A Framework for Evaluating Layer 1s

Dear Bankless Nation,

About a year ago, a prominent crypto fund commissioned me to create a report evaluating the state of Layer 1s that could feasibly overtake Ethereum.

They had a thesis: Ethereum gas fee issues would persist, price out users, and activity would flow to other chains.

The question was: to which chain would it go?

I found out it was really hard to evaluate these new emerging platforms with young, untested infrastructure. Native wallets were just launching, exchange support minimal, and there were barely any applications on these networks to try out.

This was just before the meteoric rise of alternative Layer 1s–the likes of Avalanche, Solana, and Terra (rip). Infrastructure was built out while Ethereum gas fees persisted. New users flooded these alternative Layer 1 networks in search of greener pastures.

The thesis turned out to be right — kinda.

As a result, I’ve been thinking about this question a lot since then.

How the hell can you evaluate these things? What’s the appropriate framework? What key metrics and fundamentals should investors be looking for when evaluating the Layer 1 landscape?

Layer 1s — specifically smart contract networks —have a ton of variables that could result in growth.

But what are the quantifiable ones that we can look for?

Here are the 5 most important questions that I’ve come up with:

- Is it secure?

- Is it decentralized?

- Are there developers?

- Is there usage?

- Is it profitable?

Let’s unpack.

Is it secure?

Security should always be top priority when evaluating any Layer 1.

At the core, blockchains are settlement layers for value. If the settlement layer isn’t secure, it’s not worth anything. You need assurances that when you transact on the network that your transaction is final. There should be no chance of reversibility from bad actors.

There are different ways to measure security depending on the underlying consensus mechanism, but the end goal is simple – a blockchain network needs watertight settlement assurances. Settlement assurances are a guarantee a transactor holds that states a network won’t reverse a transaction — It’s final.

This is an important topic when looking at the broader Layer 1 landscape. I recommend reading Nic Carter’s “It’s the settlement assurances, stupid” for a further breakdown.

A key variable for measuring settlement assurances is ledger costliness.

How much does it cost to take over the network?

You can measure this by identifying how much money is paid to validators to submit valid, honest blocks.

What is the network’s total fee revenue?

This is the amount of money validators are paid to ensure all transactions are final.

The network that pays out the higher fee revenue to validators is the more secure, and can offer the higher settlement assurances. Miners and validators have a strong incentive to submit, validate, and maintain legitimate blocks.

…But what if the network only has 21 validators getting all of the revenue? This leads us to the second question.

Is it decentralized?

A core tenet of web3 is decentralization. It goes hand-in-hand with security, but also with the ethos of the entire phenomenon of blockchain.

Layer 1s should be sufficiently decentralized. No single actor or entity should have control over the network. Anyone should have the ability to participate in validation (mining/staking) or maintaining the ledger (running a node).

It should not be closed off to a select group of people.

If it is, we may as well just use AWS and move on.

Ways to quantifiably measure this could be through the network’s node and/or validator count.

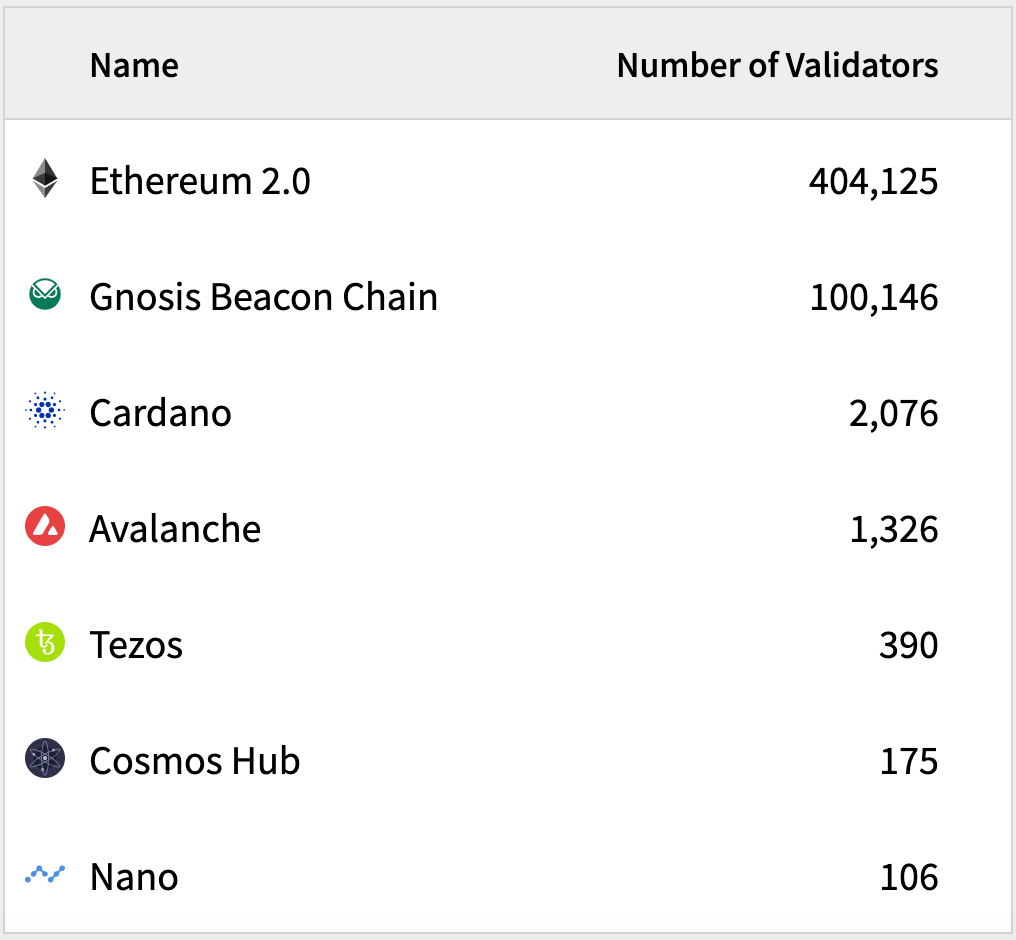

Here’s a quick summary of major Proof of Stake protocols.

If someone can’t run a node, it’s permissioned, not decentralized.

If it’s not decentralized, what’s the point?

Are there developers?

Security and decentralization are foundational attributes for any Layer 1.

Blockchain networks need these characteristics to fulfill the core vision of a secure, public settlement layer that accommodates all of crypto, decentralized finance, and web3.

Once those boxes are checked off, it means it’s safe and reliable for people to build on it.

They can trust the network won’t shut off, roll back, or get hacked.

This brings us to the next building block in the pyramid. Does the network have people building on it?

Without devs, there are no applications.

Without applications, there are no users.

No users = no value.

As a result, a robust developer ecosystem is essential for the success of a Layer 1.

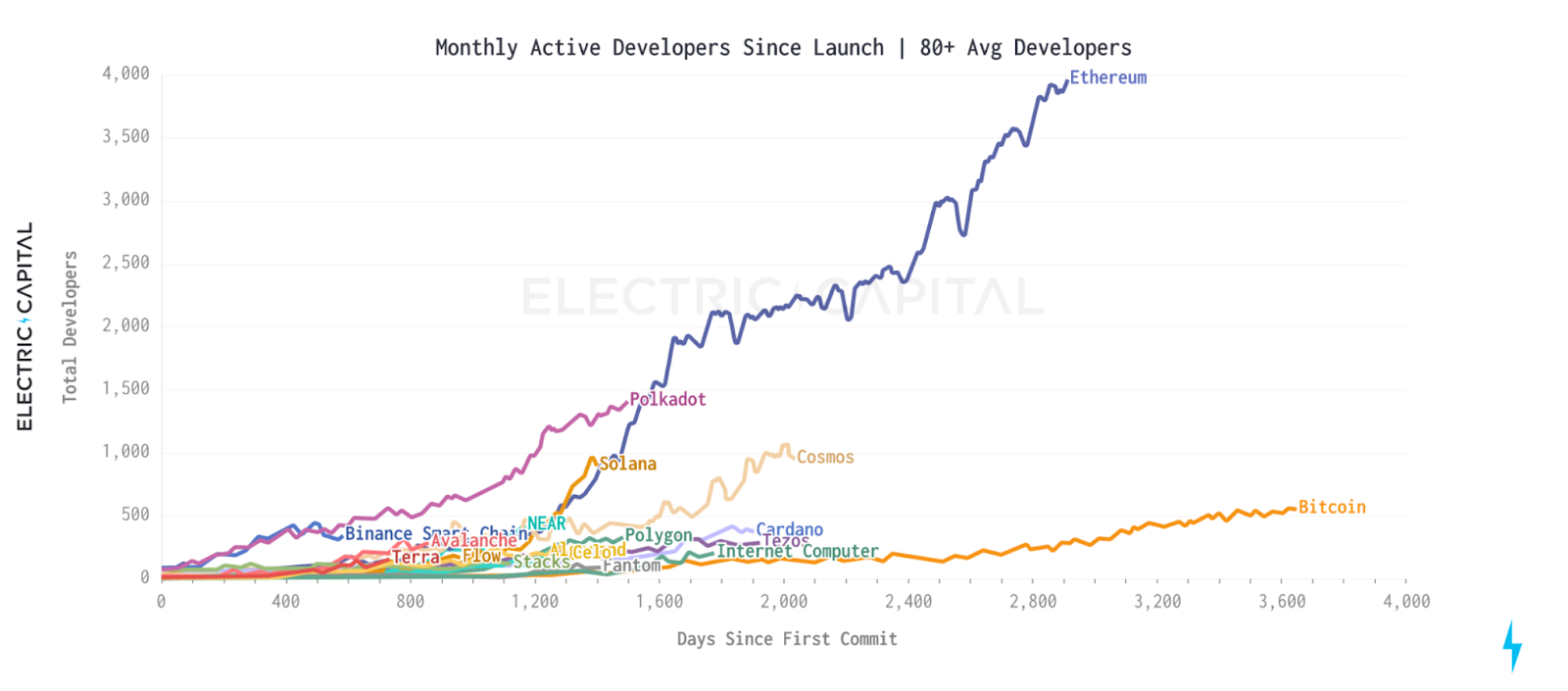

Fortunately, Electric Capital does a great job every year diving into the developer ecosystem across different networks.

Here’s a snapshot of monthly active developers from the 2021 report.

Ethereum currently dominates the developer ecosystem.

But even newer alternative smart contract platforms are outpacing Bitcoin in developer activity by a significant amount. This makes sense given the surface area that smart contracts offer for developers – they can virtually build anything with them. It’s much harder to build anything cool on Bitcoin.

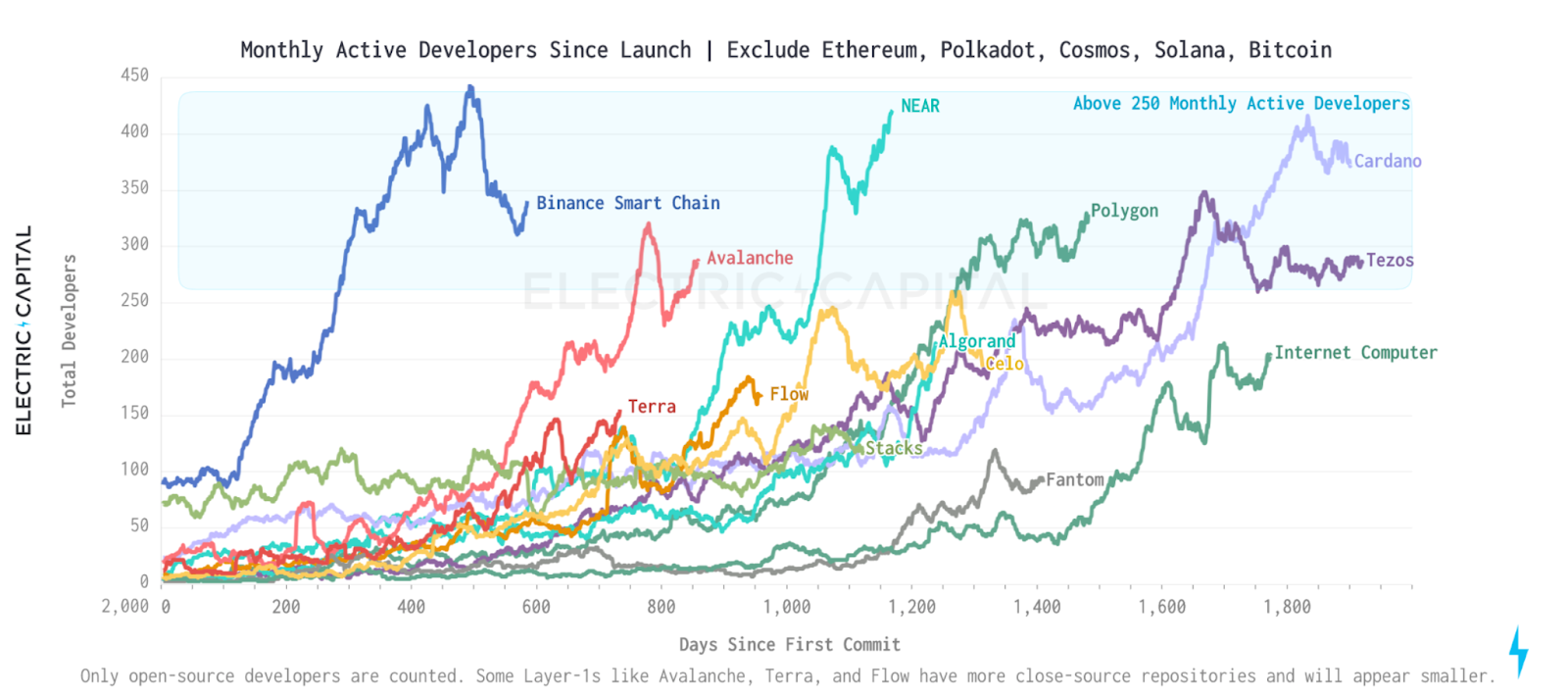

That said, here’s a more granular view for non-Ethereum contract ecosystems for those interested in zooming in.

Is there demand for blockspace?

Alright. Now we’ve checked off some major boxes for our evaluation framework.

If the network is secure, decentralized, and there are developers building applications built on it, then it’s time to start looking at if anyone is actually using those applications.

More importantly: are there users willing to pay for those applications?

Blockchains are in the business of selling blocks. They provide a service for unstoppable, decentralized value transfer over the internet.

Therefore, demand for blockspace is probably the most fundamental way to understand whether or not a Layer 1 is valuable or not.

It’s a clear indicator for whether or not there’s a demand to transfer value on the network. This can be measured in a handful of ways, ranging from network utilization to fees paid to validators/miners.

Each of these have their own pros and cons but when looking in aggregate, it can give you a clearer picture of whether or not there’s real demand for the network.

But at the end of the day, if no one wants to buy those blocks, it’s not a valuable blockchain ecosystem.

This leads us to our final question in our framework.

Is it profitable?

If there’s demand for block space, there’s only one element left to address.

Is the blockchain profitable?

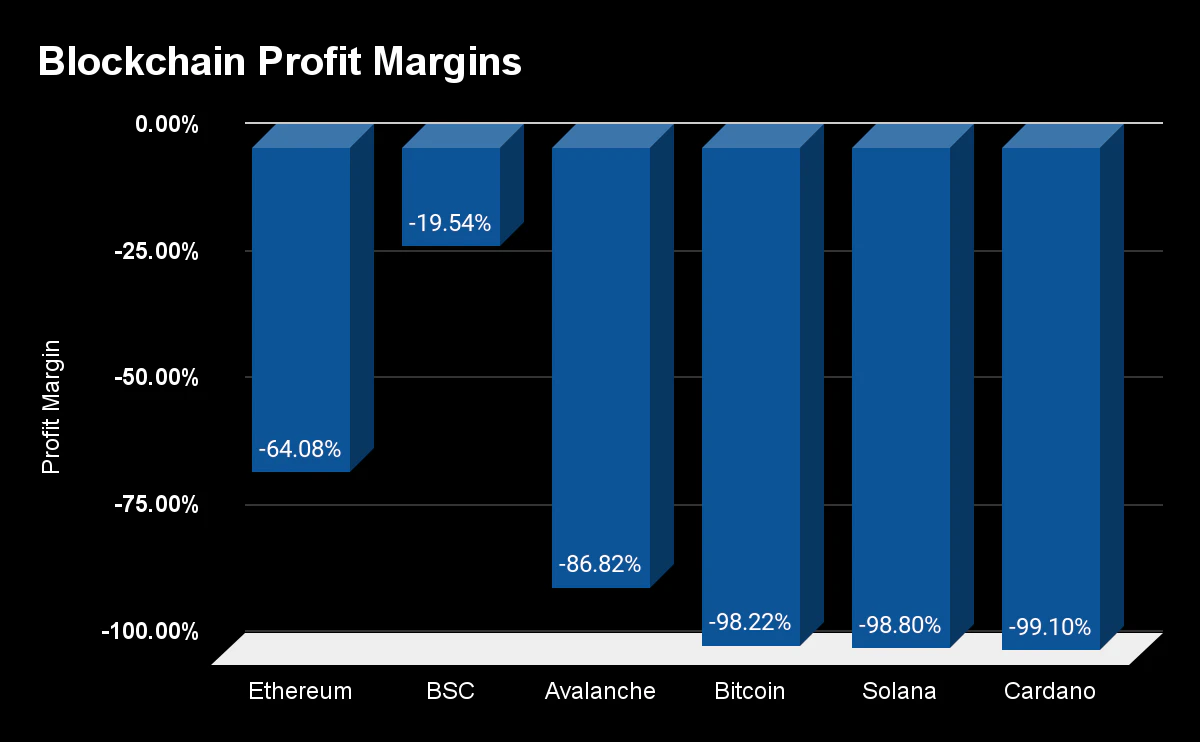

I wrote about in depth this a few months ago. But even with the metrics above, you can analyze whether or not blockchains are running a profitable business.

In short, you should figure out if the blockchain is issuing more money for security than it’s bringing in for transaction revenue.

The funny thing is that no blockchain today is actually profitable – not even close.

Across the board, blockchain networks today are spending more on security costs than they’re bringing in revenue.

This is okay – the ecosystem is young. There’s a lot of development that needs to be done. There are a lot more people to onboard into this technology.

But only one blockchain right now has a clear path to profitability.

You read the article to find out which one ;)

Conclusion

Evaluating any layer 1 is hard; especially for smart contract platforms.

These are new, open platforms for the next generation of internet applications.

Like web2, there will be trillion dollar companies that are built on this infrastructure.

Makes you wonder - how much will that infrastructure be worth?

And which one will come out on top?

Use these questions to build out your evaluation framework.