Dear Bankless Nation,

Two questions that are top of mind today:

- Is crypto a tool for sanctions evasion? Crypto isn’t seriously being used by nation state actors to avoid sanctions right now, yet politicians are speaking about crypto as if it is. What’s the truth?

- Are we headed toward recession? Commodity prices are increasing, which materially impacts just about everything. Meanwhile, Putin shows no sign of backing, and Ukraine shows no sign of giving up. High commodity prices are akin to the Fed raising interest rates; doing stuff costs more. Economic activity has more friction. Can the current state of the economy absorb these new costs?

Let’s discuss!

1. Is crypto a tool for sanctions evasion?

Right now, the idea that “crypto is helping people evade sanctions” is at the top of the global conversation.

The coordinated sanctions on Russia have been effective at delivering economic pain for the Russian state, citizens, oligarchs, and Putin alike.

In western media, crypto is being painted as a tool that ‘Putin and his cronies’ are using to evade the effect of the sanctions.

While it’s been made clear that there is no evidence that ‘Putin and his cronies’ are actually using crypto, the point is that they might be able to.

At the same time, western politicians are fearful that Putin might use crypto to evade sanctions, both Ukrainian and Russian citizens are using crypto to protect the value of their savings. We know this from the spike in BTC-Ruble volume, the premium for BTC on Russian exchanges, and on-the-ground reports of people fleeing with crypto.

What I see: the western economic sanctions are harming everyone in Russia; but the Russian citizens can use crypto as an escape hatch, while the Russian oligarchs super-yachts can't fit on the blockchain.

The large wealthy elite gets hit; the citizens escape through crypto.

This is exactly what one would predict would happen, looking at the first-principle fundamentals of how crypto works.

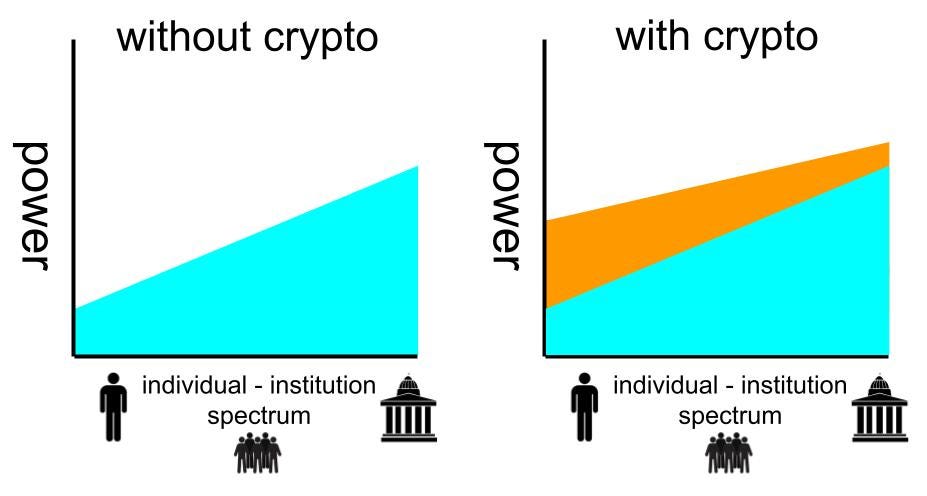

Private keys empower individuals the most. The innovations that crypto brings raise the tide for everyone, but it raises it more for people than it does institutions.

When the USA put sanctions on the Russian central bank, it froze $640b in assets spread out across the world. That’s roughly 1/3 of the crypto market cap.

The innovations and power that crypto brings to the table wouldn’t have protected this scale of wealth from western sanctions. Crypto’s not big enough.

You cannot move $640b in wealth without people noticing, no matter how awesome your zero-knowledge privacy cryptography is.

- The 2016 DAO hacker? Caught via on-chain tracemarks.

- The 2016 Bitfinex hacker? Caught via on-chain footprints.

As soon as the level of wealth is significant, and as the powers of the world care, crypto stops being useful as a tool to obfuscate your activity.

After all, it’s a public ledger.

Crypto disproportionately empowers individuals, not oligarchs.

2. Are we headed toward recession?

Commodity prices are telling a story right now and we should listen.

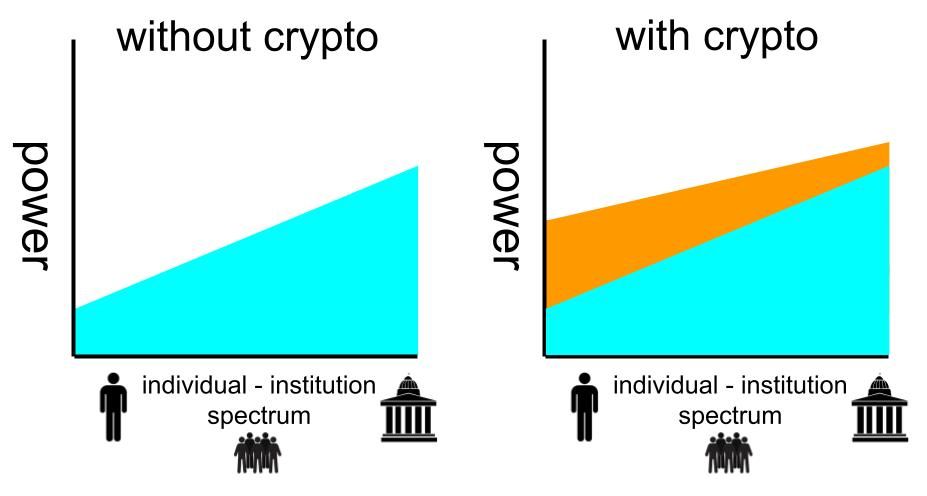

Oil

A significant supply of oil is gone from the market. Now that Russian oil is largely gone from the market, prices are increasing on the remaining supply of oil inflows from other produces.

Meanwhile, some reports have said that Russia is selling barrels of oil for as low as $15, while the global markets price a barrel at $104.

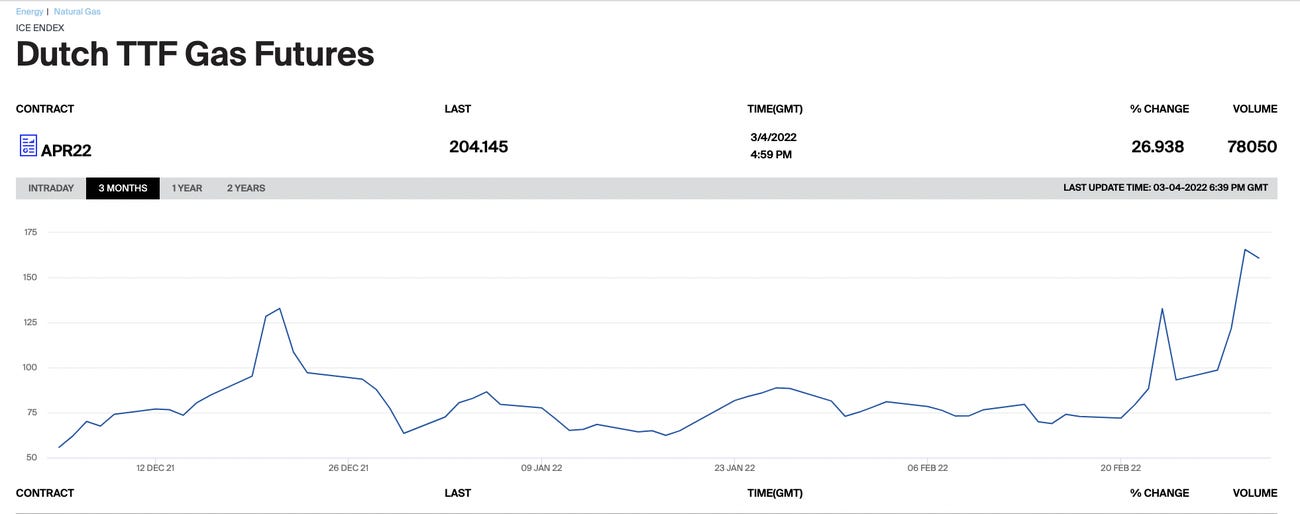

High oil prices impact everything in our economy. High oil prices are like high Ethereum gas fees; it makes all activities more expensive.

Every combustion engine has become costlier to run. Shipping and transportation just got more expensive. General economic activity has become costlier.

Wheat

Russia and Ukraine account for ~30% of the world’s global wheat exports. Wheat futures are up 40%, the biggest weekly rise in decades.

African economists have ‘raised the alarm’ to the potential damage a prolonged conflict between Ukraine and Russia might deal with the continent.

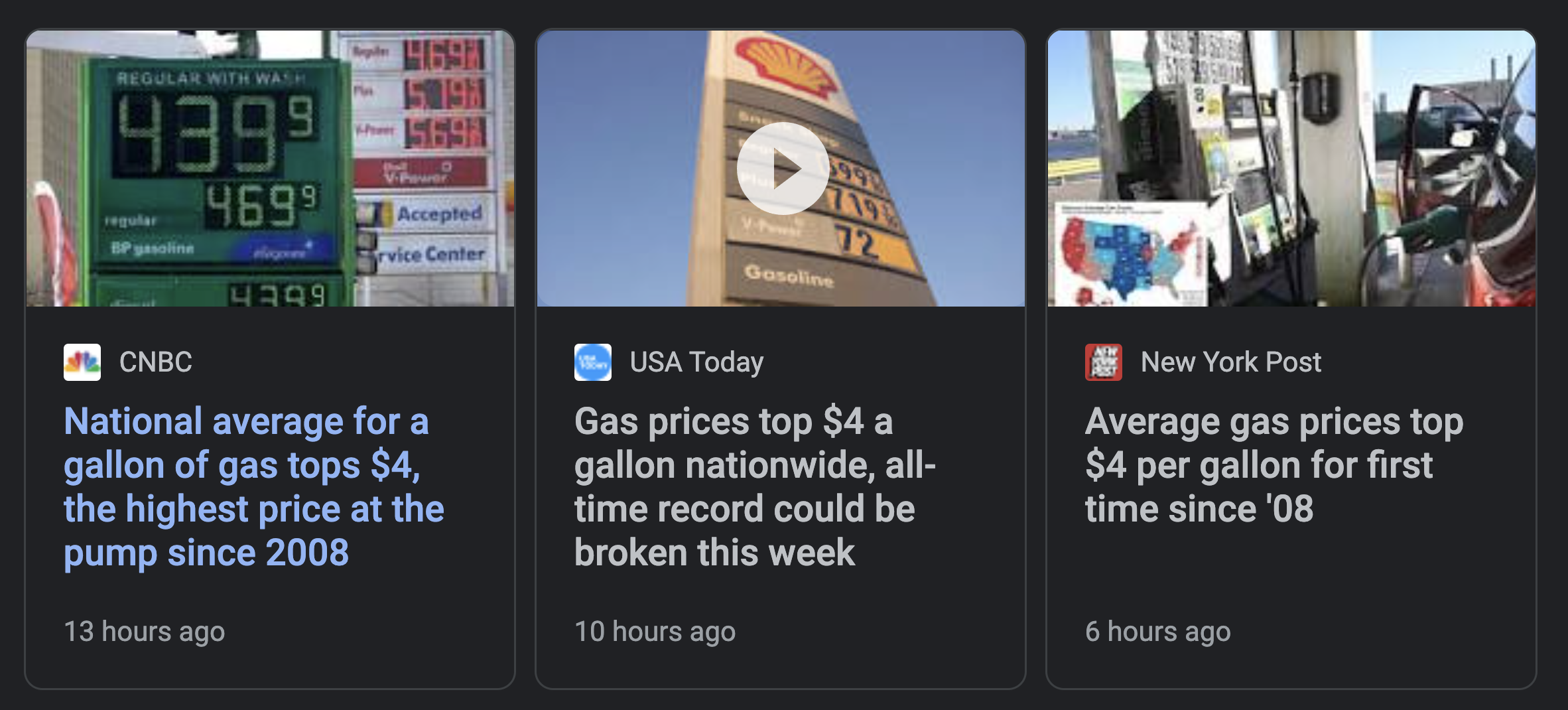

European natural gas

Europe is a huge buyer of energy from Russia, and with Ukraine’s supply of energy threatened, the costs of warming Europe have gone up.

Commodities

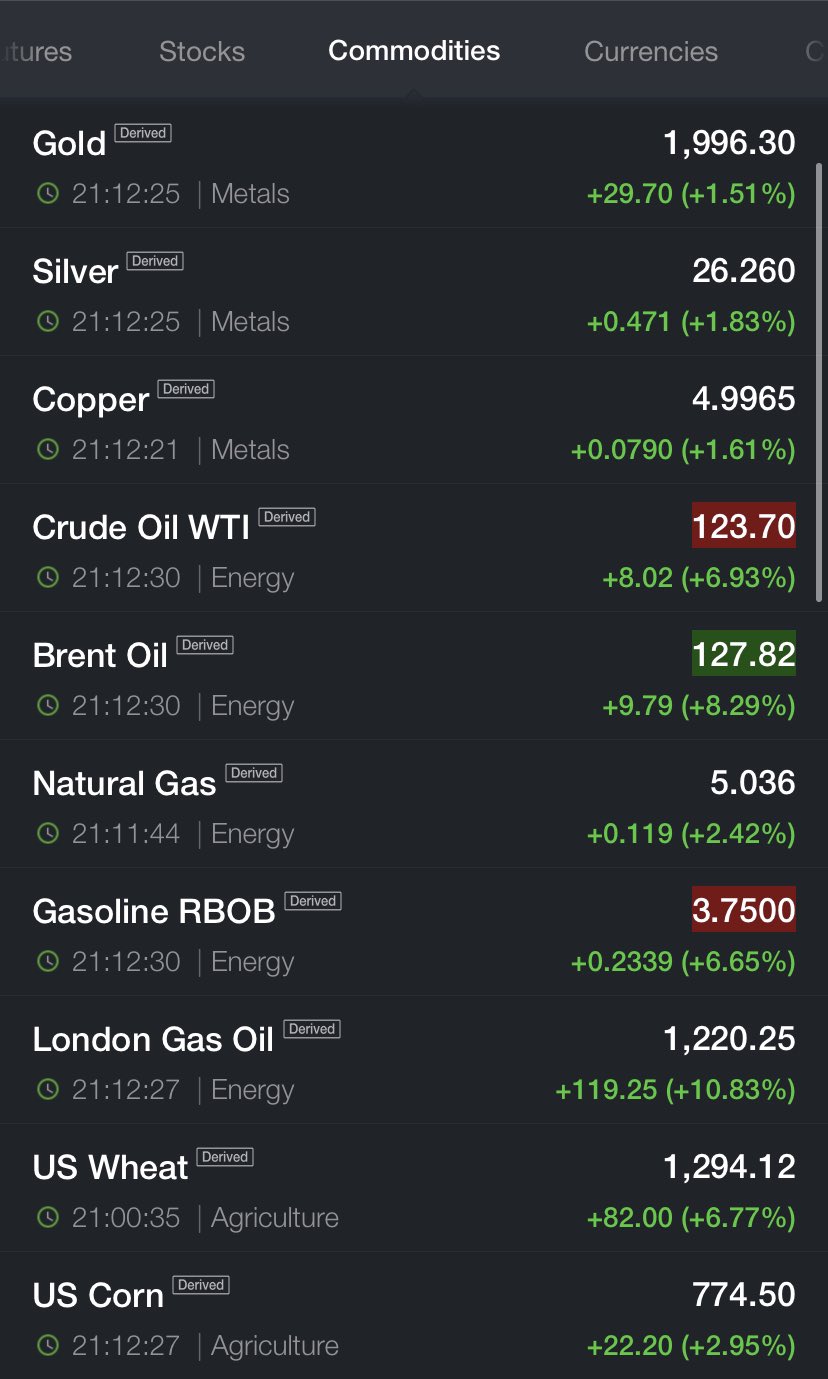

In fact, commodities, in general, are all up.

If increased commodity prices sustain for a sufficient amount of time, it might begin to have serious knock-on effects on global production.

Nic Carter distilled the bearish outlook of high commodity prices here:

Inflation and Supply Chains

There are some pretty nasty stars aligning at the moment. Right as the Fed begins to raise interest rates to combat inflation, a war in Europe triggers a gut-punch to already strained supply chains.

Inflation has already caused disruption in labor supply and business viability. Can businesses survive the knock-on effects of a sustained Russian invasion?

Putin does not seem like he’s giving up in Ukraine. Meanwhile, the unified anti-Russian spirit of the Ukrainian couldn’t be higher and have also been resupplied with new armaments from various European suppliers, 40% of which were willing to accept the donated cryptocurrency as payment.

Both sides digging in for the fight.

There are a lot of moving parts in the world right now, and we’re going to try and untangle them tomorrow on the State of the Nation at 2pm EST (11 am PST).

Kyla Scanlon returns to help us dive into these subjects further. It’s a crazy world out there, but those who stay on the frontier will have the edge.

Set a reminder and tune in tomorrow!

- David