Ethereum the supranational coordinator - Market Monday (07/13)

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

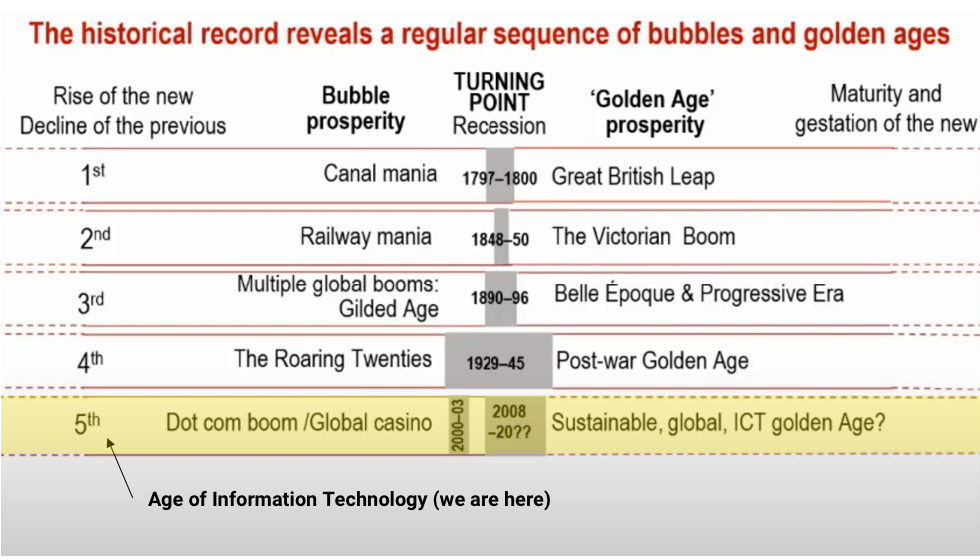

I recently watched a lecture from Carlota Perez recommended to me by Chris Burniske. In it she compared the past 4 tech revolutions to the current information technology revolution.

- Industrial revolution (started in 1771)

- Steam & railroad revolution (started in 1829)

- Steel & engineering revolution (started in 1875)

- Mass production revolution (started in 1908)

- Digital revolution (started in 1971) 👈we are here

According to Perez they all go through the same cycles. And despite how far we’ve come we’re actually only half-way through the cycle of the digital revolution.

We’re somewhere in the turning point now.

That means we’ve yet to experience the best part of this revolution—the golden age of the digital technology. A time of reduced inequality. A time of wealth expansion for everyone—especially the little guy. Maybe just around the corner.

Does that sound crazy?

Imagine telling someone in the middle of the 1930s depression that in 20 years blue collar workers would have lifetime jobs and fully equipped suburban houses.

Impossible!

And yet it happened.

How?

The exponential technology of the mass production revolution—fueled by oil.

We think we’ve come far with digital tech but we’ve just scratched the surface.

But there’s a problem to overcome

Perez walks through some of the harbingers of the golden age of the digital revolution. One of the most essential: we’d need to move further toward global economies and away from the limitations of individual nation states.

But for this we’d need something new.

“We need some global entities to control some things which are global, for instance the movement of finance, which is no longer possible to control on the national level because finance just responds to any regulation against it by moving out. So you can’t have an economy that works on a global scale without having some sort of global regulation." - Carlota Perez

👉Watch the clip here. (16:00—17:18)

Before we can usher in the golden age we’d need an entity for global rules, one that transcends nation states. A settlement layer for global finance and economic activity.

But the nation state can’t scale to this Perez says.

For this we’d need some kind of supranational economic coordinator.

One world government?

Supranational economic coordination

There’s a hidden gem in the Vitalik conversation we released today. It came after I asked him “Is crypto on a collision course with nation states?”

👉Listen to clip here. (1:33:02 to 1:36:00)

Vitalik believes centralized systems are finding it hard to escape the reality of being inside the nation state they happen to be based in. They can’t serve the world neutrally if they’re merely pawns of their national government.

- India blocking China’s TikTok for reasons of sovereignty.

- European unfriendliness to U.S. tech companies.

- US blustering against Chinese tech and China actively blocking western internet.

This is the balkanization of the centralized internet.

We’re seeing companies bounded by their nation state hosts. A stalling of progress.

But crypto provides hope:

Crypto is standing strong as one of the few remaining things that’s genuinely international and that’s a position we should be very happy we’ve been able to maintain and stay inside. - Vitalik Buterin

DAOs, DeFi protocols, algorithmic stablecoins. These aren’t companies boxed inside a nation state. These are global, permissionless, digitally native protocols.

Ethereum itself is a supranational protocol—an economic coordinator. It transcends nation states. It’s a settlement layer for global finance and economic activity. It’s a base layer for the economic rules of everyone—even nation states.

And it’s native to the digital revolution era.

Crypto and the golden age

We may have chaotic times to deal with first, but ultimately I believe Perez is right. The golden age of digital technology is still in our future.

Humanity will have a supranational economic coordinator.

But it won’t take the form of a “one world government” that’s prone to corruption and tyranny. It’ll take the form of a credibly neutral digital protocol like Ethereum.

Ethereum…the supranational economic coordinator.

What else can be trusted?

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

🎙️NEW EPISODE

Listen to episode 21 | iTunes | Spotify | YouTube | RSS Feed

MARKET MONDAY:

Scan this section and dig into anything interesting

MARKET MONDAY:

Scan this section and dig into anything interesting

Market numbers 📊

- ETH ticks up +2.5% to $242 from $236 last Monday

- BTC holds on +0.18% to $9,293 from $9,276 last Monday

- Total locked value shoots up +14% to $2.3B from $2.0B last Monday

- DAI base fee drops to 0% with savings rate steady at 0%

Market opportunities 🤑

- (Trade) Best price on SNX to sUSD swaps on 1inch

- (Send) Tokens to someone using a twitter address with Torus (details)

- (View) Your Portfolio in DeBank (also…nice DeFiPulse like graphs!)

- (Mine) Liquidity mining on MCDEX (5% of fees to badge holders w/ this link)

- (Lend) Dai on Aave for 6.99% APY (highest on the market!)

- (Margin) BTC using dYdX perpetual swap and get 10% off trading fees!

- (Stake) Buy AMPL & stake in a few clicks using Zapper (⚠️meme coin)

- (Deposit) crypto into BlockFi by July 18th & earn 2x interest (⚠️centralized!)

Yield Farming 🌾

- Compound: Lend DAI to earn 2.99% APY plus ~9.99% in COMP

- Balancer: Provide sETH & WETH liquidity for ~38.9% APY in BAL

- mStable: Deposit mUSD on Balancer to earn MTA + BAL (see weekly assignment)

- Curve: Deposit sBTC/wBTC/renBTC for ~8.89% APY + CRV (pre-distribution!)

What’s new 📰

- Credit delegation using Aave!

- First SEC-regulated securities on Ethereum are T-bills!

- CENTRE blacklisted first USDC address (this is why we need Dai)

- KyberDAO now live!

- bZx tokens are live on Uniswap (Bankless badge owners get $100 in BZRX)

- 1inch on Gnosis Safe

- Pillar Wallet launched a liquidity mining program

- This AMA with the ETH2 research team

- Binance is listing Synthetix’s SNX

- CFTC to develop a holistic framework for crypto assets by 2024 (yikes…)

What’s hot 🔥

- Coinbase may go public this year (this is tres bullish imo)

- Dai supply nearing 200M

- Crypto bank ready to fuel DeFi frenzy just as protocol sink thesis predicts

- Uniswap casually doing $45M in 24hr volume (that’s $16.4B annualized)

- Nexus Mutual has been mooning

- 1inch DEX aggregator growing like crazy (try it out)

- DeFi projects are distributing over $25M a month in yield farming incentives

- 240k DeFi users—watch it grow here (we’re a mid-sized city)

- Axie potions pumping! (see our tactic)

- The Graph is processing over 1 billion queries per month (76% of them are DeFi!)

- There’s over $5M in trading volume on Matcha

Money reads 📚

- RSA’s Read of the Week: Report on crypto dollars (see free banking section)

- Trade Insights: Yield Farming — dYdX

- Censorable assets are toxic collateral — Tony Sheng

- A crash course on what’s next for Ethereum — Tyler Smith

- Catch up on the State of Ethereum L2 — Mohamed Fouda

- Aggregation theory applied to DeFi — Ryan Rodenbaugh + Baptiste Vauthey

- Version control can help the media win back reader trust — Nic Carter

Governing DeFi

- Compound Proposal #16 - Set WBTC Collateral Factor 40% passed! Contentious governance proposal for Compound. Starting tomorrow, users will be able to borrow up to 40% of their collateral value using WBTC.

- Kyber’s Katalyst upgrade is live on mainnet! KNC holders can now stake in KyberDAO to receive a pro-rata share of ETH in return for participating in governance. You can stake KNC and track the ETH rewards here.

WHAT I’M DOING

Check out a few cool things I’m capturing right now in crypto

- Tried out liquidity mining on MCDEX. A bit tricky but was doable! Every block, holders of the ETH-PERP AMM token earn MCB. Last raise MCB was valued at $.20 per MCB. We’ll see market price once it hits Uniswap! (Don’t forget to use this link and Bankless badge holders receive 5% of the trading fees!)

- Liquidity mining with AMPL. Where to begin! AMPL is a meme coin, not a stablecoin—and I have many thoughts on it as a monetary experiment! TLDR; it has impediments, but I don’t hate it. And I do find its Geyser liquidity mining extremely clever. A game that incents AMPL liquidity on Uniswap! Careful of this one—its likely to be as volatile as BTC in 2011. Pure meme speculation.

WHAT YOU’RE DOING

What’s the coolest thing you did in crypto last week?

- @DeFi_Dad is learning how to use InstaDApp for USDC -> DAI debt swaps

- @TokenBrice is participating in the AMPL experiment

- @DelleonMcglone started using TokenSets

- @The_Ethernaut started a newsletter for Ethereum Devs

See the rest here!

WEEKLY ASSIGNMENT:

Make time to complete this assignment before next week

Yield farm MTA tokens with mStable. mStable is a new stability protocol that unites pegged assets (like stablecoins, tokenized bitcoin, gold, etc.) for lending and swapping. You can earn MTA by becoming a liquidity provider in the 50/50 mUSD + USDC pool on Balancer. The MTA token is set to be distributed later this week but you can start earning now!

DeFi Dad walks you through the following:

- What is mStable and what's the utility of the Meta (MTA) token

- How to earn 3 forms of yield with MTA + Balancer trading fees + BAL

- Confirming my Balancer LP added to the pool

- How to exit being an LP in Balancer

- Risks to Consider

You can read more about the MTA token distribution here.

👉 Check out Bankless YouTube for & tactics by DeFiDad!

👉 Check out DeFiDad’s YouTube channel for extended tactics

Extra Credit Learning

- (Beginner) 📄 Great ELI5 of Derivatives in general

- (Beginner) 📄 Camila Russo & Chris B. talking about her new book on Wed

- (Beginner) 📄 EthFinance AMA with DeversiFi

- (Beginner) 📺 Ethereum Enterprise Alliance Education Series

- (Beginner) 📄 Using Compound isn’t hard (and fun mythical animal analogies)

- (Intermediate) 📺 What is impermanent loss?

- (Intermediate) 📄 Highlights from Eth2 research team AMA

- (Intermediate) 💻 Yield Farming and Liquidity Bootstrapping

- (Intermediate) 📄 Yield Farming with Synthetix, Balancer, and Curve

- (Intermediate) 📄 Ethereum by the Numbers — June 2020

- (Advanced) 📄 A Primer on Ethereum L2 Scaling Techniques

Some recent tweets…

Actions

- Execute any good market opportunities you saw

- Complete weekly assignment: Yield farm MTA tokens with mStable

- Listen to Episode #21 — Ethereum: Past, Present, Future with Vitalik

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time, I may add links in this newsletter to products I use. I may receive a commission if you make a purchase through one of these links. I’ll always disclose when this is the case.