Dear Bankless Nation,

What money does a thief prefer?

The most credibly neutral money. That was the conclusion that fell out of our protocol sink episode from May. A thief will prefer the money that can’t be confiscated or frozen. The base settlement money. That was our thesis.

Now, we get to see this thesis play out in real-time as we watch the KuCoin hacker frantically try to liquidate over $150m in stolen funds even as centralized token issuers try to freeze and pause the stolen tokens.

This serves as an acid test—just how decentralized are our DeFi protocols?

Here’s what we’re seeing:

1) Centralized issuers froze the hacked funds (e.g. USDT, AMPL, OCEAN)

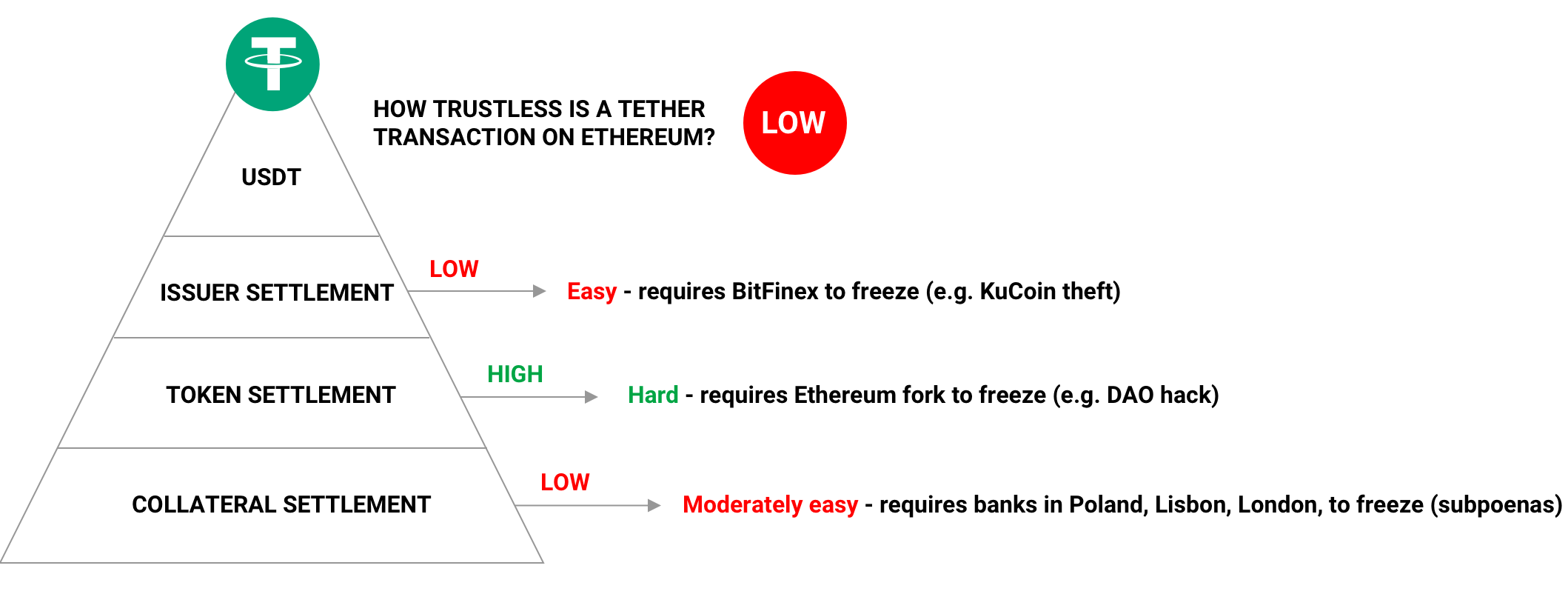

It’s silly to steal Tether. Why? The issuer can freeze the Tether you stole. Tether itself isn’t a bearer asset—it’s an IOU for money. BitFinex can freeze your stolen USDT, issue new supply, and look like a hero for catching the bad guy.

And that’s exactly what they did to the $33m in Tether stolen by the KuCoin hacker.

This hack showed that a lot of tokens fall in the category of centralized issuer willing to freeze. Some more surprising than others—this from AMPL for instance:

Hard to compete as credibly neutral money when you’re centralized enough to freeze funds.

2) Less centralized issuers didn’t freeze the hacked funds (e.g. SNX)

Of course, maybe AmpleForth wished they had coinvote governance like Kain and SNX so they didn’t have to unilaterally make the decision on whether to freeze funds.

A freeze for a token like SNX only occurs through a coinvote driven governance process. You have to write a Snythetix Improvement Proposal and have a majority of SNX holders agree. DAI operates in a similar fashion—a single entity or foundation can’t freeze funds.

As expected, the coinvote governance tokens like SNX did not freeze the KuCoin hacker’s funds—more decentralized than Tether, lower in the protocol sink.

3) Completely decentralized issuers can’t freeze funds (e.g. ETH and BTC)

Whether coinvote governance can stand up to the pressures of a nation-state legal system remains to be seen. But the actions of the hacker were instructive. The hacker didn’t liquidate for SNX or DAI, he liquidated his tokens for ETH.

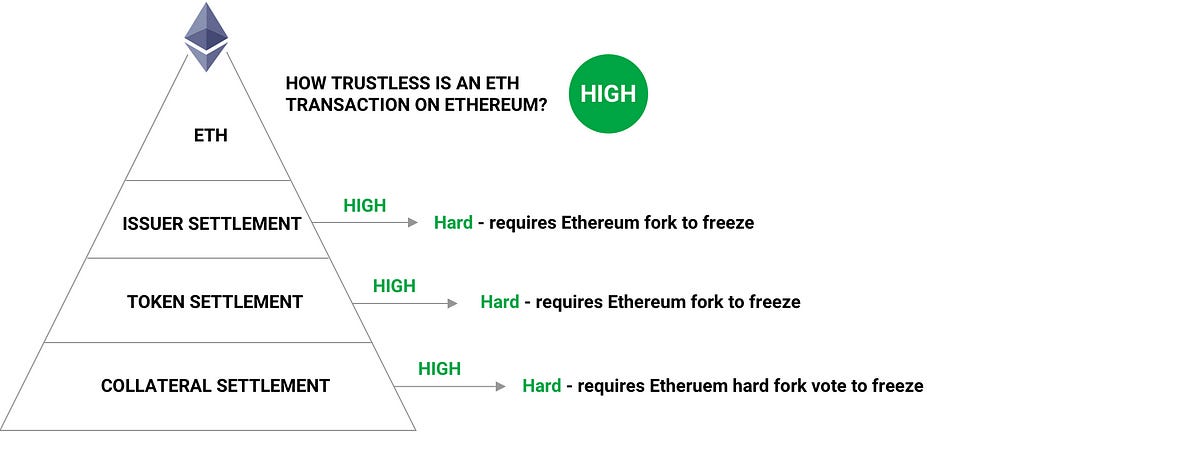

As we’ve long argued, assets like ETH on Ethereum and BTC on Bitcoin have the strongest settlement guarantees of all.

Unlike USDT and DAI, BTC and ETH are not IOUs. There’s no centralized issuer or coinvote that can freeze them. Thus they are preferred by those wishing to operate outside the confines of a specific nation-state or trusted apparatus.

They are credibly neutral base monies for the world.

Bankless digital gold.

So credibly neutral…even a thief can use them.

Or dissidents fighting for their freedom…

Or companies that compete…

Or countries at war…

The most credibly neutral systems become a critical layer for human coordination.

ETH and BTC have a bright future—if they can maintain their neutrality.

That’s what the KuCoin hack teaches us.

- RSA