Dear Bankless Nation,

Each NFT is a unique digital collectible. The price of NFTs are subjective, value lies in the eye of the beholder. Unique and subjective—these two properties make them illiquid.

Nevertheless, NFTs are valuable.

So are there ways for us to tap into the value of our NFTs?

Can we make our NFTs liquid?

NFTfi is one early attempt to do this. It’s a peer to peer marketplace for anyone to collateralize their NFT and get a loan on it (assuming someone wants to issue a loan!).

- You lock up your NFT

- Someone offers you a loan

- You agree to the terms and pay back later (with interest)

If you don’t pay up…the lender gets the NFT.

Kind of like a digital pawn shop.

This thing’s pretty new and it’s already originated 750 ETH in loans. Seems like there’s demand for NFT liquidity.

Get your NFT collection ready…

We’re going to explore how to tap into NFT liquidity today.

- RSA

📺 Watch Episode 49 of State of the Nation!

📺 Watch State of the Nation #49: State of the Charts | Ledger Status

We chat with the co-host of popular crypto podcast, Up Only, on technical analysis and where major crypto charts stand today.

We premiere State of the Nation on Youtube every Tuesday at 2pm EST—join us!

Tactic Tuesday

Guest Writer: William M. Peaster,Bankless contributor and Metaversal writer

How to get a loan on NFT assets

NFTs are unique digital media assets stored on a blockchain, most popularly on Ethereum.

Being unique digital media rather than fungible digital money, NFTs are fundamentally illiquid; however, that doesn’t mean you can’t enjoy liquidity from your NFTs at all. Accordingly, this Bankless tactic will walk you through how to use NFTfi, a marketplace for NFT-collateralized loans, to borrow against your unique, digital collectibles.

- Goal: Get loan collateral on NFTfi

- Skill: Intermediate

- Effort: Understand how NFT lending works

- ROI: Variable, but can be significant if borrowed funds are put to good use.

What is NFTfi?

There’s a case to be made that the NFT ecosystem is growing out of its adolescent period. Many people have come around to the realization that NFTs are a “blank canvas” media tech that can be used for many things, and now the race’s on to build up the infrastructure around NFTs to better actualize their possibilities.

Why? People want to be able to use their NFTs toward various ends. NFTs are programmable assets after all, so they can be used in unprecedented ways and crypto natives want to tap into these novel opportunities.

While NFT infrastructure is still being built out, but if you’re interested in getting liquidity on your NFTs, you have some interesting early contenders in NFT index projects like NFTX and NFT20 and NFT fractionalization projects like NIFTEX.

However, these platforms involve selling your NFTs for liquidity. But what if you want to retain ownership of an NFT and instead borrow against it so you can access some immediate liquidity.

One compelling young project making this kind of NFT lending possible today is NFTfi, an NFT-collateralized loan platform launched last year that lets users readily put up NFTs against loans in permissionless fashion.

The gist of NFTfi is simple: it’s a peer-to-peer (P2P) marketplace where NFT loans on the protocol are facilitated by and for users themselves. You supply an NFT (specifically an ERC-721) as collateral, then if/when someone puts up a loan offer on it, you can accept or decline the offer as you please.

As such, if you accept you’ll receive the agreed upon loan sum in Wrapped ETH (WETH) or DAI, at which point your NFT collateral will be locked in NFTfi’s smart contract infrastructure. To retrieve the NFT, simply payback the loan + interest within the designated time frame, and it’s yours again.

If you default, the lender will receive the NFT as payment instead.

Remember: this market is subjective

NFTs are incredibly subjective. As the old saying goes, “beauty is in the eye of the beholder”. You might love one project and hate another, and your friend could feel the opposite about those projects. It’s all about personal taste, really.

This dynamic comes into play on NFTfi because it’s a P2P marketplace. With NFTfi, you’re not guaranteed to receive a specific sized loan within a specific period of time. Rather, it all depends on what other NFTfi users feel like offering as they scroll through the platform’s listed collateral.

This means you might put up an NFT as collateral on NFTfi and it could sit there for a long time with no interest. Conversely, if you list a highly-sought NFT, you might receive several suitable loan offers within a matter of hours.

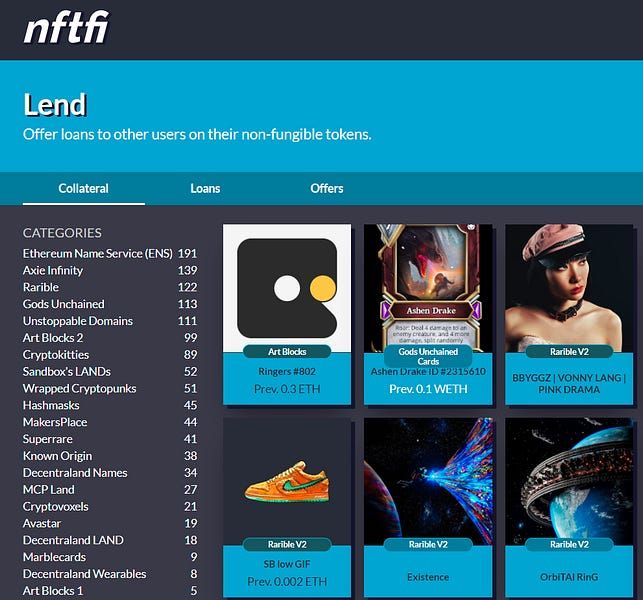

Again, it just all depends on what NFTs you’re working with. Go check out NFTfi’s Lending dashboard to get a sense for what kind of collateral types appear to be most popular currently.

Bankless Resources on NFTs:

How to borrow on NFTfi

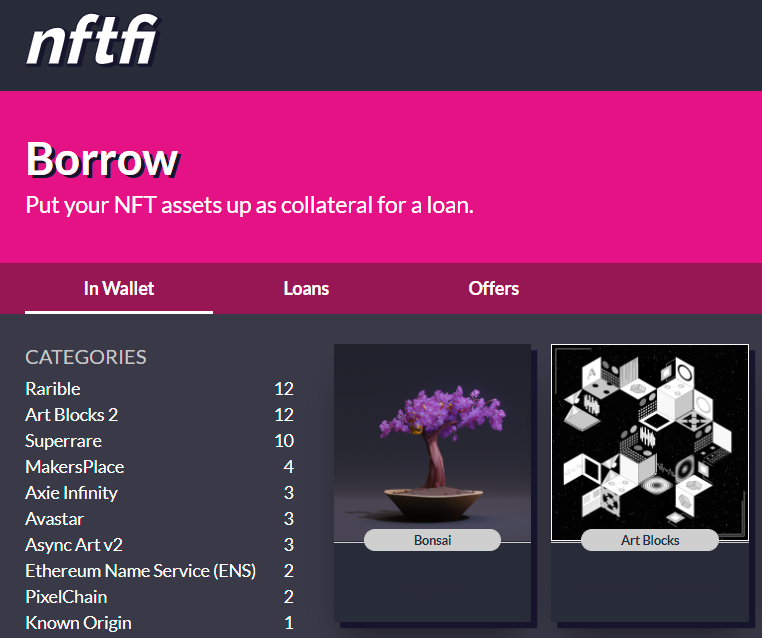

If you’re interested in getting a loan through NFTfi, the process is straightforward. Make sure you have an NFT you’re okay with collateralizing in your wallet of choice, and then head over to NFTfi’s Borrowing dashboard and connect your wallet.

Now you’ll want to follow these steps:

- The NFTfi borrowing interface will populate a list of NFTs you currently have in your wallet.

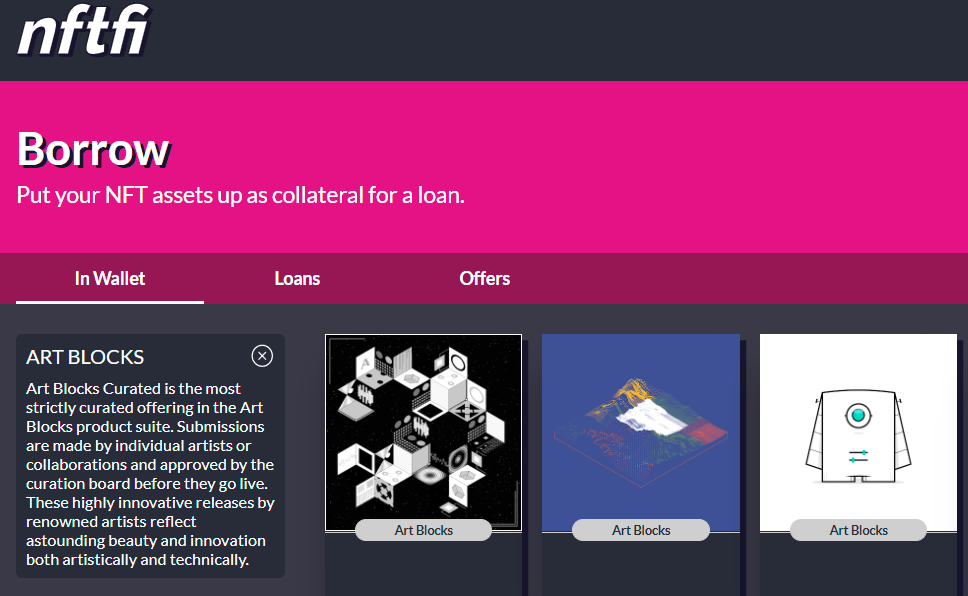

- Click on the project category you’d like to choose from, e.g. Art Blocks, at which point you’ll be taken to a dedicated hub for the pieces you hold from this category.

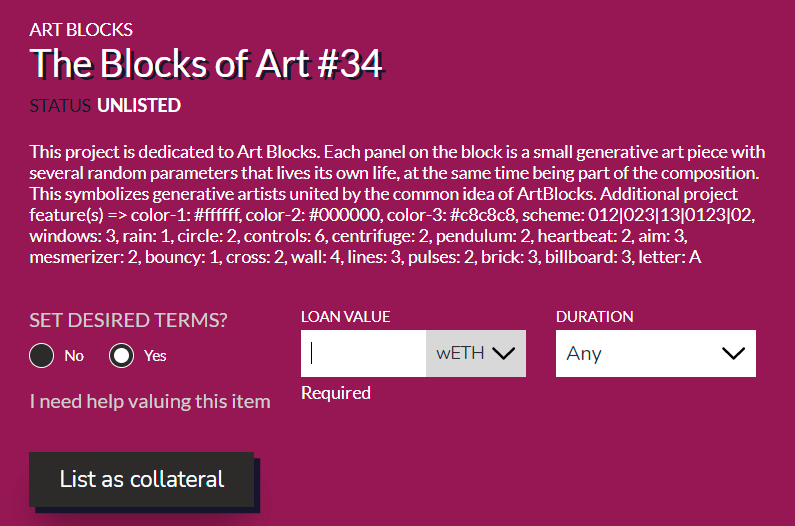

Click on the piece you want to select as collateral. On the next page, you’ll be given the chance to pick “No” or “Yes” when it comes to setting your loan’s desired terms.

If you choose “No,” you can just field offers however lenders propose them. If you choose “Yes,” you can choose the amount of WETH/DAI you’re looking for and the desired loan duration.

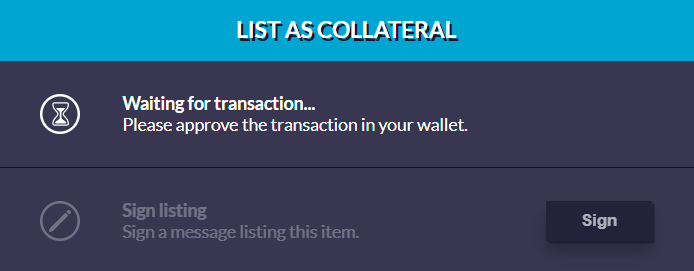

- When you’re ready to proceed, press “List as Collateral.” A prompt will pop up on your MetaMask to approve the NFTfi transaction. Confirm this transaction, and then sign the ensuing message with your wallet that formally lists your collateral.

- Once this signature is complete, your NFT will be listed on NFTfi as an available collateral type. If you receive a loan offer you wish to accept, simply click on the NFT in question, choose to accept the loan, and then your NFT will be escrowed in a smart contract. To repay your loan, head over to the borrower’s “Loan” page and press the “Repay Loan” button whenever you want.

Closing thoughts

NFTfi is the young NFT ecosystem’s premier loans protocol. To date the project has facilitated ~750 ETH worth of total loans across its CryptoKitties, Wrapped CryptoPunks, Autoglyphs, Cryptovoxels, and Axie Infinity markets!

Therefore, if you have NFTs and you’re looking for liquidity, consider checking out NFTfi, as it’s proven to be a solid avenue so far for borrowing WETH or DAI against NFTs.

I expect we’ll see plenty more NFT loan platforms going forward as NFTs continue to become more important in society, and as appraisals and other valuations techniques get built out. As a result, it’s certainly an advantageous time to get the hang of NFT loans while the scene remains so early (who knows you could be eligible for a retro airdrop in the future!).

Again, you don’t just have to sit on your NFTs. NFTfi is one promising project that offers a way to get more utility out of your choice NFTs!

Action steps

Explore NFTfi’s available collateral.

Level up on other Bankless resources on NFTs