Dear Bankless Nation,

There are thousands of DAO experiments happening in crypto.

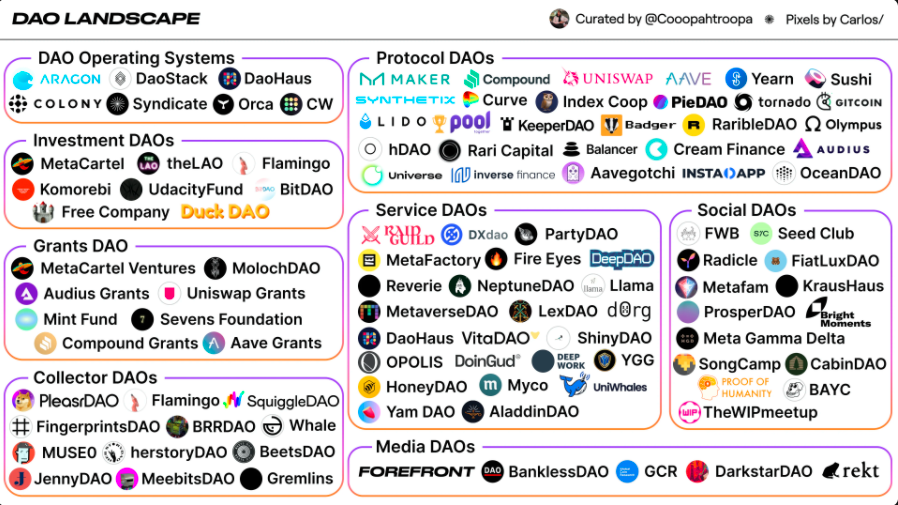

They’re popping up everywhere. Protocol DAOs, Creator DAOs, Media DAOs, Social DAOs, and DAOs that do crazy things like getting into bidding wars with billionaires for priceless artifacts.

These new organizations are an opportunity of a lifetime. We’ve claimed that they’re the future of work. And we firmly believe this.

DAOs are crypto’s coordination layer. It allows people to collectively decide on how to allocate resources on a global scale, allowing the formation of new digital communities.

And as you can imagine from the above, you can launch a DAO for anything.

There are only a couple of things you need: A mission, a way to communicate, a community treasury, and a governance framework for the treasury.

The rest is completely open.

Lucas explains what you need to know if you’re looking to launch one of these new digital orgs.

- RSA

The largest organization in the world will eventually be a DAO.

Decentralized Autonomous Organizations (DAOs) are digital communities with a shared mission, bank account, and cap table. Over the past few months, we’ve seen these new digital organizations rise to the forefront of the crypto narrative as people realize their potential to coordinate humans and money on a global scale.

Given their rise to prominence, this tactic will walk you through some of the steps and considerations you need to take if you’re looking to launch your own DAO.

- Goal: Learn what you need to know to launch a DAO

- Skill: Advanced

- Effort: Depends—it could be your life’s work or a small side project

- ROI: The sky’s the limit :)

How to launch a DAO

Public blockchains allow for people to democratically coordinate value over the internet—all they need is a shared mission.

With such a broad definition, you can virtually launch a DAO for anything. We’ve seen DAOs bid $40M+ for the U.S. Constitution, collect the Doge meme for $4M, combat climate change, buy a golf course, fund public goods, and much more. There’s an infinite design space for DAOs that’s only just being discovered.

If you’re interested in launching one of the new organizations, there are a few areas to consider:

- Mission

- Community

- Treasury

- Governance

- Ownership

1. Mission

Establishing a mission is the first step in creating a DAO, and arguably the most important.

What are you working for? What’s the goal of the DAO?

By solidifying this, you’re providing DAO members with a clear north star to work towards. If you’re still trying to dial in on what you launch a DAO for, here are ideas to get you started:

- GitcoinDAO: Fund public goods (Impact DAO)

- PleasrDAO: Collect cultural artifacts (Collector/Curation DAO)

- FreeRossDAO: Free Ross Ulbricht from prison (Impact DAO)

- BanklessDAO: Onboard 1B people to crypto (Social DAO)

- Friends With Benefits: Create the ultimate social club (Social DAO)

- Uniswap: Build an open protocol for exchanging value (Protocol DAO)

- ConstitutionDAO: Buy a copy of the U.S. Consitution (Collector DAO)

Given the above, a DAO’s mission can pretty much be anything. As a fun example, I helped launch a small DAO for skiers and surfers (The Gnar Collective) where the goal is to build a community of crypto shredders, organize trips around the world, and eventually purchase vacation properties for DAO members to crash in. This is the north star of the DAO, but obviously, it takes time to reach these goals.

The mission is only the first step. But once you have that dialed in, the next thing you need is people. This brings us to the community.

2. Community

The second step in launching a DAO is arguably the hardest one: building a community.

First, you want to identify whether your DAO should be large or small; exclusive or open. Do you want a large community of thousands of people or a small group of select individuals?

This is an important distinction to make that largely depends on your mission. If your goal is to help onboard a billion people into crypto, you’re gonna need some muscle. If you’re looking to create an exclusive social club, you’re going to want to keep it limited to select individuals.

Leveraging platforms like Discord and Telegram are a great way to drive these like-minded people into the same room to begin discussions. You can pair both of these communication platforms with Collab Land to create a more web3 experience.

The communication hub is vital to the success of the DAO. That said, one aspect to consider as you bootstrap your DAO is building a community repository of on-chain addresses to eventually distribute ownership and governance rights to.

We’ll touch more on this in a later section but there’s a handful of ways to get this done. Distributing POAPs and other NFTs, collecting ENS names, and more are all viable avenues. Having an on-chain community makes the ownership and governance aspect of the DAO a lot easier to execute when the time comes.

If you’re looking to get more into how to build a web3 community, I’ll defer to my colleague Coopah on some tips:

⚒️ Community Tools

- Discord (Communication hub)

- Telegram (Communication hub)

- Collab Land (Token-gated access)

3. Treasury

The community treasury—shared ownership—is the major unlock from web3 that makes DAOs so valuable. The treasury is how the community coordinates and deploys capital to achieve the mission. While every DAO is different, identifying the ways you’re going to bootstrap the treasury is an important step.

This all depends on the type of DAO you’re going to launch. If you’re building a Protocol DAO where there’s a fee for usage, this step can be fairly simple:

This process is also similar for DAOs that sell membership access via NFTs. At the end of the day, you should aim to put as much money into the treasury as possible as this empowers the community with working capital.

If you’re launching a Social DAO by leveraging an ERC20, this part becomes a bit more difficult. Bankless DAO has been pioneering an effort to generate on-chain revenue by launching unique projects and initiatives, where a split goes to the DAO treasury.

As a result, the community has released some of the best-selling crypto merch, launched unique NFT projects, partnered with other DAOs to create new indices, and produced some of the high signal content in crypto. All of these initiatives not only drive revenue to the DAO treasury to bootstrap working capital but also to the contributors that help get those projects off the ground!

The other avenue is what Friends With Benefits, Forefront, and others have done where they receive investments from large funds in return for a slice of the DAO’s ownership. Similarly, this in turn provides the DAO with working capital that they can deploy to achieve their mission—whether it’s paying core contributors, funding new projects, and more.

Once you have capital in the community treasury, the next step to figure it out is how to govern it.

⚒️ Treasury Tools:

- Gnosis Multisig (community treasury)

- Parcel (treasury management tool)

- SafeSnap (governance + treasury tool)

- JuiceBox (crowdfunding)

4. Governance

While governance is not everyone’s favorite thing, in a DAO, it is your civic duty as a member. Chiming in on discussions, proposals, and submitting your vote is a crucial task that needs to be done in order for the DAO to move forward.

There’s a range of ways to handle governance, but it generally falls into one of two buckets: on-chain and off-chain.

On-chain governance primarily revolves around token votes while off-chain governance is the discussions and forum posts that eventually make their way to formal, on-chain governance votes.

That said, the general governance flow that I’ve seen across DAOs goes something like this:

- High-level community discussions via chats and calls

- Forum proposal to get soft consensus

- Token vote to get hard consensus

- Execution of proposal if passed & reaches quorum

Full, open community governance is just one aspect though. We’ve also seen delegated governance come into play where the community will empower specific rights to a group of individuals/working groups. This is prominent with Grants Committees where they may take input from the broader community but ultimately are vested with the power to make the executive decision on how they distribute grants.

Identifying when, where, and how these delegated governance groups come into play is a crucial aspect of the DAO as formal governance for every action and decision can slow things down. You don’t want to go through multi-week-long governance processes to make every decision.

Having working groups with vested powers allows the DAO to move quickly and fluidly while also maintaining degrees of community say.

But use this in moderation—centralization risks exist here :)

⚒️ Governance Tools:

- Snapshot (token voting)

- Tally (token voting & governance aggregator)

- Discourse (forum discussions)

- Boardroom (governance aggregator)

- Messari Governor (governance aggregator)

5. Ownership

Once you have a governance framework, you’re ready to distribute ownership. This is how you represent membership access and vote on governance decisions.

As eluded to throughout this article, there are two main ways to distribute ownership: fungible tokens (ERC20s) vs. non-fungible tokens (NFTs).

Some projects leverage their community’s NFTs (like Lootbags for Loot) as governance weight to vote on Snapshot while communities like FWB leverage their native ERC20 token. Both have their advantages and disadvantages.

As mentioned in the treasury section, the big win with NFT member ownership is that it’s easier to sell the membership rights via an NFT drop (not legal advice, pls check with a lawyer), making it much easier to bootstrap capital in the community treasury.

For ERC20s, especially for those in the U.S., selling membership access can become more convoluted. Here, there’s a stronger need to have a legal team to vet the process and there’s always a chance that Gary Gensler comes knocking at your door (again not legal advice, please consult a lawyer).

The main advantage of using fungible tokens is it’s a better mechanism for bootstrapping an internal economy. The fungible nature of ERC20 tokens opens up the door for incentivizing contributors more easily than NFTs. Moreover, by distributing a significant portion of the supply to the treasury, it creates a higher leverage mechanism for bootstrapping capital in the long run if the DAO is successful.

With all of that in mind, there’s definitely a future where DAOs can leverage both NFTs and ERC20 tokens in their ownership structure and governance framework; however, it’s still fairly early in this area.

⚒️ Ownership Tools:

DAOs will eat the world

The first sentence in this article stated that the largest organization in the world will eventually be a DAO. I firmly believe this.

DAOs offer a novel way for humans to coordinate with one and another over the internet, and have collective ownership in it. This dynamic is powerful that crypto natives are just beginning to recognize.

Eventually, the rest of the world will come to this same realization, and the year of the DAO will be upon us.

If you’re looking to launch a DAO, either just to have fun with your friends or a bootstrap a serious initiative that aims to change the world, there’s a massive opportunity and design space for you.

To summarize, here are 5 steps you can take to launch a minimum viable DAO:

- Establish a mission (this part is open!)

- Build a community on Discord or Telegram paired with Collab Land

- Create a shared treasury with a Gnosis Multisig

- Construct a governance framework with Snapshot

- Distribute ownership with Mirror or Coinvise

The rest is up to you and the community.

Good luck :)

Action steps

Launch a DAO with the tips & tools in this article!

Level up with more DAO resources