Best yields in the crypto bear market

Dear Bankless Nation,

It’s been a week since the Terra meltdown—one of the largest systemic shocks crypto has seen.

Billions of capital have left crypto, which means yields are fast drying up.

But three crypto assets are still holding the line: BTC, ETH and stablecoins.

And if you know where to look, there are still plenty of yield opportunities out there.

Today, Ben scours some of the most tried-and-tested DeFi protocols to show us where you can earn the best yields during this bear market.

- Bankless

Are the glory days of yield farming over?

As token prices tank, liquidity mining incentives dry up, and on-chain activity slows, DeFi yields have continued to fall. Long gone are the days in which stablecoin deposits into money markets would yield mid-double-digits, as it’s now difficult to find greater than 4% returns in these same protocols.

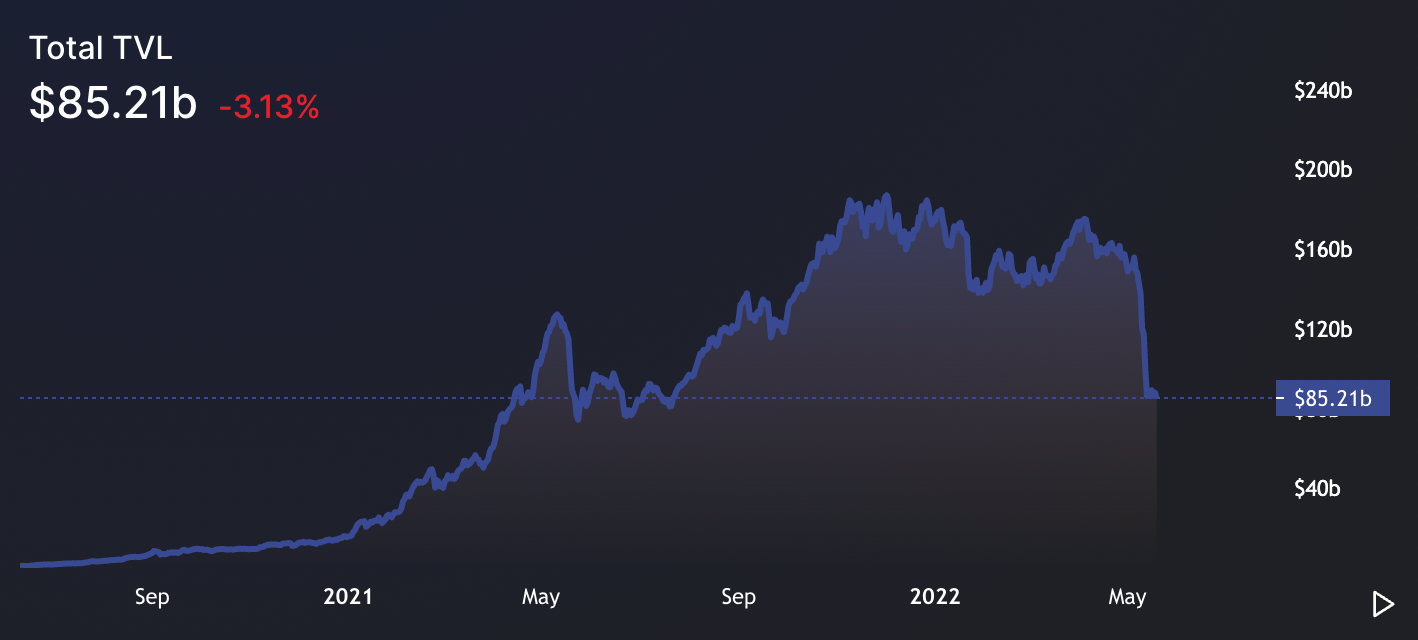

The drying up of yields also comes amidst outflows from DeFi as a whole, as following the collapse of UST, TVL across all chains has fallen nearly 38% from ~$137 billion to ~$85 billion in the span of a week. We’ve also seen numerous pegs, such as the stETH-ETH, come under duress as panic has spread throughout the system.

Despite this, there are still several attractive yield opportunities for users willing to stomach the risks. Remember, DeFi is the frontier - In order to earn outsized returns, you have to take on commensurate risk.

Let’s explore a few of the most attractive risk-adjusted yield opportunities that are still available for ETH, BTC, and stablecoins.

1. Maple Finance

- Network: Ethereum, Solana

- Asset(s): ETH, USD

- Projected Yield: 5-9% APY

- Risk: Medium/High

🖼️ Protocol Overview

Maple is an undercollateralized lending protocol. The platform provides a venue in which users can lend their tokens to KYC’d institutions, such as Alameda Research and BlockTower Capital, allowing these firms to access credit on-chain.

Loans made on Maple are originated through lending pools managed by other professional crypto firms (known as pool delegates), who conduct due diligence on the creditworthiness of the borrowers within their respective pool. The protocol is live on Ethereum and Solana and has originated more than $1.3 billion in loans since inception.

🌾 Yield Strategy

There are currently three Ethereum pools accepting user deposits: The USDC pool managed by Orthogonal Trading (a trading firm), with the USDC and wETH pools managed by Maven 11, an asset manager. Users can deposit each pool’s namesake asset to earn lending interest and MPL rewards, with the USDC pools yielding between 8.3-8.7%, and the wETH pool netting depositors 6.9%.

⚠️ Risks

There are several key risks users should be aware of before deciding to lend on Maple. The first is liquidity risk, as lenders on Maple are subject to various lock-up periods, currently at 90 days for each of the pools discussed above. In addition, lenders of course take on the risk that borrowers will not pay back their loans. While it would represent a permanent, on-chain stain to a borrower’s reputation, it is certainly within the realm of possibility that a borrower will default on their loan. Given the low-principal coverage on pools, which ranges between ~1.5-3.5% for each, users would get little recourse in the event of a default.

2. Convex Finance

- Network: Ethereum, Solana

- Asset(s): USD

- Projected Yield: 8-11% APR

- Risk: Low

🖼️ Protocol Overview

Convex is a yield protocol built on top of Curve, a decentralized exchange. As experienced DeFi users will know, Curve utilizes a vote-escrowed (ve) token model, in which holders of the protocol’s native governance token, CRV, can lock their tokens in exchange for veCRV, an illiquid, non-transferrable token. Among other benefits, veCRV holders can earn boosted CRV rewards (up to 2.5x) when providing liquidity, with the size of the boost proportional to the number of tokens held by an LP.

Given that it is cost prohibitive for many users to acquire the amount of CRV needed for a large boost, Convex provides a valuable service that provides any Curve liquidity provider who stakes their LP tokens, regardless of if they hold veCRV, with boosted rewards, increasing their returns.

Convex’s other offerings go beyond the scope of the article. To read more about them, click here

🌾 Yield Strategy

There are numerous farms on Convex in which users can stake their LP tokens to earn Curve swap fees, CRV rewards, and CVX rewards. Among the current highest yielding are the d3Pool, which consists of stablecoins FEI, alUSD, and FRAX, the alUSD-3CRV pool, which holds alUSD, DAI, USDC, and USDT, and the GUSD-3CRV pool, composed of GUSD, DAI, USDC, and USDT. The three pools are currently yielding between 8-11% each.

⚠️ Risks

Although LPing stablecoin pools on Curve and staking on Convex comes with reduced risk of impermanent loss, as many assets within them are pegged to one another, users should still be aware of several important risks. For starters, users are exposed to the underlying assets in each pool – Should the market lose confidence in one of the pool's assets, it is possible for a Curve pool to become imbalanced, meaning not all LPs will be able to exit with each asset in equal proportion. In addition, users are subject to two layers of smart contract risk from both Convex and Curve.

3. Balancer

- Network: Ethereum, Arbitrum, Polygon

- Asset(s): ETH, USD

- Projected Yield: 5-11% APR

- Risk: Low

🖼️ Protocol Overview

Balancer is a decentralized exchange. The protocol is highly customizable in that it supports the creation of multi-asset liquidity pools with differing weights, rather than the traditional equal-weight model seen with other AMMs such as Uniswap and Curve. Balancer pools also utilize a vault architecture which enables idle capital to be routed into other protocols, such as lending markets, to earn additional yield for liquidity providers. Like Curve, Balancer utilizes a ve-model in which BAL holders can lock their tokens for veBAL, allowing them to obtain boosted rewards when providing liquidity.

🌾 Yield Strategy

As with Curve, there are numerous pools on Balancer in which liquidity providers can earn yield without incurring impermanent loss. This includes the bb-aUSDT-DAI-USDC pool, currently yielding between 8-18% (depending on the size of an LPs boost) in which users can earn trading fees, BAL rewards, and interest revenue from Aave, as unutilized liquidity is deposited into the money market to further enhance LP returns.

Other attractive pools are the USDC, DAI, and USDT pool, which yields 5-11% depending on veBAL holdings, and the wstETH-ETH pool, which yields 7-11%. It’s worth noting that this pool is currently imbalanced, holding roughly 65% wstETH to just 35% ETH.

⚠️ Risks

The risks of providing liquidity on Balancer are similar to that of providing liquidity on Curve. Along with smart contract risk, LPs to each of the underlying assets within a pool, as well as to the risk of it becoming imbalanced. In addition, users who venture out on the risk Curve and provide liquidity for pools that contain non-like assets run the risk of incurring impermanent loss.

4. GMX

- Network: Arbitrum, Avalanche

- Asset(s): ETH, BTC, USD

- Projected Yield: 30-45% APR

- Risk: Medium/High

🖼️ Protocol Overview

GMX is a decentralized perpetuals exchange live on Arbitrum and Avalanche. The protocol enables traders to take up to 30x leverage by allowing them to borrow from a multi-asset liquidity pool known as GLP.

GLP is similar to an index, as it mostly contains large-cap assets such as ETH, BTC, and stablecoins like USDC, DAI, USDT, and FRAX. The weights of the individual assets within GLP are determined based on their utilization based on positioning, with volatile assets assigned a higher weight when traders on the DEX are long, and stablecoins making up a greater portion of the pool when they’re short.

🌾Yield Strategy

The primary way in which users can earn yield on GMX is by providing liquidity to GLP. The pool is currently yielding ~43%, with returns consisting of ETH-based borrow interest from traders taking out leveraged positions, as well as esGMX (escrowed-GMX), which are vested GMX rewards.

⚠️ Risks

There are several important risks GLP holders should be aware of. First, as with providing liquidity to any pool LP’s take on price exposure to the underlying assets within the index. In addition, in providing leverage to traders through GLP, liquidity providers are essentially taking the opposite side of their trade. The price of GLP’s reflects this, increasing when the market moves against traders positioning and decreasing when it moves with it. Finally, GLP holders are of course subject to smart contract risk.

Bonus Yield Opportunities

Now that we’ve gone through some of the more yield opportunities in depth, let’s quickly highlight some other ways in which users can put their capital to work.

Notional Finance (3-6% APY - Risk: Low)

Users can lend ETH, USDC, DAI, and BTC on the Ethereum based lending platform to earn fixed-rate lending interest currently ranging between 3-6%.

Tokemak (6-9% APR - Risk: Medium)

Users can make single-sided deposits of ETH and various stablecoins such as USDC, DAI, alUSD, FEI, and FRAX into the decentralized market making protocol to earn TOKE rewards.

Ribbon Finance (14-25% APY - Risk: High)

Ethereum, Avalanche, and Solana users can deposit their funds into Ribbon’s vaults to generate income through running automated options strategies, such as selling covered calls and cash secured puts.

Conclusion

Yields have compressed, but there still remains several attractive opportunities in which users can earn healthy, outsized yields relative to traditional markets and grow their crypto stack through this bear market.

Capital may be fleeing DeFi in this moment of panic, but those willing to remain on the frontier will continue to be rewarded.