Building a Decentralized Blackrock

Dear Bankless Nation,

Blackrock holds over $8.5T in Assets Under Managment (AUM). Meanwhile competitors like Vanguard and Fidelity hold $6.7T and $5T, respectively.

These investment management companies are no small fish. They collectively represent tens of trillions of dollars of capital, while their core index products continue to eat up equity market share.

For reference, in the U.S., indices represent a $4T trillion dollar asset class by market capitalization—composing 14% of the U.S. stock market.

These products are a crucial piece to the financial system as they make retail investing reliable and accessible. Indices offer investors a passive mechanism to gain exposure to specific sectors without having to worry about picking winners or diving deep into each company and investment. You simply get diversified investment exposure in a single asset.

So with DeFi aiming to upgrade our existing financial system using decentralized infrastructure, this market shouldn’t be ignored. There’s massive opportunity here.

Even within crypto, providing access to indexes could be a driving force behind DeFi adoption. A DeFi index allows any new crypto investor to easily get exposure to the innovation in this sector—no need to dig into all of those DeFi metrics like TVL, revenues, P/S ratios, etc. Just buy, hold, and rest easy.

The best part?

All of this lives on open internet accounts accessible anywhere in the world—no brokerage accounts required. It’s bankless finance at its finest.

With that in mind, we’re going to dive into how the Index Coop is aiming to tackle this exact area.

They’re trying to build a decentralized Blackrock.

Let’s explore today.

- Lucas

WRITER WEDNESDAY

Guest Writer: DevOnDeFi, Core Contributor for the Index Coop.

WTF is the Index Coop?

As a bankless reader, you’ve probably heard about The DeFi Pulse Index (DPI), one of the leading DeFi indices which is increasingly used as a proxy to gain exposure to the innovation in decentralized finance. It’s similar to the S&P500 for U.S. stocks!

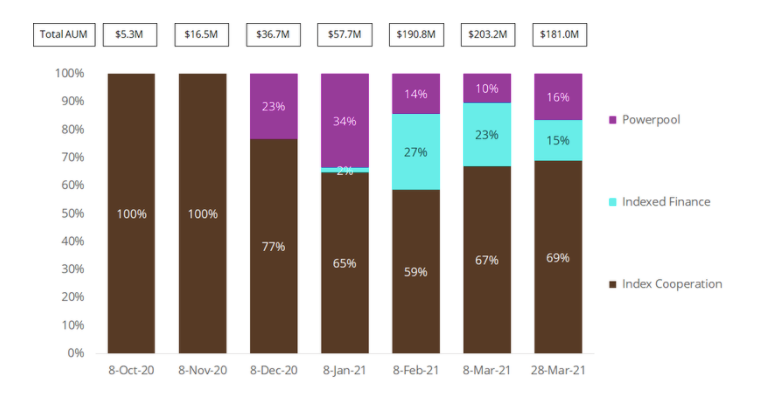

The Index Cooperative is a Decentralized Autonomous Organization (DAO) behind the DPI. They create and maintain fully collateralized crypto index products built on Set Protocol’s battle-tested V2 infrastructure. Product methodologies are sourced from expert community members and industry thought leaders such as CoinShares and DeFi Pulse.

Think of it as an emerging mega-asset manager for crypto—kind of like Blackrock.

As a decentralized and autonomous asset manager, The Index Coop is governed, maintained, and upgraded by its active community of INDEX token holders. To put it simply, the INDEX token is the backbone of the DAO as it acts as the incentivization layer allowing the organization to grow and operate.

The Coop’s Vision

The Index Coop aspires to become a decentralized Blackrock or Vanguard, with ambitions to match or surpass these venerable names in traditional finance in terms of both Assets Under Management (AUM) and product quality.

👉 Felix Feng, co-founder and CEO of Set Protocol laid out his view for how that could play out here.

The core mission of the Coop is to build a complementary range of index products enabling everyday individuals to easily gain exposure to crypto investment themes without having to worry about picking winners, in-depth sector knowledge, shouldering gas costs or rebalancing.

So with >$6 trillion of assets held in index products in traditional finance, we know there’s no shortage of an addressable market for the Index Coop.

Community-Driven Development

Community members style themselves as Owls, after The Index Coop’s brand icon, and at the time of writing, there are approximately 2,750 members in The Index Coop’s Discord, 430 in the forum, and 13.2k followers on Twitter.

Within this wider community, there is a core group of active contributors which includes members of the Set team (more later) and ‘Golden Owl’ contributors such as BigSky_7, DarkForestCap, JDCook, LemonadeAlpha, Matthew Graham, OverAnalyser, Regan Bozman, and Verto0912, who you will see busy in Discord and on Twitter. There are also regiments of Silver Owls, Bronze Owls, and general Owlets powering this community-driven project, where all tangible contributions are funded out of the community treasury.

🧠 You can learn more about the Index Coop’s Community Treasury basics and rewards here.

This is the coolest part about the Index Coop. It’s not run by a single, centralized developer team. Instead, it’s run by a decentralized group of core contributors, composed of different working groups, where anyone can participate and contribute if they have the interest and motivation to do so!

The Relationship with Set Protocol

Set, the leading provider of crypto asset management tools and infrastructure, launched the Index Coop in September 2020 in partnership with leading data provider, DeFi Pulse—hence DPI as the first product. This is also why the Set team was granted an allocation of the INDEX token distribution (more details here).

Set continues to help The Index Coop with technology, engineering, and product resources, while working on hiring a community engineering team and CTO.

⚒️ Interested engineers should join the Discord and look for the ‘dev’ channel to learn more about some of open engineering roles within the Coop and crypto at large!

Given their role in the conception of The Index Coop, technology value add, and all round passion for the project, Set will always be key contributors and partners.

The growing number of index products launched and managed by The Index Coop will mostly run on Set rails and the wider army of community Owls will help promote and distribute said products.

Put another way, Set Protocol’s technology will largely act as the foundational back-end as the project decentralizes the key functions of governance, treasury, engineering, product, methodologist, biz dev, sales, marketing, research, content, design, community, etc.

The Index Coop’s Current products

DeFi Pulse Index (DPI)

The Index Coop’s first and best known product is the DeFi Pulse Index (DPI), an ERC-20 token which is a market cap-weighted index that tracks the performance of DeFi tokens across the broader market. The full methodology is explained here, but the short story is that the index holds the top dozen DeFi tokens (holdings subject to change) from established projects, with vibrant communities, and sufficient liquidity for the index to buy and sell into.

As of writing, the DPI has $133m in AUM and held by over 13,000 addresses. Perhaps more importantly, over 70% of this AUM is un-incentivized—meaning it’s not earning INDEX token rewards for providing liquidity. Importantly, this property of un-incentivized AUM is larger than all other competing DeFi index products.

A recent report from Coingecko showed DPI’s AUM continuing to dwarf the competition—which is more highly incentivized with liquidity mining rewards!

In the age of the Internet and network effects, this digital investment product is fast-becoming the sector leader. And with a bull market in progress, The Index Coop is hoping that the DeFi Pulse Index hits $1bn AUM before the end of the year

👀 Fun Fact: Lucas actually made this prediction that DPI would hit $1B in market cap by EOY in the Bankless 2021 Predictions.

CoinShares Gold and Cryptoassets Index (CGI)

In partnership with CoinShares, the largest digital asset manager in Europe with nearly $5bn in AuM, The Index Coop launched CGI—a low-volatility index that offers exposure to gold, BTC and ETH.

The Index Coop is the first crypto DAO to partner with a public company to create an index product—an impressive credential within a few months of the Coop’s inception.

CGI utilizes the concept of volatility harvesting through (a) forming an equally-weighted basket of cryptoassets (BTC and ETH) and (b) combining it with gold using a weighted-risk contribution as a monthly rebalancing mechanism. By decreasing volatility levels, CGI seeks to yield superior risk-adjusted returns when compared to a number of alternative strategies, including holding cryptoassets or gold alone.

🤓 You can read the full methodology on the CGI here. The index was developed by leading academic and industry research from CoinShares and Imperial College London, one of the world's best universities!

Community Owls like to think of CGI as the World's best treasury asset. Traditionally, gold has acted as an essential component of a strong investor portfolio, acting as a low-correlated asset and a hedge against financial calamity. Although gold has faced serious opposition from cryptoasset investors, it offers a valuable investment strategy for those looking to strengthen their portfolio against market downturns and enhance risk-adjusted returns.

By pairing bitcoin and ether against a non-correlated asset (i.e., gold), the CGI ultimately decreases volatility and delivers a risk and return profile superior to holding gold or cryptoassets alone.

Particularly suited towards institutional investors, high net worth individuals, and DAO treasury funds, CGI offers a new risk-managed tool that could act as the gateway for new institutional market participants looking to get exposure to crypto. This could result in large inflows into CGI and other Index Coop products.

Flexible Leverage Index (FLI)

FLI is a 2x leveraged position on ETH which lets you “leverage a collateralized debt without having to manage a collateralized debt, by abstracting collateralized debt management into a simple index, reproducible by an ERC20 token built on Set Protocol”.

Like the DPI, DeFi Pulse is once again the Methodologist behind this index!

If that is a little technical, FLI enables crypto investors to avoid:

- Monitoring their leveraged loan 24/7, having to always be ready to act

- High fees, transactions not being included fast enough or the relative UIs being unresponsive during times of high volatility

- Paying for overpriced stablecoins to deleverage on time or panic trading to save his positions

- Being liquidated and having to pay the penalty

FLI has several key advantages over legacy leveraged tokens:

- Zero slippage via composable entry and exit

- Unique Index algorithm reduces rebalancing needs by an order of magnitude

- Emergency deleveraging possible during Black Swan events for additional fund safety

FLI was launched on March 17th, a few weeks before this article, and has already garnered over $16m in AUM as of writing.

Metaverse Index (MVI)

You have probably heard of the ‘Metaverse’ via crypto thought leaders or Bankless’ great Metaversal newsletter, but if you haven’t, here’s how Forbes introduces the concept:

“Welcome to the metaverse, alternate digital realities where people work, play, and socialize. You can call it the metaverse, the mirror world, the AR Cloud, the Magicverse, the Spatial internet, or Live Maps, but one thing is for certain, it’s coming and it’s a big deal.”

As per the most recent forum post, MVI seeks to reward long term investment in a decentralized and virtual future. Holders of MVI are taking a view that the future of entertainment, sports and business will shift to a virtual environment and that transactions will take place on the Ethereum blockchain within this metaverse. The Methodologists behind this index include community members DarkForestCap and Verto0912, along with Messari’s excellent Mason Nystrom.

After passing all of the Index Coop’s governance processes, the MVI is launching today, Wednesday April 7th!

This was the winning submission for the Metaverse Index logo competition from from @ralefram. Beautiful, right?

Looking Ahead: Future Index products

Token Terminal Index (TTI)

Proposed as a product by the Token Terminal team, the TTI passed Decision Gate 1. However, it recently failed Decision Gate 2 and as a result, is still in the consideration and refining stages. Regardless, the TTI proposes an interesting alternative to the DPI.

In contrast to traditional market cap-based indexes, smart beta indexes employ alternative index construction rules with the aim of improving a portfolio’s risk-adjusted returns. These indexes seek to combine the benefits of passive investing and the advantages of active investing strategies and ‘factors’.

TTI uses a fundamentals-based ruleset for its index construction: assets included in the TTI are chosen primarily based on their price to sales ratio.

If you’re a recurring bankless reader, you’re probably familiar with the P/S ratio. But to recap briefly, the price to sales ratio compares a protocol’s market cap to its revenues. A low ratio could imply that the protocol is undervalued and vice versa.

The price to sales ratio is an ideal valuation method especially for early-stage protocols, which often have little or no net income. Given the nascency of the crypto market, the Token Terminal team believes that the price to sales ratio offers an important tool for relative analysis between different crypto protocols.

🚀 If you're interested keeping up with the TTI’s development, join the Discord or keep an eye on The Index Coop twitter profile for more updates.

Bankless’ BED Index

Some of you may have heard of LemonadeAlpha’s BED meme—which essentially says that you can ‘rest easy in BED’; holding Bitcoin, Ether, and DPI in a perfectly even 33%/33%/33% allocation.

BED is meant to be the easy, cover-all crypto portfolio.

The guys at Bankless are big fans too—and have proposed building it with The Index Coop. The goal here is that the Index Coop can soon have a single token that allows any new crypto investors to buy ‘BED’ in the most efficient and elegant way. Set it and forget it—you can rest easy with the BED index.

🏴 You can read the detailed discussion about the Bankless BED Index in the forum.

Methodologist program

As you may have gleaned above, Methodologists play an important role in the Index Coop. As such, the DAO implemented a token rewards framework to attract the best Methodologists in crypto to come and launch their index products in partnership.

Beginning two months after The Index Coop launched (September 2020), a Methodologist bounty comprising 7.5% of all INDEX tokens is distributed over an 18 month period to all Methodologists publishing data for active Index Coop Indices. That’s a pretty juicy bounty, which ends April 2022, so if you have an idea for a killer crypto index product do read further information for Methodologists here!

As explained above, there are also external and community Methodologists in The Index Coop. For example, MVI is an index managed by community members while CGI is managed by external Methodologists (Coinshares).

The Role of INDEX

As mentioned at the start, at the center of The Index Coop is the INDEX token. The Coop’s native token rewards contributing Owls, represents a specific investment thesis, and used in governance in the DAO and for tokens held in the index products The Index Coop manages (like the DeFi tokens within the DPI).

The thesis behind INDEX has been described as:

- ‘Leveraged Meta-governance (in DeFi)’ by @BigSky_7

- ‘INDEX is a long-dated option on DeFi’ by @LemonadeAlpha

Prominent Ethereum community member, DCInvestor, describes The Index Coop’s potential like this:

While there’s nothing concrete today, potential value capture mechanisms for the INDEX token in the future may include:

- Streaming fees from index products

For example, DPI generates a streaming fee of 0.6%/year - apply this across a number of products, large AuM, and many years, and revenues get very interesting - Intrinsic productivity

Perhaps even more impactful than streaming fees, The Index Coop can productively use the assets held in its index products to conservatively earn returns in DeFi - a revenue opportunity potentially two or three times greater than streaming fees. If this financial engineering has you concerned, this exact strategy is leveraged in TradFi on a Delta Neutral basis (meant to be risk free)

📚 Bonus Reading: Here’s a great Twitter thread on the bull case for $INDEX by Golden Owl, Lemonade Alpha as well as an interesting forum discussion on effective treasury management/value capture.

Beyond value capture, there’s an interesting governance power building behind the INDEX token too—similar to how huge TradFi index managers hold large numbers of constituent shares and vote on those companies’ internal affairs.

Here’s a recent example of The Index Coop participating in top DeFi token Compound’s governance (note the other venerable major voters!). Importantly, the scale of The Index Coop’s governance participation in DeFi is only set to increase as the DPI grows.

A Step Towards Decentralizing Blackrock

Hopefully this post has given you a deep and wide coverage of The Index Coop, the leading asset management DAO in crypto and how we’re aiming to build a suite of crypto products to rival the likes of Blackrock, Vanguard, and other major TradFi institutions

If you’d like to learn more about, here are some useful links:

Keep an eye on The Index Coop—we may well be witnessing the early stages of a crypto Blackrock appearing 👀

Action steps

Dive into the Index Coop’s mission

Read up Bankless resources on the DPI and other indices

Author Bio

DevOnDeFi is a core contributor for The Index Coop. He’s an experienced crypto and financial services industry professional and helps Coop with design, growth, and marketing.