A Guide to Earning on dYdX

Dear Bankless Nation,

Exactly two months ago, we wrote about the potential for perpetual markets in crypto.

We asked why, despite the market opportunity, perpetuals and other derivatives represented only a fraction of total activity in DeFi.

Luckily, that’s starting to change.

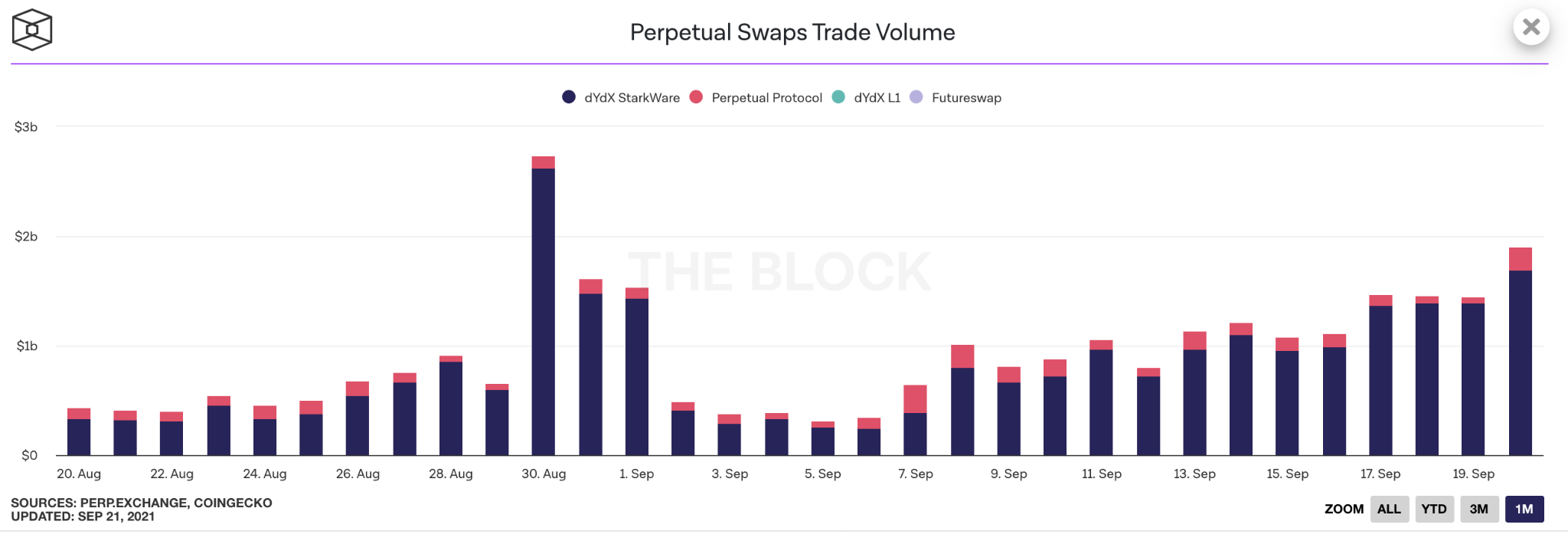

Since dYdX launched their token in August, we’ve seen activity explode. Trading volumes, liquidity, and everything else have been up and to the right.

This was expected. Tokens are a steroid for growth after all—and we’re seeing that play out right in front of us.

With the launch of $DYDX, there’s a bunch of new opportunities available for those looking to get involved.

Here’s what you need to know.

- RSA

A Guide to Earning on dYdX

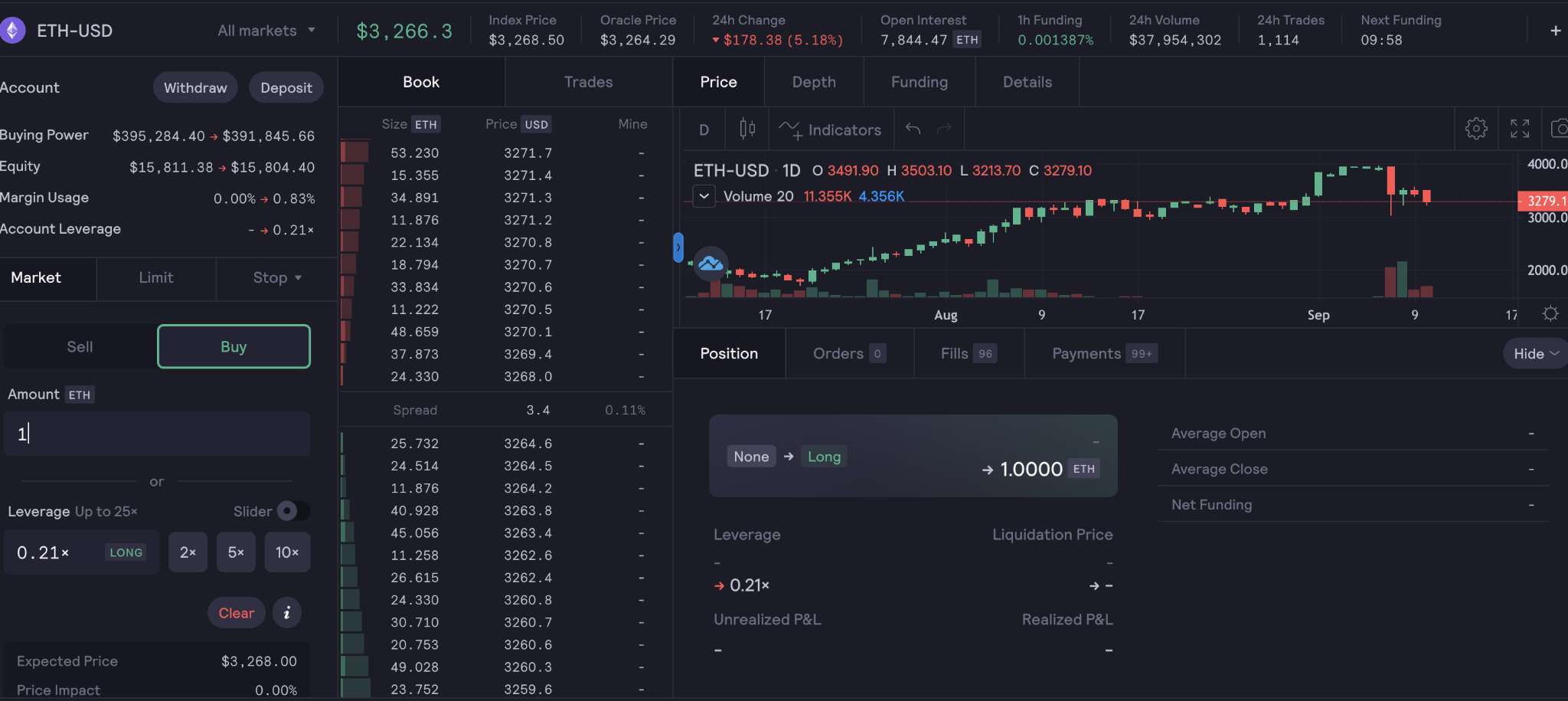

Back in April, we showed you how to onboard dYdX’s Layer 2 and start trading perpetuals. Since then, the dYdX has grown exponentially, launching 24 markets, onboarding tens of thousands of users, and attracting many of the best market makers in crypto, making it one of the leading decentralized perpetual protocols on the market.

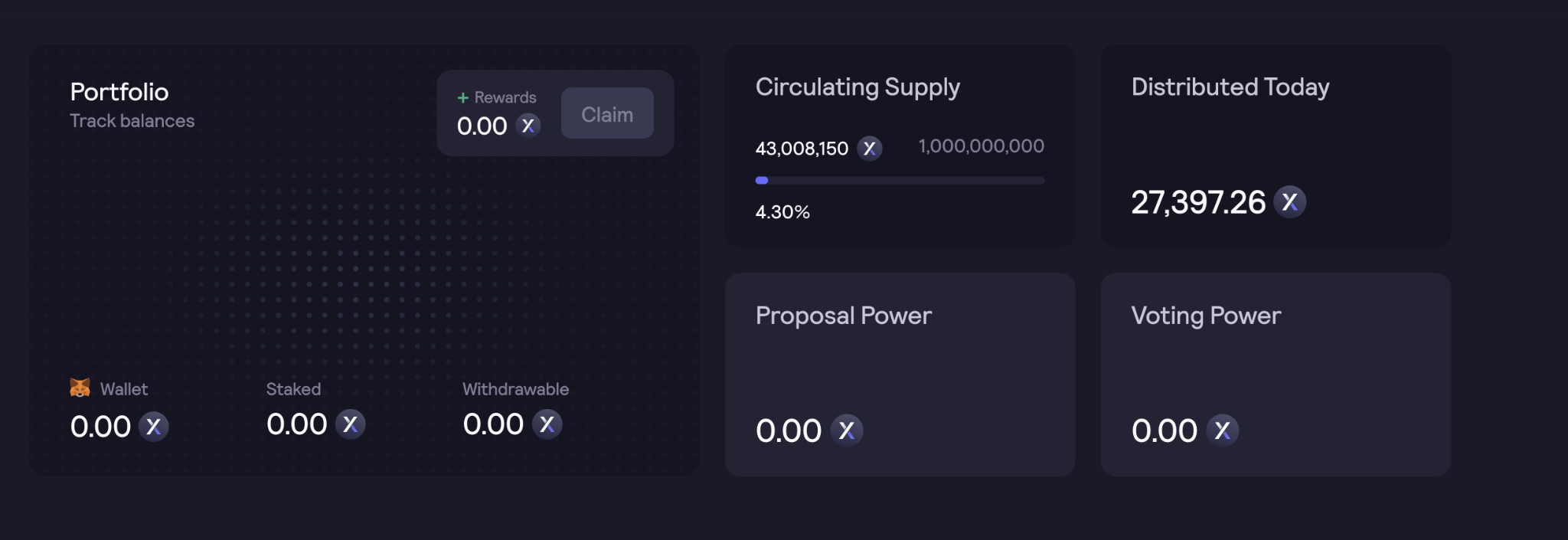

In August, the dYdX Foundation released $DYDX, further handing control of the protocol over to its users. The token has a variety of liquidity mining programs and earning opportunities that reward users based on their activity on the protocol.

In this guide, we will give an overview of each of these programs, and show how to start earning DYDX.

🏆 Get 10% off trading fees!

Before we begin…did you know Bankless readers get 10% off dydx trading fees? Add the Bankless discount to your wallet now. Get 10% off fees.

3 DYDX Earning Opportunities

dYdX Protocol currently has two main liquidity mining programs available to users:

💰 Opportunity #1: Trading Rewards

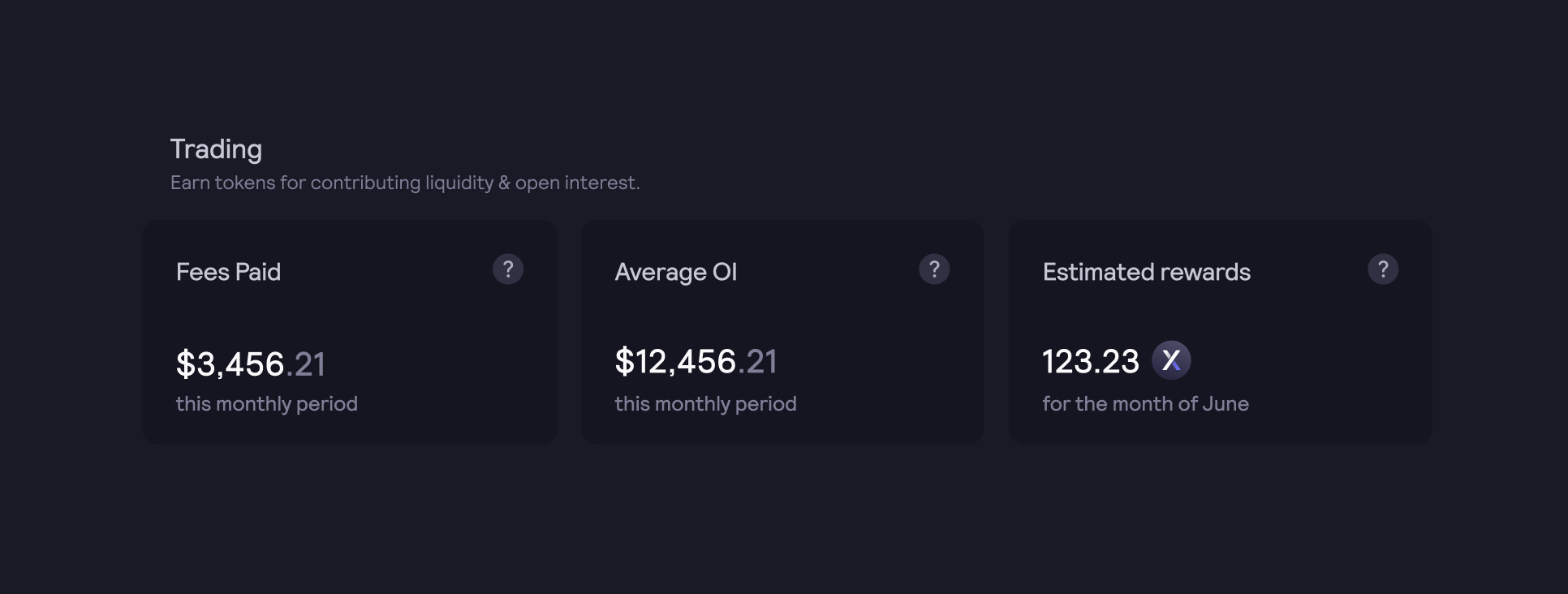

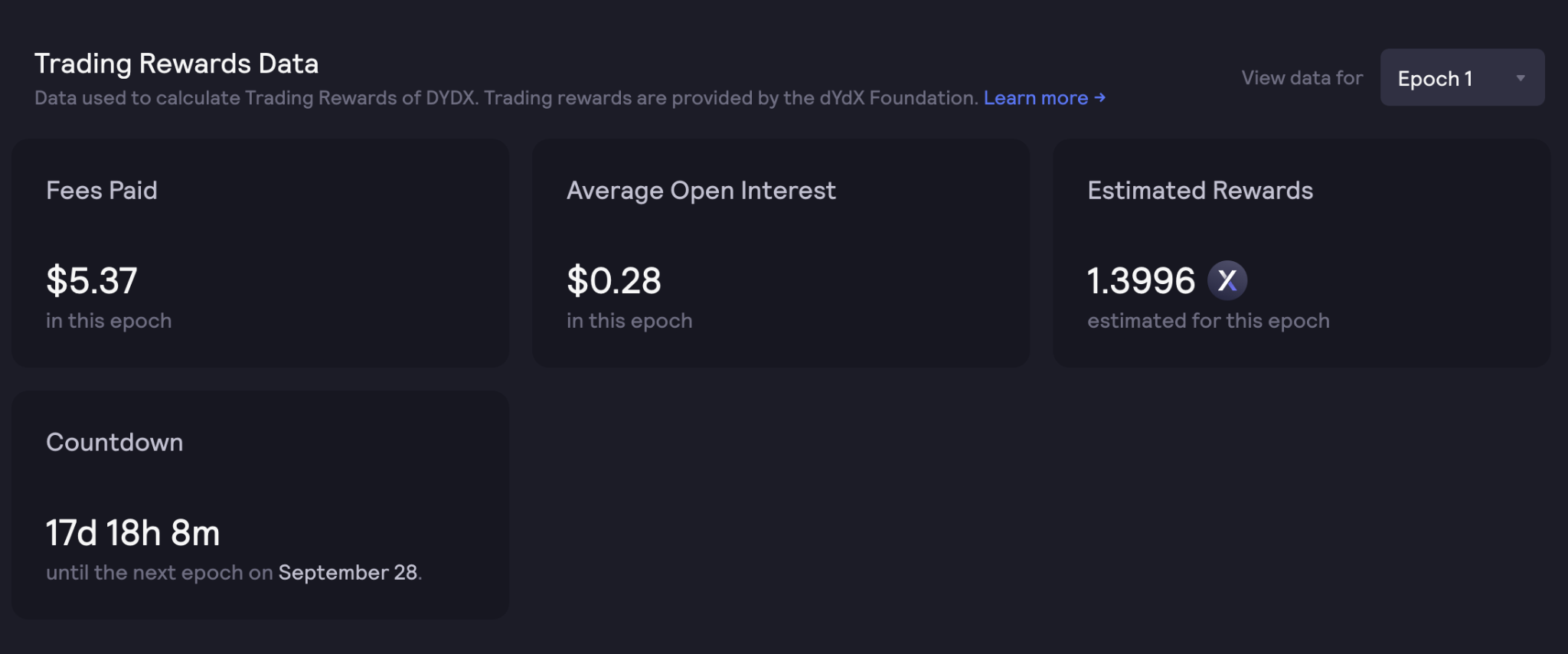

The first program is the most popular: Trading Rewards. With this program, 25% of the total token supply (250M DYDX) is currently being distributed to active traders on the protocol, based on a combination of fees paid and open interest during each 28-day epoch.

Every epoch, 3,835,616 DYDX is awarded to traders. This has been a key driver in getting more traders on the platform, as users can go long, short, or anything else possible with perpetuals while earning a nice rebate at the end of each epoch.

DYDX tokens earned from trading rewards are transferable at the end of each epoch, however, it’s important to note that DYDX token holders incur a cooldown phase of 7 days in order to claim their tokens.

There’s a good amount to learn about this program, so if you’re interested in reading more about the Trading Rewards formula, head to the Trading Rewards Documentation.

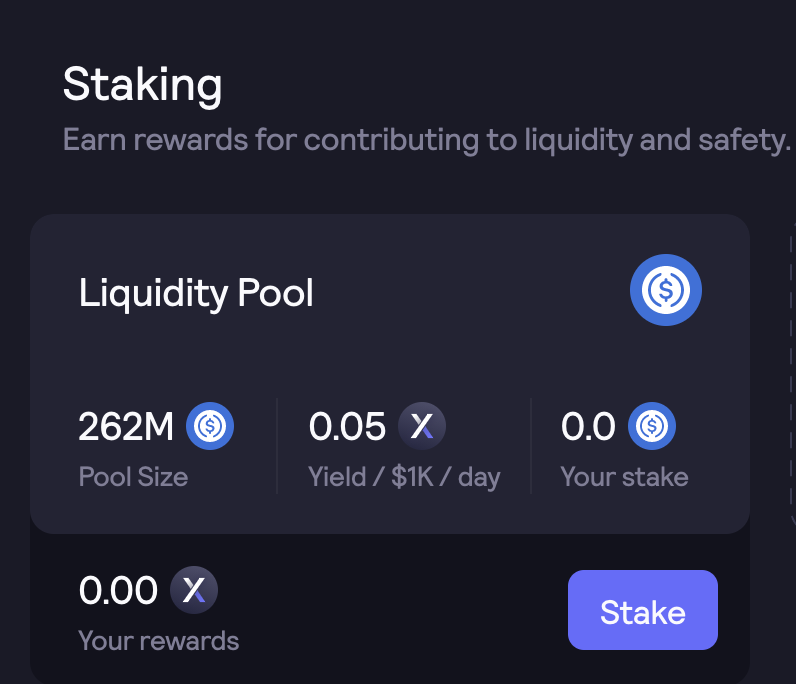

💰 Opportunity #2: Liquidity Staking Pool

Liquidity is a core piece of the dYdX protocol. To promote this and incentivize professional liquidity providers, DYDX tokens are distributed to users who stake USDC to the Liquidity Staking Pool. Any dYdX user has the ability to deposit USDC and earn DYDX where the program accounts for 2.5% of the total supply (25M DYDX).

Users who elect to deposit and stake their USDC in the Liquidity Staking Pool receive a tokenized position, stkUSDC. Importantly, there are two states of a staked position: active and inactive. Active positions are available to use as liquidity, earn staking rewards, but cannot be withdrawn by the staker. On the other hand, inactive positions are not available for liquidity, do not earn rewards, but can be withdrawn by the user.

Users who want to withdraw from the pool are subject to the epoch schedule, where users must request to unstake their USDC at least 14 days before the end of the current epoch. This period of 14 days is known as the blackout window, and no withdrawals can be requested during it.

With that in mind, there’s another side of the market as well—those that borrow from the liquidity in the pool. The protocol features a list of community-approved liquidity providers who are allowed to use the staked USDC to market make on the dYdX Layer 2 Protocol, deepening the liquidity available across the markets. The following entities are approved by the community, with a pre-set budget of the total liquidity. These are:

- Wintermute: 25%

- Amber Group: 25%

- WooTrade (Kronos): 20%

- Sixtant: 20%

- DAT Trading: 10%

It’s worth noting that these selected entities are restricted from using borrowed funds outside of the dYdX Layer 2 Protocol. The Liquidity Staking Pool currently has over 290M USDC, which will soon be used to directly add liquidity to the dYdX order books.

Lastly, we have to mention the risks associated with depositing in this pool. The biggest thing to know is that the community-approved borrowers are not required to lock collateral at any point. It’s all under-collateralized loans.

However, these entities are all verified professionals and reputable liquidity providers within the community. If a borrower fails to repay an owed balance back to the pool by the end of an epoch, it’s considered to be in default and the entity is barred from borrowing further USDC until the debt is paid. For liquidity stakers, if the borrowers fail to repay the debt, stakers may lose the USDC. In order to mitigate this risk, each staker and liquidity provider are required to become party to the revolving credit agreement. This doesn’t ensure that LPs will repay all amounts borrowed, but it does add an additional layer of protection for stakers.

💡 To read about the risks of staking, head to the Liquidity Pool Documentation.

💰 Opportunity #3: Discounts on trading fees

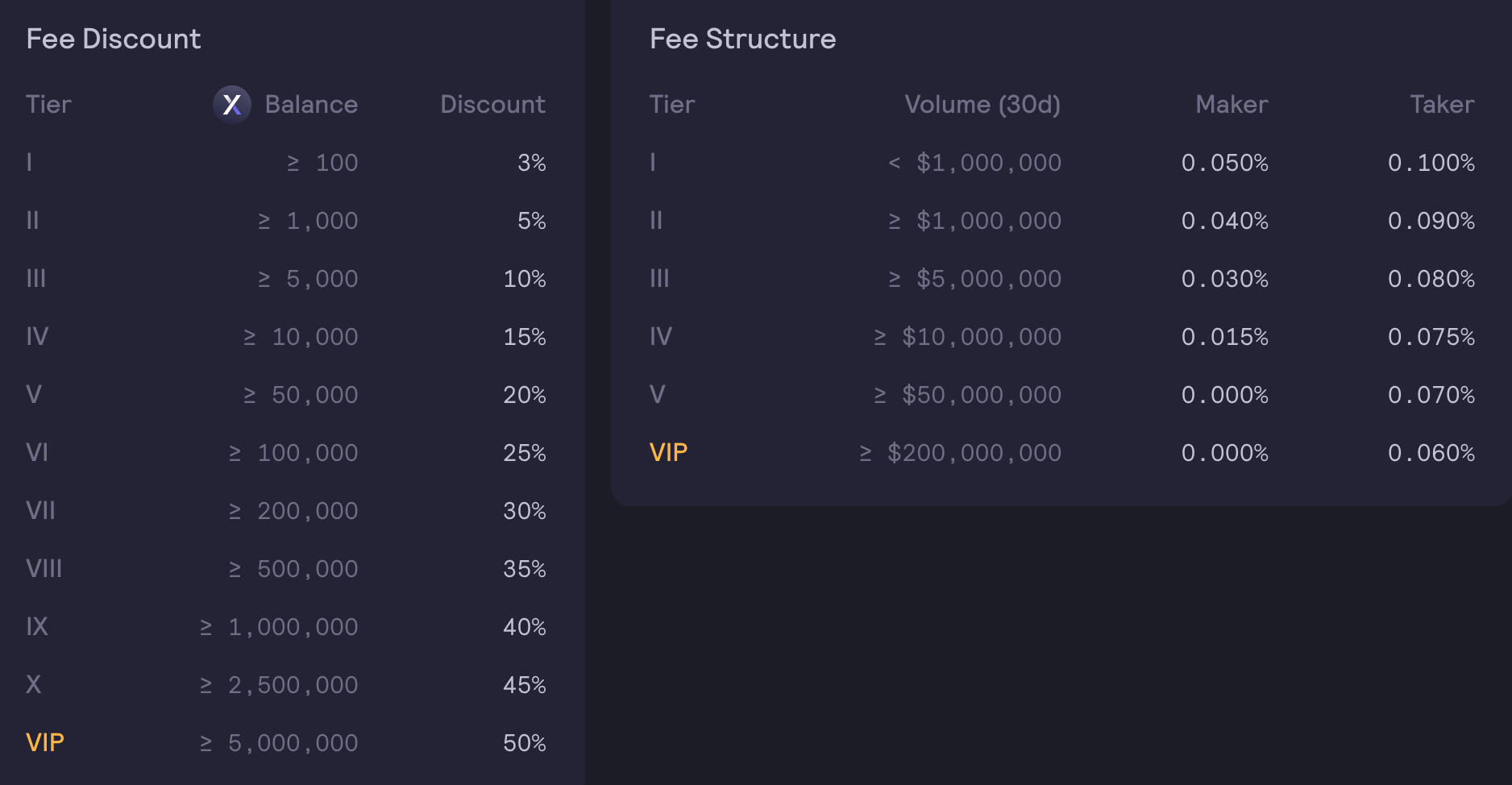

While not a direct earning opportunity, it’s worth highlighting that the protocol offers trading discounts for those that hold DYDX tokens as well as volume-based discounts. Trading fee discounts range from 3% for holding 100 DYDX to 50% for those VIP members that hold north of 5M DYDX. The full breakdown on the discounts is broken down below:

How To Guide

🛑 Note: dYdX is not available to US users.

Trading Rewards

Earning trading rewards is a fairly straightforward process.

- Open at least one position on dYdX

- Continue holding the position, or continue actively trading throughout the epoch.

🧠 Note: These rewards are estimates and may go down over the course of an epoch as more trading volume occurs on the exchange. This is especially true if you do not continue trading throughout the epoch.

- Once an epoch ends, rewards are claimable after the 7 day Waiting Period. To claim all available rewards, head to the Community Dashboard.

And that’s it! If you’re looking to check in on your estimated rewards, head to the Rewards Tab.

Liquidity Staking Pool

- Stakers of the Liquidity Staking Pool can stake USDC. To do so, head to the Community Dashboard.

- Click “Stake” on the Liquidity Pool

- Enable USDC, determine how much you would like to stake, and complete the layer 1 transaction.

- Staking rewards can be claimed block by block. To claim rewards, click “claim” on the Community Dashboard.

🔒 Note I: Withdrawals must be initiated at least 14 days prior to the end of en epoch. Once initiated, withdrawals will be available after the epoch concludes.

💵 Note II: USDC stakers receive stkUSDC in return. This is an ERC20 token that can be sent or theoretically exchanged. It is a claim on the USDC staked in the pool and thus theoretically a representation of the overall risk of the pool.

Conclusion

The launch of the DYDX governance token has been an important addition to the dYdX protocol.

With trading rewards and the USDC staking pool, there’s plenty of opportunity for those looking to earn rewards on the protocol by just being an active trader or simply staking USDC within it.

Happy trading and best of luck!

Action Steps

- 📈 Get a DYDX rebate by going long, short, and more

- 💲 Earn DYDX rewards by staking USDC

- 🏷️ Trade at a discount by holding at least 100