How to Win the Merge

Dear Bankless Nation,

In case you’ve been living in your TradFi cave, the third and final testnet (Goerli) went live yesterday.

Check out our livestream if you missed it!

Given this monumental software upgrade on Ethereum, many of you have been asking if there are profit opportunities.

Yes.

From liquid staking protocols and DeFi lending to an ETHPOW airdrop, Ben is here to tell us how to gain exposure to this once-in-a-lifetime event.

— Bankless Team

At long last, it’s here. Following the successful completion of the Goerli Testnet, the Merge is coming with a TTD of block 58750000000000000000000, which is estimated to be sometime between September 15-16.

The benefits of the Merge have been discussed ad nauseum, but for good reason. The event is one of the most significant catalysts in Ethereum history as it impacts the network on several fronts.

For instance, the Merge will significantly reduce Ethereum’s energy consumption, alleviating critics’ concerns around its environmental impact and making the asset more attractive to ESG-conscious institutional investors.

The Merge will also clear the path for other changes to Ethereum at the protocol level, such as proposer-builder separation. This helps democratize MEV extraction by separating block production from block validation, as well as EIP-4844, which will reduce transaction costs for rollups by an order of magnitude.

Finally, the Merge will greatly increase the attractiveness of ETH the asset. ETH’s issuance will be cut by ~90%, likely making it deflationary, while also providing stakers with the ability to earn a yield on their holdings.

The most obvious way to gain exposure to this monumental event is to buy ETH… but there’s more than that. There are numerous other ways for investors willing to go out on the risk-curve to gain exposure.

Let’s explore four different ways in which investors can capitalize on the Merge.

1️. Liquid Staking Tokens

👉 Examples: LDO, RPL, SWISE

Liquid staking services are the most direct beneficiaries of the Merge, with the non-custodial protocols likely to experience significant growth in the months following the transition to PoS.

The value proposition of liquid staking is straightforward — It allows users to do all three of the following at once: Maintain custody of their collateral, earn a staking reward, and deploy their assets within DeFi through the issuance of a liquid staking derivative (LSD).

The Merge will dramatically accelerate the growth of these protocols as it will de-risk staking by removing the pre-Merge technical and execution risk.

In addition, a completed Merge and a clearer timeline for withdrawals will also help reduce the discount that LSDs trade at relative to ETH. Lido’s stETH is currently valued at ~0.963 ETH, but when I wrote about Celsius’ implosion in June, recall that the stETH:ETH parity depegged as hard as ~0.933 ETH.

True—Beacon Chain withdrawals will not be enabled until the Shanghai network upgrade, expected to be ~6-12 months post-Merge. But the magnitude of the Merge will drive a decrease in this discount, making staking with these protocols more attractive as it implies depositors are taking on less price risk.

Furthermore, liquid staking protocols are likely to grow deposits due to the projected increase in staking yields. Today, Beacon Chain validators solely earn block rewards. Post-Merge, stakers will be able to earn transaction fees and revenue from MEV. This is projected to dramatically increase the staking yield from roughly ~4%, where it sits today, to anywhere from 6-12%.

These growth drivers should also lead to increased revenues for liquid staking protocols, as deposits, higher yields, and a potentially higher ETH-price (the asset in which their revenue is denominated) will bolster their top-line.

There are currently three liquid staking protocols with publicly traded tokens: Lido (LDO), Rocket Pool (RPL), and Stakewise (SWISE).

Each token can play a different role within a portfolio:

- Investors looking for blue-chip exposure may want to take a look at LDO, as it is the largest entity staking on the Beacon Chain with a 31.2% share of deposits. Lido has an even greater hold over the liquid staking sector with a 90.3% market share within this niche. The token currently trades with a market cap of $1.48B and FDV of $2.70B.

- Tokenomics-oriented investors may look to Rocket Pool’s RPL, the second largest liquid staking protocol with a 1.6% share of Beacon Chain deposits and a 4.5% share in the liquid staking sector that has a MC of $467.52M and FDV of $519.73M. RPL has unique tokenomics in that minipool operators, or entities validating via Rocket Pool, are required to purchase 1.6 ETH worth of RPL for each new validator they spin up, which ties demand for the token to growth for RPL. This ties demand for the token to growth.

- Investors wanting to maximize risk and optimize for beta can look to StakeWise (SWISE), which trades at a MC of $26.66M and FDV of $198.45M. While the protocol has just a 0.4% and 1.3% share of Beacon Chain and liquid staking deposits respectively, it is likely to be the highest beta token among the three due to its smaller size and low float.

2️. Event-Based DeFi Bets

Buying tokens is not the only way to get exposure to the Merge. Savvy market participants can leverage DeFi in a variety of different ways to “trade the narrative” and express their views on how different markets will react to it before, during, and after.

One way in which a user can do this is by lending ETH on money markets like Aave, Compound, and Euler. Why? There will likely be a considerable increase in demand to borrow ETH around the time of the Merge, as investors will want to accumulate as much of the asset as possible in order to farm the “airdrop” from a potential PoW-based Ethereum fork (ETHPOW).

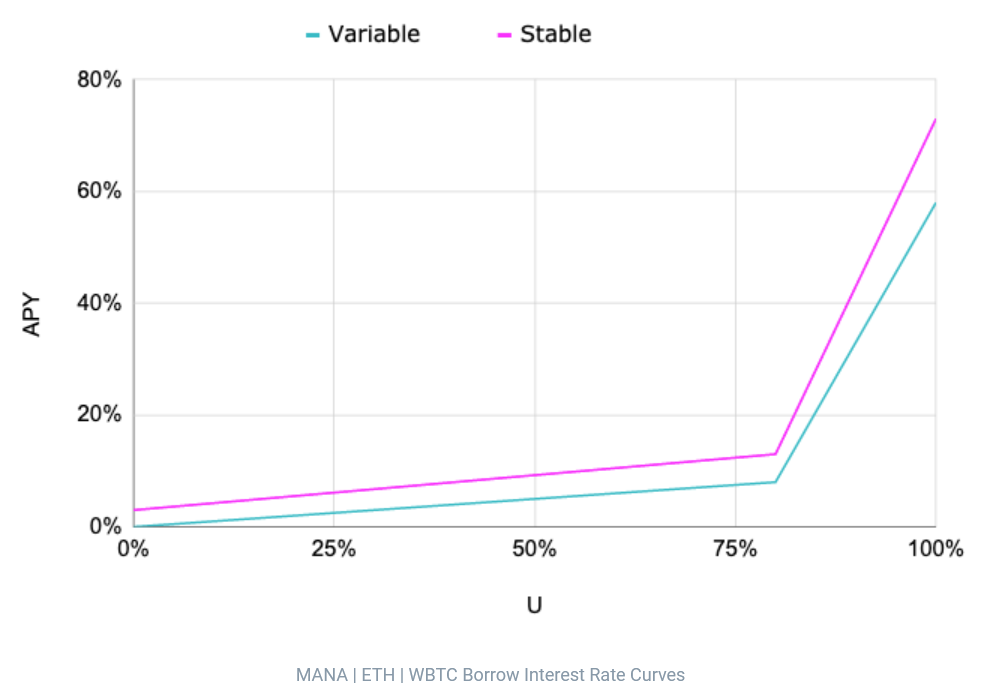

As interest rates on these protocols are based on utilization (i.e., how much of the asset is borrowed), a major spike in borrowing demand would lead to incredibly high deposit rates for lenders. The interest rate curve for ETH on Aave V2 begins to “kink” or accelerate rapidly at 70% utilization. With this market currently at 61.56% utilization, and having spiked considerably since August 8, it is certainly possible that this scenario unfolds.

Of course, this strategy is not without risk. In an extreme scenario where there are incredibly high borrowing demand, meaning there is little ETH liquid in Aave, lenders may be temporarily unable to withdraw the asset until borrowers repay or more deposits flood into the protocol.

A second way to use DeFi to express a view on Merge-related events is to use Voltz Protocol, an AMM for interest-rate swaps to bet on the LSD staking yields.

Since returns from staking are likely to increase post-Merge, market participants can use Voltz to express this view by posting ETH as margin and purchase variable rate stETH or rETH tokens (which are issued synthetically). Users can magnify their returns by utilizing leverage, though this of course introduces considerably more risk as it opens them up to the risk of liquidation. Please be careful when using leverage of any kind!

👉 To read more about how to use Voltz to trade the Merge, click here.

3️. PoW Airdrop Farming

There are billions at stake in the mining industry, and as Lucas wrote earlier this week, it is a near certainty that some PoW instantiation of Ethereum will exist post-Merge. Numerous high-profile industry figures, such as Justin Sun and his exchange, Poloniex, have already pledged to support this hard fork and plan to list the ETHPOW token.

While it is unclear if this chain will have any long-term viability, or how much value ETHPOW will have, users can still put themselves in a position to earn the seemingly inevitable airdrop in multiple different ways.

The simplest way to qualify for this airdrop is to hold ETH in a non-custodial wallet (Metamask, Coinbase Wallet, etc.).

But if you’re looking for higher-risk opportunities, one way is to take the other side of the bet by borrowing ETH on a money market, which can be profitable if the value of the airdrop is greater than the cost of borrowing ETH. This strategy comes with considerable risk though. Not only may borrow rates exceed any earnings from the airdrop, but borrowers also stand to be liquidated should the price of ETH soar, or their collateral fall in value. Given the high likelihood of massive volatility on the day of the Merge, investors will need to proceed very carefully.

Another way investors can farm the airdrop without taking on any price risk is to create a delta-neutral ETH position using perpetual futures. To do this, a user would purchase spot ETH while shorting an equivalent amount of ETH using perps on a CEX or DEX. This way, users are exposed to ETH, so they can earn the airdrop, while not taking on the price risk that comes with holding the asset. This strategy will be profitable if the value of the airdrop exceeds funding (the cost of keeping open a perps position).

However, there is no such thing as a free lunch. This strategy is significantly risky, as funding, like borrow rates may skyrocket with the Merge approaches. Any kind of leveraged strategies like these, coupled with the volatility will put users at outsized risk of being liquidated.

Proceed with caution!

4️. Follow-On Beneficiaries

Finally, a post-Merge Ethereum is poised to have a transformative impact on other sectors of the Ethereum economy.

One of these beneficiaries are Layer-2s (L2), as the transition to PoS will pave the way for scalability upgrades (e.g. EIP-4844) which will dramatically reduce transaction fees for end-users on rollups by decreasing the cost of storing call data on-chain. This fee reduction should serve to catalyze L2 adoption by increasing the number of users that can transact on the network and unlocking the capability to build new, novel dapps.

Investors can (and already have begun) capitalize on this by investing throughout the L2 ecosystem, such as on the L2 base layer (OP), or L2-native DeFi primitives like Synthetix (SNX) and GMX (GMX), or smaller-caps projects native to different ecosystems. Don’t forget about supporting L2 infrastructure like fast-bridging services such as Synapse (SYN) and Hop Protocol (HOP).

Another industry that is set to change after the Merge is MEV. The competitive dynamics of MEV are set to change drastically following the implementation of proposer-builder separation which will separate the production of blocks (deciding what transactions go in one) from the validation of blocks. David eloquently outlined this yesterday in The Ethereum Watershed.

There are numerous projects within the MEV stack with publicly traded tokens that could provide a way to gain exposure to this shift, such as Manifold Finance (FOLD) Rook Protocol (ROOK), and Cow Protocol (COW).

While many of these tokens have run considerably in recent weeks, they are still poised to be long-term beneficiaries of a PoS Ethereum.

Conclusion: Choose Your Own Adventure

The Merge is fast approaching, and promises to bring with it significant changes to the Etheruem economy, as well as shorter-term chaos on-chain.

The safest way to gain exposure is to simply buy ETH.

But this is no longer the 2018 bear market and we live in a DeFi world, so there are numerous other ways in which investors can play the Merge, whether it be through investing/trading in liquid staking protocols and long-term Merge beneficiaries in the L2 and MEV sectors, or by using DeFi to earn yield or farm the ETHPOW airdrop.

How will you gain exposure, anon?

Action steps

- 📚 Read David’s The Ethereum Watershed yesterday if you missed it