Dear Bankless Nation

Riding a bull market is like riding a bull. It’s trying to buck you off.

A bull market is like an extended obstacle course, with pits, traps, and obstacles along the way. One of its favorite tricks is to bombard you with too much signal so that everything turns into noise.

Surviving a bull market is difficult. But there are a few rules you can use to make the whole process a lot smoother.

But make no mistake there’s no easy mode. No one gets a free-pass to the top.

You have to take control over the experience. Or else you’ll get bucked.

So with that, here are some simple rules to follow as we navigate this bull cycle:

1. Keep your Foundations

In bull markets, people go risk-on.

People look towards the long tail of crypto assets. This means investors will look lower and lower down the list of assets, sorted by market cap, trying to find the next low-cap gem. Why?

Because low market cap coins have higher pump potential, and it’s easier for them to do a 1,000x increase than BTC or ETH. Bull markets are characterized by this behavior.

Bear markets are the opposite. Investors go risk-off. They put their capital into the higher market cap assets. That’s why Bitcoin always does well in bear markets but underperforms in bulls. Bitcoin is the ‘stable’ foundation for crypto.

That XYZ low cap gem with a $20M market cap? Not a stable foundation.

You also damage your foundation when you take on leverage. That means borrowing against your assets, to buy more. In bull markets you’ll be tempted to do this. But doing this means putting your toes over the edge. Too much leverage, and more than just your toes…you fall off the cliff and die.

Taking on leverage means you could lose all of your deposited assets.

The #1 rule for living through a bull market is to always position yourself so that if you lose, you can still be in the game.

Keeping the majority of your portfolio in crypto monies like BTC and ETH, and not taking on leverage or being overly exposed to micro cap tokens, are strong strategies for keeping healthy, stable foundations.

By following this rule, you will always be in the game.

2. It’s Okay to Miss the Pump

Pumps happen in bull markets. Literally. All. The. Time.

You will not capture every single pump. Actually, you’ll probably miss most pumps.

If you chase the pump, there will become an endless desire to micromanage your portfolio. You will open up your Zapper or Zerion and ask yourself “Am I adequately positioned? I don’t have any exposure to XYZ… should I sell ZYX to buy some?”

During this bull market, you can do one of two things:

- Chase the pump

- Let the pump come to you

In my experience #2 is the higher ROI path. Less stress, less gas fees (keep your ETH!), and less surface area for getting unlucky.

Chase fundamentals but let the pump come to you.

3. Control Your Emotions

Learning to be okay with missing the pump is simply an exercise in mindfulness. Mindfulness practice, daily meditations, reflection, and emotional awareness are things that all humans should be doing. Living an observed life is good.

In bull markets, it’s also edge. The investor with the cooler head tends to win out. The trader that understands their emotions has more information to work with.

Know thyself, or you’ll get bucked.

4. Don’t Increase Your Sell Targets

The following tweet is an absurd way to live:

Yet our lizard brains convince us this is rational behavior during a bull market. If ETH hits $1k, that means it’ll hit $10k. If it hits $3k, that means it’ll hit $30k. This is dangerous!

The increasing price of an asset is not justification for raising sell targets. Targets aren’t supposed to move anyway. Targets are made to be hit.

Set your sell targets then have the discipline execute them.

5. No One Knows Where the Top Is

Take a look at these two charts below. Would you buy or sell? They’re both pretty hot charts; maybe you want to get in on the action?

These are ‘the tops’ of Bitcoin in 2013 and 2017. If you haven’t noticed yet, parabolas look like parabolas at every point in the parabola.

There is no deciding when the prices of crypto assets get off the parabolic ride, and into a long-term correction. It could always go further up the parabola.

But make no mistake, at some point the parabola ends. Bull markets are games of musical chairs. At some point, the music will stop, and if you are caught overexposed to a long position, then you’re going to be one holding (or worse, buying) at the top.

6. Navigate the Dark Forest

Everything about the cryptocurrency industry is a Dark Forest (extra credit reading: Ethereum’s Dark Forest is Worth Cultivating).

There’s no path through the Dark Forest, and it’s full of monsters waiting in the shadows. Getting through a bull market unscathed requires you to navigate your way through the Dark Forest.

You’ll need to know where the traps are, who to trust, how to verify information, and get knowledge straight from the source. Monsters in the bull market Dark Forest come in all shapes and sizes.

Here are three:

Phishing Monsters (steal from you)

Scamming Monsters (scam you)

Pumping Monsters (delude you)

You can protect yourself against bull market monsters by generally being skeptical about people who are trying to part you from your assets.

If you don’t feel extremely secure about the outcome of the events proceeding your trade, don’t make the trade!

7. Breath and take it all in

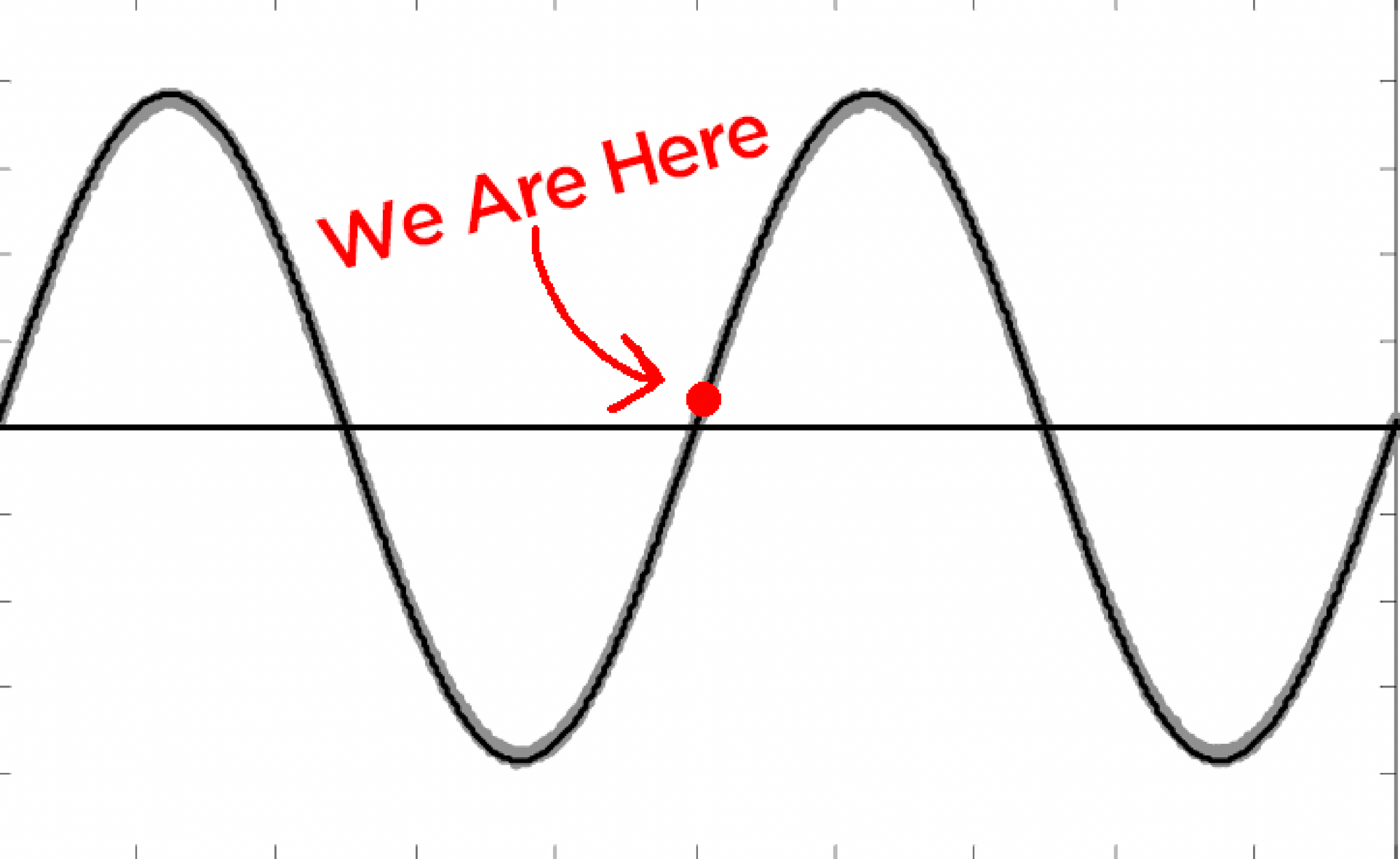

The cryptocurrency industry moves forward in waves. Here’s where I think we are in the current wave that is being experienced by this industry:

Except these waves aren’t neat and tidy. They don’t operate as a function of time the way our human brains do. Here’s how these bull cycles actually manifest:

Bull markets are short. They are a flash in the pan. They’re the brief moments the rest of the world finally decides to care about crypto.

Bull markets are when the world suddenly turns its collective attention to crypto and reprices the whole entire industry all at once. Bear markets happen when the world forgets about crypto for a longish time in between the bull runs.

Many people in 2017, myself included, weren’t prepared to be forgotten in 2018. But there I was, holding my bag of ETH that people no longer cared about. I still have that same bag in 2021, but it took 3 years for people to remember it again.

True, the world forgets about crypto a bit less each cycle as it becomes more embedded in our institutions. But it’s not too early to begin preparing for the bear market—it’s not too early to prepare to be forgotten—what will you do during the next bear market?

I’ve found bear markets are the best time to make friends and connections. It’s the best time to put your head down and build. The people that stick around are generally the people you want to associate yourself with, as they are playing long-term games. Not short term speculative bubbles. So start connecting with them now.

The message here is to enjoy the bull market. Take it all in. Each one is one-of-a-kind. They all offer their own challenges and rewards. Bull markets are year-long internet festivals.

So stay mindful. And enjoy the ride!

- David