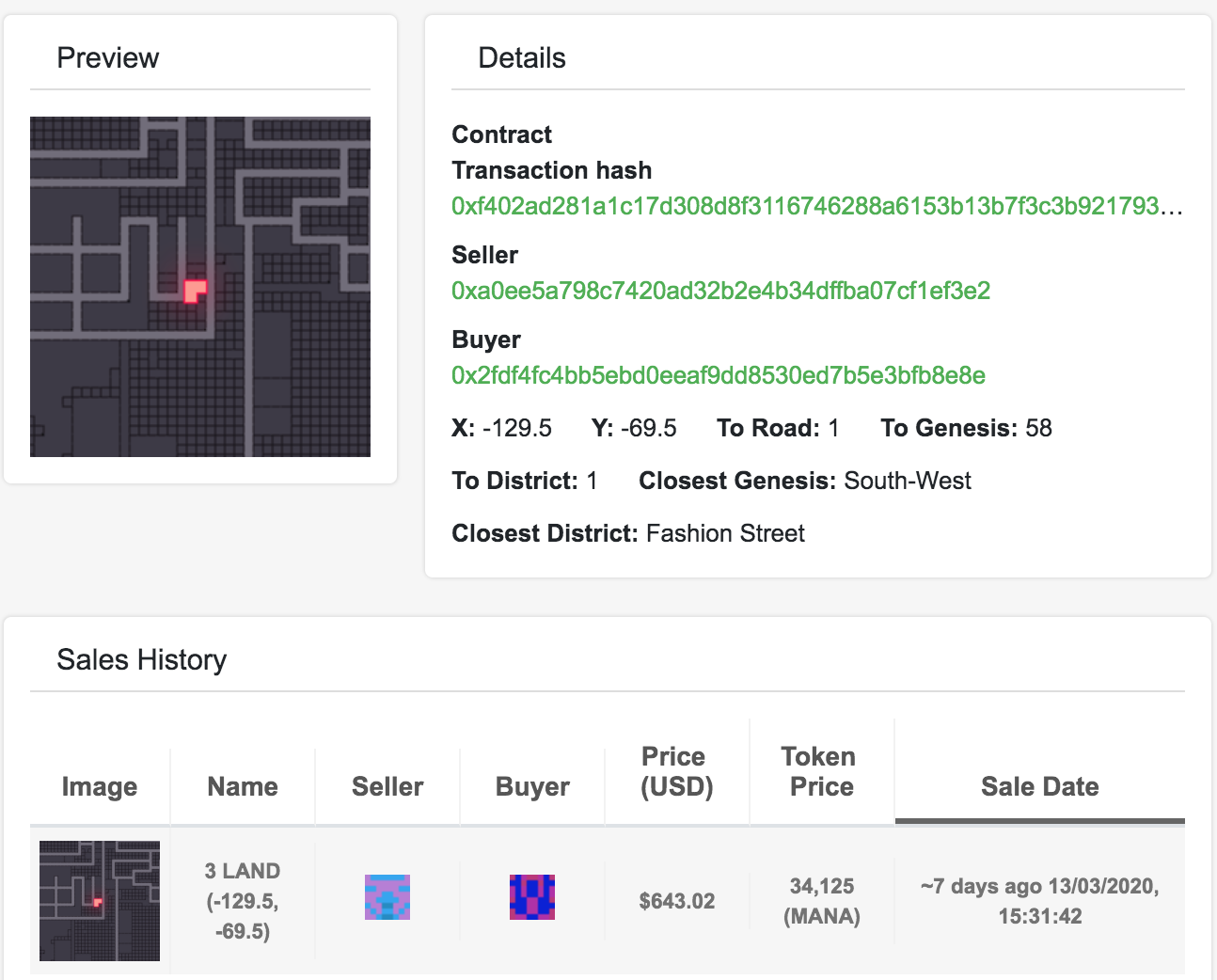

Let’s take Decentraland land for example.

This set of 3 lands sold for almost 35,000 MANA. (MANA is the currency of Decentraland)

That’s around 11,700 MANA each. We know that historically lands connected to roads, (grey lines), have easily sold for 15,000 to 20,000 MANA each.

Even if you take the low end of 15,000 MANA, that’s a profit of 3,300 MANA a parcel. 10,000 MANA = $250 USD!

Do that on a larger scale and you’re making $1,000’s sometimes $10s of thousands per trade.

Rely on Skill, not just Hodling

As you get better at scouting opportunities, negotiating, finding buyers, networking and keeping on top of strong markets, you’ll make more money.

This is a much better strategy in my opinion to simply Hold MANA or other coins. Other assets trade in ETH. So instead of holding say, 10 Eth, you can continue trading digital assets and increase that to 15 ETH, sometimes 4-5x!

As this requires skill not just luck, you can actively get better at improving your portfolio positioning.

The Risks and Rewards

There is ample upside to trading NFT’s.

- Little competition as it’s a new industry.

- Huge money making potential. A few have made 6 figures profit within a year or two doing just this.

- Pioneering a completely new and emerging industry.

You also get to understand market activity at a level most don’t. So once bigger projects start transacting millions of dollars daily, you will be in a GREAT position to trade and make money.

Risks?

There are plenty.

- NFT’s are a new industry, you have to make sure you’re working with well funded projects.

- Ideas might seem great but after a pre-sale, there’s usually a big volume drop off as interest dies down. If volume decreases big time, you’ll just be left with tokens that no one wants to buy.

That’s why my number 1 rule is volume. I only trade in high volume projects. Decentraland and Gods Unchained come to mind. They transact 100’s of Eth weekly so I know I can get a small % of that.

Hold long term or flip?

Sometimes you get extremely rare items at a great price.

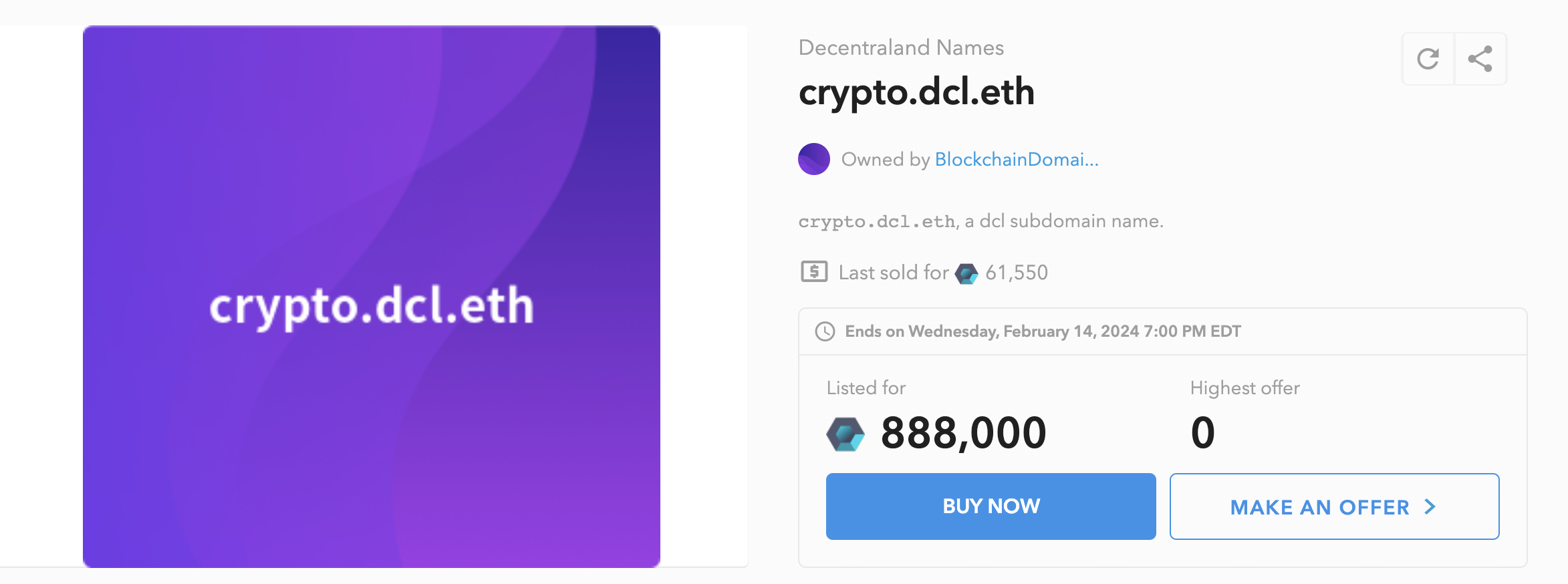

For example, I bought the name ‘SatoshiNakamto’ for my Decentraland Avatar. For a Crypto VR project that might one day attract 10s of thousands, hopefully millions of users, this name might be BIG dollars.

The name ‘Crypto’ just sold for 61,000 MANA—that’s $1,500 USD!.

(Above) This Decentraland Name just sold for $1,500 5 days ago

Sometimes you get items you can make a sweet 30-50% of profit on and increase your stack big time.

I’ve had trades where I’ve made 300k to 400k MANA in a single day!

That’s a lot of money. MANA was trading at 10 cents for a long time so getting a quick $40k USD is huge.

I can immediately re-invest that to a bigger deal and continue flipping.

In time you will learn how and when to sell.

The future for NFT’s

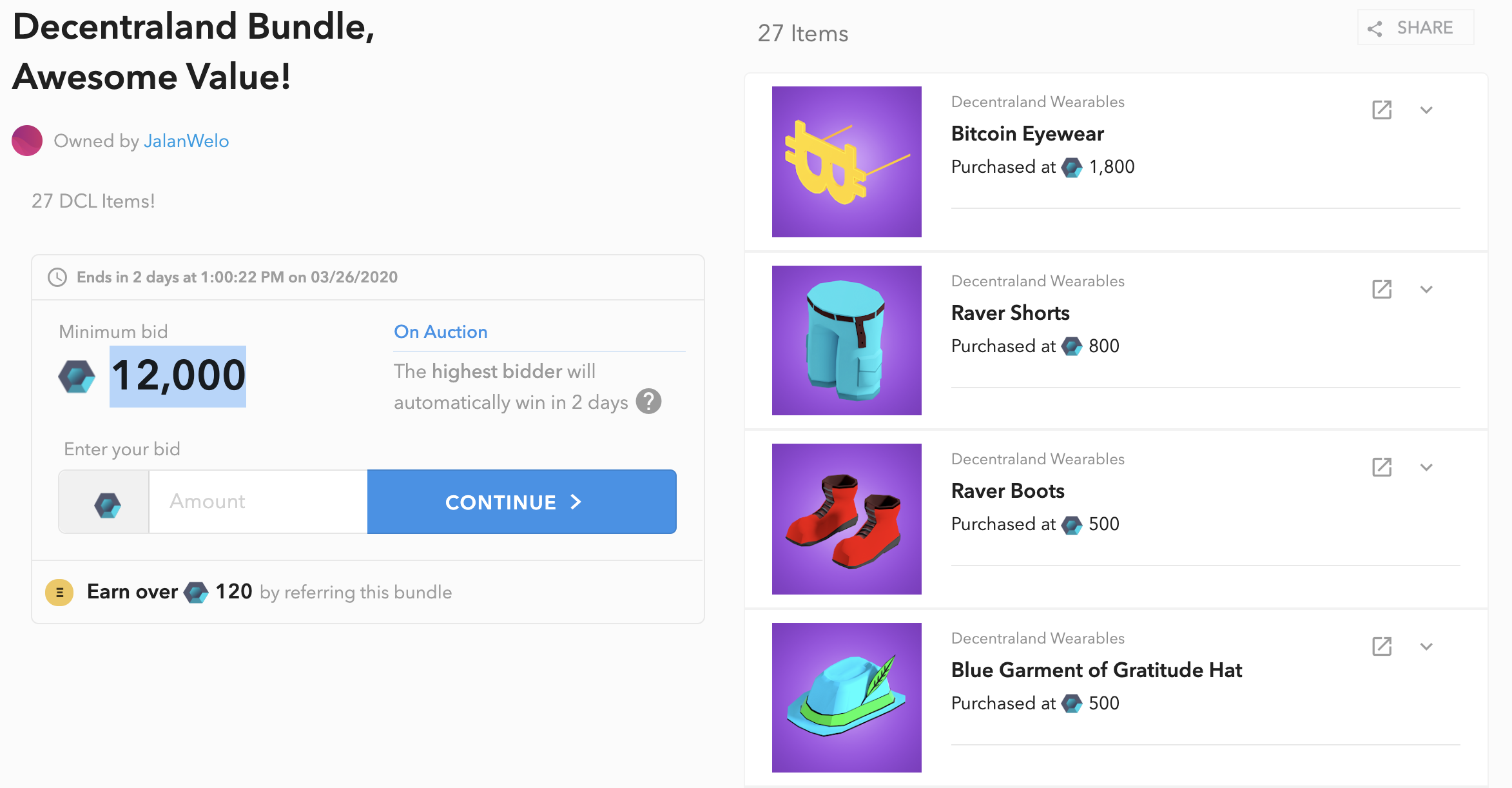

NFT’s have only grown since their rise to fame with CryptoKitties. From digital land projects to digital pets. Even digital wearables and names, all kinds of things are popping up where people are buying for $1,000’s.

(Above) Decentraland Bundle of items and names—12k Mana starting price is over $360!

The future looks bright as the space is also attracting institutional investors like DCG and Coinbase. (RSA note—even the Winklevoss twins recently launched an NFT market)

As funding comes in, innovation will thrive and people are creating all sorts of mechanisms like RocketNFT—get a loan using your NFT as collateral—or even NFT renting.

Imagine renting a popular sword for a tournament?

People are even working on sharding or creating fractions of NFT’s to be traded on an exchange! So you can own a share of a popular $10,000 USD NFT!

The future seems bright and if you’re getting involved in this now, you will be way ahead of the game if a giant like Atari or Pokemon come to the wonderful world of NFT trading.

Author Blub

Matty has spent the last 2 years buying and selling NFTs or CryptoCollectibles. He runs dclblogger.com in an effort to bring NFT awareness to investors. There are more opportunities than simply holding crypto currencies.

Action steps

- Read Matty’s flip Case Studies and 10 Beginner Tutorials

- Explore Popular Games (By Volume)—Decentraland, Gods Unchained

- Buy an NFT—You only learn when you have skin in the game

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.