Coinbase Week

Dear Bankless Nation,

On Wednesday Coinbase’s stock ($COIN) will be publicly listed on the NASDAQ.

This is a landmark event for crypto.

The is the first crypto-native company to list on U.S. public markets. This listing gives traditional investors pure exposure to the crypto industry in a way a) they can understand and b) they can easily buy.

With COIN, you don’t have to be smart enough to know which crypto assets will dominate in the future, you’re buying exposure to an exchange that sells them all.

Forget the gold rush…this is upside in a company selling the picks and shovels.

Better yet, Coinbase released Q1 results ahead of its listing and it’s a MONSTER.

- Q1 2021 volume hit $335B (that’s over 1.7x all 2020’s volume in one quarter!🤯).

- Active users jumped from 2.8 million in Q4 to 6.1 million in Q1 2021.

- Cash machine cranking with $1.8B in Q1 revenue and $800 million in profit.

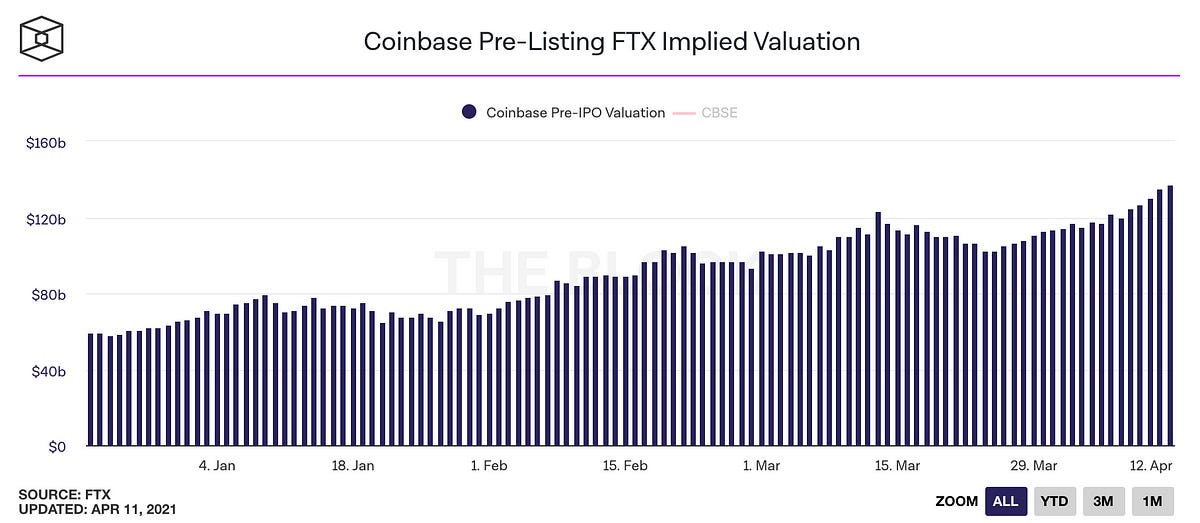

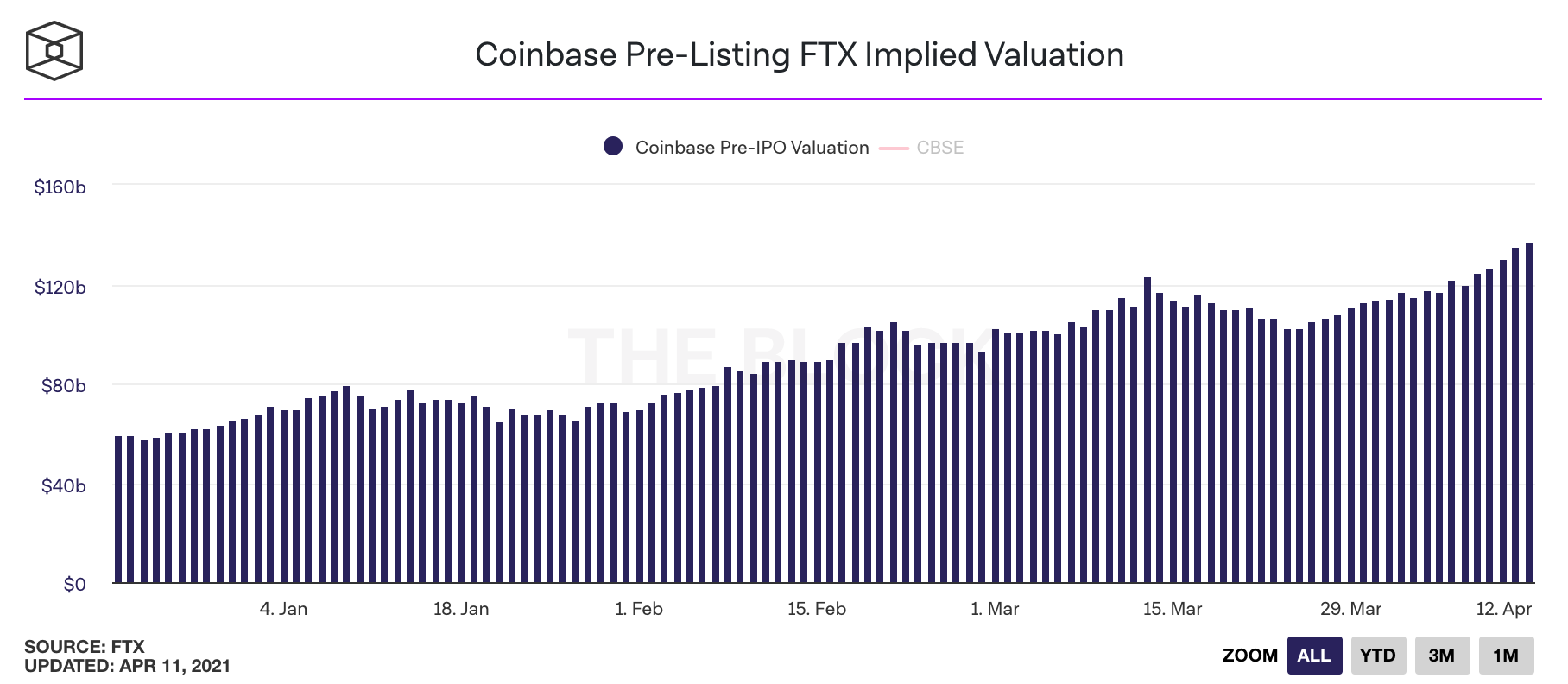

The Coinbase FTX implied valuation ahead of the direct listing has been marching upwards for all of 2021 and is now valued at $136 billion.

Here’s our take about what’s about to happen on Wednesday:

Our current crypto thesis (and shared by many) is that we are in a late-stage fiat credit cycle. Money is cheap. There’s a ton of cash looking for places to go, and this is partly why crypto assets have outperformed basically everything since March 2020.

It doesn’t matter what valuation COIN takes on day one. It’s going to pump.

- $100b valuation? It pumps.

- $200b valuation? It pumps.

- $300b valuation? It still pumps.

If we are truly in a late-stage fiat credit cycle, then it won’t matter what Coinbase’s valuation is. Coinbase operates the largest toll-road from the world of fiat to the crypto Ark that can save investors from perpetual devaluation.

People will pay the toll to use that road.

So now let’s talk about what this means for three groups: DeFi, CeFi, and the Banks.

What does this mean for DeFi?

The UNI Coinbase trade has been the talk of DeFi since mid-late 2020.

The rationale? If a first generation crypto exchange is worth $100b, what’s the value of a DeFi exchange that’s now regularly surpassing Coinbase volume and already has 13x the trading pairs of the entire NYSE?

UNI has hit a new All-Time-High today—maybe it’s because everyone knows it’s Coinbase Week.

UNI isn’t the only token showing a lot of energy today either.

SUSHI is up 14% and ZRX is at an ATH of 4 years in the making.

The other obvious take is that attention on Coinbase is going to put further attention on crypto-assets at large. But perhaps more specifically, the assets on Coinbase that aren’t Bitcoin. Of the 55 assets that are on Coinbase, 39 of them are tokens on Ethereum, and the rest are L1 currencies (BTC, BCH, LTC, EOS, DOT, etc)

When you look beyond Bitcoin, you find DeFi.

Following in the footsteps on the NFT movement, Coinbase could be a vehicle that blasts the DeFi conversation open for a broader population.

That means more capital into DeFi tokens…but it also means more DeFi users.

Today there’s maybe 1.8m unique Ethereum addresses using DeFi…assuming every user has 4 addresses…that means there’s less than 500k DeFi users.

Meanwhile Coinbase has 100x more users than DeFi—over 56 million registered users. 😱

How many of these will start their DeFi journey after joining Coinbase?

If BTC is the gateway drug to ETH, maybe Coinbase is the gateway drug to DeFi.

This is good for DeFi.

What does this mean for CeFi?

UNI isn’t the only asset feeling the Coinbase Week energy.

BNB, the pseudo-equity token for Binance, had a killer quarter up almost 20x which has massively outperformed most DeFi tokens and ETH so far in 2021.

Technically, Binance is already ‘public’ if you think the BNB asset is the true equity of Binance (we’re not sure we do), and it would make sense that a Coinbase listing would have positive downstream effects. Binance is the offshore, unregulated correlate to the U.S. domiciled, highly regulated Coinbase…and it even has its own Ethereum simulator chain!

A publicly traded Coinbase is good for FTX—it opens the U.S. and they didn’t buy a Miami stadium for nothing. It’s good for Gemini—when Gemini IPO Cameron and Tyler?? (and will you issue a token airdrop)? It’s good for Kraken—this is the legitimacy the industry needs to turn crypto banks into actual banks.

Public Coinbase gets the crypto banks closer to a seat at the table with the big boys.

This is good for CeFi.

What does this mean for the Banks?

Zzzzzzz….the banks have been sleeping on crypto. They’ve never had a real challenger. They think their privileged position protects them from competition.

They think they can still get away with stuff like this:

They think we need them.

They’re wrong.

A $200 billion Coinbase would be bigger than Wells Fargo, Citigroup, Morgan Stanley, and Blackrock…and it’d be closing in on the market cap of Bank of America.

Zoom out for a minute…a 9-year old crypto company that’s already bigger than the banks. How crazy is that?

The banks can’t ignore a publicly traded Coinbase above $100B.

The FinTechs they could handle. The FinTechs built on banking rails. But these crypto banks are building on open, permissionless money networks. They’re cutting banks out of the value stream.

Maybe they need to start acquiring fast to stay in the game?

A public Coinbase is a shot across the bow for traditional finance.

It’s a wake up call for the Banks.

Good for DeFi. Good for CeFi. Bad for the Banks.

It’s finally here…it’s Coinbase Week.

- David and RSA