Growing DAI to trillions: RSA w/ Maker's Steven Becker

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Maker is releasing a major upgrade to DAI next Monday. A big deal. It’s not everyday that the worlds first decentralized central bank upgrades its money!

I caught up with Steve Becker COO of the Maker Foundation. Steven has a unique perspective—partially because he came to crypto in a different way. His crypto rabbit hole wasn’t BTC or ETH like most of us…for him the journey started with Maker.

Here’s what we covered:

- Why BTC and ETH doesn’t meet his definition of money

- DAI as the world’s first unbiased digital cash

- Potential of PurityDAI—a purely crypto-backed version of DAI

- Thoughts on Libra vs. Maker

- Steven’s panel w/ the central bankers

- How DAI grows to trillions with the help of central banks

- Why it might be inevitable that DAI becomes a fiat currency one day

Lots of level ups in chat. Calibrate your thoughts around crypto money, tokenization, and Maker as a protocol.

- RSA

THURSDAY THOUGHT

Growing DAI to trillions:

RSA w/ Maker's Steven Becker

Note: this conversation has been edited for brevity. I put the 🔥 stuff in bold.

RSA: Steven, what’s you background? How’d you get involved in Maker?

SB: I have a background in diversified financial services. Everything from financial risk management all the way to derivatives trading. At one point I even had a statistical arbitrage hedge fund.

I’ve always been interested in the broader economic essence of how things work, granular things like interest rates and yield curves. After I moved to the U.S. and started looking after my own trading portfolio, the next thing you know I get a message that says:

”Are you interested in looking after the risk of a stablecoin project on the blockchain”

My first instinct, oh this is crypto—so no. I’ve got enough volatility in my life. (Laughing)

I was interested in blockchain, but not BTC as a currency. Interested in Ethereum, but not ETH as a currency. These didn’t fulfill my definition of a currency.

I got another message a couple weeks later. This time it said:

“Would you like to be part of a project that focuses on the risk of a decentralized stablecoin?”

I know how to create a centralized stablecoin, but when I heard decentralized I thought—I don’t know how that works. Let me have a look. So I went into research mode and it became clear to me that the most perfect decentralized stablecoin was a benchmark asset and that Maker’s protocol was really close to it. And I was sold. Completely sold. Every aspect of my traditional financial life this thing touched on.

RSA: Most people fall down the crypto rabbit hole with BTC or ETH first, you went straight to Maker?

SB: Yes. Completely. Bitcoin and Ethereum were interesting, especially the cryptographic components. But in terms of actual BTC and ETH token, I had no interest whatsoever. To me these were never going to become a currency. In my reading of financial history currencies function in a specific way and these weren’t hitting all the checkboxes.

And when I looked at centralized stablecoins, these are just a digital representation of a currency, but you still have central party risk, it doesn’t scale. Decentralized stablecoins, specifically Maker, in which you can input collateral of whatever you can possibly think of, this is something that can be a currency, an economic engine, and can scale. Central banks, commercial banks, community banks—DAI is something they can actually use.

RSA: You saw Maker as a bridge between legacy finance and crypto?

SB: That’s correct. Rune and the guys that put this protocol together created a complete system that touches on every facet of the financial system. And, I must be honest with you—I don’t think they were completely aware of it. They were solving for one thing, but inadvertently touched on everything.

That’s a game changer. An inflection point. If you think about it in terms of the dismantlement of Bretton-Woods that’s an inflection point. The creation of derivatives was an inflection point. In 10-15 years, people will talk about the DeFi movement and the Maker protocol as an major economic inflection point.

The DeFi space is the driving point that’s showing how the Maker protocol is useful and valuable.

RSA: Curious about your definition of money. Is BTC money, is ETH money, is DAI money?

SB: The definition of money is a wonderful thought-process everyone should be constantly challenged with. From my definition, DAI is the world’s first unbiased digital cash.

If you take a look at the characteristics of money, the one that sticks out—you need it to be widely accepted. It also has to have a nice stable store-of-value. You can use it to transact with. And if everything goes right, everyone starts pricing in it. Those are the three things you want to see happening to an asset in order for it to become money.

The biggest problem with Bitcoin is that it’s simply not accepted. It’s not a unit of account for anybody. Not a lot of folks are going to be pricing things in BTC. So it becomes very speculative.

To your question, is BTC and ETH money? My answer is no it’s not. Is DAI money, yes it is. Though this is a point of gradient as well. DAI is a lot closer to the perfect sense of what money is than BTC and ETH.

RSA: Viewing moneyness as a spectrum makes sense. In single collateral DAI, the collateral has been crypto native—ETH only. With multi-collateral DAI, you’re adding trusted assets. How does that change the project? Does it make it less pure?

SB: That’s a brilliant point. Let’s talk about tokenized real-world assets. In order for blockchain to take on its full potential, you need to create an economy on top of it. You need to show how this blockchain economy is going to dovetail and augment the traditional economy.

You’re going to see an exponential growth in economic activity because of blockchain. Centralized actors are going to create digital tokens that are based on-chain and they’re just going to represent something of a claim on a central asset. Then they’re going to put their processes on chain. Then their businesses on chain.

In supply chain finance for example there’s $6 trillion locked up in financial moats. Supply chain can use the Maker protocol to unlock that $6 trillion. DexFreight is a wonderful example of this.

The point—we’re showing the traditional market how they can use the blockchain to unlock more value rather than telling them how blockchain is going to come eat their lunch.

That’s why the Maker protocol is so powerful. You can use crypto native assets with their associated risk profiles. But you can also show the traditional world how to transform their assets into tokens and make the risks transparent. The transparency is the part that’s missing. By doing that, you’re creating a way for the analog world to join the blockchain world.

And eventually blockchain becomes the native platform on which everything is built. It’s not going to be substituting or killing, it’s going to be a transitioning.

RSA: So crypto native or trusted assets, you’re saying—hey, why not both. What about the idea of a purity DAI that’s only backed by crypto native assets? Does that split up liquidity?

SB: Let me put it this way. I like the fact that we’re having these conversations. Because it’s about consumers. It’s about what they want.

It’s possible to have a purity DAI that serves a subset of crypto-native hardcore types—and that’s fine, we’ll have users that want different things. So I think purity DAI could become a reality along with a tokenized real world asset DAI as reality. A collection of possibilities that together in aggregate will diversify the whole ecosystem and make the ecosystem it more robust.

I like that people are questioning the philosophy of blockchain. At the same time, if you want to make this thing a source of value for everybody then the analog world needs to be included. So you need to have that spectrum. The DNA of the protocol has to be able support this granularity.

But is purity DAI forthcoming? That’s up to governance.

RSA: In multi-collateral DAI the governance gets a bit thicker. The risk decisions get more complicated. Does this impact decentralization of the protocol? Do these decisions turn Maker into more of a bank?

SB: I want to see ecosystem development around the four stakeholders. DAI suppliers, Maker governance, DAI users, and liquidity providers.

Remember governance decisions by these stakeholders aren’t completely open in spectrum. Scientific governance does have a certain constraint in terms of what you want to decide on. You can’t just turn Maker into an ice cream factory.

And yes, governance is going to become a lot more complex. There’s talk of liquid democracy, delegated voting. What’s that construct going to look like? It’s up to Maker governance to self-organize and determine.

The decentralized risk function will self-organize too. The complexity get diversified through the entire Maker community. What you’ll find is teams of subject matter experts. For crypto native collateral types that are highly illiquid—there may be a risk team that’s brilliant at figuring out the parameters. For tokenized real-world assets—there may be a risk and legal team that’s exceptional at parameterizing that. The ecosystem around decentralized risk is going to naturally form.

So complexity with the right DNA can be a good thing. Because it can create the right ecosystem. And I think scientific governance gives us the right DNA.

RSA: So how does DAI grow from $100 million to $100 billion. How about trillions? Will the new DAI Savings Rate (DSR) help?

SB: In order for DAI to become the world’s first unbiased currency it has to grow to the levels where central banks are. That means it has to be in the hundreds of billions if not trillions.

How does it get there? Tokenized real-world assets. When municipalities like Berkeley start issuing their bonds on chain and Maker governance takes those bonds as collateral. The more you induce assets to come on chain or be created on chain, the quicker you’ll see the supply of DAI expand.

But the challenge is not so much DAI supply—trillions in supply is the easy part. It’s the demand side. That’s the hard part. You can create $1 trillion in DAI supply but where’s the demand coming from?

I think demand comes from interbank financing—that’s already a driving factor for currency demand around the world. A bigger source? Central Banks. They’re now developing their own centralized digital currencies. But what if they used the decentralized Maker protocol as their tool instead? Central banks using Maker would mean massive demand.

Thinking about how to get demand isn’t the problem. Implementing it is the kicker. And the DAI savings rate (DSR) is a start. It’s going to allow an interbank infrastructure to more easily grow on the Maker layer.

RSA: Maker vs. Libra?

SB: So I was on a panel at the OECD in Paris. I was listening to the head of compliance at Libra discussing Libra. The thing he kept saying is that Libra is just a payments mechanism. They don’t expect to have hundreds of billions of Libra created. Not a currency, but a payments mechanism.

Maybe that’s just the position they’re taking because of events that led up to that point. I can’t comment on that.

DAI is different. DAI is going to be the world’s first unbiased digital cash. DAI is going to be a digital currency. The Maker protocol provides a credit generation mechanism to create and facilitate an economy—and strangely enough the byproduct of that is this digital currency called DAI.

RSA: Unbiased digital cash—you keep mentioning it. What do you mean by unbiased?

SB: Unbiased is an extension of what people mean by permissionless and decentralized. Unbiased means no one person and no one entity group controls the currency. This means you don’t have any untoward influence or bias over the mechanism.

From a jurisdictional point of view, you could have jurisdictions applying their regulation over how DAI is operated in their country or area. Maybe in one country if you want to accept DAI as a coin you need to be registered as a vendor—ok. How people use DAI in a particular country may fall under their jurisdiction. But the jurisdictions do not have any influence over DAI itself. That’s the unbiased part.

RSA: Crypto banks like Coinbase vs. money protocols like Maker. How does Maker compete with crypto banks vs work with them?

SB: Maker is pivotal to generating the necessary economy for all of these crypto banks.

For example, I get asked if I see centralized stablecoins as a threat. I actually don’t. I hope there are 60, 70, 80 of them that come out. Because they are constrained by balance sheets, they are constrained by their operations, where the Maker protocol is only constrained by the collateral you use in it. You’ll always need to have something like Maker as the glue that binds all the stablecoins together.

The Maker protocol is that layer on the blockchain that creates that financial infrastructure that everyone interacts with. So DAI is going to be the glue that binds. I welcome crypto banks.

RSA: Is there a world where use of DAI will require KYC?

SB: It’s regulation on the edges. Think about the ocean, you can’t regulate the ocean but you can regulate the boats on the ocean. You regulate the businesses that use the ocean, of course there are a whole bunch of people who can jump into their kayaks and use the ocean—you don’t have to regulate them.

If you look at the approach regulators have taken with other decentralized projects like BTC and ETH they require KYC and AML on the businesses that offramp and onramp BTC and ETH, these are considered to be the business gatekeepers. The same characteristic is inherited by the Maker protocol. So KYC and AML is already in place to the satisfaction of regulators.

RSA: Related to this—can Maker be stopped?

SB: The answer is no.

Thinking back to that same OECD panel I mentioned earlier, it was a little bit disturbing. The summit was called the OECD blockchain policy summit. The word blockchain was in there. The primary characteristic of a blockchain is that it’s decentralized. That’s the foundation of this whole thing. And there I was on this panel and not once did they talk about anything decentralized.

I kept thinking, you don’t want to talk about decentralization because you don’t want to show it’s a point of uncertainty. So on my panel I kept banging the gavel on decentralization, saying you’ve got to focus on what decentralization brings. How it’s important, how it creates value you won’t access with a centralized digital currency.

A common refrain I found dumbfounding—they considered Libra to be a decentralized protocol. I take exception to that.

There’s tendency to allow the incumbents to take this technology, create private blockchains and say, that’s sufficient. But decentralization means you can’t stop it. You can’t control it.

RSA: As central bank digital currencies roll out and paper cash is eliminated, will crypto be the only money with uncensorable cash like properties left?

SB: Essentially yes.

Central bank digital currencies (CBDC) come in two forms: wholesale and retail. CBDCs wholesale make sense, because you’re using blockchain to settle with other central banks. So you can do secure transfers, you can keep the money flowing around the world easier.

The thing that perturbs me and also disturbs some of the central bankers I’ve talked to is CBDC for retail. That means anyone can open an account directly with the Federal Reserve, no commercial bank inbetween.

The reason it’s disturbing is that in bad times there’s a flight to value—gold, commodities, the dollar. But if there’s a retail CBDC durning a flight to value everyone’s going to go to CBDC and abandon commercial banks. Which means you’ve inadvertently put a massive amount of financial influence and power in the hands of your central banker.

Ultimately if we do head in that direction, where money is a form of control, you’ll find folks naturally progressing toward blockchain.

RSA: DAI is a synthetic, what’s next in the pipeline for additional Maker synthetics?

SB: I’m going to refer again to Maker governance. We’ll help come up with ideas, and they’ll determine what we do.

On synthetics. You can have Yuan DAI, Yen DAI, Euro DAI, that’s all fantastic. But this is the important part, there must be an underlying market behind it because that’s where the natural arbitrage comes from. The mechanism that keeps a stablecoin in place is the arbitrage mechanism.

Here’s some futurism: if you have a look at the history of money and how it develops, you’ll see that everything naturally becomes fiat. It becomes trust-based. And I’m of the opinion that if you get a critical mass of the analog world coming on chain, you’ll start to see DAI getting a little bit of that characteristic.

Folks start saying, “it’s so stable and everyone’s using it why are we using 150% collateral ratio, why not 100%?” and then “it’s so stable, it’s so robust, why don’t we decrease collateral even further”. And then, this starts to sound lot bit more like fractional reserve banking. Sounds more like fiat.

Futurist thinking, but this causation could naturally make DAI a fiat based currency.

RSA: I’ve not heard anyone else in crypto make that point, but it’s something I’ve long believed. I can see something like this happing with BTC too. You have people holding BTC, then you have people depositing their funds into crypto banks for better services, then the crypto banks roll out fractional reserve and the people are fine with it because once again—better services.

Then there’s a bank crisis. The people demand action. The government and crypto banks form a public-private banking system. It’s the story of the gold standard and the formation of the Federal Reserve all over again and we’re back to fiat.

So, if that’s the case is this all in vein? (Laughing…nervously)

SB: That’s a good question and the end answer is, do you want a fiat currency in a centralized world or in a decentralized world? That’s the essence of it. It’s a bit of a think, it’s not an easy answer. Because fiat by it’s nature, means you have to have trust in something. That’s what fiat literally means.

In decentralized fiat, trust comes from the decentralize protocol. With centralized fiat it means you have to believe in a whole bunch of central governments. Now that’s the thing you have to twist in your mind, where do you get the trust from?

RSA: I’ll need to give that one some thought, we should discuss again. Until then, is there anything else you’d like to tell us about Maker or the launch of Multi-Collateral DAI on Monday?

SB: Please get involved with governance, check out MakerDao.com, looks at the tools, get involved in social media. The more you’re involved the more you create the robustness to this protocol.

To the Bankless community and readers, I really appreciate their contribution. 🔥

RSA: Good luck with the launch!

Actions

- Consider: what do you think of Maker’s vision for bankless money & credit

Subscribe to the Bankless program. $12 per mo. Includes Inner Circle & Deal Sheet.

👉Send Bankless a DAI tip for today’s issue

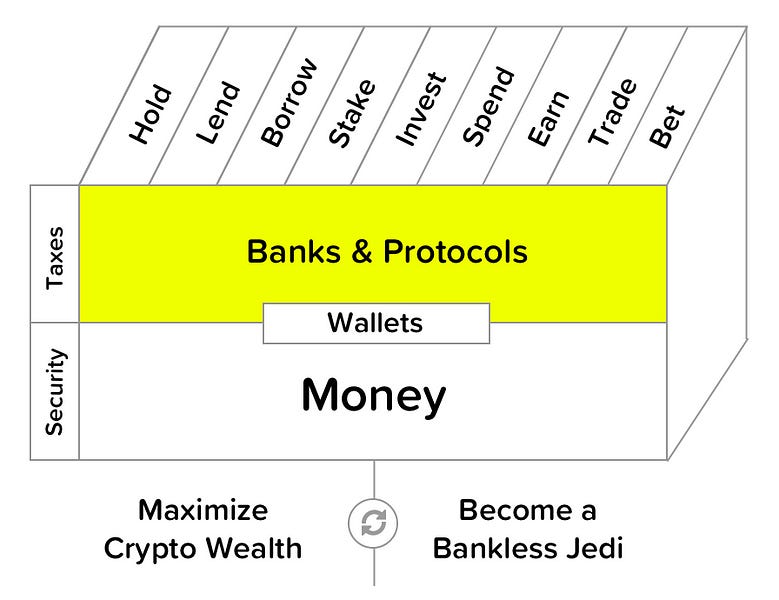

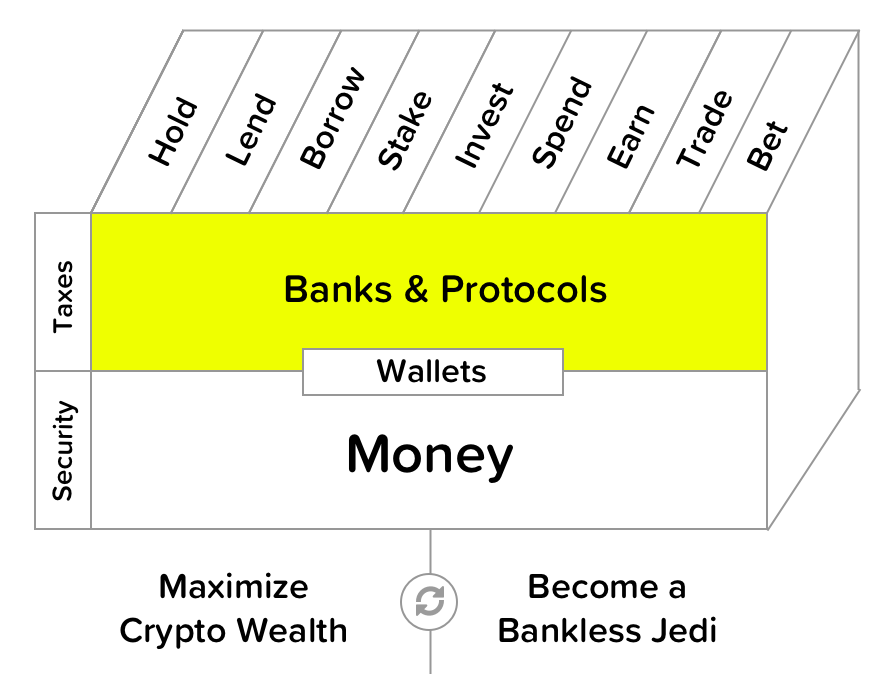

Filling out the skill cube

By learning about the Maker system and its approach to money you’re leveling up on the protocols layer of the skill cube. Important stuff.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.