5 Ways Crypto is like early Visa

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

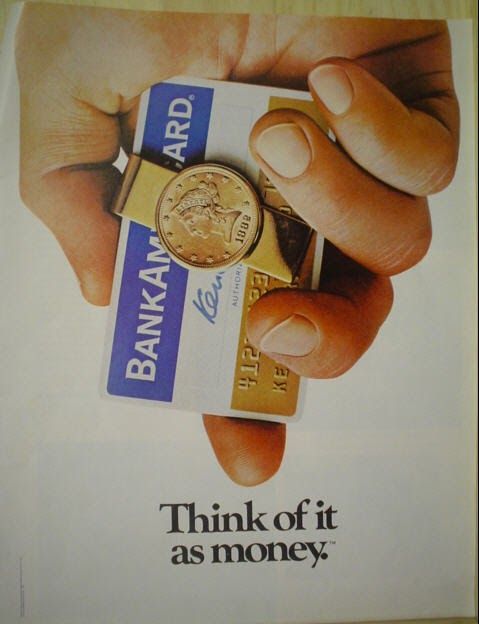

Does this early 1970’s Visa ad remind you of anything?

This thread from Emanuel drew me in.

There was a time when Visa was revolutionary tech. How could a plastic card replace real money? People would never accept it. Merchants would never accept it. Banks would never adopt it.

It would fail.

But it didn’t fail. It changed commerce. Many of us grew up using plastic—not cash.

Are there parallels between early Visa and modern crypto?

There are! Read on…some of these will blow your mind.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

5 Ways Crypto is like early Visa

Guest Post: Emanuel Coen, creator of Cryptotesters.com

If you’re going bankless, you’ve probably been following the crypto space for a while. In the darkest moments, amidst market turbulences, you might have found yourself asking if and when Ethereum is going to become a core piece of financial infrastructure. We humans are impatient and sometimes fail at recognizing that ambitious projects take time.

Bill Gates said it best…

To make sense of the present, I like to look at the past. Recently, I read David Stearn’s book ‘Electronic Value Exchange’ and I was mind blown by the amount of parallels between the early days of Visa and crypto today.

What is Visa?

Before we look at those parallels, we first must understand what Visa is. Many readers may be surprised to learn that Visa itself does not actually issue cards. Visa is not a bank, nor is it a public utility or a governmental institution. Visa does not extend credit to consumers, nor maintain their accounts. It does not recruit businesses to accept the cards bearing its name, nor does it maintain their accounts. It does not even build or sell those little point-of-sale terminals used to read the cards. So what is Visa, and what does it actually do?

Visa is in essence an enabling organization. For most of its history, it has been a not-for-profit cooperative membership association, owned and governed by the same set of financial institutions it serves. Visa provides an infrastructure, both technical and organizational, in which multiple competing financial institutions can cooperate, just enough, to provide a service that none could have realistically provided alone.

In short, Visa makes money move.

Ok, with that grounding let’s look at 5 ways crypto is like early Visa.

#1 Money Memes 💰

Turns out changing people’s money habits and views on the nature of money has never been easy. Dee Hock, the founding father of Visa knew he had to first get people accustomed to electronic payments before they would trust this new method to exchange value over banknotes and paper checks. That’s why Dee made advertising a personal mission. From media ads to brochures and corporate business cards, everything that had an impact on how Visa was perceived by the public, went through him. “Think of it as money” was Visa’s iconic tagline and first big advertising push. The campaign ran on television, print and other news outlets. Interestingly, it was not just paid for by Visa itself but by all member banks.

Today in crypto, memes are an incredibly powerful method to spread ideas around the utility of crypto. However, we don’t need to rely on firms to run advertisements. In crypto, every investor is a stakeholder and memes like “ETH is money” or “Money Legos” emerge organically as they are created by the community.

#2 Airdrops! 💸

Visa knew that every payment system relies on network effects to become successful. In Visa’s case, that meant growing a merchant base that would accept Visa cards as well as getting credit cards in the hands of users.

To bootstrap a user base, Visa member banks literally airdropped cards to people's homes and gave them a line of credit without asking any questions. Once users started using these cards, banks learned more on their clients purchasing behaviour and were able to adjust credit lines.

This practice was later made illegal by the US congress. Not only was it controversial at the time to incentivize people to take on debt, the practice was also incredibly insecure as cards were regularly stolen out of mailboxes. Since users didn’t even realize they had been issued a card, the fraud would often only be discovered a month later when they received their first card statement by mail.

Does this remind you of all the phishing schemes in the crypto space and how negatively crypto is often portrayed by the press?

#3 Bad UX 😢

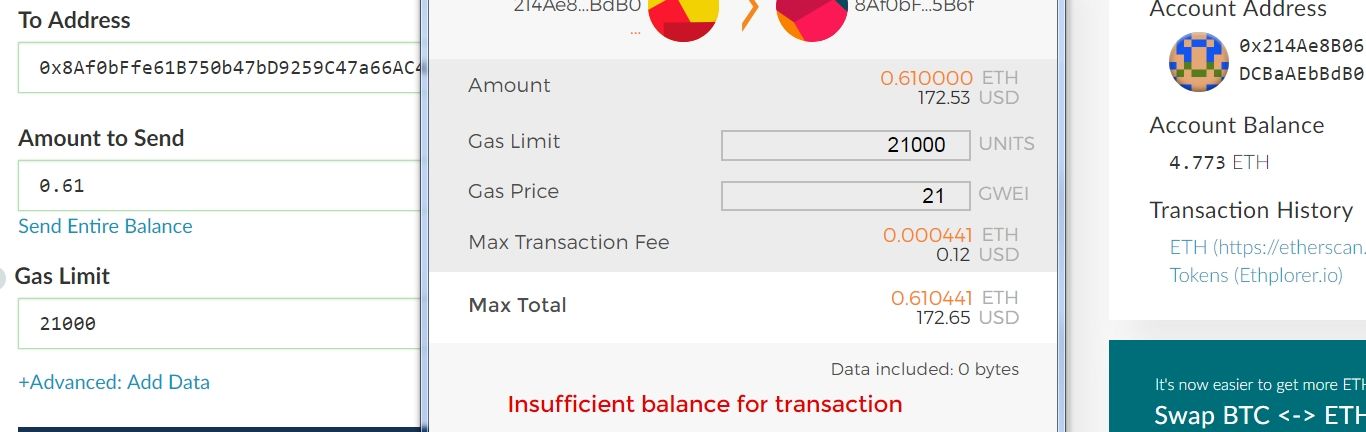

We often talk about bad UX in crypto but it pales against the UX of card payments in the 1970's.

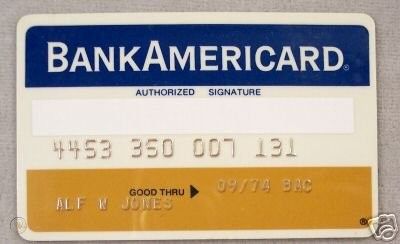

Let’s go through a typical transaction to see how that’s true. Let’s say you’re the holder of a ‘Visa’ card (called BankAmericard at the time) and want to pay for a TV. Since the transaction amount would have been above the merchant’s floor limit (typically $50 but sometimes higher for airlines and hotels), the merchant had to call their bank (acquirer) and verbally convey the transaction details to get a transaction authorized.

Next, the acquirer would call the issuing bank of the customer, which would manually check:

- if the card was not on a 'black list'

- the user's current balance, credit limit and purchase history

If everything was in order, the issuer would return an authorization code to the acquirer and the acquirer would give this authorization code to the merchant who was waiting on the line during this entire process. The merchant would then get the customers signature and write it on a 'sales draft' along with the authorization code.

The entire process took 15 minutes on average. Don't ask me why anyone voluntarily chose this payment method.

For the customer, the story ended here but for the banks it continued as the payment was only cleared not settled.

Post-sale, merchants had to send their sales draft to their acquiring bank by mail who had to sort all the incoming drafts manually to chase the payment up with the issuing bank. Finally, the issuing bank would settle the payment through the normal check clearing system.

The process was incredibly prone to error and unsurprisingly, there were always disputes between the banks.

It took a lot of technological innovation and experimentation (there were competing payment networks') to get the payment experience right. Point-of-sale devices, the magnetic stripe and high-speed communication networks between the authorization centers all eventually helped replacing human authorizers with automated computerized logic but it didn’t happen overnight.

And you thought sending a transaction using MetaMask was hard!

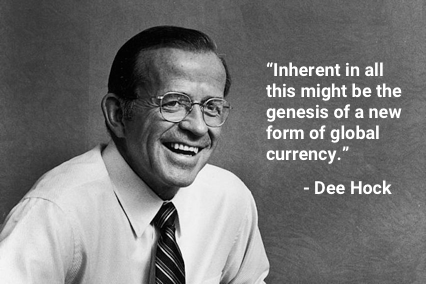

#4 The Revolution 🏴

The creation of Visa was accompanied by a similar feeling of transformation than many have in crypto today. In fact, Dee Hock would certainly be a crypto fan today.

A quote from Dee:

If electronic technology continued to advance, and that seemed certain, two-hundred year old banking oligopolies controlling the custody, loan, and exchange of money would be irrecoverably shattered.

Another:

"Nation-state monopolies on the issue and control of currency would erode…The vast preponderance of the system would fall to those who were most adept at handling and guaranteeing alphanumeric value data in the form of arranged particles of energy.”

Last one:

“Inherent in all this might be the genesis of a new form of global currency.”

Hock had been slowly coming to the realization that “money” had become nothing more than “guaranteed alphanumeric data” and that the traditional competences of banks would start to matter less and less in the decades ahead.

No better way to guarantee alphanumeric value data than on a Blockchain no?

#5 - Credibly neutral 🏳️

Dee knew that in order for banks to join, the network had to be credibly neutral. Afterall, the member banks were competitors at heart. That's why Visa was formed as a jointly-owned organization (no stocks, dividends) and all accumulated net revenue was used to finance the ongoing work of the operation.

It was crucial to create an organizational structure that would balance out incentives and assure that even small banks had a say in decision making. Thus, at core, the Visa network consists of operating regulations. A series of rules and regulations that govern everything from the physical design of the card, to the fees each party must pay and the rights and responsibilities each party has during a transaction dispute. These rules along with Visa's role as a sort of judiciary, created the necessary trust between the members that was fundamental for the system to function and grow.

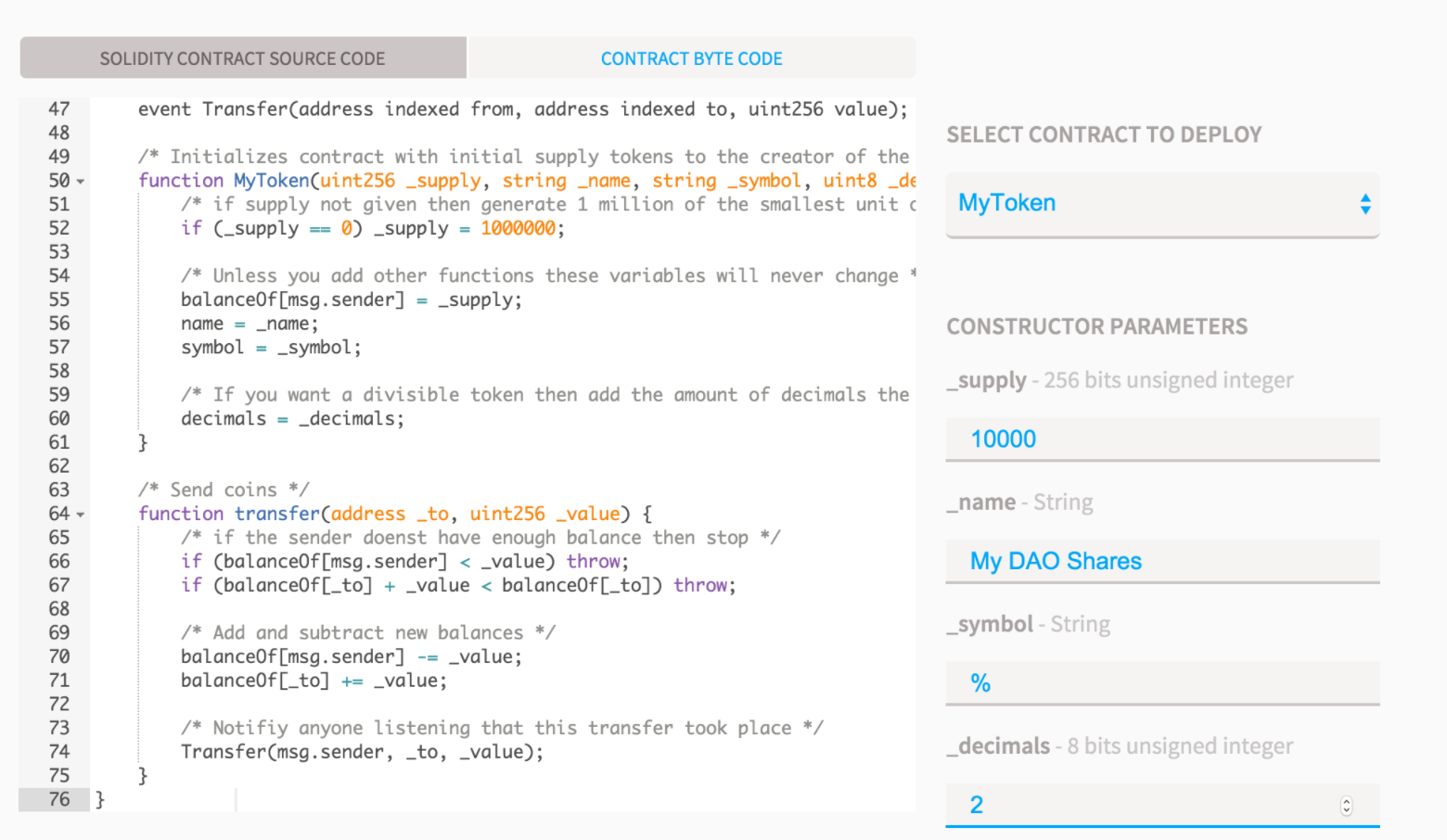

Blockchain's have these operating principles baked into the protocol and remove the need for mediation in disputes. Moreover, they significantly loosen the requirements for participation. Issuance and settlement must occur according to the credibly neutral rules of the a blockchain protocol—they rules are executed by code and maintained by the social consensus of users.

Interestingly, Hock later said that he always wanted to include participating merchants and even cardholders as full owners in the Visa organization, but the idea was always strongly resisted by the licensee banks.

Final Thought

If Visa is an enabling organization, then crypto is an enabling platform and there are important differences.

In Ethereum’s case, an organization to rule over the network is no longer necessary as blockchains provide economic finality and transactions are not subject to disputes. Furthermore, actors can not only cooperate, Ethereum’s composability means that developers can plug into any existing application to build services that they alone couldn’t provide. Instead of just moving fiat currencies, the Ethereum network moves all sorts of financial assets from fiat currencies to securities and digital collectibles.

Lastly, participation in Ethereum is open to anyone and encompasses individuals just as much as organizations. In other words, crypto networks like Ethereum are the logical next step of the evolution of a value exchange network.

But for all these differences, both early Visa and current crypto have strong parallels. Money memes, airdrops, UX issues, a revolution, and credibly neutrality were important to Visa in the 1970s and are important to crypto today.

How we exchange value is about to change. Again.

Action steps

- What are the 5 ways Crypto is like early Visa?

Guest Author Blub

Emanuel Coen is the creator of the crypto product comparison platform Cryptotesters.com, showing people who are interested to get started with crypto, which wallet to use or where to buy crypto. More categories such as loans, saving accounts and decentralized exchanges are planned soon.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.