DeFi will eat corporate debt

Dear Bankless Nation,

Credit markets are essential fuel for innovation. But today, they don’t exist in DeFi.

If you’re a long time reader, you may remember this piece from Jake Chervinsky in August. He argues that there’s no lending protocols in DeFi—at least not yet.

Instead, popular lending protocols like Compound and Aave are more like interest rate protocols. They provide rates on capital (aka collateral) for borrowers and suppliers.

They don’t rely on the promise of future payments, trust, or reputation. They remain solvent by requiring borrowers to always over-collateralize their positions.

Over-collateralized DeFi loans are trust-minimized. But they’re also capital inefficient. A large portion of the global market for loans can’t operate under this architecture—they need actual credit lines.

That’s where decentralized credit markets come into play.

If successful, these markets could make their way into the traditional world someday—just as BTC has crept into corporate treasuries.

Here’s how.

- RSA

🎙️ Exclusive Episode: Lyn Alden Debrief

Listen to the debrief episode following our podcast with Lyn Alden. Available for all full subscribers!

WRITER WEDNESDAY

Guest Writer: Sid Powell & Joe Flanagan, co-founders of Maple Finance

Credit makes the world go round

Credit markets have been a crucial driver of economic growth for centuries. As early as 1780 B.C., Mesopotamian farmers were leveraging their farms as collateral to borrow funds to manage cash flow until the next harvest (these were the original yield farmers).

And today, access to credit is integral part of our financial well-being. We need credit in order to achieve long term goals, and to play long term games. Imagine a serious endeavor like building a factory. This requires a significant amount of time, labor, and capital to complete—and even longer to pay off.

Commercial credit is especially important for smaller businesses as they generally cannot issue bonds or sell stock on a public market.

Phil Knight’s memoir of Nike’s highlights how crucial credit lines were to Nike in the early days. If they wanted to keep up with demand, they needed capital to support the ever growing orders from their suppliers. As Knight describes it, “I spent most of every day thinking about liquidity, talking about liquidity, looking to the heavens and pleading for liquidity.”

If entrepreneurs cannot readily access and borrow capital, innovation is hampered.

Unfortunately, we’re still missing that in DeFi…

DeFi’s Missing Lego Piece

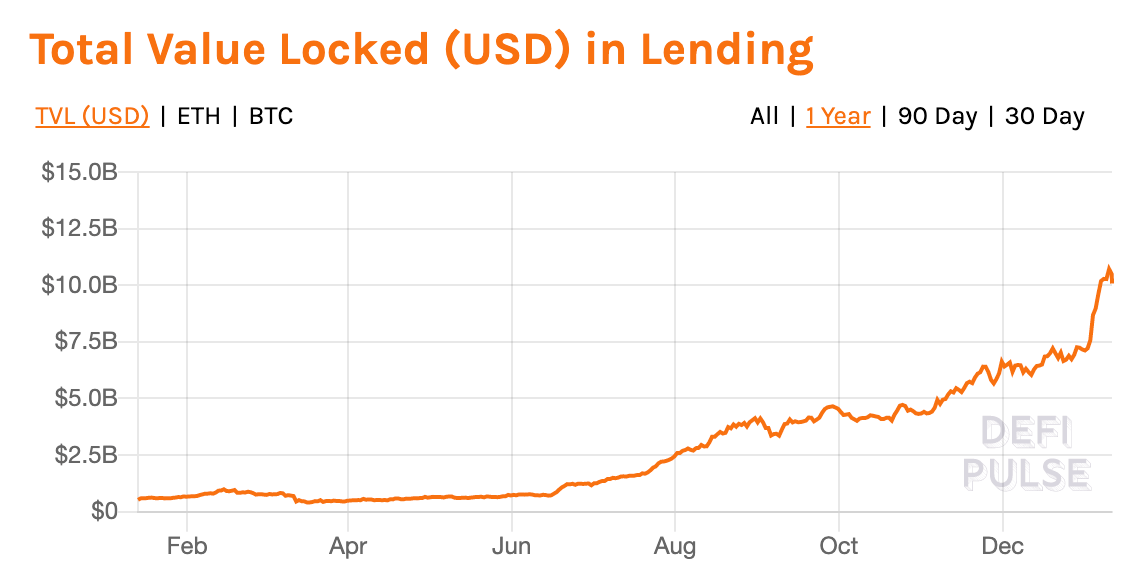

Lending has been one of the breakout sectors of DeFi over the past few years. It currently represents nearly half of the ~$25B market. Leading protocols like Aave and Compound allow users to deposit crypto assets to earn interest or leverage its value to borrow other assets on the platform.

But as many know, there’s a problem with today’s “lending protocols”. They require all loans to be over-collateralized, meaning users have to deposit more value than they can actually borrow (generally more than ~120%). Compound and Aave ensure solvency under this model as the protocol automatically liquidates users that fall below the minimum ratio.

While these protocols represent significant progress in DeFi’s evolution, they are not efficient credit markets.

As Jake Chervinsky of Compound argues, these protocols are explicitly designed to avoid relying on future promises. While this approach has kept these protocols solvent and effective sources for leverage, it has also precluded them from introducing fundamental features of a credit market like trust and reputation.

The inefficiencies in this system are obvious—depositing $150 to borrow $100 is only useful in a fairly narrow set of circumstances (and hence why overcollateralized loans are relatively uncommon in traditional finance).

However, this is the status quo for lending in DeFi today because trust remains challenging in a pseudonymous world. Credit scores and borrower assessments in traditional finance require identity—something which can be difficult in our anonymous world of DeFi.

How DeFi Credit Markets Grow to Billions

Let’s talk about two lending needs from our own industry.

Crypto miners need credit for capital expenditure on rigs and operation expenses for power requirements. Trading funds and market makers need credit for portfolio leverage and liquidity provisioning.

These two alone represent billion dollar sectors within crypto that could be empowered by decentralized credit lines on Ethereum. And with it, they could more efficiently run their business—they could expand operations and grow at faster paces.

The players in these sectors have strong balance sheets with low leverage, experienced managers, impeccable reputations and are cashflow positive. In short, they’re highly attractive borrowers.

However, their needs are not being met in DeFi. As mentioned, today’s “lending” protocols in DeFi are not capital efficient for borrowers, and they’re not viable options for large companies actually looking for credit (not leverage).

So instead, miners and traders are flocking to centralized lenders in droves. Genesis’s lending business is exploding as they’ve added over $5B in origination in Q3. BlockFi has also been growing at an insane clip.

It’s obvious that there’s a demand for credit in crypto. Centralized lenders are demonstrating that the market is currently worth billions—and it’s only getting warmed up.

So when decentralization?

Why Decentralized Credit Will Eat Centralized Credit

On-chain credit introduces significant improvements over its centralized counterparts.

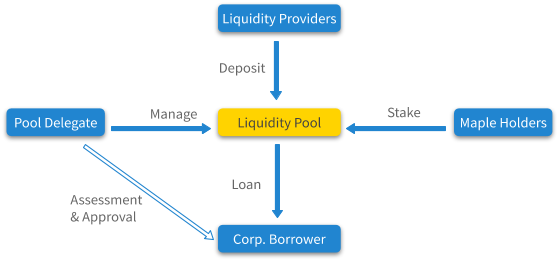

Decentralized credit markets massively expand the potential supply of lenders, creating more competitive markets. With open architecture, anyone, anywhere can become a lender if they’re willing to take on the risk. Just like anyone can become an LP on Uniswap, anyone will eventually be able to pool capital and earn an interest rate by providing credit to verified corporate borrowers.

On-chain credit markets also introduce significant efficiency gains because borrowers have a direct feed into the capital market instead of going through gatekeepers. In other words, they tap directly into the pool of capital via an open protocol versus dealing with an intermediary to access the capital—leading to lower rates for borrowers. Lastly, borrowers can create bidding tension for price discovery by syndicating a loan among multiple pools of lenders.

While credit markets have historically been opaque and dominated by institutions, decentralized ones will democratize access with full transparency on both sides of the market.

On-chain credit markets built on Ethereum have auditable loans and liquidity reserves, giving liquidity providers more certainty that their funds will not vanish as they have with some centralized lenders. In addition, the programmable nature of decentralized protocols opens up the design space for incentive alignment, in turn creating more efficient credit markets.

For example, Maple requires entities performing credit assessment to stake MPL tokens in order to cover defaults, aligning incentives among both parties and protecting lenders.

Given the skyrocketing demand for credit and a huge pool of potential lenders, decentralized credit markets could easily grow bigger than the $25B locked in DeFi today.

Fueling DeFi’s Fire

At Maple we decided to build an on-chain credit market because we believe DeFi is a transformative industry that will require credit to grow.

Having previously worked in commercial lending and traditional finance, we know first-hand how important credit markets are for innovation. As we fell down the crypto rabbit hole and explored how we could best contribute to the growth, we decided to focus on improving capital flow to direct it to where it can add the most value.

Despite the explosive growth in DeFi, it will not reach its potential without functioning credit markets. Improving the efficiency of lending markets across the crypto ecosystem enables more capital to be loaned out for every dollar deposited—it’s a new function to grow the ecosystem.

The introduction of decentralized credit also rewards good actors by allowing them to build up a reputation in DeFi—which will eventually lower their borrowing costs. Finally, credit will fuel thriving companies who struggle to use overcollateralized loans rather than reinvesting all of that capital back into the business.

DeFi Grows Up

Creating efficient credit markets that serve professional borrowers will help create a more sustainable source of yield for liquidity providers.

While ‘DeFi Degens’ are happy to bounce between flash-in-the-pan yield farms, it remains challenging for long-term focused lenders to earn a competitive yield on their assets. Lending to premium crypto-native institutions like funds, market makers and miners represents a more sustainable source of yield than “coin pumps” in yield farms.

There’s an emerging trend of DeFi products built for patient investors. Just as DeFi Index Funds provide passive exposure to DeFi tokens, decentralized corporate debt pools represents a real improvement for the majority of investors that seek set and forget solutions.

As DeFi matures past the fast-money casino of 2020, a growing number of institutions will begin to use crypto-native products. As a result, it’s easy to envision how decentralized credit markets will initially serve crypto native companies in the short term. But the potential reach and application of decentralized credit markets extends well beyond.

Just as BTC has crept into corporate treasuries, it’s only a matter of time before DeFi primitives like decentralized credit markets start making its way into the traditional world. One billion at a time.

Action steps

- Understand the prospects of corporate debt markets in DeFi

- Dig into Maple and hop into the discussion via Discord

Author Bio

Sid Powell and Joe Flanagan are co-founders of Maple Finance. They’ve both worked in traditional finance where they participated in $3b+ of corporate bond issuance, established and ran a $200m+ bond funding program, and managed finances at a commercial lending FinTech company.