Ethereum: The Digital Finance Stack

Level up your open finance game three times a week. Subscribe to the Bankless program below.

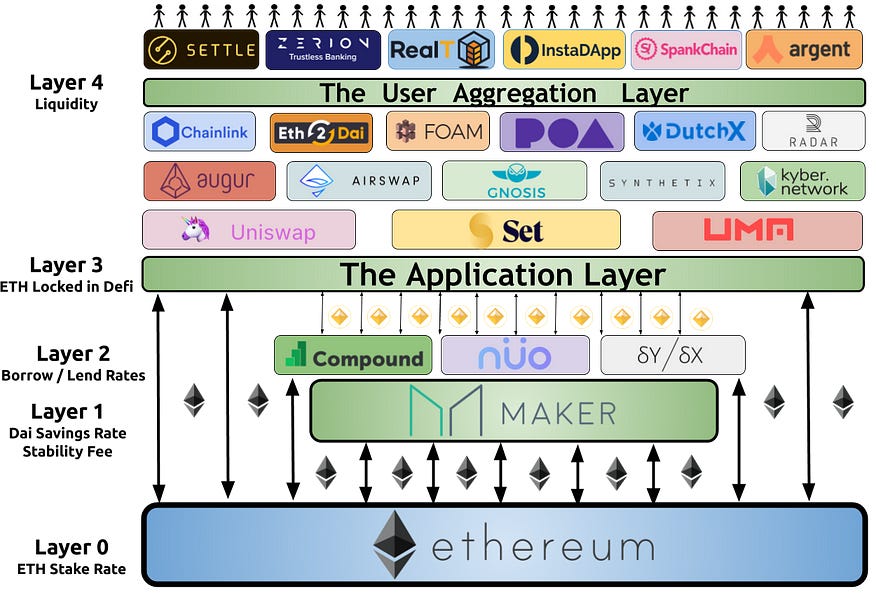

The following article is summarized in this section, and image, below

Ethereum is a set of layers that build on top of each-other. Each layer provides the foundation and the stability for the layer on top of it to express itself effectively. Each layer also has its own metric that builds, and responds to, the market forces inside the Ethereum economy.

Layer 0 — Ethereum

The ETH Staking Rate

Layer 1 — MakerDAO

The Stability Fee; The Dai Savings Rate

Layer 2 — Lending + Borrowing

The Dai Volume-Weighted Average Borrow / Supply Rates

Layer 3 — The Application Layer

ETH Locked in DeFi

Layer 4 — Liquidity

Transaction Volume of Assets

The stability of each layer adds to the potential to the layers above it. This is why Ethereum development is so crucial that we get right. Likewise, it shows the importance of correctly building MakerDAO as well, although not as important as building Ethereum well.

If these two foundations of the Ethereum economy are built adequately, they will be able to support a vibrant ecosystem of financial applications that entirely managed by code, and interacted with by market participants.

Layer 0: The Global Bond Market

Metric: The ETH Stake Rate

Ethereum 2.0 will enable ETH staking. Those with 32 ETH can validate network transactions on their computer, and earn interest for doing so. The amount of interest varies depending on the validator pool size. You can see the ETH 2.0 staking rates here.

This Proof-of-Stake network is the beginnings of a singular digital bond market. With ETH as the currency, those with capital are able to stake, and receive a low-risk return. This return is proportionate to the size of capital, and total time staked. It is a stable investment strategy, for those who want access low risk, low maintenance, exposure to ETH and the Ethereum digital economy.

In the traditional bond market, you can purchase a Bond, Note, or Bill from the U.S. Treasury. Upon redemption of the Bond, Note, or Bill, purchasers often receive 1–3% more than they paid for. These rates are variable, however, as these securities are freely traded on the secondary market, and altogether generate the yield curve. In other words, when you purchase a bond, you stake your USD inside the network of the U.S. economy, and you receive a guaranteed return that is proportional to the size of capital, and the time to maturity (staking period) of the bond.

I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.

— James Carville, political advisor to President Clinton

Bond markets control everything. By far the largest market size of all global securities ($18 Trillion), the bond market is perhaps the most powerful guiding force for all global capital.

Bond markets have power because they’re the fundamental base of all markets. The cost of capital (or, the interest rate on a bond), ultimately determines the value of stocks, real estate, or basically all asset classes.

This is because the bond market, and the ETH Stake Rate, are the bottom-most layer of their respective financial markets. They determine the market dynamics of all markets that exist upstream.

ETH 2.0: Rebuilding the Bond Market

In Ethereum 2.0, the functions of the centralized government and its federal reserve have been consolidated into the code of protocol. The fixed, predetermined staking rate in Ethereum 2.0 solves the issue of a central party from printing money.

Additionally, ETH Stake Rate generates the incentive to provide capital to the network to come and provide security for the blockchain.

In other words: the government issues bonds to produce the economy that supports the military that protects the government and economy.

In Ethereum, the blockchain issues rewards to those who stake, in order to pay for the security of the digital economy.

Layer 1: MakerDAO: The Bedrock

Metrics: Dai Savings Rate, The Stability Fee

MakerDAO is the place where Dai is born. In order for Dai to be born, the generator of the DAI, the CDP Holder, commits to paying The Stability Fee. The Stability Fee is the interest rate on the loan, and is a tool that is used to manage the price of Dai on the secondary market. Higher fees = higher DAI price.

It also determines the cost of capital. The Stability Fee is a measure of the estimated return that the CDP holder expects to receive in a given year, with the loan that they produce from their collateral assets. If the Stability Fee is at 20%, and the CDP holder generates Dai, they believe that they can make more than 20% / year with what they will do with their Dai. The Stability Fee represents the “pull” side of the total market capitalization of Dai. The higher the SF, the lower the supply of Dai.

MakerDAO announced the Dai Savings Rate in 2018. The DSR is a tool that will help MakerDAO manage the price of Dai, while also increasing its capacity to scale its market cap. Before the DSR is introduced, all Stability Fees paid by CDP holders go to burning MKR (Or PETH). This is the risk management fee taken by MakerDAO. Not all assets are equally risky, and some are almost risk-free (such as a tokenized U.S. treasury bond, perhaps). The less risky an asset, the more its Stability Fee goes towards the Dai Savings Rate, rather than burning MKR. The higher the DSR, the higher the supply of Dai, as there is more reward to go around to those who lock-up Dai in the DSR.

Left: Non-Risky, Fees paid to DSR ||| Right: Risky, Fees paid to MKR

The Dai Savings Rate is the twin to the Ether Staking Rate. The DSR enables you exposure to risk-free returns, in a currency with a stable value, enabling high predictive capacity to the value of your return. The DSR is the gravitational force that pulls Dai from the secondary market, as the risk-free return is perpetually available.

So long as there is Dai in existence, there is someone paying the Stability Fee. If there is someone paying the Stability Fee, then there's someone who is able to capture Dai paid to the Dai Savings Rate. The more people paying the Stability Fee, the more people are able to capture the rates for the DSR.

Layer 2: Lending and Borrowing

Metrics: Dai Weighted Average Borrow (WABR) & Supply Rates (WASR)

Introduced by Vishesh Choudhry (@visavishesh) on his tweet-thread here

Created by @visavishesh on Twitter

The Dai Weighted Average Borrow (WABR) & Supply Rates (WASR) has origins in LIBOR, a legacy financial tool to measure the average costs of a loan from various banks.

Weighted Average Borrow (WABR) & Supply Rates (WASR)

The Dai WABR and WASR takes the averaged rate that Dai is supplied to, or borrowed from all Dai lending/borrowing platforms. By weighting the average price, by the volume found at each market (Compound, DyDx), the Borrow and Supply Rates gives a number that shows the rates for supplying Dai to, or borrowing Dai from, ‘the Market’. These two numbers will be a useful metric to track, as money managers look for data to support their decisions.

Dai Market Rates for 29 June 2019

WASR: 16.5%

(receive 16.5% yearly, on average, by lending Dai)

WABR: 19.5%

(pay 19.5% yearly, on average, when you borrow Dai)

These rates will likely vary greatly into the future, as current daily price reflects current daily market state.

You can check the rates, and see changes over time, on Vishesh’s website (Vishesh on Twitter @visavishesh).

Layer 3: The Application Layer

Metrics: ETH Locked in DeFi

The money legos layer. The expressive layer. The algorithmic middlemen layer.

Ethereum’s Application Layer is where Ethereum gets interesting.

What’s Ethereum’s Application Layer?

Ethereum’s big innovation was the incorporation of the ‘EVM’, or ‘Ethereum Virtual Machine’ into its blockchain. A ‘virtual machine’ is programmer-speak for ‘a computer’. Ethereum’s EVM is how the Ethereum blockchain processes computations natively on the blockchain. In other words, the EVM allows Ethereum to run software, and enables this software to process the digital assets (aka money, property, tokens) found on it’s blockchain. This is where the term “programmable money” comes from. Ethereum applications are basically computer software that programs how money, or other assets, operate.

Ethereum’s Application Layer: The ‘Internet of Value’

Programmable money is powerful. So powerful, Ethereum researchers and developers have only begun to scratch the surface of what ‘can be’. Similar to how the possibilities of the Internet was difficult to imagine in the ’90s, the Internet of Value is showing the early signs of an equally fertile landscape of possible applications and use cases. One important difference is that the Internet runs on Data, where the Ethereum runs on Value.

Ethereum’s First Big Apps

- MakerDAO: Digitally-native stablecoin, Dai

- Compound: Digitally-native autonomous asset lending and borrowing

- Kyber Network: On-chain liquidity protocolthat aggregates liquidity from various parts of Ethereum

- Uniswap: Digitally-native autonomous asset exchange

- Augur: Digitally-native prediction market

- DYDX: Algorithmically-managed derivative market

- UMA (Universal Market Access) Protocol: Synthetic asset platform

- 0x (‘Zero-X’): A platform for providing orders to order-book based exchanges

These apps all represent some sort of financial primitives; each adding a crucial building block to the growing network of finance-based applications. Many of these applications also resemble legacy financial services from centralized companies. UMA Protocol generates tokens that track the value of other assets, like shares of stocks on the NYSE, giving access to stock market exposure to a global pool of investors. DYDX is a platform for leveraging long or short on an asset, and is an alternative to other margin trading platforms like TD Ameritrade, or Robinhood. Augur is a marketplace for buying and selling shares of the probability of future outcomes, a product theoretically available in a centralized form, but always limited by governmental regulation. Uniswap is simply an exchange, like the NYSE, but managed algorithmically, to match buyers and sellers of any asset. Similarly, Compound enables those to put up collateral in order to borrow an asset, and pay fees to those who lend it.

Below is an illustration of the transactions that go between various protocols.

What this image illustrates is the maturation of one of the early visions of cryptocurrency enthusiasts: the Internet of Money. The Internet we know operates on data, this new Internet operates on Value. As more valuable assets come to Ethereum, and as more application can program these assets, the Ethereum network grows in its ability to create novel financial products

This is also how Ethereum grows compounding network effects. Each financial primitive adds another dimension of options of things that can be built on Ethereum. Each primitive is an individual LEGO, with a growing number of total LEGOs found inside Ethereum.

The Financial Stack

All of these platforms all leverage both Dai and Ether in order to operate. The volumes of Dai and Ether, and the daily transaction counts going through these platforms will all be highly impacted by both the Ether Staking Rate (Layer 0), the Stability Fee / DSR (Layer 1), and Dai WABR & WASR. These 3 metrics represent the three market-generated rates that will determine the availability of capital for all applications in the above layers.

Synthesizing the Stacks

Layer 0 is the algorithmically-controlled commodity money issuance layer. All new Ether issuance arrives at Layer 0, and Layer 0 is the layer that is responsible for the security of Ethereum blockchain. Layer 0 issues more Ether (per person) when security is low, but less Ether (per person) when security is high. This ensures that Ethereum is sufficiently secure, while enabling sufficient Ether to migrate to higher up the financial stack.

The ETH Stake Rate determines Layer 0’s gravitational pull towards the bottom of the stack, and towards ETH.

Layer 1 is the stability layer. Layer 1 takes the Ether issued at Layer 0, and transforms it into its stable form, Dai. Layer 1 enables individuals to make long-term calculations with how to manage their capital, as they now can make an informed economic decision, because they know that Dai will represent a similar value in the future.

Layer 1 is also the capital generation layer. Layer 1 is where money can be minted directly by individuals, and added to the total pool of money in the macro-economy. The cost of this is the stability fee, which represents the cost-of-capital inside Ethereum.

The Stability Fee generates a proportional Dai Savings Rate, which, like the ETH Stake Rate, also exerts a gravitational force upon Dai further up in the financial stack. The Dai Savings Rate manages the scarcity of Dai, comparable to how the ETH Stake Rate manages the scarcity of ETH.

Layer 2 is the ‘availability of capital’ layer. Layer 2 determines the cost of borrowing, balanced by the interest paid to suppliers. Layer 2 is the “peer-to-peer credit window” layer.

Lending and Borrowing of assets, that have reduced restrictions compared to MakerDAO, but also generate less systemic risk. At this layer, you can borrow Dai, generally with lower fees and lower penalties during liquidation events.

Ether can exist in 1 of 3 places

1. Staking

Ether, acting as a Capital Asset, that provides a regular dividend return.

2. ETH locked in Apps

Ether, acting as a Store of Value, acting as collateral for trustless/permissionless participation in global finance.

3. On the Secondary Market

The price that the secondary market must pay for access to the above two services.

The above also works for Dai. 1. DSR 2. SF 3. Dai Price

The price of Ether is determined by the collective pull of 1+2 on 3

The staking layer (2-ETH Stake Rate) determines the fundamental rate of return on ETH. The risk-free ETH Stake Rate offers a promised rate of return, regardless of the rates found above it, on the Application Layer.

The application layer (1-ETH Locked in Apps) reflects the market appetite for financing. Supplying to, or borrowing from, the market. Collectively, suppliers and borrowers input far more capital than take out, as borrowers can only borrow less value than the ETH they collateralized. Collateralize $1500 of ETH, borrow $1000 ETH: collective lockup: 1/3 of the loan’s value in ETH.

Every action has an equal and opposite reaction. Both systems 1 and 2 are designed to incentivize ETH to come inside their respective control. As the apps being built generate more compelling features and services, it pulls away ETH from staking on Ethereum. The Ethereum protocol offers higher returns when there are less stakers, (See EthHub for rates)

1 and 2 pull on 3, the price of ETH. In order to provide the equal and opposite force to the pulls of 1 and 2, the price of ETH on the secondary market appreciates. This is the fundamental bull case for Ethereum. That Ethereum’s Virtual Machine computer generates enough meaningful applications, that the ETH Stake Rate appreciates via ETH scarcity, and both these mechanisms exert strong collective pulls on the price of ETH on the secondary markets.

Layer 4: User Aggregation

The Final Layer. The Liquidity Providing Layer. The Middleware Layer. The Interface Layer. The Efficient Market Hypothesis Layer.

Layer 4 is the last layer to emerge, as it is completely dependent on the applications below it for structure and purpose. The best example of a successful Layer 4 application has been InstaDapp’s cross-protocol bridge.

InstaDapp built a service that transfers automatically transfers one’s debt from MakerDAO to Compound, from one borrowing platform to another, to access better rates. InstaDapp generates 13 internal transactions, to complete the single transaction executed by the user.

InstaDapp made a bridge between MakerDAO and Compound, and allowed users to cross this bridge with a single transaction. By enabling easy-auto migration from protocol to protocol, InstaDapp will help add liquidity to the parts of Ethereum that need or deserve it.

Settle Finance offers a similar service: A decentralized exchange interface that aggregates market data and provides the best rates found across all exchanges. By generating a liquidity service, with a good UI, Settle can capture users and reduce friction for their interactions with Ethereum’s finance, Settle can aid in the general liquidity and efficiency of the Ethereum ecosystem.

Token Card presents an interesting aggregation scenario. By connecting the payment network like Visa to a crypto-backed debit card, Token Card aggregates users, and supplies transaction volume to the decentralized exchange landscape, every time a user makes a transaction. Sufficient users of the Token Card debit card should aid on the volume and liquidity found in the application layer.

RealT is a tokenized real estate platform. Investors purchase shares of real estate, and receive their share of rent on a daily basis. RealT adds to the volume of daily Dai buying and selling, as it aggregates users with its service, and moves Dai throughout the Ethereum ecosystem. As more users come to RealT, and more properties are sold, more rental income is swapped for Dai, and sent out to RealToken holders, adding to the liquidity of the application layer. (I work at RealT! Check it out!)

Predictions and Conclusion

1. These metrics will always be crucial for measuring the Ethereum economy.

2. Ethereum provides microscopic details of how the market behaves. On-chain analysis of how market forces play out will be an expansive and lucrative industry.

3. These metrics will illustrate mass psychology more clearly than ever before

4. They will determine the state of the future global macro economy.

Library

I hope you’ve enjoyed reading this. I think it’s my most expansive yet! If you would like to read more content by me (@trustlessstate), here a list of some of my favorites:

Evaluating MKR

The Buyback and Burn model changes EVERYthing

DAI is not 1 Dollar

A new perspective for the role DAI has in its relation to Ether.

MakerDAO: What Doesn’t Kill It, Makes It Stronger

An analysis on the recent performance of the MakerDAO system

MakerDAO: Bitcoin, in Two Coins

The MakerDAO system separates specific features of Bitcoin into it’s two coins MKR and DAI, while adding a few new ones on top.

MakerDAO: The Decentralized Global Reserve Bank

Join the open-finance revolution by participating in the MakerDAO ecosystem

Yes, I’m aware of my affinity with colons.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.