Dear Bankless Nation,

Everybody apes.

Apeing means buying a crypto asset without much in the way of research or thought. You just go with the vibes. The assets feel right…so you hit the buy button.

You’ve done it. I’ve done it.

This is crypto. Everybody apes.

But if apeing is all you do in crypto you’re gonna have a bad time. The real way to generate wealth is to buy high conviction assets and hold for long time horizons.

With a few exceptions, all the wealthiest people in crypto have one thing in common: they’ve been holding it for years. The more years, the more wealth.

But with the right approach and sizing, apeing can generate positive returns.

Why?

Because crypto moves fast. There are new opportunities every day. By the time you’re able to spend those countless hours on research, you might have missed the upside of multiples.

A lot of people got into crypto by accidentally apeing on the right coin.

We can’t stop you from aping.

But we can show you how to ape responsibly.

Here’s everything you need to know before you ape.

- RSA

🙏 Sponsor: Ledger Nano S Plus—The perfect hardware wallet to securely enter Web3. 🔐

🎙️ STATE OF THE NATION

Listen to podcast episode | iTunes | Spotify | YouTube | RSS Feed

At Bankless, we’ve hammered on the point that crypto is the biggest wealth creation opportunity of our lifetime.

With a TAM of the entire ecosystem of financial products and services, a $2T market cap of all crypto assets is laughable. Wise investors will tell you to pick your bag of blue-chip tokens to DCA into and hold with high conviction.

But in a market where certain assets can moon 10x in the span of a couple of days, we can’t help but dream of making it rich quickly. That’s why many of us get caught in the hype and mania when new projects and tokens are about to be released. It’s our chance to make fast money and so we ape some portion of our portfolio and gamble on the outcome.

There’s nothing wrong with wanting to make a quick buck. We should all have a shot at financial independence. But it is risky, especially in crypto.

That’s why we wrote this guide on apeing responsibly.

Here are a few things to keep in before you ape.

What is apeing?

First off, let’s define The Ape.

When buying a token or NFT, you can either invest or you can ape. Investing is methodical. It involves a thesis, research, conviction, strategic allocation, and feeds into a larger portfolio strategy. Apeing doesn’t care about any of that. It’s a quick grab at potential upside without any meaningful forethought. It’s a gamble.

As I said, there’s nothing wrong with apeing. Everyone at Bankless apes, even Ryan. I aped into APE. But I explicitly had a framework for what I was doing:

- Apeing is always a function of FOMO and an attempt at making a quick buck.

- Apeing requires only the bare minimum of due diligence.

- Apeing should only happen with small amounts of your portfolio, generally up to 5%. (Only ape what you can afford to lose as there’s a higher probability than usual that you will lose it all.)

- Apeing is not a high-conviction decision. Apeing means having an exit plan.

With these considerations in mind, there is still a minimum of due diligence that could save you from painful lessons.

Ape Level: Degen

To me, security, liquidity, and exit planning are all critical apeing requirements. But we’ll touch on that later.

First, here are some of the basic tips that you can employ in 15 mins that can save you from making a bad decision:

1. Do some research

Apeing is all about minimal viable research. But, if you have the time it will benefit you to do some basic research. This advice applies especially well to NFT projects that have delayed releases:

- Team: Check the background on the team. Have they delivered before? If they rug you, what’s at stake? A little bit of sleuthing would have saved the Pixelmon community a ton of pain.

- Competition: Is this a one-of-a-kind project pushing into new territory for the first time, or is it a sexy team in a crowded field of sexy teams working on this same type of project? If there's tons of competition you may want to ape less.

- Audits: Has the protocol been audited before? By which company? We’re going to dive into security and audits in a later section but if its a new DeFi protocol, it’s always worth doing a quick check on whether or not the protocol has been vetted by security professionals.

- Token Distribution: Another good heuristic to tell if a project is well-intentioned is to check the token distribution. If a sizable chunk is going to private investors, founders, or other “in-group” members, it may be a cash grab. It’s also worth checking the token emission schedule. Is the protocol offering 1M% APY? There’s probably going to be some sell pressure.

2. Ape from a separate wallet

Scammers will take advantage of your FOMO as you try to speedily scoop up tokens and NFTs. That’s why, whenever you ape, do it from a separate hot wallet. Spin up a new Metamask and transfer funds over.

This advice will save you if you’re interacting with contracts from a unique interface. If you’re swapping on Uniswap, you can have a high degree of trust that nothing funky is going on behind the scenes. But if you’re on a project’s website and there’s a unique button that incorporates some smart contract logic, it’s safer to use a separate wallet.

3. Track sentiment on social media

When you’ve identified an investment opportunity that will make you a quick buck, it’s very easy to fall into confirmation bias. You’ll look for evidence to validate that said project will moon and you’ll cash out a nice fat bag.

That’s why you should actively seek information that negates your confirmation bias. When sleuthers, developers, and veterans notice problems with a project, they’ll scream it from the top of their lungs. You should listen.

Twitter is a great place for this. Apply their advanced search engine and look for any negative news around a project’s launch. If you see any red flags raised around the topics discussed in this article, consider apeing less, or not at all.

These are some of the basic considerations you should take before you ape.

If you have some extra time on your hands and want to ensure everything checks out before risking your crypto assets, here’s what you should cover.

Ape Level: Sophisticated

1. Security

The biggest consideration in any guide like this should be security. Remember, we’re talking about programmable money here. If there’s a flaw in the code, it’s your money on the line.

Unfortunately, with code, security is never a given. Even developers will miss something. But what we can do is create higher confidence intervals for security. Signals that indicate a higher level of security that we can feel more comfortable with.

So what should you look out for?

Transparency

Every project that will deploy to a public blockchain should have its code visible for all to see.

Recall that blockchains are public ledgers, meaning that transactions and code are all public, even if slightly obfuscated. As such, it’s highly suspicious if a project is hiding its codebase from the public.

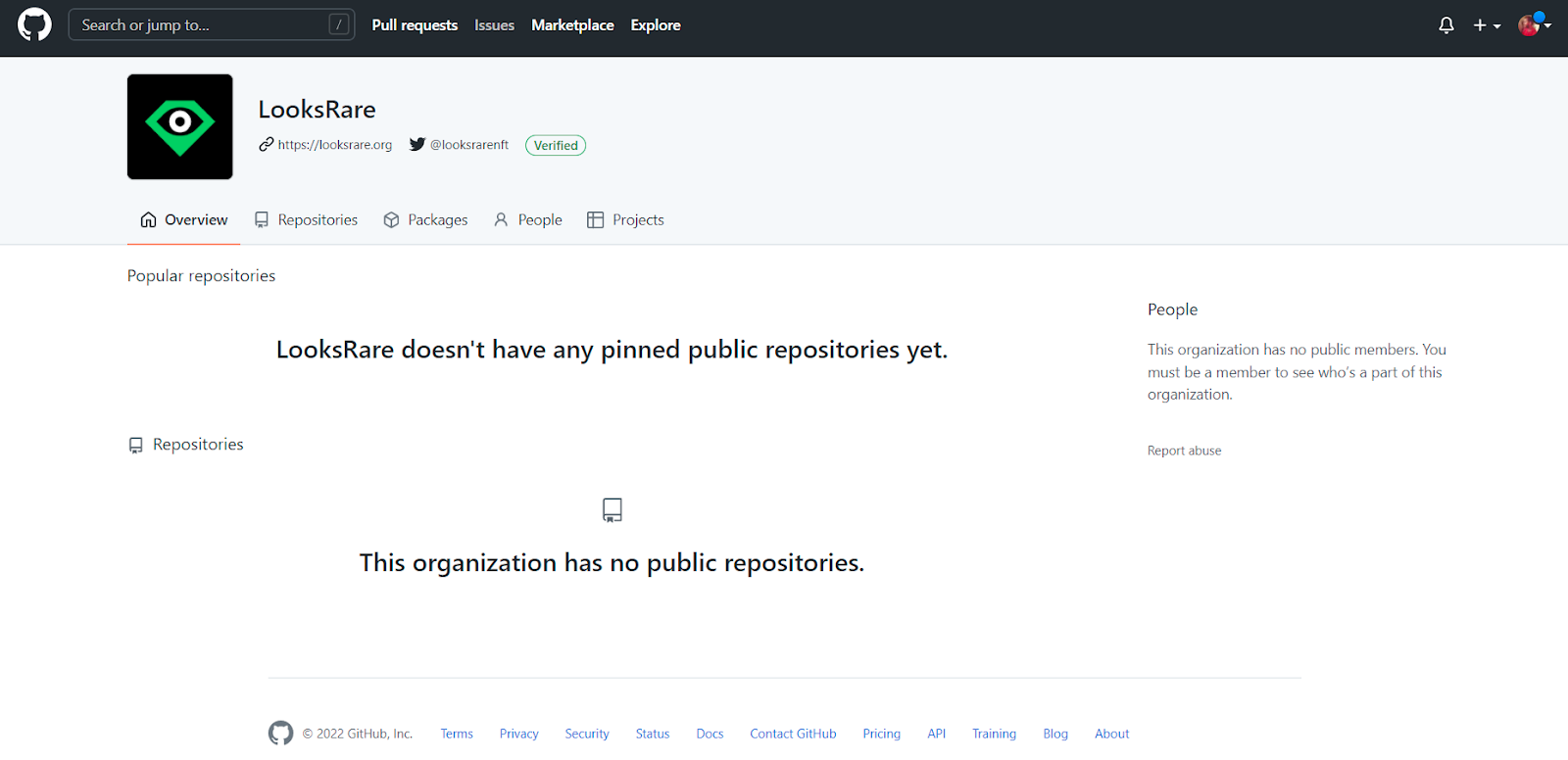

Check any reputable project site and you’ll see a link to their Github. If the project you want to ape into does not have any public repositories on Github, proceed with caution.

Using battle-tested contracts

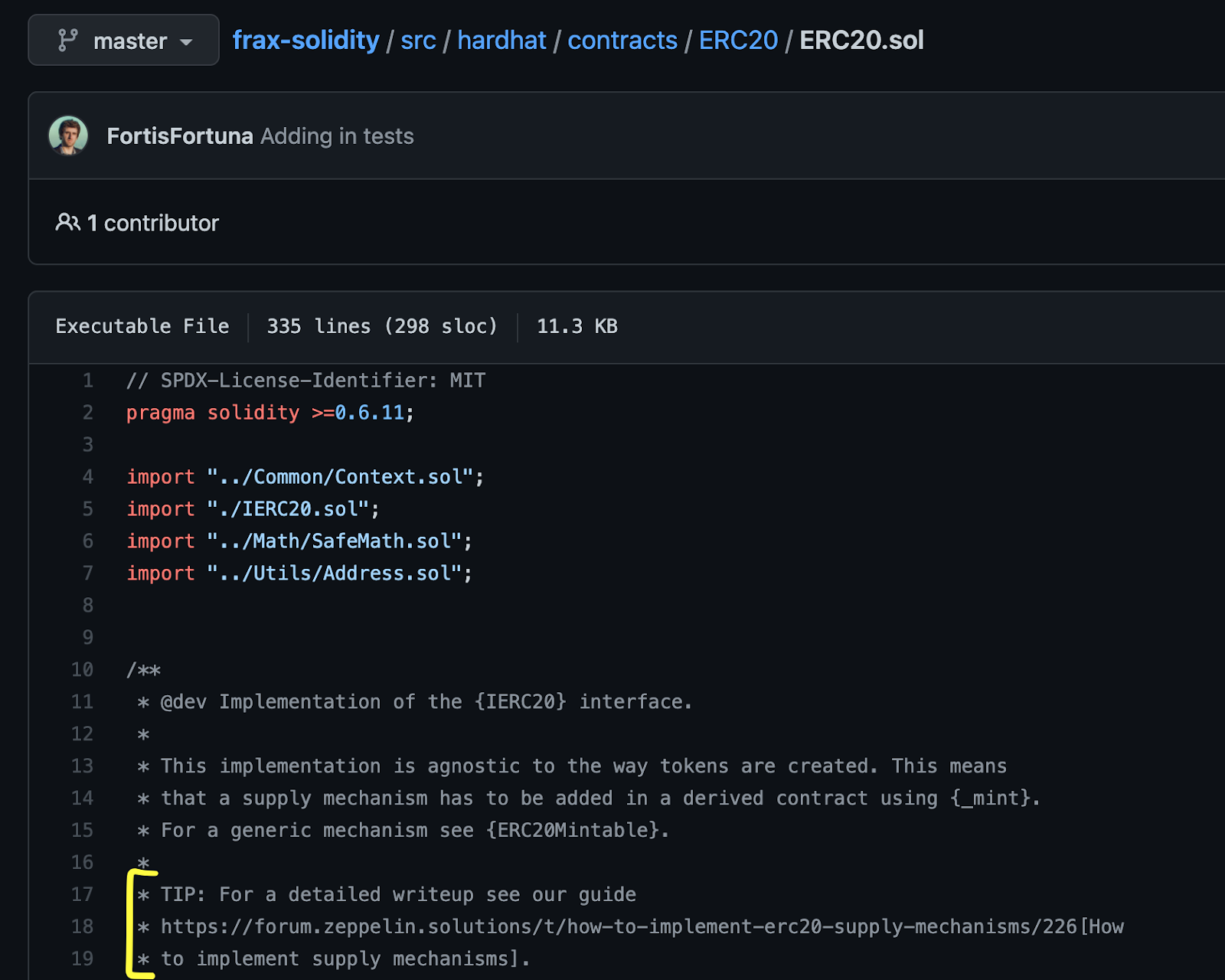

Project developers do not have to build their protocols from scratch, coding each smart contract from the ground up. Nowadays, there are many audited smart contract libraries that allow developers to copy and paste battle-tested code.

The most popular of these libraries is OpenZeppelin’s suite of contracts. Almost every project nowadays uses some of OpenZeppelin’s code. You can find other popular libraries here.

I’d generally advise this method if you’re apeing into a token or NFT, not a protocol. Tokens and NFTs are well-trodden territories, meaning there’s a strong argument for using a standard library.

Checking project repositories for library usage isn’t easy if you’re not familiar with programming. But one good way to get started is to check out a project’s Github and start looking for contract files. For example, if this project will deploy on Ethereum, look out for .sol files. Clicking into them, you’ll find indications that a particular library is being used.

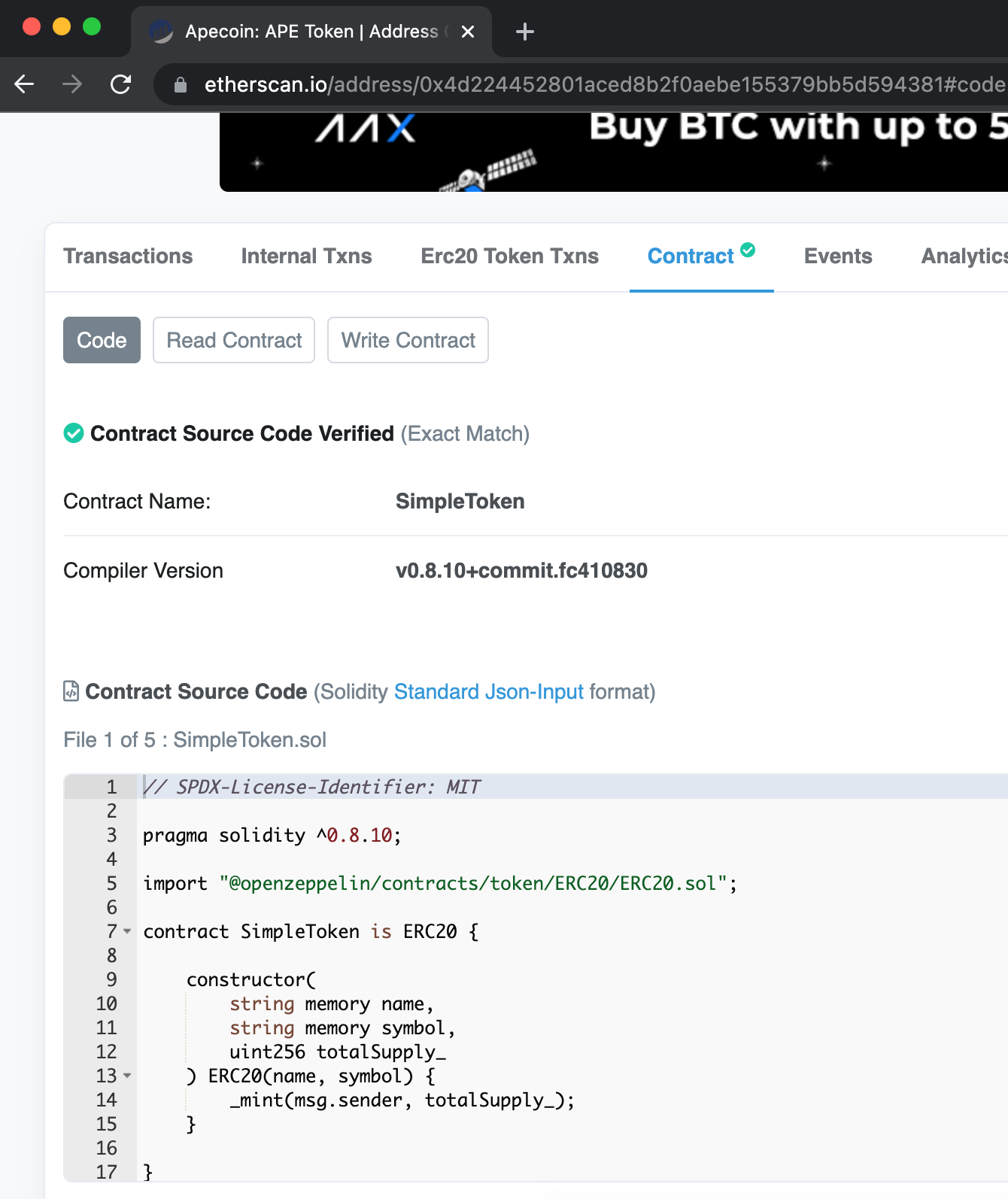

If the project is already deployed, you can also find the contract address on Etherscan and click the Contract tab to read the code directly.

Audit Status

Any project that is serious about launching a protocol will get an audit. Note that I said protocol. Most tokens/NFTs won’t receive an audit. Audits are expensive and take time. For boiler-plate tokens and NFTs, most developers will draw from standard libraries (like OpenZeppelin) to ensure their contracts are secure.

For example, APE did not get an audit, nor do they have a public Github. But if I check their contract address on Etherscan, I can see that they’ve imported OpenZeppelin’s standard ERC20.sol contract, which implies a high degree of security.

However, if you plan on apeing into a protocol, especially one that is new, you should definitely look for an audit. For example, Rari Capital may use the standard OpenZeppelin implementation of the ERC20 contract, which does not require a separate audit. But each of their bespoke contracts: Yield Aggregator, Fuse, and Governance have all received their own audits by security professionals.

Once again, the public blockchain is public, meaning that any deployed contract is fair game for malicious actors to try and exploit. Getting an audit is not a 100% guarantee of safety, but auditors often do catch major bugs that could put your funds at risk.

There are a number of auditing firms out there, but some of the reputable players are:

- Consensys Diligence

- OpenZeppelin

- Trail of Bits

- ChainSecurity

- Certik

- Quantstamp

2. Liquidity

So perhaps the project you want to ape that passes your security threshold. The next thing you’ll want to note is the available liquidity for that token.

If you’re not familiar with the lessons from this story, the takeaway is that sending your transaction out into the mempool is like lighting a flare in the dark, surrounded by predators looking to extract value. In other words, when you fire off a transaction, you may trigger a series of bots that will begin executing giga-brain strategies based on the slight deviation your transaction created in the markets.

These predators (bots) often take advantage of imperfections in liquidity and slippage to maximize their returns.

Take WTF for example:

In this case, the triggering transaction was when developers added WTF to a liquidity pool on Uniswap v2 with no ETH to pair against, meaning there was no clear market price. One bot arbitrarily bought 99.99% of the pool for 2 ETH, setting a market price for WTF and bots continued to bid higher and higher for the remaining 0.01% until the market price was highly inflated. This meant that selling even a small amount of WTF would be massive profitable, which is exactly what happened.

Poof, 58 ETH was drained from the liquidity pool.

The lesson here is that prices in AMMs vary depending on the available liquidity within a pool. So when liquidity is low, individual transactions could easily swing the price. But when liquidity is high, transactions have lower slippage and buyers can be a bit more confident in the market price.

A general rule of thumb here is that if your token buy order on an AMM incurs more than roughly 5-8% slippage, I would wait until there is more liquidity available. Otherwise a whale can come in and make a massive purchase and rug the value of said token.

⚠️ Note: If a project doesn’t mean sufficient security of liquidity requirements, that doesn’t mean you can’t ape in. If you still want to ape, just ape less.

As always, only ape what you can afford to lose.

3. Have an exit plan

As with all investing, you should always have an exit plan in mind.

What are your goals? When will you make a profit? How much are you willing to lose?

When apeing, this consideration is even more important. When you ape, you’re playing a risk-on game for quick and dirty short-term gains. You have to set your own parameters for the game and stick with them.

Consider the nature of your game - Are you apeing into tokens, NFTs, or high yield protocols? Each game has different rules and behaviors. From there, set some basic parameters:

- How much will I ape?

- What max price will I sell at? What minimal price will I sell at?

- How long will I hold vs. sell to recoup losses?

Over the past few months, I’ve noticed that many newly-launched governance tokens follow similar trends. A sharp spike, a quick fall, sometimes a second spike, and then slow stabilization.

This is my template for apeing into these types of coins. I’ll ape a small amount of my portfolio into these coins and closely monitor markets for that first initial spike. My rule is simple, in the best-case scenarios, I sell when my portfolio is up 2x. Worst case scenario, I sell when my portfolio drops 50%.

It doesn’t matter that I bought LOOKS at $2 and missed the top at $7 because I sold at $4. Why? Because I doubled my money and that’s good enough for me. It also doesn’t matter that I bought SOS too late and sold before the second rally. Why? Because my rule was to sell when I lost 50% and I did that.

When you ape, you’re gambling. Your exit plan will be somewhat arbitrary, but having one and sticking to it will reduce the cognitive burden you shoulder when trying to play the markets.

Don’t ape more than you’re willing to lose

It’s okay to ape. Crypto moves fast and there’s a massive wealth creation opportunity for those that can take advantage of it. But this holds true for building a sophisticated portfolio with strategic allocation.

However, there are new opportunities every day. Allocating a small percentage of your overall portfolio for degen activities and trying to make a quick buck is okay.

The only rule you need to follow is: Don’t ape more than you’re willing to lose.

Follow it and you should be alright.

Best of luck out there, degens.

Action steps

- 🐵 Ape into the same coins that DAOs are scooping up

- 🏗️ Use these tools to perform your own on-chain analysis

- 📖 Read our Beginners Guide to Cosmos

Author Bio

frogmonkee is an editor at Bankless and previously a core contributor at BanklessDAO.