How to earn fixed yield on BarnBridge

Dear Bankless Nation,

Crypto adoption has largely been driven by retail investors.

It’s been from people like you and me—not mutual funds, endowments, and definitely not banks. Institutional adoption is an added bonus, but fundamentally, our values lie with decentralization and individual empowerment. It’s in self-sovereignty.

But we face a challenge with the next wave of adoption: we need Fixed-rate yields.

As early adopters, we’ve grown to tolerate variable yields. But the next wave of crypto-curious adopters won’t look kindly on volatility.

If we want them to ditch banks, we need to offer more stability. There’s too much friction in active fund management and too much risk in volatile yields.

Last month, we took our first look at fixed yields derived from a two-sided marketplace.

Today, we take a different approach that allows one party to assume the yield volatility risk for the other.

Will fixed interest be DeFi’s next big break? Might be.

Let’s dive in.

- RSA

How to earn fixed yield on BarnBridge

BarnBridge is a decentralized protocol for tokenizing risk. The project offers blockchain-based products that help users hedge against, and calibrate their exposures to, DeFi yield fluctuations.

This tactic demonstrates how you can earn fixed yield through the project’s flagship SMART Yield system whenever you want!

- Goal: Learn how to use SMART Yield

- Skill: Intermediate

- Effort: 1 hour of research

- ROI: up to 5.7% APY currently

What is BarnBridge?

“We plan to create the first cross-platform derivatives protocol for any and all fluctuations. To start, we will focus on yield sensitivity & market price. Downstream, we plan to introduce a far wider variety of hedges against fluctuations in the decentralized ecosystem. BarnBridge aims to be platform and asset agnostic.”

— The BarnBridge whitepaper

Technically speaking, BarnBridge is a derivatives protocol for market fluctuations. It’s a decentralized system for hedging, namely for “hedging yield sensitivity and market price.”

In practice, this means BarnBridge pools deposits and splits yields preferentially between two sides of users, a senior side and a junior side.

Accordingly, the protocol divides risk into liquid, tokenized tranches known as SMART Bonds. Senior bondholders are guaranteed safer returns but face dampened exposure to upside price movements. Junior bondholders take on more exposure to leverage, thus earning higher yields for taking on more risk.

So why BarnBridge? By giving investors the ability to choose their own risk profiles across top protocols like Aave and Compound, BarnBridge makes DeFi more efficient and risk-flexible.

In doing so, BarnBridge helps DeFi become more attractive to those in traditional finance who’ve come to expect stability and predictability from TradFi!

BarnBridge’s Top Products

The BarnBridge protocol provides two flagship services right now: SMART Alpha and SMART Yield.

Let’s briefly explore what both of these systems have to offer.

SMART Alpha 🌀

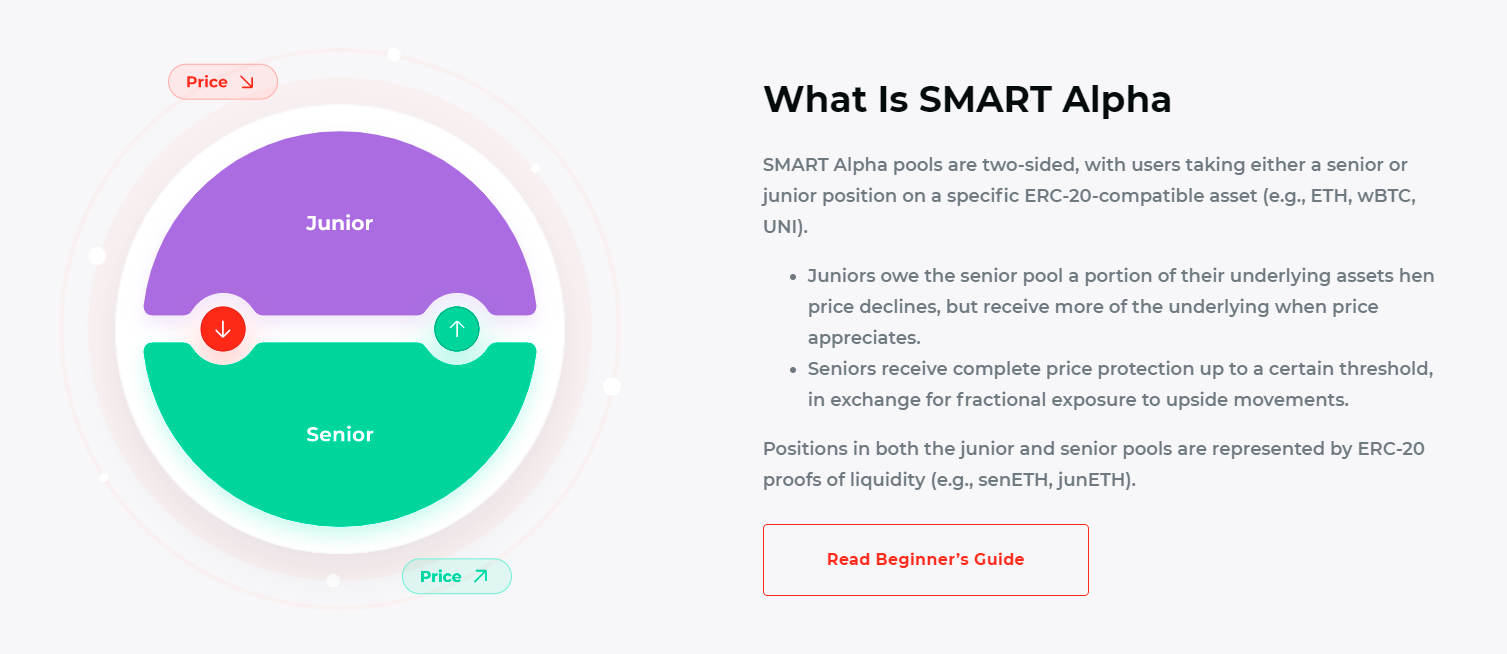

SMART Alpha is a “market price exposure risk mitigation system using tranched volatility derivatives.”

Don’t be alarmed by that big language. This decentralized product is all about allowing investors to optimize control over their exposure to a particular crypto, e.g. ETH, WBTC, etc.

SMART Alpha doesn’t provide its Senior bondholders with fixed-rate interest. Rather, the product distributes yields on a fluctuating basis per junior-side pool dominance, i.e. “the share of a given ERC-20 token’s pool that is composed of junior depositors.”

To get the full scoop on SMART Alpha, check out the BarnBridge beginner’s guide.

SMART Yield 🌾

SMART Yield is an “interest rate volatility risk mitigation system using debt-based derivatives.”

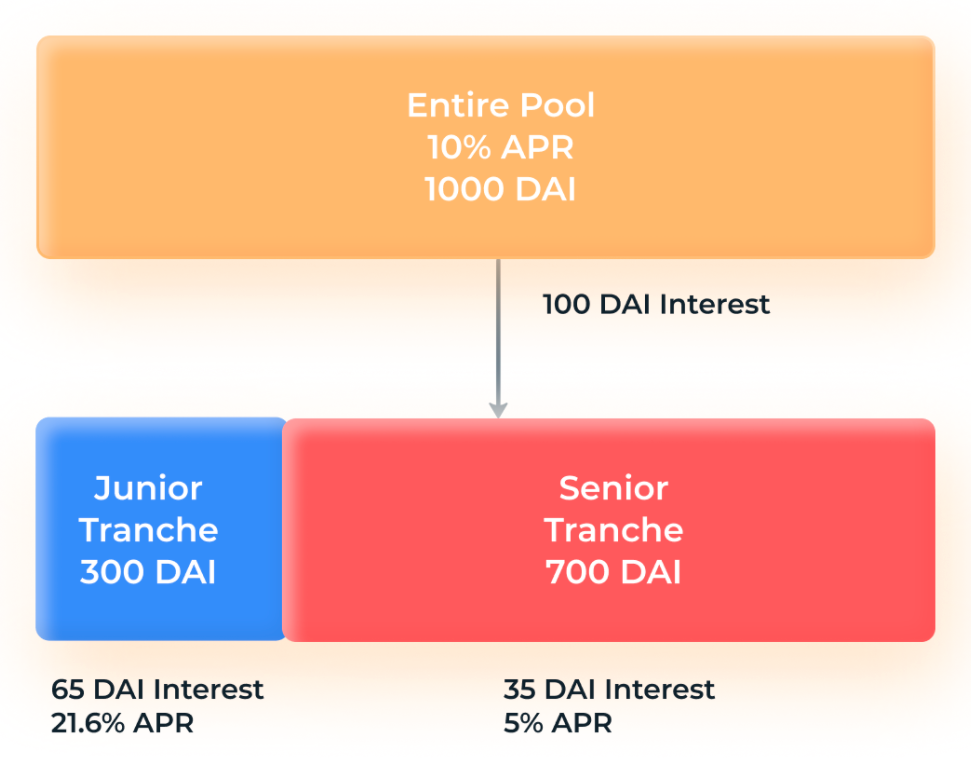

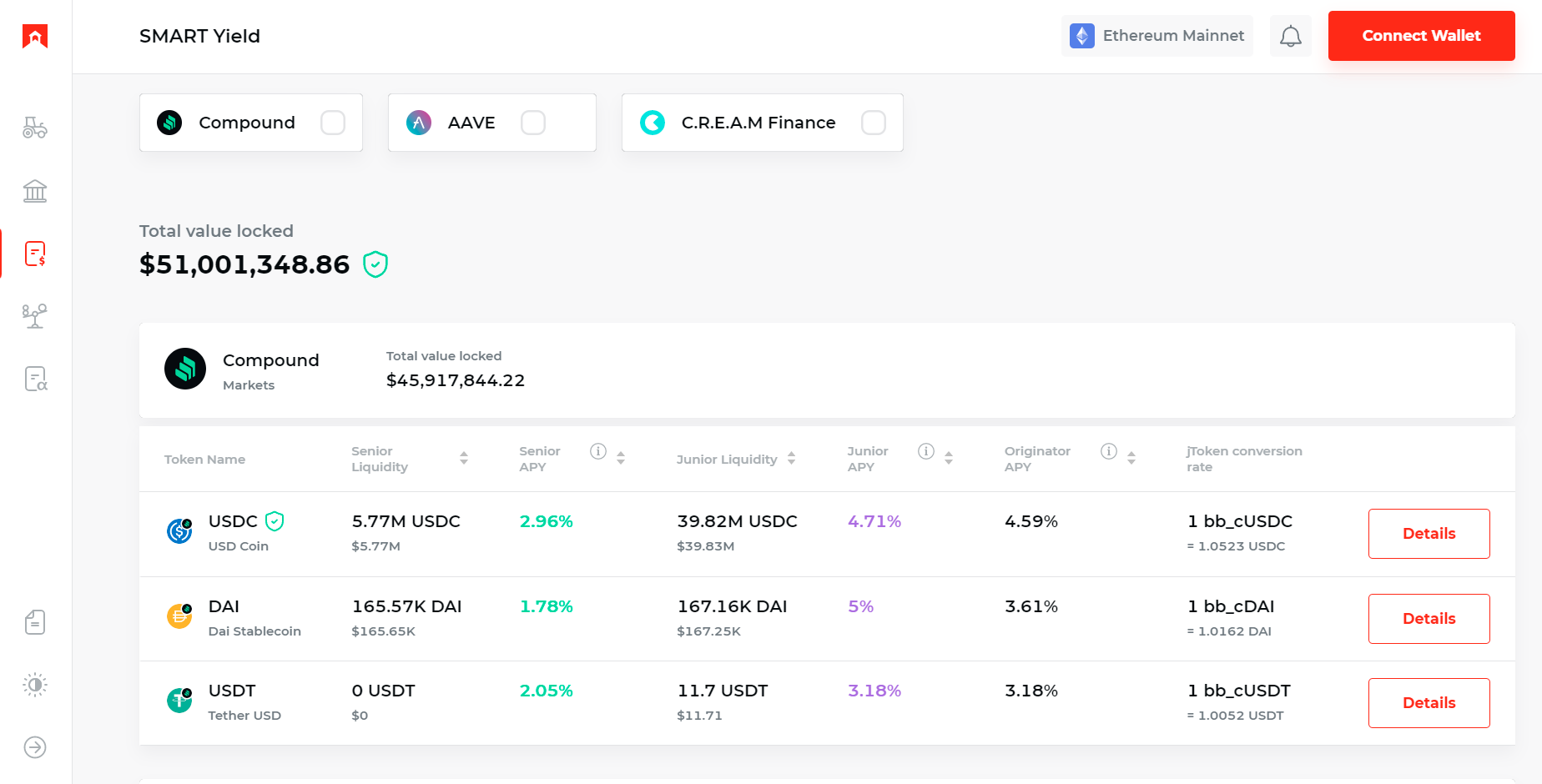

In other words, SMART Yield provides investors with fixed-rate or levered variable yields on their stablecoin deposits. The system aggregates users’ deposits into Aave, Compound, and C.R.E.A.M. Finance and tranches the ensuing yields into senior and junior risk profiles.

Senior SMART Yield bonds are represented by ERC-721 NFTs that are known as sBonds. This is similar to how Uniswap V3 liquidity provider positions are expressed as NFTs. Conversely, junior bonds are known as jBonds and are represented by fungible ERC-20 tokens.

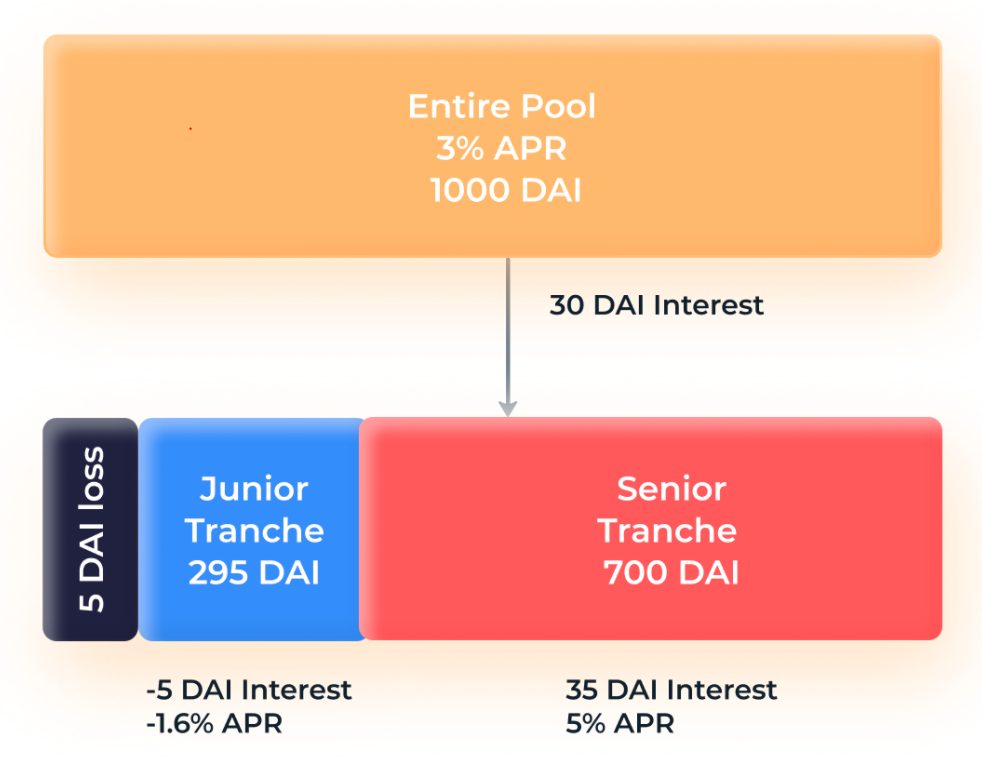

Ideally, both sBond and jBond holders earn yields. However, if the APY provided by the underlying lending market dips below the yield guaranteed to senior bonds, then junior bondholders cover the shortfall.

That said, let’s look at two simplified scenarios from the BarnBridge whitepaper to illustrate how this looks in action. In Scenario 1 both types of bonds are in the green, while in Scenario 2 only the sBonds are netting a positive ROI.

Scenario 1 📈

Scenario 2 📉

👩🏫️ Bankless BarnBridge tip:

- BarnBridge offers a third decentralized product, known as SMART Exposure. It can help investors “passively rebalance between any two assets via tokenized strategies.” Keep it on your radar accordingly! 📡

How to earn fixed yield via SMART Yield

Since SMART Yield offers senior bondholders a fixed yield, we now specifically turn our attention to sBonds. If you’re interested in acquiring sBonds, you can follow these steps:

- Navigate to BarnBridge’s SMART Yield dashboard.

- Pick a stablecoin pool from one of the three integrated lending markets. Note: the highest guaranteed APY right now is the 5.72% rate offered by the C.R.E.A.M. Finance USDT pool.

- Click on the “Details” button for your pool of choice, at which point you’ll be taken to the pool’s main Deposit interface. After reviewing the market info, including the Average senior maturity metric, connect your wallet and press “Deposit.”

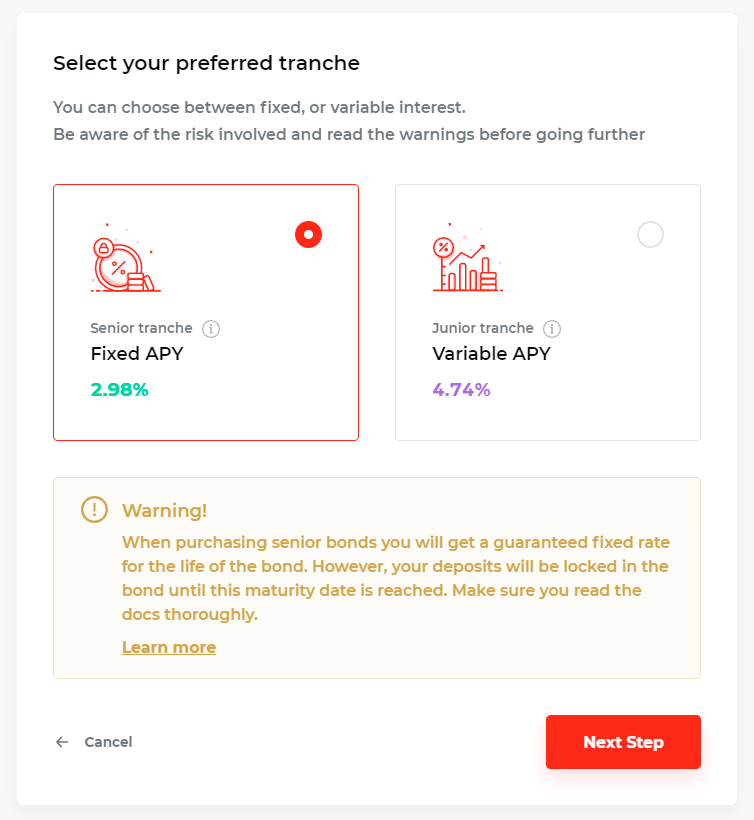

- You’ll now be asked to pick your preferred tranche. Select the Senior tranche Fixed APY option. Before proceeding, keep in mind that “your deposits will be locked in the bond until [its] maturity date is reached.”

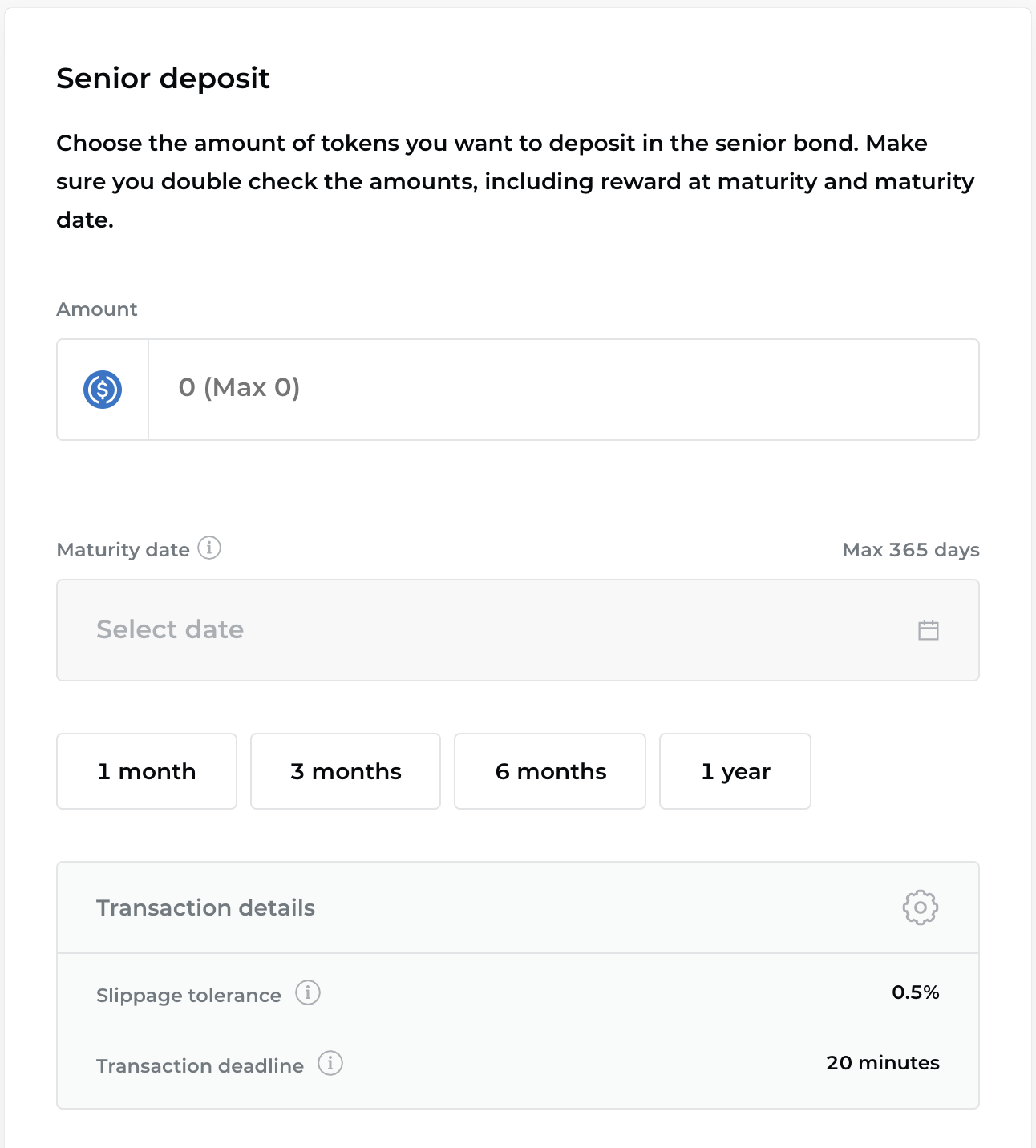

- You’ll be taken to a Senior deposit interface. Go down to the bottom of the UI and click the “Enable” button. Complete the ensuing transaction through your wallet to allow BarnBridge to spend your funds.

- Now it’s time to set up your bond’s terms. Input your desired deposit amount, e.g. 500 USDC, and your desired maturity date. BarnBridge offers preset options for 1-month, 3-month, 6-month, and 1-year terms.

- After you have everything set up how you want, review the Transaction summary section at bottom of the UI. If everything looks good, press “Deposit” and complete the ensuing deposit transaction through your wallet.

- Once your deposit confirms, you’ll receive an sBond in the form of an ERC-721 NFT. Use this NFT to redeem your principal + interest through SMART Yield at your sBond’s maturity date.

- You can now track the performance of your bonds as you please via BarnBridge’s Portfolio page!

Zooming out

The SMART Yield system facilitates compelling fixed-rate yield opportunities for DeFi investors.

Notably, BarnBridge’s rollout of its SMART Yield and SMART Alpha systems this year marks the completion of the vision the project laid out in its initial whitepaper. Now the name of the game is expanding the utility of sBonds and jBonds and making it easier to use them.

To that end, BarnBridge is collaborating with other DeFi protocols on using SMART Bonds as collateral and exploring further deployments on L2 scaling solutions like Optimism, Arbitrum, and beyond.

Lastly, keep your eyes peeled on DeFi’s first tokenized risk protocol because the team is currently building out SMART Leverage, a lending market, and SMART Fiat, a “fixed income asset token” that can foster a native capital market for BarnBridge.

Action steps

- 📖 Read “Whitepaper complete: where do we go from here?” by BarnBridge

- 👨🌾️ Head to the BarnBridge dashboard and lock in your fixed yield

- 👀 Give SMART Alpha a look