Abandoning Ethereum

Dear Bankless Nation,

This weekend, there was a lot of drama on crypto-Twitter.

For those that aren’t familiar, Twitter plays a huge role in this industry. Crypto-Twitter, or ‘CT’, is a fun, chaotic place where lots of different conversations are all happening all at once.

It’s how alpha is shared, where communities converse with other communities, and occasionally, where fights happen.

This weekend was one of those weekends. 🥊

What are we fighting about?

These crypto-twitter ‘fights’ centered around a few themes, but to put it reductively, it felt like Ethereum vs the VC traders.

The ‘Ethereum Abandoners’ said…

- Ethereum, as an ecosystem, doesn’t care about people that can’t afford gas fees.

- Ethereum culture is gatekeeping the industry by claiming that other competing chains are ‘illegitimate’, even while they are allowing users to be crypto natives at reasonable fees.

- The Ethereum community has ‘lost the plot’ as it comes to stewarding this industry, and is now focused on pumping ETH.

The Ethereum advocates said…

- Trading firms (like 3 Arrows Capital) masquerade as Venture Capital firms, but are blatantly promoting their ETH killer positions in order to ‘pump their bags.’

- Stop using Ethereum’s high fees as an excuse to invest in far more centralized ‘Ethereum killers’ that sacrifice decentralization for scale.

- Stop falsely branding the Ethereum community as ‘people who got rich, lazy, and stopped caring about inclusion’—we’re building non-stop over here.

Setting the Stage

For a number of months now, Three Arrows Capital (3AC) has been aggressively promoting the Avalanche blockchain. We had them on the show back in May to discuss the major ETH run that had just happened.

Kyle Davies and Su Zhu (together they run 3AC) have a reputation of making fantastic trades and generating a sufficiently large following of people who copy their moves.

3AC generally takes outsized bets into a specific category, genre, or specific asset based on the current narratives or macro-trends at the time. They also get very loud about their positions on Twitter.

Fill…then Shill.

These positions have rotated throughout many different assets. After their ETH trade in the first half of this year, it seemed they rotated into a Bitcoin position thinking it would regain dominance, and more recently they’ve been promoting Avalanche, likely on the heels of the massive Solana run-up.

This is simply what traders do! Traders gonna trade.

This is different than the culture of the Ethereum ecosystem. While much of crypto is filled with traders who trade the narratives that arise, a decently large part of the Ethereum community focuses on longer time horizons. These two perspectives are fundamentally at odds with each other, and I believe is really what divided the industry on crypto-twitter this weekend.

Ryan Selkis of Messari stated it well:

I think people tolerate the narrative trading game because it’s an inevitable part of how the industry works. People trade. Some people trade a lot. Some people trade big. If there are profits to be made, someone’s going to take them. So while Ethereum builders may not like the constant rotation of narrative trading, they tolerate it.

But things change when you actually start attacking Ethereum in order to justify a position that is ultimately a ‘trade’ and not a ‘long-term belief’.

And that’s how crypto-twitter blew up this weekend.

Kain vs Su

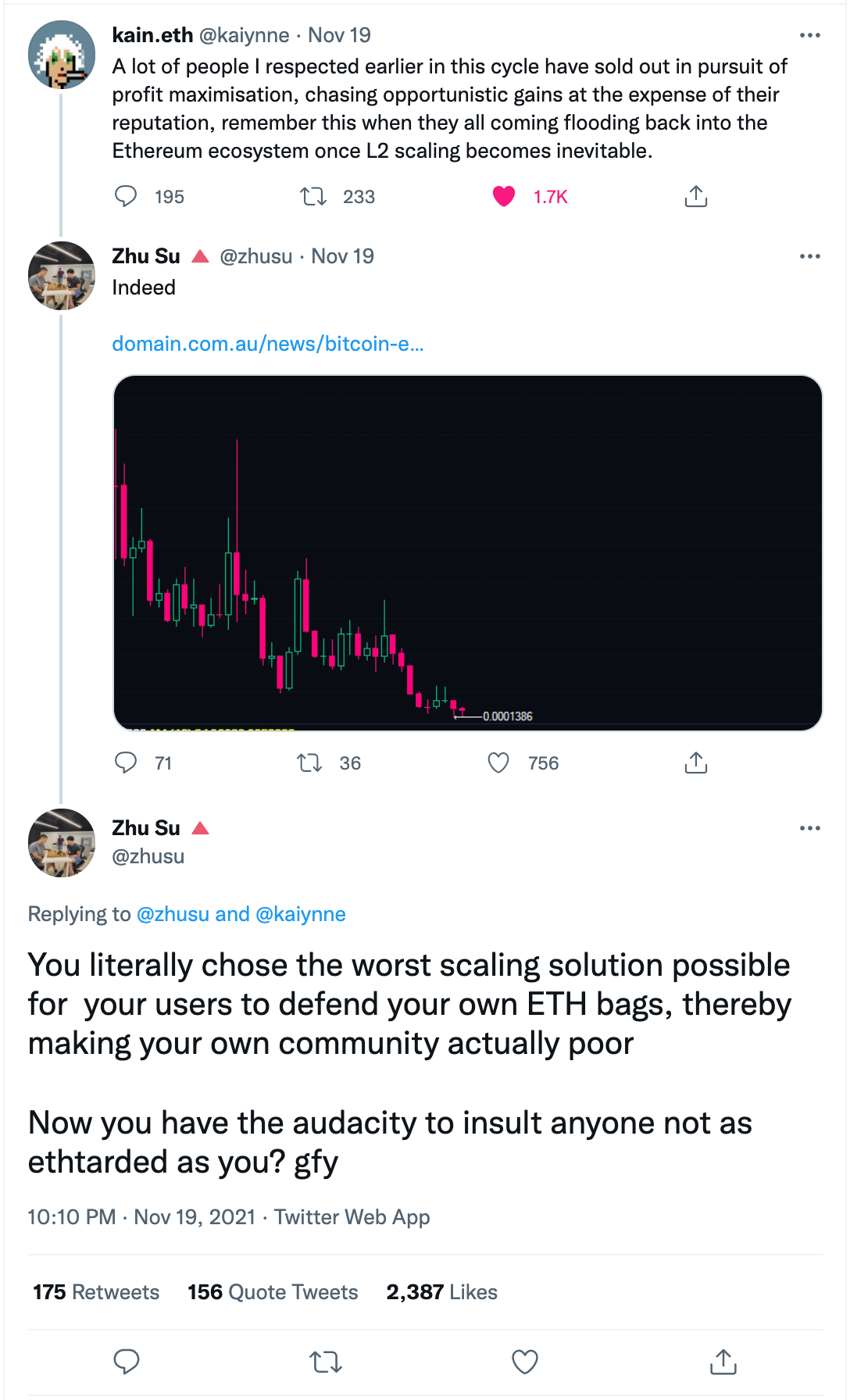

It started when Kain Warwick of Synthetix tweeted this out on Friday:

While not specifically naming 3AC here, 3AC definitely stands out as more or less exactly who Kain is referring to.

Su Zhu responds to this tweet, claiming hypocrisy due to Kain selling a portion of his SNX tokens to purchase a ~$50m worth of real estate in Australia.

Kain responds:

So we have the founder of a DeFi protocol with a net worth north of $500m, that sold some of his assets to purchase multiple properties, going up against a billionaire trader pumping his recent ETH killer bags who Kain is claiming has ‘sold out’ in pursuit of ‘profit maximalism’ and forgone morals in order to make more money.

You can see how things got pretty spicy this weekend 🌶

That was just Day 1.

Day 2 of Fighting

On Saturday afternoon Su Zhu tweets this.

Abandoned Ethereum…strong words!

This is Su claiming that Ethereum has ‘lost the plot’ and is now a ‘whale-chain’ that is not able to service the average user, and therefore goes against what crypto stands for in the first place.

Here’s when I hopped into the conversation:

I got my fair share of flak for this tweet (💩 was being thrown left and right); the majority of critiques was that I was making the assumption that anything that’s not Ethereum is ‘not decentralized’, and co-opting the word ‘decentralization to mean ‘Ethereum’.

Also, people didn’t like the ‘sin’ word, but I actually chose that word extremely intentionally and will be elaborating on that point tonight on Up Only.

When Push Comes to Shove

The Ethereum community is known for its inclusiveness and openness. This culture came about as a reaction to the close-mindedness and fostering maximalism of Bitcoin culture that pushed Vitalik and many of the future-Ethereans out of Bitcoiner circles.

This openness and acceptance has been a very important part of Ethereum but is also a double-edged sword. Where Bitcoiners learned to make very firm, hardline stances, Ethereans learned to be more willing, accepting, and trusting of new ideas, new people, and new efforts.

This generalized acceptance has allowed for a lot of new communities to be formed inside of the greater Ethereum ecosystem, but it also lets wolves wear sheep’s clothing.

During 2018-2020, Ethereum did not have a spine. During this time, it was actually Bitcoiners that set the narrative of what Ethereum was. Ethereum as a community was a complete push-over. Its accepting and inclusive nature prevented it from putting up hard walls around what was acceptable and what wasn’t.

This has certainly changed.

Exhibit A.

Exhibit B.

Exhibit C.

Exhibit D.

The Critique Chain

Something that’s fascinating to me is watching the Ethereum community critique the majority of ‘ETH Killers’ in the same way that Bitcoiners critique Ethereum.

- A centralized blockchain that only a few people can run nodes on

- Early insiders who got an outsized allocation of funds

- Building an ecosystem on empty promises

So it makes sense when people from the Avalanche or Solana community look towards the Ethereum community and see the same things that Ethereans see in Bitcoin.

The incumbent chain wants to spin this narrative of every other chain as a centralized VC chain. The disruptor chains want to spin the narrative of lazy, ‘lost the plot’ elitists who no longer care about the values they originally purported.

These critiques just get passed down the chain. Any chain that’s bigger than yours is lazy incumbents. Any chain that’s smaller than yours is a centralized VC chain.

So What’s True?

At some point in this critique chain, someone is right. At some point, the critiques become true. It’s simply a matter of finding where on the spectrum these critiques become true.

This is where my personal beliefs about what is true come into play.

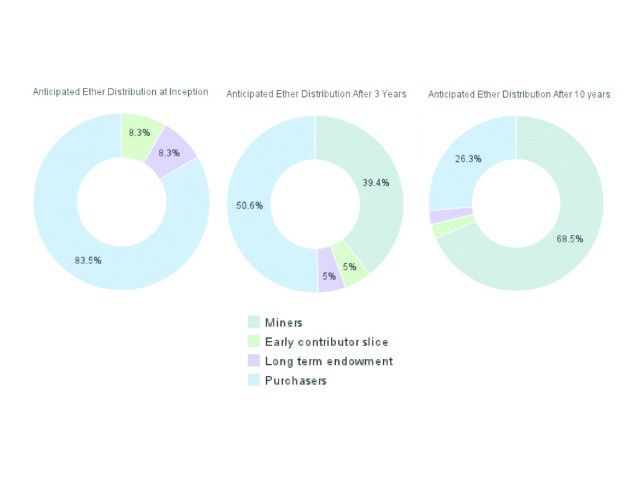

Bitcoiner maximalists are wrong about Ethereum. The Ethereum pre-mine was actually a genesis distribution event, in which Ethereum minted 72m ETH, and sold 60m of it to roughly 9,000 people, and raised $14m for development. Roughly half of that 12m was split between early-contributor rewards and the EF for long-term development funding.

Part of the story of the Ethereum presale was its permissionless nature:

Now anyone could be an investor in one of the most cutting-edge technology companies out there. All they needed was an internet connection and at least 0.01 bitcoin.

- Mihai Alisie

Additionally, the Ethereum blockchain from its very first block was a constrained blockchain, meaning that its transaction capacity was even lower than what it has today because the ethos of the Ethereum blockchain was maximum decentralization from block #1.

Compared to the ‘ETH Killers’

Token Distribution

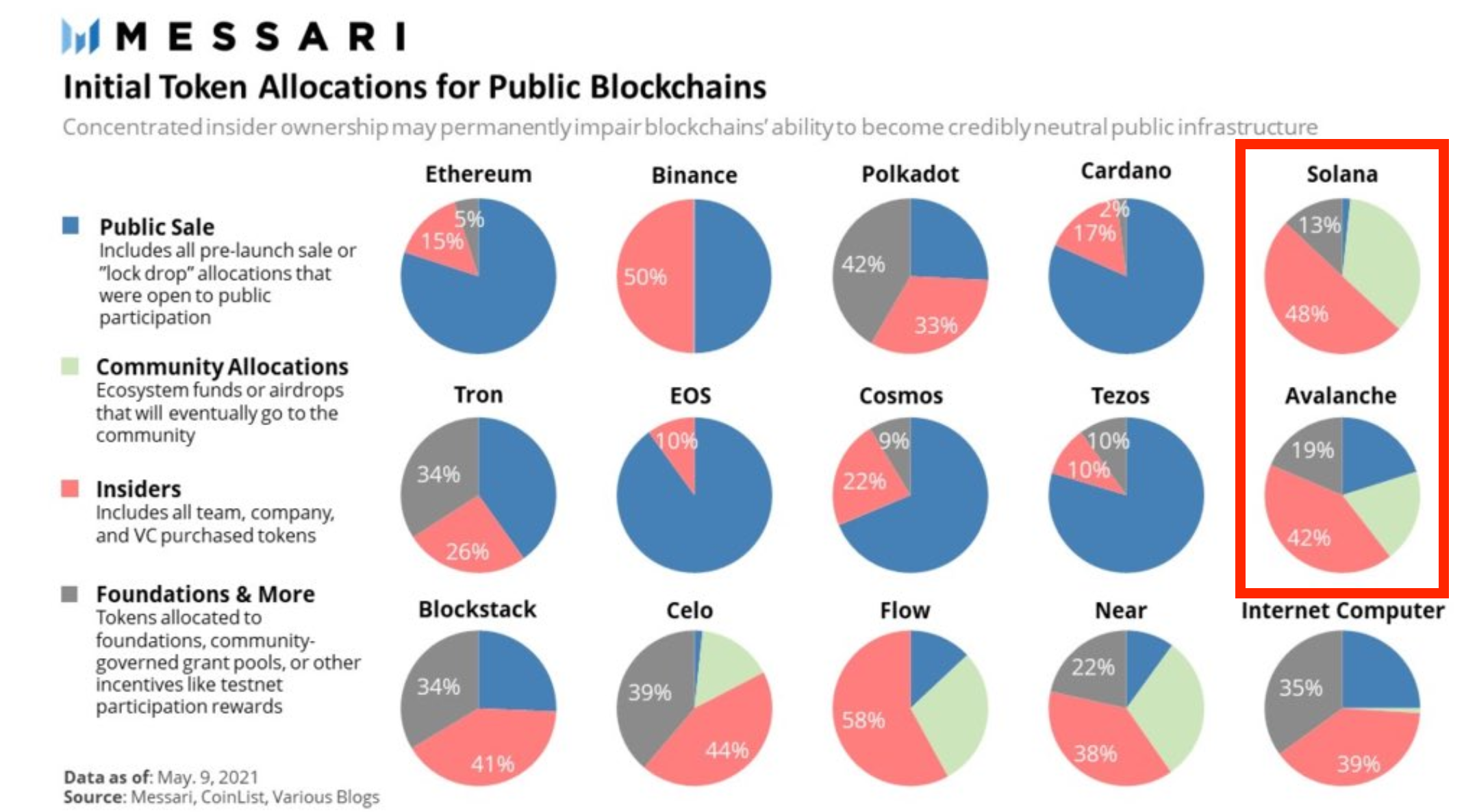

We simply do not see these same choices being made by the ‘ETH Killers’ that were a part of the conversation this weekend.

Solana and Avalanche are the most egregious examples of private early rounds of token distribution. Where the Ethereum sale was free and open to the public, without KYC, both Solana and Avalanche have had private rounds where VC funds are able to gain a significant amount of the supply.

Here’s Kyle Davies tweeting about how his AVAX tokens are locked up:

Lockups are good, they prevent VCs from dumping too soon. But also, what’s better than VC lockups? Not having insider VCs at all. VCs could have bought into the Ethereum pre-sale, but they would have received the same rates and privileges as any other user, and not given any preferential treatment.

Chain Decentralization

Where Ethereum started off with a commitment to decentralization—namely, the ability for non-validating users to run nodes—Solana and Avalanche have not made these same commitments. And this is the crux of the issue,

3AC claimed that they are investing in ‘legitimate experimentation’ as it comes to blockchain scalability, but the others cried BS. Hasu framed it here:

The claim here is that systems like Avalanche or Solana have merely chosen a different part of the decentralization, which is not innovation and is instead simply an excuse to maximize profits by entering the very hot game of the L1 wars.

Here’s Polyna’s takedown of Solana in response to the Solana CEO’s claim that Solana is ‘objectively decentralized’.

According to Ethereans, it’s really important to have a culture that prioritizes decentralization. If you don’t, then decentralization is always something that you can ‘tackle later’, and you’re free to keep on kicking the can down the road. The alternative chains have simply not shown any meaningful commitment to decentralization, both in their strategy for distributing tokens and for decentralization block production.

Has Ethereum abandoned its users?

One of Su’s spiciest comments was that Ethereum has abandoned its users. Its fees are too high to support the common user and the Ethereum is too busy celebrating its new fee burn to care about how regular people can’t afford the chain.

These comments really ticked off the Ethereum community, especially the builders.

Here’s Banteg from Yearn:

Lightclients, an Ethereum core dev:

Eric Conner:

Polynya:

Conclusion

I think this weekend is a pivoting moment for the industry. In my opinion, the gloves are off. The pleasantries cast aside. The Ethereum community generally sits down and takes the FUD punches thrown by almost everyone else in the industry, but it seems like the community as a whole has had enough, and as it turns out, the nice fuzzy Unicorn-branded community also has the teeth and claws needed to fight back.

All this drama made so much noise that it even got Edward Snowden to comment:

While the dynamics of Ethereum maximalisms, versus ETH killers will continue to play out, I do hope that we as an industry can stop worshipping traders who use their influence to push the markets in a direction so that they can counter-trade them.

In an industry that promises to redefine money, it makes sense that there’s a lot of money-worshippers out there. I hope we all, myself included, can come out of the trance that money puts us all under, and remember the principles and values that this industry puts on the table for the whole entire world.

- David