Gradually, then Suddenly

Dear Bankless Nation,

Gradually, then Suddenly is a line frequently chanted by Bitcoiners, alluding to how Bitcoin will slowly fight an uphill battle to become global money…until suddenly society shifts, headwinds become tailwinds, and ‘its all downhill from here’.

This axiom existed well before the COVID crises, where governments and central banks appear to be backed into a corner with debasing their currencies.

Bill Gates has a famous line: “Most people overestimate what they can do in one year and underestimate what they can do in ten years.”

Rewinding the clock back to 2017, the crypto world thought that central banks were secretly accumulating BTC, and ETH staking was around the corner.

This line of thinking was a symptom of the euphoric optimism of a mania. But that was three years ago. The world has changed a lot since then.

The Crypto World Today

Let’s take three big changes:

- China is now rolling out its central bank digital currency and airdropping it to citizens. This appears to be the first of a wave of central banks who are moving forward with CBDCs.

- Commercial Banks in the U.S. have been given the green-light to custody digital currencies for their customers. BTC and ETH purchases via PayPal/Venmo are around the corner.

- Square’s Cash App generated $875 million of revenue from Bitcoin during the second quarter of 2020, up 600% YoY. You can bet other payment apps are going to want in on that as well.

Modern Monetary Theory (MMT) vs. Bitcoin

Most importantly, and most fundamentally, COVID has eliminated the options for central bank monetary policy down to a single choice: Modern Monetary Theory (MMT).

While central banks around the world are printing trillions, Bitcoin’s brand as the asset that is diametrically opposed to MMT is becoming clearer to a wider set of the population.

Regardless of which political party assumes power in the U.S., it appears that MMT will be the dominant monetary policy for the time being—perhaps indefinitely. The game-theory suggests as much: either don’t print money and let the economy crumble from deflation (hello civil unrest), or print money and reduce the absolute value of government debt, keep businesses and asset prices afloat, and appease the citizenry.

Some believe that QE and stimulus packages (UBI) are going to become the norm…

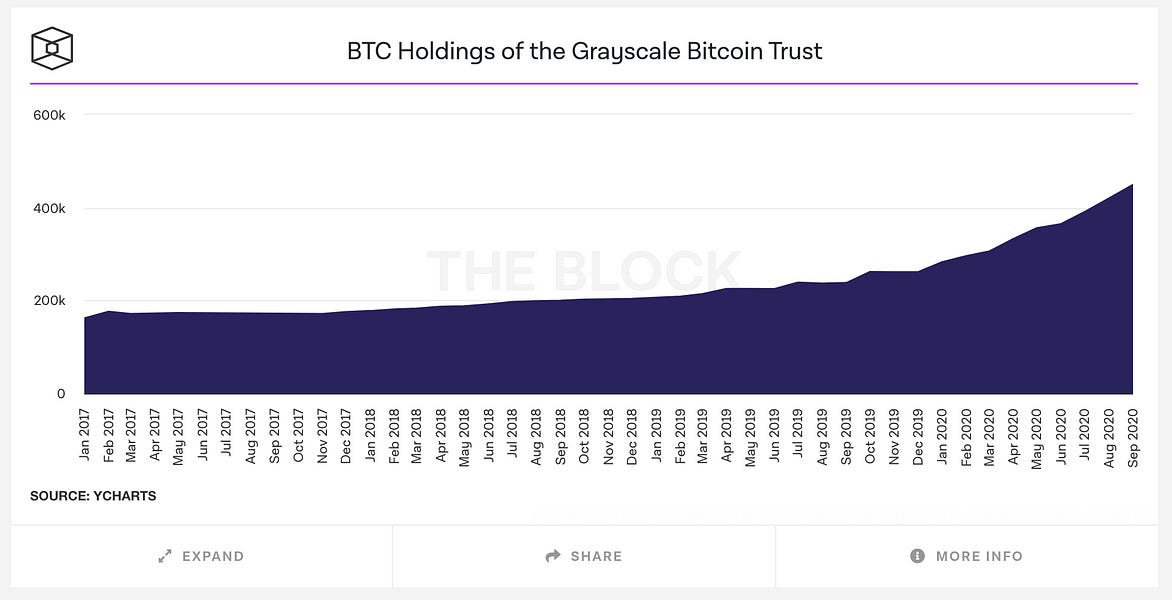

Meanwhile, Grayscale is absorbing BTC at an accelerating rate:

The fundamentals behind Bitcoin couldn’t be stronger. All while public companies like Square and MicroStrategy scoop up millions of BTC as an inflation hedge—likely the first of many.

Ethereum poised for breakouts

Fighting on a different front, Ethereum appears similarly poised for breakouts. The CFTC chairman is ‘impressed by Ethereum, full stop’.

This proclamation comes on the heels of the charges against BitMEX, which is a company that represents the polar opposite of DeFi’s values. BitMEX, a black box of an exchange, vs DeFi, a global, programmatic financial system where all activity and information is in the public square.

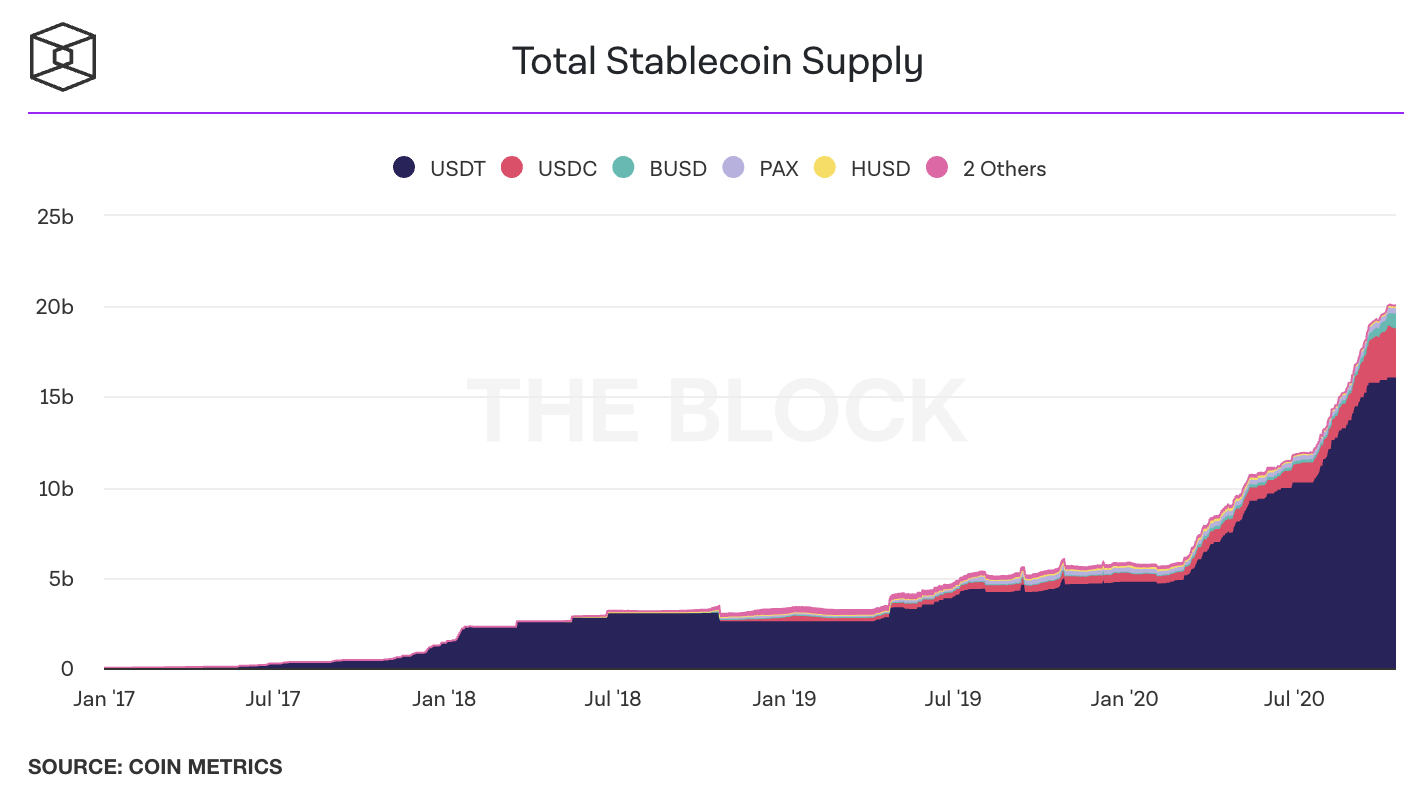

Ethereum offers instant and liquid infrastructure for global crypto-dollar demand, in a world in which the looming threat of a deflationary environment means that dollar demand is strong.

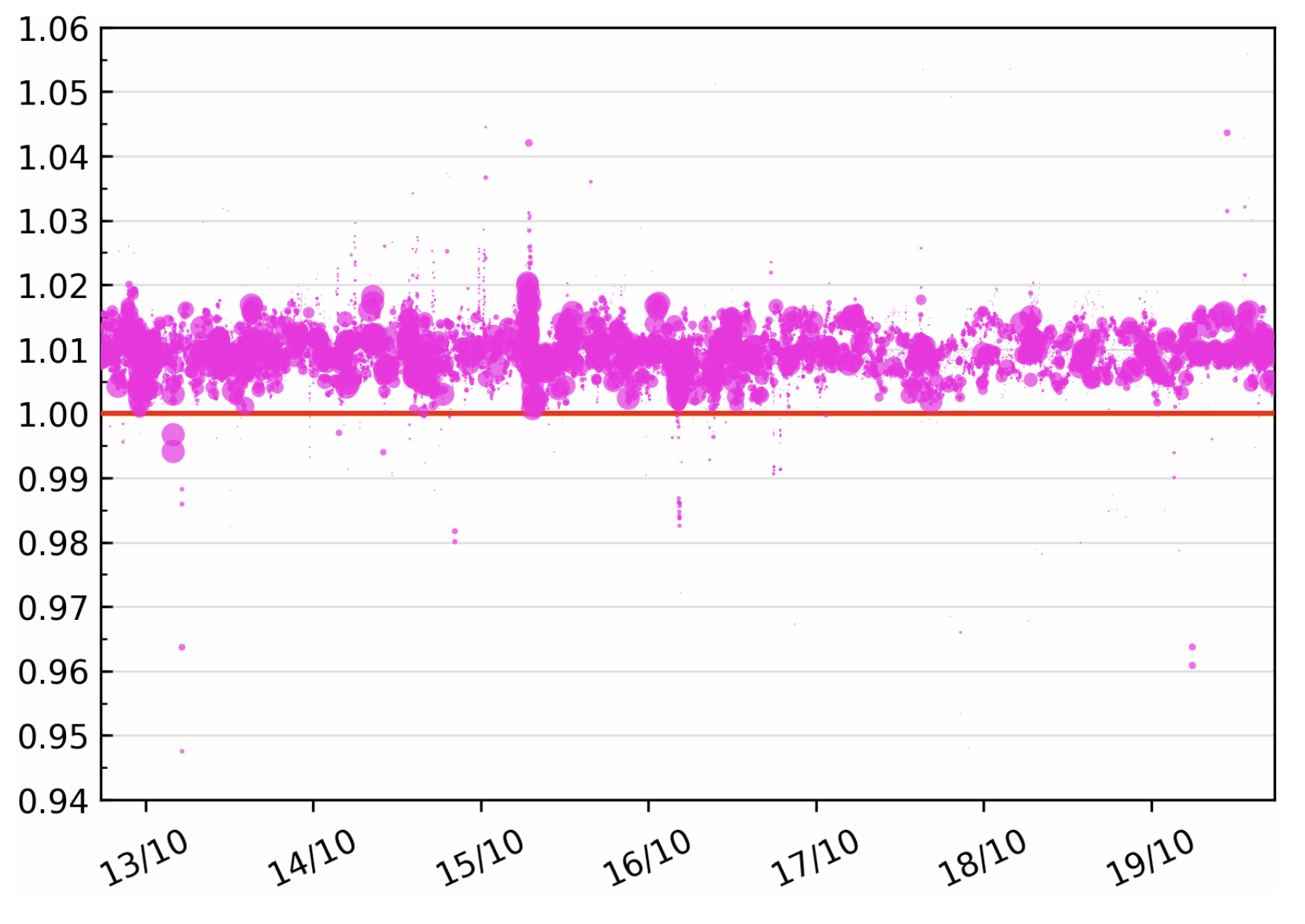

Even after #DeFiSummer2020 seems to have come to an end, DAI is still well above its peg, illustrating that the demand for Ethereum crypto-dollars is persistent, regardless of the ongoing of any temporal mania.

Above: Demand for DAI pushing the price of DAI above its peg of $1

Ethereum 2.0 will feel sudden

Looking forward, I expect the ‘Gradually, then Suddenly’ meme to play out with Ethereum 2.0 as well.

Ether price in 2018/19 seems to reflect bearishness on the execution of Ethereum 2.0, and there doesn’t seem to be any indication that this has changed. The current state of $ETH seems to be pricing in a linear execution of Ethereum 2.0, rather than a parallel execution.

How the Market Thinks about Ethereum 2.0:

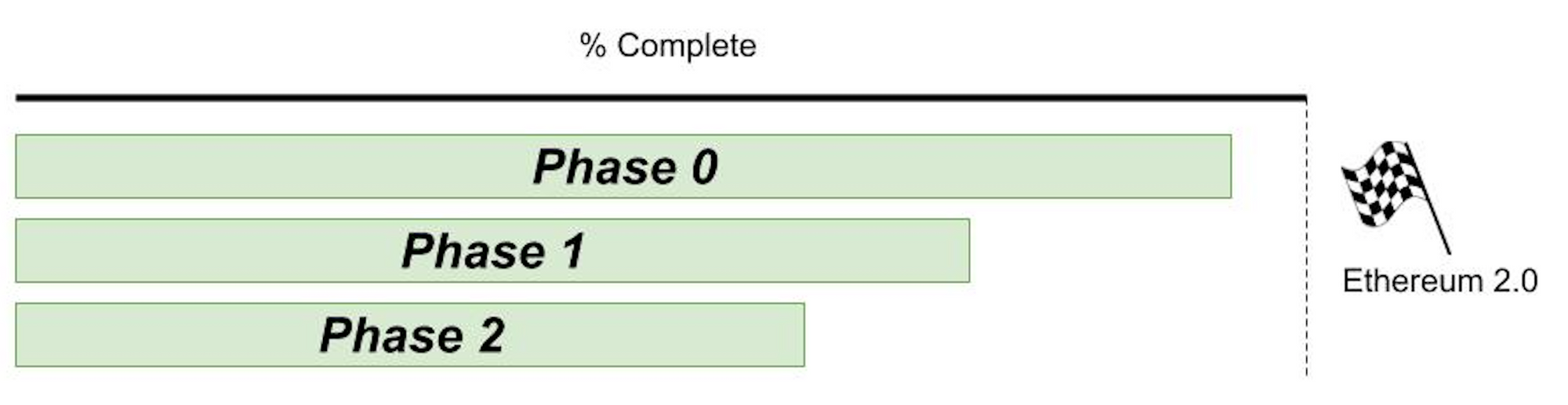

How Ethereum 2.0 Actually Is:

In reality Phase 1 and Phase 2 of Eth2 have been progressing alongside Phase 0. While Phase 0 is a prerequisite for moving on to Phase 1 and 2, they have all been progressing relatively independently.

With Phase 0 of Eth2 complete, there are simply fewer unknowns, and the remaining phases have foundation to stand on as they cross the finish line as well.

It also means in addition to reduced execution risk of Ethereum 2.0, ETH is about to add the other two (of three) remaining pillars of value accrual (Staking + Burning). And Vitalik has convictions this happens in 2020…

Gradually, then suddenly, the price of ETH will begin to reflect the thousands and thousands of labor-hours that have been poured into Ethereum 2.0 these last three years.

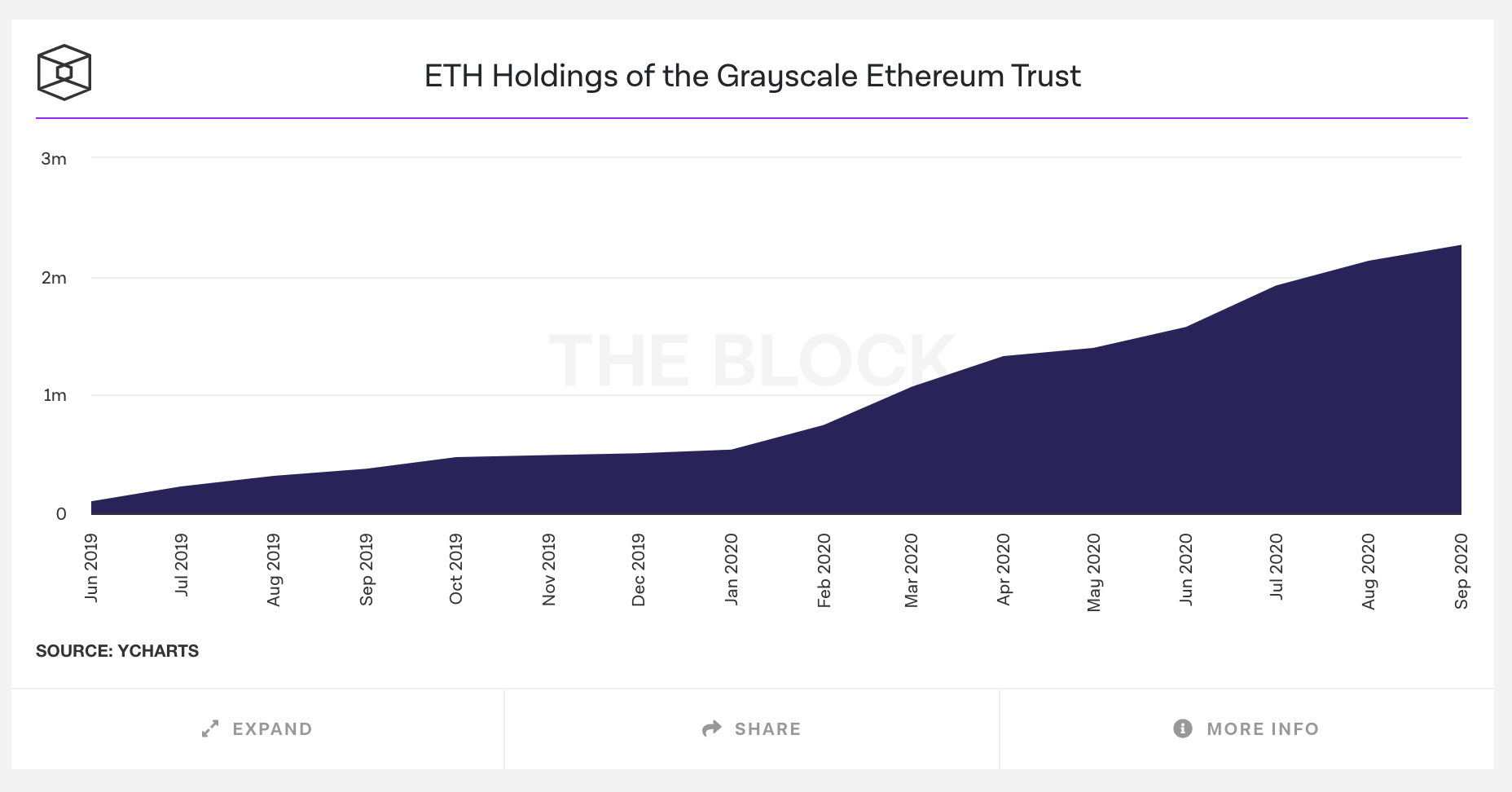

Just like BTC, ETH is also being absorbed into Grayscale:

“Gradually, then Suddenly”

Going through the data, a very clear story is being told.

Every single chart is up and to the right. I was in the middle of screenshotting each example of an ‘up and to the right’ chart from The Block’s new Data Dashboard, but I would have ultimately just copied the entire website.

In the timeline of ‘Gradually, then Suddenly’, we seem to be at the end of the ‘Gradually’ phase, but not yet at the ‘Suddenly’ phase.

We’re at the ‘then’ phase.

The calm before the storm.

- David

P.S. Want to learn more about the state of Eth2? Join us Thursday for an AMA with Danny Ryan, core Eth2 researcher. Starts at 12pm EST on the Bankless Youtube.