Dear Bankless Nation,

This week will go down in crypto history.

The third-largest stablecoin and one of the biggest blockchains collapsed.

Retail investors lost savings. Builders are leaving. And now regulators will pounce.

There’s a lot of recovery to be done.

But in order for us to learn from our mistakes, we need to know what happened.

We need a post-mortem.

Ben takes us on a step-by-step play through the past week’s events.

- Bankless

Introduction

We are in the midst of the biggest collapse in crypto's history.

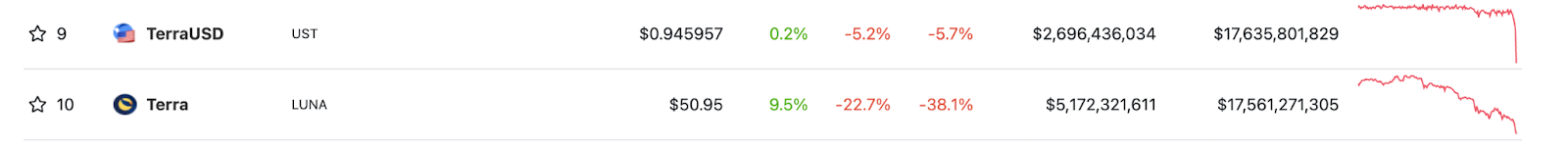

UST, the third-largest stablecoin (largest not issued by a centralized entity) has de-pegged, trading at $0.35 at the time of writing.

Its seigniorage token, LUNA, has collapsed in value, falling 99.9% from its all-time high, eviscerating more than $41 billion in value in one of the largest, single-asset wealth destruction events in history.

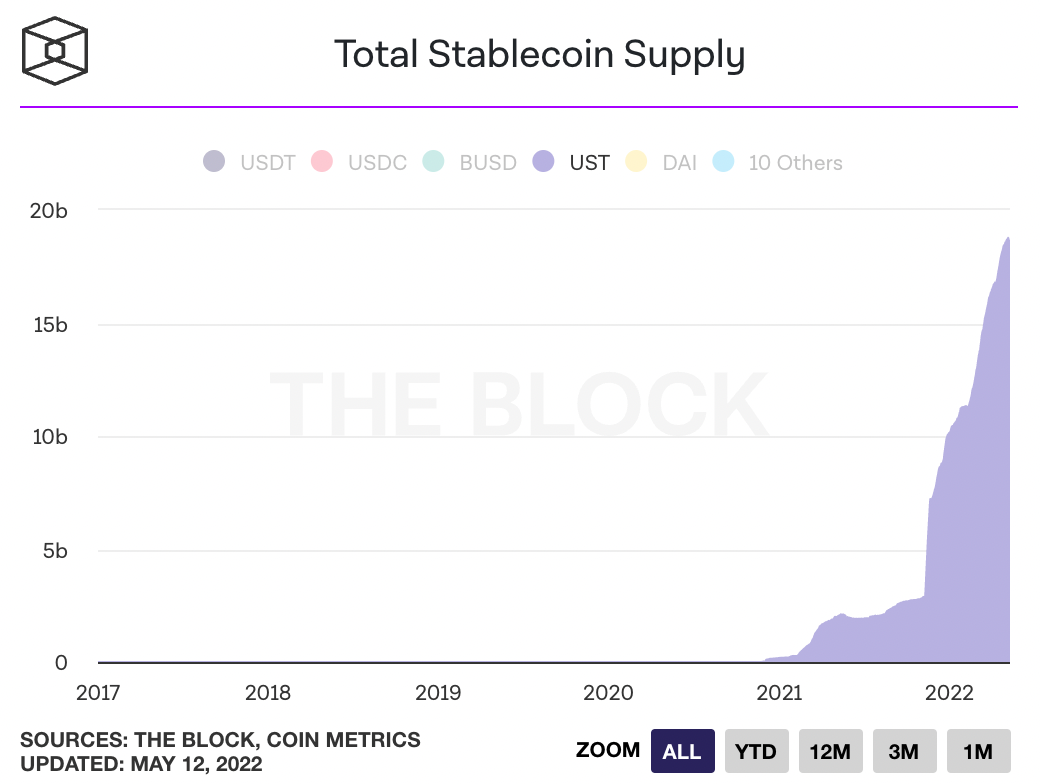

The collapse, which some speculate is the result of a Soros-esque attack, comes at a time where Terra was becoming seemingly invincible. In just under two years, UST achieved an impressive feat: it had grown its circulating supply to more than $18.46 billion, placing it third among all stablecoins, with LUNA outperforming all other major crypto-assets.

Leading Terra is Terraform Labs (TFL) CEO and co-founder Do Kwon with the non-profit Luna Foundation Guard (LFG), who recently raised a warchest reserve of BTC and AVAX that was worth more than $1.8 billion.

Just before the crash, the team (in a partnership with Frax Finance) was in the process of moving liquidity for the Curve 4Pool. This liquidity pool on DeFi’s largest exchange comprised of UST, FRAX, USDC, and USDT (notably excluding DAI), and sought to be the dominant trading pair.

To the outside observer, these moves seemed to be addressing key risks within the system by providing UST with exogenous backing, and creating opportunities to earn yield on the stablecoin outside of Anchor, a Terra money market that helped bootstrap growth by paying out 19-20% fixed rate yields on UST deposits.

Terra, which many cited as unsustainable, seemed to be heading into the right direction.

Until it wasn’t.

Let’s unpack the collapse of UST to see how the system broke down, and what the broader implications of its failure may be.

An Overview of UST and LUNA

UST is a fully algorithmic stablecoin, intended to maintain stability through a 1:1 mint and redeem mechanism.

Here’s how it works.

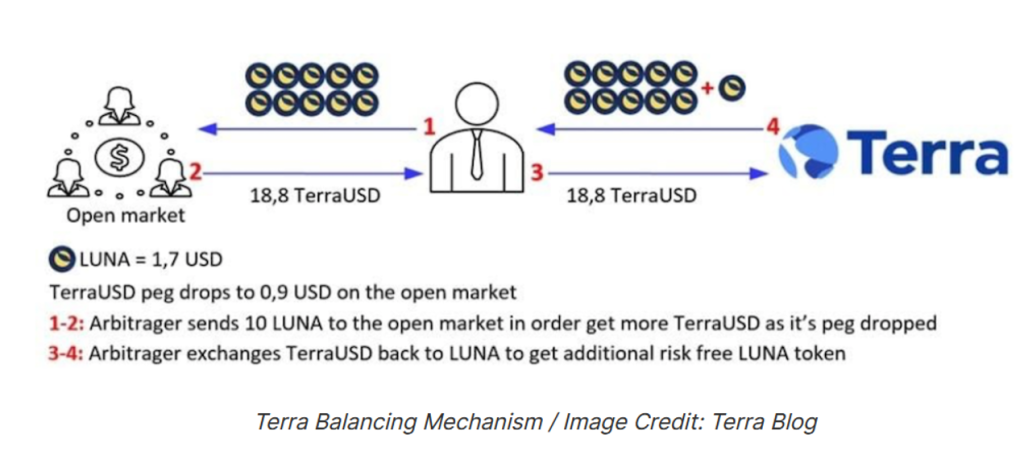

- To mint UST, a user must burn an equal amount of LUNA (e.g. burn $1 of LUNA to mint $1 of UST).

- To exit the system, a user can redeem their UST for a commensurate amount of LUNA.

This means that when the stablecoin is trading above peg, i.e. greater than $1, arbitrageurs are incentivized to come in and capture the difference between its current price and $1 by burning LUNA, increasing the supply of UST and lowering its price.

This same mechanism is also employed when LUNA is trading below $1. In that scenario, an arbitrageur can redeem UST for $1 of LUNA, similarly capturing the difference between the market price of UST and its intended peg, in doing so increasing the price of UST through decreasing its supply.

Up until May 7, UST’s algorithmic mechanism had largely been successful in keeping UST trading at peg. There are a few key insights to be gleaned:

- Unlike stablecoins like DAI, Terra’s UST is not backed by any exogenous collateral. Instead, it is collateralized by assets external to the system, with LUNA instead absorbing the volatility of the system. This means that the value and liquidity of LUNA essentially serves as the “backing” of the system, as it determines the capacity in which UST holders can exit.

- UST’s survival, therefore, depends on the market demand of LUNA. LUNA is primarily used to secure the Terra blockchain, the L1 network built on Cosmos SDK on which UST is issued.

- UST also relies on the open market to maintain stability, requiring third-party market makers like Jump Crypto, a major stakeholder in the Terra ecosystem, to keep it trading at peg.

- The system is more capital efficient, as it does not require overcollateralization (like DAI), or demand for debt, to grow its circulating supply.

- The mechanism is vulnerable to what's known as a “death spiral.” As discussed above, were holders to lose confidence in the peg, they could exit the system by redeeming their UST and minting LUNA. If enough were to do so at the same time, causing LUNA to lose a significant portion of its value, it could lead to a “run on the bank” in the form of mass redemptions. This then in turn causes LUNA to hyperinflate, rapidly losing more of its value, and trapping UST holders in the system. This scenario outlined in this final point is what we’ve seen play out over the last several days.

The Series of Events

Now that we understand the relationship between LUNA and UST and how its stability mechanism is designed, let’s explore how the crisis unfolded over the past several days.

The Initial Panic: May 7 - May 8

Context: Many in DeFi look to Curve pools, a decentralized exchange optimized for trades between like-assets such as stablecoins, to assess peg stability. The deeper the liquidity, and the more balanced a pool, the less likely a stablecoin is to de-peg. Changes to either can greatly impact the market’s psychology and confidence in a given stablecoin.

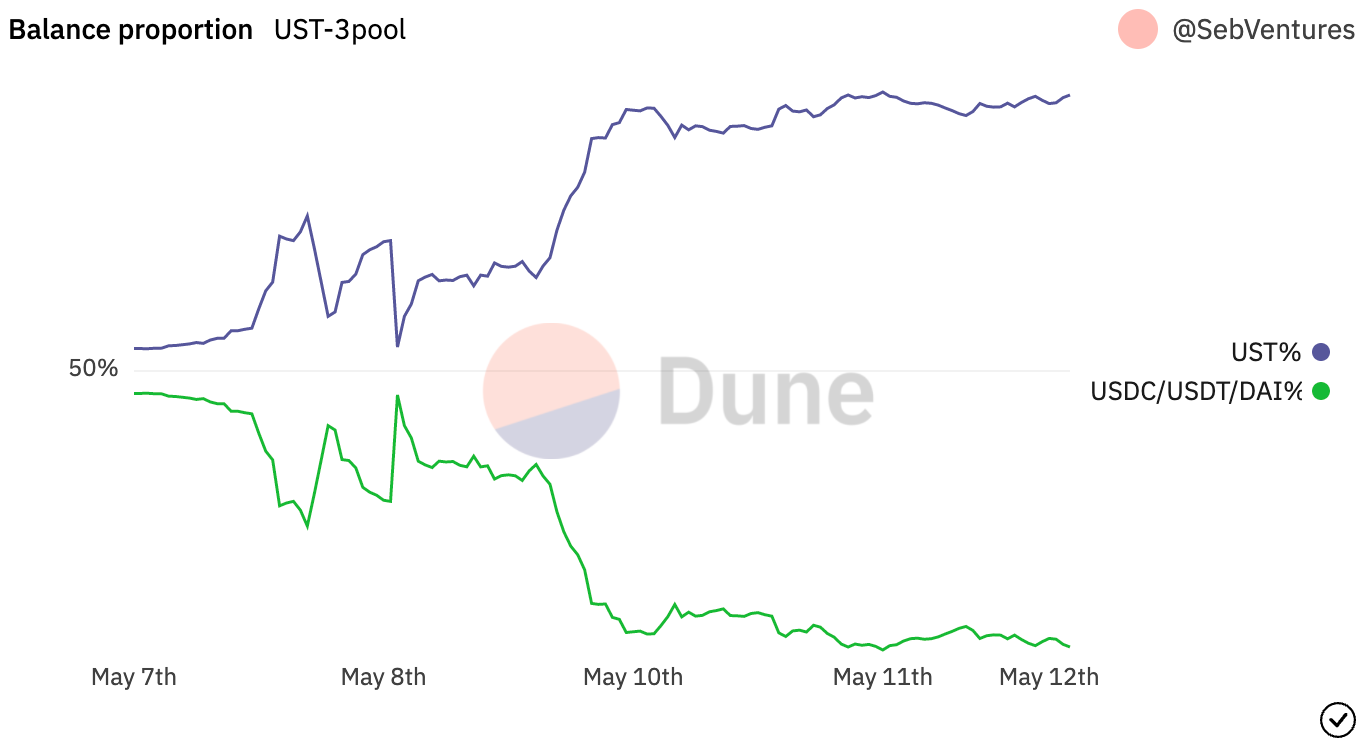

UST’s peg first came under duress on Saturday, May 7, as a result of an $85 million swap from UST to USDC in the USTw-3CRV Curve pool.

The pool is intended to have a 50:50 ratio of UST and 3CRV (the base trading pair on Curve which contains USDC, USDT, and DAI). Although it held roughly 5-6% of the UST supply at the time, it represented the largest source of on-chain, non-Terra native liquidity for the stablecoin.

This large trade wound up shaking confidence in the pool’s liquidity providers, who quickly withdrew their 3CRV, causing the pool's balance to dip as low as 77% UST and 23% 3CRV on May 8.

UST also began to trade below its peg on Binance, the most liquid centralized exchange for the stablecoin, with its price reaching as low as $0.985 cents on the exchange.

All was still relatively well. This ratio, and the price of UST, ultimately recovered following an influx of ~$250 million of 3CRV into the Curve pool, reaching as high as 54.2% UST and 45.8% CRV, though it immediately began to destabilize again.

In addition, the price of UST had been bid back up to ~$0.995 on Binance.

On the night of May 8, the Luna Foundation Guard (LFG) entered the fray. LFG announced that they would be deploying $1.5 billion of its reserves:

- Loaning $750 million of BTC to market makers to be sold to defend the peg of UST

- Loaning another $750 million of UST which was to be used to buyback BTC after volatility subsided

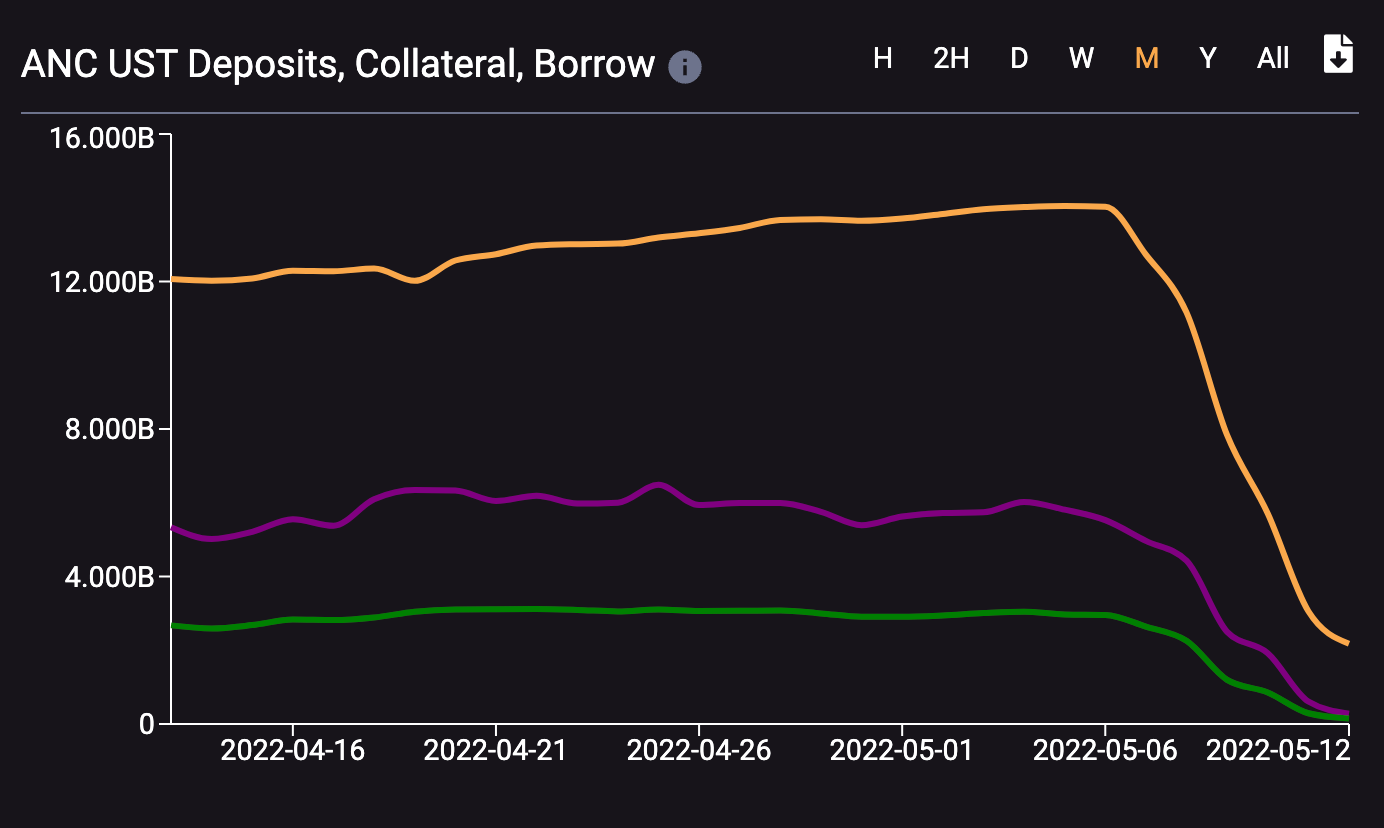

However, despite this announcement and the initially successful peg defense, there were signs that confidence in UST was already permanently shaken. Between May 7 - May 8, Anchor saw more than $2.86 billion in outflows, with deposits falling ~20.4% from $14.02 billion to $11.16 billion over the span of the two days. Meanwhile, the price of LUNA dropped roughly 17.1% from $76 to $63.

People were beginning to head for the exits, and the doors were shrinking.

The Second De-Pegging: May 9

On May 9, the peg once again began to break down. The price of UST dropped over the course of the day, falling as low as $0.60 on Binance, with the exchange at one point blocking traders from placing bids lower than $0.70.

The vast majority of on-chain liquidity for UST was drained, with the USTw-3CRV pool ratio ending the day at 95:5. Other Curve pools suffered a similar fate, as LPs fled for the exits with whatever funds they could. The panic also continued on Anchor, with its money market seeing an additional 3.83 billion of UST withdrawn.

Another critical marker that further fueled the panic was UST “flipping” in market-cap. Before the crisis began on May 7, LUNA traded with a circulating market cap of ~$25.2 billion, while the total value of the UST supply was $18.79 billion.

This meant that in theory, not all UST holders would still be able to exit the system through the mint and burn mechanism, though in practice, regardless of the “re-flippening” this would likely not be the case regardless, as the underlying liquidity and the continual devaluation of LUNA would mean that the system would not be able to support redemptions from all holders.

The “re-flippening” finally occurred when LUNA traded down to ~$51, and at around a market-cap of $17.5 billion. While not having any practical effect on the mechanism, it further weakened confidence in the system and damaged market psyche by inflaming fear among market participants.

Furthermore, the price of LUNA finished the day down 48%, crashing from $60 to $31, as redemptions ramped up, further decreasing the available runway for UST holders to exit.

Hyperinflationary Death Spiral: May 10 - May 12

Although UST managed to be bid back up to ~$0.93 on Binance, by this point its fate had been all but sealed.

- UST violently depegged again, trading as low as $0.225 on the exchange.

- On-chain liquidity had also dried up completely - The balance in the USTw-3CRV pool ranged between 97-98% UST.

- Anchor depositors continued to flee en masse, with the protocol holding just 2.18 billion in UST deposits, an 84.49% decrease since before the beginning of the crisis.

With liquidity gone, this means that, as touched on above, the only way in which UST holders can exit the system is through redemptions, i.e. minting new LUNA and selling it on the open market. The pursuit of this method caused the circulating supply of LUNA to hyperinflate 8190% from 386 million to 32 billion+ between May 10 and the time of writing on May 12, causing the price of LUNA to drop 99.1% from $31 to $0.01 during this period.

This means that based on its current market cap of $357 million, more than $41 billion in value has been destroyed since April 5, when LUNA’s valuation stood at $41.93 billion, and traded at a price of $119.

The massive destruction in value has also placed the security of the Terra blockchain at risk, with the chain needing to be halted in order to prevent a 67% attack that could see validators collude to steal assets from the network. It also comes after TFL proposed via governance to stake 240 million LUNA as a means to increase the chain's security.

Furthermore, Terra proposed to burn 1.4 billion UST sitting in the Terra community pool and has been bridged to Ethereum in order to help bring the stablecoin back to peg and to expel bad debt. This accounts for 11.8% of the total UST supply, which currently sits at 11.78 billion.

These measures come after rumors circulated on May 10 that LFG was seeking a $1-$1.5 billion “bailout” from prominent trading and market making firms in order to stabilize the system, and a day before CoinDesk reported that Do Kwon was one of the founders behind Basis Cash, a failed algorithmic stablecoin project.

The situation has also wreaked havoc through the broader crypto market, which has also sold off dramatically since May 10, falling more than 11.3% and losing more than $169 billion in value. In addition, the panic has bled over into other stablecoins, particularly Tether (USDT). The 3Pool on Curve has largely being drained of USDC and DAI, currently at a balance of 8% USDC, 8.6% DAI, and 83.4% USDT, while the price of the latter stablecoin fell as low as $0.952 on Binance in the early hours of May 12.

Conclusion and Implications

Although events have yet to fully play out, the far-reaching consequences of Terra’s collapse cannot be understated.

For starters, it is yet another example of the importance of true decentralization. The need for a decentralized currency that can function as a medium of exchange is paramount. UST claimed to be meeting this need - But in practice it was highly centralized. While proponents often stated that UST was decentralized in that it was not backed by theoretically seizable collateral like USDC, in reality the system required an incredible amount of human intervention and back-room, closed-door deals in order to function properly. It was yet another DINO project - Decentralized In Name Only.

The incident is also poised to bring increased regulatory scrutiny onto crypto, in particular stablecoin issuers. Per reporting from CoinDesk, the European Commission is floating regulations that would cap issuance of stablecoins which see more than 1 million transactions per day at €200 million. In addition, US Treasury Secretary Janet Yellen mentioned UST’s collapse when discussing the need for oversight over stablecoin issuers in congressional testimony.

The wealth destruction from this event only seems likely to exacerbate the length and depth of the bear market that crypto finds itself in. Although prices have fallen dramatically over the past several days, the litany of insolvent funds and washed out traders is likely to continue to reverberate through the market over the coming days and weeks.

Finally, and most importantly, the failure of Terra and UST has, and will continue to have, an incredibly destructive real-world impact on human lives. The r/TerraLuna subreddit is filled with numerous posts in which users state they are contemplating suicide as a result of losing their life savings. Countless groups of people, whether they be builders on Terra, retail traders and farmers, and even Web2 startups now face tremendous uncertainty in their personal and professional lives.

Crypto is resilient. Although it will take some time, the ecosystem will emerge stronger from this. But the events of the past several days are the starkest possible reminder that what happens in the metaverse has consequences in meatspace.

Action steps

- ☎️ Check in on the mental health of friends & family with crypto investments