Ether futures are here

Dear Bankless Nation,

Today, ETH futures went live on the CME. This is a big deal.

Three things worth addressing here.

- What are ETH futures?

- Why are they good?

- Is this bullish or bearish for ETH?

Let’s take them in order.

1. What are ETH futures?

ETH Futures are exchange-traded products that attempt to price the future value of an asset. The Chicago Mercantile Exchange (CME) is the place for trading commodity futures (wheat, coffee, oil, BTC, and now ETH!)

CME is offering 8 ETH-future products, each set at a specific future-time in which the contract must be settled. This allows for investors to pick their preferred time-frame for their participation in ETH buying or selling.

CME monthly contracts are listed for 6 consecutive months and 2 additional December contract months.

All monthly contracts expire on the last Friday of the month. This month’s contract will settle on February 26th. You can view the next-in-line settled contract on TradingView here. At the time of writing, the February contract is priced at $1735.25, where the current ETH price on Coinbase is $1,704. This means that people are willing to pay $31.25 (+1.83%) above the spot price, for the future settlement of ETH.

A market participant can pay $1735.25 today for the delivery of 1 ETH on February 26th. If the price of 1 ETH on February 26th is $2,000 then the purchaser of the contract at the current price of $1735.25 is happy because they received a 14% discount on the value of their purchase. Instead, if the price of ETH is $1,000 they are very sad because they over-paid by 43%.

The CME offers the next 6 consecutive months for trading ETH futures and two Decembers. Since we are in February (but before the last Friday of the month), we have February through July CME ETH Future contracts open for trading, and December of 2020 and December of 2021. If it were later in the year, we might be including the December 2020 contract in the 6 consecutive months, and there would only be 7 total contracts available. The December 2022 contract would open once the December 2020 contract is settled (on the last Friday of December 2020).

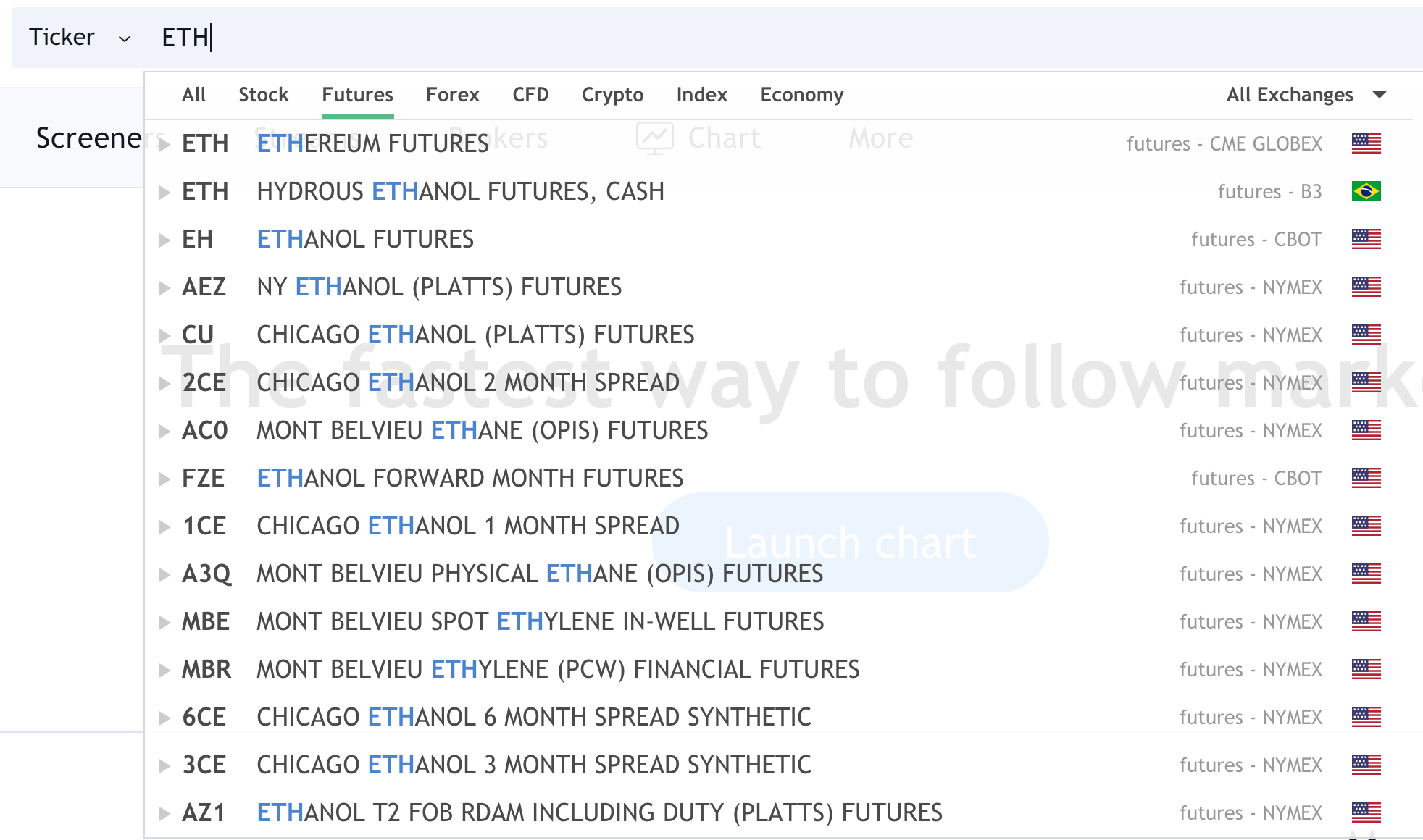

Finding the charts for these contracts is easy. When you go into TradingView, you can type in ‘ETH’ into the search bar, and hit the ‘futures’ tab. The top of the list is ‘Ethereum Futures’ from CME GLOBEX.

You can click on that, and you will see a drop-down for all the CME Contracts that are live.

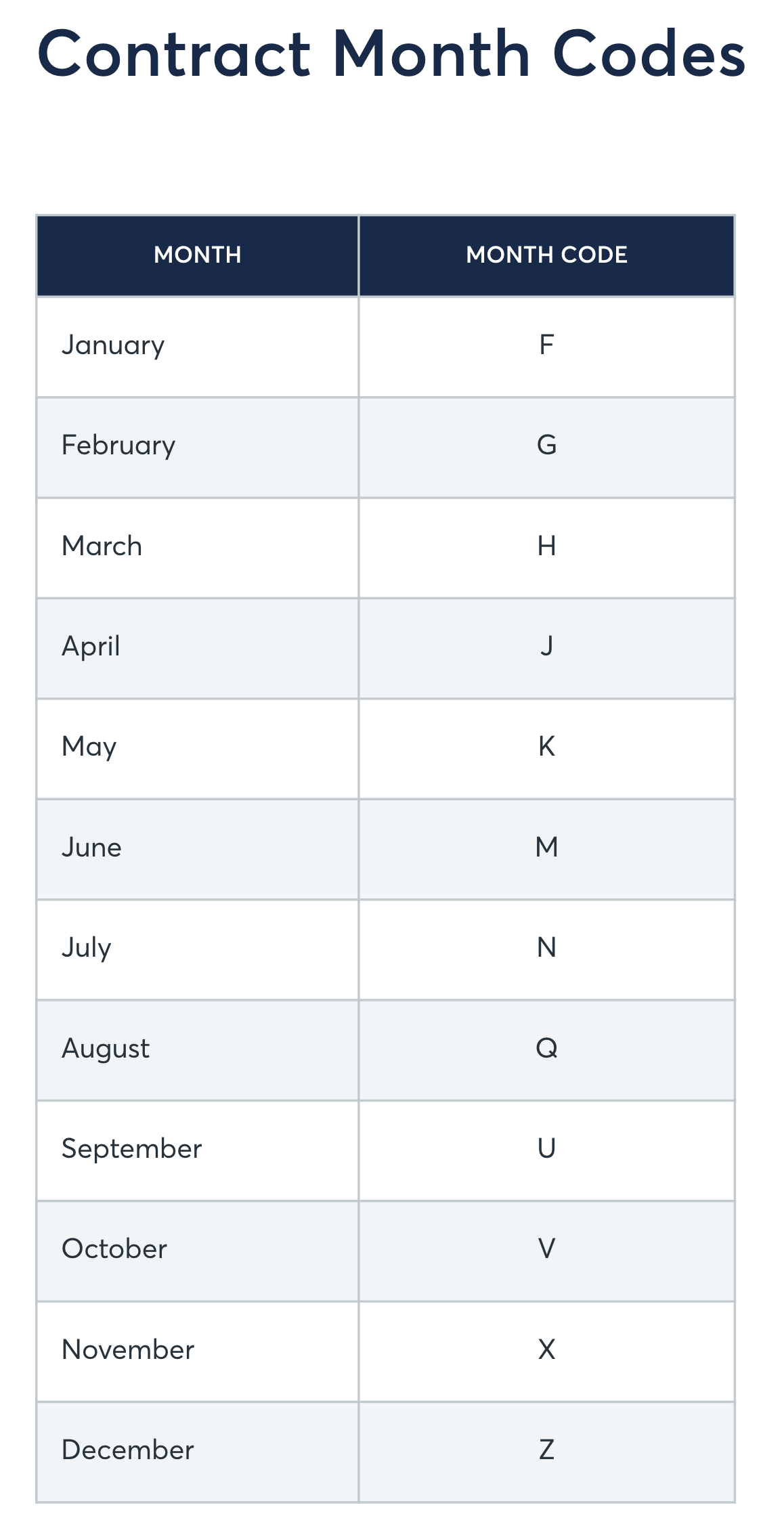

You can see how the market is pricing the future value of ETH at a specific moment in time using these various options. Here’s a handy cheat-sheet for how CME codifies its contracts:

As the date of contract settlement draws closer, the spot price of ETH (the price found on exchanges like Gemini or Coinbase) should converge to the future price.

Why? Well imagine it’s the day before contract settlement; any difference between the ETH spot price and CME ETH Futures price implies that the market is going to move that much inside the next 24 hours before settlement. In theory, there shouldn’t be big price differences in the near-term and larger spot/futures price discrepancies in the longer time frames.

This should be intuitive. I have pretty strong convictions that the ETH price is between $1650 and $1750 tomorrow. I have no clue what the price of ETH will be in December of 2022, and neither does the market.

2. Why are CME futures good?

Here are three reasons why CME futures are useful financial infrastructure.

Better Price Discovery

Futures are a fantastic price discovery mechanism. These 8 different products from CME allows for 8 different vehicles for expressing an opinion as to what the value of ETH will be in the future. Without futures, we’d just have one vehicle for expressing this opinion: the ETH spot price.

Price discovery is crucial for the maturation of an asset. When an asset has mature and solidified price discovery tools, the asset becomes much more suitable for a wider range of investor categories. Price discovery mechanisms are important for reducing speculative volatility and allows for stronger assurances about the longer-term value of the asset. People feel more secure in their investment if there are people who are pre-paying for the asset that they won’t actually receive for 18 months! This long-term focus of ETH futures can help newer investors measure their risk and making educated, informed moves.

Prerequisite for an Ether ETF

Price discovery is a critical requirement for a future Ether ETF. ETFs only work when there is extremely strong assurances about the value of the underlying asset, and futures are a great way for these assurances to be built. Importantly, the CME is a U.S. company, meaning that ETH is undergoing price-discovery using U.S. venues; something that makes U.S. regulators very happy.

One of the main reasons behind the continual denial of the Bitcoin ETF is the fact that BTC price discovery was largely occurring on off-shore, unregulated exchanges. These reports might as well have just said the name ‘Bitmex’, and now that Bitmex is stilted Bitcoin ETF proposals have much stronger foundations to stand on.

I expect that once the Bitcoin ETF gets approved, the Ether ETF will not be far behind it. It took BTC ten years to get CME futures, and ETH only six. Thanks for fighting that fight, big brother Bitcoin!

Onboarding Institutional Investors

If you are reading this, it’s likely that you aren’t going to be a consumer of CME ETH futures. Most individual Bankless readers are better off trading spot ETH or using a crypto native futures product.

But that’s ok. This CME product really isn’t meant for the individual; it’s meant for the institution. Futures are a great product for slower-moving, well-capitalized entities. These entities aren’t buying on Uniswap, and they might not be ready to take physical custody of the asset. They might want to make large, dollar-cost-averaging purchases that span many months, to make sure that they are getting a fair and optimal price.

Additionally, one futures contract is priced at 50 ETH! Most individuals aren’t buying in these quantities, and it’s expected that CME ETH futures participants are buying many contracts, not just one or two.

Unlike Coinbase, Gemini, Kraken, or any other U.S. crypto-exchange, CME is a venue that many institutions are already familiar with and have supporting compliance and infrastructure ready to go. The larger the institution, the slower it is to turn the ship; CME ETH futures means that these big, slow-moving institutions don’t need to move as far in order to access ETH exposure.

Lastly—a listing on the CME means U.S. regulators are saying “Yes, Ether is a commodity money like bitcoin, gold, and silver. It’s not a security.” This is the legitimizing clarity institutional buyers have been waiting for since Ethereum’s ICO.

The theme here is that it is institutions are gaining stronger assurances as to the safety and risk of putting ETH on their balance sheets.

3. BulIish or Bearish for ETH?

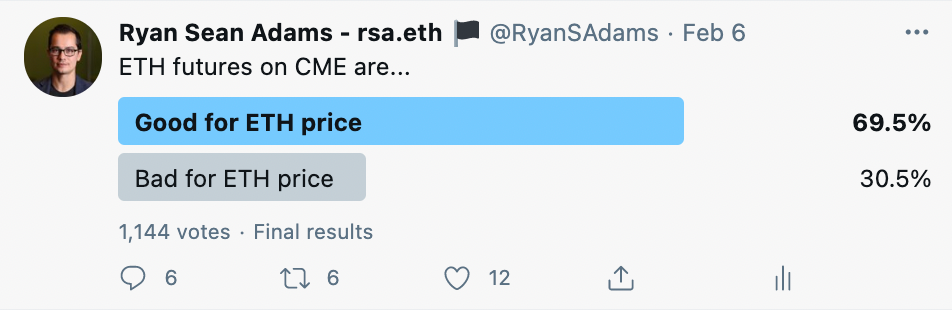

There’s a lot of conversation about whether CME Ether Futures are bullish or bearish for the future price of ETH.

The bears point out that CME Bitcoin Future’s opened at the end of 2017 and that soon after Bitcoin and the rest of the crypto market tanked—they claim futures caused the drop. They believe the market dropped because institutional investors suddenly had a mechanism to express bearishness, and they did, taking BTC price with them.

The bulls like me don’t buy that analysis. We think the timing of the CME Bitcoin futures and the peak of last cycle’s BTC price is purely a coincidence. At the peak of the last crypto-cycle, Bitcoin had already 100xd from its previous bottom. It was destined to enter a retracement of its path from $200 to $20,000. CME Bitcoin future’s did not cause it. This time we’re much earlier in the bull cycle. Institutions might once again express their sentiment—but this time it might be bullish. 🚀

At the end of the day, 99.9% of institutions do not have ETH on their balance sheet, and the significant majority of these institutions do not consider crypto-exchanges as viable onramps for ETH exposure. CME Futures gives them a vehicle to gain exposure to ETH they previously didn’t have—this makes number go up.

With today’s report of Tesla’s $1.5b Bitcoin buy and the launch of Ether’s CME futures it’s already been a crazy week and it’s only Monday! But these two events are related: futures had to come before big institutional purchase—this is us witnessing the financialization of crypto monies in real-time.

Elon bought BTC in January, but which cryptocurrency do you think he buys next?

Probably one with a future.

- David