How to earn yield with Frax Finance

Dear Bankless Nation,

Algorithmic stablecoins were a hot topic last year.

Rather than relying on over-collateralization like DAI or dollar reserves in a bank account like USDC, algorithmic stablecoins play around supply and demand market dynamics to maintain a stable peg.

What we found out is that they’re really hard to build. We saw a lot of them blow up and fail as these teams explored the design space. But the concept is still pretty interesting.

Fast forward to today and some of these players are dialing on the right designs.

Frax Finance is one of them. It leverages partial collateralization paired with a novel algorithmic stability mechanism to maintain its peg—and it’s worked so far. 👀

The protocol has over $1B circulating in its emerging stablecoin. They’re also building some interesting products around it like the Frax Price Index—a crypto-native version of the Consumer Price Index.

Sound interesting?

William gives you all the details and how to earn yield with it (APY sitting at 40% 💰).

- RSA

Frax Finance is an algorithmic stablecoin protocol powering FRAX.

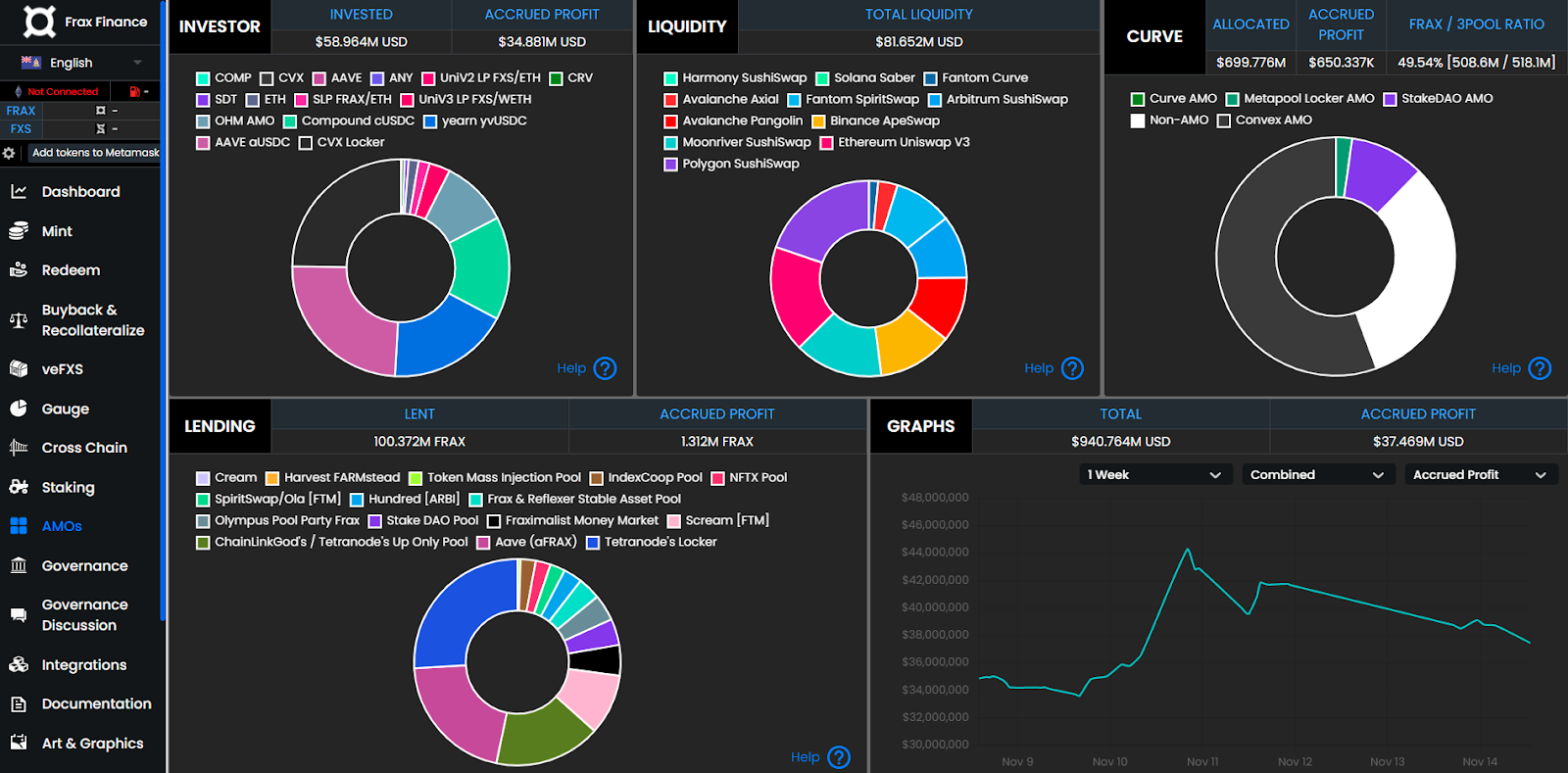

Frax’s v2 system introduced “Algorithmic Market Operations Controllers (AMOs)” to the DeFi ecosystem. These new controllers allow FRAX’s monetary policy to be managed by the open market rather than only by collateralized mints.

Is this model the future of DeFi stablecoins?

A growing number of users think so. As such, this Bankless Tactic will explain the basics of Frax Finance and then show you how to start earning through Curve’s FRAX-3CRV pool, which is owned by Frax’s largest AMO.

- Goal: Learn about Frax Finance and how to earn with FRAX

- Skill: Intermediate

- Effort: 1 hour of research

- ROI: +40% APY through a Curve + Stake DAO + Frax staking stack

Intro to Frax Finance

We’ve seen more than a few algorithmic stablecoin projects go bust in DeFi over the last year. The design space for these assets is incredibly difficult because generating and supporting money that’s not fully collateralized can pose serious challenges.

That said, one algorithmic stablecoin protocol that’s not only survived but thrived in recent times is Frax Finance.

A great starting point for understanding Frax is to grasp where its design fits within the wider stablecoin ecosystem. For context, some of the most popular types of stablecoins are as follows:

- Off-chain fully-collateralized: USDC, USDT

- On-chain over-collateralized: DAI, LUSD

- Algorithmic non-collateralized: AMPL

- Algorithmic partially-collateralized: FRAX

In combining algorithmic management with partial collateralization to support its FRAX stablecoin, Frax Finance is thus a “fractional-algorithmic” or “hybrid” stablecoin protocol, a model the project pioneered.

In practice, this means the FRAX supply is partly backed by collateral as well as algorithmic stabilization, i.e. the “base stability mechanism.” The amount of FRAX that’s unbacked at any given time fluctuates per the demand of the market. In other words, the collateralization ratio (CR) of FRAX goes up when the stablecoin’s value dips below $1, and it goes down when FRAX is above $1.

Another core element of Frax Finance is its Frax Shares (FXS) governance and utility token, which the protocol accrues value via seigniorage, minting/redemption fees, and extra collateral. Additionally, FXS is minted for collateral when the protocol wants to increase its CR, i.e. when FRAX is below $1.

Frax V1 vs. Frax V2

“On-chain stablecoins are moving more towards targeting their exchange rate in the open market [rather] than the deposit collateral/mint model. This is DeFi 2.0 stablecoin theory.”

— Frax Finance founder Sam Kazemian

The newer Frax v2 system expands upon, rather than replaces, the Frax v1 system.

Try this mental model: if Frax v1 is a banking algorithm for FRAX, then Frax v2 introduces generalized versions of that base algorithm that function like “central bank money legos.”

In the Frax lexicon, these v2 money legos are known as “Algorithmic Market Operations Controllers,” or AMOs. Their purpose is to power programmable monetary policy around FRAX by allowing the protocol to mint directly into DeFi money markets. To stay in line with FRAX’s base stability mechanism, these AMOs can engage in any market operations that do not affect the FRAX price and decrease the CR.

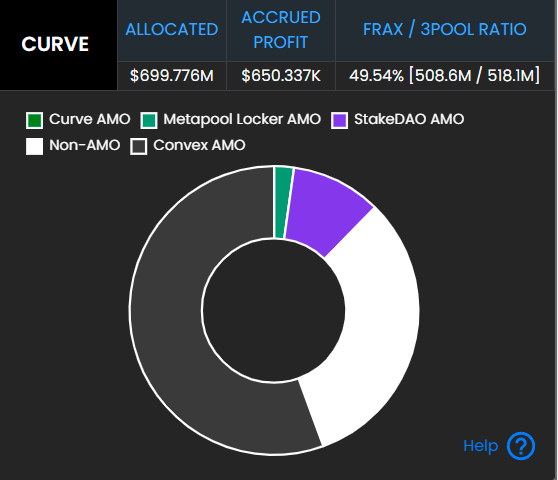

For example, consider Frax’s Curve AMO, which can put newly-minted FRAX and idle USDC collateral to productive use in the FRAX+3Crv pool. The result? Improved liquidity and peg stability for FRAX, plus a constant stream of fees accrued to FXS holders since the Curve AMO is the admin of the metapool. Moreover, this AMO and all others burn FXS per the FXS1559 system, which routinely converts the excess value to FXS buy-and-burns.

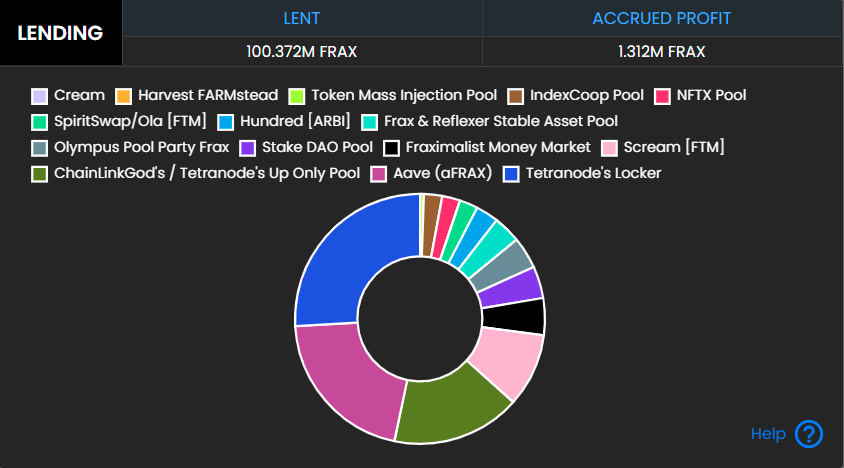

Another example to consider is the FRAX Lending AMO, which mints FRAX directly into money markets like Aave and C.R.E.A.M. Finance. As such, this controller improves the circulating supply of FRAX while also earning interest via lending and supporting FXS buy-and-burns. Notably, this model is how Maker’s new Dai Direct Deposit Module (D3M) works, which allows Dai to be minted directly into Aave.

Coming up: Frax Price Index

So now you know the basics of Frax v2 and AMOs. What’s next for this ambitious fractional-algorithmic stablecoin protocol?

That’d be the Frax Price Index (FPI), a crypto-native version of the mainstream Consumer Price Index. Due to be released in the coming weeks, the FPI will be founded upon a Chainlink-powered CPI oracle plus crypto-based indices.

“The vision for the FPI is to create a new fully decentralized unit of account for stablecoins to peg to which is more inflation-resistant than the dollar but still price stable to a basket of goods” the Frax team explained this autumn.

How to yield farm via Curve’s FRAX-3CRV pool

Interested in supporting a decentralized and capital-efficient stablecoin like FRAX?

Here’s how to get started.

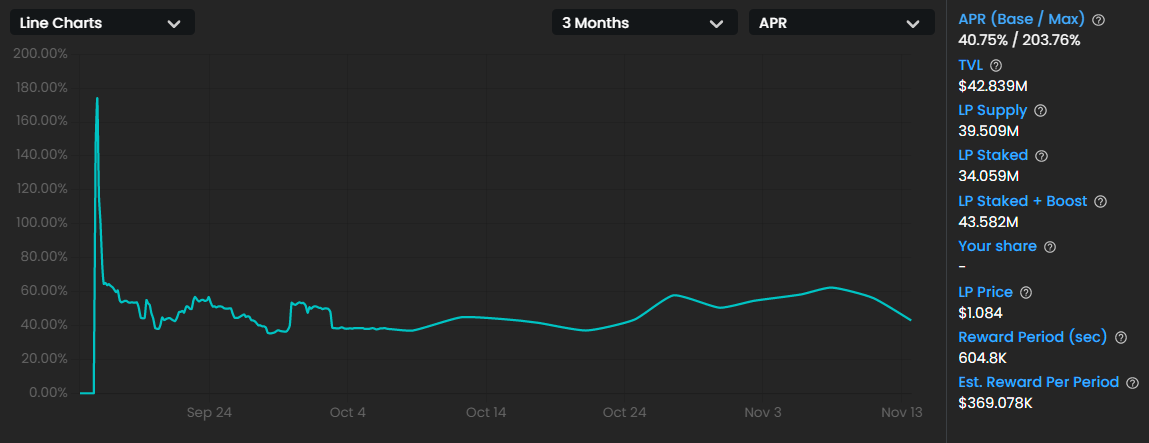

One possibility is supplying liquidity to Curve’s FRAX-3CRV pool so you can earn while also supporting FRAX’s liquidity and peg. You could then deposit your LP tokens into Stake DAO’s passive FRAX strategy and thereafter stake your sdTokens back on Frax to earn +40% APR via FXS and SDT rewards.

Not bad, right! If this kind of DeFi action peaks your interest, then you can consider following these steps to join in:

- Curve’s Frax pool (which currently +1B in currency reserves) accepts deposits in FRAX, DAI, USDC, or USDT. Make sure you have some of these tokens to proceed. For example, you could deposit only FRAX into the pool or any combination of the accepted stables.

- Navigate to the pool’s deposit page and connect your wallet; input the amount of tokens you want to supply, click “Deposit,” and complete the transaction with your wallet.

- At this point, your wallet will receive Curve liquidity provider (LP) tokens in the form of FRAX3CRV-f, which represent your underlying deposits.

- Now you’re ready to head over to Stake DAO, a multi-service DeFi platform that offers automated investment strategies. On the project’s Strategies page connect your wallet and then click on the Passive Frax Strategy.

- You’ll arrive at an interface where you’ll input the amount of FRAXCRV-f you want to supply to the strategy. Press “Approve” and complete the ensuing transaction to let Stake DAO interact with your Curve LP tokens.

- Once that’s finished, you’ll fire off another “Deposit” transaction to finalize the deposit and receive sdFRAX3CRV-f tokens, i.e. Stake DAO LP tokens.

👉 Keep in mind that farming in this way exposes you to smart contract risks. Also, remember that to totally unwind this position you’ll have to unstake on Frax, unstake on Stake DAO, and then withdraw your liquidity from Curve.

- Almost done! With your new sdFRAX3CRV-f tokens you’ll go to Frax Finance’s Staking page and scroll down to the sdFRAX3CRV-f staking option.

- As you can see above, this yield farm is generating a base APR of +40% right now via FXS and SDT rewards (and up to +200% APR if you opt to participate in Frax’s veFXS vesting and yield system!). To proceed, connect your wallet.

- Click on the “Available” button to stake all your sdFRAX3CRV-f tokens, select a lock-up period to configure your rewards boost, and then press “Stake.”

- Complete the approval transaction and then the deposit transaction to finalize the staking of your tokens. Now you’ll start earning FXS and SDT rewards, which you can claim through the same staking portal shown above!

Zooming out

Frax Finance v2 is a decentralized, flexible, and capital-efficient stablecoin protocol, and the success of FRAX to date has shown that algorithmic stablecoins can, in fact, thrive.

For proof of that success look no further than how FRAX currently has ~$1B in total circulating value, making the asset among the largest stablecoins in DeFi and surpassed in size only by PAX, DAI, BUSD, USDC, and USDT.

All that said, it seems we’ll be hearing much more about Frax Finance in the future as DeFi continues to innovate around AMOs and as the Frax Price Index starts to come into its own. Additionally, the way Frax’s FXS1559 system cements value capture into the protocol is surely going to influence other DeFi projects going forward!

Action steps

- 👀 Check out the Frax Finance app.

- 🚀 Read our previous tactic, How to stake any amount of ETH!