How to invest in crypto & sleep comfy

Dear Bankless Nation,

Yesterday Goldman Sachs announced plans to launch a DeFi ETF.

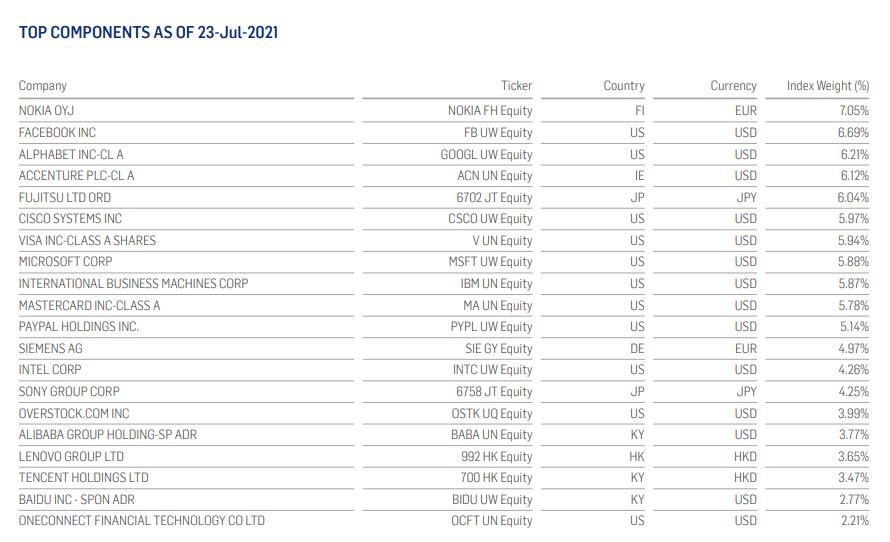

This is the list of companies in their DeFi ETF…

The largest weighting in the index is…Nokia?? 😬

It’s like they’re trolling us.

How does owning Cisco stock give you exposure to DeFi?

They could have added equities with actual crypto stories like Coinbase, Square, Silvergate Capital…but they choose to schlep IBM on you instead.

This ETF isn’t crypto. This doesn’t give you exposure to decentralized finance. This is bankers taking advantage of a hot narrative and using it to steal your money.

Hey SEC…you cool with this but we still can’t have a BTC ETF?

Well, we’re not going to let retail get screwed with garbage like this.

We’re going to help propagate real DeFi index assets.

Last week Bankless DAO and the Index Coop launched the Index Goldman Sachs should’ve launched…the BED index.

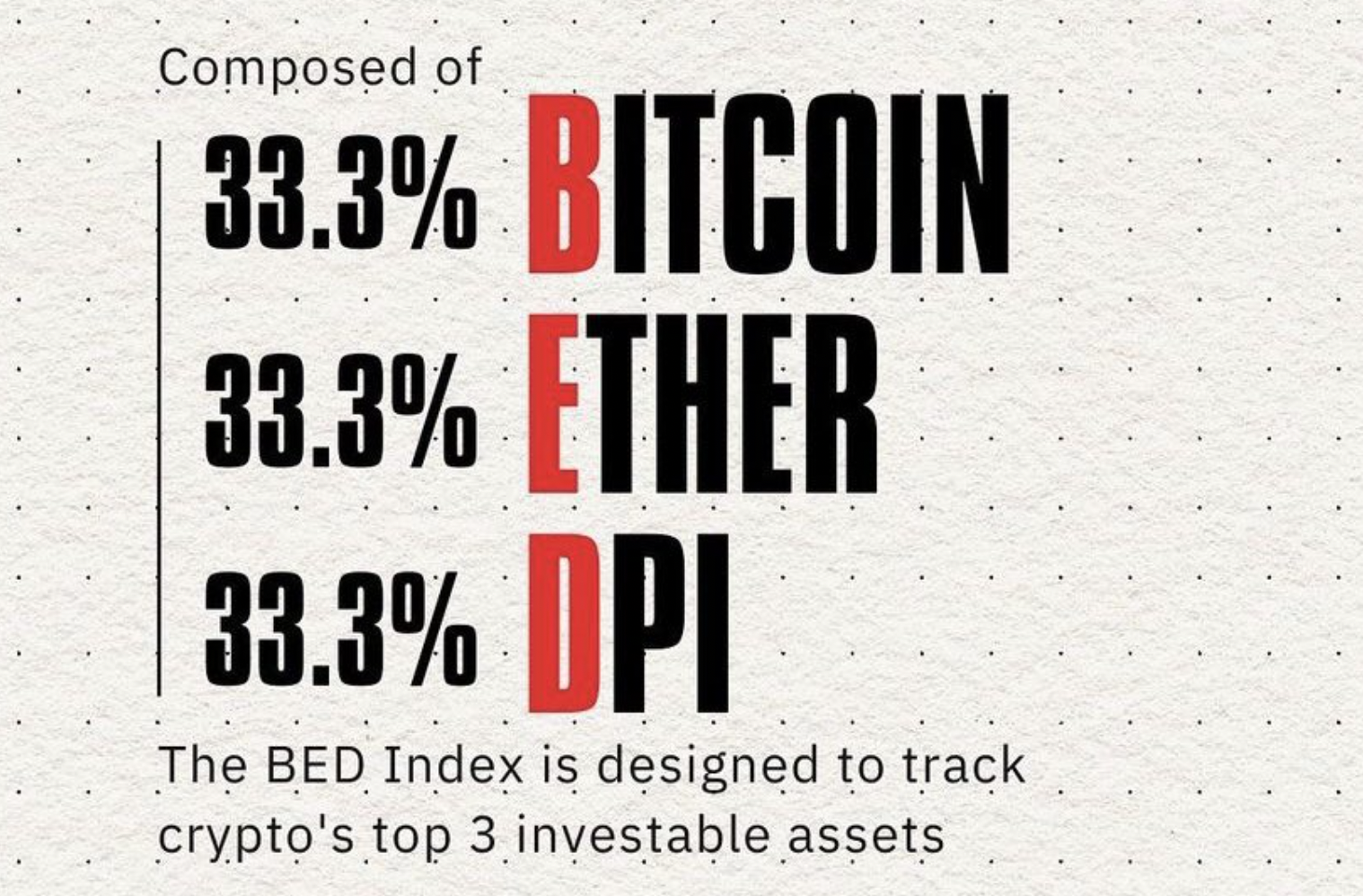

BED is a passive, set-it-and-forget-it exposure to major bankless themes—digital gold (BTC), programmable money (ETH), and Decentralized Finance (DPI).

Two thirds of the index is weighted in crypto monies (ETH and BTC) with the remaining third invested in a diversified index of the top DeFi protocols that automatically rebalances on a monthly basis.

This is the portfolio we’ve talked about since the beginning of Bankless in 2019:

BED is the asset you can tell your friend about when they ask you what crypto to buy.

With BED they don’t have to cherry pick coins. They can avoid the garbage.

Just get in BED then sleep well at night.

Here’s how to get BED and become a liquidity provider.

- RSA

How to mint and LP the BED Index

Bankless DAO and Index Coop just collaborated on the launch of the Bankless BED Index.

We believe BED is one of the easiest way for people to get exposure to the major themes in crypto: digital gold (BTC), programmable money (ETH), and decentralized finance (DPI).

This Bankless tactic will show you how to make the most of this index by demonstrating how to 1) mint BED, and 2) serve as a BED liquidity provider on Uniswap V3 (LP).

- Goal: Learn how to mint BED and earn yield by providing BED liquidity.

- Skill: Beginner to intermediate — minting is easing, LPing is a bit more complicated

- Effort: 30-45 minutes

- ROI: BED price exposure, potential LP yields, and the priceless experience of finally having something basic in crypto you can finally recommend to newcomers!

Rest easy in BED

If you’ve been into crypto beyond a handful of weeks, chances are you’re the “crypto” person to your family and friends.

Things are still relatively early, so your loved ones likely don’t know exactly what you do, or exactly why cryptoassets are meaningful, but they do see how you’re passionate and light up whenever you talk about them so they know there’s something there.

Then factor in how 2021 has been an “up only” year for crypto upon an impressive surge of activity around Ethereum, DeFi, and NFTs. This dynamic’s brought in large new waves of mainstream interest to crypto, so there’s a good chance you’ve had some close ones and/or colleagues come out of the woodworks lately and ask, “Hey I’m finally in, how should I start with this crypto thing after all?”

Historically this has been something of a difficult question to answer.

These days if you’re playing things straight down the middle, then recommending BTC and ETH as the cryptoeconomy’s two largest assets is a no brainer. But then there’s the matter of folks having to go out and pick up each of these cryptocurrencies separately, and they get lost when it comes to allocation percentages.

None of this is easy for newcomers.

Moreover, you’d be remiss to not recommend some exposure to one of the cryptoeconomy’s star verticals right now: Decentralized Finance (DeFi). But that’s another gauntlet unto itself. It’s easy enough to say go buy DeFi tokens, but without guidance newcomers might as well be blindly throwing darts at lists of inscrutable coins! And you can’t recommend the riskier stuff that might excite you personally as a crypto veteran.

All that said, there’s been a huge need for a one-stop token that offers investors straightforward access to BTC, ETH, and DeFi — i.e. a token you can rest easily recommending to normies.

The good news is we now have such a token courtesy of the Bankless BED Index!

Making the BED

“DAO-to-DAO collaboration” is a phrase you’re going to hear a lot more going forward. Take note as the new BED Index came to fruition from precisely such a collaboration!

That’s because Bankless DAO, a decentralized media organization built on bankless values, and Index Coop, a decentralized asset management protocol that facilitates crypto indices like the popular DeFi Pulse Index (DPI), teamed up and launched BED.

The BED Index (named for Bitcoin, Ethereum, and DeFi) is composed of 1/3rd WBTC, 1/3rd ETH, and 1/3rd DPI, the last of which is its own index presently filled with 14 major DeFi tokens.

Why BED, then? To offer investors of all stripes, but particularly novice crypto investors, a way to passively and simply invest into the cryptoeconomy’s top bellwether assets.

This “keep it simple stupid” crypto investment strategy is combined with a token that auto-rebalances its weightings, meaning no manual tinkering needed, and offers low streaming fees, which is friendly on anyone’s pockets. The result is BED, which has been designed to be an ideal, one-click, set-and-forget-it asset for investors wanting basic exposure to crypto.

Minting and Providing Liquidity for BED

You have 3 main avenues you can acquire, or recommend acquiring, BED through. They are as follows:

- Minting BED via the underlying TokenSets interface by supplying proportional portions of the underlying BTC, ETH, and DPI.

- Using the underlying TokenSets interface to buy BED using supported tokens like WBTC, ETC, DAI, and beyond.

- Trading into BED on Uniswap V3.

Now, we’ll demonstrate how to mint BED from scratch and how to earn yields by serving as liquidity providers with the ensuing BED liquidity!

1) Getting BED

🧠 Skill Level: Beginner

⚒️ Requirements: A web3 wallet like Metamask

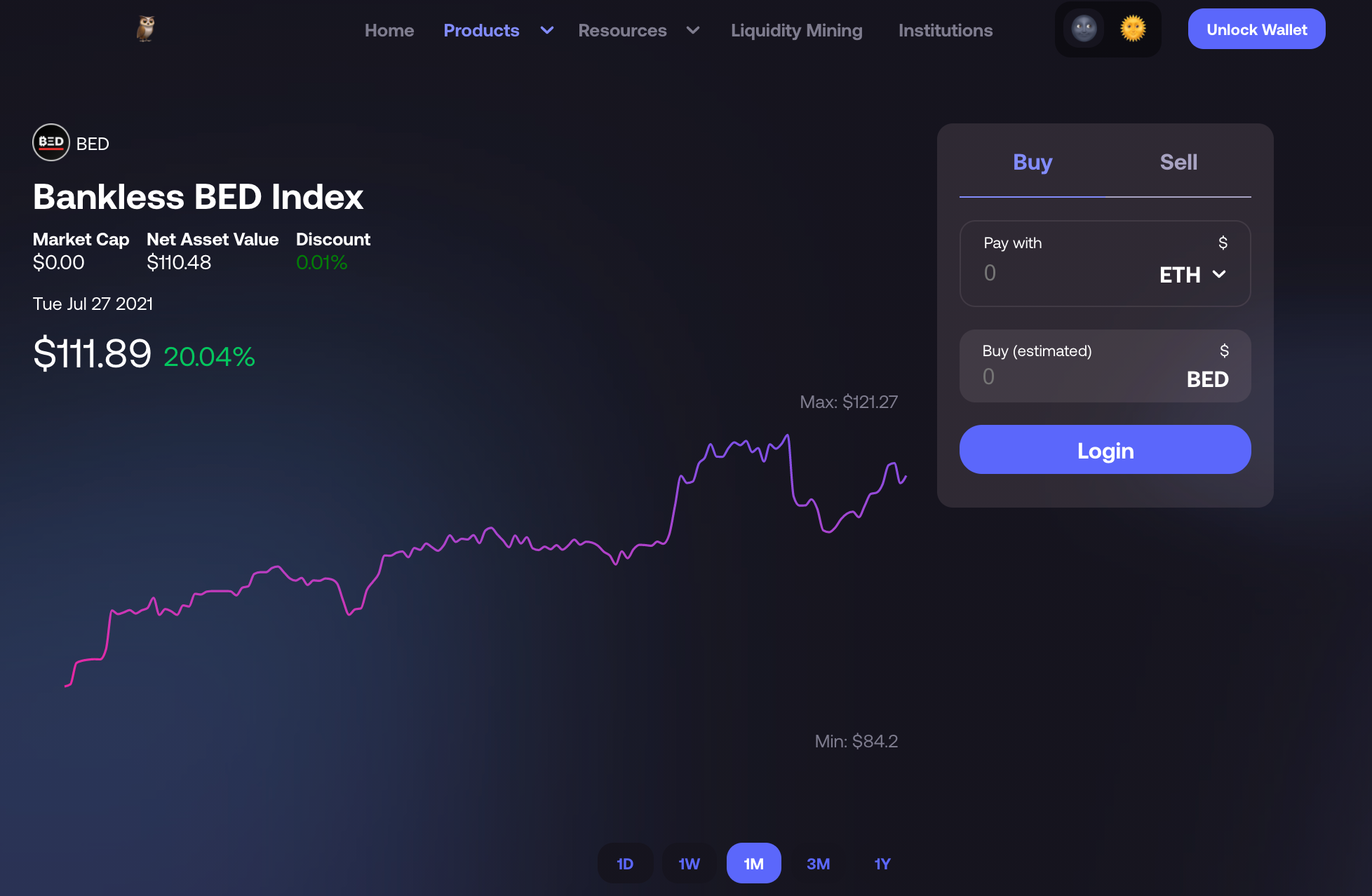

Getting BED is a simple process. First you’ll head over to the Bankless BED Index dashboard on the Index Coop’s website. Simple connect your wallet (Metamask, WalletConnect, and Coinbase Wallet supported!) and you’ll be ready to go.

The Index Coop’s page supports purchases in ETH, DAI, and USDC—so you have options!

Once you’ve denominated the amount you’d like to purchase, click “buy” and sign the transactions. Once confirmed on Ethereum, congratulations! You can now sleep well at night knowing you have automated exposure to crypto :)

🐳 Looking to mint large sums of BED? Go directly to the TokenSets page and use “buy” to get freshly minted BED—TokenSets will automatically mint new BED if your order causes significant slippage on V3.

2) Becoming a BED Liquidity Provider

🧠 Skill Level: Intermediate/Advanced

⚒️ Requirements: Metamask + an understanding of Uniswap V3

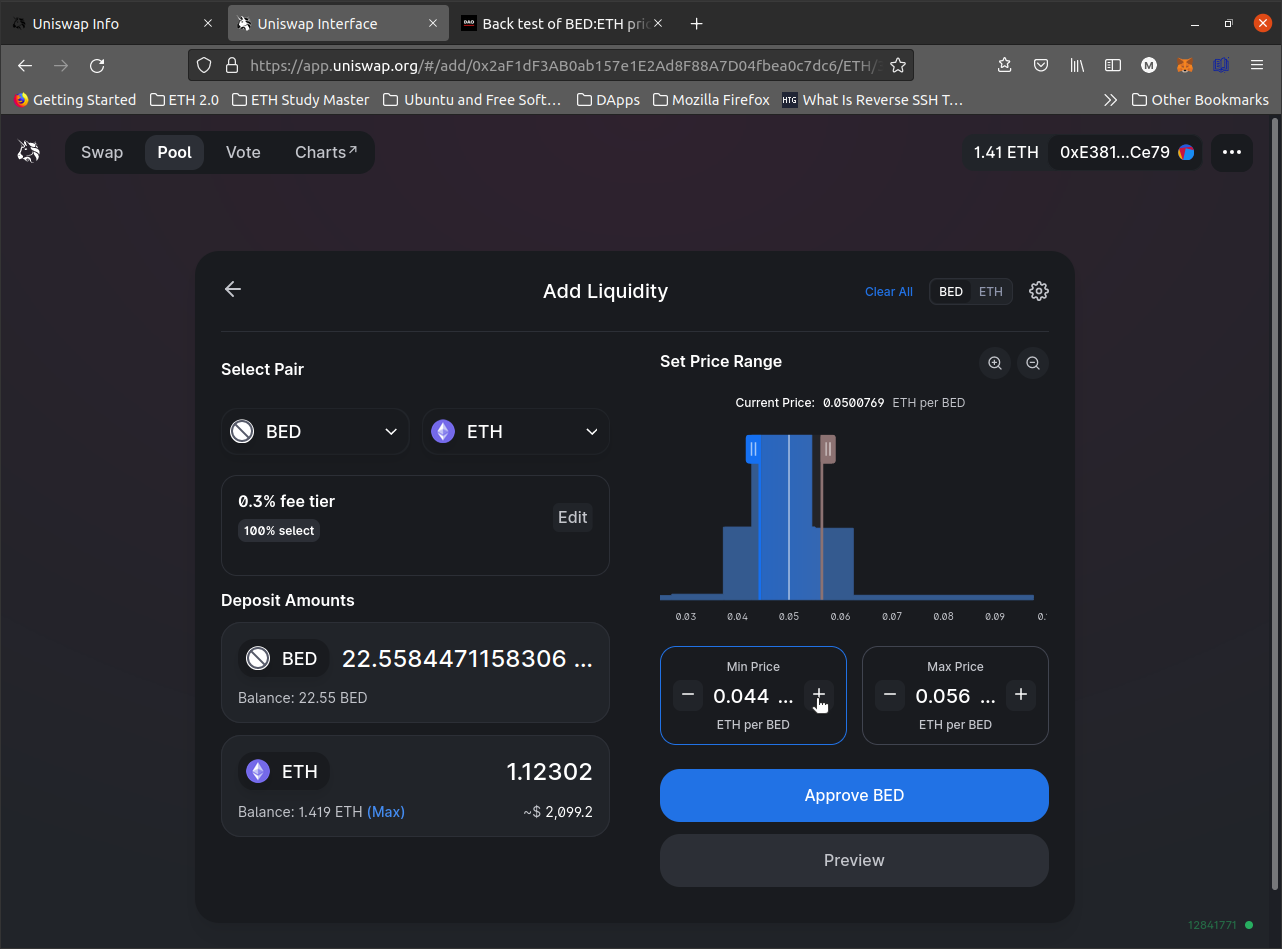

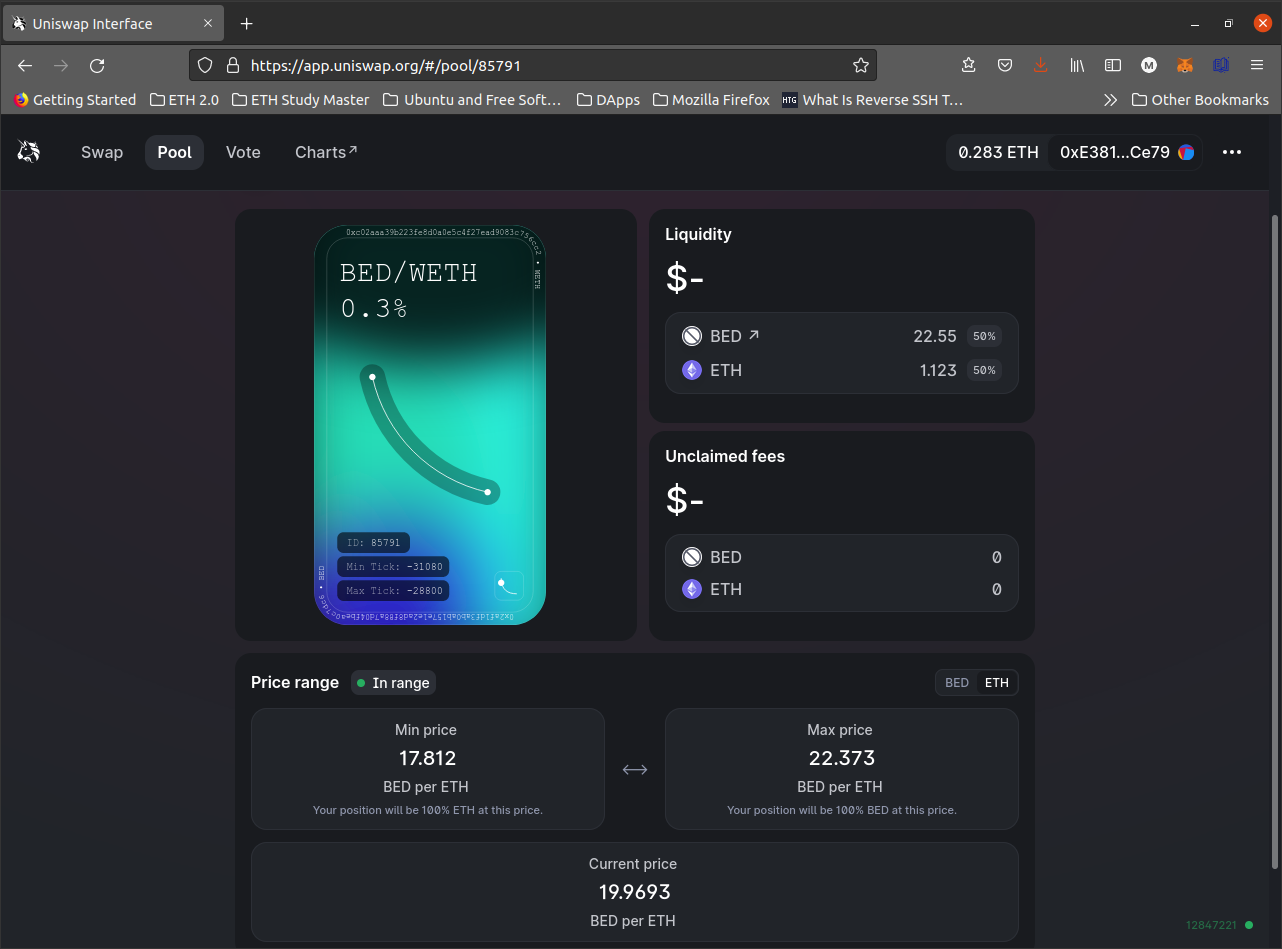

Once you’ve acquired BED, it doesn’t have to sit idly by — you can start earning yields by putting your BED to work in DeFi! While more integrations on are on the books, the first step is with liquidity providing (LPing) to the Uniswap V3 BED/WETH pool.

🚨 Alpha: Early estimates showing ~10-30% APY in trading fees on the BED/ETH pair depending on your V3 price range!

If this is a DeFi opportunity you’re keen on, you can LP by following these steps:

- Head to the Uniswap V3 BED/WETH Pool dashboard.

- Input the amount of BED/WETH you want to provide and determine your desired liquidity range. If you need help determining the price range, read up on this post from Over Analyser (tl;dr: +/- 12.5% is the general recommendation w/ moderate active management).

- Press “Approve BED” to let Uniswap spend your funds and complete the ensuing transaction. Then select “Preview,” “Add,” and “Confirm” through your wallet. Once that deposit transaction is confirmed, you’ll be serving as a Uniswap V3 BED/WETH LP!

🦄 New to Uniswap V3? Check out our guide on how to LP.

Why it matters

Now with the BED Index, you have a solid crypto starter pack you can recommend to family and friends.

The BED Index is definitely not a get-rich scheme, but it is crypto’s new gateway drug: it can help novice crypto investors easily build up exposure to the top cryptocurrencies while they learn more about the space.

Moreover, DeFi veterans can serve as BED market makers on Uniswap V3 and earn trading fees for providing liquidity as a service!

Action steps

- Get exposure to BED (beginner)

- Provide liquidity to BED/ETH pair on Uniswap V3 (advanced)

- Check out the TokenSets dashboard for the Bankless BED Index! 👀