$500m in meme coins...now what?

Dear Bankless Nation,

In May headlines like this were hitting mainstream:

Ethereum creator donates meme coins worth $1 billion to help India fight COVID-19

OMG what?? 👀

This was a crypto story more bizarre than any fiction writer could dream up.

At the time dog coins were mooning. These memecoins were rising to billions in marketcap mostly because people wanted to get in early on the next Dogecoin.

Memecoin logic.

Now memecoin token projects like to leverage Vitalik’s legitimacy, so sometimes they’ll airdrop a large portion of their supply to one of his public wallets.

Vitalik holds it! Must be legit!

These projects expected him to do nothing with the tokens as he’d previously ignored all unsolicited airdrops. They’d just pile up in his ETH address like burnt tokens.

But then dog tokens grew to be worth billions of dollars.

Kind of silly to just leave them there right?

So Vitalik decided to send the tokens to public goods—India’s COVID Relief Fund, life extension research, and…GITCOIN. Classic Vitalik.

That’s where mainstream left off.

But that’s where things get interesting. That’s where our story begins today…

Imagine you’re Gitcoin and you just got $500m in illiquid dog coins.

What do you do?

Now imagine you’re a holder of the dog coin and a new entity suddenly has the power to dump your coin to zero—what do you do?

So began the coordination game between Gitcoin and Akita on May 12, 2021.

Gitcoin with the power to dump. Akita with the power to fork.

Both options leaving each party with less. A textbook Prisoner’s Dilemma.

But could they find a way to use DAO governance and smart-contracts to create a more optimal outcome?

This is a wild story and an incredible case study on coordination and slaying Moloch.

Only possible on Ethereum.

- RSA

A Web3 Prisoners Dilemma

TLDR

In May, Vitalik Buterin sent GitcoinDAO millions of AKITA tokens—creating a DAO to DAO Prisoners Dilemma. Vitalik’s donation set off a chain reaction of events in both tokenized communities that channeled energy towards both DEFECT and COORDINATE outcomes, but ultimately resulted in both communities choosing to COORDINATE.

The Beginning: A Gift to Gitcoin

On May 12th, Vitalik decided to do something wild with billions of dollars worth of Doggie tokens in his wallet. These tokens were the latest in a long line of tokens sent to him by memecoin founders looking to create momentum for their projects and ostensibly draft off his legitimacy by showcasing him as a “supporter of the cause”.

In this instance, he decided to send a message, and donate the coins to a number of causes he truly cares about including India COVID-19 Relief, a variety of life extension initiatives, and digital public goods funding.

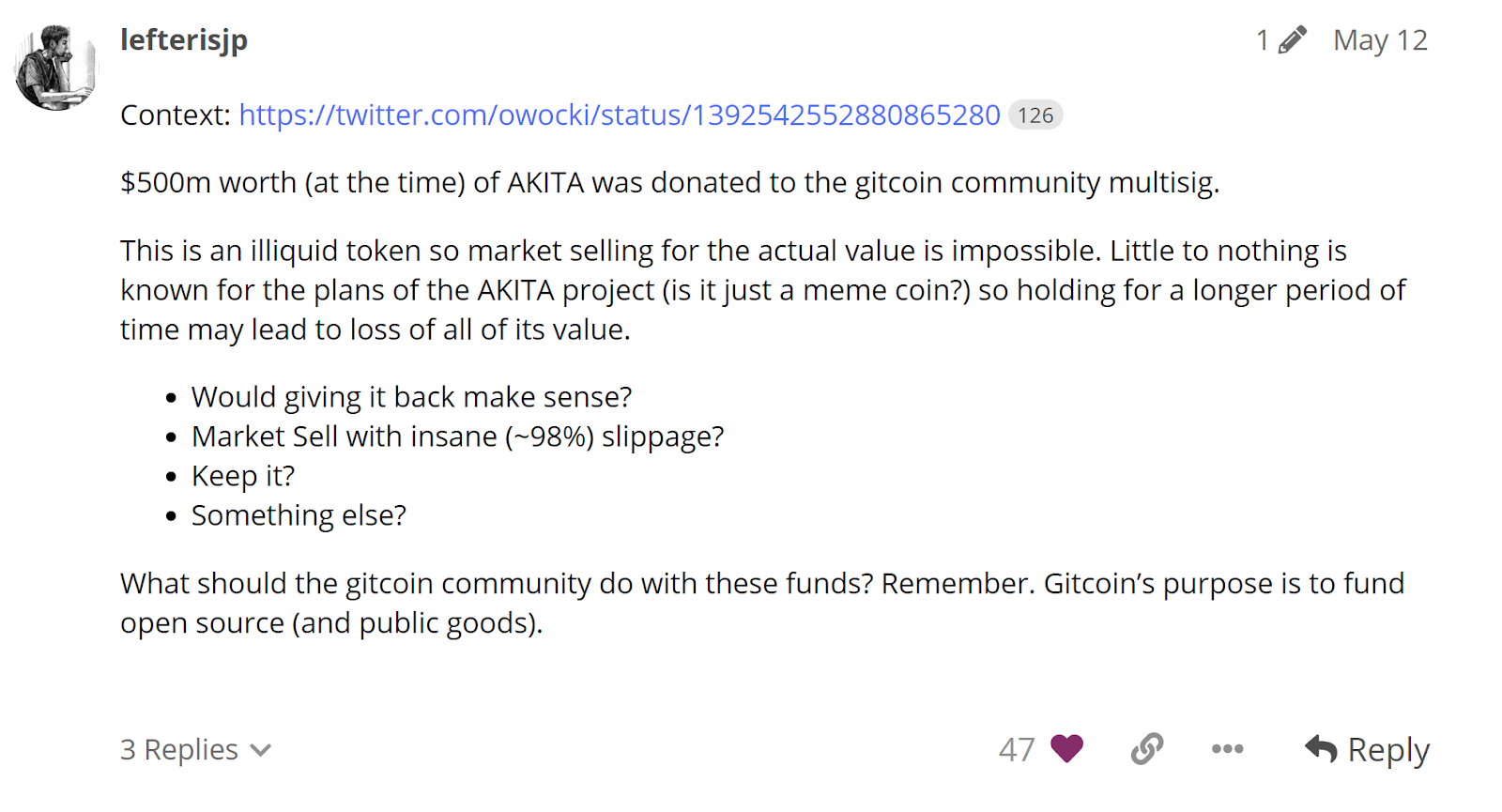

The Gitcoin Grants Multisig was fortunate enough to receive $500,000,000 of a specific token from Vitalik: AKITA. Unlike other tokens, AKITA had very little liquidity, with only around $5,000,000 available at its peak. It had also, in the course of just a few weeks, increased its market cap by an order of magnitude in an already frothy market.

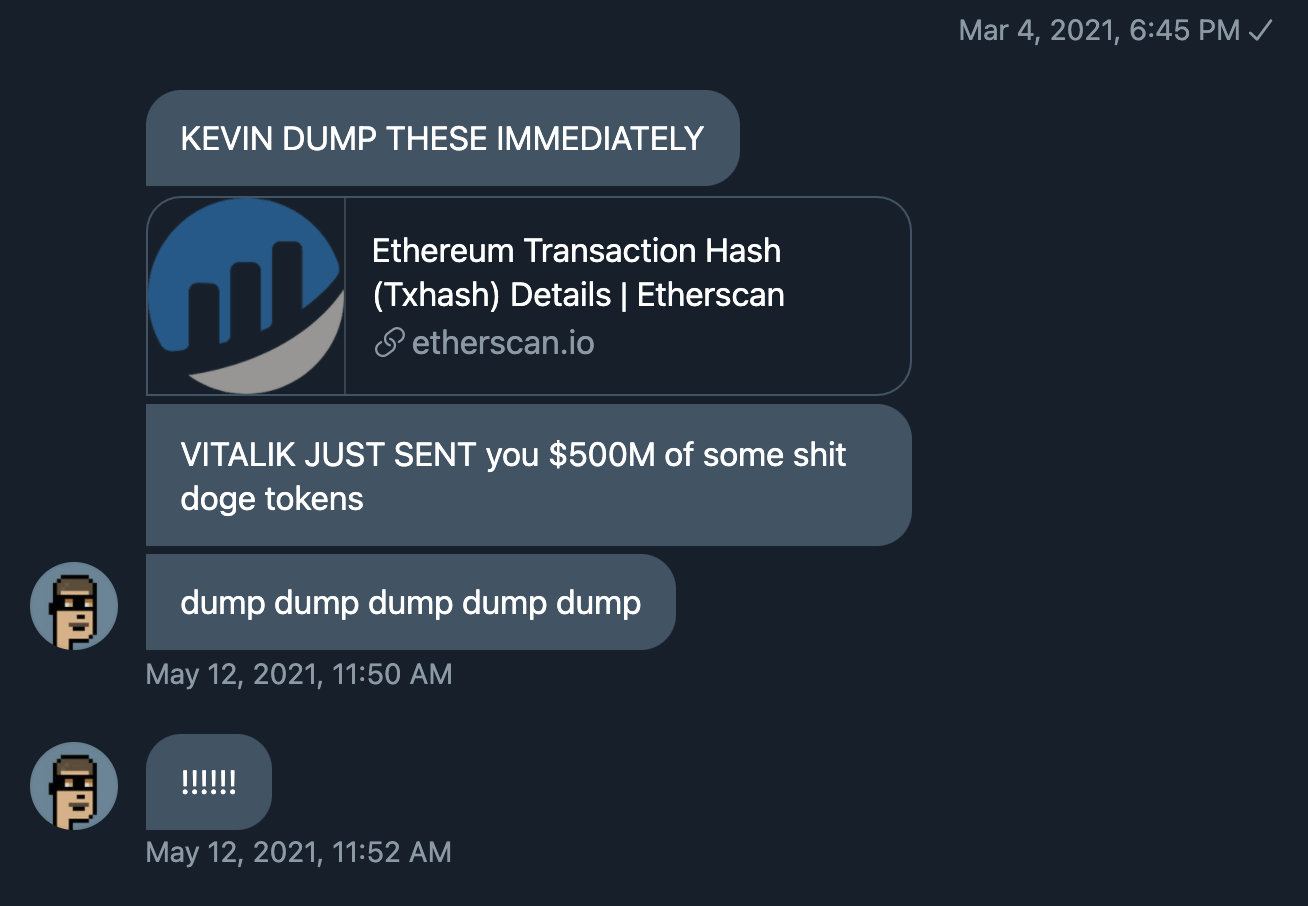

So at that moment, Gitcoin was unwittingly thrown into an unlikely coordination game with Akita. Immediately, the team got flooded with messages telling them to dump the tokens to front-run the Akita community.

But what wasn’t yet public was that in less than a week—on May 25th—these decisions would all be in the hands of the community via the launch of GitcoinDAO. As such, the Gitcoin Core team decided to step back and let the DAO governance decide what to do, ultimately creating a unique tutorial island for the DAO in its nascency.

Launching Governance

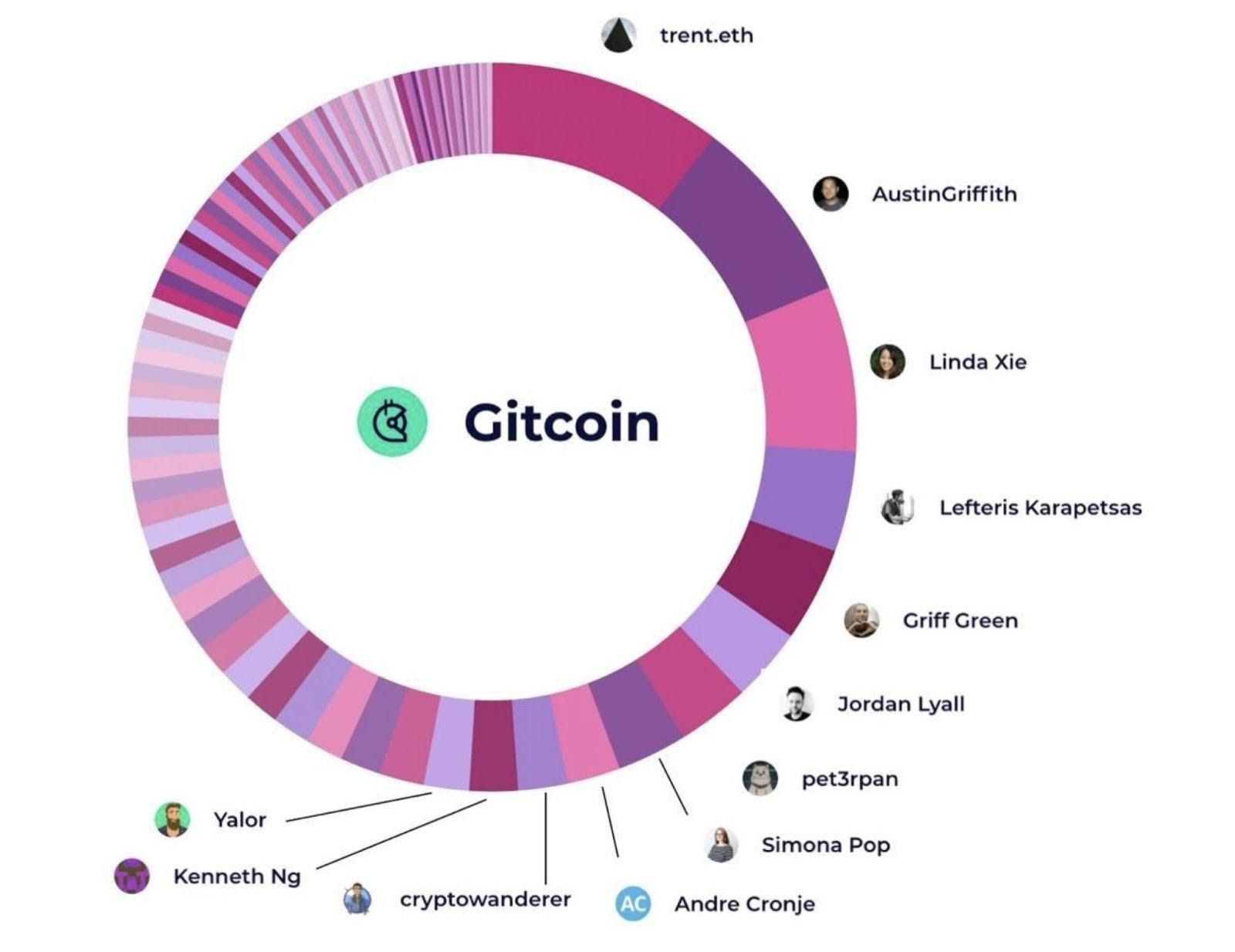

On May 25th, Gitcoin’s native governance token, GTC, went live as a means of transitioning control of the Gitcoin platform (including the multisig that funds it) to the community.

That process resulted in over 150 Stewards applying to help steer the ship and over 20,000 individual holders delegating to them. Notably, all of these were members who had already been active in the community—tokens were only distributed to those that had used the platform over the last 3 years, whether they worked on bounties, funded grants, and more.

The top 12 Stewards elected to govern Gitcoin as of May 26th 2021 showed a lot of promise:

And as this group formed and began to coordinate, the conversation quickly turned to the elephant in the room: what to do with the AKITA.

Over the coming days, dozens of suggestions poured in on what to do with the funds, with suggestions ranging from selling all of the tokens at market or even giving 100% of them back to Vitalik.

After a couple of weeks, the discussion was distilled into 7 main suggestions by James Waugh and the rest of the Fire Eyes crew, which the community then voted on. These were:

- Proposal from @HelloShreyas outlining a short/medium/long term strategy to sell 10% of Gitcoin's AKITA balance and place 90% of its AKITA balance in a Sablier contract unlocked over 2 years.

- Proposal from @castall proposing the Gitcoin community use AKITA as part of the next quadratic matching pool (in current and future rounds).

- Proposal from @lightnode to deposit 100% of AKITA tokens to the Based market

- Proposal from @relic to burn all AKITA tokens held by the Gitcoin Multisig except for 5% and leaving 5% to stimulate progress between both communities.

- Proposal from @cryptowanderer to burn 100% of AKITA tokens to 0x0

- Proposal from @tjayrush proposing the Gitcoin community return the AKITA funds to their source (Vitalik's sending address).

- Proposal from @androolloyd to liquidate 100% of AKITA for ETH

The winning proposal, eventually, was to find an effective way to liquidate 100% of all AKITA.

What Happened Next?

What happened next was surprising to many in the Gitcoin community, and a strong reminder that everything that happens in crypto is by default a public, multiplayer game.

The AKITA core dev team took fast, decisive action, and responded by recommending that their community sell all of their AKITA, and even threatened to fork AKITA to cut Gitcoin out of the allocation.

In addition to the proposal to fork Gitcoin out, the AKITA community also began loudly protesting the outcome, even creating some memes that they had become Gitcoin’s prisoners.

It appeared that the AKITA community’s main complaints were as follows:

- The Gitcoin governance process, being so new, was not clear enough to them.

- The AKITA community did not have a say in their governance.

- There was no upside for either party in the outcome as interpreted, only mutually assured destruction.

What an interesting turn of events!

In summary:

- The GitcoinDAO had voted to unwind 100% of its AKITA position in an open governance process.

- The AKITA community, anxiously following along, panicked, assuming that any plan to sell such a large percentage of their tokens would send the token price to 0.

- They decided, in a lose-lose scenario, to burn it all down and start anew.

To understand why this happened, and what happened next, we need to dive into a bit of game theory.

The Prisoner's Dilemma

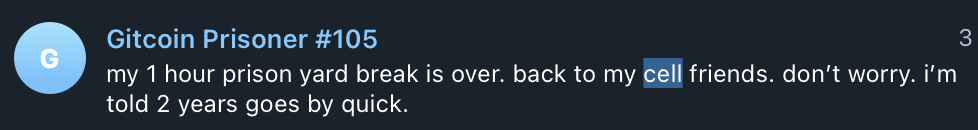

Any good student of Coordination Failures is familiar with the Prisoner's Dilemma—a type of game that shows why two completely rational individuals might not cooperate, even if it appears that it is in their best interests to do so.

The standard dilemma looks something like this:

Two members of a criminal gang are arrested and imprisoned. Each prisoner is in solitary confinement with no means of communicating with the other. The prosecutors lack sufficient evidence to convict the pair on the principal charge, but they have enough to convict both on a lesser charge.

Simultaneously, the prosecutors offer each prisoner a bargain. Each prisoner is given the opportunity either to betray the other by testifying that the other committed the crime, or to cooperate with the other by remaining silent. The possible outcomes are:

- If A and B each betray the other, each of them serves two years in prison

- If A betrays B but B remains silent, A will be set free and B will serve three years in prison

- If A remains silent but B betrays A, A will serve three years in prison and B will be set free

- If A and B both remain silent, both of them will serve only one year in prison (on the lesser charge).

In short, each actor has an incentive to DEFECT, but if both players defect then each is worse off. The rational behavior is to find a way to COORDINATE and serve less total prison time.

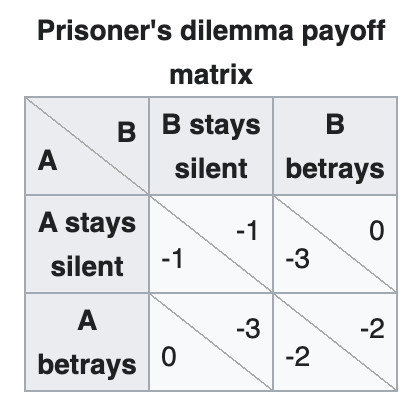

Gitcoin’s AKITA Prisoner’s Dilemma

The Gitcoin communities and AKITA communities had fallen into a coordination game, and they would need to learn to coordinate and trust each other if they wanted to jointly succeed. We can map out the exact same Prisoner’s Dilemma matrix for the Gitcoin/AKITA scenario with the following information:

- The GitcoinDAO had decided to liquidate 100% of the AKITA, thereby possibly sending AKITA to 0. (DEFECT)

- The AKITA community, anxiously following along to the open process then panicked, assuming that such a large supply of tokens would send the token price to 0. And they took a countermeasure in proposing to fork Gitcoin out. (DEFECT)

Now let's look at the 2x2 payoff matrix for Gitcoin/AKITA:

DAOplomacy

What happens next is a true testament to the ability for internet-native communities to cooperate almost entirely pseudonymously, with no real reason to expect the other party would uphold their end of the bargain.

Before we dive in, let’s remember that we’ve been talking about GitcoinDAO and AKITA as though they are two entities, but there are thousands of members of both the Gitcoin and AKITA communities, all of whom come from different backgrounds, perspectives, and geographies. Moreover, both groups were getting different information from different places. Thousands of unique Degens and Regens were colliding and trying to find a way to coordinate with each other, what a fun (and messy) coordination experiment!

Slowly but surely, the two groups began to understand each other. On the Gitcoin side, the author of the original passing proposal, Andrew Redden, came in to clarify the meaning of their proposal to other Stewards. The goal was, in fact, to divest 100% of tokens slowly over time, in a way that maximized the value of the public goods treasury for Gitcoin.

At the same time, Relic—the project lead for the AKITA community—invited DAO Stewards to do an AMA with the AKITA community in the AKITA telegram to help. By doing the AMA, some (not all) members of both communities began to understand the other’s position.

With new information in hand, the GitcoinDAO Stewards set up a second vote to decide on a mechanism for selling all of the tokens.

The Second Proposal

As of mid June 2021, the GitcoinDAO Stewards had:

- Openly deliberated about what to do (May 25 - May 31)

- Voted on proposals, and passed one (May 31 - June 5)

- Met with the AKITA community and got in touch with the AKITA core team. (June 7th)

- Met to discuss the proposal and how to implement it. (June 11 - June 14th)

From the past AMA, it was pretty clear that (a) the sentiment of AKITA towards Gitcoin was pretty sour and (b) the AKITA community was going to fork their token.

One might imagine that those two pieces of new information had been grokked in the minds of the GitcoinDAO Stewards as they moved forward, though they were still bound by the proposal that they had passed to completely divest of AKITA.

A vote was held to decide how to execute on the goals put forward. Andrew wrote the following:

After some conversations with the Akita community it has become clear that the best path to maximize our ETH outcome is to enable some form of participation with them.

Highlights:There will be a buy back and burn program that funds the AKITA LBP, for every 1 AKITA purchased X will be burned. Specifics not finalized.

The ETH raised here will be put into the LBP with a time of completion set for 3 months.

Based on our conversations I propose the following:

Option 1:We split the LP Tokens as follows:

40% to Gitcoin

40% to Akita (streamed over the length of the LBP through Sablier)

20% to a Charity (yet to be chosen) funds ETH raised will be delivered via Gitcoin, post-sale.

Option 2:We split the LP Tokens as follows:

80% to Gitcoin

20% to a Charity (yet to be chosen) funds ETH raised will be delivered VIA Gitcoin, post sale.

We agree to burn more Akita via Sablier by streaming to the 0x000 address Y tokens for each X Akita in the LBP.

Option 3:We don't split the LP Tokens

We agree to burn more Akita via Sablier by streaming to the 0x000 address Y tokens for each X Akita in the LBP.

Without a serious burn or a share of the ETH being raised, AKITA is not in a position to cooperate.

After several more days of debate, the GitcoinDAO had chosen Option 1 as a means to implement the proposal and exit the position in AKITA.

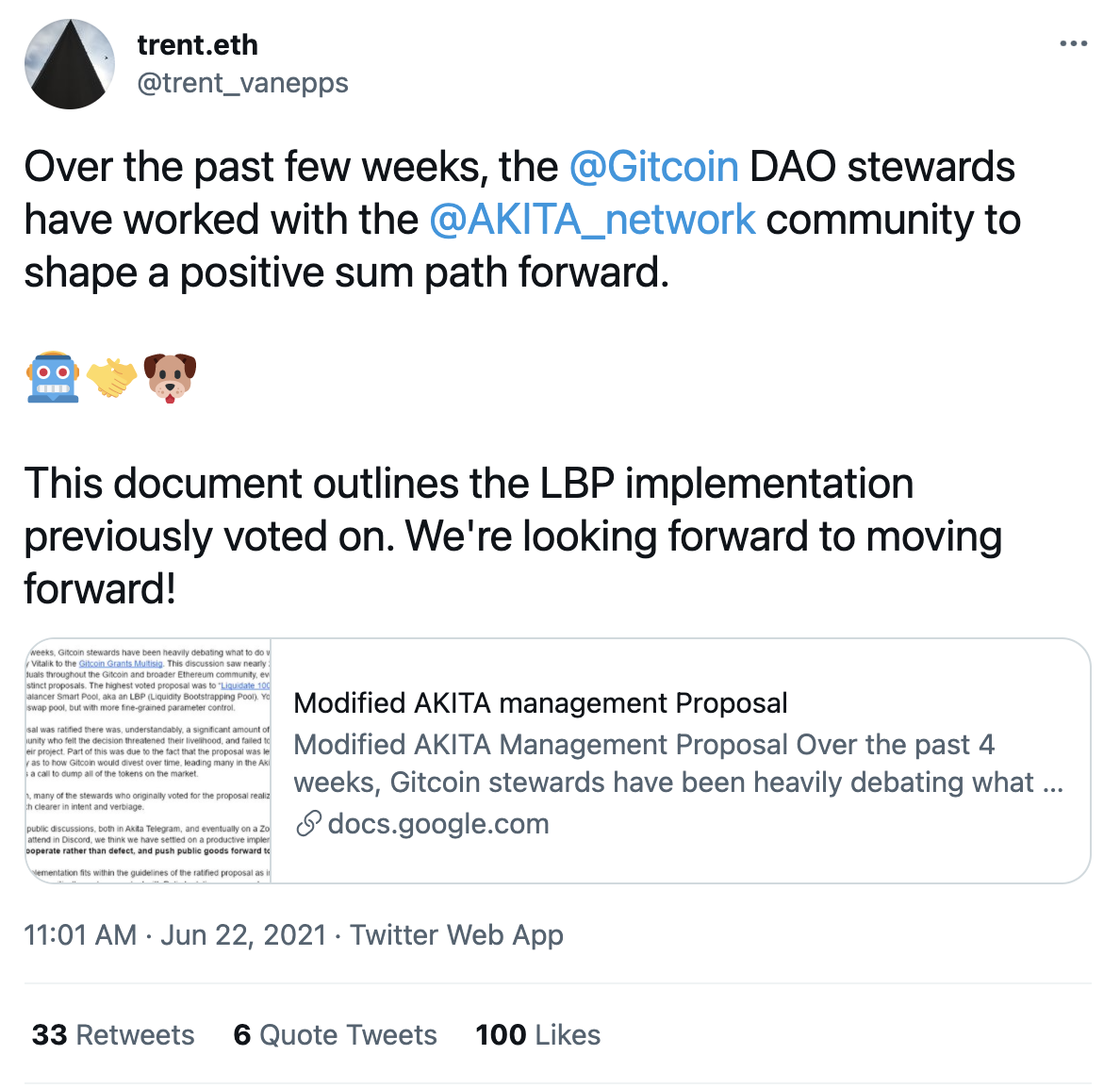

Gitcoin Steward Trent Van Epps made the announcement:

And upon the announcement, the sentiment from the AKITA community began to turn—and the dev team backed away from their proposal to fork the AKITA token.

And the memes began to change too…

Oh how far the story has come!

- GitcoinDAO defected

- AKITA defected

- GitcoinDAO coordinated

- AKITA coordinated

- DAOplomacy continues

All in all, not bad for a first test of a system that aims to slay Moloch and defend public goods.

Conclusion

By now, we’re all familiar with crypto tribalism.

Token Project A is suspicious of Token Project B. Token project B thinks token project A is illegitimate. They fight it out in a war of memes, shitposts, and flame wars—sometimes escalating in alternatively horrible/dramatic/hilarious ways. But these situations rarely wind themselves down and rarely are differences resolved.

Most crypto tribes choose to DEFECT/DEFECT. As Cobie put it best, the tribes are so boring now—the cycle is repetitive and predictable.

How ironic that with the world saturated with information, today’s tribes who choose to defect have such a hard time learning to return to coordination and to more-positive sum games, even if that would make everyone better off.

Of course there are exceptions—there are crypto-communities that are friendly with each other, for example, like Ethereum and Zcash. But rarely are there crypto communities that get out the pitchforks and later stop doing so, unless one of them simply ceases to exist.

So how do you get two groups of 1000s of degens to coordinate with one another?

Turns out that sending tokens from one ecosystem to another is a great way to do it. When Vitalik sent those tokens to the Gitcoin multisig, he was just trying to fund causes he believed in. As he stated on gov.gitcoin.co:

I gave the coins to Gitcoin because I support their work in public goods funding and I think robust public goods funding institutions are something that the open source and crypto worlds really need more generally. There’s a lot of good that could be done (for the Ethereum community, for the world at large, and for the AKITA community as well) out of having a large and sustainable long-term pool of funds being guaranteed for future public goods funding rounds.

The first order effect that Vitalik had desired was more public goods funding for the Ethereum ecosystem. The second order effect of Vitaliks actions was that two DAOs had to scramble to learn to coordinate—in a giant postmodern crypto-economic DAO vs. DAO prisoner’s dilemma.

In a strange way, Vitalik kind of pioneered a new mechanism here.

We’ll call it the MTT—Massive Token Transfer. By shifting the center of gravity of the AKITA community into Gitcoin governance, the two communities collided in a major way. Whether these two communities create positive sum outcomes for each other and for the world remains to be seen.

But one might like to think that if anyone can solve this coordination game, it’s a DAO that’s dedicated to solving coordination failures— like funding open source software.

Action steps

Dig through the Gitcoin AKITA situation

Level up on Coordination & Moloch:

Author Bio

Regen Spartan is a dApp developer who believes DAOs can create a better world. She has been a Ethereum community member since 2017.