5 Ways to Launch a Token Sale

Dear Bankless Nation,

People tend to over-index the current narrative.

During the bear market, the narrative was simple: tokens bad. ICOs were scams, cash grabs, and bad actors—no exceptions. Ethereum was just a tool for ponzi schemes.

But the bear market brought experimentation. The tourists left, the builders stayed. Turned out tokens could be really useful. We figured out how to accrue value to tokens and how to use bankless protocols to distribute them.

DeFi did what it does best. It iterated…

- April 2020 - Initial Uniswap Offering

- May 2020 - Liquidity Mining

- July 2020 - Decentralized auctions

- September 2020 - Retroactive Airdrops

We got better at distributing tokens and incentivizing the right behavior.

Now the market is catching up. Investors are risk on. Tokens are back. At some point people over-index the token narrative in the bullish direction. (Such is the nature of markets—everything’s a fractal.)

But let’s use this post to catch up.

What are the token distribution mechanisms in DeFi today?

Regan breaks it down for us.

- RSA

Guest Writer: Regan Bozman, CEO at Dove Mountain Partners

The Evolving Landscape of Token Launches

The past year has seen a truly spectacular amount of innovation in financial products built on Ethereum, including the rise of a number of novel token distribution mechanisms. Some of these mechanisms are decentralized forms of existing tools. For example, Mesa is an on-chain version of an auction platform like CoinList.

Liquidity mining on the other hand, is a relatively new and unique innovation.

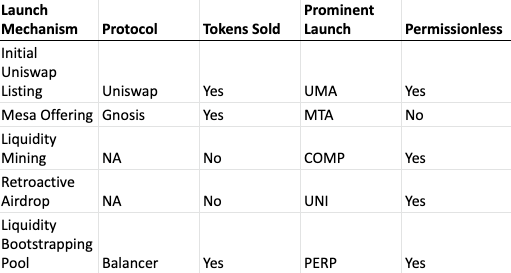

Below I’ll run through some of these new token distribution mechanisms and their respective strengths and weaknesses, including:

- Initial Uniswap Listing

- Gnosis Mesa Offering

- Liquidity Mining

- Retroactive Airdrop

- Liquidity Bootstrapping Pool

Tokens, Tokens, Tokens

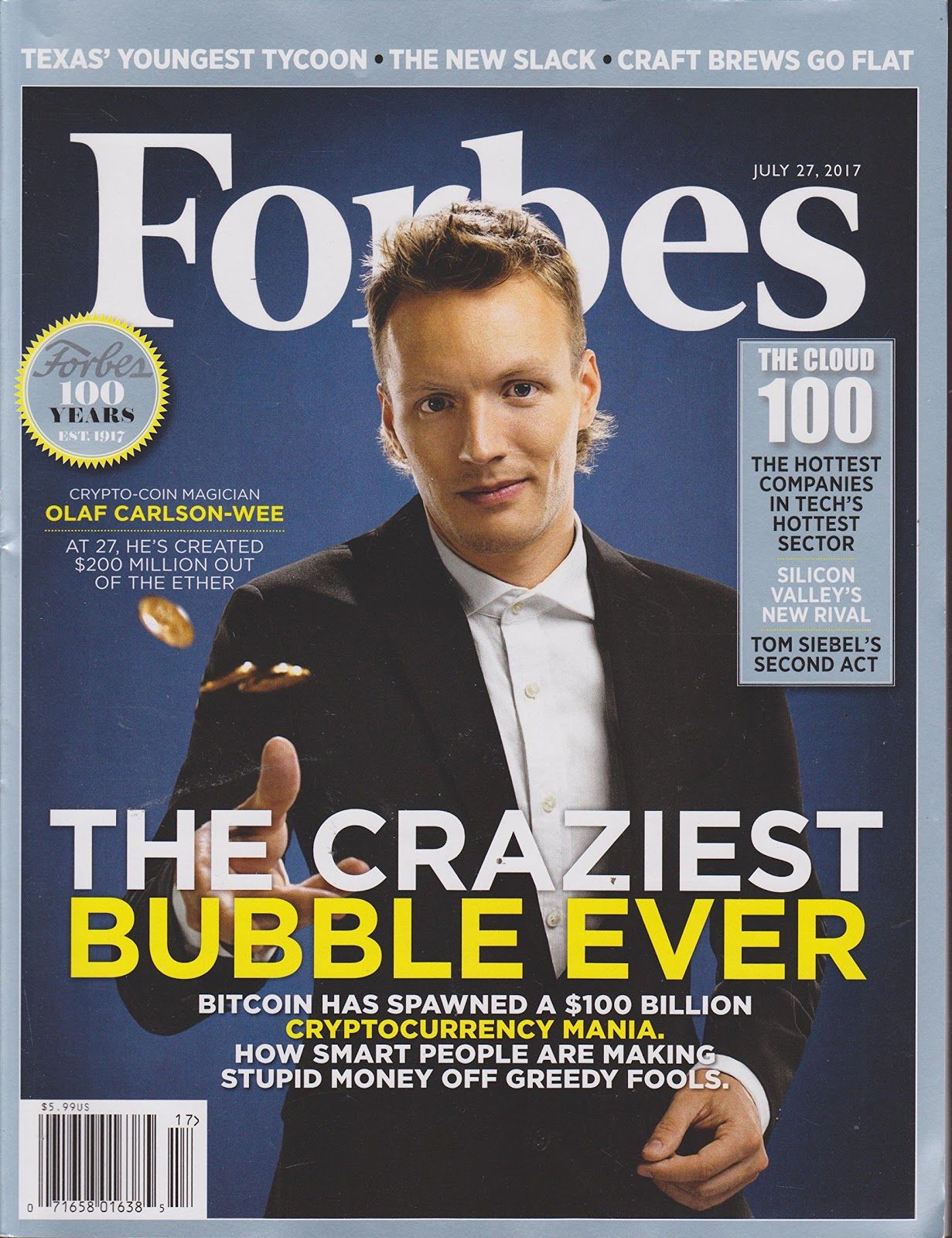

While Initial Coin Offerings (ICO's) date back to 2013, they really took the market by storm in 2017. A combination of impressive technological progress, fraudsters, regulatory whitespace created an absolute frenzy of fundraising activity. The stories have been well documented—while meaningful projects emerged out of the boom, lots of people lost money.

Token distribution models evolved meaningfully from 2017 to 2020:

- SAFT's rose to popularity in 2017 as companies like Protocol Labs raised large amounts of money to fund pre-launch networks via regulated mechanisms

- In 2019, IEO's came into vogue as investors demanded shorter liquidity timelines. Binance popularized the IEO in January 2019 with its $7M IEO of Bittorrent Token. IEO's guaranteed investors liquidity, offered projects an easy onramp to exchanges, and gave exchanges a new line of business. Unsurprisingly, the quality of projects declined and IEO's have become less popular.

Despite many premature reports of their death, token sales are alive and well. Teams like NEAR and Avalanche have conducted successful raises over the past twelve months. While a full overview of token distribution models is outside of this article’s scope, it's worth noting that SAFT sales, token sales, IEO's, and auctions are different approaches to the same mechanism—they involve a team selling tokens through a centralized third-party.

Ethereans at the Gate

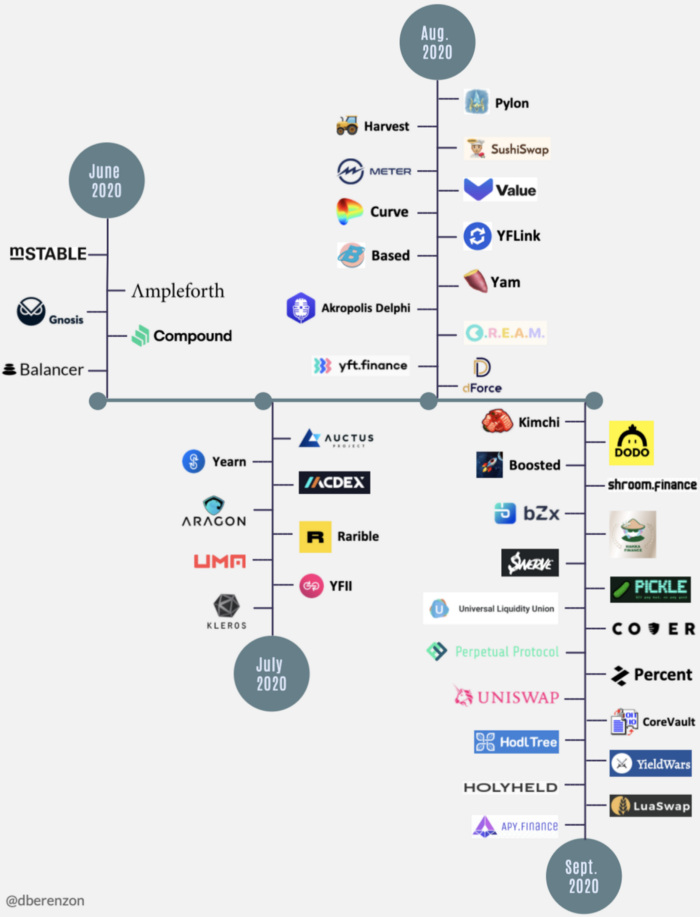

The rate at which novel token distribution mechanisms launched on Ethereum over the past twelve months is astounding. There are now nearly half a dozen popular mechanisms to launch tokens directly on Ethereum. These launch tools aren't just different from their predecessors in that they're decentralized—in many cases, these launches divorce token distribution from fundraising.

Here are 5 DeFi Native Token Distribution Mechanisms:

Let’s walk through them each.

1. Initial Uniswap Listing (April 2020)

Uniswap is a decentralized trading protocol that makes it easy for anyone to list and trade ERC20 tokens. Uniswap's primary innovation is leveraging an automated market maker, which significantly lowers the barrier to creating liquid markets for any asset.

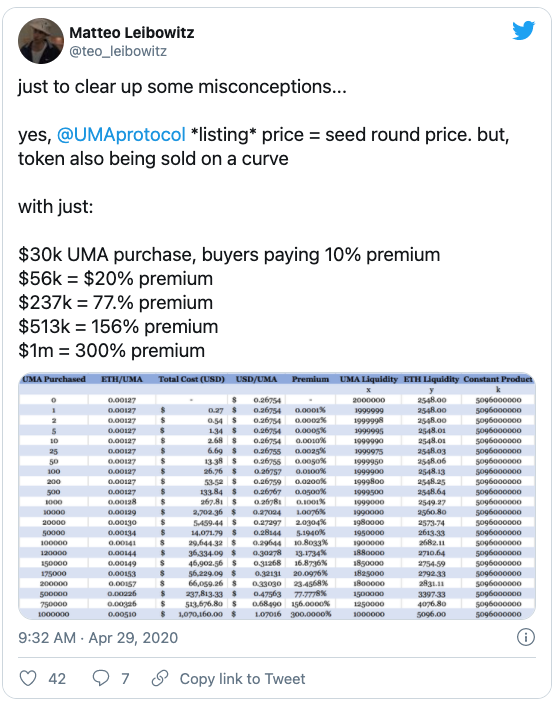

In an Initial Uniswap Listing, a team funds a liquidity pool with equal amounts of its native token and ETH. UMA, which is building infrastructure for synthetic assets, launched its token directly on Uniswap in April.

While Uniswap is the most widely used product in DeFi, Uniswap launches have some severe drawbacks. Given the initial liquidity pool is the only supply of tokens, users cannot sell, which means that the token price can only go up. This is exactly what happened with $UMA—despite the teams' claims that they were selling the token at $0.267 (its seed round price), the token price spiked to over $2 within five minutes of the start of the sale. Bots front-run the pricing curve, bidding up gas prices and eventually dumping tokens on retail traders.

2. Mesa Offering by Gnosis (July 2020)

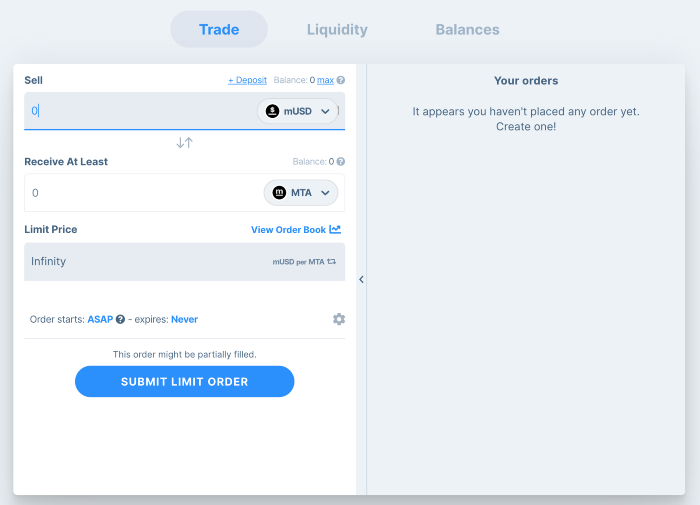

Gnosis is a decentralized trading protocol built on Ethereum with some novel mechanisms. Mesa is built on top of Gnosis and lets teams run decentralized auctions. In a Mesa Offering, the team sets multiple limit orders in advance at custom price brackets (batches). The same clearing price is guaranteed for participants on all orders within each batch auction (which happens every five minutes).

mStable was the first prominent team to leverage Mesa, using it to launch $MTA in July 2020.

Mesa has some real benefits—its ring trade functionality can increase liquidity and the batched auction mechanism does help prevent front-running. But it's really complicated (and may involve explaining what non-deterministic results are to your community).

For example, a lot of people were confused by the $MTA sale. More recently, API3 had their Mesa launch disrupted by a technical exploit. Unlike the other mechanisms listed here, Mesa listings are not permissionless—teams must get approved by the DXdao to conduct a listing.

3. Liquidity Mining (May 2020)

Liquidity mining refers to a token distribution in which users earn a protocol's native token by providing it with capital. Liquidity mining is distinct from the strategies laid out above in that users do not purchase tokens, but are rewarded with them—the so called Fair Launch. Compound kicked off the liquidity mining craze in June 2020 when it started distributing COMP to lenders and borrowers on the platform.

Liquidity mining is a proven mechanism to distribute tokens to a networks users. It also helps to decentralize a network and is a growth marketing tool. The main drawback is that it’s not a great tool for teams that need to fundraise as part of launch. An example of this, because the fair launch token YFI didn’t have a significant treasury the community recently went back to holders to mint an additional $225m worth of YFI to fund ongoing development—the plan was approved!

4. Retroactive Airdrop (September 2020)

Uniswap kicked off the retroactive airdrop craze when it launched its governance token UNI, and distributed 60% of the 1 billion tokens to users of the platform. It distributed 150M UNI to the 250,000 Ethereum addresses that had ever used Uniswap including 400 UNI to every address that had used Uniswap (currently worth ~$8,000).

UNIversal Basic Income (Source)

The retroactive airdrop is a great tool to reward early users of a network, but it’s easily gamed. For example, some people have published public guides to maximize your chances of future airdrops (RSA—oops was that us? 👹). However, as more teams adopt the tactic (see 1Inch and Tornado), retroactive airdrops will likely become a staple of token launch going forward.

5. Balancer Liquidity Bootstrapping (September 2020)

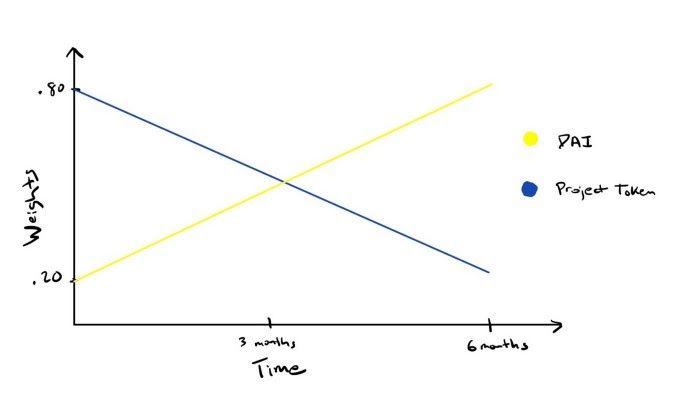

Balancer is a decentralized liquidity protocol built on Ethereum. One of its unique features is that it’s able to support liquidity pools of up to 8 assets (Uniswap can only support two) and pools of uneven weights (Uniswap can only support 50:50 pools).

In March 2020, Mike McDonald from the Balancer team introduced the idea of Liquidity Bootstrapping Pools (LBPs). In September, Perpetual Protocol became the first team to leverage a LBP when it launched $PERP.

Balancer LBP's offer teams flexibility in that they can supply an unbalanced ratio of tokens (e.g. 80/20 XYZ/USDC).

The pools are also designed to avoid front running—they generally start at a high initial price and fall over time as participants are incentivized to wait until the price falls. For example, Perpetual Protocol started with a PERP:USDC 90:10 pool and then slowly adjusted it to a 30:70 pool over a three day period, ensuring that the price would come down gradually.

LBP's have proven popular because they give teams control over parameters in order to ensure a smoother distribution. It also creates a liquid market and is fairly effective at price discovery.

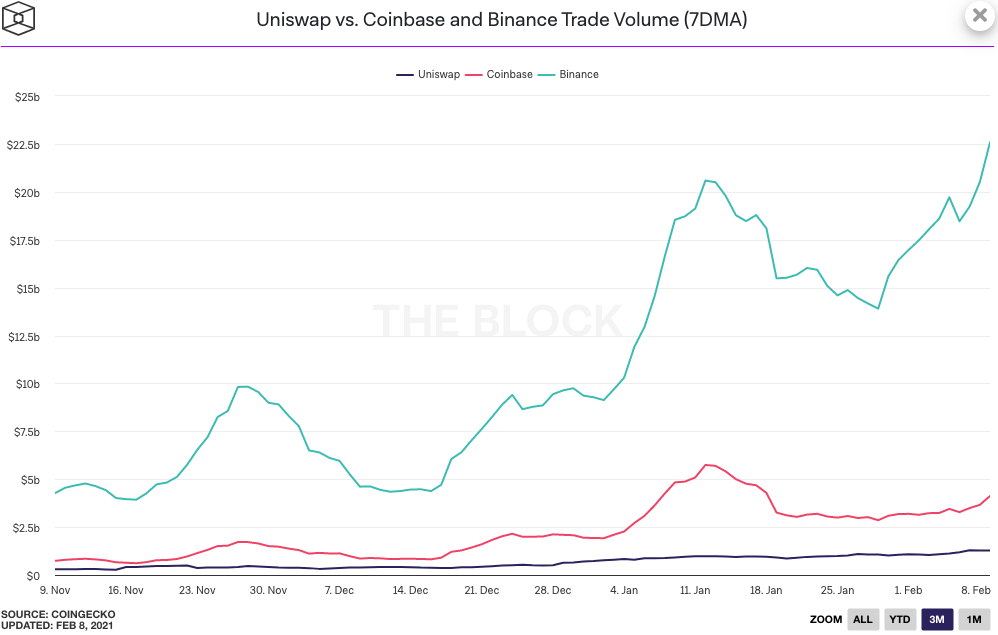

What about Initial Exchange Offerings?

While decentralized exchanges have been on a stellar growth trajectory over the past year, they remain much smaller than their centralized counterparts. Binance did more than $32B in trading volume in the past 24 hours—more than 10x Uniswap. Centralized venues for token launches still offer some significant advantages:

Usability: DeFi apps remain challenging to use. In order to participate in an LBP, a new crypto user has to (1) buy USDC and ETH on Coinbase (2) set up an Ethereum wallet like Metamask (3) Send USDC and ETH (for gas costs) to Metamask (4) figure out how to use Balancer.

This is a challenging experience—DeFi is still the frontier and centralized exchanges are still much easier for most people to use. Some exchanges have introduced products to abstract away these complexities like this Uniswap mining product.

- Distribution: Centralized exchanges offer much wider distribution than DeFi products. Coinbase has more than 40 million users, and despite being the most widely used app in DeFi, Uniswap barely has 100,000 monthly users. Perpetual Protocol’s LBP (which was successful by all means) had ~1300 participants whereas CoinList’s Flow auction was 10x bigger.

It’s also worth noting that the rigorous compliance procedures of most exchanges stand in stark contrast to the Wild West of Ethereum. It is highly likely that a least some regulators will attempt to reign in DeFi protocols in the near future, which may make centralized exchanges an even more attractive launch venue.

Looking Forward: Launching a Successful Network

The evolution in token launch mechanisms over the past year is a testament to how much innovation is currently happening in the Ethereum ecosystem.

However, these mechanisms are a means to an end—launching a network. Dapper Labs leveraged CoinList to launch Flow and gave its community an allocation at seed round price, generating a large amount of goodwill. Meanwhile, Curve embraced a decentralized ‘fair launch’ but chose to do so under shady circumstances, losing community trust.

Growing a network still relies on an engaged community, thoughtful token economics, a top notch team, and meaningful traction.

All of these factors alone matters more than how the network is launched.

Action steps

- Study the different token launches from the past few years

Author Bio

Regan Bozman is CEO at Dove Mountain Partners. He was previously Director of Business Operations at CoinList, where he was the first employee. He's also a co-founder of Free Company, a collective of Web3 operators investing in early stage projects. Free Company has backed teams like Audius, Boardroom, Dune Analytics, and Rabbithole.