Alpha Report | April 2022

Dear Bankless Nation,

Good news! Your Bankless subscription just got another upgrade. 🚀

Introducing…the Alpha Report.

Our new monthly report gives you:

- Token ratings (what should I buy/sell/hold?) 📊

- Market themes (what catalysts should I watch?) 📈

- DeFi at a glance (what’s the health of the DeFi market?) 👀

Our best DeFi ideas distilled into 15 mins of actionable alpha. Crazy valuable insight.

This month we’ve initiated coverage on BAL, FXS, MKR, SUSHI, & TRIBE. 🔥

Expect to get one of these on the first Friday of every month as part of your Bankless Premium Subscription from now on.

You ready?

Let’s get to the Alpha. 🚀

- RSA

Token Ratings 📊

Analyst notes, coverage, and six-month price targets on DeFi’s largest tokens.

👉 Get the full token rating spreadsheet here 👈

Rating Scale:

- Overweight – We expect this token to outperform the broader market.

- Neutral – We expect this token to perform in line with the broader market.

- Underweight – We expect this token to underperform the broader market.

Balancer (BAL)

🏅 Rating: Overweight

🎯 Price Target: $31-46 (100-200% upside)

- We are initiating coverage of BAL, the native token of decentralized exchange Balancer, with a rating of overweight.

- We are assigning this rating due to the activation of veBAL. An overhaul of BAL’s tokenomics, the upgrade will entitle holders who lock LP tokens from the 80/20 BAL/ETH pool to 75% of fees generated by the protocol, boosted yields when providing liquidity, 10% of emissions, and the right to vote on BAL rewards directed to different pools on the exchange.

- We believe veBAL significantly enhances the utility of the token, with a design that locks up supply while simultaneously using it as liquidity and drives demand through voting rights over emissions. Like tokens with a similar design, such as CRV, we feel that BAL will become a top target among DAOs who wish to lay claim to liquidity on the exchange. We have already seen the first signs of this, with a proposal making its way through Aave governance to acquire 300,000 BAL, worth $4.5 million at current prices.

Frax Finance (FXS)

🏅 Rating: Overweight

🎯 Price Target: $64-97 (100-200% upside)

- We are initiating coverage of FXS, the native token of stablecoin protocol Frax Finance, with a rating of overweight.

- We are assigning this rating due to the 4pool proposal. As discussed earlier in this report, the 4pool of FRAX, UST, USDC, and USDT intends to replace the 3pool of USDC, USDT, and DAI as the primary base pair among Curve pools. The pool would deepen liquidity and add utility for FRAX by pairing it with numerous other stablecoins on DeFi’s largest exchange by TVL.

- We believe the 4pool proposal is poised to position FRAX as among Ethereum’s largest and most liquid decentralized stablecoins. In turn, this uptick in usage should lead to increased demand for FXS, and revenues generated for veFXS holders. Given the substantial holdings of CVX among the entities involved in the proposal, Frax, [Redacted] and Terra hold about 5.2% of the total supply, we feel this proposal has a very high likelihood of passing through Curve governance.

Maker DAO (MKR)

🏅 Rating: Neutral

🎯 Price Target: $2842-$3411 (25-50% upside)

- We are initiating coverage of MKR, the native token of MakerDAO, with a rating of neutral.

- We are assigning this rating due to the 4pool proposal. As discussed throughout the report, the pool would see DAI, replaced as one of the base stablecoins on pools across Curve. The proposal poses a significant threat to the protocols competitive positioning on the exchange, with the potential to cede share to decentralized alternatives like FRAX and UST.

- We feel that while DAI may lose share on Curve, it’s unlikely to pose a threat to its niche as the most battle-tested, overcollateralized, debt-based stablecoin. In addition, we believe that the shot across the bow from the 4pool may bolster the appetite among the Maker community to overhaul MKR token economics to help beef up their competitive position. Despite this, and although DAI supply is likely to grow, we believe it will earn a smaller piece of a growing pie.

SushiSwap (SUSHI)

🏅 Rating: Neutral

🎯 Price Target: $4.96-$5.95 (25-50% upside)

- We initiate coverage of SUSHI, the native token of decentralized exchange SushiSwap, with a rating of neutral.

- We assign this rating to Sushi due to the recent “Enter the Stargate” snapshot vote. The vote signaled support among the community to integrate Stargate, a recently launched cross-chain interoperability protocol, into Trident, the newest iteration of SushiSwap’s AMM. This would allow traders on the DEX to make swaps across chains and L2s without the need to bridge or custody wrapped assets.

- We believe Stargate represents a major growth opportunity for SushiSwap. Should the proposal pass, the protocol would be in prime position as the first interchain, EVM-compatible DEX. Given the overwhelming support on the snapshot, and the prescense of SushiSwap alumni 0xMaki on the Layer Zero team, we feel that the proposal has a strong chance of passing. However, we believe the project still faces some headwinds due to continued uncertainty surrounding its leadership, as well as the lack of utility for the token in its current form.

Tribe DAO (TRIBE)

🏅 Rating: Overweight

🎯 Price Target: $1.12 -1.68 (100-200% upside)

- We initiate coverage of TRIBE, the native token of the Tribe DAO, with a rating of overweight.

- We assign this rating due to the proposed “xTRIBE” token upgrade. Proposed by Fei Protocol founder Joey Santoro, xTRIBE represents an overhaul of the TRIBE token design by automatically accruing and compounding emissions, entitling holders to the largest revenue share within the soon to be launched Turbo product, and enabling holders to vote on emissions to different pools on Rari Capital’s Fuse, a protocol for creating isolated lending markets. Per the proposal, xTRIBE would be a fully liquid token that requires no lockup, while TRIBE buybacks, which currently are done at a rate of 25% of protocol equity, would remain in place.

- We believe that xTRIBE would represent a significant improvement to the value proposition of TRIBE by increasing both utility and demand. We also feel that it is likely to kick-off the “Fuse Wars” in which Fuse pool operators, such as DAOs, may purchase and accumulate xTRIBE to increase yields, and therefore liquidity, for their depositors. Given the community support based on responses to the governance forum post, we feel the proposal is likely to pass.

Market Themes 📈

An overview of 3 important trends in DeFi that investors should keep an eye on.

1. The Rise of UST On Ethereum

One major trend that investors should be monitoring is the rise of UST on Ethereum. Fueled by the explosive growth in the price of LUNA following an announcement stating an intent to purchase $10 billion worth of BTC reserves, along with a multi-chain UST deployment strategy, Terra has become increasingly aggressive about securing integrations across Ethereum DeFi. This has resulted in partnerships with protocols such as Rari Capital’s Fuse, Olympus DAO, Tokemak, and Curve.

The supply of USTw (UST bridged onto Ethereum through Wormhole) sits at $988 million, accounting for roughly 5.9% of the total UST supply and placing the stablecoin as the 7th largest on the network. A substantial portion of this liquidity sits on Curve, the largest decentralized exchange by TVL, as more than $669 million of USTw is held in the USTw-3CRV pool, representing ~67% of the chain's total supply.

A major potential catalyst for the adoption of UST on Etheruem is the proposed “4pool.”

The creation of Terra, Frax, [Redacted] Cartel, and Debt DAO, the 4pool (USTw, FRAX, USDC and USDT) aims to replace 3CRV (USDC, USDT, and DAI) as the base trading pool for tokens on Curve. With currently more than $9.3 billion in 3CRV liquidity, this represents a major opportunity for UST to establish itself as one of Ethereum’s most dominant stablecoins.

2. Derivatives on Layer-2

A second important trend to monitor over the coming months is the continued rise of derivatives protocols on Ethereum Layer 2s. Taking advantage of the increased scalability provided by Optimistic and ZK-Rollups, L2-based derivatives protocols have emerged as among the most utilized applications on these scaling solutions.

Per DeFi Llama, two of the three largest protocols by TVL on Arbitrum are in the derivatives sector. GMX, a perpetuals exchange, and Dopex, an options exchange, account for a combined $1.07 billion in TVL, and place fifth and sixth in weekly active users among applications on the network.

Optimism has similarly found itself to be a derivatives hotbed as Synthetix, a synthetic asset issuance protocol, Lyra, an options protocol, and Perpetual Protocol, a DEX for trading perpetual futures, hold the first, fifth, and sixth most TVL out of any DeFi application on the L2. Accounting for a combined $252 million in TVL, the three have Optimism’s second, third, and sixth highest weekly active user count, respectively.

Given the secular growth in usage and TVL on Ethereum L2 and the demand among farmers for more sustainable yield generation strategies, DeFi derivatives seem poised to continue their strong growth trajectory.

3. DAOs as Capital Allocators

A third emerging trend across DeFi has been the rise of the DAO as a capital allocator. Part of the broader trend of “DAOFi,” which refers to DAOs as DeFi users and investors, we have seen these decentralized organizations continue to accumulate strategically valuable tokens.

The motivation behind these purchases has largely been driven by the desire among DAOs to attain or control liquidity through meta-governance. An example of this is the March 2022 purchase of $4.41 million worth of CVX, the native governance token of Convex Finance, by Silo Finance, an isolated lending protocol. This was done for Silo to gain access to Convex’s meta-governance rights over CRV, the native token of Curve Finance, to drive CRV emissions and therefore liquidity, to the SILO-FRAX pair. The purchase was another example of DAOs as “smart money” within DeFi, as CVX has risen 108% to $36.75 from Silo’s cost basis of $17.64.

Besides Silo, CVX has continued to be a top target among DAOs whether it be through market purchases or accumulation through farming with protocol-controlled value. The total CVX held by DAOs increased by more than 5.4 million in 2022, with about 12.7% of the total, and 22.6% of the circulating CVX supply under control of these DeFi-native entities.

Given the explosive rise in the price of CVX, and the signal in these purchases, investors should continue to closely track DAO activity.

DeFi at a Glance 👀

A look at on-chain metrics to get a picture of the current state of Ethereum DeFi.

1. Ethereum DeFi TVL

TVL in Ethereum DeFi rose 13.14% m/m from $93.01 billion to $105.24 billion between March and April 2022. This rise is attributed in large part to the increase in price of ETH and other crypto assets.

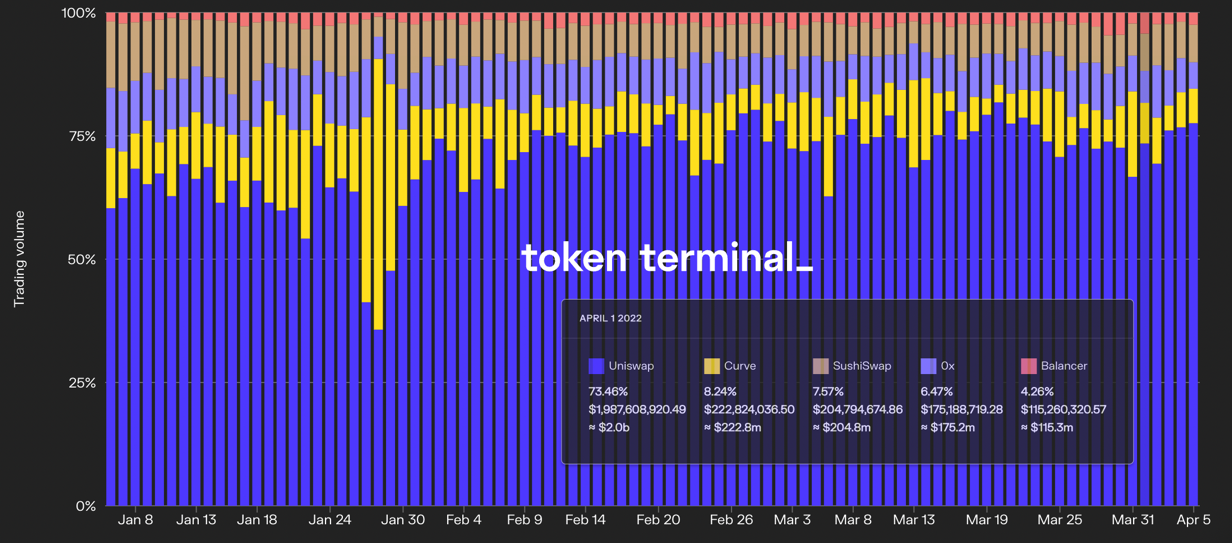

2. Spot DEX Volume Market Share

Uniswap maintains its market share as Ethereum’s largest DEX by volume, accounting for 73.6% of daily volumes at the start of April 2022. This represents a slight -0.27% m/m decrease from its 73.8% share at the beginning of March 2022.

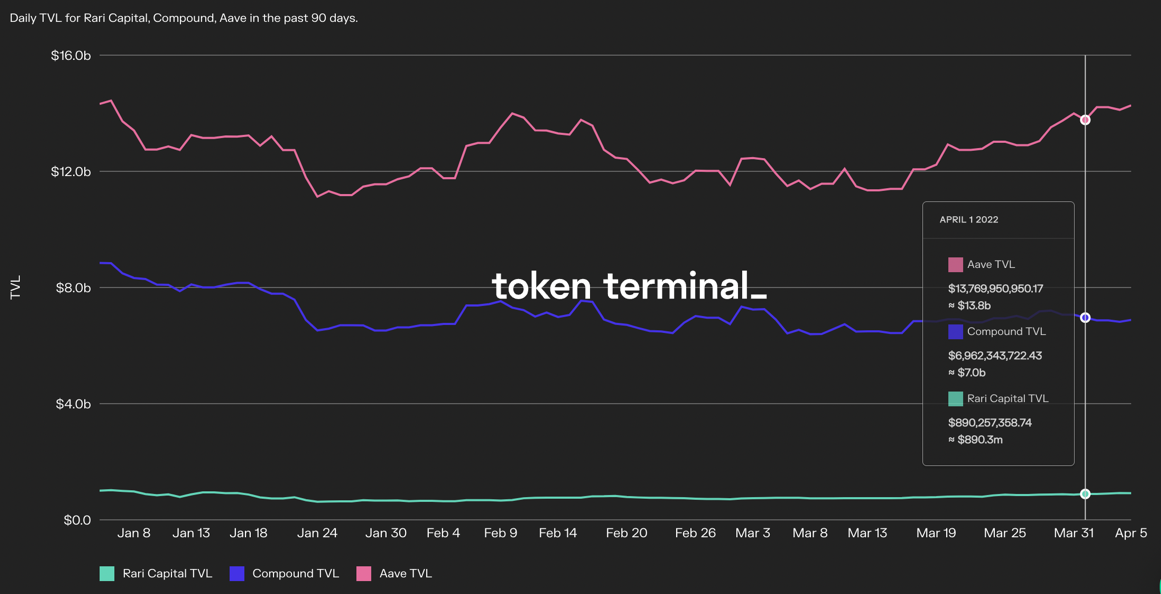

3. Lending Market TVL Market Share

Aave remains the largest money market by TVL with $13.8 billion, accounting for 63% share at the start of April 2022. This represents a 3% m/m increase from the protocol's 60% share at the beginning of March 2022.

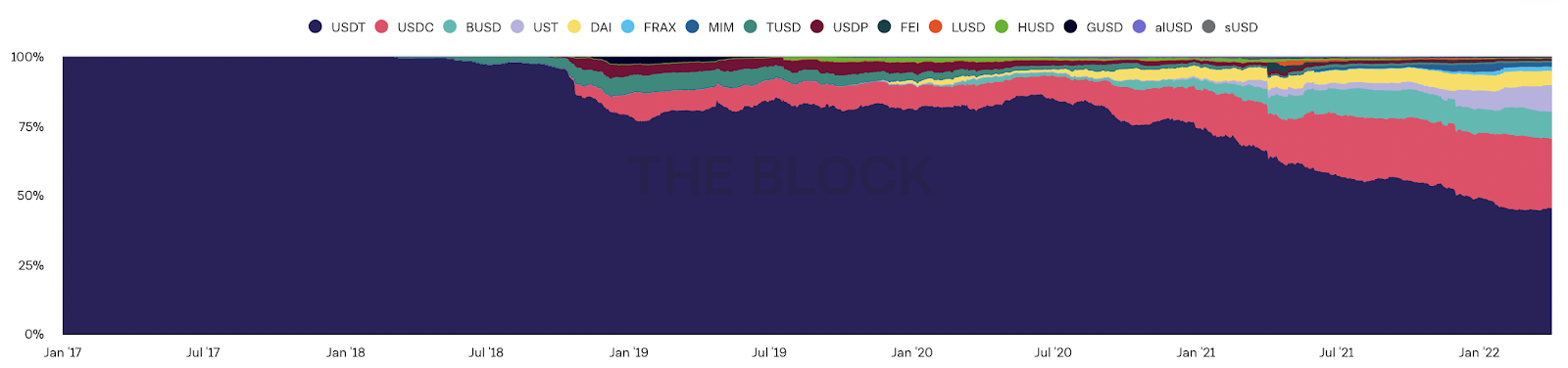

4. Stablecoin Supply Market Share

Although USDT remains the largest stablecoin by circulating supply with a 45.28% share, UST has been among the fastest growers, seeing its market share rise 7.73% to 9.51% over the course of March 2022.