Fixed Rate Yields That Outperform ETH Staking

Dear Bankless Nation,

DeFi needs fixed rate yields.

In traditional finance, fixed income represents a $6.5T market in the U.S. alone. There’s a massive opportunity to build these safe-haven assets on a global, permissionless, instant payment rail.

Luckily, they’re starting to pop up on Ethereum.

Over the past two years, we’ve seen tons of different approaches — from fixed rate lending, to interest rate swaps, to DeFi-native mechanisms like yield splitting tokens.

There’s a lot to unpack.

More importantly, where are the opportunities?

Can you lock in a fixed rate in ETH that outperforms the current staking yield?

Our Bankless Intern, Jack, makes his debut on the newsletter today to showcase all of it.

- Bankless Team

P.S. Keep an eye on Twitter for the tl;dr thread on this article!

Crypto markets are volatile and fixed rate returns are uncommon.

This is a huge problem for creditors and debtors looking to match fixed rate liabilities with fixed rate assets. TradFi entities in particular need access to convenient fixed rate solutions for proper asset and liability management.

The ability to mitigate risks associated with a given investment is vital for every category of financial institution — banks, pension funds, insurance companies, and hedge funds — and is often accomplished via derivatives, which provide a highly capital-efficient solution to risk management and often receive preferential accounting and disclosure treatments opposed to balance sheet restructuring activities.

Take the perspective of a lender in financial markets. In the absence of effective hedges against changes in yields on ETH staking, lenders cannot provide fixed-rate products without exposing themselves to substantial interest rate risks. While OTC desks have developed derivative contracts for ETH staking yields, these contracts are inaccessible to many market participants and are off-chain, limiting use cases and insulating agreements from the composable ecosystem offered by DeFi.

Commercial banks looking to hedge against rising rates may opt to sell US Treasury futures instead of selling US Treasuries for cash. While the bank retains the benefits of a sale, usage of a futures contract avoids the immediate transfer of cash or other assets between counterparties and thus avoids a taxable event for the seller.

The average individual (i.e., not operating on degen criteria) also places a premium on mitigating volatility in their investment portfolios. With the bear market in force, it’s likely that you, the reader, would have traded some amount of potential return when BTC was $69k and ETH surpassed $4.5k in exchange for significant downside protection.

Unfortunately, we both shot for the stars but ended up shooting ourselves in the metaphorical, collective foot. We all pray for the resumption of the bull market, but in the meantime, you have the opportunity to absorb more knowledge than Tai Lopez sitting in his garage full of books and Lambos.

Next time it comes around, you’ll be educated on various fixed yield derivatives and products, allowing you to better manage your portfolio risk during the next cycle.

Fixed Rate Solutions in DeFi

Developers have already been hard at work pursuing solutions to dampen volatility in crypto markets. Some have turned to exotic derivatives in their search for the next haute DeFi product.

DeFi protocols are solving these problems in the interim.

At present, there are four general solutions to access fixed yields:

- Yield Splitting

- Interest Rate Swaps

- Structured Finance and Tranching

- Fixed Rate Lending

Analysis of fixed and variable returns offered by these unique approaches and their respective protocols will allow for the comparison of future returns between different strategies by adjusting return on investment (ROI) from the income stream proportional to the unique risk profile of the underlying asset.

Let’s unpack.

1. Yield Splitting

Yield splitting protocols, much as the name suggests, split yield-bearing tokens (say rETH or stETH) into both principal and yield components with known maturity dates.

What are the yield and principal, exactly?

Imagine borrowing $100 at an interest rate of 6% per annum, with payments due at the end of each month and the loan repayment due in full at maturity in one year. Every month, that chalks up to $0.50 in bank interest. When compounded on a monthly basis, these interest payments represent an approximate 6.17% yield to the lender. At the end of the year, the borrower must also repay the principal (or loan amount) of $100.

The loan given in the example above represents an interest-only repayment structure, the type of debt instrument yield splitting protocols employ.

Importantly, a maturity date must be established to price the principal and yield tokens.

Until this time, all yield generated from the underlying asset will only accrue to yield token holders. At the contract’s maturity, the holder of the principal token will be able to redeem the principal token for the underlying collateral in a 1:1 ratio. Because the yield is not accruing to the holder of the principal token, it will trade at a discount to the par value of the underlying.

The difference between the underlying asset and the principal token is effectively the value of the yield token, which will be greater than zero until the contract’s maturity. The formula that determines the values of principal and yield tokens can be expressed as:

- Yield Token Price + Principal Token Price = Underlying Asset Price

If the aggregate value of the yield and principal tokens is greater than the value of the underlying asset, an arbitrage opportunity exists in which one can mint principal and yield tokens to sell on the market.

When the underlying asset price is greater than the combined value of the yield and principal token, an arbitrage opportunity occurs, enabling the purchase and redemption of both tokens for an underlying asset with greater value. Because of this, the total price of principal and yield tokens will closely mirror the underlying asset’s value.

The valuation of principal and yield tokens is affected by the yield generated and the time until maturity. Yields fluctuate over time. As such, the price an individual is willing to pay for the yield token will increase when yields increase and vice versa.

As the maturity of the contract approaches, investors will also be less willing to pay for yield tokens, as the total amount of yield to be generated is lower.

Holders and purchasers of principal tokens have essentially fixed their returns, as they can hold onto their security until its maturity and redeem it at that point for a known amount of the underlying asset. There is no rate fluctuation, as changes in returns – both negative and positive – are borne by yield token holders.

Protocols that use a principal/yield token structure include:

Although slight variations exist, all split a yield-bearing asset into principal and yield tokens. This structure allows leveraged variable rate speculation, in which an individual mints principal and yield tokens from the underlying asset, sells the principal tokens, and purchases more of the underlying asset, repeating the process until the desired exposure to the variable rate is achieved, while also allowing for users to lock in fixed rates via purchasing principal tokens.

2. Interest Rate Swaps

Interest rate swaps — while prominent in the TradFi world — have yet to be realized in DeFi markets.

It was first brought to prominence in DeFi by Voltz Protocol. The premise of Voltz is simple, with the protocol designed to offer a product similar to traditional interest rate swaps: the buyer agrees to pay a fixed rate and receives a variable rate from the seller. Buyers of the interest rate swap are known as Variable Takers, and sellers of the swap are known as Fixed Takers in Voltz’s nomenclature.

Margin is natively built into the protocol, vastly improving capital efficiency, enabling users to hedge with less capital or magnify their exposure to rate fluctuations.

The notional derivative market in TradFi dwarfs the spot market. Similarly, the notional value of Voltz’s interest rate swap markets have the potential to dwarf market caps of their underlying assets. This is a huge opportunity if this same dynamic plays out as it does in TradFi markets.

How it works

Fixed Takers (sellers of swaps) in Voltz can fully collateralize their positions without exposing the user to liquidation risk or increasing potential exposure to rate changes.

Voltz further improves capital efficiency by modeling upper and lower bounds that the interest rate is expected to fluctuate within until the maturity of a given pool to calculate initial and liquidation margin requirements.

Oracles provide rate information for the pool and determine cash flow distributions to Fixed and Variable Takers, while a virtual automated market maker is used for price discovery. The nature of the swap implies that Fixed Takers have a known and capped payout. Variable Takers, however, have limitless upside exposure to increases in the variable interest rates offered on the underlying. The payoff matrix generated by this phenomenon incentivizes more speculative activity within the Variable Taker group.

Liquidity providers are crucial to the protocol’s ability to provide a seamless trading experience for both Fixed and Variable Takers.

The AMM is modeled after Uniswap’s and employs the concept of concentrated liquidity. As only one asset is required for trade, LPs on Voltz are immune to impermanent loss. However, they are exposed to losses from what the protocol calls “Funding Rate Risk,” which occurs when there is an imbalance between Fixed and Variable Taker activity and rates move beyond the LP’s liquidity tick ranges.

As a result, the LP now holds an out-of-the-money position. Funding Rate Risk effectively replaces impermanent loss from spot market AMMs. It is a tradeoff that must be considered and balanced with the ability to receive the protocol’s trading fees.

3. Structured Finance and Tranching

Tranching protocols take inspiration from traditional financial instruments, including the notorious collateralized debt obligations (CDOs) that were at the center of the Great Financial Crisis, in which different noteholders exist with varying repayment priorities for each class.

Examples of tranching protocols include:

What these protocols do at its essence is to take liquidity and segment up risk into different pools. Both protocols establish senior (lower risk) and junior pools (higher risk), with the senior pool having priority to any cash flows from lending or yield farming activities and secured by credit enhancements from the junior tranche; in the event yield generated from the underlying is not sufficient to pay off the senior pool, junior participants will incur a loss.

In exchange for providing security to senior pool participants, the junior pool has the ability to generate additional upside if the aggregate yield earned on senior capital exceeds yield paid to senior pool participants. Participants in the senior tranche earn a fixed rate and enter into their position at or below the current yield generated by the underlying yield-bearing token.

BarnBridge calculates the yield offered to the senior tranche using the formula:

- Senior Yield = Moving Average Yield Rate * Junior Loanable Liquidity / Total Pool Liquidity

In which the “Moving Average Yield Rate” is defined as the three-day moving average yield generated by the underlying.

Tranche Finance, in contrast, determines the fixed rate offered to all fixed-rate takers via governance token vote, meaning the rate is not fixed and is subject to change at any time. Changes in fixed rates may be to the benefit or detriment of senior tranche participants.

The prior BarnBridge V1 iteration, while designed to protect the returns of senior pool participants, did not explicitly guarantee a fixed rate, as senior pool participants faced potential degradation of returns after a drastic enough decrease in the variable rate offered on the underlying, and therefore does not offer truly fixed rates, as well.

4. Fixed Rate Lending Protocols

Much like their more famous siblings — variable rate lending protocols offered by Aave and Compound — fixed-rate lending protocols allow users to access over-collateralized loans.

Unlike variable rate lending protocols however, the lender and borrower agree to a fixed interest rate, with the resulting transaction appearing similar to a zero-coupon bond issuance by the borrower.

Loans may be liquidated similarly to variable rate lending protocols, but at the loan’s maturity, the borrower pays a fixed rate to the lender. Additionally, pre-specified maturity means lenders are unable to access their funds until the maturity of the loan and borrowers face implications for prepayment of loans, in contrast to on-demand withdrawals for lenders (if liquidity is available) in variable rate protocols and the ability for borrowers to fully close positions at any time.

In fixed rate lending protocols, a borrower may incur repayment penalties or be forced to lend until the maturity of the contract in order to close out a position.

Fixed-rate lending protocols include:

Outperform the Benchmark

At this point, you’re probably wondering…

How can I include fixed-rate derivative and lending strategies in my portfolio to outperform my benchmark for passive income generation in crypto - the ETH staking reward rate?

I used this incredibly detailed analysis of validator returns to establish a baseline scenarios for ETH stakers.

This analysis was performed prior to the Merge, so I proportionally adjusted the upper and lower quartile bounds (optimistic and pessimistic rewards rate scenarios) with respect to the current ETH staking yield.

Circling back to the whole “staking Ethereum can be thought of as consol bond and rates may one day be quoted as a spread over the ETH reward rate” concept, it makes sense to view this reward rate as the risk-free rate, or the lowest rate of return an astute DeFi investor would accept.

While all of the above protocols allow users to take fixed rate positions, only a select few (Voltz Protocol, Element Finance, Sense Finance, Notional Finance, and Yield Protocol) offered products that I felt offered a fair comparison to the ETH staking reward rate.

🤓 For more details around the methodology and the framework for project inclusion, scroll to the bottom!

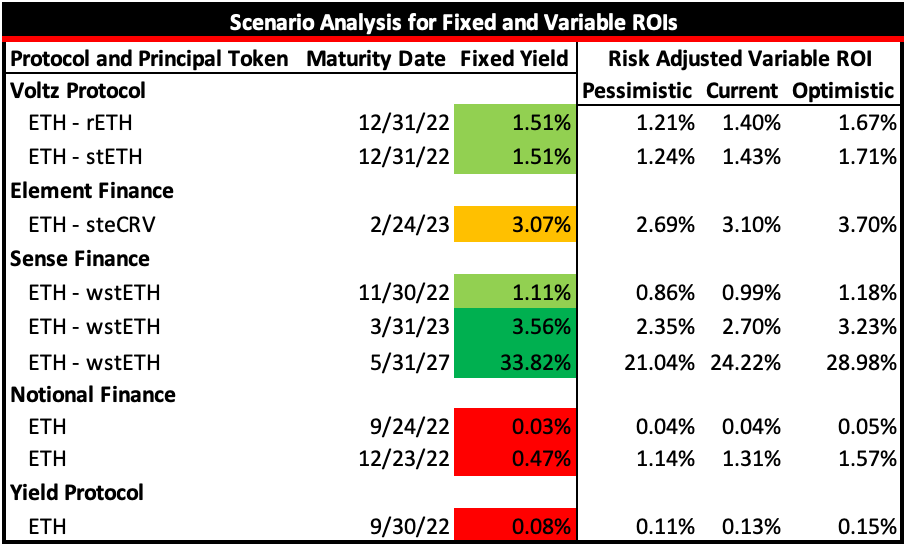

From there, we compared the estimated ROI from staking ETH over the maturity of the fixed rate strategy with the return offered by the fixed rate instrument:

Fixed rates in red represent strategies that return less than pessimistic estimates. In contrast, a fixed rate highlighted in orange indicates that the strategy met or exceeded the pessimistic forecast but failed to exceed expected staking returns.

Those shaded in light green met or exceeded expected variable ROI from staking, while those in dark green met or surpassed the most optimistic staking expectations.

As liquid staking derivatives and ETH-stETH stable pools have different variable returns than the Ethereum staking reward rate, we can assume they have a different risk profile.

For rETH and stETH, the risk of slashing is lower than independently staking Ethereum, and both protocols offer slashing insurance to protect user deposits. Additionally, it is much easier to stake with Lido or Rocket Pool than to run your own validator, and users who don’t have 32 ETH lying around are afforded the opportunity to stake. Investors trade marginal returns for these assurances and conveniences, accepting yields lower than the risk-free rate.

Liquidity providing ETH-stETH for Curve, represented by the steCRV principal token, also has a different risk profile than simply staking with Lido. Bolstered returns represent smart contract risk from Curve, in addition to native smart contract risk within Lido and exposure to impermanent loss. While Curve is battle-tested, a high return profile suggests that investors are simply uncomfortable with the Protocol to accept returns lower than the current variable APR. If this was not the case, we would expect the yield to approach the current variable ETH staking reward rate. To account for these differences in the risk profiles of the various principal assets compared to Ethereum staking, estimated variable ROIs generated from the staking reward rate analysis are adjusted proportionally for risk.

I must, unfortunately, announce that all of the media attention given to Voltz has brought smart capital to the protocol. As degen as the application may appear, the fixed ROI generated from interest rate swaps on both rETH and stETH is surprisingly close to the expected ROI from staking with Lido or Rocket Pool.

Sorry, anon, no obvious arbitrage opportunity here. Efficient market theory or something like that smh.

But I guess that is supposed to happen. However, the protocol allows speculative market participants to place bets based on how they believe the market may move AND presents the only opportunity out of all protocols listed for sophisticated market participants to hedge risk, both to the upside and downside, at efficient rates!

If you believe that staking reward rates will decrease, take the fixed rate offered on Voltz. Bullish staking reward rate users, likewise, can lever up on variable rates offered by the Protocol. Element’s fixed yield ETH product slightly underperformed the expected ROI from staking, but the similarity of returns compared to the variable staking reward rate offered by the principal token provides risk-averse investors the ability to hedge against fluctuations in interest rates. Fixing yield with Element offers an end result similar to using Voltz Protocol, but utilizes a different investment instrument.

On the fixed lending front, something weird is happening at Notional. Lending at fixed rates for the earlier and longer-dated maturity issuances offer fixed returns below pessimistic estimates. Additionally, the APR offered on the fixed rate loan maturing in September is 111% greater than that offered by the December note.

If that isn’t an inverted yield curve, I don’t know what is. Terrible market crash on the horizon? Probably, but we’ll leave that question to the economists.

Yield Protocol also fails to offer a desirable fixed rate on ETH lending. Inefficiencies in fixed rate lending markets may be a direct result of current market uncertainty and volatility, as lenders must lock their ETH to maturity: flexibility and liquidity are vital to portfolio health in bear markets.

There’s alpha in fixed income

While multiple potential arbitrage opportunities stand out, perhaps the most enticing is fixing the yield on ETH with Sense Finance until May 31, 2027. The potential to fix returns on ETH at 7.21% per annum is too good of an opportunity to pass up.

This fixed rate exceeds the most optimistic future reward rates when proportionally adjusted for the risk profile of stETH. While it is likely that gas fees will increase, temporarily increasing the staking reward rate, it is equally plausible that increases in rewards will be combated by an increase in the number of validators, reducing yield on ETH.

Additionally, at this moment, Beacon Chain withdrawals are not enabled, meaning that if gas fees further decrease, the validator count will remain fixed, artificially depressing staking yield as validator count can only respond to increases in gas fees.

Voltz Protocol offers the best solution to mitigate interest rate risk for participants looking to obtain “market” pricing on their yield derivatives.

Actual market pricing enables entities to hedge against portfolio risks and does not force them to take speculative positions on the direction of interest rates. Instead, it allows the conversion of variable rate cash flows from staking into fixed yields at rates competitive with projected ETH staking rewards rates.

The ability to fix rates in DeFi is crucial for the sector’s adoption by traditional financial institutions. The recent launch of Voltz Protocol is an essential innovation for decentralized fixed rate derivatives markets, not only due to the capital efficiency the protocol offers but also because it provides accurate pricing for interest rate swaps, especially when compared to the current offerings of alternative fixed yield products.

Beyond interest rate risk management applications, market inefficiencies across fixed rate protocols provide opportunities for astute DeFi users to generate accessible, low-risk sources of return compared to staking ETH.

In addition, these products offer another source of speculation for DeFi users and enable an entirely new type of degen behavior, one that trades rates, not token price.

The prominence of fixed rate markets will likely increase as crypto becomes more mainstream.

While the actual use cases for yield derivatives today are relatively limited in scope, ossification of crypto markets will bring demand for fixed rate products in DeFi in line with the demand observed in TradFi markets.

Methodology Notes

- Front end of Swivel Exchange refused to work and was thus excluded from my analysis due to my inability to gather information on current products offered.

- Pendle Finance was excluded as it only offers fixed rates on non-stable LP pairs.

- Tranche Finance was excluded from my analysis, as despite offering one fixed rate ETH product, it yields a meager 15 bps at the time of analysis, a foolish trade for any investor.

- BarnBridge and HiFi were excluded as neither offering any form of fixed rate opportunity on ETH.

- Notional Finance and Yield Protocol variable rate calculations assume that users would stake ETH with Lido, as it represents the highest return on liquid staking derivatives listed in this analysis, making this yield reasonable to use as the opportunity cost of capital for ETH lending.