Crypto can fix public goods

Dear Bankless Nation,

We rely on governments to solve market failures—they’re supposed to solve problems like information asymmetries, negative externalities, and underfunded public goods.

Governments are supposed to fix things free-market capitalism can’t fix on its own.

But there are problems. Governments are inefficient and solving these market failures can be costly and prone to corruption. This is a reason why politicians are always advocating for higher taxes for the social good…

And I don’t need to tell you this, but it’s not looking like our politicians will solve big societal problems anytime soon.

But crypto can. It can offer a better, more effective alternative to public institutions.

Quick example: with crypto, we can mitigate information asymmetry in markets—everything is immediately viewable and verifiable by the public at any time.

The SEC mandates corporate transparency in audited quarterly financials.

But crypto gets this data on-chain for free 24/7.

And that’s just scratching the surface.

Web3 can solve our biggest market failure and public good problems.

Donovan explains.

- RSA

How Blockchains Solve Market Failures And Public Goods Problems

On a high level, governments should provide public goods because they are too important to be left to free-market capitalism.

Ask an economist, however, and the explanation is a tad more technical. The premise of governments providing public goods is oriented around two main theorems:

- The first theorem starts with a set of assumptions about what an ideal market would look like when it is fully competitive and perfectly efficient.

- The second theorem states that when there is a deviation from the first theorem (i.e., market failures), governments should intervene to restore efficiency.

Therefore, by pointing out that real-world markets are bogged with inefficiencies and collective action problems, this technical theoretical toolkit that has dominated the economics discipline through the 20th century provides the ideological justification for governments to adopt an active role.

Markets are great, but its many problems — market failures like information asymmetries, negative externalities and underprovision of public goods (or positive externalities) — are everywhere and just waiting to be solved by prescient policymakers.

Here’s a twist: Government interventions aren’t as costless as economists imagine it to be. In theory, incorruptible, selfless public servants with no knowledge problems are carefully modulating the economy in the name of the public interest. In practice, charismatic buffoons get elected into office by the unwashed masses, face perverse incentives, and are subject to regulatory capture.

It turns out that the costs of democracy may be so costly that imperfect markets are sometimes preferable. Suffice to say, public policy is the art of choosing between two imperfect alternatives.

But blockchains offer a third solution

Blockchains offer a credible, third alternative. Many of the collective action problems that pervade politics and real-world markets are fast being solved in Web3.

Public blockchains like Ethereum are immutable, publicly accessible, and programmable substrate that excels at facilitating human coordination on a global scale.

Unlike the opaque inner workings of the administrative state, or the coordination failures of markets, blockchains are transparent and its smart contracts incorruptible after deployment. This gives it a good chance to solve the perennial problems of principal-agent accountability that have plagued our existing institutions.

Blockchain technology today isn’t perfect.

But already its existing uses are developing many viable working models that can replace and make many traditional functions of governments obsolete.

Here are 3 examples that are in production, today.

1. Stablecoins solve informational asymmetries

Take the market failure of information asymmetry. Extensive financial regulations today try to eliminate information asymmetries by binding banks to transparent and fixed reporting standards so it offers investors certainty about the underlying security of assets.

This gets at the heart of the regulatory hoo-ha surrounding Tether. In theory, USDT should be backed by an equal amount of dollar-denominated assets.

But in practice, no one really knows.

USDT is controversial because the robustness of its financial backing lacks transparency. Bloomberg investigated Tether’s financial backings only to find it shrouded in mystery. It’s no surprise then that stablecoins have invited intense scrutiny from U.S. regulators.

With blockchains, the solution is simple: Issue the stablecoin on the public ledger.

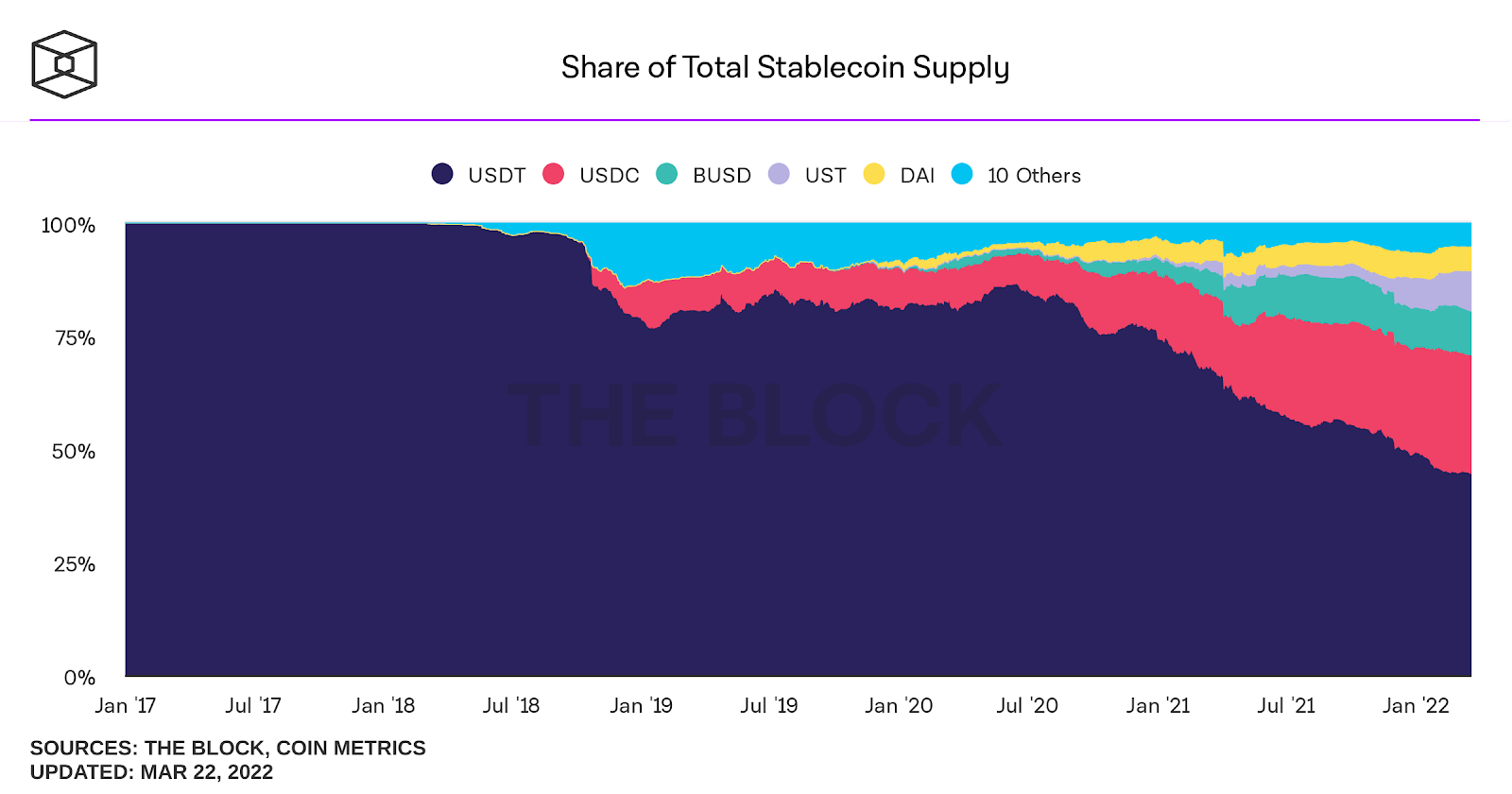

Today, dozens of decentralized stablecoins such as MakerDAO’s DAI, Terra’s UST or Frax Finance’s FRAX are doing just that. These decentralized stablecoins make up ~20% of the total stablecoin market in market capitalization.

Because they exist on the blockchain, the backings of these stablecoins are transparent and publicly accessible. Analysts, journalists, and concerned citizens can verify for themselves the financial backings and overcollaterization ratios of stablecoins and determine the risk independently, instead of waiting for quarterly reports which when released are akin to lighting dynamite fuses to stock prices.

2. Decentralized identities and occupational licensing

Another example of government laws that are designed to solve information asymmetries is occupational licensing — consumers use them as a signal to discern competent providers from swindlers and bad apples.

We think of occupational licensing as necessary for lawyers and doctors. But did you also know that in the US alone, occupational licensing extends to at least 1,100 different occupations, including low-skill professions like massage therapists, barbers, and florists?

This heavily-captured economy means that average Americans spend years and thousands of dollars jumping through regulatory hoops to acquire a silly license in order to make an honest living. As with many government laws, they start with good intentions, then unravel into a monstrosity over time.

Coming to the rescue are decentralized identity systems on blockchains (AKA Proof of Personhood Passports) such as Proof of Humanity (PoH) and BrightID.

The basic idea behind this technology is that identity creation and verification can be performed on a decentralized blockchain network by having other users vouch for you. Users within such a reputational system (or a web of trust) have a financial stake at hand to make correct verifications, making it hard for malicious actors to be verified by other trusted nodes.

Think of it as a right-click-saver trying to pass off as an actual CryptoPunks holder — the blockchain ledger immediately exposes their facade.

Decentralized identity systems make reliable information available and therefore render occupational licensing laws redundant. A person’s reputation and their job experience can be verified by anyone on the ledger, obviating the need for a state bureaucracy to issue a licensing regime that is vulnerable to regulatory capture by corporate lobbies.

In one fell swoop, blockchains provide the public good of information ubiquity, offering a practical solution to the market failure of information asymmetry.

3. Blockchains fund public goods efficiently and in neutral ways

Public goods problems are another area where blockchains are proving extraordinarily helpful. Traditionally, public goods provision is inefficient because of coordination failures arising from unequal preferences and spending power.

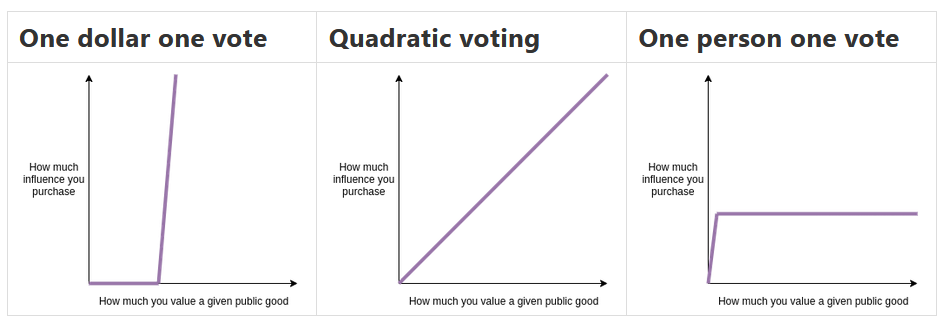

Consider how markets provide public goods. In the above graph, they resemble plutocratic systems of “one dollar one vote”. That’s unfair because it privileges the preferences of the wealthy. The poor can turn to crowdsourcing solutions, but they’re still forced to shoulder a disproportionally larger fiscal burden.

How about creating public goods in a political democratic system of “one person one vote”?

It sounds fairer at first, but the outcomes don't fare much better. When everyone’s voting power is capped to one vote, the people whom a public good really matters greatly for (think microloans for disenfranchised minorities) are powerless at advancing its production. When every schmuck is automatically entitled to a vote, widespread voter ignorance also cancels out the wisdom of informed voters.

In both cases, public goods provision runs into coordination failures because the intensity of preferences, differences in spending power or the wisdom of the average person are moot variables. The outcome is the underprovision of a valuable public good.

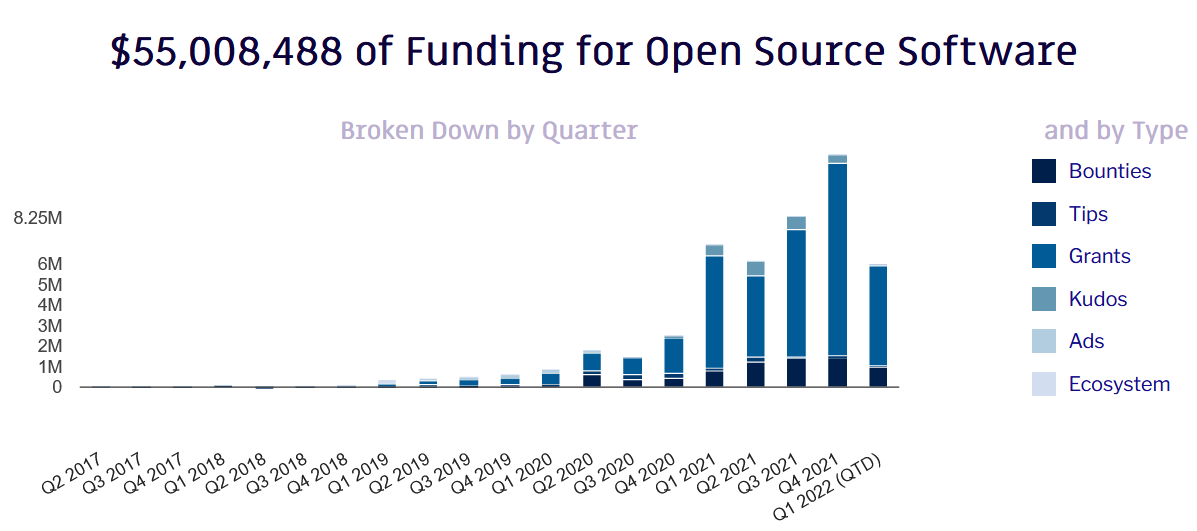

On this front, blockchain protocols like Gitcoin are fast making history of public goods problems. Gitcoin employs a quadratic funding formula that scales funding in a democratically efficient way. They do this by matching every single donor’s contribution with the deep pockets of large foundations. The idea is that if a wide group of people signal the value of a public good through their willingness to pay, then it makes sense to prop them up with institutional funding.

In effect, Gitcoin offers the best of both worlds: it effectively aggregates preferences in public goods while at the same time incentivizing the rich to pay a fairer share.

To date, Gitcoin has raised $55 million in funding across 2,410 open source projects!

What makes Gitcoin different from a fundraising platform like GoFundMe that might also employ quadratic funding? Here is where the “blockchain” part matters. Because Gitcoin is a decentralized application on a blockchain, it coordinates willing funders together while minimizing the need to trust centralized entities.

Crypto-skeptics dismiss the benefits of decentralization. But when Canadian truckers raised millions in protest of the Trudeau government’s vaccination mandates last month, the centralized fundraising platforms they used either blocked them or were shut down by the courts.

From a user perspective, this too was a classic problem of informational asymmetry. Donors who believed in the Canadian trucker’s cause were donating to platforms without any idea if their monies will securely be transferred because of the platform’s political bias or external regulatory clampdowns.

In short, blockchain-based protocols like Gitcoin not only raise money more efficiently but also provide a credibly neutral way for individuals to fund and build public goods.

Blockchains reduce negative externalities

Gitcoin’s ingenious use of quadratic funding doesn’t only solve public good problems, it also solves the motherlode of market failures: Externalities.

Specifically in this case, the inefficiency of government taxation.

While public goods are generally useful, not everyone values or uses them equally. Politicians try to justify ever-increasing tax-and-spend policies by couching it in collectivist rhetoric like the “public interest” or a “social good”, but these euphemisms are frankly nonsensical.

Even if people pay equal taxes, people do not consume equally (and vice versa). Childless taxpayers are forced to subsidize public schooling education for parents. The risk-averse who live healthy and save for a rainy day subsidize the medical bills of the imprudent risk-seeker. Nature lovers who enjoy public parks get a better bargain than digital geeks that prefer the indoors.

The list goes on.

Quadratic funding curbs negative externalities because it raises money more efficiently than broad-based taxes, thereby reducing the cost on less willing payers. At the same time, the thousands of public goods that are produced are spinning the wheels of innovation and creating positive externalities for Web3 at large.

Quadratic funding enabled by blockchain infrastructure kills a flock of birds with one stone.

Blockchains are the ultimate public good

There are many more examples of market failures and public goods problems that blockchains are solving which I could point to:

- If Web2’s infrastructure cannot reliably host information, the Arweave blockchain promises to store data forever and make broken HTML links a thing of history.

- If the carbon footprint of proof-of-work mining is too high, proof-of-stake consensus is an attempt to curb that environmental externality.

- If culture is a public good, the tokenization of art on blockchains is opening the door to a patronage economy while availing artists with a viable monetization model.

Crypto-skeptics like to think that pointing out Web3’s existing centralization chokepoints scores them a slam-dunk against its futile quest in decentralization. But what they greatly miss are the relative improvements that blockchains bring to the table.

Blockchain technology offers a credible solution to the many societal problems that our existing outdated and entrenched institutions have struggled to solve. They aren’t perfect - but they are a work-in-progress, the operative word being “progress”, as in human progress. That is a big enough reason to keep an open mind to its development.

Action steps

- Study different market failures and how web3 can solve them

- Read Coordination Failures: Know Thy Enemy