5 Reasons The Merge is Bullish

Dear Bankless Nation,

We’ve been talking about this a lot lately but…

The Merge is coming, and it’s massively bullish for ETH.

Before we get into why let’s be clear that The Merge is no longer theoretical. It’s not vaporware, despite what the critics want to believe.

Testing has been happening for months now. And this weekend, client teams hit another milestone as they completed another test run of the real thing.

And guess what?

Everything went smoothly.

It’s only a matter of weeks before there’s an official date locked in.

Once this happens, the FOMO is going to kick in as fundamental catalysts with The Merge will drive a wave of new demand for ETH.

Let’s explain.

Here are 5 reasons why The Merge is bullish for ETH.

1. ETH’s Triple Halving

One of the main catalysts for ETH with The Merge is the 90% reduction in token issuance.

Ethereum’s transition to Proof of Stake (PoS) allows the network to substantially reduce its inflation rate on the back of the new consensus algorithm’s security efficiencies. Simply put, the network doesn’t need to issue nearly as much ETH to secure the network with PoS.

As a result, ETH’s inflation rate is set to drop by the equivalent of three Bitcoin halvings. This has been dubbed the “triple halving” by members of the Ethereum community.

Bitcoiners are notorious for promoting the Bitcoin Halving as a bullish catalyst for the asset. This is true - it’s a narrative that has defined crypto. In fact, every time there’s been a BTC halving, the asset has hit a new ATH within months.

This is why you should be bullish on Ethereum’s triple halving. Ethereum will speedrun the last 12 years of Bitcoin issuance reduction in a single moment this summer.

As a result, ETH’s issuance will drop to <1% annually, making it the asset with the lowest issuance on the market and making Ethereum the first profitable blockchain in history.

If BTC halvings are any indicator of what can happen to market prices, the triple halving alone is enough to propel ETH to new all-time highs.

But that’s just one part.

2. Ethereum becomes environmentally friendly

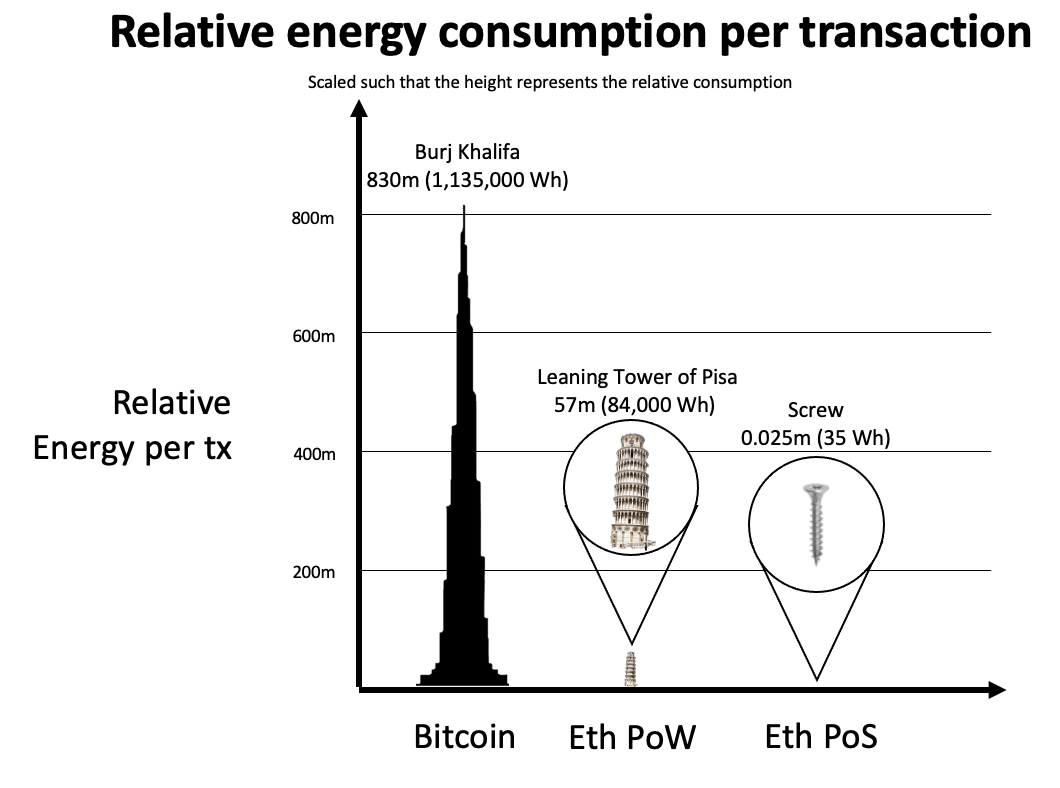

With the transition to PoS, Ethereum eliminates virtually all of its energy consumption - about 99.95% to be exact.

This is a massive narrative win for the network as environmental concerns with Proof-of-Work (PoW) are one of the biggest detriments to crypto’s mainstream adoption.

On the surface, PoW is too energy-intensive for an increasingly environmentally-conscious world. But PoS doesn’t consume any more energy than running a laptop.

Eliminating environmental concerns will be a key catalyst in winning over institutions and the public. For reference, ESG mandates can act as a significant barrier for large-scale investors looking to allocate capital towards crypto.

With PoS, institutions have the ESG stamp of approval - opening the flood gates for new money to come into the asset.

Also, no more ridiculous claims that NFTs are killing the environment. LFG.

3. ETH Staking APY Increases

With The Merge, transaction fees will be directed away from hardware miners and towards ETH stakers—driving up the staking APY from 4% to upwards of 9-12%.

The effects of this are fairly straightforward.

For one, hardware miners have recurring energy costs, creating a forcing function for them to sell their ETH rewards. With PoS, the sell pressure is substantially lower as there are minimal costs associated with running a validator.

And here’s something many people miss—ETH and its rewards won’t be withdrawable until the next fork many months after The Merge. This is a huge misconception as people think there will be 11M+ ETH that will be unlocked with The Merge. False! The ETH stays locked.

Learn more about The Merge with Ryan & David below!

It should be obvious that a higher staking yield is a major demand driver for ETH. In a world where real yields are negative and government bonds offer nothing, Ethereum is offering double-digit real yields. Investors can’t ignore it.

ETH is on a path to becoming the internet bond.

More people will flock to stake ETH following The Merge, locking up more of the ETH supply.

The increased staking yields and the inability to withdraw the rewards ultimately creates a black hole for ETH.

ETH goes in, nothing comes out.

4. ETH becomes deflationary

The combination of the triple halving, the inability to withdraw staked ETH, and EIP-1559 creates an environment where ETH becomes deflationary.

You can simulate this right now on ultrasound.money

The network is on track to burn 3.1M ETH per year (remember that transaction fees won’t go down with The Merge!) and is projected to issue less than 1M ETH per year, depending on the amount of ETH staked.

On a net issuance basis, there’s no more ETH hitting the market. Supply shock!

5. Gasoline on the Fire

The rise of Alt-Layer 1s happened on a narrative of cheaper transaction fees and massive token incentive programs.

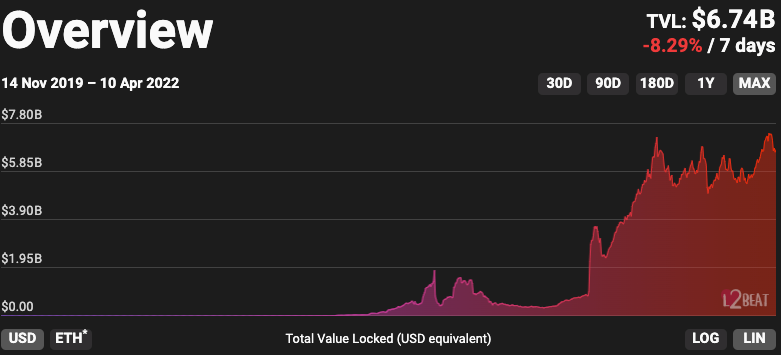

This forced Ethereum’s Layer 2 ecosystem to kick in gear, driving billions of dollars in opportunity costs to these scaling solutions with value on L2’s at all time highs. And here’s the good news—it’s all been organic growth. No token incentive.

None of the “Big 4” Layer 2s—Arbitrum, Optimism, StarkNet, and zkSync—have launched a token yet.

So what happens when Ethereum’s scalability solutions fight back with the exact same playbook?

What happens if they launch 9-figure incentive programs that rival Alt-L1s?

They’ll siphon away demand.

Layer 2s are primed and ready to launch their native tokens. They’ve been fine-tuning the technology for the better part of a year. They’ve found a product-market fit with a bustling application layer. They all have investors with a cap table who will want liquidity.

They’re ready for a growth steroid.

The launch of L2 native tokens will fuel a rocketship of activity as users and investors look to scoop up ownership in these ecosystems, generating more transaction revenue for Ethereum.

This in turn will drive up the staking APY and amount of ETH burned.

Higher yields, higher deflation. Layer 2s are good for ETH.

The perfect storm is brewing.

- Lucas