DeFi needs trust minimized money

Dear Bankless Nation,

Do you want your money stable or trustless?

Previously we’ve had to pick just one.

Stablecoins like USDC have grown to over $40B in the past few years and have become widely adopted throughout DeFi. But there’s an elephant in the room. These crypto dollars rely on central banks, crypto banks, and the traditional financial system to hold and issue—they’re not trustless—they may be digital dollars with crypto superpowers, but they’re not bankless.

And we can’t build a new financial system if we’re relying on the legacy institutions.

Don’t get us wrong—crypto dollars are great. They’ll have a role in our decentralized future. But they fall on the stable not trustless end of the spectrum.

ETH lands on the other side of the spectrum. It’s trustless not stable. On the Ethereum network, ETH has no trust dependencies. It’s baked into the base layer. Unfortunately, this also means ETH is extremely volatile which is not ideal for a money.

Here’s the question: what if we could design a stable, trust-minimized form of money?

What if we could remove the volatility from ETH while keeping it trustless?

Wouldn’t that be the holy grail?

That’s the goal of Reflexer Labs and RAI is how they hope to achieve it.

Let’s dig in.

- RSA

THURSDAY THOUGHT

Guest Post: Stefan Ionescu, Cofounder of Reflexer Labs

Why DeFi Needs Trust-Minimized Ethereum Stable assets

Stable assets are the bedrock on top of which decentralized finance has flourished in the past few years.

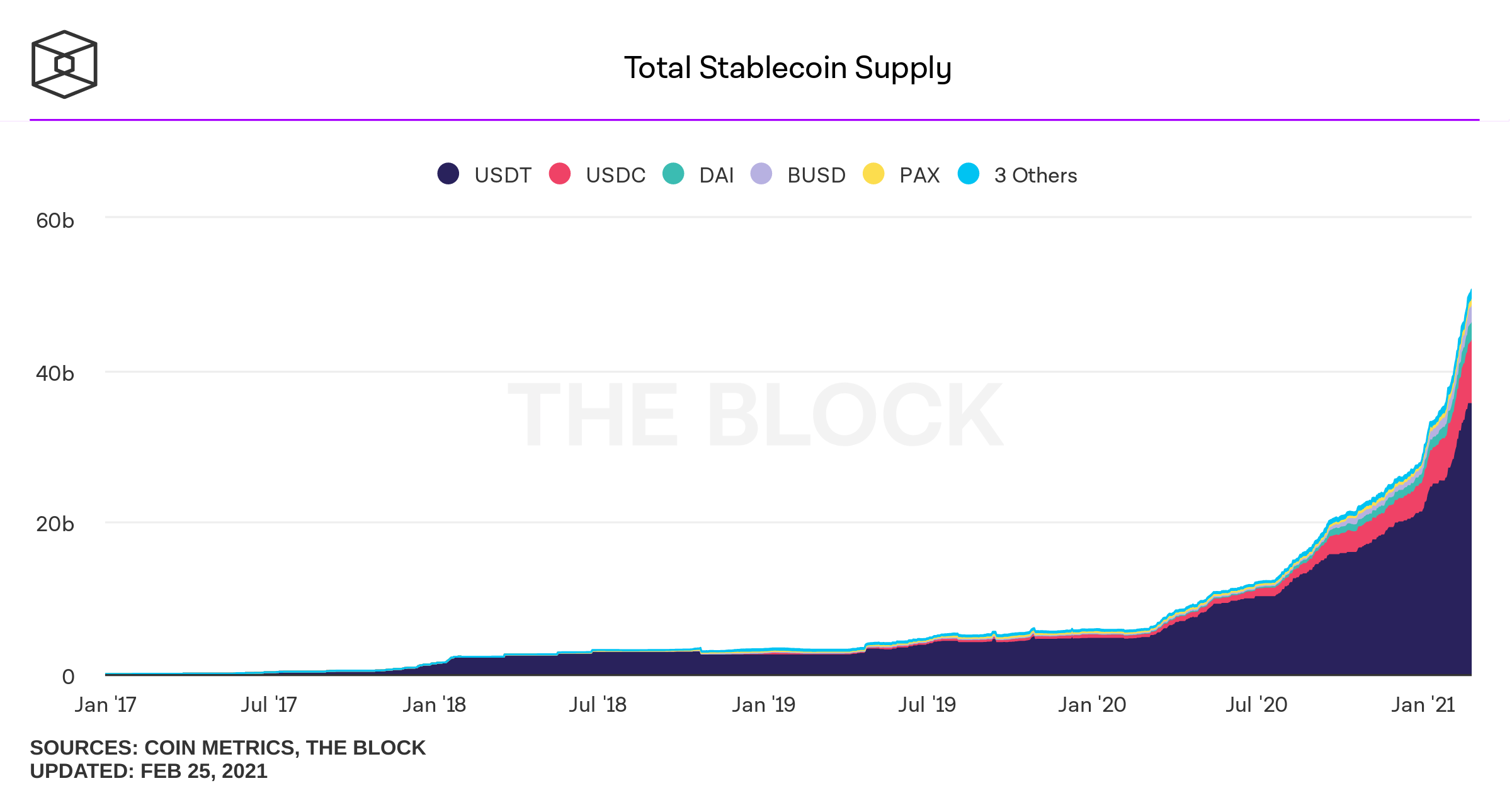

In 2020, the total market cap of stablecoins grew from $5B to more than $20B and exploding to over $40B in the early innings of 2021. The biggest winners were fiat backed stablecoins such as Tether and USDC which are now some of the main entry points for new users to experience the innovation happening in DeFi.

This sudden growth fueled more use-cases than ever before and incentivized builders to experiment with new models to bootstrap stable assets. At the same time, DeFi started to attract attention from regulators who looked to pass laws that can hamper open financial innovation.

The best way to stop a revolution is to aim at its source. In DeFi’s case, you’d have to regulate or forbid the use and creation of stablecoins. Like any other obstacle our industry has faced, this can be circumvented with innovation and by eliminating trust assumptions from the protocols we build.

The Need for Trust Minimization

An example of a bill that was proposed last year targeted at the stablecoin sector was the STABLE Act. If the Act were to pass in its current form, stablecoin issuers would need to obtain a federal banking license as well as jump through multiple hoops in order to comply with financial regulations.

Even though it may have been proposed with good intentions, the STABLE Act is just one of many more-to-come examples which gives an unfair advantage to existing, large players like central banks. In contrast, the main goal of stablecoins is to foster the creation and adoption of a parallel financial system that is open, transparent and efficient.

Many developers, including myself, were attracted by the prospect of building money legos on top of a foundation that cannot shift beneath us. This foundation is being attacked and the way to protect it is to build stable assets with minimal trust assumptions.

Trust minimization goes hand in hand with social scalability. It is easier for someone to adopt a currency if they know that they don’t need to trust a 3rd-party with its management and creation. Consequently, money is more useful when it is censorship-resistant, meaning that everyone is free to do whatever they please with it.

Circling back to crypto, you can clearly see that developers are attracted by protocols such as Uniswap and Sablier which, even though they are not money, they act as neutral layers to manage value and build more sophisticated applications on top.

These protocols are even more attractive when they leverage trust minimized monies, because the hard work of a developer that integrates with them cannot be ruined by any piece in the stack. This is an example of how governance minimized stable assets can be the source which contributes to the usefulness and security of everything that’s built on top of them. Trust-minimized foundations enable further trust-minimized applications to be built.

In addition to social scalability, minimizing trust contributes to the overall security of a protocol. Protocols that can be governed will attract different ambassadors, each one with their own biases, motivations, and opinions on how things should change. The possibility of changing a protocol, while useful, opens the door for malicious parties to intervene and modify the rules in a way that benefits them at the expense of everyone else.

Removing control from a protocol ensures that everyone is treated equally and few or no conflicts arise that can put the protocol in danger. Similarly, removing control from a platform meant to issue a stable asset can give more confidence to people using it.

Sliding Down the Protocol Sink

The degree of trust minimization for a stable asset can be determined using The Protocol Sink Thesis. This thesis uses utility and attack surface to determine which protocols are more “dense” than others. A dense protocol falls further down the “sink” and is able to attract and support more applications without disrupting their operation. The utility of a protocol brings the need to shrink its attack surface which in turn makes the protocol even more useful.

In order to build censorship resistant monies that slide further down the sink, stable asset issuers can guide their design decisions using the Uniswap Philosophy. This philosophy is a set of principles embedded in Uniswap which made it one of the most successful, trustless and widely integrated money legos.

- Let’s start with the automation principle. Uniswap does not need any outside input in order to function properly. The rules are clearly defined in the code and every participant knows what to expect when they interact with the smart contracts. While it may not be possible for a stablecoin crypto asset protocol to be completely automated, it can have clearly defined bounds for what is possible to change as well as a public roadmap to progressively become trust minimized.

- The second principle is self-sufficiency. Self-sufficiency is important because the protocol ensures its own survival simply by being used and without the need for benevolent actors to intervene. A protocol should be able to produce enough cash flow to attract more capital as well as offer rewards for updating its components (for example, oracles). Alternatively, a protocol may require that users pay for its maintenance when they interact with it.

- The last principle is the minimization of external dependencies. Protocols that have few or no connections to other applications have a smaller attack surface and thus they expose user funds to less risk. At the same time, the disadvantage of isolating a protocol is that it cannot benefit from the power of composability. There is a balance though: if every dependency is trust minimized, the possibility of an attack is reduced. All in all, stable asset creators need to weigh the different tradeoffs of integrating with other components.

A Hidden External Dependency

One external dependency that all stablecoin projects have is the peg, which is usually meant to represent a fiat currency (such as the US Dollar) on-chain. Pegging to fiat, although popular, is the main reason why regulators are paying more attention to stablecoins. On top of this, pegging to another currency makes a stablecoin’s fate reliant on it.

If we don’t peg, then how are we going to achieve stability? It’s an interesting question because when you look at popular currencies that other projects peg to, you will notice that they are not by themselves pegged to anything. This leads to an even more important question: is it possible to design a crypto-native stable asset that, similar to many fiat currencies, is not pegged to anything and is still considered “stable”?

An early experiment shows that it may just be.

RAIsing the Standard for a Stable Asset

The experiment mentioned above refers to Proto RAI, a demo of the recently launched RAI stable asset.

RAI was built on top of the principles contained in the Uniswap Philosophy.

It is a non-pegged, ETH backed stable asset which is meant to be governance minimized according to a specific schedule and following very detailed guidelines. It is also a new way to think about “stability” in the crypto space without having to bind a stable asset to an external reference point such as the US dollar.

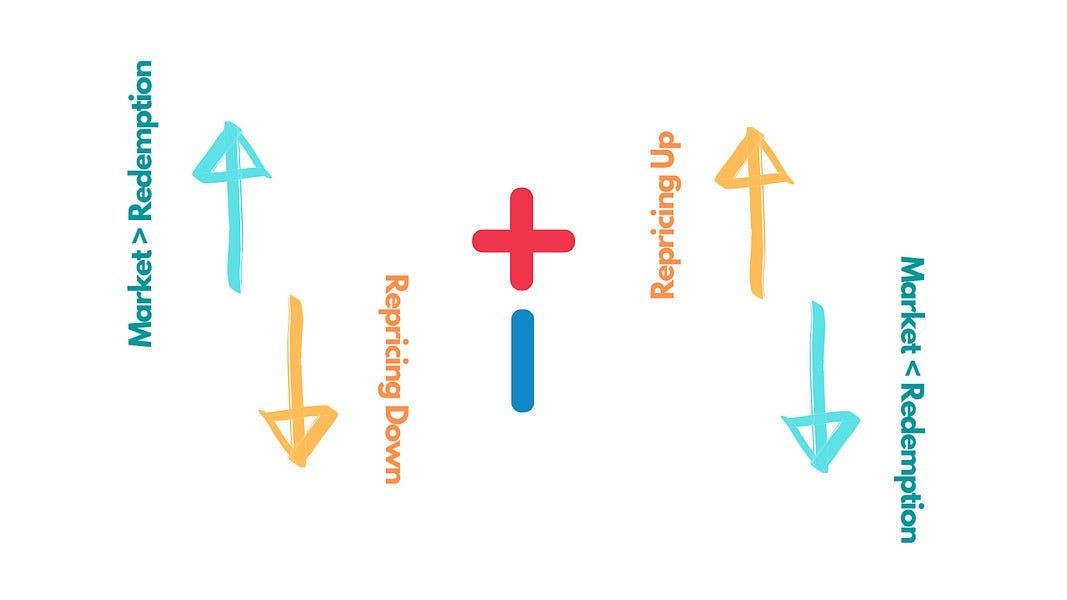

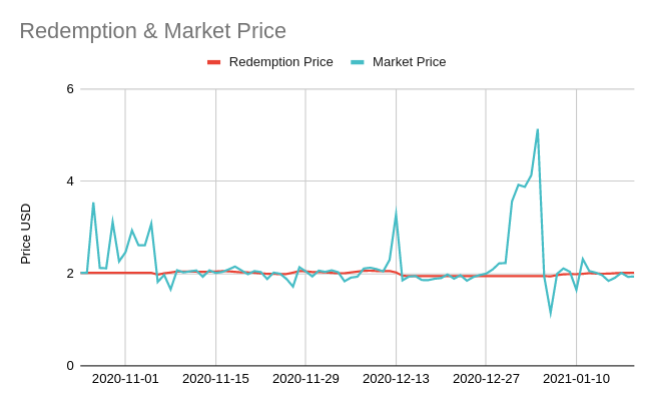

RAI employs principles from control theory in order to stabilize itself. Its “moving peg” (or as I call it, the redemption price) can start at an arbitrary price (such as pi) and then the “peg” changes according to what RAI’s market price is on exchanges. The simplest, although not fully accurate way to describe RAI’s mechanism is as follows: if the market price of RAI is above the redemption price, the protocol will determine how fast the redemption price will start to go down.

This means that each unit of RAI inside the protocol will progressively be worth less compared to one unit of ETH. Concretely, this means that each RAI holder will start to lose value and they are encouraged to sell, whereas each person that minted RAI using their ETH is encouraged to mint even more.

On the other hand, if the market price of RAI is below the redemption price, the protocol will determine how fast the redemption price will start to go up. This means that each unit of RAI inside the protocol will progressively be worth more compared to one unit of ETH. Moreover, it means that each RAI holder will start to gain value and they are encouraged to buy more RAI, whereas each person that minted RAI using their ETH is encouraged to repay their positions.

In this game of “moving the peg around”, a change in the redemption price does not immediately result in a market price change. Rather, this is a game of expectations.

For example, if I see the redemption price moving up and I don’t do anything, at some point someone who understands what the protocol is doing can start to buy more RAI (go long on RAI). Buying more RAI in this case is a self-fulfilling prophecy: if enough people go long on RAI, the market price will start to go up and follow the redemption price which has already appreciated. This results in a net gain for RAI holders and a liability for people who minted RAI with ETH because they now need to buy RAI at a higher price in order to close their positions.

In the other scenario where the redemption price is going down, someone who’s watching the protocol can start to short (or sell) RAI. Selling will make the market price go down and this way it will follow the redemption price which has already depreciated. This results in a net loss for RAI holders and a gain for people who minted RAI because they can now buy RAI from the market at a cheaper price than before and close their positions.

Aside from the redemption price, there is another, more important component in the protocol which is called the redemption rate. This is the pace at which the system modifies the redemption price and it gives everyone an idea of what “yield” they can get by going long or short on RAI. As an example, the protocol can say that the redemption rate is 0.5% per day, meaning that the redemption price will be 0.5% higher in 24 hours compared to the value it has right now. The redemption rate is a signal of whether it is worth it for you to long or short RAI (compared to taking other, unrelated opportunities in the market) and it entices people to take action with the system.

The Value of RAI’s Design

After this entire walkthrough you might want to know: why build RAI instead of simply pegging to a currency and call it a day?

It’s because this design has the potential to solve a couple of problems that are present in current stablecoin systems. One major example is the lack of negative interest rates which could have helped a stablecoin like DAI during Black Thursday. Something like a negative redemption rate would have devalued DAI, and in turn, DAI holders would have been incentivized to sell and bring the market price down.

A secondary effect of the redemption rate is that the protocol can create more or less demand for minting RAI even if people do not lock or withdraw collateral from the system. This is important because it means that the protocol has more discretion in setting its own monetary policy and thus attract or repel capital whenever it is needed.

It also means that RAI does not fully depend on constant demand growth for locking ETH inside the protocol and can instead create its own incentives for keeping itself stable.

A third argument for RAI is that its design can help make the system credibly neutral. There is no need to use bank stablecoins (such as USDC) as a collateral source in order to encourage RAI creation. This avoids the scenario where RAI becomes dependent on the fate of fiat backed coins and instead manages to detach itself from the traditional financial system.

The Ideal Stable Asset

At this point you might ask yourself: if a stable asset is trust minimized and has minimal external dependencies, is it somehow “better” than other alternatives?

The simple answer is that it depends who you ask.

Some people may prefer flexibility and opt for being able to upgrade a protocol in the long run. Others will choose the trustless option where, no matter what our differences may be, each one of us is free to leverage a protocol however we see fit and without thinking about how the rules may change.

Both paths have their own merits and together they will contribute to a better future for DeFi.

Action steps

Explore Reflexer Labs’ RAI design

Bankless Resources on the importance of trust minimization

Author Bio

Stefan Ionescu is a Cofounder of Reflexer Labs. Reflexer set on a mission to build RAI, a non pegged, stable asset that will have less governance input as time goes on. Prior to Reflexer, he did his stablecoin R&D while he was a Binance X grantee.