Dear Bankless Nation,

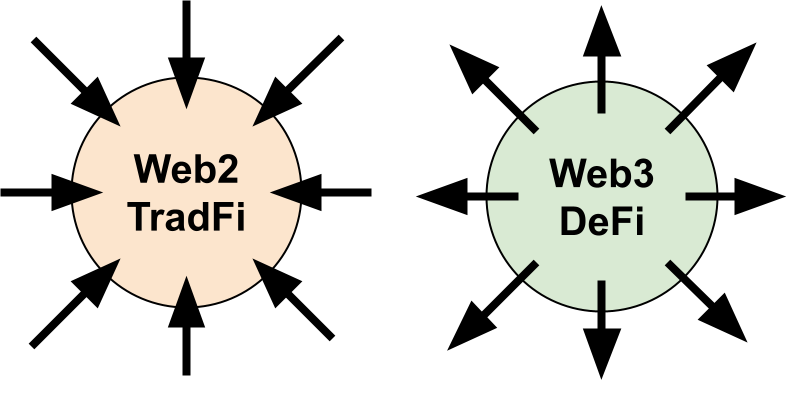

In Web2 and traditional finance, value flows inwards.

Value accrues to the insiders—the founders, the investors, the billionaires.

As a result, it’s created malicious and misaligned platforms that have sucked us in.

But in Web3, this value flow is reversed.

It flows outwards. It accrues to anyone that interacts with it.

This creates a new system that’s better aligned with human values.

And when we create value-aligned systems, our society get better.

Crypto isn’t here to make you rich.

It’s here to set you free.

David explains.

- RSA

Free markets are an incredible force.

They allow humans to come together and produce a global price on something.

“This is how much we value that”, says society, via the market.

But today's 'free markets' aren't really free. Access to markets is gatekept, and the ability for something of value to become instantiated into an asset is permissioned.

Traditional financial institutions worked in the analog world, but the technology that supports traditional markets has lagged behind what society is ready for. People these days associate “markets” with strictly just “finance”, which is a shame because they’re so much more than that.

With just a few new primitives – smart contracts, tokens, and private keys – we have unlocked our innate human desire to express what we see as valuable upon the world.

By aligning personal freedoms with free markets, we unite culture and economics in a new age of expressivity & efficiency.

And cool things can happen.

Captured Markets

Here’s the Grayscale GBTC Chart.

Does something seem missing? It appears… unwhole. What’s with all the gaps?

Here’s the BTC chart on Coinbase where Bitcoin trades 24/7/365:

Ah, much better. Very holistic. Complete. Fully expressed.

The differences between these two charts reflect the different systems upon which this asset is expressed.

The Grayscale BTC trust trades on the traditional stock market, which is only online 253 days of the year. Since these markets are only open for 6.5 hours per day, the value of GBTC is expressed for 19% of the year.

For 81% of the time, the market value of BTC is not being expressed by our legacy platforms. It is silenced.

The Bitcoin system is designed for 100% uptime, enabling the truest expression of the nature of the asset. Yet, the expression of its value is throttled by the medium upon which it trades.

This “feature” of the traditional stock market has left the door open for innovators to build newer exchanges that enable a higher fidelity relationship between markets and their participants. Early crypto exchanges like Coinbase, unbridled by banking hours, spun up 24/7/365 crypto marketplaces, enabling Bitcoin to fully express its unique properties upon its users.

DeFi is doing the same

DeFi didn’t invent finance, but for the majority of humans, it might as well have.

Financial institutions put up walls around their products and services, in order to gatekeep access to their tools of power and control. By charging a toll for access, they can create power for themselves and use it to dictate the future direction of our society.

Where is ‘DeFi’ in the traditional world?

It’s behind the walled gardens of banks and brokerages. When you deposit your USD into Wells Fargo, they take it and yield farm inside the closed doors of TradFi. There’s a world of financial activity behind the wall gardens of Wall Street, only accessible by banks, brokerages, hedge funds, and Nancy Pelosi.

As a result, the majority of us are under their control. If we want to access the financial tools of the world, to get a mortgage, a student loan, a credit card, we must pay them for access.

The inherently free and open institution of the marketplace is currently owned by the few and sold to the many. The place in which we discover what we value is kept away from the majority of society, which restricts people from being able to express their opinions of how our world should look.

Platforms that Enable Our Expression

The assets we trade on various marketplaces are reflections of what we value as a society. It’s not Bitcoin that imparts its value upon us, it’s us that imparts our values upon Bitcoin. Bitcoin doesn’t tell us it’s valuable, we tell Bitcoin that it has value to us.

We provide the value.

We value provable scarcity. We’re the ones that like peer-2-peer money.

Because Bitcoin has properties that align with our values, we collectively produce a price for it on the secondary markets, and it’s important that we have platforms that enable us to fully express the value of the assets we trade.

In addition to having marketplaces that do not throttle our ability to express ourselves, it’s also crucial to have platforms that are unconstrained in what types of assets we can trade.

Tokens.

A “token” is just a vehicle for value. Tokens are empty containers for us to deposit our perceptions of value into. A token is a blank slate of an asset, and it’s up to us to ascribe value to it.

Smart contracts are the language upon which we etch value into these blank slates. The EVM is the writing we use to say “this is valuable because…”

If we want to fully express what we deem valuable in this universe, we need to open up the design space for financial assets. If we want capitalism to more closely align with our human values, we need more assets to trade that aren’t just equities on the stock market.

DeFi tokens. DAO tokens. Social tokens. JPEGs. 1/1s. Membership NFTs. Music NFTs. Memecoins.

How limited are we in our ability to express what we value when the only assets we have to receive that expression are equities, bonds, and derivatives?

Yawwwnnn 🥱

The difference in human value expression between our current options on traditional markets, versus the endless possibilities in ERC20 and 721 tokens is the difference between a dystopia and a utopia.

Fungible tokens and Non-Fungible Tokens.

That’s all of the tokens.

There are no other types of tokens! Between these two token standards, we have the tools we need to create any token that the market decides holds value. Using these tools, humans are enabled to maximally express our human values, using markets that never turn off.

Asset issuance in TradFi is intensive, expensive, and fundamentally constrained, whereas token issuance in DeFi is cheap, easy, and limitless.

We’re going from marketplaces that only work 19% of the time, that only allow for like 3 categories of assets, to unstoppable, all-ways on marketplaces that allow us to freely create any possible type of token we can come up with.

This is how we go from a Wall-Street centric world to a world centered around cultural expression.

This is where we put money into culture, and how we put culture into our money.

Societal Change

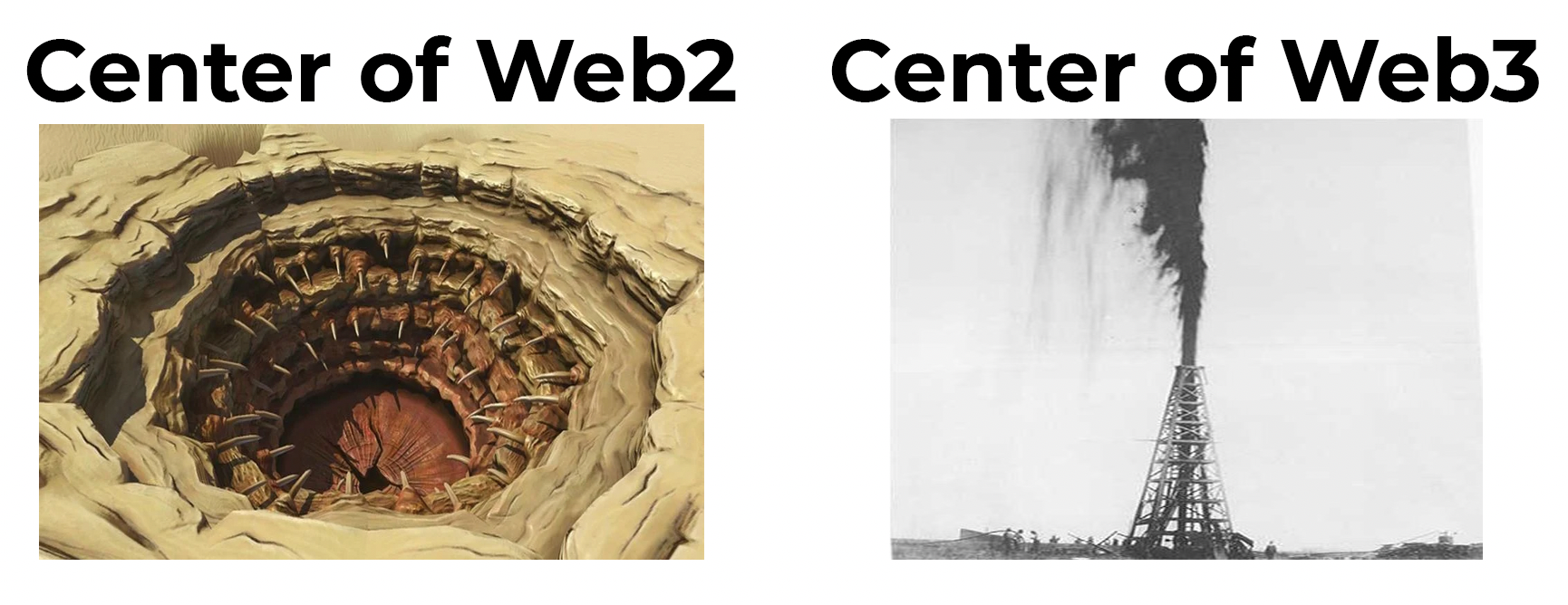

Living inside a paradigm of trust and intermediaries prevents value from being able to flow outwards. When a new source of value is discovered in the world, intermediaries descend like vultures and capture as much as possible.

The tolls that intermediaries take limits how far this value is able to permeate through society. Every intermediary adds friction to this outbound value flow and prevents it from reaching the margins.

Because of this paradigm, the world is one of inwardly concentrating wealth.

This makes the long-term equilibrium of Web2 and TradFi conclude in inner-billionaires competing for power using their respective platforms.

- Jeff Bezos and Amazon

- Mark Zuckerburg and Facebook

- Jamie Diamond and Goldman Sachs

- Sudar Pichai and Google

- Tim Cook and Apple

So much of our lives are captured.

Most of the world’s population are captured by some mechanism, somehow. Banks capture us via interest payments on our student debt and mortgages. As a consequence, we are vulnerable to be captured by our 9-5 wage jobs, which can become a toxic and exploitive relationship as a result. We can become locked down to specific geographic areas, forcing us to engage in domain-specific behaviors we might not otherwise have chosen to express. The net effect of this can even result in being locked by toxic relationships with those around us.

As a society, we currently operate inside of an environment of social structures that extract from us, rather than enable us to be better.

This was not always true.

Facebook created a free and open social network.

Instagram unlocked tons of creative potential.

Twitter unleashed a torrent of free thought.

Double-entry bookkeeping unlocked DeFi in the 1500s!

But as society adapted to the new normal that these social systems brought, they, in turn, evolved from enabling to extractive.

The long-term equilibria of these systems ended up being wealth concentration at the center, which a bunch of vultures on the periphery, and the rest of society at the margins.

New Equilibria via Private Keys

Long-term equilibria of Web3 protocols place power and wealth (which are the same thing btw) at the margins.

While the Web2 TradFi billionaires are summoned to Congress to answer to Nation State whims, Web3 protocols disappear in a cloud of airdrops and community exits.

T-Rexs’ can’t see you if you don’t move, and Nation-States can’t find you if you’re decentralized.

By pushing power to the many rather than the few, these protocols invisibly walk among us. They’re owned by the people on the bus. The mom at the grocery store. The laptops in our bags and the desktops in our homes. They're the tokens in our ledgers, and the cold-storage wallets in our brains.

Access to private keys is essential for this new equilibrium to emerge.

Previous systems of value did not favor the individual. Gold was large and heavy. Fiat has back-door theft via the money printer. Equities are held in brokerages. And ownership over these assets comes down to court rulings, which is a 3rd party that can be influenced.

Cryptography puts power into the hands of the individual. With cryptography, we rely on math and math alone. No one else.

Private key cryptography enables self-sovereign property rights to exist at the margins of society, disproportionately empowering those that need it the most by allowing value to route around the value-extractors, and be directed to the value-creators.

Combined with a financial system as ubiquitous as the internet itself, no two people can have differential access to asset ownership and financial possibility.

Cryptography sets us free.

Inward vs Outward Flowing Value

Web3 and DeFi reverses the flow of value from inwardly concentrating to outwardly distributing. This is an inversion of the equilibrium of value, and its impacts upon how society organizes are going to be massive.

Inward flowing value in Web2 and TradFi makes work an uphill battle. Work is harder. You need to work hard just to stay in the same spot.

Outward flowing value in Web3 and DeFi turns progress from being uphill to downhill. With aligned protocols at our backs, humans will be able to venture further into the frontier.

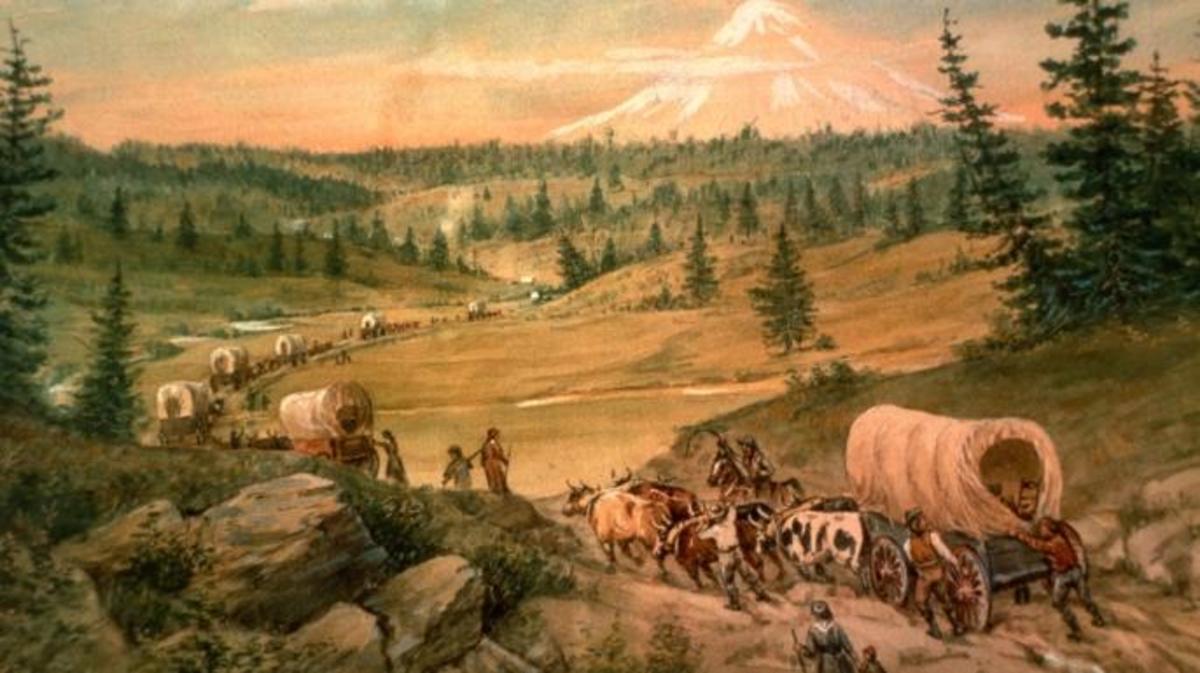

We’ve seen eras in which value was discovered outwardly rather than inwardly.

The 1400 to 1750 era of “Gold, God, and Glory” brought with it extrinsic motivational forces that convinced adventurers into seafaring explorations which expanded the map beyond Europe and into new frontiers.

The American westward expansion during the 1800s was motivated by economic opportunity and a desire to access more freedom than was the East had to offer.

The Space Race of the 1960s was spurred by extrinsic motivations of going out to claim something on the frontier.

Web2 concentrates power in Silicon Valley. TradFi concentrates wealth into Wall Street. In contrast, Web3 takes a $10,000 airdrop and chucks it over the horizon and into the metaverse. Go fetch.

If you want some of the value that these protocols are spitting out, you gotta get your private keys and journey into the frontier.

Web3 Social Structures

Cryptography allows us to design social structures with a baked-in assumption of strong individual property rights. Access to private keys is permissionless and free, enabling Web3 structures to have the maximum ability to choose how it distributes power.

Web3 and DeFi can access the maximum number of individuals. It also has the two token types needed to maximally express the best way of generating value.

The maximum number of individuals combined with the maximum ways to express value…

Ethereum has collided these two particles together, unleashing a new paradigm of what ‘finance’ even means, and how society will engage with it.

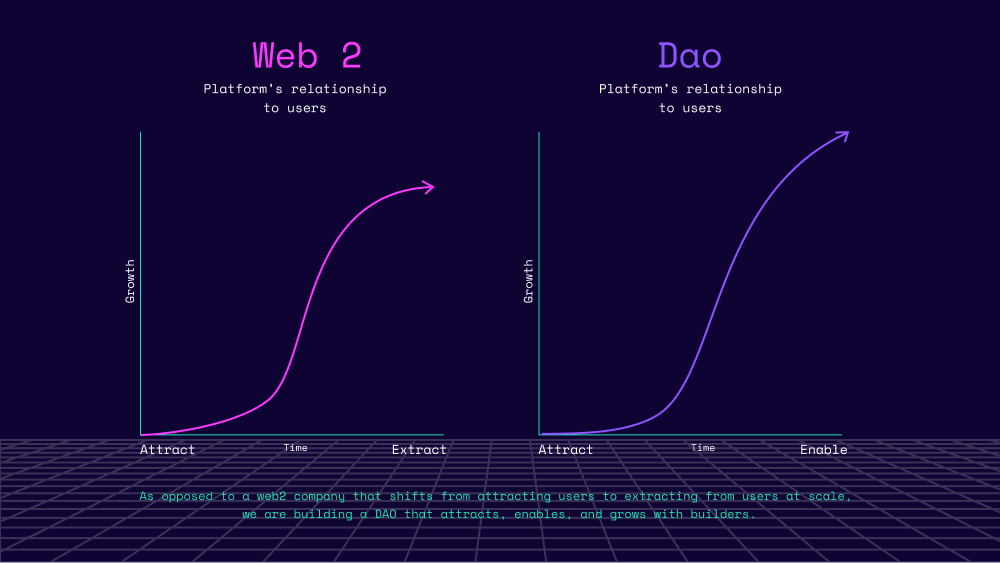

Extract to Enable

Our relationship with the platforms we use are going to evolve from extraction to enablement.

The capacity for our systems to compete for our attention using financial assets over hearts and likes fundamentally changes how these platforms will behave.

Extract

Both Web2 platforms and Web3 protocols want what’s best for themselves.

In the Web2 world, this meant concentrating wealth towards those who fight for the protocol the most. The founders, CEOs, and inner-billionaires. Platforms that try to distribute the value discover that it is quickly captured by the nearest intermediary; therefore it keeps power at the center.

Pushing power to the margins in Web2 is lossy.

Web2 platforms do not have a path to distribute value to their users. The best they can do is provide social connections with likes. With no monetary value able to push out, the flow of value becomes one-way; from the users to the center.

This is why we have a toxic relationship with our Web2 apps. They are a narcissistic bottomless pit of our attention, energy, and emotion.

They’ll take whatever you give, with no thought of returning the favor.

Enable

Web3 protocols do have the means of distributing value efficiently to margins. They have the ability to granularly issue assets and send money directly to the users. This gives these protocols the ability to answer the desires of their users with perfect fidelity.

The ability to send users value is a powerful new primitive that is going to be the source of a significant amount of competition between protocols for decades to come.

And competition is good for the consumer.

Instead of Web2 platforms competing on which can capture the most attention, Web3 protocols compete on which can sustainably create and distribute the most value.

“How much can I extract from my users” evolves into “how wealthy can I make my community?”

“How can I generate rage?” adapts to “How can I answer to the needs of my people?”

“Can I take some of that?” changes to “Can I amplify that?”

Where Web2 platforms suck our attention so billionaires can compete in billionaire games, Web3 platforms compete on which platforms enable their users the most.

Aligning with the systems around us

When systems find alignment with each other, good things happen.

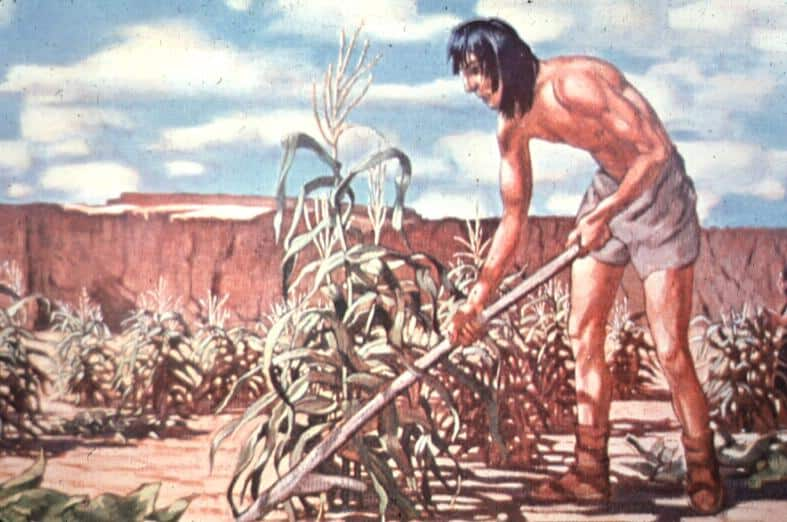

Once upon a time, humans learned to cooperate with plants, for the mutual benefit of both species. Humans used plants to produce more food, and plants used humans to grow more plants. Humans did the bidding of the plants, and the plants supplied the humans with nutrients. This was able to sustain more humans, who were then able to sustain more plants.

When we find resonance with the systems around us, really good things happen!

We once learned to domesticate plants and animals, and we will also learn to domesticate the protocols that dictate our lives.

As our ancestors once trained wolves to become dogs, so too will we train our protocols to provide us with unconditional love and appreciation for who we are as humans.

In the 2020s, our relationship with our social structures will evolve from eating poisonous mushrooms to learning how to cultivate farms and grow crops.

There will soon be protocol-level abundance.

Protocol Artificial Selection

The open and permissionless nature of Ethereum produces an intense and highly iterative foundation for experimentation. Competition in DeFi is fierce and the rate of protocol adaptation is faster than any technology development cycle we’ve ever seen before.

Artificial selection experiments typically use organisms with a high rate of generational turnover. You can get ~20 generations of fruitflies inside of a month, allowing scientists and researchers to be able to produce desired results quickly.

The same is true for Web3. DeFi was born in December 2017, and has already morphed through many app development cycles since then. In December of 2017, MakerDAO launched and people were absolutely blown away that you could mint a stable token (DAI) from your collateral (ETH).

Today, this is basic sh*t.

Since then, we’ve invented and appended many new genes onto the Ethereum ecosystem (yield farming, governance, NFTs etc)

Every new gene into these protocols gives them better tools to be able to reflect the desires of the developers building them.

Not only are we refining our genes to be more precise (improving the tools we have); we’re also finding new genes to help create more elaborate structures. As we are capable of making new protocols from these new tools, they in turn add further tools to our toolbelt.

At first, our Web3 and DeFi protocols are dull, imprecise, and rounded at the edges.

But as we iterate, they become precise and effective.

They become precisely and effectively capable of expressing the values that we embed into them.

In the same way we give treats to our dogs to get them to sit, stay, and shake, we will train our protocols to behave and be nice to us.

Becoming the best version of ourselves

I have had the privilege of being set free by crypto.

Having had a taste of what Web3 has had to offer, my previous bias towards saying ‘no’ has turned into a bias towards ‘yes’.

Simultaneously, it’s become easier to say ‘no’ to things I was previously cornered into saying ‘yes’ to.

Because of Ethereum, it’s become easier to discover how I truly want to spend my time on this earth, and easier to learn what is my own true nature as a human, after becoming unbridled from the shackles of misaligned social structures.

Cobie discusses this same phenomenon from a different angle, in a clip that reverberated across crypto-twitter:

Financial insecurity plagues the planet. In order for society to evolve into the best version of itself, we must solve for abundance at the protocol level.

We’ve actually not yet met the best versions of ourselves! Who will we discover, when we collectively become enabled by the protocols that guide our lives?

What is our true nature?

How does society change when our social structures turn from extractive to enabling?

What happens when we replace soul-sucking doomscrolling with invigorating actualization?

What happens when the net effects of our platforms are for us to be more free and experience more things, rather than capturing our attention and filling us with rage or envy?

What happens when we combine strong individual autonomy over our money, with a permissionless financial platform that seems to be intent on minting every viable type of token possible.

What happens when the maximum number of people are enabled to express their values upon an infinite spectrum of possible tokens?

What happens when our protocols compete for our love, rather than our rage?

Thanks to the decentralized power of the printing press and double-entry bookkeeping, 1,600’s Europe became completely unrecognizable from 1,400’s Europe. 200 years is a long time, but compared to the progress we made from 0 to 1,400, it was a blink of an eye.

The 2050s will be completely unrecognizable from the 2020s, and it will be because we will have found much better answers to ‘what is our true nature’ than we’ve never had before.

In 2050, we might have flying cars and editable genes, but that won’t be why society will appear so different. It will be because we produce social structures that align with our interests and have a stake in our betterment.

Culture emerges out of the social structures that guide us, and Web3 is building social structures that produce emergent positive behaviors for us and those around us.

A Rising Tide

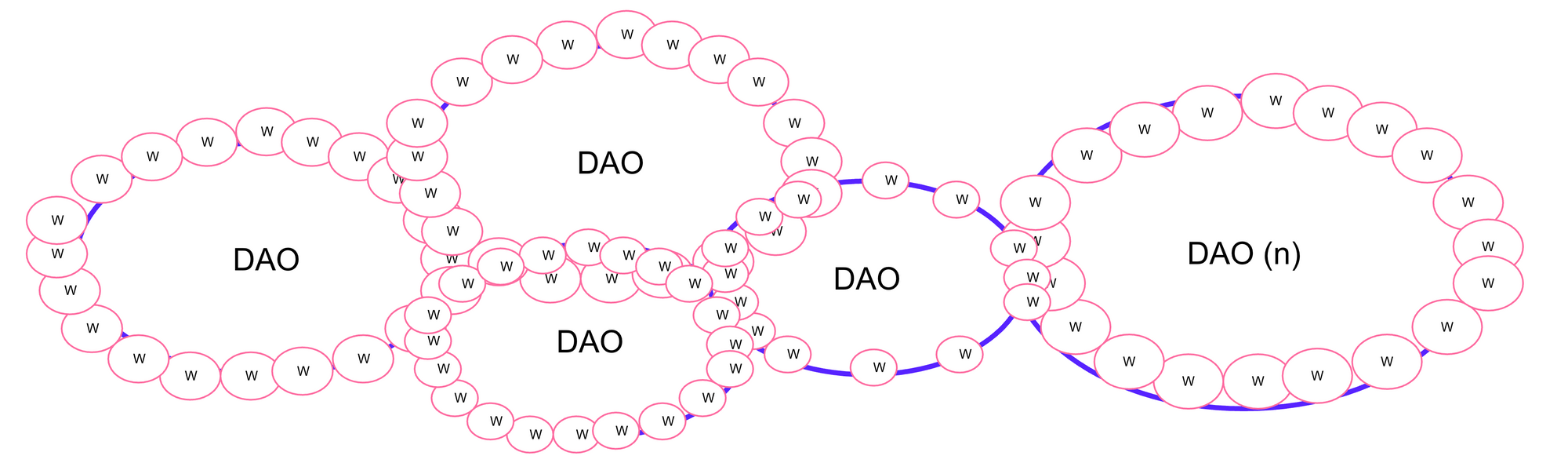

The future world of Web3 is where we live inside of a sea of protocols. Like nature, protocols will grow to fill the void around them. The protocols that enable us in ways that are most aligned with what we want are going to be the systems that propagate to the furthest reaches of the world.

As humans, we will bounce from protocol to protocol as we go about our day, and as a result, we’ll receive generalized economic outputs from the inputs we contribute to the protocols around us.

Generalized economic output is the most sustainable form of UBI that I can imagine. Rather than a government-issued UBI, we have protocol-issued rewards. Rather than receiving money unconditionally, our protocol-issued income is dependent on being active members of society.

We actually have to be engaged members of society in order to receive this basal level of income, yet this income is still permissionless, censorship-resistant, and universally accessible.

By returning value to its participants, this web of Web3 protocols produces an emergent safety net for all of society.

Building a Better Future

We need to be careful as we advance into this new future.

The power of Web3 is that our social structures will naturally reflect the values of the communities that compose them. They will resemble and represent our wants and desires upon the world.

It’s a huge unlock that we can have protocols that reflect our values. But also, it’s pretty terrifying.

The biggest weakness of Web3? Sometimes, we suck!

Humans are shitty! We’re flawed! We get corrupted!

Humans are responsible for wars, genocide, and nuclear bombs. It’s always us!

Having social structures that reflect our human values is a double-edged sword. It will reflect our flaws! Worst case it actually amplifies them, as we’ve seen in late-stage Web2.

There are plenty of ways to reread this article using a dystopic lens. The CCP social credit system and protocols that ‘enable us if we do good’ kinda sounds like the same thing.

Who decides what’s “good”?

It’s great if our protocols reflect the values of the majority, but does that mean they will oppress the values of the minority?

Will these protocols funnel us into homogeneity and restrict our ability to think outside the protocol?

What if we make social structures that ultimately come to box us in in the same way Facebook has, but this time with money.

How we build these things, and what values we embed into them is really important.

I take solace in the fact that development in this space is rapid and iterative. The foundation itself is highly conducive to experimentation, allowing us to easily amplify what works, and move on from what doesn’t.

The ability for us to abandon one protocol and migrate to another is always just one transaction away. In Web2, we can’t easily migrate across protocols. Facebook doesn’t allow us to export our social graph; neither does Twitter. They have us locked into their system, and this feature is how these systems slowly turned from enablement to extractive.

Web3 drops the cost of protocol migration down to 0, forcing protocols to fight tooth and nail to keep us aligned and contributing to their system.

Converging on Values

The legacy that crypto will leave us is an infinite array of assets with market capitalizations that reflect our human values.

Market value based on human values.

As this industry develops and matures, we will be able to audit ourselves as a society.

Our ledgers are transparent, our assets are infinite, and our markets are unstoppable. Once crypto platforms are as adopted as the internet currently is, there will be no hiding from who we are. We’ll be able to clearly determine who we are as a society because where we chose to collectively put our money will be viewable on CoinGecko.

This is why we must have free markets. This is why we must have the ability to mint any kind of token, which trade on markets with 100% uptime.

What we value, and what our values are, will become the data that our nodes gossip over P2P communication networks. These technologies will enable us to come to a global consensus about what we care about; only once we know the answer to this question can we begin to iterate and improve on it.

This is how we will scale Dunbars number from 150 to Planet Earth.

Say that aliens visit Earth. They see our cities, our tech, our moral code.

They’re curious—what are you doing here?

The humans respond—we’re getting coordinated.

Humans first need to “get coordinated” so they can begin to formulate an answer to the question “What is our collective purpose?”.

Phase one of humanity is us trying to all get on the same page. Phase two of humanity is us asking ourselves “Now that we’re all on the same page, what are we going to do next?”

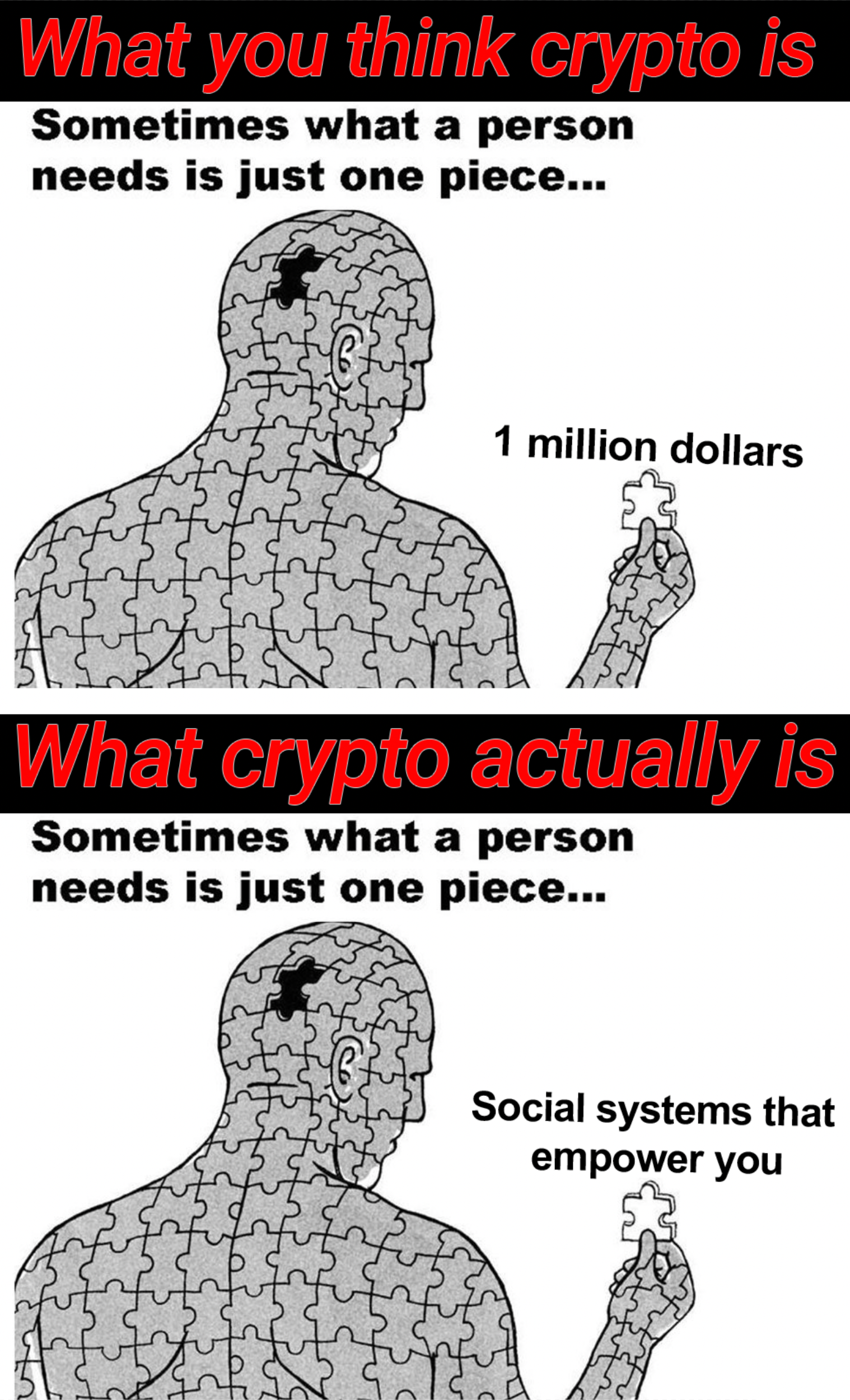

Two Phases of Crypto

As it stands, crypto isn’t doing so hot on the whole “reflecting human values” thing. Saying that crypto reflects human values would indicate that we’re all greedy pump-in-dumpers who are trying to get ours and leave.

Will crypto be about greedy pump n dumps and rug pulls for the end of time?

Or will it actually mature into social structures that produce long-term stable equilibria for the next leg up of humanity?

From the wise words of Kevin Owocki:

While greed is necessary for blockchain technology to bootstrap itself, it is not the final form of the blockchain ecosystem. Greed is just the boot loader.

Crypto is a multi-stage rocket:

Phase 1 of the rocket is financial incentives (more rich).

Phase 2 of the rocket is more sovereignty (more free).

Crypto wasn't created to make you rich

It was created to set you free.