Dear Bankless Nation,

Welcome to the weekly recap of the biggest crypto news for the second week of July.

Celsius files bankruptcy

I’ve used a centralized crypto lender (AKA crypto bank). The argument for these financial services is pretty straightforward and it goes a little something like this:

“DeFi UX is bad. People don’t want to store 24-word-long seed phrases on paper. Want your Mom to use DeFi? Then be pragmatic about it. Crypto banks will onboard millions of new users into the world of crypto. That’s how crypto goes mainstream!” - Really pragmatic crypto expert in his first crypto bull market

The problem of course, is that crypto banks don’t actually exist in the world of crypto, but in a nicely furnished entry lounge, or when markets are down - in the exit parking lot. Centralized crypto lenders are in the business of peddling DeFi products, but its foundational building blocks aren’t on blockchain infrastructure.

In other words, a crypto bank’s promise of yields is fundamentally an off-chain, unverified claim that users have to take on faith. You’re missing the point of Web3.

And these off-chain delights have off-chain ends.

After Voyager and 3AC, Celsius is the third to file for Chapter 11 bankruptcy protection this week. A court filing this week shows Celsius' liabilities of $5.5B, of which 85% ($4.7B) is owed to users.

But not before closing the entirety of its ~$800M debt across Compound, Aave, Maker and other dapps to release its collateralized loans. We don’t know if users will get back their money from Celsius, and if so how much, but lawyers and courts (not smart contracts) will decide. You can argue in a court of law, but not in the smart contract world of DeFi.

Su Zhu helps StarkWare launch its token

This one here’s a bit of a merry-go-round. It begins with longstanding rumors of a StarkWare token for its Layer-2 platform StarkNet.

As seen from the past month’s chaos, we know that 3AC had a slice of everything crypto-related, and that includes a share of the StarkWare token allocation set aside for investors.

But 3AC is now in the gutter, and allyourassetsarebelongtoliquidators, including that share.

Apparently, the liquidators failed to “exercise StarkWare’s token purchase offer” before a 5th July deadline and “has caused the Company to lose substantial value”. You know, similar to how 3AC lost substantial value of its clients holdings. In any case, that’s what it took to break Zhu’s five week Twitter silence, and he isn't happy.

StarkWare’s surprise is ruined but the candles are still lit. What are they to do? I guess, sing the song and blow it out, but in a way which very blatantly does not acknowledge the elephant in the room.

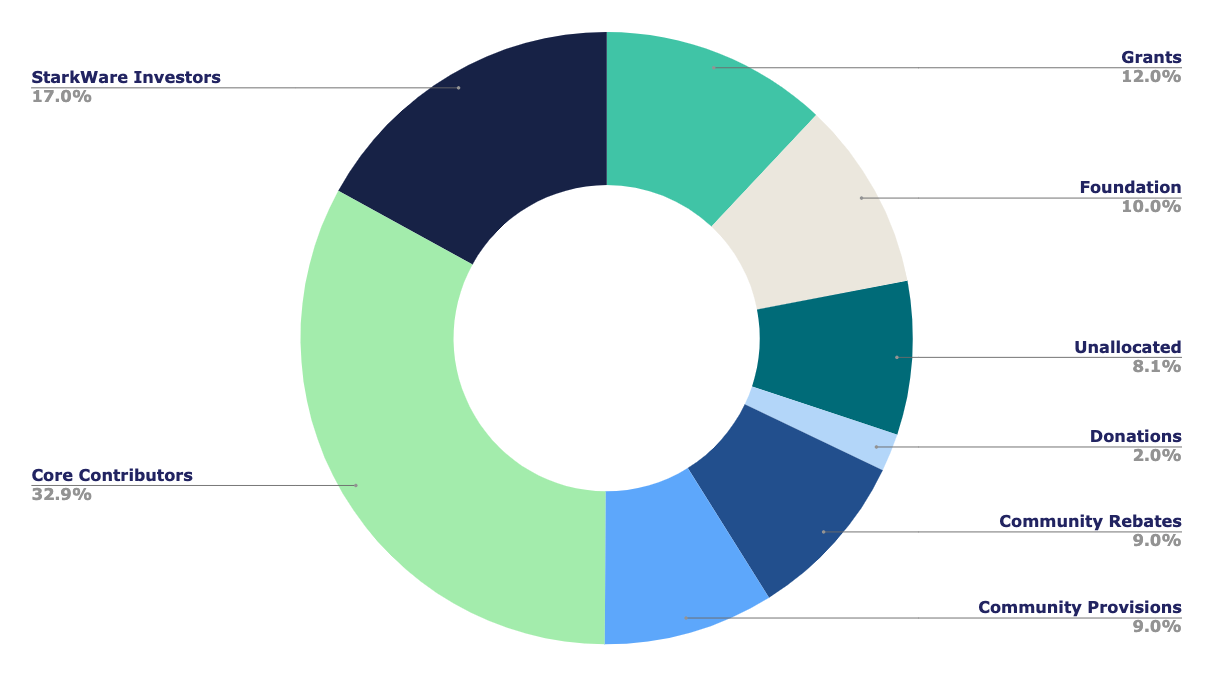

The StarkNet token will be used for governance, staking and the network’s transaction fees (in contrast to other L2s like Optimism where ETH is still used for gas). 10 billion tokens have been minted off-chain and will go live in September. Here’s what the split looks like:

Some observations:

- A 49.9% allocation to insiders is pretty hefty (Optimism’s was 36%).

- The tokens are minted off-chain, which makes it hard for potential tokenholders to discern the value of the token and how much whales control.

- In terms of a potential airdrop, only 9% (900M) under Community Provisions might go towards it (Community Rebates don’t count). The StarkWare community isn’t happy (see here, here and here) with what seems to be perceived as a largely centralized token distribution for insiders and a paltry airdrop for the community.

Is ETH a security?

“I think Ethereum is a security, I think it’s pretty obvious, [...] it was issued by an ICO, theres a management team, there was a pre-mine, there’s a hard fork, there’s continual hard forks, there’s a difficulty bomb that keeps getting pushed back.”

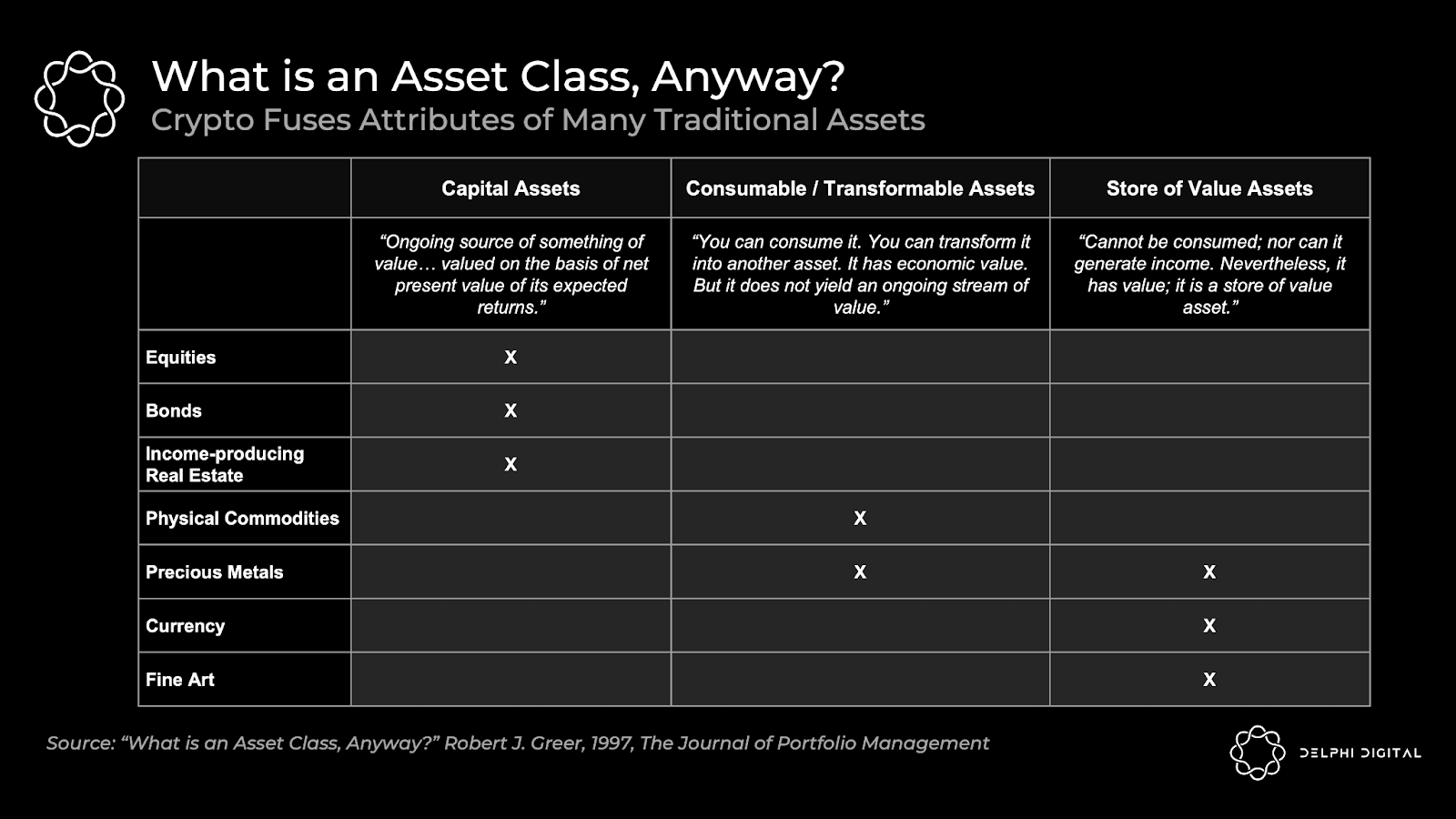

If Saylor’s right, that has dramatic regulatory implications for ETH. Traditionally, U.S. law determines a security through the Howey Test, which qualifies something as a security if there’s an “investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others”.

The Ethereum foundation has gone to great lengths to distinguish ETH not as a securities offering and a profit-oriented stock, but as a kind of commodity good, a resource fuel (gas) to run applications on its blockchain, and that has set the de-facto standard for how ICOs are perceived by investors and regulators. As Camila Russo chronicles in The Infinite Machine:

The framing… that ether was a product with a specific functionality, opened the door for a whole new way of raising money. Now startups would be able to get funding from anyone who wanted to contribute, all over the world, under what seemed like a safe haven. They weren’t selling securities. These weren’t shares in any company. They didn’t give out dividends that depended on the company’s revenue and investors didn’t have any rights. They were selling digital tokens, made to be used inside these platforms. They were selling utility tokens.

Bitcoiner’s attempt to frame proof-of-stake networks as securities fixate on the more active “managerial” aspect of the network, so it lends easily to a “profit motive” then a “securities” conclusion. But of course, Bitcoin itself undergoes substantial network development, most notably the SegWit upgrade in 2017 and more recently Taproot last year.

So is ETH a capital asset (security), a consumable commodity (gas), or a store-value-value like gold/Bitcoin? Bankless has argued that it’s all three. But it’s frankly an endless debate of semantics.

Web3 News Roundup

Polygon week

Big week for Polygon.

First, Polygon has been selected as one of six companies to participate in a Disney Accelerator program that represents the media conglomerate’s efforts to break into the Web3 world of NFTs. In the official press release:

“The Disney Accelerator kicks off this week, connecting the 2022 class with the creativity, imagination, and expertise of Disney. Over the course of the program, each participant company will receive guidance from Disney’s senior leadership team, as well as a dedicated executive mentor.”

Polygon is the only Layer-2 platform selected, and MATIC has jumped ~27% since the announcement.

Second, support for MATIC deposits and withdrawals are now live on Robinhood.

Third, Aave’s decentralized social media Lenstube is launching, on top of - you guessed it - the Polygon mainnet. Check it out.

Launch of NFT marketplaces

More hot launches this week. sudoAMM by sudoswap is a new on-chain NFT marketplace that lets users automate their NFT transactions along a price curve in a liquidity pool.

GameStop NFT is another non-custodial NFT marketplace built on the Ethereum L2 Loopring.

Here’s the line-up for next week:

- Ben is taking us on a trip through lesser known Layer-2s

- Kevin Owocki is laying out a Regen Investment thesis

- Luke Gromen joins the podcast to talk about the scariest macro landscape in decades

It’s ETH CC next week! See you in Paris if you’re there.

- Donovan