Crypto Fixing Climate Change

Dear Bankless Nation,

The growth of our industry will be divided into two phases:

- First…we need to grow and develop so we don’t die.

- Then…we need to grow and develop so we can change the world.

For the first decade of crypto’s life, it’s been all about growing fast enough so that these protocols, apps, or projects can become self-sufficient and anti-fragile.

Lots of early projects didn’t make it through their bootstrapping phase and are relegated to history.

Many projects are still around in varying degrees of maturity and robustness, and new projects are built upon the strong foundations available to them, thanks to the success of the projects that have persisted over the years.

Now for the first time in crypto’s history, some projects have completed their original developmental roadmap, and are now asking themselves “What next?”.

When a project finishes its technical roadmap, i.e. the smart contracts are ‘done’, all the integrations are complete, the oracles are hardened, etc, it then turns to its purpose roadmap. Apps must ask themselves “Now that we’ve created this powerful DeFi protocol, what should we do with it? Where should we direct this power?”

This is the current state of MakerDAO, which is the project that is perhaps the furthest along in its maturity and development.

Rune Christensen, the founder of MakerDAO (and now just another guy in the community) recently posted The Case for Clean Money on the MakerDAO governance forums. (Here’s our podcast to go with it)

Rune’s post outlines the argument about why it’s rational for MakerDAO to take direct action towards turning MakerDAO into a DeFi application that finances and serves climate-aligned capitalism.

The evidence that MakerDAO is ready for this move is clear, as France’s third-largest bank, Societe Generale, is already making governance proposals to the protocol to accept SG’s collateral, allowing them to tap into the power of Maker as a credit facility.

That’s right—legacy financial institutions are requesting access to MakerDAO in order to access capital not otherwise available to them.

With great power, comes great responsibility, and Rune Christiansen thinks that Maker should use this power to finance climate aligned companies and

From Rune’s proposal:

Stablecoins are what they eat

A Dai stablecoin backed by sustainable and climate resilient collateral is one with a powerful climate aligned brand. In a world that’s critically challenged by the climate crisis, demand for Dai will grow in line with the growing success and relevance of its collateral. The climate crisis is beginning to have a profound impact on people’s identity and personal lives - in particular the youngest generations - as exemplified by this recent study showing that more than half of young people believe humanity is doomed 56 Percent of Young People Think Humanity Is Doomed

With Great Power Comes Great Responsibility

DeFi applications and crypto-economic protocols at large are powerful. When something is powerful, it means that it can impart change upon the world around it.

The more powerful something becomes, the more change it can impact.

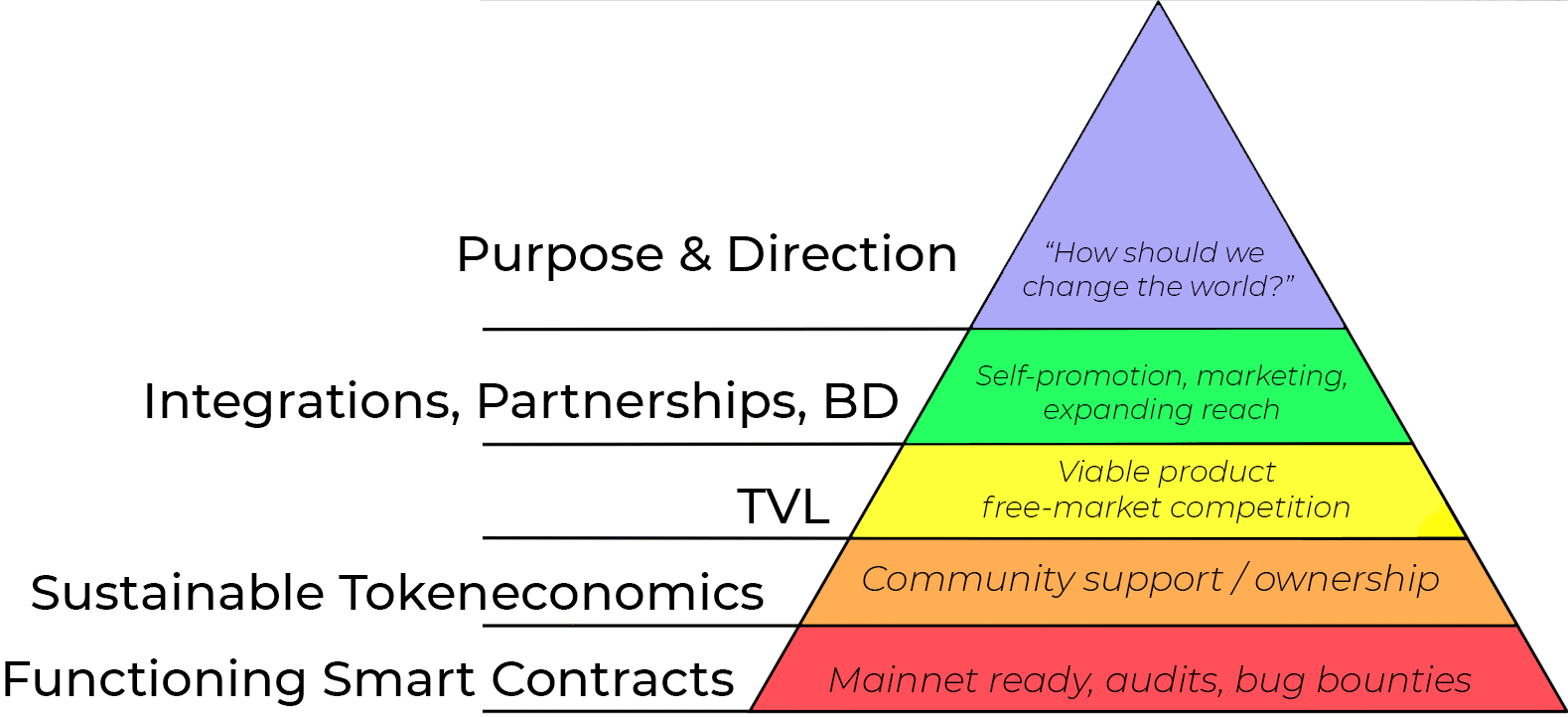

Here’s a fork of Maslow’s Hierarchy of Needs, but reconstructed for DeFi apps. As DeFi apps become stronger and more sustainable ecosystems, they progress towards their big question which is “How and where should we point the power that we created?”

Many DeFi apps might choose to not even ask themselves this question. Indeed, having purpose and direction is actually a political choice that many projects and teams might not ever want to deal with. There are plenty of climate-change deniers out there who might think that Rune’s proposal to have Maker specifically help finance climate-aligned projects might not be in the best interest of the organization, and might actually harm the growth of Maker.

Additionally, making the political choice to change the world in a subjective way also goes against the protocol sink thesis, which states that the most ‘politically neutral applications are more scalable and easier to build upon’.

By Maker choosing to become a climate-aligned protocol, it forces climate alignment upon every single DeFi app and user who integrates with DAI or Maker Vaults.

If Maker were to chose to go in this direction and begin focusing on establishing green real-world collateral inside of its contracts, that would force climate alignment upstream to every DeFi app and user who uses DAI or Maker’s Vaults. Yearn, Compound, Aave, PoolTogether…just to name a few.

Do these apps want Maker to make that political choice for them?

Will they even care?

The Case for Maker Maximalism

One critique of this decision is that this is not a politically neutral choice, and it’s potentially putting climate alignment ahead of MakerDAO success in terms of priority. Maker is choosing to ignore many possible revenue streams from ‘dirty collateral’ by only focusing on one possible revenue stream, which is ‘clean collateral’.

However, I think there is a case that the climate-aligned strategy is actually the optimal one, in terms of MakerDAOs success, and that this strategy can actually be appropriated by the entire DeFi stack for the benefit of the entire ecosystem.

Marketing and PR

There’s a lot of people out there that hate the world of money and finance, believing that capitalism is the bane of all existence.

Maker’s choice to put climate alignment at the top of its priority list offers an opportunity to change the narrative about the perils of finance. No longer does finance disregard its role and responsibility towards our planet and our humanity; DeFi is taking its power seriously and directing it towards saving the planet.

Oh, but old finance? The banks of the world?

They don’t care about climate. But maybe DeFi will.

That’s why you should ❤️ DeFi.

Regulatory Shield

It’s going to be a lot easier to fight the regulatory fight if DeFi becomes branded as this climate-aligned financial ecosystem. If we, as an industry, manage to brand ourselves as the “industry that is financing climate change,” it puts up a massive protective shield against any would-be regulator who tries to do harm via bad regulation.

Simply put, being climate aligned wins over a ton of general public support.

So while the choice to be a climate-aligned financial stack might be a political one, it actually also might be the best strategic choice. It could win our industry a ton of allies, both on the regulatory front, but also simply by generating positive mindshare throughout the households of the world.

Crypto is becoming increasingly cooler rather than being a place of shadowy super-coders, and industry-wide adoption of climate-change principles can really propel DeFi into a new place in the public consciousness.

Crypto is ready for what’s next

Overall, whether or not Rune’s proposal makes it through Maker governance, it still signals that our industry has concretely moved into a new phase of development.

We are no longer looking inwards to see how we can make ourselves better. Now, we are looking outwards and seeing how we can make the world better.

With great power comes great responsibility, and nothing is more powerful than an open-source financial ecosystem of unfettered capitalism that also has a desire to change the world.

There are global problems out there that require global solutions, and crypto has the potential to rise to the scale needed to provide these global solutions.

Crypto was birthed into the world weak and immature.

It asked the rest of the world “please don’t kill us”.

Twelve years later, crypto is ready to go toe-to-toe with some of the world’s largest problems, and there are organizations willing to take this fight head-on.

It’s time to change the world.

- David

Action Steps

- Execute any good market opportunities you saw

- Listen to The Future is MakerDAO | Rune Christensen